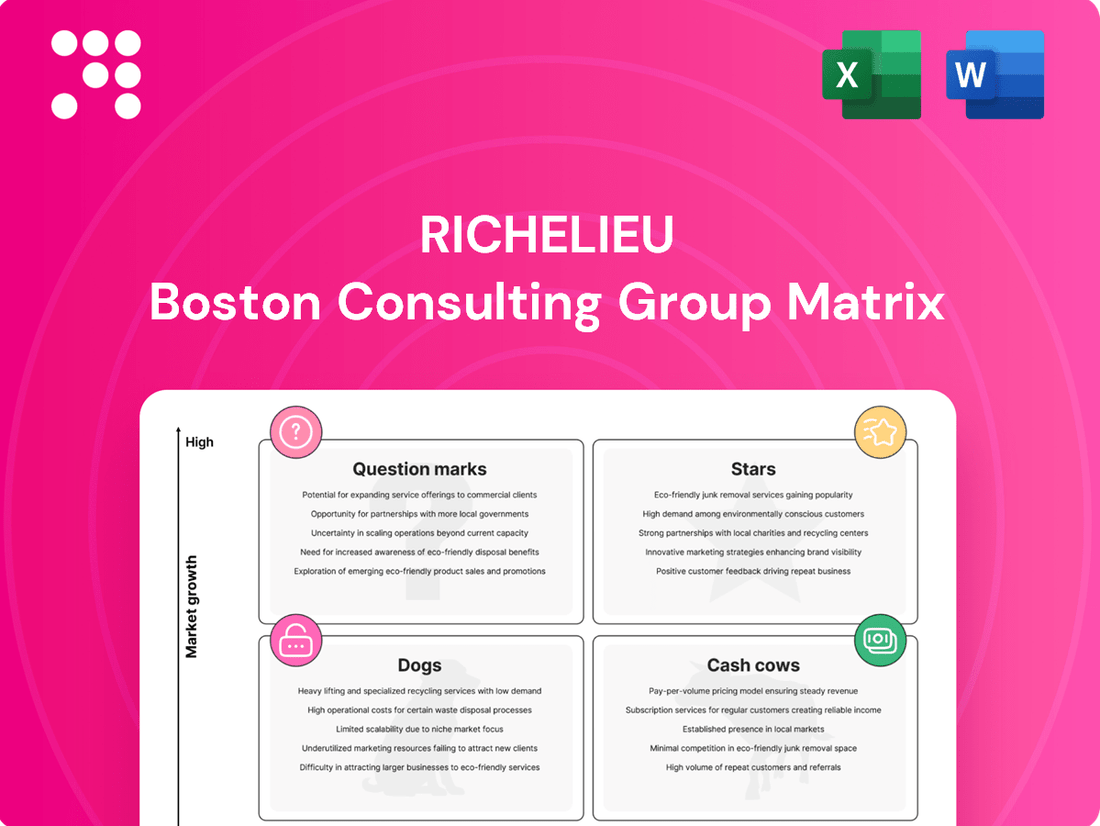

Richelieu Boston Consulting Group Matrix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Richelieu Bundle

Uncover the strategic positioning of this company's product portfolio with our insightful BCG Matrix preview. See which products are poised for growth, which are generating steady income, and which may require a closer look.

Ready to transform this understanding into actionable strategy? Purchase the full BCG Matrix report for detailed quadrant analysis, expert recommendations, and a clear roadmap to optimize your investments and product development.

Stars

Richelieu's high-end specialty hardware for manufacturers represents a significant Star in its BCG portfolio. The company's robust performance in this segment, evidenced by a 9.9% sales increase in Q1 2025, underscores its dominant position.

This segment thrives on advanced and specialized hardware essential for contemporary furniture and cabinet manufacturing. Richelieu's strategic focus, amplified by acquisitions, is clearly expanding its market share in this high-growth area.

Richelieu's strategic acquisitions of Allegheny Plywood and Rhoads & O'Hara Architectural Products in 2024 and 2025 respectively have dramatically broadened its portfolio in architectural panels and decorative surfaces. This expansion taps into a market segment fueled by shifting design aesthetics and a growing need for specialized construction materials.

