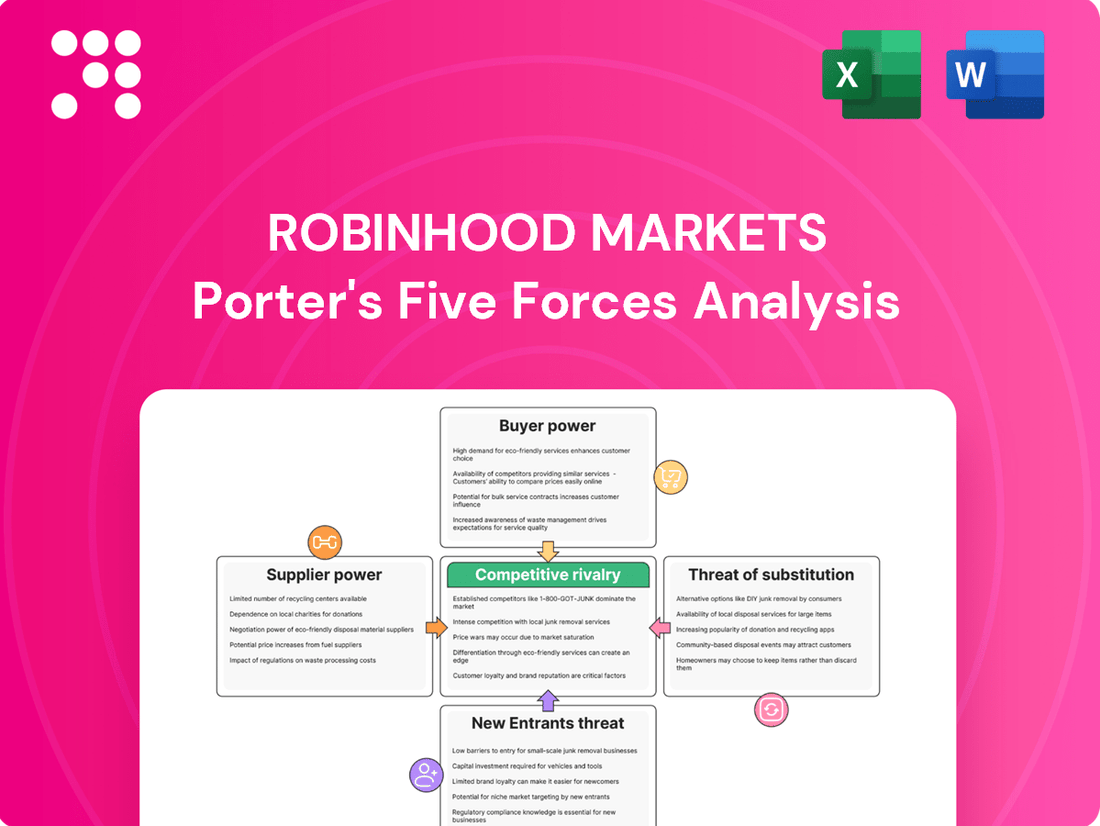

Robinhood Markets Porter's Five Forces Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Robinhood Markets Bundle

Robinhood Markets faces intense competition from established financial institutions and agile fintech startups, significantly impacting its market power. The threat of new entrants is moderate, as regulatory hurdles and brand loyalty create barriers, but the low cost of technology allows for easier market entry. Buyer power is high due to readily available alternatives and the ease of switching platforms.

The complete report reveals the real forces shaping Robinhood Markets’s industry—from supplier influence to threat of new entrants. Gain actionable insights to drive smarter decision-making.

Suppliers Bargaining Power

Robinhood's reliance on a limited number of market makers for its payment for order flow (PFOF) revenue stream grants these entities considerable bargaining power. In 2023, Robinhood reported PFOF revenue of $552 million, a significant portion of its total revenue, highlighting this dependency.

The concentration of PFOF suppliers means that any shifts in their pricing, service terms, or the regulatory landscape impacting PFOF could directly affect Robinhood's financial performance. This concentrated supplier base suggests a moderate to high level of bargaining power for these specialized financial institutions.

Robinhood's operational core relies heavily on its suppliers for real-time market data, news feeds, and sophisticated financial analytics. Without these essential inputs, the platform's ability to offer a seamless and informative trading experience would be severely hampered.

