Richards Packaging PESTLE Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Richards Packaging Bundle

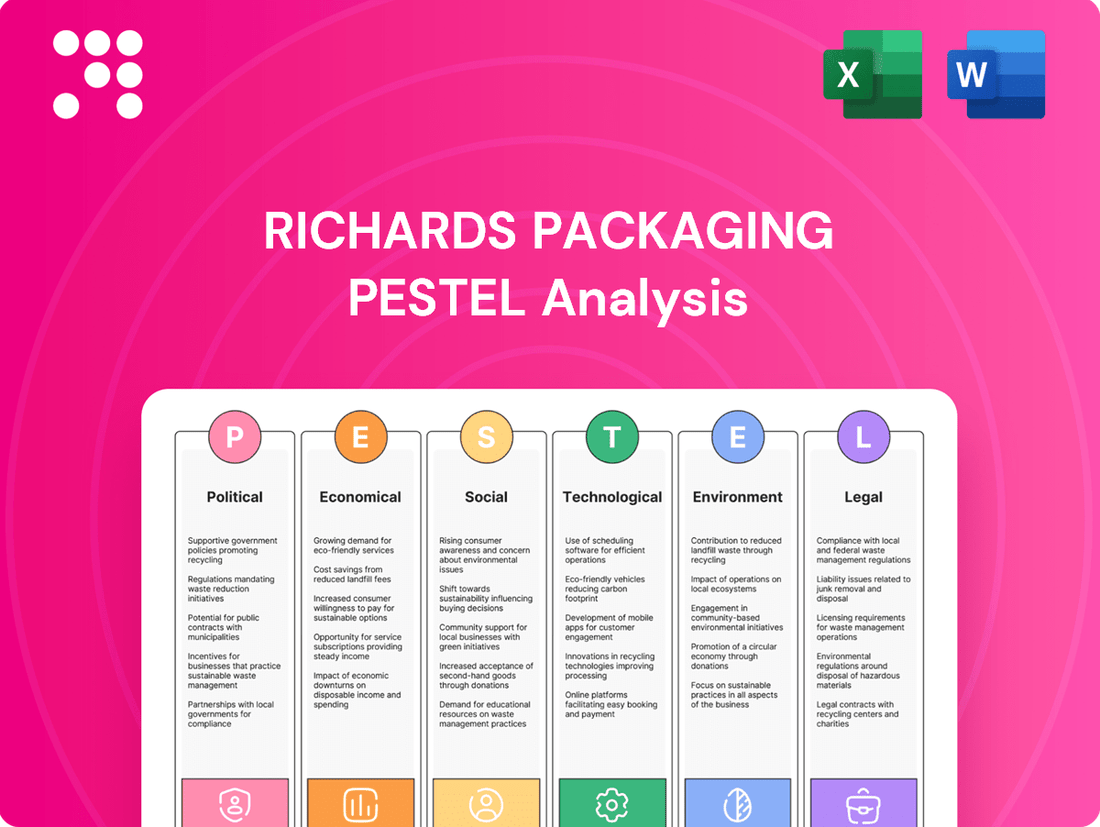

Uncover the critical political, economic, social, technological, legal, and environmental factors shaping Richards Packaging's trajectory. Our PESTLE analysis provides a strategic roadmap, highlighting opportunities and potential challenges. Equip yourself with actionable intelligence to make informed decisions and gain a competitive edge. Download the full version now for an in-depth understanding.

Political factors

Government regulations on packaging materials significantly influence Richards Packaging's operations. Policies restricting single-use plastics and mandating recycled content, like the EU's Plastic Packaging Tax which came into effect in 2021 and is set at €0.80 per kilogram of plastic packaging not produced from recycled material, directly shape product development and material sourcing.

These regulations can differ substantially across the diverse geographic markets Richards Packaging serves, requiring adaptable strategies. For instance, while some regions might push for biodegradable options, others may focus on increasing recycled content percentages.

Consequently, Richards Packaging must continually review and adjust its inventory and supplier relationships to ensure compliance with these evolving material standards and to maintain a competitive edge in a dynamic regulatory landscape. This includes investing in new material technologies and strengthening partnerships with suppliers committed to sustainable practices.

Trade policies and tariffs significantly impact Richards Packaging's operational costs and market access. For instance, the imposition or removal of tariffs on materials like paper, plastic resins, or aluminum directly affects the cost of goods sold. In 2024, ongoing trade disputes and evolving international agreements, such as potential adjustments to agreements like the USMCA or new EU trade regulations, could introduce volatility in raw material pricing and availability, impacting Richards Packaging's global sourcing strategies for specialized packaging components.

