Robinhood Markets PESTLE Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Robinhood Markets Bundle

Unravel the complex web of external factors shaping Robinhood Markets's future with our comprehensive PESTLE analysis. From evolving political regulations to shifting economic landscapes and technological advancements, understand the forces driving change. Equip yourself with actionable intelligence to navigate this dynamic environment. Download the full PESTLE analysis now and gain a critical edge.

Political factors

Financial regulators globally are intensifying their scrutiny of payment for order flow (PFOF), a practice central to Robinhood's revenue. For instance, the U.S. Securities and Exchange Commission (SEC) has been actively reviewing PFOF, with Chair Gary Gensler expressing concerns about potential conflicts of interest. This heightened oversight could lead to outright bans or significant restrictions, directly threatening Robinhood's profitability.

The potential impact on Robinhood's business model is substantial. In 2023, PFOF constituted a significant portion of their transaction-based revenue, and any adverse regulatory action could force a costly pivot. Debates surrounding PFOF are ongoing in major markets, with policymakers considering proposals that could fundamentally alter how retail brokers operate and generate income.

Robinhood's cryptocurrency operations are significantly shaped by the evolving stance of governments worldwide on digital asset regulation. Changes in legislation, such as the SEC's ongoing scrutiny of certain tokens as securities, directly impact which cryptocurrencies Robinhood can list and trade, potentially limiting its product offerings and revenue streams. For instance, in early 2024, the regulatory landscape continued to be a key focus, with ongoing discussions about stablecoin regulations and anti-money laundering (AML) requirements for crypto exchanges.

New licensing requirements or outright bans on specific digital assets can create compliance hurdles and operational challenges for Robinhood. For example, if a major market implements strict new rules for crypto custodians or trading platforms, Robinhood would need to adapt its infrastructure and policies, which could incur significant costs or even necessitate withdrawal from that market. The company's ability to expand its crypto services globally hinges on navigating these diverse and often conflicting international regulatory trends.

Political stability in the United States, Robinhood's primary market, directly impacts investor confidence and, by extension, trading volumes. Periods of heightened political uncertainty, such as upcoming elections or significant geopolitical events, can lead to market volatility. This volatility can either spur increased trading activity as investors react to news or cause a pullback as they adopt a more cautious stance, directly affecting Robinhood's transaction-based revenue streams.

Major political events, like the 2024 US presidential election, can significantly influence economic policy, including regulations affecting financial markets and fintech companies like Robinhood. Shifts in government priorities could lead to changes in capital gains taxes, trading fees, or consumer protection laws, all of which have the potential to alter the competitive landscape and investor behavior on the platform. For instance, any proposed changes to the regulatory framework for online brokerages would be closely watched by Robinhood's user base.

Consumer Protection and Investor Safeguards Legislation

New or proposed legislation focused on bolstering consumer protection and investor safeguards presents a significant political factor for Robinhood. Laws emphasizing enhanced risk disclosure, investor education initiatives, and stricter suitability requirements could translate into increased compliance burdens for the company. For instance, in 2024, regulatory bodies continued to scrutinize commission-free trading models, pushing for greater transparency around payment for order flow.

These regulatory shifts may impact Robinhood's customer acquisition and retention strategies by potentially increasing the complexity of onboarding new users or requiring more robust educational resources. As of early 2025, discussions around fiduciary duty standards for retail investment platforms are ongoing, which could necessitate changes to how Robinhood presents investment advice and product suitability.

Key areas of legislative focus include:

- Enhanced Risk Disclosure: Mandates for clearer, more prominent warnings about investment risks, particularly for volatile assets.

- Investor Education Requirements: Potential obligations to provide more comprehensive educational materials and tools to users.

- Suitability Standards: Increased scrutiny on whether investment recommendations or platform features align with individual investor profiles and risk tolerances.

- Payment for Order Flow Transparency: Continued pressure to disclose and potentially limit arrangements that could create conflicts of interest.

International Trade Relations and Market Access

Robinhood's global ambitions are directly tied to international trade relations. For instance, the US's ongoing trade disputes with China, while not directly impacting Robinhood's core US operations, could create a ripple effect, potentially leading to broader economic instability that affects investor sentiment globally. As of early 2024, the landscape of trade agreements remains dynamic, with ongoing negotiations and potential shifts in protectionist policies influencing market access for financial technology firms.

Geopolitical considerations play a significant role in Robinhood's ability to expand. Entering new markets often requires navigating complex regulatory environments and establishing partnerships, which can be hindered by international political tensions. For example, if a country adopts stringent capital controls or data localization requirements due to geopolitical concerns, Robinhood's expansion into that market could be significantly delayed or even blocked. The company must carefully assess these risks, especially as it considers offering its services in regions with evolving political landscapes.

- Trade Agreements: The absence or presence of favorable trade agreements between the US and other nations can directly impact Robinhood's cost of operations and its ability to offer competitive pricing for international users.