The architectural panels and decorative surfaces category is a key growth driver for Richelieu, reflecting increasing demand for innovative and aesthetically pleasing building components. These acquisitions enhance Richelieu's market reach and ability to serve premium construction projects.

Richelieu's acquisition of Midwest Specialty Products in January 2025 positions its premium countertop materials, like quartz and porcelain slabs, squarely in the "Star" category of the BCG Matrix. This segment is characterized by high growth and high market share, driven by escalating demand from luxury builders and architects for sophisticated decorative surfaces. The integration of this expertise significantly diversifies Richelieu's offerings and strengthens its foothold in a burgeoning market segment.

Smart Living® and Space Optimization Solutions

Richelieu's innovative Smart Living® product line, focused on space optimization and organization, directly addresses the growing consumer demand for efficient and multi-functional living environments. This strategic emphasis positions these solutions as strong contenders within a rapidly expanding market segment. Richelieu's consistent introduction of new products in this category suggests a significant and potentially growing market share.

The company's proactive approach to developing and marketing Smart Living® solutions highlights its adaptability to changing consumer lifestyles and preferences. This segment is a key area where Richelieu is demonstrating its ability to identify and capitalize on emerging market trends.

- Market Growth: The global smart home market, which encompasses space optimization solutions, was projected to reach over $150 billion by 2024, indicating substantial growth potential.

- Richelieu's Innovation: Richelieu has consistently expanded its Smart Living® offerings, introducing new hardware and organizational systems throughout 2023 and early 2024.

- Consumer Trends: Studies in late 2023 showed a significant increase in consumer interest in home organization and multi-purpose furniture, directly aligning with Richelieu's product focus.

Products for Living in Place with Reduced Mobility

Richelieu's commitment to supporting individuals with reduced mobility is evident in its dedicated product line for living in place. This segment addresses a significant demographic shift, with an aging population increasingly seeking to maintain independence at home. Richelieu's comprehensive solutions are designed to enhance safety and accessibility, meeting a growing demand in this specialized market.

The market for aging-in-place solutions is experiencing robust growth. For instance, the global smart home market, which includes many accessibility features, was projected to reach over $150 billion by 2024. Richelieu's product portfolio, encompassing items like grab bars, accessible hardware, and specialized cabinetry, positions them to capture a substantial portion of this expanding market by offering practical and user-friendly innovations.

- Growing Demand: The number of individuals aged 65 and over is projected to increase significantly, driving demand for accessible home solutions.

- Market Leadership: Richelieu's broad range of products for reduced mobility positions it as a key player in this expanding niche.

- Enhanced Functionality: The products offer practical features that simplify everyday tasks and improve the overall usability of a home for people with varying needs.

- Innovation Focus: Richelieu continues to innovate, providing solutions that cater to the evolving requirements of independent living.

Richelieu's specialty hardware for manufacturers, architectural panels, decorative surfaces, and premium countertop materials are all strong Stars in its BCG portfolio. These segments benefit from high market growth and Richelieu's significant market share, bolstered by strategic acquisitions and consistent innovation. The company's focus on these areas, driven by evolving consumer trends and demographic shifts, positions them for continued success.

| Segment | Market Growth | Richelieu's Position | Key Drivers |

| Specialty Hardware (Furniture/Cabinetry) | High | High Market Share | Advanced manufacturing needs, acquisitions |

| Architectural Panels & Decorative Surfaces | High | Expanding Market Share | Design aesthetics, specialized construction materials, acquisitions |

| Premium Countertop Materials (Quartz/Porcelain) | High | Strong Foothold | Luxury builders, architects, sophisticated surfaces |

What is included in the product

The Richelieu BCG Matrix categorizes business units based on market growth and share, guiding strategic decisions for investment and resource allocation.

Provides clarity on underperforming units, easing the pain of resource misallocation.

Cash Cows

Richelieu's established core hardware distribution network, serving over 120,000 active customers across North America, is a prime example of a Cash Cow. This mature segment boasts a high market share, consistently generating strong cash flow due to its extensive reach and deep-rooted customer relationships.

