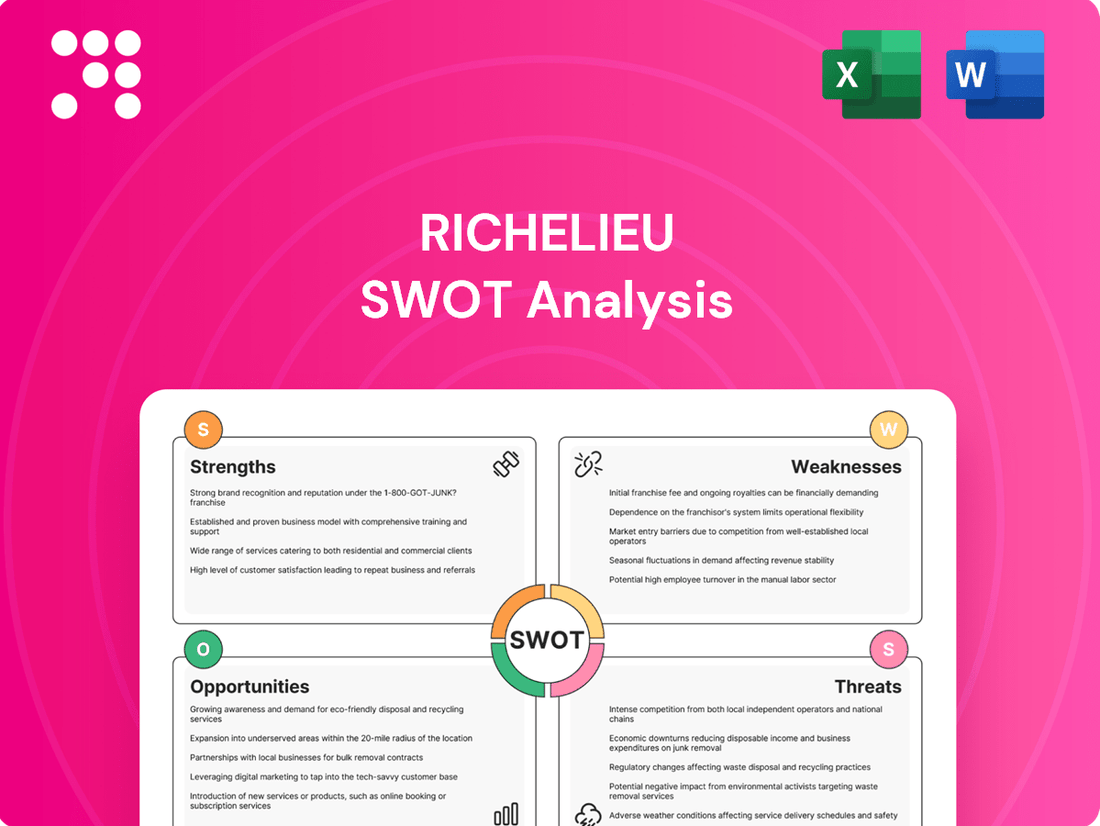

Richelieu SWOT Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Richelieu Bundle

While Richelieu's strong brand reputation and diverse product offerings present significant strengths, understanding the full picture of its market position requires a deeper dive. Our comprehensive SWOT analysis reveals critical opportunities for expansion and potential threats that could impact future growth.

Want the full story behind Richelieu's competitive advantages, potential weaknesses, and strategic growth drivers? Purchase the complete SWOT analysis to gain access to a professionally written, fully editable report designed to support your strategic planning and investment decisions.

Strengths

Richelieu boasts an impressive North American footprint, with a network of over 116 centers. This extensive reach includes 52 locations in Canada, complemented by three manufacturing plants, and 64 centers strategically positioned throughout the United States. This broad geographical presence is a significant asset, enabling efficient service to a wide customer base and ensuring timely distribution of their diverse product offerings.

Richelieu's diverse product portfolio, boasting over 145,000 specialized hardware and complementary items, is a significant strength. This vast selection positions the company as a convenient one-stop-shop for a wide array of customers.

By catering to distinct market segments such as furniture and cabinet makers, renovation superstores, and both residential and commercial woodworkers, Richelieu effectively broadens its customer base and revenue streams. This comprehensive offering mitigates reliance on any single market niche.

Richelieu's strong acquisition strategy is a key strength, evidenced by its active pursuit of complementary businesses. The company successfully integrated several acquisitions throughout 2024 and into early 2025. Notable examples include Mill Supply, Darant Distributing, and Midwest Specialty Products.

