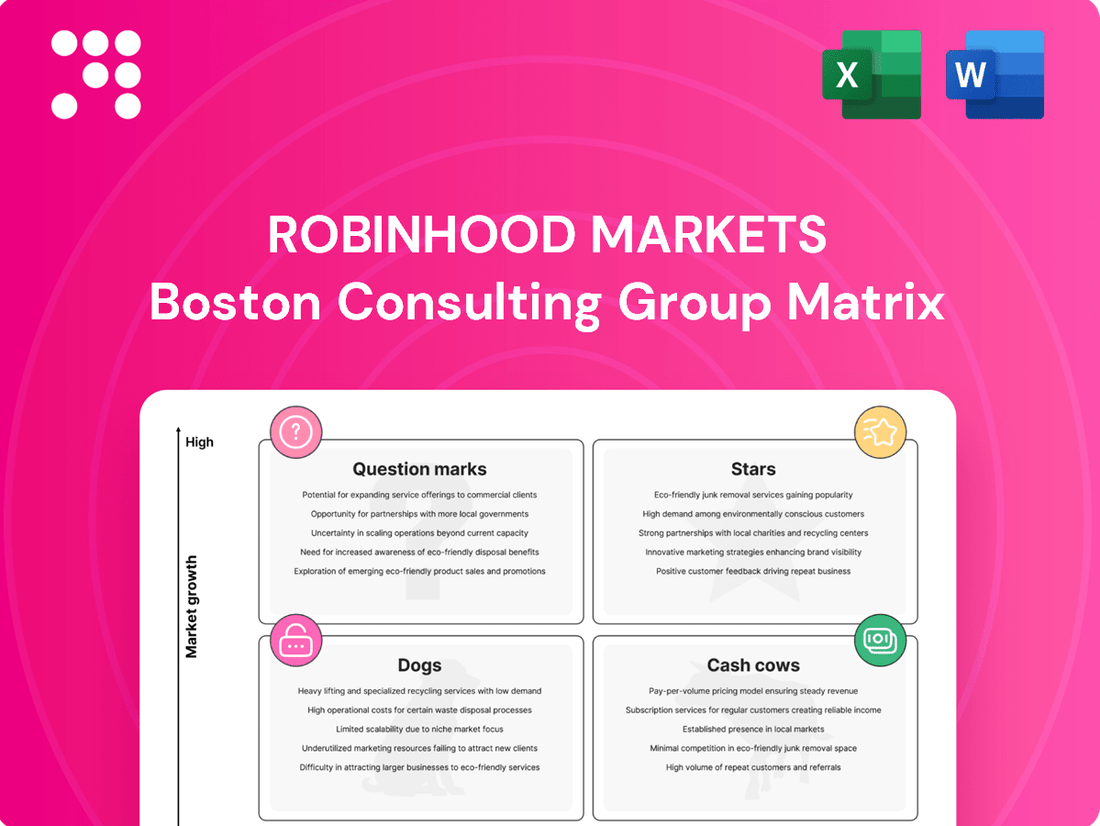

Robinhood Markets Boston Consulting Group Matrix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Robinhood Markets Bundle

Curious about Robinhood Markets' strategic positioning? Our BCG Matrix analysis reveals their key offerings as potential Stars, Cash Cows, Dogs, or Question Marks, offering a glimpse into their market share and growth prospects. Don't miss out on the full picture; purchase the complete BCG Matrix for a detailed breakdown and actionable insights to navigate the competitive landscape.

Stars

Cryptocurrency trading on Robinhood has experienced remarkable expansion. Revenue from this segment surged by 100% year-over-year in Q1 2025, reaching $252 million, and saw an even more dramatic 700% increase in Q4 2024, hitting $358 million. This rapid growth solidifies crypto as a key revenue generator for the company.

This performance places Robinhood's crypto business in a high-growth market, demonstrating its success in capturing a substantial and expanding share of retail crypto trading. The platform's accessibility has clearly resonated with a broad user base, positioning it as a significant player in this dynamic sector.

Options trading represents a significant growth engine for Robinhood. In the first quarter of 2025, options revenue surged by 56% year-over-year, reaching $240 million. This robust performance is further underscored by an 83% increase in options revenue to $222 million in the fourth quarter of 2024, alongside a record 500 million options contracts traded.