- Geopolitical Stability: Regions experiencing political instability or conflict present higher risks for market entry and may deter investment, potentially limiting Robinhood's global reach.

- Market Liberalization vs. Protectionism: A trend towards financial market liberalization would benefit Robinhood by easing entry into new countries, whereas protectionist policies could erect significant barriers.

Political factors significantly shape Robinhood's operational landscape, particularly through intensified regulatory scrutiny. The U.S. Securities and Exchange Commission (SEC) continues to review payment for order flow (PFOF), a core revenue driver, with concerns about conflicts of interest potentially leading to restrictions or bans. This regulatory environment directly impacts Robinhood's business model, as evidenced by PFOF's substantial contribution to its 2023 transaction-based revenue.

The evolving stance on cryptocurrency regulation globally presents another critical political challenge. Changes in legislation, such as the SEC's ongoing examination of tokens as securities, directly affect Robinhood's ability to list and trade digital assets, potentially limiting its product offerings and revenue streams. Navigating diverse international regulatory trends is crucial for the company's crypto expansion, with ongoing discussions in early 2024 focusing on stablecoin regulations and AML requirements.

Political stability in the United States, Robinhood's primary market, directly influences investor confidence and trading volumes. Events like the 2024 U.S. presidential election can lead to policy shifts impacting financial markets, including potential changes to capital gains taxes or trading fee structures. Furthermore, legislative efforts focused on consumer protection, such as enhanced risk disclosure and suitability standards, could increase compliance burdens for Robinhood, as seen in ongoing discussions about fiduciary duty standards in early 2025.

What is included in the product

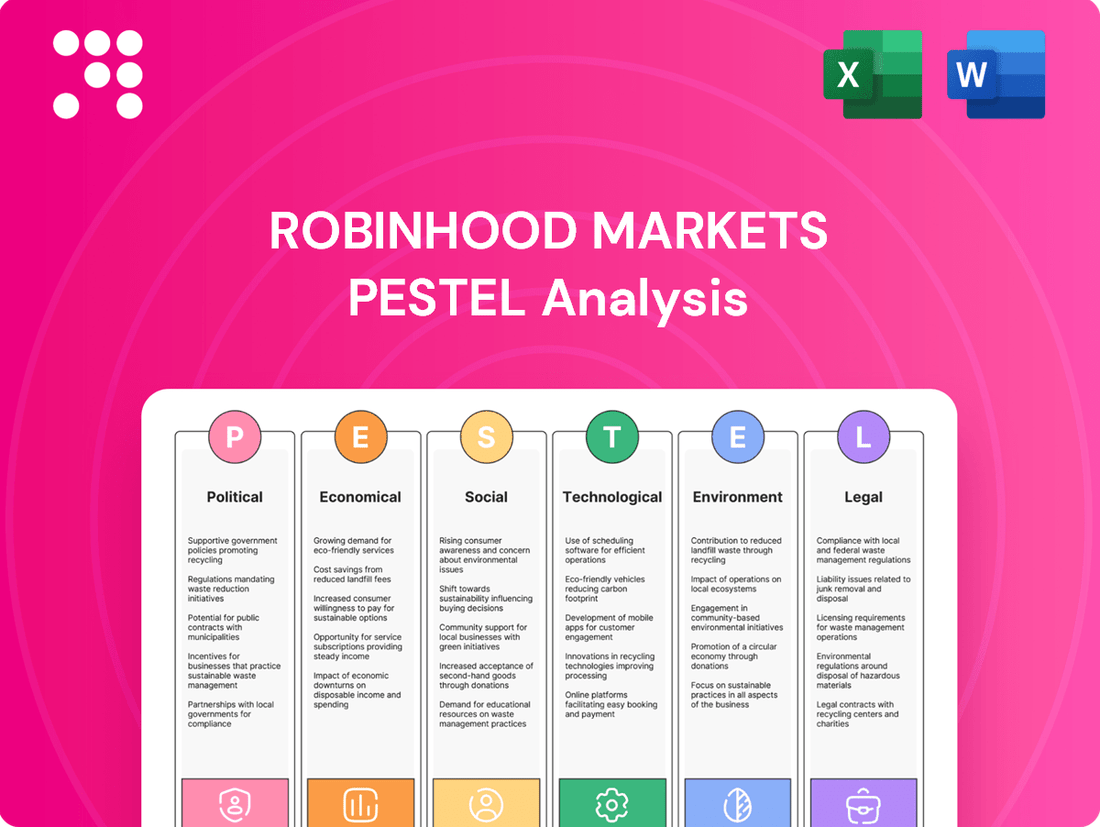

This PESTLE analysis examines the external forces impacting Robinhood Markets, covering Political, Economic, Social, Technological, Environmental, and Legal factors.

It provides a comprehensive understanding of the macro-environment, highlighting key trends and their implications for Robinhood's strategic planning.

A PESTLE analysis for Robinhood Markets acts as a pain point reliver by providing a structured framework to proactively identify and address external threats and opportunities, thereby mitigating potential disruptions and informing strategic decision-making.

