Richards Packaging Porter's Five Forces Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Richards Packaging Bundle

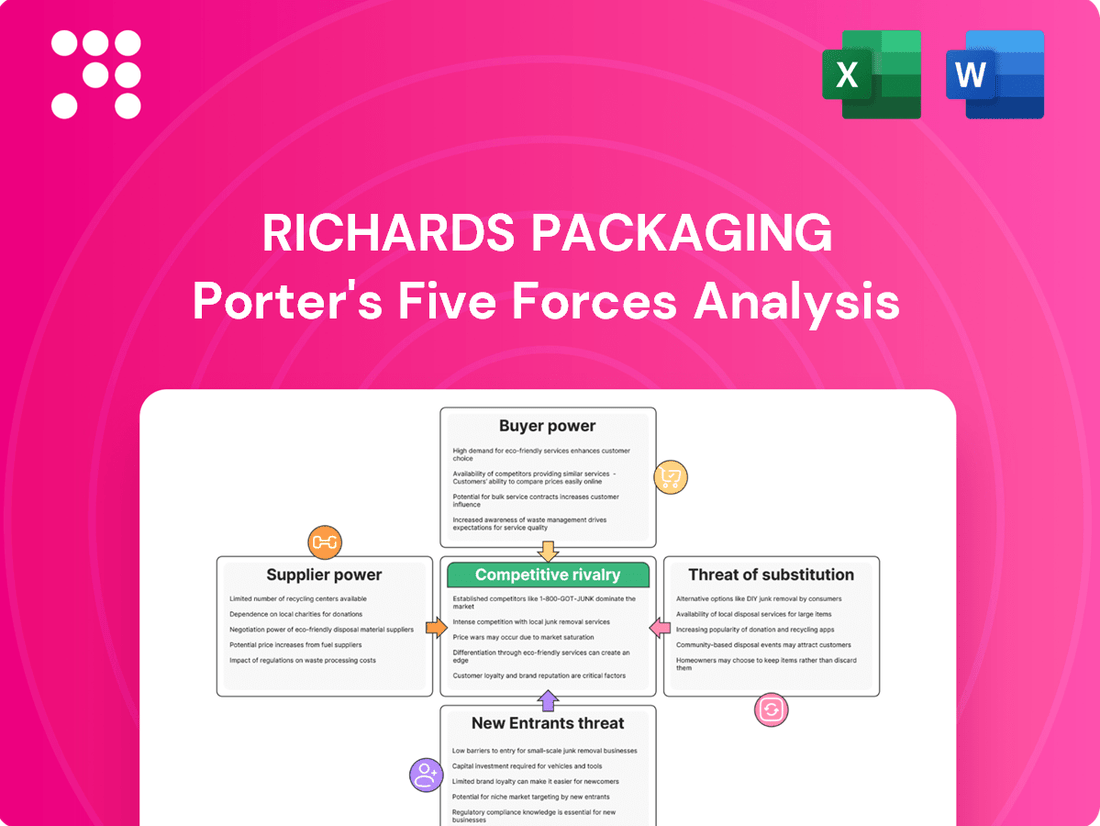

Richards Packaging operates within a competitive landscape shaped by moderate buyer power and the constant threat of substitutes in the packaging industry. Understanding these forces is crucial for strategic planning.

The full Porter's Five Forces Analysis reveals the real forces shaping Richards Packaging’s industry—from supplier influence to threat of new entrants. Gain actionable insights to drive smarter decision-making.

Suppliers Bargaining Power

If Richards Packaging depends on a limited number of suppliers for critical components like specialized containers or unique closures, those suppliers gain significant leverage. This concentrated supplier base is particularly impactful when these specialized materials are not easily sourced elsewhere, giving suppliers more control over pricing and terms.

Richards Packaging, as a packaging distributor, faces varying supplier power. If their customers demand highly specialized containers requiring significant retooling of machinery or stringent material certifications for regulated sectors like healthcare, switching to a new supplier for these specific needs could incur substantial costs for Richards. This would elevate the bargaining power of those particular suppliers.

However, Richards Packaging's role as a distributor inherently provides a degree of flexibility. They can often source a wide range of packaging materials and solutions from numerous manufacturers, which can mitigate switching costs for them. This broad supplier base generally limits the power any single supplier holds over Richards.

