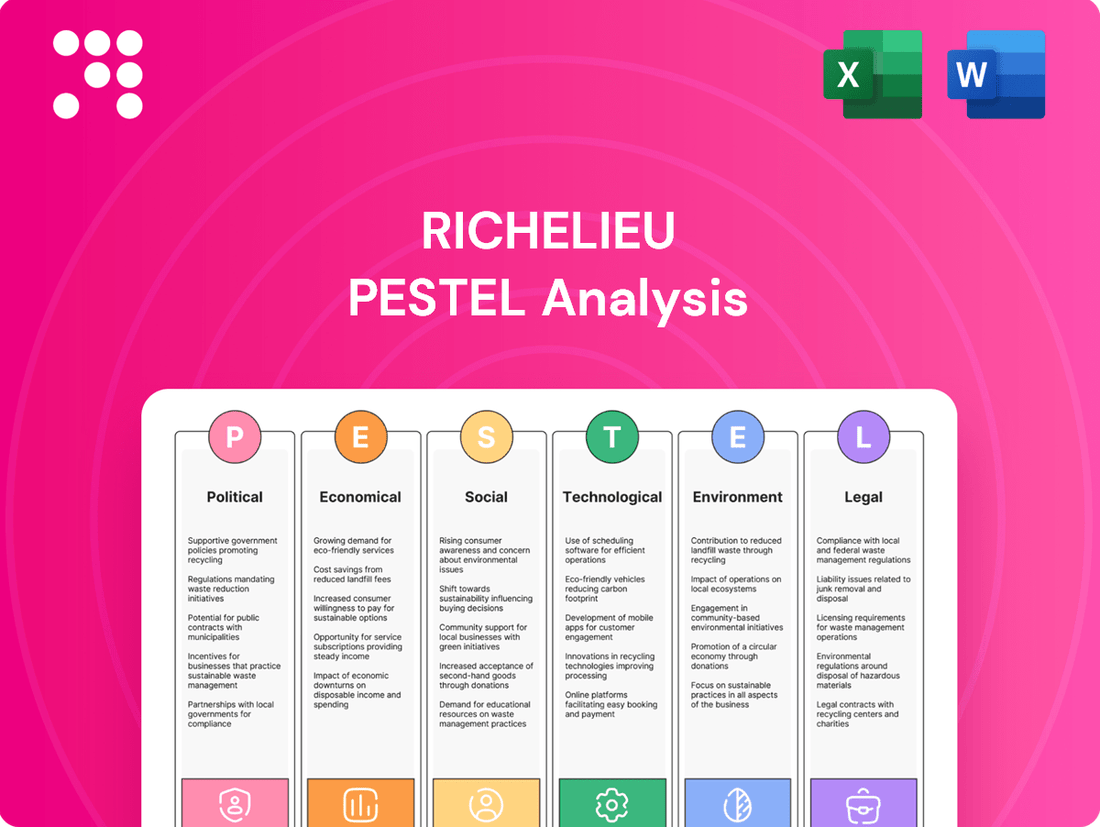

Richelieu PESTLE Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Richelieu Bundle

Gain a critical understanding of the external forces shaping Richelieu's trajectory with our comprehensive PESTLE analysis. Uncover the political, economic, social, technological, legal, and environmental factors that present both opportunities and challenges. Equip yourself with actionable intelligence to refine your strategic approach. Download the full PESTLE analysis now and secure your competitive advantage.

Political factors

Richelieu's operations across North America are significantly shaped by trade agreements like the USMCA. In 2025, the landscape is further complicated by new tariffs, such as the United States' increased duties on Canadian steel and aluminum, which directly impact Richelieu's material sourcing costs and the overall price competitiveness of its products.

These evolving trade policies require Richelieu to be agile, adapting procurement strategies and optimizing distribution networks to navigate potential cross-border disruptions. For instance, a 10% tariff on imported steel could add millions to Richelieu's cost of goods sold if not effectively managed through alternative sourcing or hedging.

The U.S. Bipartisan Infrastructure Law, enacted in 2021, allocates over $1.2 trillion for infrastructure improvements, with a significant portion dedicated to roads, bridges, and public transit. This substantial government commitment directly fuels demand for construction materials, benefiting companies like Richelieu that supply hardware and related products for these projects.

Canada's federal budget 2024 also emphasizes infrastructure, proposing billions in investments targeting green infrastructure, public transit, and affordable housing. These ongoing and planned expenditures across North America create a robust market environment, translating into increased sales opportunities for Richelieu as construction activity accelerates.

The regulatory environment in North America, particularly concerning complex permitting and evolving building codes, presents both hurdles and advantages for Richelieu. Navigating these regional and national regulations is crucial for maintaining product compliance and ensuring operational efficiency. For instance, the introduction of the 2024 Ontario Building Code, effective in 2025, aims to streamline processes and harmonize with national standards, potentially easing regulatory burdens for companies like Richelieu operating in the region.

