Richards Packaging Boston Consulting Group Matrix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Richards Packaging Bundle

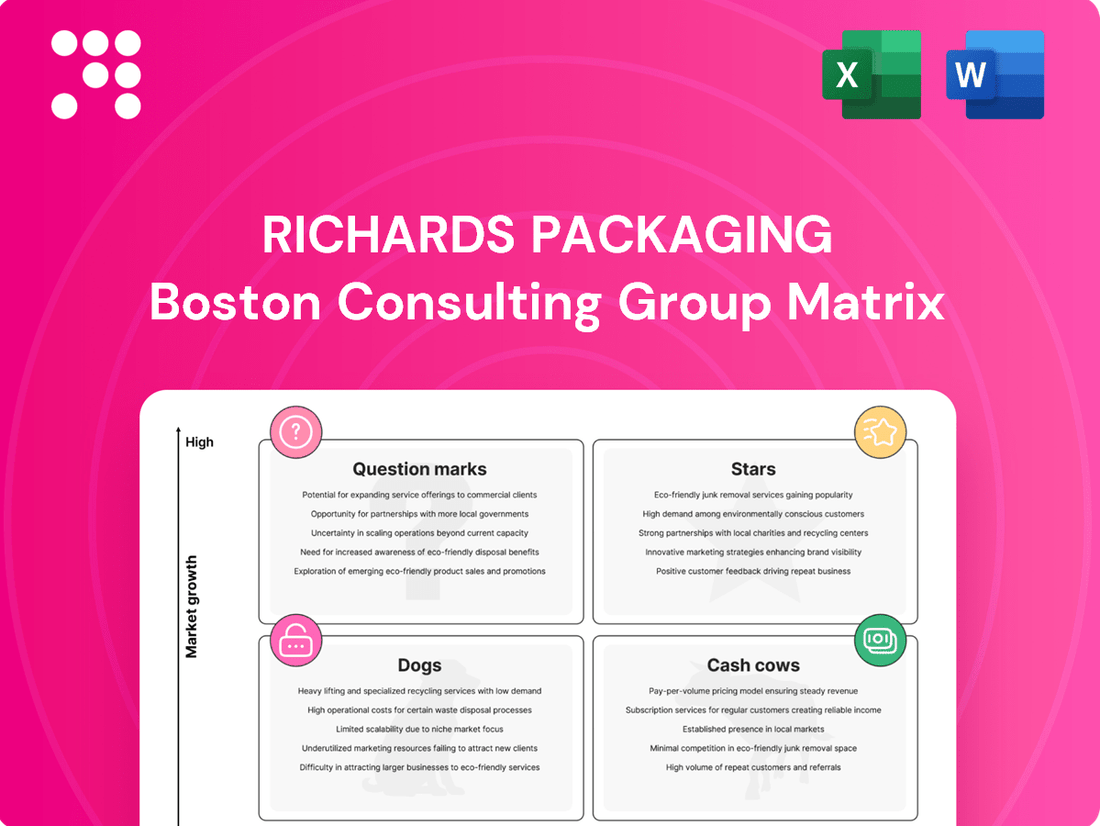

Curious about Richards Packaging's strategic product portfolio? Our BCG Matrix preview offers a glimpse into their market positioning, highlighting potential Stars, Cash Cows, Dogs, and Question Marks.

Unlock the full potential of this analysis by purchasing the complete Richards Packaging BCG Matrix report. Gain detailed quadrant placements, data-backed recommendations, and a clear roadmap for informed investment and product decisions.

Don't miss out on the comprehensive insights that will empower your strategic planning. Secure your copy today and equip yourself with the knowledge to navigate the market with confidence.

Stars

Richards Packaging demonstrates a robust position within the healthcare packaging sector, notably through strategic acquisitions such as DermapenWorld® for medical devices and dermatological cosmetics. This segment thrives on the critical need for product safety and specialized packaging, indicating a strong market presence.

The healthcare packaging segment is poised for significant growth, fueled by the integration of advanced technologies and an expanding global footprint for brands like WorldPRP®. This growth trajectory is supported by increasing demand for sterile and tamper-evident packaging solutions in the medical and pharmaceutical industries.

