Robinhood Markets SWOT Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Robinhood Markets Bundle

Robinhood Markets boasts strong brand recognition and a user-friendly platform, appealing to a new generation of investors. However, regulatory scrutiny and intense competition present significant challenges to its growth and profitability.

Want the full story behind Robinhood's strengths, risks, and growth drivers? Purchase the complete SWOT analysis to gain access to a professionally written, fully editable report designed to support planning, pitches, and research.

Strengths

Robinhood's platform is a significant strength, lauded for its intuitive design that makes investing accessible to a broad audience, especially younger demographics. This user-friendliness has been a key driver in attracting millions of new investors.

The brand's recognition within the fintech sector is substantial, with a strong presence that resonates particularly with tech-savvy individuals. This recognition aids in customer acquisition and fosters a sense of community among its users.

Robinhood's commission-free trading model remains a significant strength, having democratized access to investing for millions. This innovative approach, first introduced for stocks and ETFs, expanded to options and cryptocurrencies, making it easier and cheaper for a wider audience to participate in financial markets. This disruptive strategy was instrumental in Robinhood's rapid user acquisition, setting a new industry standard.

Robinhood has seen impressive user growth and engagement. By the close of 2024, the company reported a substantial 25.9 million funded accounts, a clear indicator of its expanding reach and platform appeal. This robust user base directly translates to increased activity and a more vibrant trading environment.

The company's assets under custody (AUC) also tell a compelling story, reaching $193 billion by the end of 2024. This significant figure highlights growing investor confidence and the increasing amount of capital being managed on the Robinhood platform, underscoring its success in attracting and retaining assets.

Diversified Revenue Streams and Profitability

Robinhood has made significant strides in diversifying its revenue beyond its initial payment for order flow (PFOF) model. This includes generating substantial income from interest on customer cash balances and the increasingly popular Robinhood Gold subscription service. For instance, in Q1 2025, net interest revenue alone accounted for a considerable portion of their earnings.

The company's transition to profitability is a key strength, showcasing its ability to effectively monetize its large user base. This is evidenced by strong year-over-year growth in both revenue and net income reported throughout 2024 and into Q1 2025. Robinhood has maintained healthy gross profit margins, underscoring its operational efficiency and the success of its diversified revenue strategies.

- Diversified Revenue: Reduced reliance on PFOF through interest on cash and Robinhood Gold subscriptions.

- Profitability Achieved: Demonstrated consistent growth in revenue and net income in 2024 and Q1 2025.

- Monetization Success: Effectively converting its user base into paying customers and revenue-generating assets.

- Healthy Margins: Maintaining strong gross profit margins, indicating efficient operations.

Innovative Product Offerings and Expansion

Robinhood's consistent introduction of innovative products, such as fractional shares and crypto trading, has been a key differentiator. The expansion into robo-advisory services with Robinhood Strategies and AI-powered tools like Robinhood Cortex further enhances its appeal to a broad investor base.

The company's strategic acquisitions, including TradePMR for Registered Investment Advisor (RIA) custody and Bitstamp for international cryptocurrency markets, significantly broaden its service portfolio. These moves aim to transform Robinhood into a more comprehensive financial ecosystem, catering to diverse client needs beyond its initial retail brokerage focus.

- Fractional Shares: Enabled access to high-priced stocks for smaller investors.

- Robinhood Strategies: Introduced robo-advisory services for automated portfolio management.

- Robinhood Cortex: Leverages AI for enhanced investment insights and tools.

- Acquisitions (TradePMR, Bitstamp): Expanded into RIA custody and international crypto markets, diversifying revenue streams.

Robinhood's commitment to innovation is a core strength, continuously introducing features like fractional shares and crypto trading. The development of Robinhood Strategies for robo-advisory services and AI-powered tools like Robinhood Cortex further solidifies its position as a forward-thinking financial platform.