Robinhood Gold, a key offering in Robinhood's portfolio, shows robust growth, positioning it as a potential star in the BCG Matrix. The subscription service saw a remarkable 90% year-over-year surge in subscribers, reaching 3.2 million in Q1 2025. This rapid expansion highlights strong market demand for its premium features.

Further underscoring its success, Robinhood Gold also grew to 2.6 million subscribers in Q4 2024, representing an 86% increase. This sustained growth directly fuels Robinhood's 'Other revenues,' which experienced a significant 54% jump in Q1 2025, indicating a high revenue-generating capacity.

The appeal of Robinhood Gold is driven by valuable benefits such as an IRA match, enhanced interest rates on uninvested cash, and sophisticated trading tools. These features contribute to its high market adoption and solidifies its status as a growth-oriented product within Robinhood's ecosystem.

Net Deposits and Total Platform Assets

Robinhood's net deposits reached a record $18.0 billion in the first quarter of 2025, showcasing an impressive annualized growth rate of 37%. This surge in customer inflows, coupled with a 70% year-over-year increase in total platform assets to $221 billion, highlights Robinhood's effectiveness in attracting and retaining customer capital within the highly competitive brokerage landscape.

These figures are crucial indicators of Robinhood's market position and growth trajectory. The substantial net deposits suggest successful customer acquisition strategies and a strong ability to encourage existing users to deposit more funds onto the platform.

- Record Net Deposits: $18.0 billion in Q1 2025.

- Annualized Growth Rate: 37% on net deposits.

- Total Platform Assets: Surged 70% year-over-year to $221 billion.

- Implication: Strong customer acquisition and retention, indicating effective capital growth.

Advanced Trading Tools & Features (e.g., Robinhood Legend, Futures Trading)

Robinhood is actively enhancing its platform for experienced traders, introducing advanced tools like the Robinhood Legend desktop experience and expanded futures trading capabilities, which launched in late 2024. This strategic move aims to capture a larger share of the active trading market, which is a significant growth opportunity for the company.

These new offerings are tailored to meet the demands of more sophisticated investors, potentially increasing user engagement and attracting a segment of the market that may have previously found Robinhood too simplistic. By broadening its appeal, Robinhood is positioning itself to compete more effectively in the active trading space.

- Robinhood Legend Desktop: Launched in late 2024, offering a more robust trading environment.

- Futures Trading: Expanded offerings in late 2024 to cater to active traders.

- Market Share Potential: These advanced tools target a high-growth segment, aiming to increase Robinhood's market share beyond its initial user base.

Robinhood Gold, with its significant subscriber growth of 90% year-over-year to 3.2 million in Q1 2025, clearly fits the Star category. Its strong performance and high market adoption, driven by valuable benefits, indicate it's a leading product in a rapidly expanding market segment. This sustained growth directly contributes to Robinhood's overall revenue expansion.

| Product | Market Growth | Market Share | BCG Category |

| Robinhood Gold | High | High | Star |

What is included in the product

Robinhood's BCG Matrix likely positions its core trading platform as a Cash Cow, while newer offerings like crypto and debit cards are Question Marks needing investment.

The Robinhood BCG Matrix offers a clear, one-page overview of its business units, simplifying strategic decisions.

Cash Cows

Interest on customer cash balances is a prime example of Robinhood's Cash Cows within the BCG Matrix. This revenue stream is remarkably stable and requires very little additional capital to maintain its profitability. It essentially capitalizes on the funds customers hold in their accounts, transforming dormant balances into a reliable income source.

Robinhood saw significant growth in this area, with net interest revenues climbing 14% year-over-year to $290 million in Q1 2025. Furthermore, Q4 2024 demonstrated a robust 25% increase, reaching $296 million. This upward trend is largely attributed to an expansion in interest-earning assets and increased securities lending activities, showcasing efficient utilization of existing customer deposits.

Robinhood's commission-free stock and ETF trading, while not directly charging fees, acts as a significant cash cow. This is primarily due to the massive trading volumes it facilitates, which in turn drive revenue through payment for order flow (PFOF) and securities lending. For instance, equity notional trading volumes saw an impressive 84% year-over-year increase to $413 billion in Q1 2025, following a substantial 154% surge to $423 billion in Q4 2024.