The value-added services offered by Richards Packaging, such as custom design and specialized sourcing, suggest they maintain relationships with a diverse network of manufacturers. This implies they have the capability to shift production or sourcing for specific client needs, further dampening the bargaining power of individual suppliers by providing alternatives.

Suppliers who provide highly specialized or proprietary packaging solutions, like patented dispensing mechanisms or novel eco-friendly materials, possess significant leverage. Richards Packaging's broad product catalog implies a strategy to mitigate dependence on any single, highly unique supplier, offering a diversified approach to sourcing.

Threat of Forward Integration by Suppliers

The threat of suppliers integrating forward into distribution and sales is a key consideration for Richards Packaging. If suppliers were to establish their own distribution channels, they could capture a larger portion of the value chain, thereby increasing their bargaining power significantly. This would allow them to bypass Richards Packaging’s existing network and potentially offer more competitive pricing directly to end customers.

However, for Richards Packaging, the presence of an established distribution network and the provision of value-added services like inventory management and just-in-time delivery might mitigate this threat from their current supplier base. These services create stickiness and make it less attractive for suppliers to replicate Richards Packaging’s capabilities. For instance, in 2024, Richards Packaging reported that its integrated supply chain solutions contributed to significant operational efficiencies for its clients, a factor that would be difficult for individual suppliers to replicate independently.

- Supplier Forward Integration: Suppliers establishing their own distribution networks to bypass Richards Packaging and capture more value.

- Mitigating Factors: Richards Packaging's established distribution, value-added services (e.g., inventory management), and client relationships reduce the immediate threat.

- Industry Context (2024): The packaging industry saw continued consolidation, with larger players potentially having the resources to explore direct sales, though the complexity of distribution networks remains a barrier.

Importance of Richards Packaging to Suppliers

The bargaining power of suppliers for Richards Packaging is generally considered moderate. If Richards Packaging were a substantial customer for a particular supplier, that supplier might have more leverage. However, Richards Packaging serves a vast customer base, estimated at over 18,000 regional businesses across North America.

This broad reach implies that Richards Packaging likely sources materials from a diverse array of suppliers. Consequently, it's improbable that any single supplier relies heavily on Richards Packaging for a significant portion of their revenue. This diffusion of customer dependency weakens the leverage individual suppliers can exert.

Furthermore, the packaging industry often involves standardized materials and components. This availability of alternatives means suppliers cannot easily dictate terms if Richards Packaging can readily switch to another provider. For instance, in 2023, the North American rigid packaging market was valued at approximately $118 billion, indicating a competitive landscape for material suppliers.

- Supplier Dependence: Richards Packaging's extensive customer base (18,000+ businesses) reduces the likelihood of any single supplier being overly reliant on them.

- Industry Competition: The broad North American packaging market, valued around $118 billion in 2023, suggests ample alternative buyers for suppliers.

- Material Standardization: The commonality of many packaging materials allows Richards Packaging to switch suppliers if terms become unfavorable.

Suppliers' bargaining power for Richards Packaging is generally moderate, influenced by the company's vast customer base and the availability of alternative materials. While suppliers of highly specialized or proprietary packaging solutions can exert more influence, Richards Packaging's diversified sourcing strategy and its role as a distributor with value-added services help to mitigate this power.

The threat of supplier forward integration is present, but Richards Packaging's established distribution network and client relationships offer a buffer. In 2024, the packaging industry's ongoing consolidation means larger suppliers might explore direct sales, though the complexities of distribution remain a hurdle. The North American rigid packaging market's significant value, approximately $118 billion in 2023, underscores a competitive supplier landscape that benefits Richards Packaging.

| Factor | Impact on Richards Packaging | Supporting Data (2023-2024) |

|---|---|---|

| Supplier Concentration | Moderate to High for specialized items, Low for standard | Limited reliance on single suppliers due to diverse sourcing. |

| Switching Costs for Richards | Low for standard materials, High for specialized components | Industry value of $118 billion (2023) implies many alternatives. |

| Supplier Differentiation | High for proprietary/unique solutions | Patented mechanisms or novel eco-materials increase supplier leverage. |

| Threat of Forward Integration | Moderate | Consolidation in 2024 may increase this, but distribution complexity is a barrier. |

What is included in the product

Explores market dynamics that deter new entrants and protect incumbents like Richards Packaging, while evaluating the influence of suppliers and buyers on pricing and profitability.

Instantly identify and address competitive threats with a comprehensive breakdown of industry power dynamics.