Strategic acquisitions, such as TradePMR for RIA custody and Bitstamp for international crypto expansion, are broadening Robinhood's service offerings. These moves are crucial for transforming the company into a more comprehensive financial ecosystem, capable of serving a wider array of client needs.

| Product/Service | Key Feature | Impact |

|---|---|---|

| Fractional Shares | Allows purchase of portions of high-priced stocks | Increased accessibility for retail investors |

| Robinhood Strategies | Robo-advisory for automated portfolio management | Appeals to investors seeking passive investment solutions |

| Robinhood Cortex | AI-powered investment insights and tools | Enhances user decision-making capabilities |

| TradePMR Acquisition | Adds Registered Investment Advisor (RIA) custody services | Expands reach into professional wealth management |

| Bitstamp Acquisition | Entry into international cryptocurrency markets | Diversifies revenue and global presence |

What is included in the product

Delivers a strategic overview of Robinhood Markets’s internal and external business factors, highlighting its user-friendly platform and brand recognition while acknowledging regulatory scrutiny and competitive pressures.

Highlights Robinhood's competitive edge and areas for improvement, enabling targeted strategies to address market challenges.

Weaknesses

Robinhood's substantial reliance on Payment for Order Flow (PFOF) presents a significant weakness. In 2023, PFOF accounted for approximately 41% of Robinhood's total revenue, a figure that highlights its vulnerability to regulatory shifts. This practice, where market makers pay Robinhood for the right to execute its customer orders, has drawn criticism regarding transparency and potential conflicts of interest.

The ongoing regulatory scrutiny surrounding PFOF creates substantial risk for Robinhood. Should regulators implement stricter rules or even ban the practice, Robinhood's core revenue stream could be severely impacted. For instance, the SEC's proposed rule changes in late 2023, aimed at increasing market transparency and potentially curtailing PFOF, underscore this vulnerability.

Robinhood has faced significant regulatory challenges, including substantial fines. In 2024 and 2025, the company incurred tens of millions of dollars in penalties from bodies like FINRA and the SEC.

These fines stemmed from issues such as weak anti-money laundering (AML) systems, cybersecurity gaps, and a lack of transparency regarding specific trading practices.

Such ongoing regulatory scrutiny can significantly increase compliance expenditures, harm the company's public image, and potentially lead to operational limitations, impacting its ability to innovate and grow.

Robinhood's significant reliance on cryptocurrency trading volume, a key revenue driver, exposes it to substantial concentration risk. The inherent volatility of the crypto market means that sharp downturns can directly and dramatically impact Robinhood's financial performance. For instance, during the first quarter of 2024, cryptocurrency transaction revenues accounted for approximately 4% of total net revenues, a figure that, while seemingly small, represents a critical component of their growth strategy.

Reputational Risks and User Trust Issues

Robinhood has faced significant reputational damage due to past controversies. For instance, the trading restrictions imposed during the meme stock frenzy in early 2021, particularly concerning GameStop, resulted in widespread criticism and a substantial backlash on social media. This has directly impacted user trust, with many customers expressing dissatisfaction and considering alternative platforms.

Ongoing regulatory scrutiny, including investigations and fines from bodies like the SEC, further contributes to these trust issues. These events can lead to a decline in user satisfaction, potentially causing existing users to close their accounts and making it harder for Robinhood to attract new customers. A strong reputation is vital for any financial services company that depends heavily on user confidence.

- Negative Press: Incidents like the 2021 trading halts generated significant negative media coverage.

- User Trust Erosion: Surveys and customer feedback often cite these past events as reasons for distrust.

- Account Churn: While specific numbers fluctuate, periods following major controversies have seen increased account closures.

- Acquisition Challenges: Negative sentiment can deter potential new users from signing up for the platform.

Intense Competition and Diminishing Competitive Advantage

Robinhood's initial edge from its commission-free trading model is now significantly eroded. Traditional giants like Fidelity and Charles Schwab have embraced similar fee structures, leveling the playing field. This intense competition means Robinhood faces a tougher battle for new users, driving up customer acquisition costs.

The fintech space itself is crowded, with platforms like Webull and MooMoo aggressively targeting the same demographic. This saturation dilutes Robinhood's unique selling proposition and forces it to innovate and spend more to retain its market share. For instance, as of early 2024, the cost to acquire a new customer in the online brokerage space has seen an upward trend due to these competitive pressures.