Exchanges and data aggregators, as key suppliers, wield significant bargaining power because they often control proprietary information that is vital for Robinhood's services. This dependence means Robinhood must carefully manage its relationships and contract terms with these data providers.

In 2023, the cost of market data for brokerage firms remained a substantial operational expense. For instance, the fees charged by major exchanges for direct data feeds can run into millions of dollars annually, highlighting the leverage these suppliers possess.

Robinhood's negotiating strength is directly tied to its capacity to find and integrate alternative data sources or to secure data that is uniquely valuable. The more options Robinhood has, the less dependent it is on any single supplier, thereby reducing their bargaining power.

Technology infrastructure providers, such as cloud computing services and cybersecurity solutions, hold moderate bargaining power over Robinhood. A limited number of dominant tech companies supply these critical IT components, making it challenging for Robinhood to switch providers due to the significant costs and complexities involved in migrating large-scale financial systems. For instance, in 2023, the global cloud computing market was valued at over $600 billion, with a few major players like Amazon Web Services (AWS), Microsoft Azure, and Google Cloud dominating a substantial share.

Liquidity Providers for Crypto

Robinhood's cryptocurrency trading relies on liquidity providers, who are crucial for ensuring smooth transactions and competitive pricing. The specialized expertise and capital required for crypto market making mean these providers can wield significant influence.

The bargaining power of these crypto liquidity providers stems from the concentration of specialized market makers and the need for deep order books to facilitate efficient trading. If these providers dictate unfavorable terms, Robinhood's ability to offer competitive crypto trading could be compromised.

- Specialized Market Making: The technical complexity and capital intensity of providing liquidity in the crypto markets limit the number of capable providers, enhancing their leverage.

- Concentration of Providers: A few key firms often dominate crypto market making, giving them more power to negotiate terms with exchanges like Robinhood.

- Impact on Pricing and Execution: Unfavorable terms from liquidity providers can lead to wider bid-ask spreads and slower trade execution, directly affecting Robinhood's customer experience and profitability in its crypto segment.

Financial Institution Partners

Robinhood's reliance on financial institution partners for critical services like cash sweep programs and securities lending grants these partners a degree of bargaining power. These institutions, often large banks and established clearing firms, possess specialized infrastructure and navigate complex regulatory landscapes, which can make them indispensable. For instance, in 2023, Robinhood continued to utilize partners like J.P. Morgan Chase Bank, N.A. for its cash sweep program, a service that allows uninvested customer funds to earn interest.

The specialized nature of services such as clearing and settlement, coupled with the regulatory compliance requirements these partners must meet, contributes to their moderate supplier power. These are not easily replicated services, and switching costs can be significant. Robinhood's operational stability and revenue streams, particularly from interest on cash balances, are directly tied to the effectiveness and reliability of these partnerships.

- Cash Sweep Programs: Partners like J.P. Morgan Chase Bank, N.A. facilitate the earning of interest on uninvested customer funds.

- Securities Lending: Clearing firms are essential for the operational backbone of Robinhood's trading activities, including securities lending.

- Regulatory Compliance: The inherent regulatory burdens on financial institutions can amplify their perceived value and thus their bargaining power.

- Mitigation Strategy: Robinhood's ability to cultivate multiple banking and clearing firm relationships helps to diversify risk and temper individual supplier leverage.

Robinhood's reliance on a limited number of market makers for its payment for order flow (PFOF) revenue stream grants these entities considerable bargaining power. In 2023, Robinhood reported PFOF revenue of $552 million, a significant portion of its total revenue, highlighting this dependency. The concentration of PFOF suppliers means that any shifts in their pricing, service terms, or the regulatory landscape impacting PFOF could directly affect Robinhood's financial performance.

The bargaining power of suppliers for Robinhood is moderate to high, primarily due to the specialized nature of services and the concentration of providers in key areas. For instance, market data providers and technology infrastructure companies often operate in oligopolistic markets, limiting Robinhood's alternatives and increasing supplier leverage. In 2023, the cost of market data for brokerage firms remained a substantial operational expense, with major exchanges charging millions annually for direct data feeds.