Richards Packaging's custom design and global sourcing services are a significant differentiator, allowing them to meet unique client packaging needs. This capability is crucial in a market where tailored solutions are increasingly valued, potentially boosting market share as demand for specialized packaging grows.

Sustainable packaging is a burgeoning sector, with the global market anticipated to reach approximately $500 billion by 2028, demonstrating robust growth potential. Richards Packaging's commitment to recyclable, reusable, and biodegradable materials, including innovative plant-based alternatives, positions them favorably to capture this expanding demand. This strategic focus aligns perfectly with evolving consumer preferences and stricter environmental regulations worldwide.

E-commerce Packaging Solutions

The e-commerce packaging sector is a rapidly growing area, fueled by the surge in online shopping. This trend necessitates packaging that is not only protective but also convenient and environmentally conscious. Richards Packaging's strategic emphasis on providing efficient and effective solutions for e-commerce businesses places it in a strong position to capitalize on this dynamic market. For instance, the global e-commerce packaging market was valued at approximately $60 billion in 2023 and is projected to reach over $100 billion by 2028, showcasing significant expansion.

- Market Growth: The e-commerce packaging market is experiencing robust growth, with projections indicating a compound annual growth rate (CAGR) of around 8-10% over the next five years.

- Richards Packaging's Role: The company's specialization in tailored packaging solutions for online retailers aligns perfectly with the increasing demand for specialized, durable, and brand-enhancing e-commerce packaging.

- Key Drivers: Increased consumer reliance on online shopping, coupled with a growing emphasis on sustainable materials and efficient logistics, are primary drivers for this market segment.

- Competitive Landscape: Richards Packaging aims to differentiate itself through innovation in materials, design, and supply chain integration to meet the evolving needs of e-commerce clients.

Specialized Closures and Dispensing Systems

Richards Packaging's Specialized Closures and Dispensing Systems segment is a vital contributor, offering critical components across numerous sectors. The ongoing drive for product innovation fuels a growing demand for advanced, high-performance closures. This trend presents a significant opportunity for Richards to expand its footprint within this specialized, yet indispensable, market segment.

The market for dispensing systems is particularly dynamic. For instance, the global market for cosmetic pumps and closures was valued at approximately $3.5 billion in 2023 and is projected to grow at a CAGR of over 5% through 2030. This growth is driven by consumer demand for convenient and precise application methods.

- Market Growth: The demand for specialized closures is bolstered by innovation in consumer goods, pharmaceuticals, and personal care products.

- Technological Advancement: Features like tamper-evidence, child resistance, and precise dispensing mechanisms are increasingly sought after.

- Industry Trends: Sustainability is also a key driver, with a focus on recyclable and biodegradable closure materials.

- Competitive Landscape: Richards Packaging competes with a range of global and regional players, necessitating continuous investment in R&D and manufacturing capabilities.

Richards Packaging's presence in the healthcare sector, bolstered by acquisitions like DermapenWorld®, positions it strongly in a market demanding high safety and specialized solutions. The company's custom design and global sourcing capabilities further enhance its ability to cater to unique client needs in this critical industry.

The e-commerce packaging segment is experiencing substantial growth, with the market valued at approximately $60 billion in 2023 and projected to exceed $100 billion by 2028. Richards Packaging's focus on efficient, protective, and sustainable solutions for online retailers directly addresses the key drivers of this expansion.

The specialized closures and dispensing systems market, valued at around $3.5 billion for cosmetic pumps and closures in 2023, is driven by innovation and consumer demand for convenience. Richards Packaging's investment in advanced, high-performance closures aligns with this trend, offering significant growth opportunities.