- Intensified Competition: Traditional brokerages and new fintechs now offer commission-free trading.

- Eroded Advantage: Robinhood's initial differentiator is no longer unique.

- Increased Acquisition Costs: More players mean higher spending to attract and retain users.

- Market Saturation: Platforms like Webull and MooMoo are direct competitors for the same user base.

Robinhood's business model faces significant headwinds due to its heavy reliance on Payment for Order Flow (PFOF), which accounted for roughly 41% of its revenue in 2023. This practice, while lucrative, exposes the company to substantial regulatory risk, as evidenced by ongoing discussions around potential bans or stricter regulations by bodies like the SEC in late 2023. Furthermore, the company has been subject to considerable fines, totaling tens of millions in 2024 and 2025, for issues including weak anti-money laundering systems and cybersecurity gaps, which damage its reputation and increase compliance costs.

The company's dependence on the volatile cryptocurrency market also presents a weakness. While crypto transaction revenues were about 4% of total net revenues in Q1 2024, this segment is crucial for its growth strategy and any downturns can disproportionately affect its financial performance. Adding to these challenges, Robinhood's reputation has been tarnished by past controversies, such as the 2021 trading restrictions on meme stocks, leading to user distrust and potential account churn. This, coupled with the erosion of its commission-free trading advantage as competitors like Fidelity and Charles Schwab adopt similar models, intensifies competition and raises customer acquisition costs.

| Weakness Category | Specific Issue | Impact/Data Point | Regulatory/Competitive Context |

| Revenue Dependence | Payment for Order Flow (PFOF) | 41% of total revenue in 2023 | Vulnerable to regulatory changes (e.g., SEC proposals late 2023) |

| Regulatory & Compliance | Fines and Penalties | Tens of millions in 2024-2025 | Issues with AML, cybersecurity, transparency; increases compliance costs |

| Market Volatility Exposure | Cryptocurrency Trading | 4% of total net revenues (Q1 2024) | High concentration risk due to crypto market volatility |

| Reputation & Trust | Past Controversies (e.g., meme stock trading halts) | Eroded user trust, potential account churn | Negative media coverage, customer dissatisfaction |

| Competitive Landscape | Erosion of Commission-Free Advantage | Competitors (Fidelity, Schwab) offer similar models | Increased customer acquisition costs, market saturation (Webull, MooMoo) |