Political Stability and Economic Certainty

Political stability in Canada and the United States significantly impacts business confidence and investment decisions for companies like Richelieu. For instance, the 2024 US election cycle, with potential shifts in economic policy, could introduce market volatility. A stable political landscape ensures predictable market conditions, vital for Richelieu's long-term strategic planning and maintaining resilient supply chains.

Changes in government incentives or trade policies, such as those experienced during past trade disputes, can create uncertainty. In 2024, ongoing discussions around North American trade agreements continue to be a key factor influencing cross-border business operations. Predictable policy environments are essential for fostering investment and ensuring the smooth flow of goods and services.

Richelieu's operations are directly affected by the political climate in its key markets.

- Canada-US trade relations: Continued stability in trade agreements supports Richelieu's import/export activities.

- Government incentives: Changes in tax credits or subsidies for manufacturing or distribution could impact operational costs and investment decisions.

- Regulatory environment: Consistent and predictable regulations across both countries are crucial for supply chain management and market access.

Government Incentives for Green Building

Governments worldwide are actively promoting green building through a variety of incentives. For instance, the Inflation Reduction Act in the United States offers significant tax credits for energy-efficient home improvements and renewable energy installations, directly impacting demand for sustainable building materials. Many European nations have also set ambitious targets for energy-efficient buildings, with programs like Germany's KfW efficiency house standards encouraging the use of eco-friendly construction methods and materials.

These policies translate into tangible market opportunities for companies like Richelieu. The push for renewable materials and stringent energy-efficient design codes fuels a growing demand for specialized hardware and sustainable products. This trend is projected to continue, with the global green building market expected to reach over $3.5 trillion by 2027, indicating a substantial and expanding customer base for environmentally conscious solutions.

- Government Support: Policies such as tax credits and subsidies for energy-efficient upgrades are becoming more prevalent.

- Market Growth: The global green building market is experiencing robust expansion, driven by environmental regulations and consumer demand.

- Demand for Sustainable Products: Increased focus on renewable materials and energy-efficient designs directly benefits distributors of eco-friendly hardware.

- New Market Segments: Environmental regulations are creating new opportunities for businesses offering sustainable building solutions.

Political factors significantly influence Richelieu's operational landscape, particularly concerning trade agreements and government spending. The USMCA, for example, continues to shape cross-border commerce, with ongoing adjustments to tariffs and trade regulations in 2024 and 2025 impacting sourcing and pricing. Government investments in infrastructure, such as the U.S. Bipartisan Infrastructure Law and Canada's 2024 budget, directly stimulate demand for construction materials, creating substantial sales opportunities for Richelieu.

Navigating diverse regulatory environments, including evolving building codes and permitting processes across North America, is critical for Richelieu's compliance and efficiency. Political stability is also paramount, as it fosters business confidence and predictable market conditions essential for long-term strategic planning and supply chain resilience, especially with potential policy shifts anticipated from the 2024 US election cycle.

Governments are increasingly promoting green building initiatives through incentives like the U.S. Inflation Reduction Act, driving demand for sustainable materials. This global trend, with markets like Germany's KfW standards, is expanding the customer base for eco-friendly hardware, projecting significant growth for companies aligned with these environmental objectives.

Key political considerations for Richelieu include the stability of Canada-US trade relations, the impact of government incentives on operational costs, and the consistency of regulations for market access. The growing emphasis on green building, supported by governmental policies and robust market expansion, presents new avenues for businesses offering sustainable construction solutions.

| Political Factor | Impact on Richelieu | 2024/2025 Data Point |

|---|---|---|

| Trade Agreements (USMCA) | Shapes import/export costs and competitiveness. | Potential for new tariffs on steel/aluminum in 2025 impacting sourcing. |

| Infrastructure Spending | Drives demand for construction materials. | US Bipartisan Infrastructure Law (over $1.2T) and Canada's 2024 budget allocate billions to infrastructure projects. |

| Regulatory Environment | Affects compliance, permitting, and operational efficiency. | Ontario Building Code 2024 aims to streamline processes starting 2025. |

| Political Stability | Influences business confidence and investment. | 2024 US election cycle may introduce market volatility; stable environments are crucial for planning. |

| Green Building Policies | Creates demand for sustainable products. | US Inflation Reduction Act offers significant tax credits for energy-efficient upgrades; global green building market projected to exceed $3.5T by 2027. |

What is included in the product

This Richelieu PESTLE analysis meticulously examines the impact of Political, Economic, Social, Technological, Environmental, and Legal factors on the business, providing a comprehensive understanding of its external operating landscape.

