Richards Packaging SWOT Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Richards Packaging Bundle

Richards Packaging possesses significant strengths in its diverse product portfolio and established customer relationships, but faces potential threats from evolving market demands and competitive pressures. Understanding these dynamics is crucial for informed decision-making.

Want the full story behind Richards Packaging's strengths, risks, and growth drivers? Purchase the complete SWOT analysis to gain access to a professionally written, fully editable report designed to support planning, pitches, and research.

Strengths

Richards Packaging boasts a robust and varied product range, encompassing containers, closures, and dispensing systems. This broad offering caters to a wide array of industries, including vital sectors like healthcare, food and beverage, cosmetics, and industrial markets.

Serving over 18,000 regional businesses, this extensive customer base across diverse end-markets significantly reduces reliance on any single industry. Such diversification acts as a powerful buffer against sector-specific downturns, contributing to a more resilient and predictable revenue flow, a key strength as of 2024.

Richards Packaging's position as the leading packaging distributor in Canada and the third largest in North America is a significant strength, underpinned by its extensive logistical capabilities. This robust network, comprising 18 strategically located facilities across North America, ensures efficient and timely service delivery to a broad and diverse customer base.

Richards Packaging distinguishes itself by offering a suite of value-added services beyond simple product distribution. These include crucial offerings like custom packaging design, efficient global sourcing, streamlined inventory management, and comprehensive supply chain solutions. This commitment to providing tailored packaging addresses specific client needs, fostering stronger customer relationships and a distinct competitive edge.

Consistent Financial Performance and Shareholder Returns

Richards Packaging consistently delivers stable financial results, a key strength that benefits its investors. This stability is evident in its regular monthly distributions to unitholders, providing a predictable income stream. For example, in the first quarter of 2024, the company reported distributable cash flow per unit of $0.55, underscoring its operational efficiency and commitment to shareholder returns.

Further bolstering its financial resilience is a robust balance sheet. Richards Packaging maintains a low debt-to-equity ratio, which stood at approximately 0.5x as of March 31, 2024. This financial prudence not only reduces risk but also enhances the company's flexibility to pursue growth opportunities or navigate economic downturns.

- Consistent Monthly Distributions: Regular payouts to unitholders demonstrate operational stability.

- Strong Balance Sheet: A healthy financial foundation supports long-term viability.

- Low Debt-to-Equity Ratio: Indicative of prudent financial management and reduced financial risk.

- Financial Flexibility: The company's strong financial position allows for strategic adaptability.

Strategic Acquisitions and Growth Initiatives

Richards Packaging demonstrates a strong strategic advantage through its consistent pursuit of acquisitions. These moves are specifically designed to broaden its product offerings and extend its market presence. For instance, the company successfully integrated HL Production and National Dental Innovations in February 2025, following its acquisition of Insight Medical Technologies in June 2024. These strategic tuck-in acquisitions are key components of a larger business transformation strategy.

This approach to growth is not just about expansion; it's also a calculated effort to diversify revenue streams and enhance operational cost efficiency across the organization. The integration of these acquired entities is expected to yield synergistic benefits, contributing to a more robust and resilient business model.

- Strategic Acquisitions: Acquired HL Production and National Dental Innovations (February 2025), and Insight Medical Technologies (June 2024).

- Growth Initiatives: Expansion of product lines and geographic reach through targeted tuck-in acquisitions.

- Business Transformation: Diversifying revenue streams and improving cost efficiency as core objectives.

Richards Packaging's diversified product portfolio and extensive customer base are significant strengths, reducing reliance on any single sector and ensuring revenue stability. As North America's third-largest packaging distributor, its expansive logistical network of 18 facilities facilitates efficient service across diverse markets.

The company's financial health, marked by consistent monthly distributions and a low debt-to-equity ratio (approximately 0.5x as of March 31, 2024), underscores its operational efficiency and financial prudence. This stability provides a predictable income stream for investors and enhances flexibility for future growth.

Strategic acquisitions, such as HL Production and National Dental Innovations (February 2025) and Insight Medical Technologies (June 2024), bolster its market presence and product offerings. These moves are integral to a broader strategy focused on revenue diversification and improved cost efficiency.

What is included in the product

Delivers a strategic overview of Richards Packaging’s internal and external business factors, highlighting its market strengths, operational gaps, and potential threats.