Payment for Order Flow (PFOF) is a critical revenue driver for Robinhood, acting as a cash cow. This practice, where Robinhood routes customer orders to market makers in exchange for payment, underpins a significant portion of its transaction-based revenue. In the first quarter of 2025, this segment saw impressive growth, reaching $583 million, a substantial 77% increase.

Despite facing ongoing regulatory examination, PFOF continues to be a highly profitable and established element of Robinhood's operations. The company effectively utilizes its extensive user base within a mature market to generate a steady and reliable stream of income from this practice, solidifying its position as a cash cow.

Securities Lending

Securities lending has emerged as a significant contributor to Robinhood Markets' financial performance, particularly within the context of its BCG Matrix. This practice, where Robinhood lends out fully paid customer securities to other financial institutions, generates valuable interest income. It’s a well-established market activity that represents a low-cost, high-margin revenue stream for the company.

The impact of securities lending on Robinhood’s revenue is evident in recent financial reports. For instance, net interest revenues saw a substantial increase in the fourth quarter of 2024 and continued this upward trend into the first quarter of 2025. This growth directly reflects the increasing contribution of securities lending to the company's overall profitability.

- Securities lending bolsters net interest revenues, with significant growth seen in Q4 2024 and Q1 2025.

- This revenue stream is derived from lending out customers' fully paid securities.

- It represents a low-cost, high-margin business model for Robinhood.

- The activity aligns with established market practices, enhancing its sustainability.

Existing Funded Customer Base

Robinhood's existing funded customer base represents a significant Cash Cow. In Q1 2025, this base grew to 25.8 million users, up from 25.2 million in Q4 2024, marking an 8% year-over-year increase. This substantial and loyal customer segment reliably generates consistent revenue through trading fees, interest on cash balances, and recurring subscription income from services like Robinhood Gold.

The stability and predictability of this revenue stream are key characteristics of a Cash Cow. The company benefits from economies of scale in serving its existing users, meaning the cost to acquire new customers is lower than retaining and serving current ones. This established user base requires less incremental marketing spend, allowing for efficient cash generation.

- Existing Funded Customer Base: 25.8 million in Q1 2025.

- Year-over-Year Growth: 8% increase.

- Revenue Generation: Trading activities, cash balances, premium subscriptions.

- Key Benefit: Stable and predictable cash flow with lower marketing investment per user.

Robinhood's established funded customer base is a clear cash cow, providing a consistent revenue stream. This base grew to 25.8 million users in Q1 2025, an 8% increase year-over-year. The company benefits from economies of scale, making it more cost-effective to serve existing users than to acquire new ones, thus generating efficient cash flow.

| Metric | Q4 2024 | Q1 2025 | Year-over-Year Change |

| Funded Customers (Millions) | 25.2 | 25.8 | 8% |

| Equity Notional Trading Volume ($ Billions) | 423 | 413 | 84% |

| Net Interest Revenue ($ Millions) | 296 | 290 | 14% |

Full Transparency, Always

Robinhood Markets BCG Matrix

The Robinhood Markets BCG Matrix preview you are viewing is the complete, unedited document you will receive upon purchase. This means you get the full strategic analysis, ready for immediate application without any watermarks or demo content. The report accurately reflects the final product, allowing you to confidently assess Robinhood's market position and plan future strategies.

Dogs

Robinhood's initial forays into international markets have encountered significant headwinds. In 2020, the company notably halted its planned launches in the UK and Australia, citing regulatory complexities and intense competition as key deterrents.

Despite these setbacks, Robinhood reported an international customer base exceeding 150,000 by the first quarter of 2025. However, the company's market share in these nascent or previously attempted international territories remains minimal, and growth has been sluggish, categorizing these ventures as 'Dogs' within the BCG Matrix until substantial market penetration is demonstrated.

Within Robinhood's product suite, certain niche or less utilized features might be categorized as Dogs in a BCG Matrix analysis. These are functionalities that, while potentially offering value to a small user segment, do not command significant user engagement or contribute meaningfully to the platform's overall revenue generation. For instance, if Robinhood offers specialized charting tools or access to very obscure investment products that see minimal adoption, these could represent such a category.