The Richelieu PESTLE Analysis offers a structured approach to external factors, acting as a pain point reliever by proactively identifying potential challenges and opportunities, thus reducing uncertainty and the need for reactive problem-solving.

Economic factors

The North American construction market is on a strong upward trajectory, with projections indicating a market size of approximately USD 2.76 trillion by 2025. This substantial growth is fueled by a dual demand for new builds and extensive renovation activities spanning residential, commercial, and critical infrastructure projects.

Richelieu, as a key player in distributing specialty hardware and related products, stands to gain considerably from this robust market expansion. The increasing activity in new construction and the ongoing need for upgrades and repairs across various sectors directly translate into higher demand for Richelieu's product offerings.

North American housing markets are expected to see a slowdown in existing home sales in 2025, largely due to persistent elevated mortgage rates, which have hovered around 7% for much of 2024. While home price growth is still anticipated, albeit at a more moderate pace compared to previous years, affordability remains a significant hurdle for many potential buyers.

These dynamics directly affect Richelieu's customer base. A less robust housing market can dampen demand for new construction projects, a key area for residential woodworkers. Similarly, renovation superstores may experience reduced foot traffic as homeowners, facing higher borrowing costs and affordability pressures, postpone discretionary upgrades.

Interest rate fluctuations are a significant economic consideration for Richelieu. Projections indicate that 30-year mortgage rates are likely to remain high, potentially averaging approximately 6.7% in 2025.

These elevated rates can directly affect consumer behavior, particularly concerning major purchases like homes and renovations, which could dampen demand for Richelieu's offerings.

It is crucial for Richelieu to closely track these interest rate trends, as they directly influence the spending power of its broad customer base and overall market activity.

Consumer Spending on Home Renovation

Consumer spending on home renovations is anticipated to stay strong through 2025, with forecasts suggesting a continued rise in expenditures. This trend is driven by a significant portion of homeowners, nearly half, planning various renovation projects, with a particular focus on kitchens and bathrooms. These areas represent crucial markets for Richelieu, aligning with their product offerings.

The ongoing demand for home improvements and personalization is a positive indicator for Richelieu's business. This sustained homeowner investment directly benefits their sales channels, which include cabinet makers and large renovation superstores. For instance, data from 2024 indicated that home improvement spending reached over $450 billion in the US alone, a figure expected to grow.

- Homeowner renovation spending projected to increase in 2025.

- Approximately 50% of homeowners intend to renovate, prioritizing kitchens and bathrooms.

- This sustained demand directly supports Richelieu's sales to key industry partners.

Inflation and Material Costs

Inflationary pressures and the potential for new tariffs are significant concerns for Richelieu, directly impacting its material costs. For example, if tariffs were imposed on Canadian hardware imports, as has been a discussion point in recent trade relations, Richelieu might face higher expenses for crucial components used in its furniture and cabinetry products.

Managing these rising costs is paramount for Richelieu's financial health. The company must navigate the delicate balance of absorbing some of these increases to remain competitive while also passing on costs to consumers to protect its profit margins. This challenge is particularly acute in the current economic climate, where consumer spending can be sensitive to price changes.

The impact on procurement and pricing strategies is substantial. Richelieu's ability to secure raw materials and finished goods at predictable prices is essential for stable production and sales. For instance, a sudden spike in lumber prices, a key material in furniture manufacturing, could significantly alter the cost structure of their offerings.

- Inflationary Environment: As of early 2024, global inflation rates remained elevated, though showing signs of moderation in some regions, impacting the cost of goods across various sectors.

- Tariff Risks: Discussions around potential tariffs on goods from countries like Canada, a significant trading partner for many North American manufacturers, present a direct risk to import costs.

- Material Cost Volatility: Key materials used in furniture and cabinetry, such as lumber, metals, and resins, have experienced price fluctuations, with some commodities seeing double-digit percentage increases in the preceding 12-18 months.

- Competitive Pricing Pressure: Maintaining competitive pricing is crucial for Richelieu in a market where consumers are increasingly price-conscious due to broader economic conditions.

Economic factors significantly shape the market landscape for Richelieu. While the North American construction market is robust, projected at USD 2.76 trillion by 2025, elevated mortgage rates, around 6.7% for 30-year mortgages in 2025, could temper new home sales and renovations. Conversely, consumer spending on home improvements is expected to remain strong, with nearly half of homeowners planning projects, particularly in kitchens and bathrooms, which directly benefits Richelieu's core business.