Customers Bargaining Power

Richards Packaging's customer base is largely composed of small and medium-sized businesses. This widespread distribution of clients means that no single customer holds a significant portion of the company's revenue. For instance, in 2023, the company reported that its largest customer represented only a small percentage of its total sales, underscoring the lack of customer concentration.

This diversified customer profile significantly dilutes the bargaining power of individual customers. Without reliance on a few large clients, Richards Packaging is less susceptible to demands for lower prices or unfavorable terms from any single buyer. This broad reach provides a degree of insulation against the leverage that dominant customers might otherwise wield.

Customers possess significant bargaining power when numerous alternative packaging suppliers exist, including direct manufacturers. The ease of switching suppliers directly impacts Richards Packaging's ability to dictate terms. For instance, in 2024, the packaging industry saw continued growth, with many smaller regional players offering competitive pricing, thereby increasing customer options.

Small and medium-sized businesses, a significant customer segment for packaging solutions, often operate with tighter margins. This inherent price sensitivity directly translates into increased bargaining power for these customers. They are more likely to push for lower prices, forcing suppliers like Richards Packaging to engage in aggressive cost competition.

Richards Packaging's strategic emphasis on efficient and effective packaging solutions demonstrates an awareness of this customer need for cost-effectiveness. For instance, in 2024, the company continued to invest in optimizing its production processes to manage costs. This focus on operational efficiency is crucial for maintaining competitiveness in a market where price is a key differentiator for many buyers.

Threat of Backward Integration by Customers

For most small and medium-sized businesses, the idea of producing their own packaging is usually out of reach. The significant upfront investment in machinery, specialized knowledge, and ongoing operational costs makes backward integration a non-starter. This reality significantly limits their ability to exert strong bargaining power over suppliers like Richards Packaging.

While large corporations might have the resources to explore in-house packaging production, Richards Packaging primarily serves the SME market. This strategic focus means the threat of major customers integrating backward is minimal, thereby strengthening Richards Packaging's position and reducing customer leverage.

- Low Threat for SMEs: The capital expenditure and technical expertise required for packaging production make backward integration impractical for most small and medium-sized businesses.

- Reduced Customer Bargaining Power: This barrier to entry limits customers' ability to negotiate lower prices or more favorable terms by threatening to produce their own packaging.

- Richards Packaging's Market Focus: The company's concentration on the SME segment further mitigates the risk of significant backward integration by its customer base.

Information Availability to Customers

The increasing availability of information online significantly empowers customers. With easy access to pricing, product comparisons, and reviews, customers can more readily identify alternatives and negotiate better terms. For instance, in 2024, the global e-commerce market continued its upward trajectory, with consumers increasingly leveraging digital platforms to research and compare offerings before making purchasing decisions.

Richards Packaging, however, can mitigate this by focusing on value-added services. Offering custom design, specialized sourcing, and dedicated support creates a deeper customer relationship that transcends simple price comparisons. This approach fosters customer loyalty and reduces the likelihood of customers switching solely based on minor price differences, thereby maintaining a degree of control over pricing power.

- Information Accessibility: Online resources provide customers with unprecedented access to pricing and product details, strengthening their negotiation position.

- Value-Added Services: Richards Packaging differentiates itself through services like custom design and sourcing, building customer loyalty beyond basic product features.

- Market Transparency: Enhanced market transparency in 2024 means customers are better informed, increasing the pressure on suppliers to offer competitive pricing and superior value.

Richards Packaging faces moderate bargaining power from its customers, primarily due to the fragmented nature of its customer base, which consists mainly of small and medium-sized businesses. This diffusion means no single customer accounts for a substantial portion of revenue, limiting individual leverage. For example, in 2023, the company highlighted that its largest customer represented a minimal percentage of total sales, reinforcing this dispersed customer power dynamic.

The ease with which customers can switch suppliers also contributes to their bargaining power. With a growing number of packaging providers, including smaller regional ones, Richards Packaging must remain competitive on price and service. The packaging industry's continued expansion in 2024, marked by the entry of new players, further enhances customer options and their ability to negotiate.

While the threat of customers producing their own packaging is low for the prevalent SME segment due to high capital and expertise requirements, informed customers can still leverage market information. The increasing online transparency in 2024 allows buyers to easily compare prices and services, pushing suppliers like Richards Packaging to focus on value-added offerings and operational efficiency to maintain their competitive edge.