Robinhood's dependence on financial institution partners for critical services like cash sweep programs and securities lending also contributes to supplier bargaining power. These partners, often large banks, possess specialized infrastructure and navigate complex regulatory landscapes, making them indispensable. For example, Robinhood continued to utilize partners like J.P. Morgan Chase Bank, N.A. for its cash sweep program in 2023, a service vital for earning interest on uninvested customer funds.

The specialized expertise and capital required for cryptocurrency market making mean that liquidity providers can wield significant influence. Concentration of these providers in the crypto markets gives them more power to negotiate terms, potentially impacting Robinhood's pricing and execution quality in its crypto segment.

What is included in the product

This analysis unpacks the competitive forces impacting Robinhood Markets, examining the threat of new entrants, buyer and supplier power, the threat of substitutes, and the intensity of rivalry within the online brokerage industry.

Robinhood's Porter's Five Forces analysis offers a dynamic, customizable framework to visualize and mitigate competitive pressures, allowing for agile strategic adjustments in a rapidly evolving fintech landscape.

Customers Bargaining Power

Customers can easily switch from Robinhood to other brokerage platforms because many competitors also offer commission-free trading and comparable digital interfaces. This low barrier to entry means users can readily move to a platform offering better features, greater trust, or more specialized services, putting pressure on Robinhood to remain competitive.

The absence of substantial financial penalties or complicated account transfer procedures further contributes to this low customer stickiness. For instance, in 2024, the average customer acquisition cost for fintech companies, including brokerages, remained relatively low, underscoring the ease with which users can explore and adopt new platforms.

Robinhood's initial surge in popularity was a direct result of its commission-free trading, highlighting how sensitive its customer base is to fees. Even without explicit trading commissions, users are keenly aware of and sensitive to other costs such as bid-ask spreads or the quality of trade execution. This means customers will readily move to platforms offering superior overall value.

For instance, in the first quarter of 2024, Robinhood reported a 6% increase in total net revenues to $618 million compared to the previous year, driven by higher asset management fees and net interest revenue, rather than trading commissions. This shift suggests a continued, albeit evolving, price sensitivity where customers are evaluating the total cost of service, not just explicit trading fees.

Any move by Robinhood to introduce new fees, or even the perception of hidden costs, could trigger a significant outflow of users to competing brokerage platforms that offer more transparent pricing or perceived better value. This price sensitivity remains a critical factor in maintaining customer loyalty and market share.

Retail investors today have an unprecedented amount of information at their fingertips. They can easily research and compare brokerage platforms, looking at everything from trading fees to the user-friendliness of the app. This widespread access to data, readily available through financial news sites, review platforms, and social media, significantly reduces the traditional information gap between companies and their customers. For instance, by mid-2024, numerous independent reviews and comparison sites offered detailed breakdowns of Robinhood's offerings against competitors like Fidelity, Charles Schwab, and Webull, highlighting fee structures, available assets, and customer service ratings.

This transparency directly empowers customers. Knowing the various options and their associated costs and benefits means investors can make more informed choices about where to place their capital. They are no longer limited to a single broker due to a lack of knowledge. This ability to easily switch or choose the best platform based on features and pricing gives customers leverage, allowing them to demand better services and competitive pricing from Robinhood and its peers.

Large, Fragmented Customer Base

Robinhood's customer base, while vast, is characterized by its extreme fragmentation. As of the first quarter of 2024, Robinhood reported 23.7 million funded accounts, but each individual investor typically holds a relatively modest account balance. This means no single customer possesses substantial individual leverage to negotiate terms or demand specific services.

However, this doesn't render customers powerless. The collective voice of millions can indeed influence Robinhood. For instance, widespread dissatisfaction expressed on social media platforms or through formal complaints to regulatory bodies can significantly impact the company's brand image and operational strategies, forcing adjustments to policies or product offerings.

The bargaining power of customers in this scenario is thus more about aggregated influence than individual clout.

- Fragmented Base: Millions of individual investors with small account balances limit individual customer bargaining power.

- Collective Influence: Aggregated customer sentiment, amplified through social media and complaints, can pressure Robinhood.

- Reputational Risk: Negative collective sentiment poses a significant risk to Robinhood's brand and customer trust.