Offers a clear, actionable framework for identifying and leveraging Richards Packaging's competitive advantages, thereby alleviating the pain of strategic uncertainty.

Weaknesses

Richards Packaging's reliance on the healthcare sector, which accounts for over 52% of its product mix, presents a significant weakness. This concentration exposes the company to the inherent volatility and potential downturns within this specific industry. For instance, the softening private clinic market in 2024 and early 2025 has already begun to impact revenue streams.

Furthermore, the anticipated conclusion of contracts with key healthcare businesses, such as Parata, expected by Q3 2025, will directly reduce the company's exposure to this sector but also shrink its overall revenue base. This loss highlights the vulnerability associated with dependence on a limited number of large clients within a crucial market segment.

The food and beverage sector within packaging has faced considerable headwinds, with significant inventory oversupply from both customers and suppliers leading to revenue contraction throughout 2024. This overstocking has directly suppressed sales volumes in this vital segment for packaging providers.

The rigid packaging distribution sector is seeing increased consolidation, with the top five firms now holding more than 60% of the market share. This trend intensifies competition for all participants, including Richards Packaging.

While Richards Packaging is a significant player, it faces robust competition from larger entities within this concentrated market. This necessitates continuous strategic adaptation to maintain its competitive edge and market position.

Operational Cost Pressures

Richards Packaging has been grappling with significant operational cost pressures. Despite reporting revenue growth, for instance, a 3.7% increase in net sales to $353.9 million in the first quarter of 2024 compared to the prior year, rising expenses have eroded profitability.

These pressures are notably evident in increased lease expenses and administrative spending. For example, the company's selling, general, and administrative expenses (SG&A) increased by $8.6 million in Q1 2024. This rise in operational overhead directly impacts the bottom line, making cost management a critical challenge.

- Rising Lease Expenses: Increased costs associated with property leases put a strain on overall operational budgets.

- Higher Administrative Spending: Investments in administrative functions, while sometimes necessary for growth, have contributed to increased overhead.

- Impact on Net Income: The combination of these rising costs has directly affected the company's net income, highlighting the need for efficiency improvements.

- Cost Management Imperative: Effectively controlling these escalating operational expenditures is vital for sustaining and improving profitability in the competitive packaging market.

Sensitivity to Global Macroeconomic Volatility

Richards Packaging's performance is notably susceptible to shifts in the global economic landscape. Fluctuations in economic growth, interest rates, and inflation directly influence both business investment and consumer spending habits, creating an environment that demands constant adaptation. For instance, a slowdown in key markets could easily dampen demand for packaging solutions.

The company must remain acutely aware of how broader economic downturns or unexpected supply chain interruptions can significantly impair its sales volumes and operational efficiency. These external factors can lead to increased costs and reduced output, directly impacting profitability. Richards Packaging needs robust strategies to navigate these potential headwinds.

Specific vulnerabilities include:

- Exposure to Consumer Spending: As a significant portion of their products serve consumer goods industries, a dip in consumer confidence or disposable income directly translates to lower packaging orders.

- Supply Chain Disruptions: Reliance on global raw material suppliers means that geopolitical events or logistical challenges can disrupt production and increase input costs.

- Currency Fluctuations: Operating in multiple countries exposes Richards Packaging to risks associated with unfavorable exchange rate movements, impacting reported earnings.

Richards Packaging's significant reliance on the healthcare sector, representing over 52% of its product mix, creates a pronounced weakness. This concentration makes the company vulnerable to the inherent volatility and potential downturns within this industry, as evidenced by the softening private clinic market impacting revenue in early 2024 and 2025.

The anticipated conclusion of contracts with key healthcare clients, such as Parata by Q3 2025, will not only reduce exposure to this sector but also shrink the company's overall revenue base, highlighting the risks of dependence on a few large customers.

Furthermore, the food and beverage packaging segment has experienced revenue contraction throughout 2024 due to significant inventory oversupply from both customers and suppliers, directly suppressing sales volumes.

The company also faces rising operational costs, with SG&A expenses increasing by $8.6 million in Q1 2024, impacting profitability despite revenue growth.