Inflationary pressures and potential tariffs pose challenges, impacting material costs for products like lumber and metals, which have seen significant price volatility. Richelieu must navigate these rising expenses to maintain competitive pricing, a critical factor given consumer sensitivity to price changes in the current economic climate.

| Economic Factor | 2024/2025 Projection/Data | Impact on Richelieu |

|---|---|---|

| North American Construction Market Size | USD 2.76 trillion by 2025 | Increased demand for hardware and related products. |

| 30-Year Mortgage Rates | Approx. 6.7% in 2025 | Potential slowdown in new home sales and renovation spending. |

| Homeowner Renovation Plans | ~50% of homeowners planning projects | Sustained demand for kitchen and bathroom components. |

| US Home Improvement Spending | Over USD 450 billion (2024) | Positive indicator for sales channels like renovation superstores. |

| Inflation Impact on Materials | Elevated, with some commodities up double-digits | Increased procurement costs, pressure on profit margins. |

Same Document Delivered

Richelieu PESTLE Analysis

The preview shown here is the exact document you’ll receive after purchase—fully formatted and ready to use. This comprehensive Richelieu PESTLE analysis delves into the Political, Economic, Social, Technological, Legal, and Environmental factors impacting the organization, providing a strategic overview.

This is a real screenshot of the product you’re buying—delivered exactly as shown, no surprises. You'll gain immediate access to a detailed breakdown of the external forces shaping Richelieu's operational landscape.

The content and structure shown in the preview is the same document you’ll download after payment. It offers actionable insights to inform strategic decision-making and risk management for Richelieu.

Sociological factors

Homeowners are placing a greater emphasis on personalized, sustainable, and functional renovations, with a notable surge in demand for custom cabinetry, smart home technology, and environmentally friendly materials, particularly in kitchens and bathrooms.

This trend is evidenced by the fact that the global smart home market, which includes integrated systems often found in renovations, was projected to reach over $150 billion in 2024, indicating a strong consumer appetite for advanced features.

Richelieu, as a key supplier of specialty hardware, is strategically positioned to capitalize on these shifting consumer preferences by providing a diverse product catalog that aligns with contemporary design and utility requirements.

Societal values are increasingly prioritizing environmental responsibility, directly impacting the building materials sector. This growing eco-consciousness fuels a strong demand for sustainable and eco-friendly products, influencing purchasing decisions at both consumer and corporate levels.

Consumers and businesses are actively seeking out construction solutions that minimize environmental impact. This translates to a preference for materials like recycled content, bio-based alternatives, and products that enhance energy efficiency, such as advanced insulation or low-flow water fixtures. For instance, by 2024, the global green building materials market was projected to reach over $300 billion, highlighting this significant trend.

Richelieu's capacity to offer a robust portfolio of these sustainable materials presents a clear competitive edge. Supplying products that contribute to energy-efficient construction or water conservation is no longer just a niche offering but a key differentiator in a market increasingly guided by environmental performance metrics.

The shift towards hybrid work, a persistent trend post-2020, is reshaping how people use their homes. This means more demand for adaptable living spaces that can seamlessly transition between work, relaxation, and social activities. Homeowners are increasingly investing in renovations that create dedicated home offices, improve connectivity, and enhance overall comfort and functionality, directly benefiting companies like Richelieu that supply the necessary hardware and organizational solutions.

Demographic Shifts and Housing Needs

North American population growth, projected to reach over 370 million by 2025, fuels ongoing residential construction, especially in expanding urban and suburban centers. Migration patterns further concentrate this demand, creating opportunities for hardware suppliers in these key markets.

Shifting household demographics, including a rise in single-person households and an aging demographic, directly impact housing needs. This translates to increased demand for hardware solutions focused on accessibility, such as lever handles and low-threshold entry systems, as well as adaptable living spaces that can be modified over time.

- Population Growth: North America's population is expected to exceed 370 million in 2025, driving demand for new housing.

- Household Size: The average household size continues to decrease, increasing the number of housing units needed.

- Aging Population: A growing segment of the population requires accessible and adaptable home features.

Growth in DIY vs. Professional Services

The home improvement sector is experiencing robust growth, but the dynamic between do-it-yourself (DIY) projects and professionally managed renovations is constantly evolving. Richelieu’s strategy must account for this, as they cater to both hardware retailers serving DIY consumers and professional woodworkers and manufacturers who rely on specialized services.

Consumer preferences for project complexity and the willingness to hire professionals versus tackling tasks themselves significantly impact sales channel effectiveness. For instance, a 2024 Houzz survey indicated that 60% of homeowners undertook renovation projects themselves, but a notable 40% opted for professional help, highlighting the continued importance of both market segments for Richelieu.

- DIY Growth: Continued consumer interest in DIY projects, often driven by cost savings and a desire for personal accomplishment, supports Richelieu's hardware retail channels.

- Professional Services Demand: As projects become more complex or time-consuming, the demand for professional installation and services increases, benefiting Richelieu's B2B clientele.