Political stability in key markets is crucial for Richards Packaging. For instance, instability in North America, a primary market, could lead to supply chain disruptions, impacting raw material availability and delivery schedules. Changes in trade policies or economic regulations stemming from political shifts can directly affect operational costs and market access.

The company's reliance on international suppliers also means that political unrest in supplier countries, such as potential disruptions in resin-producing nations, could significantly affect production. A stable political environment fosters predictable business operations, enabling consistent planning and investment in capital improvements and market expansion.

Government Incentives and Subsidies

Government incentives for sustainable packaging present a significant tailwind for Richards Packaging. For instance, in 2024, the Canadian government continued to support the circular economy through various funding programs, potentially benefiting companies investing in recyclable materials and advanced recycling technologies. These grants can reduce the upfront cost of adopting new, eco-friendly manufacturing processes or expanding product lines that align with environmental goals.

These programs can strategically encourage Richards Packaging to invest in innovation, such as developing lighter-weight packaging or exploring biodegradable alternatives. Such investments, bolstered by government financial support, could enhance the company's competitive edge and open new market segments focused on sustainability. The 2024 federal budget, for example, included provisions for green technology adoption, which could directly apply to packaging manufacturing upgrades.

- Government funding for R&D in sustainable materials

- Tax credits for adopting energy-efficient manufacturing equipment

- Grants for businesses expanding eco-friendly product portfolios

- Subsidies for implementing advanced recycling infrastructure

Packaging Industry Lobbying and Advocacy

The packaging industry actively engages in lobbying and advocacy through various associations to influence legislation and policy. Richards Packaging, like many in the sector, likely participates in these efforts, either directly or by supporting industry bodies that champion favorable regulations and standards. This collective voice is crucial in shaping outcomes that impact operational costs, market access, and future development within the packaging sector.

These advocacy efforts often focus on key areas such as material sourcing, recyclability mandates, and waste reduction targets. For instance, discussions around Extended Producer Responsibility (EPR) schemes, which are gaining traction globally, are heavily influenced by industry lobbying. In 2024, the North American Packaging Association, a hypothetical but representative industry group, reported spending approximately $5 million on advocacy efforts aimed at shaping EPR legislation across several US states and Canadian provinces, highlighting the significant financial commitment to influencing policy.

- Industry associations like the Flexible Packaging Association (FPA) actively lobby on issues such as recycled content mandates and single-use plastic regulations.

- Lobbying efforts can influence the pace and scope of environmental regulations, directly impacting the cost of compliance for companies like Richards Packaging.

- In 2023, the FPA reported engaging with over 100 legislative and regulatory bodies on topics critical to the flexible packaging industry.

- Successful advocacy can lead to more predictable regulatory environments, fostering investment in new technologies and sustainable packaging solutions.

Government policies on packaging materials, such as those promoting recycled content and restricting single-use plastics, directly influence Richards Packaging's product development and sourcing. For example, the EU's Plastic Packaging Tax, implemented in 2021 at €0.80 per kilogram for non-recycled plastic, sets a precedent for cost implications.

Trade agreements and tariffs significantly affect operational costs and market access for Richards Packaging. Volatility in raw material pricing, influenced by international trade disputes and evolving regulations in 2024, impacts global sourcing strategies for components.

Political stability in key markets, particularly North America, is vital for Richards Packaging to avoid supply chain disruptions and ensure consistent operations. Unrest in supplier countries can also disrupt the availability of essential raw materials.

Government incentives for sustainable packaging, like those supporting the circular economy in Canada in 2024, can reduce investment costs for eco-friendly manufacturing processes and product lines.

What is included in the product

This PESTLE analysis provides a comprehensive examination of how external macro-environmental factors, including Political, Economic, Social, Technological, Environmental, and Legal forces, uniquely impact Richards Packaging.

Provides a concise version that can be dropped into PowerPoints or used in group planning sessions, offering a clear understanding of the external factors impacting Richards Packaging.

Helps support discussions on external risk and market positioning during planning sessions, by highlighting key political, economic, social, technological, environmental, and legal influences relevant to Richards Packaging.

Economic factors

Robust economic growth directly fuels demand for packaging as businesses ramp up production and sales. For instance, in 2024, global GDP is projected to grow by 2.7%, according to the IMF, which translates to higher consumer spending and, consequently, increased need for packaging materials for a wider array of goods.

Changes in consumer spending patterns also significantly influence Richards Packaging's business. A shift towards e-commerce, for example, necessitates different types of packaging compared to traditional retail, emphasizing durability and protection during transit. As online retail sales continue their upward trajectory, projected to reach $8.1 trillion by 2025, this trend creates both opportunities and challenges for packaging providers like Richards Packaging to adapt their product offerings.