The sustainable packaging market, expected to reach $500 billion by 2028, presents a major opportunity. Richards Packaging's commitment to recyclable and biodegradable materials, including plant-based options, strategically positions it to capture demand driven by environmental consciousness and regulations.

| Segment | Market Value (2023 Est.) | Projected Growth (CAGR) | Richards Packaging's Position |

|---|---|---|---|

| Healthcare Packaging | Significant, driven by safety needs | Strong, fueled by tech integration | Strategic acquisitions, custom solutions |

| E-commerce Packaging | $60 billion | 8-10% (next 5 years) | Tailored, sustainable, efficient solutions |

| Specialized Closures & Dispensing | $3.5 billion (cosmetic pumps/closures) | >5% (through 2030) | Focus on innovation, high-performance features |

| Sustainable Packaging | Growing rapidly, ~$500 billion by 2028 | High, driven by consumer/regulatory demand | Commitment to recyclable/biodegradable materials |

What is included in the product

Strategic assessment of Richards Packaging's product lines, categorizing them as Stars, Cash Cows, Question Marks, or Dogs.

A clear BCG Matrix visualizes Richards Packaging's portfolio, identifying Stars and Cash Cows to strategically allocate resources and alleviate growth concerns.

Cash Cows

Richards Packaging's established distribution network in North America, operating since 1912, acts as a significant cash cow. This extensive network boasts high market penetration, serving over 18,000 regional businesses. The company reported revenues of approximately CAD 1.4 billion in 2023, with a substantial portion attributed to its mature North American operations, demonstrating consistent and stable cash generation.

Traditional Food & Beverage Packaging, despite recent oversupply concerns, continues to be a bedrock for Richards Packaging. This segment benefits from enduring consumer appetite for convenience, ensuring a steady revenue stream.

Richards Packaging's deep roots and extensive product range in food and beverage packaging are key. This established position is expected to yield substantial, though not rapidly expanding, cash flow, characteristic of a Cash Cow.

Richards Packaging's industrial packaging solutions, catering to manufacturing and other diverse sectors, are a prime example of a Cash Cow within their BCG matrix. This segment benefits from a mature market characterized by stable, predictable demand, ensuring consistent revenue streams.

These established product lines are vital for generating steady profits, providing the financial backbone for the company. For instance, in 2024, the industrial packaging sector is projected to contribute significantly to overall revenue, reflecting its low-risk, high-return profile.

Standard Plastic and Glass Containers

The standard plastic and glass containers segment represents Richards Packaging's core business, a mature market where the company commands a significant market share. This stability translates into consistent cash flow, even with limited growth potential.

These products are essential across a wide array of industries, ensuring a steady and predictable demand. This reliability makes them a classic example of a Cash Cow within the BCG matrix.

- High Market Share: Richards Packaging is a dominant player in the distribution of standard plastic and glass containers.

- Mature Market: The demand for these containers is stable but not experiencing rapid expansion.

- Consistent Cash Generation: The segment reliably produces substantial cash for the company.

- Low Growth Prospects: Future growth in this area is expected to be modest.

Inventory Management and Supply Chain Services

Richards Packaging's Inventory Management and Supply Chain Services are classic Cash Cows. These offerings leverage their extensive operational expertise to provide dependable, value-added support to a loyal customer base. This translates into a consistent and predictable revenue stream for the company.

These services are particularly strong because they address a core need for many businesses: efficient and reliable packaging logistics. By handling inventory and supply chain complexities, Richards allows its clients to focus on their primary operations. This deep integration fosters strong client relationships and recurring business.

For example, in 2023, Richards Packaging reported that its Packaging and Services segment, which includes these offerings, generated a significant portion of its revenue. While specific figures for just inventory management aren't broken out, the segment's overall performance highlights the stability of these established services.

- Steady Revenue: Built on deep operational expertise, these services provide a consistent income.

- Client Reliance: Existing customers depend on Richards for efficient packaging management.

- Low Investment: As mature services, they require minimal new investment to maintain their market position.

- Profitability: Their established nature and client loyalty contribute to strong profit margins.

Richards Packaging's established North American distribution network, operating since 1912, is a prime example of a Cash Cow. This segment serves over 18,000 regional businesses and benefits from high market penetration. The company's 2023 revenues of approximately CAD 1.4 billion were heavily influenced by these mature, stable operations, demonstrating consistent cash generation.