This analysis offers a clear, summarized version of Robinhood's external environment, making it easy to reference during meetings and presentations, thus alleviating the pain of complex, unstructured data for quick understanding.

Economic factors

Interest rate fluctuations significantly impact Robinhood's revenue from customer cash. When benchmark interest rates rise, Robinhood earns more on the uninvested cash held in customer accounts, boosting its net interest income. Conversely, lower interest rates compress this vital revenue stream.

For instance, in the first quarter of 2024, Robinhood reported net interest revenue of $174 million, a substantial increase driven by higher prevailing interest rates compared to previous periods. This highlights Robinhood's direct sensitivity to monetary policy, as central bank decisions on rates directly influence its earnings from customer deposits.

Inflation significantly impacts Robinhood's user base by eroding the purchasing power of their disposable income, which is crucial for investment. For instance, if inflation runs at 4% in 2024, the same amount of money buys less, meaning consumers have less discretionary funds available for trading on platforms like Robinhood.

When consumer prices rise sharply, individuals often prioritize essential goods and services, leading to a reduction in discretionary spending. This can translate directly into decreased trading volumes and potentially net outflows from investment accounts as users may need to tap into their savings.

Beyond consumer impact, inflation also affects Robinhood's operational costs. Higher expenses for technology, marketing, and personnel can squeeze profit margins, especially if the company cannot fully pass these costs onto its customers.

Strong economic growth typically fuels higher market valuations and boosts investor confidence, leading to increased trading activity on platforms like Robinhood. For instance, in the first quarter of 2024, the US economy grew at an annualized rate of 1.3%, signaling continued expansion, which generally supports greater participation in financial markets.

Robust employment rates are a key indicator of economic health, directly impacting disposable income and the capacity for individuals to invest. As of April 2024, the US unemployment rate stood at a low 3.9%, demonstrating a healthy labor market that encourages more people to engage with investment platforms.

Conversely, economic slowdowns or rising unemployment can dampen investor sentiment and reduce trading volumes. A significant downturn might see users on platforms like Robinhood become more cautious, potentially reducing their trading frequency or shifting towards more conservative investment strategies.

Market Volatility and Trading Volume

Market volatility directly influences Robinhood's trading volumes and, by extension, its payment for order flow (PFOF) revenue. During periods of heightened market swings, such as those seen in early 2024 driven by inflation concerns and geopolitical events, retail investors often become more active. This increased trading activity translates to more orders flowing through Robinhood's platform, benefiting their PFOF model.

Conversely, prolonged periods of low market volatility can lead to reduced investor engagement. When markets are calm and price movements are minimal, the incentive for frequent trading diminishes, potentially resulting in lower transaction volumes for Robinhood. This can directly impact the revenue generated from PFOF, as fewer trades mean less income from market makers.

- Increased Volatility Fuels Trading: Periods of significant market fluctuation, like those observed in Q1 2024 with the S&P 500 experiencing notable intraday swings, typically correlate with higher user activity on Robinhood.

- PFOF Revenue Sensitivity: Robinhood's revenue from payment for order flow is directly tied to the number of shares traded, meaning higher trading volumes, often spurred by volatility, lead to increased PFOF earnings.

- Low Volatility Impact: Extended periods of low market volatility can lead to a slowdown in retail trading, potentially reducing the volume of orders routed to market makers and thus decreasing PFOF revenue.

- Market Dynamics and Income: The interplay between market sentiment, volatility levels, and investor behavior creates a direct link to Robinhood's transaction-based revenue streams.

Competition in the Brokerage Industry

The online brokerage and fintech landscape is incredibly competitive, putting significant economic pressure on companies like Robinhood. This intense rivalry often forces firms to lower fees, invest heavily in new features, and spend more on marketing to attract and retain customers. For instance, by Q1 2024, many established players had already eliminated commission fees for stock trades, a move Robinhood helped pioneer, intensifying the need for differentiation through other services and user experience.

New entrants and the strategic shifts of large, traditional financial institutions further amplify this competition. These larger players can leverage existing customer bases and substantial capital to quickly roll out competing digital platforms. This dynamic means Robinhood must constantly innovate and manage costs effectively to maintain its market position and profitability amidst these evolving economic pressures.

- Pricing Pressure: The industry-wide shift to zero-commission trading, largely driven by Robinhood's early adoption, has created a baseline expectation for low-cost access to markets, impacting revenue models.

- Demand for Enhanced Features: Competitors are rapidly introducing advanced trading tools, educational resources, and expanded product offerings (like crypto and options trading), compelling Robinhood to continuously upgrade its platform.

- Increased Marketing Expenses: To stand out in a crowded market, brokerage firms are significantly increasing their spending on advertising and promotional campaigns, as seen in the substantial marketing budgets reported by major financial services companies in 2023 and early 2024.

- Market Share Battles: The influx of both fintech startups and established banks entering the digital brokerage space means Robinhood is in a constant battle to capture and hold onto its market share, requiring strategic pricing and product development.