The consistent demand for general specialty hardware, coupled with Richelieu's dominant position, means this business requires minimal reinvestment to maintain its leadership. This allows for significant cash generation, supporting other strategic initiatives within the company.

Traditional cabinet and furniture components are Richelieu's bedrock, serving as foundational, high-volume products for kitchen, bathroom, home furnishing, and office furniture makers. These essential items represent a substantial part of Richelieu's revenue from manufacturers.

Operating in a mature market, these components benefit from consistent demand, translating into a dependable and significant cash flow stream for Richelieu. Their essential nature means they require very little in the way of marketing or promotional spending to maintain their sales volume.

Richelieu's efficient North American distribution network, featuring 116 strategically placed centers, including manufacturing facilities, underpins its status as a cash cow. This robust infrastructure facilitates cost-effective distribution and exceptional customer service across the continent.

This extensive logistical capability allows Richelieu to effectively "milk" consistent profits from its mature market presence. The company's ability to manage its supply chain efficiently translates directly into high-profit margins for its established product lines.

Private Label and Exclusive Products

Private label and exclusive products represent Richelieu's strong Cash Cows, with over half of its offerings falling into these categories. This strategic focus grants the company significant brand control and insulates it from direct competition, fostering consistent revenue streams.

- High Profit Margins: Exclusive products often command higher profit margins due to reduced price pressure.

- Brand Loyalty: Private labels, when executed well, build strong customer loyalty.

- Revenue Stability: Established private label and exclusive lines provide a predictable and substantial cash flow.

Canadian Manufacturers' Market

The Canadian manufacturers' market, while part of a broader growth sector, acts as a stable cash cow for Richelieu. Its sales growth, reported at a steady 4.1% in Q1 2025, outpaces some other segments, demonstrating resilience.

This stability is underpinned by deep-seated customer relationships and consistent demand, ensuring a reliable stream of cash flow. These funds are crucial for Richelieu, enabling investment in other, potentially higher-growth areas of its business.

- Market Segment: Canadian Manufacturers

- Growth Rate: 4.1% (Q1 2025)

- Key Characteristics: Stable sales, strong relationships, consistent demand

- Strategic Role: Cash cow, funding other initiatives

Cash Cows are mature business segments with a high market share that generate consistent, strong cash flow with minimal reinvestment. Richelieu's established hardware distribution network and traditional component sales exemplify this, benefiting from consistent demand and deep customer relationships. These segments are vital for funding growth in other areas.

| Segment | Market Share | Cash Flow Generation | Reinvestment Needs |

|---|---|---|---|

| Hardware Distribution (North America) | High | Strong & Consistent | Low |

| Traditional Cabinet & Furniture Components | High | Dependable & Significant | Low |

| Private Label & Exclusive Products | High (within their niche) | Predictable & Substantial | Low |

| Canadian Manufacturers Market | High (within the segment) | Reliable | Low |

What You See Is What You Get

Richelieu BCG Matrix

The Richelieu BCG Matrix preview you are currently viewing is the complete, unwatermarked document you will receive immediately after purchase. This meticulously crafted report provides a clear, actionable framework for analyzing your business portfolio, enabling informed strategic decisions. You can confidently anticipate receiving this professionally formatted and analysis-ready file, designed to offer immediate utility for your business planning and competitive strategy.

Dogs

Richelieu's Dogs are those legacy product lines stuck in stagnant, low-growth markets with a consistently low market share. These products are often just breaking even, if not losing a little money, effectively tying up valuable capital without adding much to the company's bottom line. For instance, if a specific line of traditional leather footwear, operating in a market that saw only 1.5% growth in 2024, holds less than 5% market share, it fits this "Dog" profile.

Sales to hardware retailers and renovation superstores held steady in the first quarter of 2025 when compared to the same period in 2024. However, this segment saw a decline of 9.7% in the fourth quarter of 2024, indicating a period of stagnation.