Traditional Food & Beverage Packaging, despite market fluctuations, remains a core Cash Cow due to consistent consumer demand for convenience. Industrial packaging solutions also fit this category, serving mature markets with stable, predictable demand, ensuring reliable revenue streams. In 2024, industrial packaging is projected to be a significant revenue contributor, reflecting its low-risk, high-return profile.

The standard plastic and glass containers segment, where Richards Packaging holds a significant market share, is a classic Cash Cow. This mature market offers stable, consistent cash flow with modest growth prospects. Similarly, Inventory Management and Supply Chain Services leverage operational expertise for dependable, value-added support, creating consistent and predictable revenue streams from a loyal customer base.

| Segment | BCG Category | Key Characteristics | 2023 Revenue Contribution (Approx.) | Growth Outlook |

|---|---|---|---|---|

| North American Distribution Network | Cash Cow | High market penetration, established operations, stable demand | Significant portion of CAD 1.4 billion total | Modest |

| Traditional Food & Beverage Packaging | Cash Cow | Enduring consumer demand, mature market | Substantial | Low to moderate |

| Industrial Packaging Solutions | Cash Cow | Stable, predictable demand, mature market | Significant projected for 2024 | Low |

| Standard Plastic & Glass Containers | Cash Cow | High market share, stable demand | Core business driver | Limited |

| Inventory Management & Supply Chain Services | Cash Cow | Leverages operational expertise, loyal customer base | Part of strong Packaging & Services segment | Steady |

What You’re Viewing Is Included

Richards Packaging BCG Matrix

The Richards Packaging BCG Matrix preview you are currently viewing is the identical, fully formatted document you will receive immediately after purchase. This means no additional editing or formatting will be required, as the report is ready for immediate strategic application. You can confidently assess its value, knowing the purchased version will be free of watermarks and contain the complete, professionally analyzed content. This ensures you get a complete, actionable tool for understanding Richards Packaging's market position.

Dogs

Commodity-focused, low-margin packaging products with minimal differentiation and intense price competition in a low-growth market can be classified as Dogs in the BCG Matrix. These products often generate little to no profit and tie up valuable capital without significant returns. For instance, basic corrugated boxes in a saturated market might fall into this category, where price is the primary competitive factor. In 2024, the global corrugated packaging market, while large, experienced moderate growth, with many segments facing intense price pressures due to readily available supply and limited innovation.

Traditional packaging materials like certain plastics and non-recyclable composites are increasingly falling into the Dogs category for Richards Packaging. As global regulations tighten and consumer demand for eco-friendly options surges, these materials face shrinking markets. For instance, by 2024, the Ellen MacArthur Foundation reported that 95% of plastic packaging by value is still single-use, highlighting the pressure on less sustainable alternatives.

Richards Packaging has seen revenue shrink in its food and beverage sectors, largely because of too much inventory sitting around. This oversupply situation means that some of their product lines, especially those deeply affected, could be considered 'Dogs' in the BCG Matrix if the problem doesn't improve soon.

If this excess inventory continues without a solid plan to sell it off or reduce it, these specific product lines might become cash drains. They would consume resources but offer very little prospect for future growth, a classic characteristic of 'Dog' products.

Segments with declining demand due to market shifts

Segments in the packaging industry experiencing a downturn due to evolving consumer tastes or outdated technology, where Richards Packaging has a minor presence, would be classified as Dogs. Resources allocated to these areas are unlikely to generate significant returns.

For instance, certain types of rigid plastic packaging for single-use items might fall into this category as consumers increasingly favor sustainable alternatives. In 2024, the global market for flexible packaging, often seen as a more sustainable option, was projected to grow significantly, while some rigid packaging segments faced slower growth or decline.

- Declining Demand: Segments like traditional glass bottles for certain beverage categories may see reduced demand as lighter, more shatter-resistant materials gain traction.

- Low Market Share: Richards Packaging's involvement in these specific niche markets is minimal, meaning they have little influence on market trends or pricing.

- Minimal Investment: The strategy for 'Dogs' involves divesting or minimizing investment to free up capital for more promising areas of the business.