Interest rate changes directly affect Robinhood's earnings from customer cash balances. Higher rates, like the Federal Reserve's benchmark rate hovering around 5.25%-5.50% in early 2024, increase the income Robinhood generates from these uninvested funds.

Inflation impacts users' disposable income, potentially reducing trading activity. For example, a 3.4% inflation rate in April 2024 means consumers have less purchasing power for investments.

Economic growth, such as the 1.3% annualized GDP growth in Q1 2024, generally correlates with increased investor confidence and trading volumes on platforms like Robinhood.

Market volatility, a key driver of retail trading, saw the S&P 500 experience significant intraday swings in early 2024, boosting trading volumes and Robinhood's payment for order flow (PFOF) revenue.

Same Document Delivered

Robinhood Markets PESTLE Analysis

The preview shown here is the exact document you’ll receive after purchase—fully formatted and ready to use. This comprehensive PESTLE analysis of Robinhood Markets delves into the Political, Economic, Social, Technological, Legal, and Environmental factors impacting the company's operations and strategic positioning. Understand the critical external forces shaping Robinhood's future, from regulatory changes to evolving investor behaviors.

Sociological factors

A significant societal shift is the democratization of finance, making investing more accessible than ever. Robinhood has been a key player in this trend, actively lowering barriers to entry for everyday people.

This increased engagement is particularly evident among younger investors, who are drawn to platforms offering simplified, commission-free trading. In 2024, retail investors continued to play a substantial role in market movements, with platforms like Robinhood facilitating this participation.

The social impact of this trend is profound, empowering individuals who might have previously felt excluded from wealth-building opportunities. By removing traditional financial gatekeepers, Robinhood has helped foster a more inclusive investment landscape.

A significant societal need exists for enhanced financial literacy, particularly among the influx of new investors drawn to platforms like Robinhood. Many of these users, often younger and less experienced, may lack foundational knowledge, potentially leading to impulsive or high-risk investment choices. For instance, a 2023 survey indicated that over 60% of Gen Z investors reported making investment decisions based on social media trends, highlighting a critical vulnerability.

Robinhood's approach to investor education directly impacts public perception and attracts regulatory attention. While the company offers some educational content, its effectiveness in mitigating risky behaviors among its user base remains a subject of ongoing debate. The platform's design, which often emphasizes ease of use and gamified trading, can inadvertently encourage speculative activity if not balanced with robust educational support.

The pervasive influence of social media on investment decisions presents a complex challenge. Platforms like TikTok and Reddit can rapidly disseminate investment ideas, sometimes without adequate context or risk disclosure. This phenomenon was starkly evident during the meme stock rallies of 2021, where social media coordination played a pivotal role, underscoring the societal reliance on digital channels for financial information and the associated risks.

Social media platforms like Reddit's WallStreetBets and TikTok have become powerful engines for investment trends, directly impacting platforms like Robinhood. Viral discussions and coordinated efforts can create massive trading volume surges for specific assets, famously seen with the meme stock phenomenon. For instance, GameStop's stock saw unprecedented volatility in early 2021, largely fueled by online communities, leading to a significant increase in Robinhood user activity for that stock.

These decentralized social influences present both opportunities and challenges for Robinhood. Opportunities lie in engaging a younger, digitally native demographic and fostering community-driven investment. However, challenges include managing increased volatility, ensuring investor protection against potentially misleading information, and adapting to rapid shifts in user sentiment driven by online trends.

Changing Work Lifestyles and Gig Economy

The shift towards flexible work arrangements and the burgeoning gig economy significantly influences how individuals manage their finances and engage with investment platforms. As more people embrace freelance work or remote setups, they often experience more variable income streams, fostering a greater need for accessible and self-directed investment tools. This trend is evident in the growing user base of platforms like Robinhood, which cater to a demographic seeking convenience and control over their investments.

The rise of the gig economy, with its emphasis on flexibility and diverse income sources, is reshaping financial behaviors. For instance, in 2024, estimates suggest that the gig economy could account for a substantial portion of the workforce, with some projections indicating over 60 million Americans participating. This demographic, often younger and more tech-savvy, tends to favor mobile-first financial solutions, aligning perfectly with Robinhood's user experience.

- Increased Propensity for Self-Directed Investing: Flexible work often means greater autonomy, encouraging individuals to take a more active role in managing their personal finances, including investments.

- Preference for Mobile-First Platforms: The gig economy workforce, characterized by mobility and digital fluency, gravitates towards user-friendly, app-based investment tools like Robinhood.

- Diverse Income Streams and Investment Strategies: Individuals with multiple income sources may adopt more dynamic investment strategies, seeking platforms that offer ease of access and a wide range of investment options.

- Demographic Shifts: The evolving work landscape is attracting a younger, digitally native user base to investment platforms, influencing platform design and feature development.