- Market Balance: The ongoing equilibrium between DIY enthusiasm and the need for professional expertise shapes Richelieu's approach to product development and marketing across its diverse customer base.

- Economic Influence: Economic conditions in 2024-2025, such as inflation and labor availability, are likely to influence whether consumers lean more towards DIY or professional services, impacting product sales volumes for Richelieu.

Societal values are increasingly prioritizing environmental responsibility, directly impacting the building materials sector, with a strong demand for sustainable and eco-friendly products. Consumers and businesses are actively seeking out construction solutions that minimize environmental impact, leading to a preference for recycled content and energy-efficient materials; by 2024, the global green building materials market was projected to reach over $300 billion.

The shift towards hybrid work is reshaping home usage, increasing demand for adaptable living spaces that can transition between work and relaxation, benefiting companies like Richelieu that supply hardware and organizational solutions.

North American population growth, projected to exceed 370 million by 2025, fuels ongoing residential construction, especially in expanding urban and suburban centers, concentrating demand in key markets.

Shifting household demographics, including a rise in single-person households and an aging population, directly impact housing needs, increasing demand for accessible hardware solutions like lever handles and adaptable living spaces.

Technological factors

The digitalization of supply chain and distribution is a major technological driver. Richelieu can significantly boost efficiency and collaboration by adopting advanced technologies like AI, IoT, and cloud solutions across its numerous distribution centers. This digital transformation is crucial for optimizing inventory management and streamlining operations.

Digital procurement is projected to represent a substantial share of material sourcing in the coming years, underscoring the necessity for Richelieu to provide smooth and integrated online procurement experiences for its suppliers and partners.

The growing integration of smart home technology is a significant technological factor influencing the renovation market. This trend is fueling demand for innovative kitchen solutions, automated lighting, and advanced security systems. For instance, the global smart home market was valued at approximately $100 billion in 2023 and is projected to reach over $250 billion by 2030, indicating robust growth.

Richelieu, as a key hardware distributor, is well-positioned to leverage this shift. By offering products that seamlessly integrate with popular smart home ecosystems, the company can capture a larger share of this expanding market. This includes providing smart hardware components for cabinets, doors, and other architectural elements.

Technological advancements are reshaping manufacturing and distribution for companies like Richelieu. Modular building techniques, automation, and 3D printing are boosting efficiency and cutting costs in construction, a sector Richelieu serves. For Richelieu's own manufacturing, embracing these innovations can significantly expand production capacity and elevate product quality. For example, the global industrial automation market was valued at approximately $200 billion in 2023 and is projected to grow substantially, indicating a strong trend towards increased adoption.

Furthermore, automation within distribution centers is a key technological factor. Implementing advanced robotics and AI-driven logistics systems can dramatically improve the speed and reliability of Richelieu's supply chain operations. This not only benefits internal processes but also enhances the customer experience through faster order fulfillment.

Leveraging Data Analytics and AI

Richelieu can leverage big data and artificial intelligence (AI) to revolutionize its supply chain operations. By analyzing vast datasets, the company can achieve more accurate forecasting, refine planning processes, and optimize delivery routes, potentially reducing transportation costs by up to 15% as seen in similar retail logistics transformations. This data-driven approach allows Richelieu to gain deeper insights into customer preferences, leading to better inventory management and more efficient logistics.

AI's role extends to enhancing customer experience and automating warehouse functions. For instance, AI-powered chatbots can handle customer inquiries 24/7, improving service levels, while robotic automation in warehouses can speed up goods retrieval and order fulfillment. Companies adopting AI in warehousing have reported efficiency gains ranging from 20% to 50% in picking and packing operations.

- Improved Forecasting Accuracy: Utilizing AI for demand prediction can reduce stockouts and overstocking, potentially lowering inventory holding costs by 10-20%.

- Optimized Route Planning: AI algorithms can dynamically adjust delivery routes based on real-time traffic and weather data, leading to fuel savings and faster deliveries.

- Enhanced Customer Service: AI-driven chatbots and personalized recommendations can boost customer satisfaction and engagement.

- Warehouse Automation: Implementing AI and robotics in warehouses can significantly increase throughput and reduce labor costs in repetitive tasks.

E-commerce and Omnichannel Strategies

The COVID-19 pandemic significantly accelerated the digital transformation in the home improvement sector, making robust e-commerce capabilities a necessity. Richelieu, like many retailers, saw a surge in online engagement, with consumers increasingly turning to digital channels for product discovery and purchasing. For instance, a 2024 report indicated that over 60% of home improvement purchases begin with online research, highlighting the critical role of digital platforms.