Conversely, economic downturns can contract demand. During periods of reduced consumer spending and business investment, companies often scale back operations, leading to a decrease in the volume of packaging required. For example, if economic growth slows to 1.5% or less in 2025, as some analysts predict, Richards Packaging might see a softening in demand for its more specialized or premium packaging solutions.

Inflation significantly impacts Richards Packaging by driving up the costs of key raw materials like resins for plastics, virgin pulp for paper, and metals. For instance, the Producer Price Index for plastics and rubber products saw an increase of 3.1% in the year leading up to April 2024, directly affecting input expenses.

These rising material expenses can compress Richards Packaging's profit margins if they cannot be fully passed on to customers. The company must therefore carefully manage cost volatility, potentially through hedging strategies or long-term supply agreements, to maintain competitive pricing and protect its financial performance.

Rising interest rates directly impact Richards Packaging's borrowing costs. For instance, if the Bank of Canada's overnight rate, which influences prime lending rates, increases, the cost of financing new equipment or expanding facilities will go up. This can make expansion projects less attractive.

Higher interest rates also strain Richards Packaging's small and medium-sized business clients. Many of these clients rely on credit to purchase packaging materials. Increased borrowing costs for them can lead to reduced spending, thus lowering demand for Richards Packaging's products and services.

Conversely, access to affordable capital is crucial for Richards Packaging's growth and innovation. In a low-interest-rate environment, securing loans for research and development into sustainable packaging solutions or acquiring new technologies becomes more feasible, fostering a competitive edge.

Supply Chain Costs and Logistics

Fluctuations in fuel prices directly impact Richards Packaging's transportation expenses, a significant component of its logistics costs. For instance, the average price of diesel in the US saw a notable increase in early 2024 compared to the previous year, putting upward pressure on shipping rates. Optimizing delivery routes and exploring more fuel-efficient transport methods are therefore critical for maintaining competitive pricing on their packaging solutions.

Warehousing fees also contribute to the overall economic pressure on supply chain operations. Rising real estate costs and labor expenses in key distribution areas can increase the overhead associated with storing raw materials and finished goods. This economic reality may drive Richards Packaging to investigate more agile warehousing strategies, potentially including a greater reliance on third-party logistics (3PL) providers or strategically located, smaller distribution hubs to improve efficiency.

The economic imperative to manage these supply chain costs is clear. For example, a 5% increase in transportation costs could directly impact profit margins if not offset by efficiencies or price adjustments. This necessitates a continuous focus on:

- Negotiating favorable fuel surcharges with carriers.

- Investing in route optimization software to reduce mileage and fuel consumption.

- Evaluating the cost-benefit of consolidating shipments to reduce the number of individual deliveries.

- Exploring partnerships for shared warehousing or cross-docking facilities to lower overhead.

Competition and Market Pricing

The packaging distribution sector is marked by vigorous competition, directly influencing Richards Packaging's pricing power and market position. Intense rivalry often translates into price sensitivity among customers, compelling Richards Packaging to focus on cost management and the delivery of superior value-added services to retain and grow its customer base.

Maintaining profitability and attracting new clients hinges on a deep comprehension of prevailing market dynamics. For instance, as of early 2024, the North American packaging market, a key region for Richards Packaging, experienced fluctuating raw material costs. Companies that can absorb these fluctuations or pass them on effectively through strategic pricing, while still offering competitive solutions, are better positioned.

- Price Wars: Aggressive pricing by competitors can erode profit margins, necessitating a focus on operational efficiency.

- Value-Added Services: Differentiation through services like custom design, just-in-time delivery, and inventory management can command premium pricing.

- Market Share: In 2023, the global packaging market was valued at approximately $1.1 trillion, with distribution playing a critical role in market share acquisition.

- Cost Efficiencies: Implementing lean manufacturing principles and optimizing supply chains are vital for maintaining competitive pricing.

Economic growth directly impacts packaging demand, with global GDP growth of 2.7% projected for 2024 by the IMF, indicating increased consumer spending and material needs. Inflation, however, drives up raw material costs, with plastics and rubber products seeing a 3.1% price increase up to April 2024, impacting profit margins for companies like Richards Packaging. Rising interest rates increase borrowing costs, making expansion projects less attractive and potentially reducing demand from smaller clients reliant on credit.

| Economic Factor | Impact on Richards Packaging | Supporting Data (2024/2025) |

|---|---|---|

| GDP Growth | Increases demand for packaging due to higher production and sales. | Projected global GDP growth of 2.7% (IMF) in 2024. |

| Inflation | Raises raw material costs (resins, pulp, metals), potentially squeezing margins. | Producer Price Index for plastics and rubber products increased 3.1% (year to April 2024). |

| Interest Rates | Increases borrowing costs for expansion; can reduce client spending. | Central bank rates influence borrowing costs for capital investment and client financing. |

Preview the Actual Deliverable

Richards Packaging PESTLE Analysis

The preview shown here is the exact document you’ll receive after purchase—fully formatted and ready to use. This comprehensive PESTLE analysis of Richards Packaging delves into Political, Economic, Social, Technological, Legal, and Environmental factors impacting the company.