Consider features like advanced algorithmic trading tools or access to highly illiquid alternative investments. If data from 2024 indicates that less than 1% of Robinhood's active user base engages with these specific offerings, and they require ongoing maintenance or development without a clear path to monetization, they fit the Dog profile. These features consume resources that could otherwise be allocated to more popular or revenue-driving aspects of the platform.

Prior to the introduction of Robinhood Legend, the company's older desktop and web interfaces likely catered to a less active trading segment or those new to the platform. These legacy interfaces, if not significantly enhanced, could be classified as dogs in a BCG matrix analysis, indicating low market share and operating in a low-growth market. For instance, while Robinhood reported a significant increase in funded accounts, reaching 23.3 million by the end of 2023, the engagement levels on older platforms compared to the new Legend interface are not explicitly detailed, but the strategic shift implies a need to capture more active traders.

Certain Less Traded Cryptocurrencies

Within Robinhood's broader crypto offering, certain less traded cryptocurrencies might fall into the question mark category of the BCG Matrix. While the overall crypto market is a star for Robinhood, the platform's selection of digital assets is more curated than crypto-native exchanges.

These less popular cryptocurrencies, if they experience low trading volumes and consequently generate minimal revenue for Robinhood, could be considered question marks. For instance, if a specific altcoin sees less than 0.01% of Robinhood's total crypto trading volume in a given quarter, it might fit this classification.

- Low Trading Volume: Cryptocurrencies with consistently low daily or weekly trading volumes on the platform.

- Minimal Revenue Contribution: Assets that contribute negligibly to Robinhood's overall transaction fee revenue from crypto trading.

- Limited Market Interest: Digital assets that do not attract significant user attention or trading activity compared to major cryptocurrencies.

- Potential for Growth or Decline: These assets represent an investment where Robinhood needs to decide whether to invest further to increase their popularity or divest from them.

Standalone Basic Brokerage Accounts (without Gold)

Standalone basic brokerage accounts, representing Robinhood's foundational offering without the added benefits of Gold, are a significant part of their user base. While these accounts drive substantial user acquisition through commission-free trading, they typically generate lower average revenue per user (ARPU) compared to their premium counterparts. For instance, in 2023, Robinhood's total net revenue was $1.98 billion, with ARPU from funded accounts being a key metric. Users in this segment, while numerous, may exhibit higher churn rates due to the competitive landscape of basic brokerage services, making them a potentially low-growth, low-profit segment if not effectively upsold to premium services.

These basic accounts are critical for Robinhood's market penetration and brand recognition, acting as a gateway for many new investors. However, their lower ARPU means they contribute less to overall profitability per user. This segment faces intense competition from other platforms offering similar commission-free services.

- User Acquisition Engine: Basic accounts are crucial for attracting a broad user base to the Robinhood platform.

- Lower ARPU: These accounts typically generate less revenue per user compared to Robinhood Gold subscribers.

- Competitive Pressure: The basic brokerage market is highly competitive, increasing the risk of user churn.

- Upselling Opportunity: The primary strategy for these accounts is to convert users to higher-revenue generating Gold subscriptions.

Certain niche features within Robinhood's platform, or less popular cryptocurrencies, can be classified as Dogs. These offerings typically exhibit low user engagement and minimal revenue generation, consuming resources without significant returns. For example, if a specific altcoin on Robinhood accounted for less than 0.01% of total crypto trading volume in Q1 2025, it would fit this category. These segments require careful evaluation for potential divestment or strategic repositioning.

Question Marks

Robinhood's Retirement Accounts, while a newer offering, are demonstrating impressive momentum. Assets Under Custody (AUC) for these accounts surged by over 200% year-over-year, reaching a new high of $14.4 billion in Q1 2025. This growth trajectory is further underscored by a remarkable 600% increase to $13.1 billion in Q4 2024, boosted by a 3% match for Gold members.

This rapid expansion places Robinhood Retirement Accounts in the "Question Mark" category of the BCG matrix. The product exhibits high growth potential, as evidenced by its AUC figures, but likely holds a smaller market share compared to established retirement providers. Significant investment will be necessary to capitalize on this growth and gain a more substantial foothold in the competitive retirement savings market.