While brick-and-mortar stores continue to hold value, the expectation for a seamless omnichannel experience is paramount. Consumers now anticipate the ability to research online, purchase in-store, or vice versa, with consistent pricing and product information across all touchpoints. This shift demands that Richelieu invest in and refine its e-commerce infrastructure and integrate it effectively with its physical retail presence to cater to the evolving preferences of today's tech-savvy shopper.

- Digital Acceleration: The pandemic spurred a digital-first approach in home improvement retail, making online sales channels indispensable.

- Consumer Behavior Shift: Customers increasingly utilize online resources for product research and purchases, even for in-store transactions.

- Omnichannel Imperative: Richelieu must ensure a unified and convenient shopping journey across both online and physical store environments.

- E-commerce Investment: Continued investment in user-friendly e-commerce platforms is crucial to meet customer expectations and maintain competitiveness.

Technological advancements are fundamentally reshaping how businesses operate and interact with customers. For Richelieu, this means embracing digital procurement, which is expected to capture a significant portion of material sourcing in the near future, necessitating streamlined online experiences for partners. The increasing integration of smart home technology is also a key driver, fueling demand for innovative hardware solutions that can connect with smart ecosystems, a trend supported by the global smart home market's projected growth from approximately $100 billion in 2023 to over $250 billion by 2030.

Legal factors

Building codes are constantly being updated to improve safety, efficiency, and resilience, with significant new standards set to be implemented across North America in 2025. These changes will likely include more rigorous energy performance requirements, a push towards electrification, and updated mandates for fire-resistant materials and structural integrity.

Richelieu must adapt its product offerings to meet these evolving regulations, which will directly influence product design, material sourcing, and ultimately, market acceptance. For instance, a 15% increase in demand for low-VOC (Volatile Organic Compound) building materials is projected by 2026 due to stricter indoor air quality standards.

As a key player in the hardware industry, Richelieu must navigate a complex web of product safety and quality regulations across its primary markets, Canada and the United States. These regulations are not merely bureaucratic hurdles; they are foundational to consumer protection and brand reputation. For instance, adherence to standards set by bodies like the Consumer Product Safety Commission (CPSC) in the US and Health Canada is critical, ensuring that products like cabinet handles, door hinges, and other specialty hardware meet rigorous safety benchmarks.

Failure to comply can lead to severe consequences, including costly recalls, fines, and significant damage to consumer trust. In 2023, product recalls in the consumer goods sector, which includes hardware, highlighted the financial and reputational risks associated with non-compliance. Richelieu's commitment to rigorous quality control and testing, therefore, directly impacts its ability to avoid these pitfalls and maintain its market standing. This involves ensuring materials used, such as lead content in finishes or the structural integrity of load-bearing components, meet or exceed legal requirements.

The company's product portfolio, encompassing everything from decorative knobs to functional drawer slides, means it must stay abreast of evolving standards. For example, new regulations concerning the environmental impact of materials or specific performance criteria for durability can emerge. Richelieu's proactive approach to understanding and integrating these legal mandates into its manufacturing and distribution processes is essential for sustained operational success and market leadership, especially as regulatory scrutiny intensifies globally.

International trade agreements significantly shape cross-border commerce, with agreements like the United States-Mexico-Canada Agreement (USMCA) directly influencing tariffs and trade regulations between these North American nations. These pacts are crucial for companies like Richelieu to understand their impact on import/export costs and market access.

Anticipated shifts in 2025, such as potential increases in tariffs on specific metal imports, could directly affect Richelieu's cost of goods sold and its competitive edge in the market. For instance, a hypothetical 5% tariff hike on steel could add millions to procurement costs depending on Richelieu's material sourcing.

Navigating these evolving trade dynamics is essential for Richelieu to maintain efficient supply chains and implement effective pricing strategies. Understanding and adapting to changes in trade policy, including potential retaliatory tariffs, directly impacts profitability and market share.

Labor Laws and Employment Regulations

Richelieu, operating across North America, navigates a complex web of labor laws and employment regulations that vary by province and state. These regulations dictate minimum wages, overtime pay, workplace safety standards, and employee benefits, directly influencing operational costs and human resource management strategies. For instance, in 2024, minimum wage increases in several Canadian provinces and US states could impact Richelieu's labor expenses.

Compliance with these diverse legal frameworks is paramount to avoid penalties and maintain a stable workforce. Key areas include adherence to collective bargaining agreements where applicable, ensuring fair labor practices, and managing employee relations in line with local statutes. The company's extensive distribution and manufacturing footprint means a significant portion of its operational budget is tied to meeting these legal obligations.

Furthermore, broader economic trends, such as labor shortages in related sectors like construction, can indirectly affect Richelieu. A tight labor market can drive up wages across industries, potentially increasing Richelieu's own labor costs as it competes for talent. This dynamic underscores the interconnectedness of labor laws, economic conditions, and business operations.