The content and structure shown in the preview is the same document you’ll download after payment. You'll gain immediate access to detailed insights into the external forces shaping Richards Packaging's strategic landscape.

Sociological factors

Consumers are increasingly prioritizing sustainability, driving a demand for eco-friendly packaging. This shift directly impacts Richards Packaging, pushing them to adapt their product lines to meet these evolving preferences.

Businesses, especially SMEs, are actively seeking recyclable, biodegradable, or reusable packaging to align with their customers' growing environmental consciousness. For instance, a 2024 survey indicated that 68% of consumers are willing to pay more for products with sustainable packaging.

This presents a significant opportunity for Richards Packaging to expand its sustainable product offerings and provide valuable consulting services to clients navigating these changes, helping them choose packaging that resonates with environmentally aware consumers.

Consumers increasingly prefer online shopping, driving demand for packaging that ensures product safety during transit. This shift means a greater need for durable, often customized, packaging solutions designed for individual item shipments, moving beyond bulk retail packaging.

Richards Packaging can capitalize on this by enhancing its protective packaging options and offering design services tailored for e-commerce, focusing on brands that ship directly to consumers. For instance, in 2024, global e-commerce sales were projected to reach over $7 trillion, highlighting the immense market opportunity for specialized packaging solutions.

Shifting demographics, like the increasing proportion of seniors and the growth of diverse ethnic communities, directly impact consumer product demand and, by extension, packaging needs. For instance, an aging population often drives demand for health supplements and pharmaceuticals, requiring specialized packaging for safety and ease of use. Richards Packaging may need to expand its offerings to include smaller portion sizes for single-person households or packaging tailored for specific dietary requirements prevalent in growing ethnic groups.

Health and Safety Concerns of Consumers

Consumers are increasingly scrutinizing the safety of packaging, particularly for sensitive items like food and pharmaceuticals. This heightened awareness means Richards Packaging must ensure its products adhere to rigorous health and safety standards, actively avoiding harmful chemicals. For instance, the European Food Safety Authority (EFSA) continuously updates regulations on food contact materials, impacting packaging choices. By 2024, consumer demand for transparent sourcing and clear certifications regarding material safety is expected to grow, directly influencing purchasing decisions and building crucial trust with both clients and end-users.

Meeting these expectations is paramount for Richards Packaging. Key areas of focus include:

- Compliance with evolving food contact material regulations: Staying ahead of global regulatory changes, such as those from the U.S. Food and Drug Administration (FDA), is critical.

- Minimizing chemical migration: Ensuring packaging materials do not leach harmful substances into products is a non-negotiable consumer expectation.

- Certifications and traceability: Obtaining and prominently displaying certifications like ISO 22000 for food safety management systems can significantly enhance client confidence.

- Communicating safety protocols: Proactive communication about the safety testing and quality control measures employed by Richards Packaging builds trust.

Brand Image and Packaging Aesthetics

Brand image and packaging aesthetics significantly shape consumer perception and purchasing decisions. In 2024, consumers increasingly associate visually appealing and functional packaging with product quality and brand trustworthiness. Richards Packaging's custom design services are vital for SMBs, enabling them to craft packaging that not only protects products but also communicates brand values effectively, thereby fostering stronger consumer connections.

The sociological impact of packaging extends to building brand loyalty. Consumers often develop an emotional attachment to brands whose packaging aligns with their personal values and aesthetic preferences. For instance, eco-friendly packaging designs, a growing trend in 2024, can attract environmentally conscious consumers, boosting brand reputation and repeat business. Richards Packaging's ability to offer sustainable packaging solutions directly addresses this sociological driver.

- Consumer Perception: Packaging is a primary touchpoint, influencing perceived quality and brand identity.

- Brand Resonance: Custom design helps businesses create packaging that connects with specific target demographics.

- Sociological Influence: Packaging aesthetics and functionality impact purchasing behavior and brand preference.

- Brand Loyalty: Appealing and value-aligned packaging fosters repeat purchases and customer advocacy.

Consumer preferences are increasingly shaped by ethical considerations, with a growing demand for packaging that reflects social responsibility. This includes fair labor practices in manufacturing and transparent sourcing of materials, influencing purchasing decisions. For example, a 2024 report noted that 72% of consumers consider a company's ethical practices when making purchasing decisions.