Public Perception and Trust in Fintech Platforms

Public perception of fintech platforms, especially after significant events, directly impacts Robinhood's brand and ability to attract new users. For instance, following the GameStop saga in early 2021, Robinhood faced intense scrutiny, leading to a dip in user sentiment and increased regulatory oversight. This highlights how trust, once eroded, is difficult to rebuild.

Societal attitudes toward data privacy and security are increasingly critical. In 2024, consumer concerns about how their financial data is handled are paramount. A 2023 survey indicated that over 60% of consumers are hesitant to share personal financial information with new digital platforms unless robust security measures and clear privacy policies are demonstrated, directly affecting adoption rates for services like Robinhood.

Transparency and reliability are non-negotiable for sustained user confidence. Robinhood's commitment to clear communication and stable platform performance is essential. Reports from late 2024 suggest that fintech platforms with a track record of transparency, particularly regarding trading restrictions and fee structures, tend to retain users more effectively than those perceived as opaque.

- Brand Reputation: Negative public perception, often stemming from controversies like trading halts, can significantly damage Robinhood's brand, deterring potential users and impacting customer loyalty.

- User Acquisition: Trust is a key driver for user acquisition in the competitive fintech landscape. A strong reputation for security and fairness encourages new sign-ups.

- Data Privacy Concerns: Growing societal awareness of data privacy issues means users are more discerning about which platforms they trust with their sensitive financial information.

- Algorithmic Fairness: Perceptions of algorithmic bias or unfairness in trading execution can erode confidence, leading users to seek out more equitable platforms.

The increasing accessibility of financial markets, often termed the democratization of finance, has empowered a new wave of retail investors. This trend, significantly amplified by platforms like Robinhood, has made investing more approachable, particularly for younger demographics. In 2024, retail investors continued to be a substantial force in market activity, with commission-free trading models driving participation.

Financial literacy remains a critical societal concern, especially with the influx of novice investors. Many users, often drawn to the simplified interfaces of platforms like Robinhood, may lack a deep understanding of investment risks. For example, a 2023 study revealed that over 60% of Gen Z investors admitted to making decisions based on social media trends, highlighting a vulnerability to speculative advice.

Social media's pervasive influence on investment decisions presents a complex dynamic for platforms like Robinhood. Viral trends and coordinated online efforts can create significant trading volume surges, as seen with the meme stock phenomenon. This reliance on digital channels for financial information underscores both the opportunities for engagement and the challenges of ensuring investor protection against misinformation.

The evolving nature of work, including the growth of the gig economy and remote employment, influences financial management behaviors. Individuals with more flexible income streams often seek accessible, self-directed investment tools, aligning with the mobile-first approach of platforms like Robinhood. By 2024, projections indicated that the gig economy could involve over 60 million Americans, a demographic adept at utilizing digital financial solutions.

Technological factors

Robinhood's success hinges on its user-friendly mobile app, a key driver for attracting and keeping customers. Innovations in the user interface and experience are crucial for making trading accessible and engaging.

The platform's ability to offer real-time data and personalized features creates a smooth trading journey. For instance, in Q1 2024, Robinhood reported 13.7 million monthly active users, demonstrating the broad appeal of their app's design.

Continuous technological advancements are essential for Robinhood to maintain its competitive edge in the rapidly evolving fintech landscape. Staying ahead means consistently upgrading the app's functionality and responsiveness.

Robinhood's commitment to cybersecurity and data privacy is crucial for safeguarding customer assets and sensitive information. The company faces persistent threats from cyberattacks, necessitating continuous investment in advanced security measures. This includes robust encryption, multi-factor authentication, and sophisticated threat detection systems to maintain user trust and adhere to stringent regulatory requirements.

In 2023, Robinhood reported that cybersecurity and regulatory compliance remained significant operational priorities, with ongoing investments in technology and personnel to combat evolving threats. The financial services industry, in general, saw a substantial increase in cyber threats, with data breaches affecting millions of individuals. For instance, a major financial institution experienced a significant data breach in late 2023, highlighting the industry-wide challenge.

Robinhood is increasingly integrating algorithmic trading and AI to refine its operations. This includes using AI for smarter order routing, which can optimize how customer orders are executed, potentially benefiting from payment for order flow arrangements. For instance, by analyzing market data in real-time, these algorithms can seek the best execution prices for users.

AI also plays a crucial role in enhancing risk management and fraud detection for Robinhood. By identifying unusual trading patterns or account activities, AI systems can help protect both the platform and its users from illicit actions. This technology can also power more personalized investment recommendations, tailoring suggestions to individual user behavior and market conditions.

However, the growing reliance on AI in finance, including for features like personalized recommendations and automated trading strategies, raises ethical questions. Ensuring transparency in how AI makes decisions and avoiding biases that could disadvantage certain user groups are critical considerations for platforms like Robinhood as they advance these technologies.