Preview the Actual Deliverable

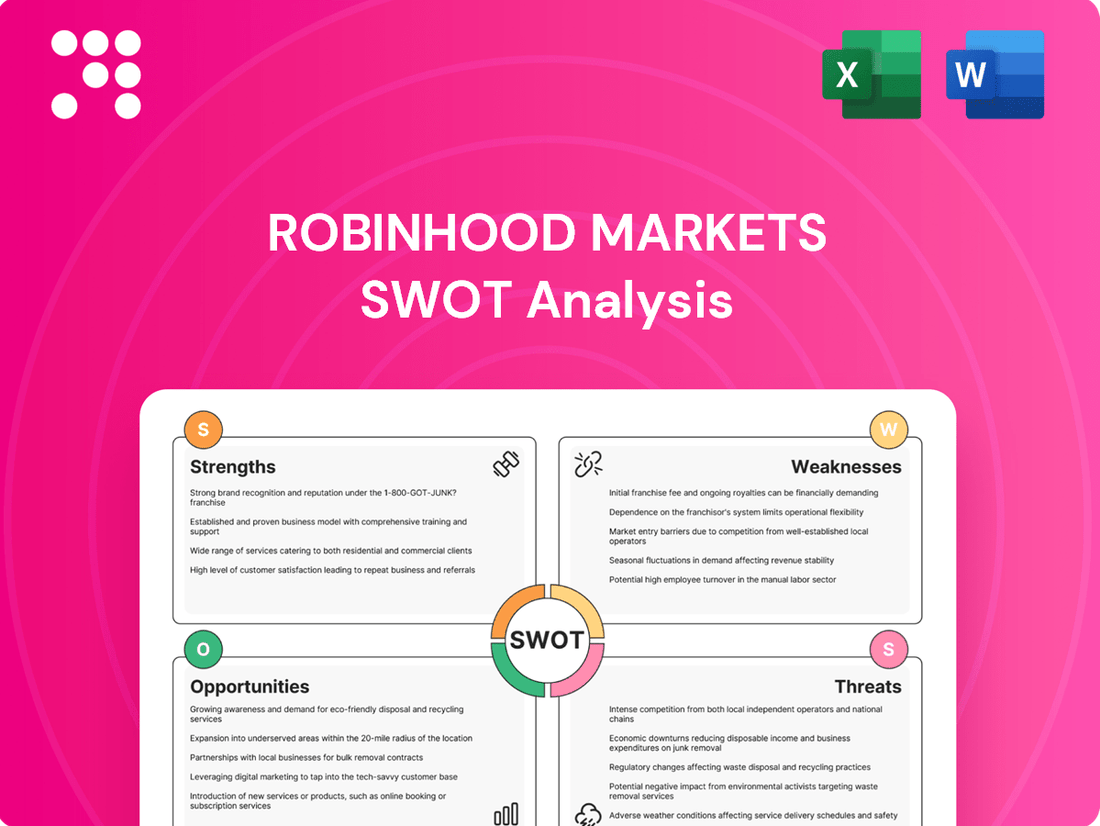

Robinhood Markets SWOT Analysis

This preview reflects the real document you'll receive—professional, structured, and ready to use. You're seeing the actual Robinhood Markets SWOT analysis, offering a clear view of its strengths, weaknesses, opportunities, and threats. Purchase unlocks the complete, in-depth report for your strategic planning.

Opportunities

Robinhood has a significant opportunity to grow by entering new international markets. Its simple, app-based approach is particularly attractive to younger, less experienced investors, a demographic that is growing globally. This user-friendly model can be replicated in regions where similar platforms are less prevalent or less accessible.

The company has already signaled its intentions, announcing plans to establish a headquarters in Singapore for its Asia-Pacific expansion in 2025. Furthermore, Robinhood has launched options trading in the United Kingdom, indicating a strategic push into established European markets. These moves are crucial for diversifying its revenue streams and reducing reliance on the U.S. market.

Acquisitions, such as the potential or completed integration of platforms like Bitstamp, could accelerate this international growth. Buying into existing infrastructure and customer bases in key regions, particularly in Europe, can provide a faster and more efficient entry point than building from scratch. This strategy allows Robinhood to leverage established regulatory frameworks and local market knowledge.

Robinhood can significantly broaden its appeal by moving beyond its core trading platform. Imagine a scenario where users can manage all their financial needs in one place, from investing to saving and even borrowing. This diversification is key to capturing more of a customer's financial life.

The company is already making strides here, with offerings like Robinhood Gold Card and the development of robo-advisory services such as Robinhood Strategies. These moves signal a clear intent to become a comprehensive financial hub, aiming to attract a wider demographic and deepen existing customer relationships.

By expanding into areas like high-yield savings accounts and credit products, Robinhood can increase its revenue streams and customer loyalty. For instance, the Robinhood Gold Card offers a compelling value proposition, potentially driving significant user engagement and wallet share, especially among younger, digitally native consumers.

Robinhood has a significant opportunity to boost user engagement and streamline operations by embracing AI and cutting-edge technology. The company's AI-powered investment tools, such as Robinhood Cortex, offer sophisticated stock analysis and trade-building features, setting it apart in a competitive market and appealing to digitally native investors.

By integrating AI, Robinhood can automate internal processes, leading to cost reductions and enhanced risk management capabilities. For instance, AI can be used to detect fraudulent activities more efficiently, a critical function for any financial platform. As of early 2024, the fintech industry is seeing substantial investment in AI, with companies aiming to leverage these technologies for personalized customer experiences and predictive analytics.

Growth in Subscription Services (Robinhood Gold)

Robinhood's subscription service, Robinhood Gold, is a significant growth engine. By early 2025, this premium offering had attracted 3.2 million subscribers, effectively doubling its user base from the previous year. This rapid expansion highlights a strong market appetite for the enhanced features provided, such as interest-free margin trading and increased yields on uninvested cash.