Preview Before You Purchase

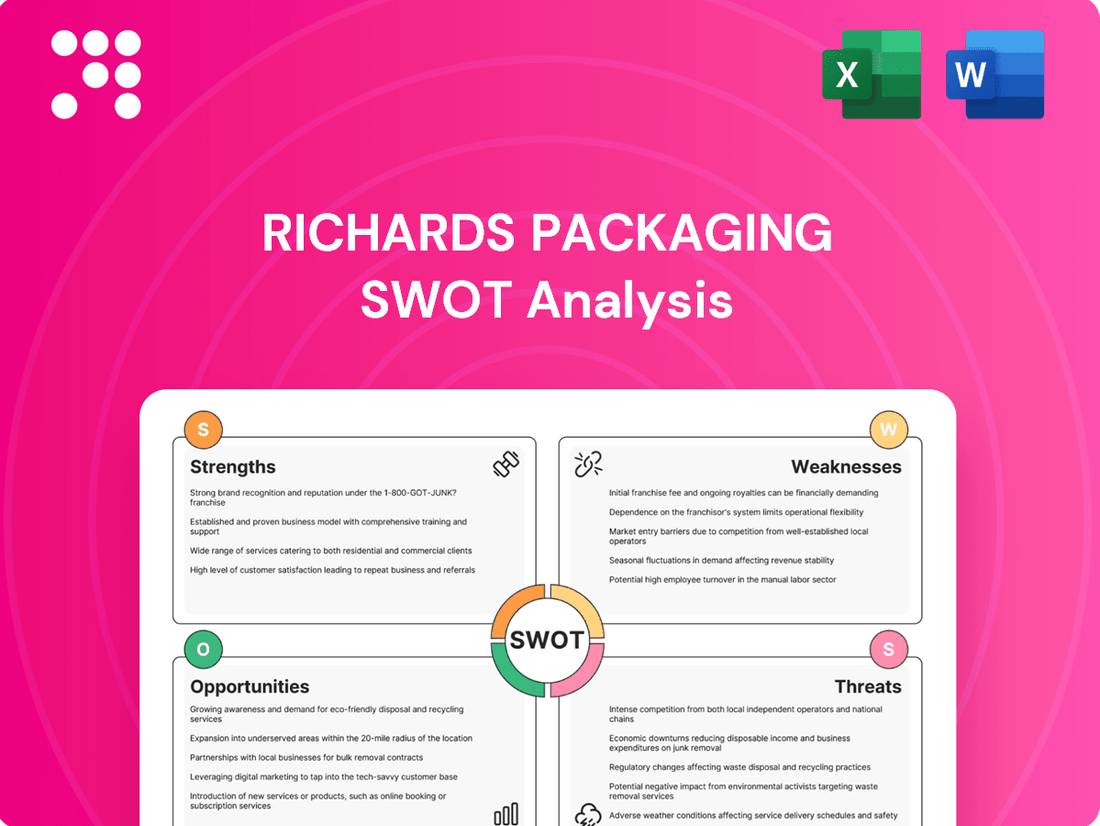

Richards Packaging SWOT Analysis

This is the actual Richards Packaging SWOT analysis document you’ll receive upon purchase—no surprises, just professional quality. You'll gain a comprehensive understanding of the company's internal strengths and weaknesses, alongside external opportunities and threats. This detailed report is ready for your strategic planning.

Opportunities

The global sustainable packaging market is projected to reach $413.8 billion by 2027, a significant increase from $270.1 billion in 2022, driven by heightened environmental consciousness and stricter regulations. Richards Packaging is well-positioned to leverage this growth by expanding its portfolio of recyclable, biodegradable, and lightweight packaging solutions, including innovative refillable systems. This strategic focus aligns with increasing consumer preferences for eco-friendly products and can lead to enhanced market share and brand reputation.

The persistent expansion of e-commerce is a significant tailwind for the packaging industry, directly fueling demand for robust and specialized packaging. Richards Packaging is well-positioned to capitalize on this trend by broadening its product lines and services specifically designed for online retailers, including innovative smart packaging solutions that can improve the unboxing experience and provide greater supply chain visibility.

Richards Packaging's strategic launch of an e-commerce channel in 2025 marks a pivotal moment in its digital transformation. This move is designed to broaden its customer base, especially by catering to small and medium-sized businesses that often require more accessible purchasing options.

The e-commerce platform is projected to simplify transactions and enhance customer engagement, potentially capturing a larger share of the online packaging market. Industry reports indicate that the global e-commerce packaging market is expected to reach over $60 billion by 2026, highlighting the significant growth potential for Richards Packaging’s new digital venture.