- Minimum Wage Compliance: Richelieu must adhere to varying minimum wage rates across its operating regions, with recent adjustments in 2024 impacting payroll.

- Workplace Safety Regulations: Strict adherence to occupational health and safety laws in each jurisdiction is crucial for employee well-being and legal compliance.

- Labor Relations Management: Managing relationships with employees and any unionized workforces requires understanding and respecting collective bargaining agreements and labor dispute resolution processes.

- Impact of Labor Shortages: Broader labor market tightness, particularly in sectors like construction, can indirectly escalate wage pressures for Richelieu's workforce.

Environmental Regulations and Certifications

Environmental regulations are becoming increasingly stringent, directly impacting industries like Richelieu. The growing emphasis on green building certifications, such as LEED (Leadership in Energy and Environmental Design), is a significant driver. For instance, in 2024, the demand for sustainable building materials saw a notable uptick, with projects seeking LEED certification often prioritizing materials with lower embodied carbon and recycled content. This trend is expected to continue through 2025 as more jurisdictions mandate or incentivize green building practices.

Governments and industry organizations are actively setting stricter rules. These often cover aspects like responsible material sourcing, minimizing construction waste, and enhancing the energy efficiency of finished products. For example, new regulations in the European Union, effective from 2024, have tightened requirements for the chemical composition of building materials, pushing manufacturers towards safer and more environmentally sound alternatives. This regulatory landscape necessitates continuous adaptation and innovation in product development.

Richelieu is well-positioned to capitalize on these trends. By offering products that facilitate clients' achievement of green building certifications, the company ensures its market relevance and supports its commitment to responsible operations. In 2024, Richelieu reported an increase in sales of its eco-friendly product lines, directly correlating with the heightened demand for sustainable construction solutions. This strategic alignment with environmental standards provides a competitive advantage.

- Increasing Demand for LEED Certified Products: By 2025, it's projected that over 30% of new commercial construction in North America will pursue LEED certification, creating a substantial market for compliant materials.

- Stricter Material Sourcing Rules: Regulations like the EU's updated Construction Products Regulation (CPR) are enhancing traceability and demanding greater transparency in supply chains for materials used in construction.

- Focus on Energy Efficiency: Building codes in many regions are being updated to require higher levels of insulation and energy-efficient components, directly benefiting suppliers of such products.

- Waste Reduction Mandates: Many municipalities are implementing stricter waste diversion targets for construction and demolition projects, encouraging the use of durable and recyclable materials.

Legal factors significantly influence Richelieu's operations, from product safety standards to international trade agreements. Adherence to regulations set by bodies like the CPSC and Health Canada is paramount for consumer protection and brand reputation, with non-compliance risking costly recalls. Evolving building codes, particularly those focusing on energy efficiency and material safety, necessitate ongoing product adaptation. International trade pacts, such as USMCA, directly impact import/export costs and market access, with potential tariff changes in 2025 requiring careful strategic planning.

Environmental factors

The construction sector is increasingly prioritizing sustainability, leading to a surge in demand for green building materials. By 2025, this trend is expected to reach unprecedented levels, encompassing bio-based materials, advanced recycled products, engineered wood, and eco-friendly insulation solutions.

Richelieu can leverage this growing market by broadening its portfolio to include a wider range of environmentally conscious hardware and related products. This strategic move aligns with evolving consumer preferences and regulatory landscapes favoring greener construction.

Stricter energy efficiency standards are increasingly shaping building codes globally, pushing for better insulation, more airtight building envelopes, and the incorporation of renewable energy sources. This trend directly fuels demand for energy-efficient hardware, innovative insulation materials, and components designed to minimize energy usage in residential and commercial structures.

For instance, in 2024, the European Union's Energy Performance of Buildings Directive (EPBD) revisions are expected to drive significant investment in retrofitting existing buildings and ensuring new constructions meet higher energy performance benchmarks. This creates a robust market opportunity for companies like Richelieu, whose hardware solutions, such as advanced sealing systems and energy-saving window components, can directly support builders and renovators in meeting these evolving regulatory requirements.

The construction industry is increasingly embracing circular economy principles, aiming to slash waste and preserve resources by incorporating recycled materials. This trend is evident in the growing use of recycled plastics within building products and the development of systems for reprocessing construction debris. For instance, in 2023, the European Union reported that over 50% of construction and demolition waste was recycled or recovered, a significant increase from previous years.

Richelieu can align with this shift by expanding its product lines to include items manufactured with recycled content, such as recycled plastic components or reclaimed wood. Furthermore, the company can support the industry's sustainability goals by partnering with or developing initiatives for the responsible disposal and recycling of construction waste, potentially creating new revenue streams or enhancing its brand image as an environmentally conscious supplier.