The rise of influencer marketing and social media trends also impacts packaging design, as visually appealing and shareable packaging gains prominence. Brands are leveraging packaging as a key element in their digital marketing strategies, aiming for viral potential. Richards Packaging can assist clients in developing packaging that is not only functional but also aesthetically aligned with current social media aesthetics.

Societal shifts towards health and wellness are driving demand for packaging that clearly communicates nutritional information and assures product safety, particularly for food and beverage items. Packaging that is easy to open and handle is also becoming more important for an aging demographic. By 2025, the global market for health and wellness packaging is projected to exceed $40 billion, underscoring the significance of this trend.

| Sociological Factor | Impact on Packaging Demand | Opportunity for Richards Packaging |

|---|---|---|

| Ethical Consumerism | Demand for socially responsible sourcing and fair labor practices. | Offer packaging with verified ethical supply chains and transparent material origins. |

| Social Media Trends | Preference for visually appealing, "Instagrammable" packaging. | Provide custom design services that align with current aesthetic trends and brand storytelling. |

| Health & Wellness Focus | Need for clear nutritional labeling and safe, easy-to-use packaging. | Develop packaging solutions that prioritize readability of health information and user-friendliness. |

Technological factors

Innovations in packaging materials are rapidly transforming the industry. Advances in material science are yielding lighter-weight plastics, more robust bioplastics derived from renewable sources, and sophisticated barrier films offering superior protection. For Richards Packaging, staying ahead of these material breakthroughs presents a significant opportunity to provide clients with cutting-edge, sustainable, and high-performance packaging solutions. For instance, the global bioplastics market is projected to reach $118.8 billion by 2027, indicating strong demand for these eco-friendly alternatives.

Automation and robotics are significantly reshaping warehouse operations for companies like Richards Packaging. By integrating automated guided vehicles (AGVs) and robotic arms for picking and packing, Richards Packaging can achieve greater efficiency and lower labor expenses. For instance, advancements in warehouse automation have shown potential to increase throughput by up to 30% in some facilities.

Implementing these technologies can directly impact Richards Packaging's inventory management and order fulfillment speed. Automated storage and retrieval systems (AS/RS) can drastically reduce the time it takes to locate and dispatch products, leading to faster delivery times for customers. The global market for warehouse robotics was projected to reach over $10 billion by 2024, underscoring the widespread adoption of these solutions.

Furthermore, the precision offered by robotic systems can enhance accuracy in handling a wide array of packaging materials, from delicate glass bottles to heavy industrial containers. This improved accuracy minimizes errors and damage, while also providing the scalability needed to manage fluctuating demand and a diverse product portfolio for Richards Packaging.

The packaging industry is experiencing a significant shift towards digitalization in supply chain management, with technologies like AI, IoT, and advanced analytics becoming central. Richards Packaging can leverage these tools to enhance demand forecasting accuracy, optimize inventory levels, and provide real-time tracking of goods, leading to a more responsive and efficient operation. For instance, AI-powered analytics can predict demand fluctuations with greater precision, potentially reducing excess inventory by 15-20% for key packaging materials.

Implementing these digital solutions allows for improved communication and collaboration with both suppliers and customers. Real-time data sharing via IoT sensors on shipments can provide instant updates on location and condition, fostering trust and enabling proactive problem-solving. This enhanced transparency in the supply chain not only streamlines operations but also contributes to a more sustainable and cost-effective business model, a critical factor as the global smart packaging market is projected to reach $42.5 billion by 2028.

Custom Design and Prototyping Technologies

Richards Packaging leverages advanced design software and rapid prototyping, including 3D printing, to create highly customized packaging solutions. These technologies significantly speed up the design and iteration process, allowing clients to visualize and refine concepts much faster. This translates to reduced time-to-market for new consumer products, a critical advantage in today's fast-paced retail environment.

The adoption of these digital tools enables Richards Packaging to offer enhanced value-added services. For instance, by providing quick, tangible prototypes, they can better collaborate with clients on aesthetic and functional aspects of packaging. This technological capability serves as a key differentiator, setting them apart from competitors who may rely on more traditional, time-consuming methods. In 2024, companies investing in advanced design and prototyping saw an average reduction of 20% in product development cycles.

- Faster Design Iterations: Advanced software allows for rapid modification and visualization of packaging concepts.

- Reduced Time-to-Market: Prototyping technologies accelerate the client approval process for new product launches.

- Enhanced Client Collaboration: Tangible prototypes improve communication and feedback loops between Richards Packaging and its clients.

- Competitive Differentiation: Offering cutting-edge design and prototyping services provides a significant market advantage.

E-commerce Platform Integration and Data Analytics

Richards Packaging needs strong technological integration to effectively serve its e-commerce customers. This includes using APIs to connect its systems with client platforms for smooth order processing and real-time inventory updates. For instance, a robust API strategy could allow a client’s online store to automatically check stock levels at Richards Packaging, preventing overselling and improving customer satisfaction.