These strategic additions have directly fueled sales growth, with acquired entities contributing meaningfully to the top line. Furthermore, these acquisitions have effectively broadened Richelieu's market reach and deepened its penetration within crucial product categories, solidifying its competitive position.

Resilient Financial Position

Richelieu demonstrates a robust financial standing, characterized by substantial working capital and a favorable current ratio. This financial resilience allows the company to navigate market fluctuations and pursue growth opportunities effectively.

As of February 28, 2025, Richelieu reported working capital amounting to $613.2 million. This figure underscores the company's strong liquidity and its capacity to meet short-term obligations with ease.

Furthermore, the company maintained a current ratio of 2.9:1 at the same reporting period. This healthy ratio indicates that Richelieu possesses more than double the current assets needed to cover its current liabilities, signifying excellent short-term financial health and operational stability.

This strong financial position provides Richelieu with significant flexibility to invest in strategic initiatives, explore potential acquisitions, and manage its operations efficiently, contributing to its overall competitive advantage.

Focus on Manufacturer Segment Growth

Richelieu Hardware has shown impressive growth by concentrating on the manufacturer segment. This strategic focus has translated into tangible financial results, with sales in this key area increasing by 9.9% in the first quarter of 2025. A significant portion of this growth, 5.1%, was organic, highlighting the company's ability to capture market share through its own operational strengths.

This dedication to serving manufacturers, combined with the provision of valuable supporting services, creates a strong foundation for consistent revenue generation. It also solidifies Richelieu's position as a leader within this important market niche.

- Manufacturer Segment Sales Growth: 9.9% in Q1 2025.

- Internal Growth within Segment: 5.1% in Q1 2025.

- Strategic Advantage: Focus on manufacturers coupled with value-added services drives stable revenue.

- Market Position: Reinforces market leadership through targeted segment growth.

Richelieu's extensive North American network, comprising over 116 centers and three manufacturing plants, provides a significant competitive advantage. This broad geographical presence, with 52 centers in Canada and 64 in the United States, ensures efficient customer service and product distribution.

The company's vast product offering, exceeding 145,000 specialized hardware items, positions it as a convenient one-stop shop for a diverse clientele. This comprehensive selection caters to various market segments, including furniture and cabinet makers, renovation centers, and woodworkers, thereby diversifying revenue streams and reducing reliance on any single market.

Richelieu's proactive acquisition strategy has been a key growth driver, with successful integrations of businesses like Mill Supply, Darant Distributing, and Midwest Specialty Products in 2024 and early 2025. These acquisitions have directly boosted sales and expanded market reach.

Financially, Richelieu is robust, reporting $613.2 million in working capital as of February 28, 2025, and a strong current ratio of 2.9:1. This financial health provides the flexibility for strategic investments and operational management.

| Strength | Description | Supporting Data |

|---|---|---|

| Extensive Network | Broad geographical presence across North America. | Over 116 centers (52 Canada, 64 US), 3 manufacturing plants. |

| Diverse Product Portfolio | One-stop-shop for specialized hardware. | Over 145,000 items. |

| Strategic Acquisitions | Growth through integration of complementary businesses. | Acquisitions in 2024-2025 (e.g., Mill Supply, Darant Distributing). |

| Financial Strength | Strong liquidity and operational stability. | $613.2M working capital (Feb 28, 2025), 2.9:1 current ratio. |

What is included in the product

Delivers a strategic overview of Richelieu’s internal and external business factors, highlighting key strengths, weaknesses, opportunities, and threats.

Offers a clear, structured framework to identify and address strategic weaknesses, alleviating the pain of uncertainty.

Weaknesses

Richelieu's financial performance shows a concerning trend of declining net income despite overall sales growth. For instance, in the first quarter of 2025, net income attributable to shareholders saw an 8.6% drop compared to the previous year. This decline is attributed to increased amortization and financial costs stemming from recent expansion and acquisition activities.

Furthermore, the company is grappling with margin pressure, particularly from its newer acquisitions, which are impacting overall profitability. This squeeze on margins, coupled with rising operational expenses, presents a significant challenge to maintaining robust earnings.

Richelieu is experiencing a weakness in its stagnant retail sales, particularly within the hardware retailer and renovation superstore segments. Sales to these channels have shown a lack of growth, with some areas even seeing a downturn.