Further Strategic Acquisitions

The packaging sector remains dynamic, with robust M&A activity. In 2024 alone, there were over 234 acquisitions worldwide, indicating a fertile ground for strategic expansion.

Richards Packaging's established strategy of pursuing tuck-in acquisitions offers a clear pathway to enhance its market standing. These targeted acquisitions can broaden its product and service offerings, thereby diversifying revenue streams and reducing reliance on any single market segment.

- Strengthen Market Position: Consolidate market share in key regions through strategic tuck-in acquisitions.

- Portfolio Diversification: Acquire companies with complementary product lines or in adjacent market niches to broaden offerings.

- Synergy Realization: Integrate acquired businesses to achieve operational efficiencies and cost savings.

- Access New Technologies: Purchase innovative packaging solutions or manufacturing capabilities to stay ahead of industry trends.

Innovation in Packaging Technology

Innovation in packaging technology presents a significant opportunity. The industry is witnessing a surge in smart packaging solutions, incorporating elements like sensors and digital connectivity through QR codes and NFC technology. For instance, by mid-2024, a notable percentage of consumer packaged goods companies were exploring or implementing smart packaging to improve traceability and consumer interaction.

Adopting these advanced packaging methods can offer Richards Packaging a distinct competitive advantage. This includes enriching product information accessible to consumers, fostering deeper engagement, and improving the transparency of the entire supply chain. Companies that integrate these technologies are better positioned to meet evolving consumer demands for information and sustainability.

Key opportunities stemming from packaging innovation include:

- Enhanced Consumer Engagement: Smart packaging can provide direct links to product details, usage instructions, or promotional content, boosting customer interaction.

- Improved Supply Chain Visibility: Technologies like NFC and QR codes allow for real-time tracking of products from manufacturing to the point of sale, reducing waste and improving efficiency.

- Competitive Differentiation: Early adoption of innovative packaging solutions can set Richards Packaging apart in a crowded market, attracting environmentally conscious and tech-savvy consumers.

Richards Packaging can capitalize on the growing demand for sustainable packaging, projected to reach $413.8 billion by 2027, by expanding its eco-friendly product lines. The continued expansion of e-commerce, with the market expected to exceed $60 billion by 2026, offers another significant avenue for growth, especially with the company's planned e-commerce channel launch in 2025. Furthermore, strategic tuck-in acquisitions, which saw over 234 global deals in 2024, present a clear opportunity to broaden its portfolio and market reach.

The company can also leverage technological advancements in smart packaging, with many consumer packaged goods companies exploring these solutions by mid-2024. This includes integrating sensors, QR codes, and NFC technology to enhance consumer engagement and supply chain visibility, offering a competitive edge in an evolving market.

| Opportunity Area | Market Projection/Trend | Richards Packaging's Strategic Advantage |

|---|---|---|

| Sustainable Packaging | Global market to reach $413.8B by 2027 | Expand eco-friendly product portfolio (recyclable, biodegradable) |

| E-commerce Growth | Market to exceed $60B by 2026 | Leverage new e-commerce channel (launching 2025) for broader customer access |

| Mergers & Acquisitions | 234+ global acquisitions in 2024 | Pursue tuck-in acquisitions to diversify offerings and market share |

| Packaging Innovation | Increased adoption of smart packaging (e.g., QR codes, NFC) | Integrate advanced technologies for enhanced consumer engagement and supply chain transparency |

Threats

The North American packaging distribution landscape is intensely competitive, with a noticeable trend towards market consolidation. The top five players are increasingly dominating the sector, creating a challenging environment for companies like Richards Packaging.

Richards Packaging must contend with significant pressure not only from these larger, consolidated competitors but also from a multitude of smaller, agile, regional family-owned businesses that often possess strong local relationships and flexibility.

Increasing regulatory scrutiny, such as the Food Safety Modernization Act (FSMA) Section 204 for enhanced traceability in the food sector, presents a significant challenge. These evolving regulations, particularly those focused on sustainability and material content, can necessitate substantial investments in new technologies and processes, thereby increasing operational complexities and compliance costs for Richards Packaging.

Global trade instability, including ongoing geopolitical tensions and the potential for new tariffs, poses a significant threat by increasing the cost of imported components and forcing costly rerouting of supply chains. For instance, the ongoing trade disputes between major economic blocs in 2024 continue to create uncertainty for businesses reliant on international sourcing.