Focus on User Experience and Features

Robinhood's customer base, particularly its younger and digitally savvy demographic, prioritizes a seamless user experience and access to innovative trading features. This means customers hold significant power. If a competitor offers a more intuitive platform or a broader selection of assets, like a wider array of cryptocurrencies or more sophisticated trading tools, users can readily switch. For instance, by mid-2024, Robinhood continued to expand its crypto offerings, a direct response to customer demand and competitive pressures.

This constant need for improvement and new functionalities translates into indirect bargaining power for Robinhood's users.

- User Expectations: Younger investors, a core Robinhood demographic, expect intuitive design and cutting-edge features, driving platform innovation.

- Switching Costs: Low switching costs for digital platforms allow users to easily migrate to competitors offering superior user experience or more desired assets.

- Demand for Innovation: The continuous demand for new products, such as expanded cryptocurrency listings or advanced trading tools, empowers customers by pushing Robinhood to adapt and evolve.

- Competitive Landscape: The presence of numerous fintech platforms offering similar services intensifies customer leverage as they can readily find alternatives.

Customers possess significant bargaining power due to the ease with which they can switch between brokerage platforms, especially given that many competitors offer commission-free trading and similar digital interfaces. This low barrier to entry means users can readily move to platforms providing better features or greater trust, pressuring Robinhood to maintain competitiveness. For example, by mid-2024, numerous comparison sites detailed Robinhood's offerings against competitors like Fidelity and Charles Schwab, highlighting fee structures and user experience.

While Robinhood's customer base is vast, with 23.7 million funded accounts as of Q1 2024, it is highly fragmented, meaning no single customer has substantial individual leverage. However, the collective sentiment of millions, amplified through social media and formal complaints, can significantly impact Robinhood's brand and strategy, demonstrating aggregated influence over individual clout.

Robinhood's core demographic, particularly younger investors, prioritizes intuitive design and innovative features, granting customers indirect bargaining power. If a competitor offers a superior user experience or a broader asset selection, such as more cryptocurrencies, users can easily migrate. Robinhood's expansion of crypto offerings by mid-2024 was a direct response to such customer demands and competitive pressures.

Same Document Delivered

Robinhood Markets Porter's Five Forces Analysis

This preview shows the exact document you'll receive immediately after purchase—no surprises, no placeholders. It details Robinhood's competitive landscape through Porter's Five Forces, examining the threat of new entrants, the bargaining power of buyers and suppliers, the threat of substitutes, and the intensity of rivalry within the online brokerage industry. This comprehensive analysis is ready for your immediate use.

Rivalry Among Competitors

The brokerage industry, especially for everyday investors, has experienced a dramatic shift towards zero commissions. This has dramatically ramped up price competition. Robinhood's initial move to offer commission-free trading has now been matched by many larger, established competitors, diminishing its unique selling proposition.

This intense price rivalry puts significant pressure on profit margins. For instance, in 2023, the average retail brokerage commission was effectively zero for most stock and ETF trades across major platforms. This forces companies like Robinhood to find other ways to generate income, such as payment for order flow or subscription services.

Robinhood faces intense competition from a growing wave of fintech startups and challenger brokers. These new entrants frequently mirror Robinhood's commission-free trading model and sleek digital interfaces, directly challenging its core value proposition. For instance, platforms like Webull and M1 Finance have rapidly gained traction by offering specialized features or targeting specific investor demographics, siphoning off potential and existing Robinhood users.

Established players like Charles Schwab, Fidelity, and E*Trade have aggressively adapted by adopting commission-free trading and significantly upgrading their digital offerings. This strategic shift directly challenges Robinhood's core value proposition.

These incumbents benefit from enormous, pre-existing customer bases and a wide array of financial products, giving them a substantial advantage. Their established trust and ability to operate at scale present a formidable barrier.

For instance, Charles Schwab reported $7.9 trillion in total client assets as of December 31, 2023, demonstrating the sheer scale of their operations compared to Robinhood's $8.6 billion in assets under custody as of Q1 2024.

Diversification into Crypto Trading

Robinhood's diversification into crypto trading faces intensified rivalry as more brokerage firms and specialized crypto exchanges offer a broader selection of digital assets. This expansion dilutes Robinhood's initial advantage as a pioneer in accessible crypto trading. For instance, by the end of 2023, the global cryptocurrency market capitalization reached approximately $1.6 trillion, indicating substantial growth and attracting numerous players.