Preview Before You Purchase

Richards Packaging Porter's Five Forces Analysis

This preview shows the exact Richards Packaging Porter's Five Forces Analysis you'll receive immediately after purchase, detailing the competitive landscape and strategic positioning within the packaging industry. You'll gain immediate access to the full, professionally formatted document, offering a comprehensive understanding of the forces shaping Richards Packaging's market. No surprises, no placeholders—what you see is precisely what you get for your strategic planning needs.

Rivalry Among Competitors

The packaging distribution sector is quite fragmented, featuring a multitude of regional and national companies. Richards Packaging, while a significant player and the third largest distributor in North America, faces intense competition, particularly in the market for standard packaging products. This broad base of competitors, ranging in size and reach, means that Richards Packaging must constantly differentiate itself to maintain its market position.

A slower industry growth rate often fuels more intense competition as companies fight for a larger slice of the existing market. This dynamic is particularly relevant for Richards Packaging.

While the overall packaging sector is considered stable, certain areas experience more volatility. For instance, Richards Packaging reported revenue increases in its food & beverage and cosmetics divisions for Q1 2025.

Conversely, the healthcare packaging segment saw a revenue decrease during the same period. These differing growth rates within its own portfolio highlight how varying segment performance can influence competitive pressures.

Richards Packaging distinguishes itself through a broad range of packaging solutions and services, including custom design and supply chain management. This extensive offering moves beyond simple product sales, lessening the pressure of direct price competition. For instance, in 2024, the company continued to emphasize its integrated approach, offering end-to-end solutions that are harder for competitors to replicate.

Exit Barriers

High exit barriers can significantly intensify competitive rivalry by trapping companies in an industry even when they are not performing well. These barriers, like specialized machinery or significant contractual obligations, make it difficult and costly for firms to leave the market, forcing them to continue competing, potentially at lower profit margins.

In the packaging distribution sector, while the physical assets might be less specialized than in manufacturing, the established infrastructure and deep-rooted customer relationships act as considerable exit barriers. Companies have invested in logistics networks, warehousing, and sales teams that are tailored to serving specific client bases, making a swift and clean exit challenging and expensive.

For instance, a distributor with a large fleet of custom-branded delivery vehicles and long-term supply agreements with major retailers faces substantial costs if they decide to exit. These commitments tie them to the market, potentially prolonging periods of intense price competition and limiting strategic flexibility.

- Specialized Assets: While not as pronounced as in heavy manufacturing, packaging distributors often have specialized warehousing and logistics equipment that has limited resale value outside the industry.

- Customer Relationships: Long-standing ties with key clients, built over years of reliable service, represent a significant investment that is difficult to recoup upon exit.

- Contractual Obligations: Long-term contracts with suppliers and customers can create financial penalties for early termination, acting as a barrier to leaving the market.

- Brand Reputation: The investment in building a strong brand and reputation within the packaging distribution space is lost if a company exits, representing an intangible but significant exit cost.

Diversity of Competitors

Richards Packaging encounters intense competition from a wide array of players. These rivals often operate with distinct strategic aims, varying cost structures, and different market focuses, making the competitive landscape unpredictable. For instance, some competitors might prioritize market share through aggressive pricing, while others focus on specialized packaging solutions for niche markets.

The company's broad customer base, spanning sectors like food, beverage, cosmetics, and healthcare, means it faces a multitude of competitors, each with unique strengths and approaches. This diversity in customer segments translates directly into a varied competitive dynamic, as rivals may specialize in serving specific industries or types of packaging.

- Diverse Competitive Strategies: Competitors employ a range of strategies, from cost leadership to product differentiation, impacting rivalry intensity.

- Varied Cost Structures: Differences in operational efficiency and scale among competitors create pricing pressures and influence market positioning.

- Niche Market Focus: Many rivals target specific customer segments or packaging types, leading to specialized competitive battles within those areas.

- Customer Base Influence: Richards Packaging's exposure to multiple industries means it contends with different sets of competitors in each sector, amplifying the overall competitive rivalry.

The competitive rivalry within the packaging distribution sector is significant, driven by a fragmented market structure and the presence of numerous players with diverse strategies. Richards Packaging, despite its size, faces this intense competition, particularly in standard packaging segments. The industry's inherent exit barriers, such as established infrastructure and customer relationships, further intensify this rivalry by keeping firms engaged even during challenging periods.