Scalability of Infrastructure and System Reliability

Robinhood's technological infrastructure faces the critical challenge of scaling to accommodate extreme surges in trading volume, a common occurrence during periods of high market volatility. For instance, during the meme stock phenomenon of early 2021, Robinhood experienced significant outages, impacting user access and trading capabilities. This highlights the need for robust cloud computing solutions and resilient server architecture to ensure continuous service availability.

Maintaining system reliability is paramount for user confidence. When trading platforms fail, especially during crucial market moments, it erodes trust and can lead to substantial financial losses for users. Robinhood's ability to leverage efficient data management and scalable systems directly influences its reputation and customer retention. The company's investment in these areas is crucial for its long-term viability.

Key technological considerations for Robinhood include:

- Cloud Computing Adoption: Utilizing flexible and scalable cloud infrastructure to dynamically adjust resources based on demand.

- Server Architecture: Designing for high availability and redundancy to prevent single points of failure.

- Data Management Efficiency: Optimizing data processing and storage to handle massive transaction volumes without performance degradation.

- Real-time Monitoring: Implementing advanced systems to detect and address potential issues proactively before they impact users.

Blockchain Technology and Cryptocurrency Integration

Advancements in blockchain technology, particularly in scalability and security, directly influence Robinhood's cryptocurrency services. For instance, the continued development of Layer 2 scaling solutions for networks like Ethereum could allow Robinhood to offer more efficient and cost-effective crypto transactions, potentially boosting user engagement. As of early 2024, the total value locked (TVL) in DeFi protocols exceeded $50 billion, indicating a growing market that Robinhood could tap into with further integration.

Improvements in blockchain consensus mechanisms and new token standards also present opportunities for Robinhood to broaden its crypto product suite. The emergence of more robust security protocols can enhance confidence in digital asset custody, a critical factor for a platform like Robinhood. By mid-2024, regulatory clarity around certain token types could further enable Robinhood to list new assets and explore DeFi functionalities, potentially offering users access to yield-generating products or decentralized exchanges.

The integration of blockchain technology has significant implications for Robinhood's operational efficiency and its ability to innovate in the digital asset space.

- Scalability Solutions: Enhanced blockchain throughput, such as through sharding or sidechains, could reduce transaction fees and processing times for Robinhood's crypto trades.

- DeFi Integration: The potential to offer access to decentralized finance protocols could expand Robinhood's revenue streams and user offerings beyond simple buying and selling.

- Asset Custody: Robust blockchain security features are paramount for Robinhood to securely manage customer digital assets, building trust and compliance.

- New Token Standards: The adoption of advanced token standards might allow Robinhood to support a wider variety of digital assets and financial instruments.

Robinhood's user experience is heavily reliant on its intuitive app, with 13.7 million monthly active users in Q1 2024 highlighting its appeal. Continuous technological upgrades are vital for maintaining its competitive edge in the fast-paced fintech sector.

Cybersecurity is a major focus, with ongoing investments in advanced measures like encryption and multi-factor authentication to protect user assets and data, a critical priority in 2023 amidst industry-wide data breaches.

AI integration is enhancing operations through smarter order routing and improved risk management, with potential for personalized recommendations, though ethical considerations around transparency and bias are emerging.

Scalability remains a challenge, as demonstrated by outages during peak volatility periods, underscoring the need for robust cloud computing and resilient server architecture to ensure reliability and user trust.

Legal factors

Robinhood Markets operates under stringent legal obligations, primarily adhering to rules set by the Financial Industry Regulatory Authority (FINRA) and the Securities and Exchange Commission (SEC). These regulations cover critical areas such as investor protection, maintaining market integrity, and ensuring operational transparency.

Failure to comply can result in significant penalties, including hefty fines and legal actions, impacting the company's financial health and reputation. For instance, in December 2020, Robinhood agreed to pay a $65 million fine to FINRA for systemic supervisory failures. The costs associated with maintaining robust compliance programs, including legal counsel and technology investments, are substantial and ongoing.

Payment for Order Flow (PFOF) remains a significant legal and regulatory focal point for Robinhood. The company has faced substantial scrutiny and legal challenges regarding this practice, which involves receiving payments from market makers for directing customer trades to them. For instance, Robinhood settled with the SEC in December 2020 for $65 million over allegations that it misled customers about its PFOF revenue.

Ongoing investigations and potential legislative changes in 2024 and 2025 continue to cast a shadow over PFOF's long-term legality and profitability. Regulators are closely examining whether PFOF truly aligns with best execution standards for retail investors. Any adverse ruling or new legislation could force Robinhood to fundamentally alter its business model, impacting its revenue streams significantly.

The legal risks associated with PFOF are multifaceted, extending beyond SEC actions to potential class-action lawsuits and increased compliance burdens. As of early 2024, the debate continues, with some market participants arguing PFOF benefits retail traders through tighter spreads, while others contend it creates conflicts of interest.

Robinhood operates under a complex web of data privacy laws, including the EU's General Data Protection Regulation (GDPR) and California's Consumer Privacy Act (CCPA). These regulations mandate strict adherence to how customer data is collected, stored, and utilized, with significant fines for non-compliance. For instance, GDPR can impose penalties up to 4% of annual global turnover or €20 million, whichever is higher.