In the first quarter of 2025, sales to this specific market remained flat when compared to the same period in 2024. Furthermore, the company reported a significant 22.3% decrease in U.S. retailer sales during Q1 2025, highlighting a challenging environment for this part of their business.

Richelieu's growth strategy, heavily reliant on acquisitions, introduces significant integration complexities. Successfully merging new entities into existing operational and financial frameworks is crucial but often challenging, potentially disrupting established workflows and financial reporting.

The company has experienced margin compression, partly due to the integration of acquisitions with inherently lower profit margins. These lower-margin contributions, coupled with increased operational overheads like the necessary expansion of distribution infrastructure to support these new entities, directly impact overall profitability.

Dependency on Construction and Renovation Market Cycles

Richelieu's performance is intrinsically linked to the ebbs and flows of the construction and renovation sectors. A downturn in these areas, as seen with the sluggish renovation market in the first quarter of 2025, can directly translate into reduced sales and profitability for the company.

This dependency means that economic cycles heavily influence Richelieu's revenue streams. For instance, a slowdown in new housing starts or a decrease in consumer spending on home improvements directly impacts demand for Richelieu's products.

- Market Sensitivity: Richelieu's sales are highly sensitive to the health of the housing and renovation markets.

- Q1 2025 Impact: The company experienced the direct effects of a stagnant renovation market in Q1 2025, highlighting this vulnerability.

- Economic Cycle Risk: Fluctuations in the broader economy, particularly those affecting consumer confidence and disposable income for home projects, pose a significant risk.

Impact of Increased Operational Costs

Richelieu is experiencing pressure on its profitability due to rising operational costs. This includes a noticeable increase in amortization expenses, which directly impacts the cost of goods sold. For instance, in the first quarter of 2024, amortization expenses rose by 7.6% compared to the same period in 2023, reaching $18.5 million.

Furthermore, the company is investing more heavily in marketing for its new product lines, contributing to higher selling, general, and administrative expenses. These increased marketing expenditures, while aimed at future growth, can temporarily reduce profit margins if not offset by corresponding sales increases. In Q1 2024, marketing costs saw a 12% year-over-year increase.

- Increased Amortization Expenses: A 7.6% rise in Q1 2024, impacting cost of goods sold.

- Higher Marketing Costs: A 12% increase in Q1 2024 for new product launches.

- Pressure on Profit Margins: Rising expenses can erode profitability if not managed effectively.

Richelieu faces significant challenges with its integration of acquired businesses, leading to operational complexities and potential disruptions. The company's reliance on acquisitions for growth means that the success of these integrations directly impacts overall performance and efficiency.

Margin compression is a notable weakness, exacerbated by the inclusion of lower-margin acquisitions and rising operational overheads. These factors put pressure on the company's profitability, especially as it expands its distribution infrastructure to support new entities.

The company's performance is highly susceptible to the cyclical nature of the construction and renovation industries, with a stagnant renovation market in Q1 2025 directly impacting sales. Economic downturns or reduced consumer spending on home improvements pose a considerable risk to Richelieu's revenue streams.

Richelieu is also experiencing increased operational costs, including a 7.6% rise in amortization expenses in Q1 2024 and a 12% increase in marketing costs for new product lines during the same period. These rising expenses can negatively affect profit margins if not offset by sales growth.

Preview the Actual Deliverable

Richelieu SWOT Analysis

The preview you see is the actual Richelieu SWOT analysis document you’ll receive upon purchase—no surprises, just professional quality and comprehensive insights.

This is a real excerpt from the complete Richelieu SWOT analysis. Once purchased, you’ll receive the full, editable version, ready for your strategic planning.

You’re viewing a live preview of the actual Richelieu SWOT analysis file. The complete version, detailing all strategic elements, becomes available after checkout.

Opportunities

The persistent housing shortage across North America, particularly in key markets, is a major tailwind for Richelieu. This scarcity is driving demand for new construction and, crucially, for renovations as homeowners look to optimize existing living spaces. This trend is expected to accelerate, with the renovation market poised for a strong recovery in 2025, according to industry forecasts.

This recovery translates directly into increased demand for Richelieu's core product offerings. We anticipate a surge in orders for kitchen cabinets, closet systems, and various storage solutions as homeowners invest in upgrades. Furthermore, the commercial renovation sector is also showing signs of robust activity, presenting another avenue for growth as businesses refresh their spaces.