Richards Packaging's broad customer base across food, beverage, cosmetics, and healthcare means it encounters a varied competitive landscape. For example, in 2024, the company's performance varied by segment, with food & beverage and cosmetics showing revenue growth while healthcare experienced a decline, reflecting differing competitive pressures across these sectors.

| Competitive Factor | Impact on Richards Packaging | 2024 Data/Observation |

|---|---|---|

| Market Fragmentation | Intense rivalry from numerous regional and national players | Richards Packaging is the third-largest distributor in North America, indicating a competitive market structure. |

| Industry Growth Rate | Fuels competition as firms vie for market share | While the overall sector is stable, specific segments like food & beverage and cosmetics experienced revenue increases in Q1 2025, suggesting localized growth-driven competition. |

| Exit Barriers | Traps companies, prolonging competitive pressures | Established logistics, warehousing, and client relationships act as significant barriers, compelling continued competition. |

| Competitive Strategies | Varying approaches from rivals create dynamic challenges | Competitors utilize strategies from cost leadership to niche specialization, requiring Richards Packaging to constantly adapt its offerings. |

SSubstitutes Threaten

The threat of substitutes for packaging materials is significant. Consumers and businesses are increasingly exploring alternatives like paper-based solutions, flexible pouches, and even reusable systems that can replace traditional rigid containers. This shift is driven by environmental concerns and evolving consumer preferences, potentially impacting demand for certain materials that Richards Packaging distributes.

Richards Packaging, by offering a diverse portfolio of packaging materials, is somewhat insulated. However, a substantial move towards a single alternative material across key customer segments could still present a challenge. For instance, the growing popularity of flexible packaging in the food and beverage sector, which saw a global market value of approximately USD 100 billion in 2023, highlights this trend.

The company's strategic investment in sustainable packaging, including exploring and distributing innovative materials, directly addresses this threat. By staying ahead of material trends and offering eco-friendly options, Richards Packaging can mitigate the risk of substitutes and even capitalize on the demand for greener packaging solutions.

The threat of substitutes for Richards Packaging is significant if alternative packaging materials or solutions can deliver comparable or superior performance at a more attractive price point. For instance, if companies find that advanced biodegradable plastics offer similar protection to traditional rigid plastic containers but at a lower unit cost, this directly impacts Richards Packaging's market position.

Richards Packaging's stated emphasis on providing 'efficient and effective packaging' highlights their strategic awareness of this competitive pressure. They likely aim to offer a value proposition where the performance benefits of their products justify their cost, or where their cost-efficiency is a primary selling point against less adaptable or more expensive alternatives.

In 2024, the packaging industry saw continued innovation in sustainable materials, with some emerging bioplastics and recycled content options showing cost competitiveness against virgin materials, particularly as regulatory pressures on single-use plastics intensified. This trend directly elevates the threat of substitutes for traditional packaging providers.

The propensity for Richards Packaging's small and medium-sized business clients to switch to alternative packaging solutions is influenced by several key drivers. Regulatory mandates, evolving consumer preferences for sustainability, and the practical ease with which new options can be integrated into their operations all play a significant role.

For instance, a growing consumer demand for environmentally responsible products directly translates into a heightened interest from businesses in adopting eco-friendly packaging. This shift can make substitutes, such as compostable or recycled materials, more attractive, potentially impacting Richards Packaging's market share if they cannot adequately meet these emerging needs.

Switching Costs for Customers

Switching costs can significantly deter customers from moving to substitute products or services. These costs can encompass everything from the expense and effort of retooling production lines to the potential disruption of redesigning branding and marketing efforts. For instance, a company that has heavily invested in specialized packaging machinery for a particular material might face substantial costs if they were to switch to a different packaging format that requires entirely new equipment.

Richards Packaging actively works to lower these barriers for its clients. By offering value-added services, such as custom packaging design and engineering support, they help their existing customers avoid or minimize the costs associated with switching. This proactive approach, which might involve providing technical consultation or prototype development, fosters customer loyalty and makes it less appealing for clients to explore alternative packaging solutions.

Consider the impact of these embedded costs. For a food and beverage company, changing packaging might not just mean new machinery, but also re-validating food safety compliance and potentially re-designing labels to meet regulatory requirements. Richards Packaging's ability to manage these complexities for their clients directly reduces the perceived threat from substitutes.