Fluctuations in the prices of key raw materials, such as PET resin and glass, directly impact Richards Packaging's production costs and, consequently, its profitability. Reports from early 2025 indicate that the price of PET resin has seen a notable increase of approximately 8% year-over-year due to supply constraints, directly squeezing margins for packaging manufacturers.

Shifting Consumer Preferences and Sustainability Demands

The growing consumer demand for sustainable packaging, particularly a strong aversion to materials like Styrofoam, poses a significant threat to Richards Packaging. If the company cannot swiftly adapt its product offerings to align with these evolving preferences, it risks losing market share to competitors who are more agile in adopting eco-friendly solutions. For instance, a 2024 NielsenIQ report indicated that 70% of consumers are willing to pay more for sustainable packaging, highlighting the financial imperative to adapt.

Failure to innovate and meet these heightened sustainability expectations could result in a negative brand perception. This shift isn't just about materials; it encompasses the entire lifecycle of packaging, from sourcing to disposal. Companies that lag behind in offering recyclable, compostable, or reusable options may find themselves increasingly out of step with market demands, potentially impacting their revenue streams and long-term viability.

- Consumer Demand for Sustainability: A significant portion of consumers, estimated at over 70% in recent surveys, are actively seeking out products with eco-friendly packaging.

- Negative Perception of Traditional Materials: Materials like Styrofoam are increasingly viewed negatively by the public, leading to a decline in their acceptance and a preference for alternatives.

- Market Share Risk: Companies unable to quickly pivot to more sustainable packaging solutions risk losing customers and market share to competitors who can meet these demands.

- Brand Reputation Impact: A failure to align with sustainability trends can damage a company's brand image, affecting customer loyalty and overall market position.

Economic Downturns and Reduced Business Spending

Global economic volatility poses a significant threat, potentially dampening business and consumer confidence. This softening sentiment can directly translate into reduced demand for packaging solutions across Richards Packaging's diverse customer base.

A pronounced economic downturn could disproportionately affect spending by small and medium-sized businesses, which represent a core segment of Richards Packaging's clientele. For instance, during periods of economic contraction, these businesses often cut discretionary spending, including packaging upgrades or increased orders.

The company's reliance on these smaller enterprises means that a widespread slowdown could lead to a noticeable decrease in order volumes and potentially pressure on pricing. This vulnerability was highlighted in the 2023 economic climate, where many SMBs reported cautious spending habits amidst rising inflation and interest rates.

- Economic Downturn Impact: Reduced consumer and business spending directly affects demand for packaging.

- SMB Vulnerability: Small and medium-sized businesses, a key customer base, are often the first to cut expenses during economic slowdowns.

- Market Sensitivity: Richards Packaging's revenue streams are sensitive to macroeconomic fluctuations and shifts in business investment.

Intense competition from consolidated players and agile regional businesses creates pricing pressure and limits market expansion opportunities for Richards Packaging.

Evolving regulations, particularly around sustainability and traceability, necessitate costly technological upgrades and increase compliance burdens, potentially impacting operational efficiency and profitability.

Global economic volatility and trade instability, including tariffs and geopolitical tensions, disrupt supply chains, inflate raw material costs, and dampen demand, especially from the crucial SMB segment.

| Threat Category | Specific Factor | Impact on Richards Packaging | Supporting Data (2024-2025) |

|---|---|---|---|

| Competition | Market Consolidation | Reduced market share, pricing pressure | Top 5 players increasing dominance in North America. |

| Regulatory Environment | Sustainability Mandates | Increased compliance costs, need for technological investment | Growing demand for recyclable/compostable materials; FSMA Section 204 traceability requirements. |

| Economic Factors | Global Volatility & Inflation | Reduced consumer/business spending, higher raw material costs | PET resin prices up ~8% YOY (early 2025); SMBs cutting discretionary spending. |

| Consumer Preferences | Demand for Eco-Friendly Packaging | Risk of losing market share to adaptable competitors | ~70% of consumers willing to pay more for sustainable packaging (2024). |

SWOT Analysis Data Sources

This SWOT analysis is built upon a foundation of credible data, including Richards Packaging's official financial filings, comprehensive market research reports, and expert industry commentary to provide a well-rounded perspective.