Underperforming acquisitions not integrated effectively

Underperforming acquisitions that aren't integrated smoothly can become a drain on resources. For instance, if Richards Packaging acquired smaller companies, known as 'tuck-under' acquisitions, and these entities don't deliver their projected synergies or integrate effectively, their operations might stagnate. This can lead to them becoming cash traps, consuming capital and management attention without contributing meaningfully to the company's growth or market position.

The challenge lies in the integration process itself. A lack of clear strategic alignment or operational synergy realization post-acquisition can result in these acquired entities underperforming. This situation forces the parent company to allocate resources to manage these underperformers rather than investing in more promising areas of the business.

- Integration Challenges: Difficulty in merging operational systems, cultures, and management structures of acquired companies.

- Synergy Shortfalls: Failure to achieve expected cost savings or revenue enhancements from acquisitions.

- Resource Drain: Underperforming acquisitions consume capital and management bandwidth, diverting focus from growth initiatives.

Products in the 'Dogs' category for Richards Packaging are those with low market share in slow-growing or declining industries. These often involve commodity packaging with little differentiation, facing intense price competition and generating minimal profits. By 2024, the demand for certain single-use plastics continued to wane as sustainability concerns intensified, impacting product lines reliant on these materials.

For Richards Packaging, this could manifest as older, less efficient packaging solutions that are being phased out by consumers and regulatory bodies. These products tie up capital and resources without offering significant future growth potential, necessitating a strategic review to either divest or minimize investment.

The company's exposure to segments where market share is low and growth is stagnant, such as certain types of specialized industrial packaging facing technological obsolescence, would also be classified as Dogs. These areas require careful management to avoid becoming a persistent drain on resources.

The challenge for Richards Packaging is to identify these 'Dog' segments, which might include specific product lines with declining sales volumes and low profitability, and to strategically reallocate capital away from them. For example, if a particular type of glass container saw a 5% year-over-year decline in orders in 2024, and Richards Packaging held a small market share in that niche, it would likely be considered a Dog.

| BCG Category | Characteristics for Richards Packaging | Example Segment (2024 Context) | Strategic Implication |

|---|---|---|---|

| Dogs | Low market share, low growth industry, low profitability, little differentiation | Certain single-use rigid plastic containers for niche consumer goods; basic industrial strapping with declining demand | Divest, harvest, or minimize investment to free up capital |

| Dogs | Commodity products, intense price competition, mature market | Standard corrugated boxes in highly saturated regional markets with minimal value-added services | Focus on cost efficiency; consider exiting if unprofitable |

| Dogs | Outdated technology, declining consumer preference, regulatory pressure | Specific types of non-recyclable flexible packaging materials facing bans or strong consumer backlash | Phase out or find niche applications; avoid further investment |

Question Marks

Richards Packaging's new e-commerce channel, set to launch in 2025, represents a significant opportunity. The global e-commerce packaging market is experiencing robust growth, projected to reach USD 64.6 billion by 2027, indicating high potential. This positions the new channel as a potential star in their BCG matrix.

However, Richards Packaging's current market share in this nascent e-commerce channel is minimal. Significant investment will be necessary to build brand awareness, develop a robust online platform, and compete with established players who already have a strong foothold. This high investment requirement, coupled with low current market share, is characteristic of a question mark in the BCG matrix.

The acquisition of National Dental Inc. in February 2025 positions Richards Packaging within the dentistry sector, a new and potentially lucrative market with approximately 30,000 dentists in Canada. This strategic move represents Richards Packaging's entry into an unfamiliar vertical, meaning its current market share is negligible.

Given this nascent position, National Dental Inc. would likely be classified as a Question Mark in the BCG Matrix. The company requires significant investment to capture market share and leverage the growth potential within the Canadian dental industry.

The acquisition of HL Production SA, including the WorldPRP® brand, positions Richards Packaging within a high-growth segment of the healthcare market, specifically aesthetic medicine. This move offers a significant opportunity for expansion beyond its existing Canadian success.

While WorldPRP® has a proven track record in Canada, achieving substantial global market share will necessitate considerable investment in strategic marketing and global distribution networks. This expansion aligns with a potential Stars or Question Marks classification in the BCG matrix, depending on market penetration and future growth projections.