The increased competition means Robinhood's unique selling proposition in the crypto space is less distinct. As platforms like Coinbase, Binance, and even traditional brokerages increasingly support a wider array of cryptocurrencies, the battle for market share in this burgeoning asset class becomes more direct and challenging. This heightened rivalry can put pressure on fees and innovation.

- Increased Competition: More platforms offering crypto trading directly challenges Robinhood's market position.

- Diluted USP: Robinhood's early crypto access advantage is diminishing as competitors catch up.

- Market Growth: The crypto market's significant growth, estimated at over $1.6 trillion in market cap by late 2023, fuels this competitive surge.

Regulation and Compliance Costs

The financial services sector is heavily regulated, and this scrutiny, particularly concerning practices like payment for order flow (PFOF), significantly increases compliance costs and operational complexity for companies like Robinhood. In 2023, the SEC continued to examine PFOF, with proposals that could reshape market structure and add to compliance overhead. This regulatory pressure can be a particular challenge for newer firms, creating a disadvantage compared to larger, established competitors with more extensive compliance departments.

These compliance burdens can disproportionately impact smaller or newer entrants. For instance, the cost of implementing robust compliance systems and adhering to evolving reporting requirements can be substantial. A 2024 report indicated that compliance spending in the fintech sector saw a notable increase, reflecting the growing demands.

- Increased operational complexity due to evolving regulations.

- Disproportionate cost burden of compliance for newer firms like Robinhood.

- Potential for regulatory shifts to alter the competitive landscape.

The competitive rivalry within the online brokerage space is fierce, driven by the widespread adoption of commission-free trading, a model Robinhood pioneered. This has led to a price war, forcing all players, including Robinhood, to seek alternative revenue streams like payment for order flow and subscription services to maintain profitability. For example, by early 2024, most major retail brokerages offered zero commissions on stock and ETF trades, eroding Robinhood's initial competitive edge.

Newer fintech competitors continue to emerge, directly challenging Robinhood with similar user-friendly interfaces and commission-free models. Established giants like Charles Schwab and Fidelity have responded by enhancing their digital platforms and leveraging their vast customer bases and product offerings, creating a significant barrier for Robinhood. By the end of 2023, Charles Schwab managed $7.9 trillion in client assets, dwarfing Robinhood's $8.6 billion in assets under custody as of Q1 2024.

Robinhood's expansion into cryptocurrency trading also faces intense competition from specialized exchanges and other brokers offering a wider array of digital assets. The global crypto market, valued at approximately $1.6 trillion by late 2023, has attracted numerous participants, diminishing Robinhood's early mover advantage. This heightened competition necessitates continuous innovation and can pressure profit margins on crypto services.

SSubstitutes Threaten

Traditional wealth management firms and financial advisors present a significant threat of substitutes for Robinhood. These services cater to investors who prefer or require professional guidance, comprehensive financial planning, and personalized strategies, directly contrasting with Robinhood's self-directed, technology-driven model.

For individuals intimidated by managing their own investments or seeking a higher level of personalized service, these established players offer a compelling alternative. This is particularly true for higher-net-worth individuals who may perceive greater value in the tailored advice and fiduciary responsibilities often associated with traditional advisors.

As of 2024, the assets under management by financial advisors in the US continued to grow, indicating a persistent demand for these services. For instance, the U.S. wealth management industry managed trillions of dollars, with a significant portion of that attributed to clients seeking personalized advice and planning, a segment Robinhood aims to capture but doesn't directly replicate.

Direct investment in physical assets like real estate or precious metals presents a significant threat of substitutes for platforms like Robinhood. These tangible assets appeal to investors seeking diversification away from traditional financial markets, especially those wary of market volatility. For instance, the U.S. residential real estate market saw a median home price increase of 5.5% in April 2024 compared to the previous year, attracting capital that might otherwise flow into brokerage accounts.

For individuals prioritizing safety and predictable returns, traditional savings accounts, money market accounts, and Certificates of Deposit (CDs) present a significant threat of substitution. These options offer capital preservation and guaranteed interest, making them appealing alternatives to the potential volatility of Robinhood's investment offerings, especially for risk-averse investors.

In 2024, the attractiveness of these substitutes is amplified by fluctuating economic conditions. For instance, as interest rates have adjusted, the yields on savings accounts and CDs have become more competitive, potentially diverting funds that might otherwise flow into brokerage accounts. This trend is particularly relevant for investors with a low tolerance for risk or those nearing retirement who prioritize stability.