The Robinhood Gold Credit Card, a recent entrant, is positioned as a 'Question Mark' in Robinhood Markets' BCG Matrix. By the end of Q4 2024, it garnered over 100,000 cardholders, signaling promising initial traction in a crowded financial services landscape.

Despite this early success, the card currently holds a relatively low market share. Significant investment will be necessary to scale its adoption and achieve profitability in this competitive arena.

Robinhood's expansion into tokenized U.S. stocks and crypto futures in the EU and U.S. during 2025 positions these offerings within the question mark category of the BCG Matrix. These products represent nascent ventures in emerging or rapidly growing markets, signaling substantial future growth potential.

While the long-term outlook is promising, Robinhood's current market share for these specific offerings is very low, reflecting their recent introduction and ongoing scaling efforts. For instance, by mid-2025, the global market for tokenized securities was projected to reach over $2 trillion, yet Robinhood's penetration into this nascent space remained minimal as they focused on building user adoption and regulatory compliance.

AI-Powered Tools (e.g., Cortex)

Robinhood is actively integrating artificial intelligence into its platform, exemplified by the development of tools like Cortex. This strategic move places Robinhood within a rapidly expanding technological sector, aiming to enhance user experience and investment capabilities through AI. These AI-powered initiatives are considered new ventures with substantial growth potential.

The company's foray into AI tools like Cortex positions them in a high-growth technological area. While these innovations represent significant investments with uncertain but potentially high future returns, they are likely in their early stages of adoption and market penetration. For instance, the broader AI market is projected to reach hundreds of billions of dollars by the mid-2020s, indicating the scale of opportunity.

- Innovation Focus: Robinhood's AI tools like Cortex represent a commitment to innovation in a high-growth technological field.

- Early Stage Adoption: These AI-powered ventures are likely in their nascent stages of market penetration and user adoption.

- Investment & Returns: Significant investment is being channeled into AI, with the expectation of substantial, albeit uncertain, future returns.

- Market Potential: The AI sector offers vast potential, with projections indicating continued exponential growth in its applications and market size.

Acquisition of TradePMR

Robinhood's acquisition of TradePMR in Q1 2025 positions the company's TradePMR segment within the BCG matrix as a potential 'question mark'. This move targets the Registered Investment Advisor (RIA) market, a new and potentially lucrative segment for Robinhood, boasting over $40 billion in assets under administration.

While the RIA market offers high growth prospects, Robinhood's current market share within this specialized niche is relatively low. This characteristic aligns with the 'question mark' classification, indicating a business unit with low market share in a high-growth industry.

- High Growth Potential: The RIA market represents a significant expansion opportunity for Robinhood, tapping into a segment with substantial assets under administration.

- Low Market Share: Robinhood's presence in the advisor-focused market is nascent, meaning it currently holds a small portion of this expanding industry.

- Strategic Entry: The acquisition is a deliberate step to gain a foothold and build capabilities within the investment advisory space.

- Future Investment: As a question mark, TradePMR will likely require significant investment to increase market share and move towards becoming a 'star' in Robinhood's portfolio.

Robinhood's expanding product suite, including retirement accounts and the Gold credit card, along with its strategic entry into new markets like tokenized stocks and AI tools, firmly places these ventures in the 'Question Mark' category of the BCG matrix. These are high-growth potential areas where Robinhood is investing heavily but currently holds a relatively small market share.

For example, Robinhood Retirement Accounts saw AUC surge over 200% year-over-year to $14.4 billion in Q1 2025. Similarly, the Gold credit card attracted over 100,000 cardholders by the end of Q4 2024. These figures highlight rapid adoption but also indicate that significant investment is still needed to capture a larger portion of their respective markets.

The company's acquisition of TradePMR in Q1 2025, targeting the RIA market with over $40 billion in assets under administration, also fits this classification. While the market is growing, Robinhood's share within it is nascent, necessitating substantial investment to scale and compete effectively.

These 'Question Marks' represent opportunities for future growth, but their success hinges on strategic resource allocation and market penetration efforts. The long-term viability and market dominance of these offerings remain to be seen.

BCG Matrix Data Sources

Our BCG Matrix leverages comprehensive data from Robinhood's financial filings, industry growth reports, and market share analysis to accurately position each business unit.