Ensuring robust compliance with these consumer protection mandates is paramount for Robinhood to avoid hefty legal penalties and, crucially, to maintain the trust of its user base. In 2023, the CCPA saw increased enforcement actions, highlighting the growing scrutiny on how companies handle personal information.

The legal implications of data breaches are severe, potentially leading to substantial financial liabilities, regulatory investigations, and lasting damage to brand reputation. Following a significant data incident in late 2020, Robinhood faced regulatory scrutiny and fines, underscoring the critical need for ongoing investment in cybersecurity and data protection protocols.

Cryptocurrency Regulations and Licensing Requirements

The regulatory environment for cryptocurrencies presents a significant challenge for Robinhood. As of early 2024, the U.S. Securities and Exchange Commission (SEC) has continued to assert its authority over digital assets, with many cryptocurrencies potentially being classified as securities. This classification could impose stringent registration and disclosure requirements on Robinhood's crypto offerings, similar to those for traditional securities.

State-level regulations also add complexity, with varying licensing requirements for virtual asset service providers across different jurisdictions. For instance, New York's BitLicense mandates rigorous compliance protocols, impacting the operational costs and feasibility of offering crypto services in specific states. The ongoing debate and potential for new federal legislation in 2024 and 2025 regarding stablecoins, digital asset exchanges, and investor protection further underscore the evolving legal landscape Robinhood must navigate.

- SEC Scrutiny: The SEC's ongoing enforcement actions and pronouncements regarding digital assets as securities create uncertainty and potential legal liabilities for platforms listing them.

- State-Specific Licensing: Compliance with over 40 different state money transmission laws and specific crypto regulations, like the BitLicense in New York, adds significant operational burden.

- Legislative Uncertainty: Anticipated federal legislation in 2024-2025 concerning digital asset market structure and consumer protection could fundamentally alter the compliance requirements for crypto trading.

- Unregistered Securities Risk: Offering cryptocurrencies that are later deemed unregistered securities by regulators could expose Robinhood to substantial fines and legal challenges.

Class-Action Lawsuits and Litigation Risks

Robinhood Markets faces persistent litigation risks, notably class-action lawsuits stemming from past trading disruptions and accusations of market manipulation, particularly during the 2021 meme stock surge. These legal battles can lead to substantial financial penalties and damage the company's reputation. For instance, in early 2024, Robinhood settled a class-action lawsuit related to its 2020 trading restrictions for $65 million, highlighting the significant costs associated with such disputes.

The ongoing threat of litigation diverts crucial management attention and financial resources away from core business operations and growth initiatives. Effective legal defense strategies and proactive compliance measures are therefore essential to mitigate these risks. In 2023, the company incurred significant legal and regulatory expenses, reflecting the ongoing challenges in navigating this complex legal landscape.

- Ongoing Class-Action Lawsuits: Robinhood continues to address legal challenges related to trading outages and past business practices.

- Financial Penalties and Reputational Impact: Litigation can result in substantial fines, as seen in past settlements, and erode customer trust.

- Resource Diversion: Legal defense consumes management time and company capital, potentially hindering strategic development.

- Regulatory Scrutiny: Past events have led to increased regulatory oversight, adding another layer of legal complexity.

Robinhood operates under the watchful eyes of regulators like FINRA and the SEC, facing strict rules on investor protection and market integrity. Non-compliance carries hefty fines; for example, a $65 million settlement with FINRA in December 2020 for supervisory failures. The company also navigated a $65 million SEC settlement in December 2020 concerning misleading disclosures about its Payment for Order Flow (PFOF) practice, a practice still under intense regulatory scrutiny in 2024 and 2025.

Environmental factors

Societal and investor demand for sustainable investments, known as ESG (Environmental, Social, Governance), is a significant environmental factor. By 2024, global ESG assets were projected to exceed $33.9 trillion, highlighting a major market shift.

Robinhood can capitalize on this by offering more ESG-focused ETFs and tools that allow users to track the environmental impact of their portfolios. This strategy could attract the growing segment of environmentally conscious investors, potentially boosting user acquisition and engagement.

Future regulations may mandate companies, including those listed on Robinhood, to disclose climate change-related financial risks. This could mean more detailed reporting on how environmental factors impact their operations and valuations, directly affecting the information available to investors.

Increased scrutiny on corporate environmental, social, and governance (ESG) performance, driven by investor demand and potential regulatory shifts, is likely to influence investment decisions. For instance, a growing preference for sustainable investments could decrease demand for securities from companies with high carbon footprints, impacting trading volumes on platforms like Robinhood.

These disclosure requirements and evolving investor preferences can indirectly shape the broader financial markets. As more climate-related risks are quantified and disclosed, asset pricing may adjust, potentially leading to shifts in sector performance and the types of investment opportunities that gain traction.