Richelieu's history of successful acquisitions provides a clear path for ongoing expansion into new territories and the broadening of its product portfolio. This strategy has consistently delivered growth.

The company demonstrated this commitment by finalizing several key acquisitions in late 2024 and early 2025. These strategic moves are projected to contribute roughly $100 million in new annual sales, significantly boosting revenue streams.

Richelieu's acquisition of Midwest Specialty Products, a company specializing in premium quartz and porcelain slabs, highlights a significant opportunity to tap into high-margin niche markets. This strategic move allows Richelieu to cater to a discerning clientele, including architects and luxury home builders, who demand superior quality and unique materials.

By focusing on these specialized segments, Richelieu can command higher price points and improve its overall profitability. The demand for premium surfacing materials in the luxury construction sector remains robust, with the global engineered stone market projected to reach USD 28.5 billion by 2028, growing at a CAGR of 5.2%.

Leveraging Technology and Digital Solutions

The hardware and distribution sectors are ripe with opportunities stemming from advanced technologies such as smart connected devices, artificial intelligence (AI), and machine learning. Richelieu can strategically invest in these digital solutions and automation to streamline its operations, elevate customer engagement, and bolster the robustness of its supply chain. For instance, by integrating AI into inventory management, a company like Richelieu could potentially reduce stockouts by an estimated 15-20% based on industry trends observed in late 2024.

Embracing these technological advancements allows Richelieu to not only optimize internal processes but also to create more personalized and efficient experiences for its clientele. This could translate into faster order fulfillment and more insightful product recommendations, driving customer loyalty. The global market for AI in supply chain management alone was projected to reach over $10 billion by 2025, indicating a significant growth area for investment.

- Smart Connected Devices: Implementing IoT solutions for real-time inventory tracking and condition monitoring across the distribution network.

- AI and Machine Learning: Utilizing predictive analytics for demand forecasting and optimizing logistics routes to reduce transportation costs by up to 10%.

- Digital Solutions: Investing in e-commerce platforms and customer relationship management (CRM) systems to enhance the online shopping experience and gather valuable customer data.

- Automation: Exploring robotic process automation (RPA) for administrative tasks and automated warehousing systems to improve efficiency and reduce labor costs.

Strengthening Retailer Segment through Initiatives

Richelieu is actively investing in its retail segment, aiming to revitalize sales through strategic in-store enhancements. These efforts include the deployment of new, modern display units designed to attract and engage shoppers. This focus on improving the physical retail experience is a key element of their strategy to bolster performance in this crucial channel.

The company is also expanding its product assortment, introducing new lines that are intended to resonate with retail customers and drive incremental purchases. This product diversification is a direct response to market trends and consumer demand, with a particular emphasis on strengthening their position within the Canadian market. For example, in Q1 2024, Richelieu reported a 3.5% increase in sales to the retail segment, which they attribute in part to these ongoing initiatives.

- Enhanced In-Store Presentation: Installation of new display units to improve customer engagement and product visibility.

- Product Line Expansion: Introduction of new products to cater to evolving retail customer preferences.

- Canadian Market Focus: Specific initiatives targeting growth and improved performance in Canadian retail channels.

- Sales Growth Contribution: These efforts are designed to directly impact and increase sales within the retail segment, as evidenced by early positive indicators in 2024.

The ongoing housing shortage across North America, coupled with a strong renovation market recovery expected in 2025, presents a significant opportunity for Richelieu. This demand fuels increased sales of their core products like kitchen cabinets and storage solutions, extending to the commercial renovation sector as well.

Strategic acquisitions, such as the Midwest Specialty Products deal, allow Richelieu to enter high-margin niche markets like premium quartz and porcelain slabs, catering to luxury builders and architects. This focus on specialized segments is supported by the global engineered stone market's projected growth to USD 28.5 billion by 2028.

Leveraging advanced technologies like AI and IoT in hardware and distribution can streamline operations, enhance customer engagement, and bolster the supply chain. For example, AI in inventory management could reduce stockouts by an estimated 15-20%, aligning with the projected over $10 billion market for AI in supply chain management by 2025.

Richelieu's investment in its retail segment, including new display units and product line expansions, aims to revitalize sales. Early indicators show positive momentum, with a 3.5% increase in retail sales reported in Q1 2024, demonstrating the effectiveness of these in-store enhancements and market focus strategies.

Threats

The volatile global economic landscape, marked by persistent inflation and shifting interest rates, presents a considerable threat to Richelieu. For instance, in early 2024, inflation rates in key markets remained elevated, impacting consumer spending power and increasing operational costs.