Climate Change Adaptation in Building Design

With the escalating impacts of climate change, there's a growing imperative for buildings to be more resilient. This means incorporating features like flood-resistant foundations, advanced drainage systems, and materials that can withstand extreme weather events. For instance, the increasing frequency of heavy rainfall events, as seen in many regions in 2024, necessitates enhanced water management within building envelopes.

This shift directly impacts the construction industry's material and hardware demands. Building codes are evolving to mandate higher standards for durability and environmental performance. In 2025, we're observing a significant uptick in the specification of disaster-resistant materials, such as impact-resistant glass and reinforced concrete, to meet these new requirements.

Richelieu can strategically position its product offerings to capitalize on this trend. By expanding its range of specialized hardware and materials designed for climate adaptation, the company can support the construction of more sustainable and secure buildings. This includes offering solutions for:

- Flood Resilience: Waterproofing membranes, elevated foundation hardware, and corrosion-resistant fasteners.

- Disaster Resistance: High-strength connectors, impact-resistant glazing components, and fire-retardant materials.

- Green Building Integration: Fasteners and mounting systems for green roofs and vertical gardens, contributing to urban cooling and biodiversity.

Sustainable Supply Chain Practices

There's a growing demand for businesses to operate sustainably across their entire supply chain. This means looking at everything from where materials come from to how products are delivered, focusing on ethical sourcing, minimizing carbon emissions in transport, and ensuring manufacturing processes are environmentally sound. For a company like Richelieu, which is both a manufacturer and a major distributor, this is a critical area.

Richelieu is expected to not only adopt these sustainable practices internally but also encourage them throughout its network. This includes everything from raw material procurement to the final delivery of goods. Aligning with global environmental targets and meeting consumer expectations for eco-friendly operations are key drivers here. For instance, many large retailers are now setting specific sustainability targets for their suppliers, which directly impacts distributors like Richelieu. In 2024, major European retailers reported that over 70% of their suppliers had some form of sustainability reporting in place, a trend expected to continue growing.

Specifically, Richelieu’s efforts might involve:

- Promoting the use of recycled or sustainably sourced materials in product manufacturing.

- Optimizing logistics routes and exploring lower-emission transportation options, such as electric vehicles for last-mile delivery.

- Implementing stricter environmental standards for manufacturing facilities and encouraging similar standards among their own suppliers.

Environmental factors are increasingly shaping the construction industry, pushing for sustainable materials and energy efficiency. By 2025, demand for green building products, including bio-based and recycled materials, is set to surge. Stricter energy standards, like those seen in the EU's 2024 EPBD revisions, are driving the need for energy-efficient hardware and insulation.

The circular economy is also gaining traction, with over 50% of construction waste recycled in the EU as of 2023, encouraging the use of recycled content in building products. Furthermore, climate change impacts are necessitating resilient construction, with a growing specification of disaster-resistant materials in 2025. Supply chain sustainability is also paramount, with over 70% of major European retailers' suppliers reporting sustainability measures in 2024.

| Environmental Trend | Description | Impact on Construction | Opportunity for Richelieu | Relevant Data (2023-2025) |

|---|---|---|---|---|

| Sustainability & Green Building | Growing demand for eco-friendly materials and practices. | Increased use of bio-based, recycled, and low-VOC materials. | Expand product lines with sustainable hardware and finishes. | By 2025, green building material demand expected to reach unprecedented levels. |

| Energy Efficiency Standards | Stricter building codes for energy performance. | Need for better insulation, airtightness, and energy-saving components. | Offer advanced sealing systems, energy-efficient window hardware. | EU EPBD revisions (2024) driving retrofitting and new builds. |

| Circular Economy Principles | Focus on waste reduction and material reuse. | Increased incorporation of recycled content and construction waste recycling. | Develop products with recycled materials; explore waste recycling partnerships. | Over 50% of EU construction waste recycled/recovered (2023). |

| Climate Change Resilience | Adapting buildings to extreme weather events. | Demand for flood-resistant, impact-resistant, and durable materials. | Provide specialized hardware for flood resilience and disaster resistance. | Uptick in specification of disaster-resistant materials (2025). |

| Supply Chain Sustainability | Ethical sourcing, reduced emissions, and eco-friendly manufacturing. | Pressure on suppliers to adopt sustainable practices. | Promote recycled materials, optimize logistics, and ensure eco-friendly manufacturing. | Over 70% of major EU retailers' suppliers had sustainability reporting (2024). |

PESTLE Analysis Data Sources

Our Richelieu PESTLE analysis is meticulously constructed using a blend of official government publications, reputable industry reports, and leading economic databases. This ensures that every factor, from political stability to technological advancements, is grounded in verifiable and current information.