Robinhood's digital infrastructure, like any online platform, relies on data centers and network operations that consume significant energy. The environmental footprint of this digital backbone is becoming increasingly scrutinized. For instance, global data center energy consumption is projected to rise, potentially reaching 6-8% of total electricity demand by 2025, according to some industry reports, highlighting the scale of the issue.

There's mounting pressure on technology companies, including financial services firms like Robinhood, to adopt more energy-efficient practices and transition to renewable energy sources. This push comes from regulators, investors, and consumers alike, all seeking to curb the environmental impact of digital services. Companies are exploring ways to optimize server usage and invest in greener energy solutions to power their operations.

Failure to address these environmental concerns can pose both reputational and operational risks for Robinhood. A strong environmental, social, and governance (ESG) profile is increasingly important for investor confidence and brand loyalty. In 2024, many investors are actively looking at a company's sustainability efforts when making investment decisions, meaning Robinhood's approach to energy consumption could directly influence its market perception and operational costs.

Waste Management from Electronic Devices

The proliferation of electronic devices, essential for accessing Robinhood's trading platform, contributes to the growing global challenge of e-waste. While Robinhood itself is a digital service, the lifecycle of the hardware used by its millions of customers and employees has environmental implications. The United Nations reported that global e-waste reached 62 million tonnes in 2020, a figure projected to increase.

This indirect environmental impact stems from the manufacturing, energy consumption, and disposal of smartphones, computers, and other devices. As a company deeply embedded in the digital economy, Robinhood's operational footprint is largely tied to the energy usage of its data centers and the hardware its workforce relies on.

Robinhood can mitigate its contribution to e-waste through several avenues:

- Promoting energy-efficient device usage: Encouraging customers and employees to use devices longer and optimize settings can reduce the demand for new hardware.

- Implementing sustainable procurement policies: For internal hardware needs, prioritizing refurbished or energy-certified devices can lessen environmental impact.

- Partnering with e-waste recycling initiatives: Collaborating with organizations that responsibly manage electronic waste can help divert discarded devices from landfills.

- Educating stakeholders: Raising awareness among users and employees about the environmental impact of electronics can foster more responsible consumption habits.

Reputational Impact of Environmental Stance

Robinhood's environmental stance significantly shapes its brand image. Environmentally conscious investors, a growing demographic, increasingly scrutinize companies' sustainability practices. A proactive approach to environmental responsibility can foster brand loyalty and attract this segment, whereas perceived indifference can lead to negative sentiment. For instance, in 2023, a significant portion of retail investors, particularly younger demographics, indicated they would divest from companies with poor environmental records.

A strong corporate social responsibility (CSR) framework, particularly concerning environmental factors, can translate into tangible benefits for Robinhood. Positive public perception stemming from environmental initiatives can mitigate reputational damage during market volatility or regulatory scrutiny. Conversely, a failure to address environmental concerns could alienate a key customer base and invite criticism from advocacy groups, potentially impacting user acquisition and retention.

The financial services industry, including brokerage platforms like Robinhood, faces growing pressure to demonstrate environmental stewardship. This pressure comes from investors, regulators, and the public alike.

- Brand Enhancement: A clear commitment to sustainability can attract environmentally aware investors, boosting brand appeal.

- Risk Mitigation: Proactive environmental management can prevent negative publicity and potential boycotts.

- Investor Demand: In 2024, ESG (Environmental, Social, and Governance) investing continued to see substantial inflows, highlighting the financial relevance of environmental factors.

- Competitive Advantage: Demonstrating strong environmental credentials can differentiate Robinhood from competitors in a crowded market.

Growing investor demand for ESG-aligned investments, projected to reach over $33.9 trillion globally by 2024, presents a significant opportunity for Robinhood to enhance its offerings with ESG-focused ETFs and portfolio impact tracking tools. Increased regulatory focus on climate-related financial disclosures by 2025 will necessitate greater transparency from listed companies, directly influencing investment information available on the platform.

Robinhood's digital operations, including data centers, contribute to energy consumption, with global data center energy demand expected to rise significantly by 2025, underscoring the need for energy-efficient practices and renewable energy adoption. The company's indirect environmental footprint also extends to e-waste, as global e-waste volumes continue to climb, highlighting the importance of promoting device longevity and responsible disposal.

A strong environmental, social, and governance (ESG) profile is crucial for Robinhood's brand image and investor confidence, especially as a notable percentage of retail investors in 2023 indicated a preference for divesting from companies with poor environmental records. Proactive environmental stewardship can provide a competitive advantage and mitigate reputational risks, particularly as investor demand for sustainable investments remains robust in 2024.

PESTLE Analysis Data Sources

Our Robinhood PESTLE analysis is built upon a robust foundation of data from official regulatory bodies like the SEC, financial market data providers such as Bloomberg and Refinitiv, and reputable economic forecasting agencies. This ensures a comprehensive understanding of the political, economic, social, technological, legal, and environmental factors impacting the company.