The success of Robinhood Gold presents a clear opportunity for further development and monetization. The program's ability to generate recurring revenue and foster deeper customer loyalty is a key strategic advantage.

- Subscriber Growth: 3.2 million Robinhood Gold subscribers as of early 2025, a year-over-year doubling.

- Key Benefits: Offers interest-free margin, higher interest on uninvested cash, and IRA matching.

- Revenue Stream: Provides a stable and growing source of recurring revenue for Robinhood.

- Customer Loyalty: Enhances user retention and encourages deeper engagement with the platform.

Capitalizing on Crypto Market Growth and Regulatory Clarity

Robinhood is poised to benefit from the increasing mainstream adoption of cryptocurrencies. The company's strategic expansion into crypto services, including staking and lending, aims to capture a larger share of this burgeoning market. As of Q1 2024, Robinhood reported $36 billion in crypto assets under custody, demonstrating significant traction.

Further growth is anticipated as Robinhood plans to enhance its crypto offerings with new altcoins and explore tokenized U.S. stocks for European investors. This diversification strategy is designed to attract a broader customer base and deepen engagement on its platform.

The evolving regulatory landscape presents a dual opportunity. While uncertainty has been a challenge, increasing clarity in crypto regulations could significantly de-risk the sector, paving the way for more robust product development and market penetration for Robinhood. The U.S. spot Bitcoin ETF approvals in early 2024 signal a potential shift towards greater institutional acceptance and regulatory frameworks.

- Growing Crypto Adoption: Increased retail and institutional interest in digital assets presents a significant revenue opportunity.

- Service Expansion: Plans for staking, lending, and new altcoin listings aim to enhance user engagement and attract new customers.

- International Tokenization: Offering tokenized U.S. stocks in Europe opens up new geographic markets and product lines.

- Regulatory Tailwinds: Potential for future regulatory clarity could reduce operational uncertainty and foster innovation in the crypto space.

Robinhood can significantly expand its user base and revenue by tapping into international markets, leveraging its user-friendly platform for less experienced investors globally. The company is actively pursuing this, with plans for Asia-Pacific expansion and recent launches in the UK, aiming to diversify beyond the U.S. market.

Diversifying its product offerings beyond core trading is a key opportunity, transforming Robinhood into a comprehensive financial hub. This includes expanding into areas like savings accounts and credit products, exemplified by the Robinhood Gold Card, to capture more of a customer's financial life and foster loyalty.

The strategic integration of AI and advanced technology presents a significant chance to enhance user engagement and operational efficiency. AI-powered tools like Robinhood Cortex offer sophisticated analysis, while automation can streamline processes and improve risk management, aligning with industry-wide investments in AI for personalized experiences.

Robinhood's subscription service, Robinhood Gold, is a substantial growth engine, with 3.2 million subscribers by early 2025, doubling its user base year-over-year. This success highlights a strong demand for premium features like interest-free margin trading and increased yields on uninvested cash, offering a stable recurring revenue stream.

The increasing mainstream adoption of cryptocurrencies offers a significant avenue for growth, with Robinhood expanding its crypto services. As of Q1 2024, the company held $36 billion in crypto assets under custody, and future plans include new altcoins and tokenized U.S. stocks for European investors, capitalizing on evolving regulatory clarity.

Threats

Robinhood is navigating a landscape of heightened regulatory oversight from agencies like the SEC and FINRA. This scrutiny is particularly focused on its payment for order flow (PFOF) arrangements and its expanding cryptocurrency services.

The potential for new or more stringent regulations poses a direct threat, capable of reshaping Robinhood's core business model. Such changes could substantially escalate compliance expenditures and potentially result in additional financial penalties or operational limitations.

Indeed, the company has already faced significant financial sanctions, with reports indicating substantial fines levied in 2025, underscoring the financial risks associated with regulatory non-compliance or evolving legal frameworks.

The financial services landscape is fiercely competitive. Traditional brokerage firms and emerging fintech companies are all aggressively pursuing customer acquisition, making it challenging for any single player to dominate. This crowded market means constant innovation and adaptation are necessary just to keep pace.