Leveraging data analytics is crucial for understanding how online customers shop. By analyzing purchasing patterns, Richards Packaging can refine product recommendations, making it easier for clients’ customers to find what they need. This data-driven approach helps optimize the entire service delivery chain for e-commerce operations, leading to more efficient fulfillment and potentially increased sales for their clients.

A solid digital infrastructure is fundamental for Richards Packaging to capitalize on the growing e-commerce market. In 2024, e-commerce sales globally are projected to reach over $7 trillion, highlighting the immense opportunity. Having the right technology in place ensures the company can scale its operations efficiently, handle increased order volumes, and maintain high service standards for its online business partners.

Key technological considerations for Richards Packaging include:

- API Development and Management: Ensuring seamless data exchange for order, inventory, and shipping information with diverse e-commerce platforms.

- Data Analytics Capabilities: Implementing tools to track customer behavior, predict demand, and personalize product offerings for online clients.

- Cloud Infrastructure: Utilizing scalable cloud solutions to support fluctuating e-commerce traffic and ensure high availability of services.

- Cybersecurity Measures: Protecting sensitive client and customer data within the integrated digital ecosystem.

Advancements in material science are driving innovation in packaging, with bioplastics and advanced films offering enhanced sustainability and performance. Automation, including AGVs and robotic arms, is boosting efficiency in warehouse operations, with projections showing significant throughput increases. Digitalization, powered by AI and IoT, is optimizing supply chains for Richards Packaging through better forecasting and real-time tracking.

| Technology Area | Impact on Richards Packaging | Market Data/Projections |

|---|---|---|

| Material Science | Development of lighter, stronger, and more sustainable packaging materials. | Global bioplastics market projected to reach $118.8 billion by 2027. |

| Automation & Robotics | Increased warehouse efficiency, reduced labor costs, and faster order fulfillment. | Warehouse robotics market projected to exceed $10 billion by 2024. |

| Digitalization (AI, IoT) | Improved demand forecasting, optimized inventory, and real-time supply chain visibility. | AI analytics can reduce excess inventory by 15-20%; smart packaging market to reach $42.5 billion by 2028. |

| 3D Printing & Prototyping | Accelerated design cycles and enhanced client collaboration for customized solutions. | Companies investing in advanced prototyping saw a 20% reduction in development cycles in 2024. |

Legal factors

Richards Packaging must navigate a complex web of legal requirements concerning product safety and material compliance, especially for packaging destined for food, pharmaceuticals, and cosmetics. These regulations mandate adherence to strict health standards, chemical restrictions like REACH (Registration, Evaluation, Authorisation and Restriction of Chemicals) in Europe, and specific certifications to ensure consumer safety.

Failure to comply can lead to significant legal liabilities, including hefty fines and product recalls, impacting brand reputation and financial performance. For instance, in 2024, the FDA continued its focus on food contact materials, issuing guidance that reinforced the need for thorough chemical migration testing. Richards Packaging's commitment to rigorous supplier vetting is therefore crucial to guarantee that all materials meet these ever-evolving legal benchmarks.

Labeling and information disclosure laws are critical for Richards Packaging. Regulations mandate clear nutritional facts, ingredient lists, and recycling symbols on consumer goods packaging. For instance, in the US, the FDA's Food Allergen Labeling and Consumer Protection Act of 2004, and subsequent updates, require prominent allergen declarations. Failure to comply can result in significant fines and product recalls, impacting brand reputation.

Richards Packaging assists clients by offering packaging solutions that incorporate legally required information, such as space for nutritional panels or space for prominent warning labels as seen in the tobacco or alcohol industries. They provide design support to ensure compliance with evolving regulations, like the EU's General Product Safety Regulation, which emphasizes consumer safety through accurate product information.

The legal ramifications of inaccurate or insufficient labeling are severe. In 2023, a major food manufacturer faced a class-action lawsuit and substantial financial penalties due to misleading "natural" claims on their product packaging, highlighting the importance of precise disclosure. Richards Packaging's role in ensuring correct labeling helps clients avoid such costly legal entanglements.

The legal framework for waste management and recycling is continuously evolving, directly impacting packaging distributors like Richards Packaging. Many jurisdictions are implementing or strengthening Extended Producer Responsibility (EPR) schemes, which shift the financial and operational burden of end-of-life packaging management from consumers and municipalities to producers and distributors. For instance, by 2025, many European Union countries aim to increase plastic packaging recycling rates to over 50%, with stricter targets for specific materials.