Peer-to-Peer Lending Platforms

Peer-to-peer (P2P) lending platforms present a distinct threat of substitution for Robinhood Markets by offering an alternative investment channel. These platforms connect individual lenders directly with borrowers, bypassing traditional financial intermediaries and the securities markets Robinhood operates within.

While P2P lending represents a niche market, it attracts investors seeking direct engagement and potentially different risk-return profiles compared to stocks or ETFs. For instance, in 2023, the global P2P lending market was valued at approximately $130 billion, demonstrating a growing appetite for these alternative investment avenues.

- Alternative Investment: P2P platforms allow capital allocation outside of traditional brokerage accounts, directly impacting the pool of funds available for equity investments.

- Direct Engagement: They appeal to investors wanting to directly fund individuals or small businesses, offering a tangible alternative to passive stock ownership.

- Risk-Reward Profile: P2P loans often carry different risk and return characteristics than publicly traded securities, drawing a segment of the investment community.

Alternative Investment Platforms

The emergence of platforms enabling fractional ownership in alternative assets such as private equity, venture capital, art, and fine wine poses a significant threat of substitution. These platforms attract investors seeking diversification beyond conventional public markets, potentially diverting capital that might otherwise be allocated to traditional investments via Robinhood. For instance, platforms like Masterworks have seen substantial growth, with over $1 billion invested in art as of early 2024, showcasing a clear alternative for capital.

These alternative investment platforms provide access to asset classes that were historically illiquid or exclusive to high-net-worth individuals. This democratization of alternative assets broadens investment choices, directly competing with Robinhood's core offerings for investor attention and capital. For example, platforms like Republic have facilitated crowdfunding for startups, allowing everyday investors to participate in venture capital, a segment previously out of reach.

- Fractional Ownership Growth: Platforms offering fractional shares in alternative assets are expanding rapidly, providing new investment avenues.

- Diversification Appeal: These alternatives attract investors looking to diversify beyond stocks and ETFs, directly competing for capital.

- Access to Illiquid Assets: They democratize access to asset classes like private equity and art, previously inaccessible to most retail investors.

The threat of substitutes for Robinhood is multifaceted, encompassing traditional financial services, tangible assets, and emerging alternative investment platforms. These substitutes cater to diverse investor needs, from a desire for professional guidance and capital preservation to seeking diversification in less conventional markets.

Established wealth management firms and financial advisors offer personalized strategies, a direct contrast to Robinhood's self-directed model, and continue to manage trillions in assets as of 2024. Similarly, tangible assets like real estate, which saw a 5.5% median price increase in the US in April 2024, attract capital seeking tangible value and diversification.

Furthermore, the appeal of savings accounts and CDs has grown in 2024 due to adjusted interest rates, offering stability for risk-averse investors. Emerging platforms for fractional ownership in alternative assets like art, with over $1 billion invested via Masterworks by early 2024, also present a growing challenge by democratizing access to previously exclusive investment classes.

Entrants Threaten

The financial services sector, including online brokerages like Robinhood, is subject to stringent oversight from agencies such as the Securities and Exchange Commission (SEC) and the Financial Industry Regulatory Authority (FINRA). These bodies mandate extensive licensing, robust compliance protocols, and significant capital reserves, creating substantial hurdles for newcomers. For instance, FINRA Rule 15c3-1 requires broker-dealers to maintain a minimum net capital of $5,000 or $100,000 depending on the nature of their business, a considerable upfront investment.

Navigating the labyrinth of approvals and establishing the necessary compliant infrastructure is a time-consuming and resource-intensive endeavor. This complexity effectively discourages many potential entrants, acting as a powerful deterrent against new competition entering the market and challenging established players like Robinhood.

Launching a modern brokerage platform like Robinhood necessitates immense capital. We're talking about significant investments in cutting-edge technology for trading, robust cybersecurity to protect user data, and extensive marketing campaigns to even get noticed. For instance, building out the infrastructure for a platform that can handle millions of transactions securely demands hundreds of millions, if not billions, of dollars.