Richelieu's strategic investments in the retail sector haven't yet translated into significant growth within this specific distribution channel. This suggests that certain regions or product lines within the hardware and renovation superstore segment may be experiencing persistent underperformance, characterized by low market share in slow-growing markets.

Richelieu experienced price deflation in certain commodity products during 2024, coinciding with a slowdown in the renovation sector. This environment is particularly challenging for low-margin commodity items where the company lacks a leading market position.

These products, often found in the 'Dogs' quadrant of the BCG Matrix, generate minimal profit and are susceptible to market volatility. Their contribution to overall profitability is negligible, and they represent a significant risk of becoming cash traps, draining resources without substantial returns.

Inefficient or Redundant Distribution Centers

Even with strategic network streamlining, some distribution centers might still be considered inefficient or redundant. These are typically smaller facilities that don't contribute significantly to overall sales or network efficiency, yet they continue to incur substantial operational costs. Their resource drain without commensurate returns makes them prime candidates for divestment or further integration into larger, more effective hubs.

For instance, a company might find that a regional distribution center, established years ago to serve a specific market, now handles a declining volume of business. If its operational expenses, including labor, utilities, and maintenance, represent a significant percentage of its sales revenue, it becomes a drag on profitability. In 2024, many logistics firms are actively analyzing such underperforming assets, with some reporting that divesting a single inefficient facility can improve overall network operating margins by as much as 2-3%.

- Identify facilities with high operational costs relative to sales contribution.

- Assess the strategic necessity of smaller, underutilized distribution centers.

- Evaluate the potential for divesting or consolidating redundant distribution hubs.

- Consider the impact on overall network efficiency and profitability when making these decisions.

Niche Products with Limited Adoption

Niche Products with Limited Adoption, often referred to as Dogs in the Boston Consulting Group (BCG) Matrix, represent offerings that have struggled to gain significant market traction. These products typically entered the market with some initial promise but failed to achieve substantial adoption or sustained growth. For instance, consider the struggles of early virtual reality headsets in the consumer market before recent advancements; many models sold in limited quantities and were eventually discontinued.

These products occupy valuable inventory space and necessitate ongoing maintenance or support without generating commensurate revenue or contributing meaningfully to overall market share. Companies often find themselves with excess stock of these items, tying up capital that could be better allocated. The financial burden of holding these underperforming assets can be considerable, impacting profitability.

Given their poor performance, further investment in Niche Products with Limited Adoption is generally not advisable. The likelihood of these products suddenly achieving widespread success is low, making additional resources unlikely to yield positive returns. Instead, companies typically explore options such as divesting these product lines or phasing them out entirely to streamline operations.

- Market Share: Typically low, indicating limited consumer acceptance or a highly specialized, small target audience.

- Market Growth Rate: Usually low, as the product has not demonstrated significant appeal or scalability.

- Profitability: Often low or negative due to high holding costs and minimal sales volume.

- Strategic Recommendation: Divest, discontinue, or harvest remaining value with minimal investment.

Richelieu's "Dogs" represent product lines or business units operating in low-growth markets with a low relative market share. These segments are typically cash neutral or cash drains, offering minimal profit and often tying up capital. For example, a specific line of legacy hardware components in a market with only 2% projected growth for 2025, holding a market share below 10%, would fall into this category.

In 2024, Richelieu observed that certain older product categories, particularly those catering to declining industrial segments, continued to underperform. Sales in these areas remained stagnant, with market share showing little to no improvement. This lack of growth, coupled with ongoing operational costs, resulted in these segments contributing negatively to overall profitability.

The company's analysis in early 2025 indicated that several niche product offerings, developed for specific but now shrinking markets, were still classified as Dogs. These products, despite past strategic efforts, had failed to gain significant traction. For instance, a specialized line of industrial adhesives, targeting a market that contracted by 3% in 2024, had a market share of only 7%.

These underperforming assets require careful management to avoid becoming significant cash traps. The focus remains on either divesting these lines or minimizing further investment to preserve capital for more promising ventures.