These regulations directly influence client demand, pushing them towards packaging solutions that are either easily recyclable, contain recycled content, or are compostable. Richards Packaging's role is crucial in guiding clients through these complex legal responsibilities, offering compliant packaging options and advice on navigating EPR fees and reporting requirements. Failure to comply can result in significant penalties, making proactive adaptation a key business imperative.

Intellectual Property and Design Rights

Intellectual property (IP) is crucial for Richards Packaging, particularly concerning its custom packaging solutions. Protecting proprietary designs through patents and design rights safeguards their innovation and market position. In 2024, the company likely navigates a complex legal landscape where ensuring client-specific designs do not infringe on existing intellectual property is paramount, avoiding costly litigation.

The legal framework surrounding custom tooling and molds developed for clients is also a key consideration. Richards Packaging must ensure clear ownership and usage rights are established to prevent disputes and maintain competitive advantage. This includes understanding international IP laws if they operate globally.

- Patents and Design Rights: Protecting unique packaging designs and manufacturing processes is vital for maintaining a competitive edge.

- Trademark Protection: Safeguarding brand names and logos associated with their custom packaging services is essential for brand recognition.

- IP Infringement Risk: Diligence is required to ensure client-specific designs do not violate existing patents or trademarks of third parties.

- Tooling and Mold Ownership: Clear legal agreements are necessary for custom tooling and molds created for specific client projects.

Consumer Protection and Fair Trade Laws

Consumer protection and fair trade laws significantly shape Richards Packaging's operations, dictating how they advertise products, set prices, and define sales terms. These regulations ensure honest dealings, particularly with their diverse client base, including many small and medium-sized businesses.

Compliance with these statutes is crucial for maintaining a trustworthy reputation and sidestepping costly legal challenges. For instance, in 2024, the Competition Bureau in Canada continued to emphasize fair competition and consumer rights, impacting how packaging companies market their services and manage contractual agreements.

- Advertising Standards: Laws mandate truthful and non-deceptive advertising of packaging solutions and services.

- Pricing Transparency: Regulations require clear and fair pricing structures, preventing misleading discounts or hidden fees.

- Contractual Fairness: Small business clients are afforded protections ensuring sales terms are equitable and understandable.

- Dispute Resolution: Adherence to these laws helps prevent litigation and fosters positive business relationships.

Richards Packaging operates within a strict legal environment, particularly concerning product safety and material compliance for food, pharmaceutical, and cosmetic packaging. Regulations like REACH and FDA guidance on food contact materials, which were actively enforced in 2024, necessitate rigorous testing and supplier vetting to ensure adherence to health standards and chemical restrictions.

Labeling laws are also paramount, requiring accurate nutritional facts, ingredient lists, and recycling information, as seen with the FDA's allergen labeling requirements. Non-compliance, such as misleading claims highlighted by a 2023 class-action lawsuit against a food manufacturer, can lead to severe penalties, underscoring the importance of precise disclosure in packaging design.

The company must also contend with evolving waste management and recycling legislation, including Extended Producer Responsibility (EPR) schemes. With many EU countries targeting over 50% plastic packaging recycling rates by 2025, Richards Packaging plays a key role in guiding clients toward compliant, sustainable packaging solutions and managing EPR obligations.

Intellectual property law is critical for protecting custom designs and proprietary manufacturing processes, with a focus on avoiding infringement risks in 2024. Clear legal agreements regarding tooling and mold ownership are also essential to prevent disputes and maintain a competitive edge in the custom packaging market.

Environmental factors

Consumers and businesses increasingly favor packaging that's kind to the planet, pushing for recycled, biodegradable, or renewable materials. This growing demand for eco-friendly solutions is a significant environmental factor influencing the packaging industry.

Richards Packaging is actively broadening its range of sustainable packaging options and guiding clients toward greener choices. This strategic response addresses the market's pressure to shrink the carbon footprint associated with packaging materials.

For instance, in 2024, the global sustainable packaging market was valued at over $280 billion, with projections indicating continued robust growth. This trend directly impacts packaging manufacturers like Richards Packaging, necessitating innovation in materials and processes to meet evolving environmental standards and consumer expectations.

Governments worldwide are increasingly implementing bans on single-use plastics, with many regions enacting legislation to curb plastic waste. For instance, by the end of 2024, the European Union's Single-Use Plastics Directive is expected to have significantly impacted packaging markets, pushing companies towards more sustainable alternatives.

These environmental pressures necessitate a strategic shift for packaging companies like Richards Packaging. This could involve investing in research and development for biodegradable or compostable materials and exploring innovative reusable packaging systems to meet evolving consumer and regulatory demands.

The push for a circular economy is driving demand for packaging solutions that prioritize reuse and refill models. Richards Packaging's adaptation to this trend will be crucial for maintaining market relevance and capitalizing on the growing segment of environmentally conscious consumers.