Many rivals have now matched Robinhood's commission-free trading model, diminishing its once-distinctive advantage. This widespread adoption of zero commissions means Robinhood can no longer solely rely on this feature to attract and retain users, forcing a greater emphasis on other value propositions.

This intense rivalry inevitably leads to price compression and escalating costs for acquiring new customers. Companies are spending more on marketing and promotions to stand out, which directly impacts profitability and puts pressure on already tight profit margins. For instance, in Q1 2024, Robinhood reported a net loss of $157 million, highlighting the cost of growth in this environment.

Robinhood's revenue streams are particularly vulnerable to market swings and the broader economic climate. A significant chunk of their income comes from the fees generated by trading activity, so when markets get choppy or head south, people tend to trade less.

During economic downturns or extended periods where stock prices are generally falling, retail investors often pull back. This reduction in trading volume directly hits Robinhood's top line and also affects the interest income they earn on customer cash reserves, impacting their overall profitability.

For instance, in the first quarter of 2024, Robinhood reported a decrease in trading-related revenues compared to the previous year, reflecting a more cautious investor sentiment and lower market participation. This sensitivity highlights a key challenge for their business model.

Cybersecurity Risks and Data Privacy Concerns

Robinhood, as a digital-first financial services company, faces significant cybersecurity risks. A data breach could not only result in substantial financial losses for its users but also severely tarnish the company's reputation and invite hefty regulatory fines. For instance, in late 2020, Robinhood experienced a data breach affecting approximately 7 million customers, with personal information like email addresses and names being accessed.

The ongoing evolution of cyber threats means continuous investment in advanced security measures is paramount. Failure to do so could lead to a loss of customer trust, which is a critical asset for any financial platform. Ensuring robust data privacy protocols is therefore not just a compliance issue but a fundamental requirement for sustained business operations and user confidence.

Key cybersecurity considerations for Robinhood include:

- Protection against phishing and malware attacks targeting user accounts.

- Securing sensitive financial data and personal identifiable information (PII) from unauthorized access.

- Compliance with evolving data privacy regulations like GDPR and CCPA, which carry significant penalties for non-compliance.

Negative Public Perception and Brand Damage

Robinhood has faced significant challenges regarding public perception, largely stemming from past controversies like the meme stock trading restrictions in early 2021. These events, coupled with ongoing regulatory scrutiny, have eroded trust among a segment of its user base and the broader investing community.

The company's brand image remains vulnerable. Continued negative press, particularly concerning customer service issues or platform stability, could further deter potential new users and alienate existing ones. For instance, reports of outages during peak trading periods in 2024 can reignite these concerns.

Furthermore, insider selling by executives, if perceived as a lack of confidence in the company's future, can negatively influence investor sentiment. While insider sales are common, the timing and volume can be interpreted as a signal, potentially impacting Robinhood's stock performance and overall market perception.

- Meme Stock Fallout: The GameStop saga in January 2021 led to widespread criticism and regulatory investigations, impacting public trust.

- Regulatory Hurdles: Ongoing investigations and potential fines from bodies like the SEC can create a perception of impropriety.

- Brand Resilience: Robinhood's ability to rebuild trust hinges on demonstrating improved customer service and platform reliability in 2024 and beyond.

- Insider Sentiment: Executive stock sales, if significant, can be interpreted by the market as a bearish signal, further damaging investor confidence.

Intensified regulatory scrutiny, particularly concerning payment for order flow and cryptocurrency operations, poses a significant threat, potentially leading to increased compliance costs and financial penalties. The company's reliance on trading volumes makes it highly susceptible to market downturns, as evidenced by reduced revenues in early 2024. Furthermore, persistent cybersecurity risks, including the potential for data breaches, could severely damage customer trust and invite substantial regulatory fines, as seen in past incidents.

SWOT Analysis Data Sources

This Robinhood Markets SWOT analysis is built upon a foundation of robust data, including their official financial filings, comprehensive market research reports, and expert industry analyses. These sources provide a clear view of their operational strengths, weaknesses, opportunities, and threats.