Innovative and Niche Sustainable Packaging Materials

Innovative and niche sustainable packaging materials, such as those derived from mushrooms or seaweed, currently represent a promising but nascent segment within the broader sustainable packaging market. While the overall sustainable packaging sector is experiencing robust growth, these specialized materials are often in their early adoption phases, meaning Richards Packaging's current market share may be limited.

Developing and scaling these materials requires significant upfront investment in research and development, establishing new production capabilities, and educating both businesses and consumers about their benefits and applications. For instance, the global market for biodegradable packaging, which includes many of these niche materials, was valued at approximately $270 billion in 2023 and is projected to grow significantly, but the specific share of highly innovative materials is still developing.

- High Growth Potential: These materials tap into a growing consumer demand for eco-friendly alternatives, positioning them for substantial future market expansion.

- Investment Needs: Significant capital is necessary for R&D, manufacturing process development, and quality control to bring these novel materials to market effectively.

- Market Education: Building awareness and acceptance among potential clients and end-users is crucial for overcoming initial adoption barriers.

- Competitive Landscape: While currently niche, these materials could disrupt traditional packaging markets if successful, requiring strategic positioning and potential partnerships.

Automated E-commerce Packaging Solutions

Automated e-commerce packaging solutions represent a burgeoning segment within the broader packaging industry. This area is experiencing robust expansion, fueled by the escalating consumer demand for faster delivery and the operational efficiencies that automation brings to fulfillment centers. For Richards Packaging, if they are actively developing or investing in these technologies, this segment would likely be classified as a Question Mark in the BCG matrix.

This classification stems from the high-growth potential of the automated packaging market, which is anticipated to reach approximately $10.5 billion globally by 2028, growing at a compound annual growth rate (CAGR) of over 12% from 2023. Despite this promising outlook, Richards Packaging might hold a relatively low current market share in this specialized niche. Consequently, significant investment in research and development, advanced robotics, and specialized infrastructure would be necessary to capture a meaningful portion of this expanding market.

- Market Growth: The automated e-commerce packaging market is projected for significant growth, driven by demand for rapid fulfillment and efficiency.

- BCG Classification: If Richards Packaging is developing or investing in automated packaging solutions, this would be a Question Mark.

- Investment Needs: This segment represents a high-growth area with potentially low current market share, requiring considerable investment in technology and infrastructure.

- Strategic Focus: The company would need to strategically allocate resources to build capabilities and gain market traction in this evolving sector.

Question Marks in Richards Packaging's portfolio represent areas with high growth potential but currently low market share. These ventures require significant investment to develop and capture market position. Success in these areas could transform them into Stars, but failure could lead to them becoming Dogs.

The e-commerce packaging channel and the newly acquired National Dental Inc. are prime examples of Question Marks. Both operate in expanding markets, but Richards Packaging's current penetration is minimal, necessitating substantial capital outlay for growth and market establishment.

Similarly, innovative sustainable packaging materials and automated e-commerce solutions also fit the Question Mark profile. These segments offer substantial future growth, yet require considerable investment in R&D and market development to gain traction against established or emerging competitors.

The WorldPRP® brand, while successful in Canada, also presents a Question Mark for global expansion. Achieving significant international market share will demand focused investment in marketing and distribution, mirroring the challenges and opportunities inherent in this BCG category.

| Business Unit/Initiative | Market Growth | Current Market Share | Investment Required | BCG Classification |

|---|---|---|---|---|

| E-commerce Packaging Channel | High | Low | High | Question Mark |

| National Dental Inc. | Moderate to High | Negligible | High | Question Mark |

| Innovative Sustainable Materials | High | Low | High | Question Mark |

| Automated E-commerce Solutions | High | Low | High | Question Mark |

| WorldPRP® Global Expansion | High | Low (Global) | High | Question Mark |

BCG Matrix Data Sources

Our Richards Packaging BCG Matrix is built on comprehensive market intelligence, integrating financial disclosures, industry research, and competitor analysis for strategic clarity.