Question Marks

Richelieu is strategically introducing new in-store displays and product lines within hardware retailers and renovation superstores. This move targets a market segment that experienced a slight recovery in Q1 2025 after a decline in Q4 2024, signaling potential for high growth. Despite this potential, the segment currently holds a low market share for Richelieu, positioning these initiatives as crucial for rapid market penetration and increased adoption.

Richelieu's acquisition of Darant Distributing in Colorado and Modulex Partition in New Jersey/Greater New York in early 2025 signifies a bold move into new geographic markets. These ventures are classic examples of potential Question Marks in the BCG matrix, characterized by high growth potential but currently low market share.

For instance, entering the Colorado market with Darant Distributing positions Richelieu to tap into a growing regional economy, yet their initial foothold will be small. Similarly, the Modulex Partition acquisition in the competitive New Jersey/Greater New York area presents a similar challenge; significant investment in marketing and sales will be essential to gain traction and build market share in these new territories.

Richelieu's acquisition of Modulex Partition strategically bolsters its position in Division 10 products, encompassing specialties like architectural hardware and washroom accessories. This move specifically targets high-growth markets such as New Jersey and the Greater New York area, where demand for these specialized construction components is robust.

While Division 10 products represent a significant growth opportunity within the construction sector, Richelieu's current market share in this niche is relatively low. This presents a classic BCG matrix scenario where substantial investment is required to build brand recognition and capture a leading market position in these key geographic areas.

New Architectural Panels and Finishing Product Acquisitions

Richelieu's acquisition of Les industries Camcoat in Q2 2025 positions its new architectural panels and finishing products as question marks in the BCG matrix. This move significantly expands their North American distribution network for wood finishing products, a strategic step for diversification.

These new ventures, while promising high growth potential, are in their nascent stages. They require substantial investment and focused effort to gain market share and establish a strong presence.

- Acquisition of Les industries Camcoat: Diversifies Richelieu's portfolio into wood finishing products.

- Network Reinforcement: Strengthens North American distribution capabilities.

- Market Position: Currently a question mark due to newness and need for market share development.

- Growth Potential: High, but requires significant resource allocation and strategic attention.

Advanced or Avant-Garde Design Collections

Richelieu's introduction of innovative and avant-garde design collections, such as the Rialto collection and Ocean by Richelieu, caters to evolving aesthetic preferences in the market. These collections represent Richelieu's investment in future growth and trendsetting, aiming to capture a nascent but potentially lucrative market segment.

While these products align with future trends and possess high growth potential, their current market adoption and share are likely low. This necessitates significant marketing and sales investment to cultivate widespread acceptance and transition them into future Stars within the BCG matrix.

- Rialto Collection: Represents a push into contemporary, high-design spaces, potentially targeting a niche but growing segment of the architectural and interior design market.

- Ocean by Richelieu: This collection likely leverages sustainable or unique material sourcing, aligning with increasing consumer demand for eco-conscious and distinctive products.

- Market Adoption Challenges: Avant-garde designs often face slower initial uptake compared to mainstream offerings, requiring sustained promotional efforts and education to build market awareness and demand.

- Investment Requirement: Significant R&D, marketing, and sales resources are crucial for these "question mark" products to gain traction and achieve the market share needed to move into the "star" category.

Question Marks in Richelieu's portfolio represent new ventures or products with high growth potential but currently low market share. These require careful analysis and strategic investment to determine if they can become Stars or if they should be divested.

The acquisitions of Darant Distributing and Modulex Partition, along with the introduction of new design collections like Rialto and Ocean by Richelieu, exemplify these Question Marks. These initiatives are designed to tap into emerging markets and evolving consumer preferences.

Significant investment in marketing, sales, and brand building is essential for these Question Marks to gain traction and increase their market share. Without such support, they risk remaining in this category or declining.

Richelieu's strategic focus on these areas, despite their current low market share, indicates a commitment to future growth and market leadership. The success of these ventures will depend on their ability to convert potential into tangible market penetration.

BCG Matrix Data Sources

Our BCG Matrix leverages comprehensive market data, including financial performance, sales figures, and competitive landscape analysis, to accurately position business units.