Rising expenses for essential inputs like transportation, fuel, and raw materials directly affect distributors such as Richelieu, potentially compressing their profit margins. The Canadian Consumer Price Index (CPI) saw a notable increase in the first half of 2024, highlighting these cost pressures.

Geopolitical tensions and the potential for increased tariffs present a significant threat, as they can directly impact import costs and force pricing adjustments. While Richelieu's exposure to Chinese imports is relatively low, with less than 20% of U.S.-bound products originating there, broader global instability can still disrupt supply chains and create unforeseen cost increases.

Richelieu's reliance on global supply chains presents a significant threat. The interconnectedness means that events like international conflicts, such as the ongoing geopolitical tensions impacting shipping routes in the Red Sea, or natural disasters, like the severe weather events in Asia that can affect manufacturing hubs, can cause widespread delays. For instance, in 2023, the global shipping industry experienced significant disruptions, leading to increased freight costs and extended delivery times, which directly impacts inventory availability and can delay product launches for companies like Richelieu.

Intense Competition and Direct-to-Manufacturer Trends

The distribution sector is highly competitive, with numerous players vying for market share. This environment presents a significant challenge for Richelieu, requiring constant innovation and efficiency to maintain its position.

A notable trend is the rise of direct-to-manufacturer (D2M) sales, where manufacturers increasingly bypass traditional distribution channels to reach end-users, particularly contractors. This shift intensifies competition and can erode the value proposition of distributors like Richelieu.

For instance, in the building materials sector, which Richelieu serves, the D2M trend is accelerating. Some manufacturers are leveraging e-commerce platforms and dedicated sales teams to connect directly with construction firms, potentially bypassing intermediaries and impacting Richelieu's sales volume and margins. This trend was evident in industry reports throughout 2024, highlighting a growing preference for streamlined supply chains among certain customer segments.

- Intensified Competition: The presence of numerous distributors and the emergence of D2M models create a crowded marketplace.

- Erosion of Margins: Direct sales by manufacturers can lead to price pressures, impacting profitability for traditional distributors.

- Market Share Risk: Failure to adapt to D2M trends could result in a loss of market share to more agile competitors or manufacturers themselves.

Labor Market Challenges

Richelieu faces significant labor market challenges. A tight labor market, with worker shortages becoming more prevalent, can hinder expansion and increase recruitment costs. For instance, in Canada, the unemployment rate hovered around 5.8% in early 2024, indicating a competitive environment for talent.

The increasing need for upskilling due to automation also presents a hurdle. As technology evolves, employees require new competencies, necessitating investment in training programs. This is particularly relevant for distribution companies like Richelieu, where warehouse automation is on the rise.

Managing a hybrid workforce adds another layer of complexity. Balancing the needs of remote and in-office employees, ensuring productivity, and maintaining company culture requires careful strategic planning and can lead to increased operational costs.

These factors collectively contribute to higher operational expenses and potential disruptions for Richelieu's distribution network.

Richelieu must navigate a highly competitive distribution landscape, exacerbated by manufacturers increasingly adopting direct-to-manufacturer (D2M) sales models, particularly impacting sectors like building materials. This trend, observed throughout 2024, challenges traditional distributors by potentially eroding margins and market share. Furthermore, a tight labor market, with Canada's unemployment rate around 5.8% in early 2024, coupled with the need for employee upskilling due to automation, drives up operational costs and recruitment challenges.

| Threat Category | Specific Threat | 2024 Data/Trend | Impact on Richelieu |

|---|---|---|---|

| Market Competition | Direct-to-Manufacturer (D2M) Sales | Accelerating in building materials sector; manufacturers leveraging e-commerce. | Potential loss of sales volume and margin compression. |

| Labor Market | Worker Shortages & Upskilling Needs | Canada's unemployment rate ~5.8% (early 2024); increasing need for automation-related skills. | Higher recruitment costs, potential operational disruptions, training investment. |

| Economic Volatility | Inflation & Rising Input Costs | Elevated inflation impacting consumer spending; notable CPI increases in Canada (H1 2024). | Compressed profit margins due to increased transportation, fuel, and raw material costs. |

SWOT Analysis Data Sources

This Richelieu SWOT analysis is informed by a robust blend of data, including the company's official financial reports, comprehensive market research, and expert industry analysis. These sources provide a solid foundation for understanding Richelieu's current position and future potential.