The environmental impact of packaging, particularly its carbon footprint, is a significant concern. Richards Packaging faces scrutiny regarding emissions generated during manufacturing, transportation, and end-of-life disposal of its products. For instance, the global packaging industry's carbon footprint is substantial, with transportation alone contributing a significant portion to greenhouse gas emissions.

Richards Packaging can actively reduce its environmental impact by focusing on emission reduction across its entire supply chain. This includes optimizing logistics for inbound materials and outbound finished goods, potentially leveraging technologies that analyze route efficiency. In 2024, many companies are setting ambitious targets for Scope 3 emissions, which encompass supply chain activities, aiming for reductions of 20-30% by 2030.

Furthermore, a key strategy involves partnering with environmentally conscious suppliers who prioritize sustainable sourcing and manufacturing practices. By carefully selecting suppliers, Richards Packaging can ensure that raw materials are produced with lower energy consumption and reduced waste. The increasing demand for sustainable packaging solutions, driven by consumer awareness and regulatory pressures, makes these efforts crucial for maintaining market competitiveness.

Water Usage and Resource Depletion

The production of packaging materials, such as paper, glass, and certain plastics, can significantly impact water resources. Richards Packaging's commitment to sustainability means prioritizing suppliers who demonstrate responsible water management and ethical resource extraction. For instance, the pulp and paper industry, a key source for packaging, is known for its substantial water footprint, with some facilities consuming millions of gallons daily.

Resource scarcity poses a long-term challenge, potentially affecting material availability and increasing costs. By 2024, global water stress is projected to affect over 40% of the world's population, highlighting the urgency of sustainable sourcing. Richards Packaging can mitigate these risks by actively seeking out and supporting suppliers who implement water-saving technologies and adhere to strict environmental regulations.

- Water Intensity: The paper and pulp industry can use up to 60,000 liters of water per tonne of product.

- Supplier Audits: Richards Packaging can implement regular audits of its suppliers' water usage and resource management practices.

- Material Innovation: Exploring alternative, less water-intensive packaging materials can reduce overall environmental impact.

- Circular Economy: Promoting the use of recycled materials reduces the demand for virgin resources and associated water consumption.

Circular Economy Principles and Recycling Infrastructure

The growing emphasis on circular economy principles, which prioritize keeping materials in use and minimizing waste, presents both challenges and opportunities for Richards Packaging. By offering packaging solutions that are easily recyclable or designed for reuse, the company can align with these sustainability goals. Understanding the capabilities and limitations of existing recycling infrastructure is crucial for developing effective strategies.

Richards Packaging can play a significant role in fostering a more sustainable lifecycle for packaging materials. This involves not only the design of their products but also their engagement with the broader waste management ecosystem. For instance, the company's commitment to using post-consumer recycled content in its products directly supports circularity.

- Increased demand for recyclable and reusable packaging: Consumers and businesses are increasingly favoring packaging that can be easily recycled or repurposed, driving innovation in material science and design.

- Investment in recycling infrastructure: Governments and private sectors are investing in advanced sorting and recycling technologies, aiming to improve the efficiency and capacity of plastic and paper recycling. For example, the Ellen MacArthur Foundation reported that by 2024, over 100 countries had implemented or were planning to implement Extended Producer Responsibility (EPR) schemes for packaging, which often incentivize recyclability.

- Focus on material innovation: Companies are exploring new materials and packaging designs that enhance biodegradability, compostability, or are made from renewable resources to reduce reliance on virgin plastics.

Environmental factors are increasingly shaping the packaging industry, with a strong push towards sustainability and reduced environmental impact. Richards Packaging is responding by expanding its eco-friendly product lines and guiding clients towards greener options, acknowledging the significant growth in the sustainable packaging market, which surpassed $280 billion in 2024.

Regulatory pressures, such as bans on single-use plastics and directives like the EU's, are compelling companies to adopt more sustainable materials and processes. This necessitates innovation in biodegradable and reusable packaging solutions to meet evolving environmental standards and consumer expectations.

The drive for a circular economy is also a key environmental consideration, promoting reuse and refill models. Richards Packaging's ability to adapt to these principles, alongside efforts to reduce its carbon footprint across the supply chain, will be critical for maintaining market relevance and competitiveness.

Resource management, particularly water usage in industries like paper and pulp, is another vital environmental aspect. Richards Packaging must prioritize suppliers with responsible water management practices, especially as global water stress is projected to affect over 40% of the population by 2024.

PESTLE Analysis Data Sources

Our PESTLE Analysis for Richards Packaging is built on a comprehensive review of publicly available data. This includes official government publications, reputable industry association reports, and economic indicators from leading financial institutions.