Beyond the initial tech build, regulatory capital requirements are a major hurdle. Financial institutions must maintain specific reserve levels, which can be substantial, especially for platforms dealing with high trading volumes and diverse financial products. This financial barrier effectively screens out many potential competitors who lack the deep pockets needed to enter and sustain operations in this highly regulated space.

Established brokerage firms, including Robinhood, have cultivated significant brand recognition and trust over years of operation. This is absolutely vital in financial services where customers entrust their money and sensitive data. For instance, a 2024 survey indicated that over 60% of retail investors prioritize brand reputation when choosing a brokerage, demonstrating the weight of this factor.

New entrants face a steep uphill battle in quickly earning consumer confidence, particularly concerning the security of funds, data privacy, and overall platform reliability. Without a proven track record, potential customers are often hesitant to switch from familiar and trusted institutions, creating a substantial hurdle for newcomers.

Building a credible and trustworthy brand in the financial sector is a long-term endeavor requiring substantial investment in marketing, customer service, and demonstrable security measures. This lengthy process and the associated costs act as a significant deterrent for many aspiring competitors looking to enter the market.

Technological Complexity and Scalability

The technological complexity and scalability required to operate a modern trading platform present a significant barrier to new entrants. Developing and maintaining a robust, low-latency system capable of handling millions of users and transactions demands substantial investment in sophisticated technology, advanced cybersecurity, and highly scalable infrastructure. For instance, as of early 2024, the financial technology sector continues to see massive investments, with venture capital funding for fintech startups reaching billions globally, underscoring the capital-intensive nature of building competitive platforms.

New players must not only replicate the core functionalities of established firms like Robinhood but also innovate to attract customers. This involves significant expenditure on software development, cloud computing resources, and specialized IT talent. The ongoing need for platform upgrades and security enhancements means that the initial investment is just the beginning; continuous capital allocation is critical to remain competitive and compliant with evolving financial regulations.

- High Upfront Investment: Building a secure, reliable, and fast trading platform requires millions in technology development and infrastructure.

- Cybersecurity Demands: Protecting user data and financial assets necessitates cutting-edge cybersecurity measures, adding to operational costs.

- Scalability Challenges: Platforms must be designed to scale seamlessly with user growth and trading volume, a complex engineering feat.

- Talent Acquisition: Attracting and retaining top-tier software engineers, data scientists, and cybersecurity experts is crucial and costly.

Access to Payment for Order Flow Networks

The threat of new entrants faces a significant barrier in accessing payment for order flow (PFOF) networks. Robinhood's business model is deeply intertwined with these arrangements, which involve market makers paying for the right to execute customer orders. For instance, in 2023, Robinhood reported $1.1 billion in PFOF revenue, highlighting its critical importance.

New platforms aiming to replicate Robinhood's commission-free trading model would need to establish similar relationships with market makers. Securing favorable PFOF terms can be difficult for newcomers, as existing players often have established, mutually beneficial agreements. This access is crucial for generating revenue to offset the costs of offering zero-commission trades.

- Market Maker Relationships: New entrants must build trust and integration with major market makers to participate in PFOF.

- Revenue Dependence: Robinhood's substantial PFOF revenue, approximately 75% of its total revenue in recent periods, underscores the necessity of these networks.

- Competitive Hurdles: The established nature of these PFOF networks creates a significant barrier, making it challenging for new firms to achieve profitability without similar access.

The threat of new entrants in the online brokerage space, like Robinhood, is significantly mitigated by high capital requirements and regulatory hurdles. For example, as of 2024, establishing a compliant brokerage platform requires substantial investment in technology, cybersecurity, and meeting regulatory capital reserves, often in the hundreds of millions of dollars.

Building brand trust and customer loyalty is another major barrier. In 2024 surveys, over 60% of retail investors cited brand reputation as a key factor in choosing a broker, a level difficult for newcomers to achieve quickly.

Access to payment for order flow (PFOF) networks is critical for Robinhood's commission-free model, with PFOF revenue contributing a significant portion of its income. New entrants struggle to secure these vital relationships, as established players often have preferential agreements.

Porter's Five Forces Analysis Data Sources

Our Porter's Five Forces analysis for Robinhood Markets leverages data from Robinhood's own SEC filings, investor relations materials, and earnings call transcripts. This is supplemented by industry-specific research reports from firms like Forrester and Gartner, alongside financial data from Bloomberg and Refinitiv.