The effectiveness of these strategies is evident when looking at customer retention. While specific 2024 data on Richards Packaging's customer retention rates directly tied to switching cost reduction isn't publicly detailed, the industry norm suggests that companies with strong value-added service offerings typically see higher retention. For example, in the broader manufacturing sector, companies that offer integrated solutions often report retention rates exceeding 90%.

- Reduced Capital Expenditure: By providing custom design and engineering, Richards Packaging helps clients avoid the significant capital outlay required for new machinery and tooling.

- Minimized Operational Disruption: Their support in the transition process helps clients maintain production continuity, preventing costly downtime.

- Enhanced Brand Consistency: Assisting with branding adjustments ensures that a change in packaging material or format does not negatively impact brand recognition and market perception.

- Streamlined Regulatory Compliance: For industries with strict regulations, Richards Packaging's expertise can ease the burden of compliance when switching packaging types.

Innovation in Substitute Industries

The threat of substitutes for Richards Packaging is amplified by rapid innovation in alternative materials and dispensing technologies. For instance, advancements in biodegradable plastics and novel packaging designs can offer comparable functionality at a lower cost or with improved environmental credentials, directly challenging traditional packaging solutions. Richards Packaging must actively monitor these developments to preemptively adapt its product offerings and maintain its market position.

Consider the burgeoning market for sustainable packaging alternatives. By early 2024, the global bioplastics market was projected to reach approximately USD 12.7 billion, with significant growth driven by consumer demand for eco-friendly options. This trend directly impacts rigid plastic containers and flexible packaging, core segments for Richards Packaging. Companies are increasingly investing in research and development for compostable films and plant-based resins, presenting a viable substitute that could erode market share if not addressed.

- Emerging Materials: Innovations in materials like mycelium-based packaging or edible coatings offer unique properties that could replace conventional plastic or paperboard.

- Dispensing Technology: New dispensing mechanisms, such as advanced spray nozzles or integrated pump systems, can enhance user experience and reduce material usage, posing a threat to standard closures.

- Cost Competitiveness: As substitute technologies mature, their production costs often decrease, making them more economically attractive compared to established packaging solutions.

- Regulatory Push: Growing environmental regulations favoring recycled content or biodegradability can accelerate the adoption of substitute materials, increasing their competitive pressure.

The threat of substitutes for Richards Packaging is substantial due to innovations in materials and dispensing technologies. For instance, advancements in biodegradable plastics and novel packaging designs offer comparable functionality at a lower cost or with improved environmental credentials, directly challenging traditional packaging solutions. Richards Packaging must actively monitor these developments to preemptively adapt its product offerings and maintain its market position.

Consider the burgeoning market for sustainable packaging alternatives. By early 2024, the global bioplastics market was projected to reach approximately USD 12.7 billion, with significant growth driven by consumer demand for eco-friendly options. This trend directly impacts rigid plastic containers and flexible packaging, core segments for Richards Packaging. Companies are increasingly investing in research and development for compostable films and plant-based resins, presenting a viable substitute that could erode market share if not addressed.

The cost-competitiveness of substitute technologies is a key driver, as their production costs often decrease with maturity, making them more economically attractive. Furthermore, growing environmental regulations favoring recycled content or biodegradability can accelerate the adoption of substitute materials, increasing their competitive pressure on Richards Packaging.

| Substitute Category | Key Characteristics | 2024 Market Trend/Projection | Potential Impact on Richards Packaging |

| Bioplastics & Compostables | Eco-friendly, biodegradable/compostable | Global bioplastics market projected to reach USD 12.7 billion by 2024 | Direct competition for traditional plastics, especially in food & beverage |

| Advanced Paperboard Solutions | Recyclable, often lighter weight | Growing demand for sustainable paper packaging, increasing innovation in barrier coatings | Substitute for rigid plastic containers and some flexible packaging |

| Reusable Packaging Systems | Durable, designed for multiple uses | Increasing adoption in B2B logistics and e-commerce for reduced waste | Threatens single-use packaging volumes, requiring adaptation in service models |

| Edible/Dissolvable Packaging | Novelty, zero-waste potential | Early stage but gaining traction in niche applications (e.g., single-serve portions) | Potential disruptor for specific product categories if scalability and cost improve |

Entrants Threaten

Entering the packaging distribution sector, like the one Richards Packaging operates in, demands substantial financial investment. Companies need significant capital for purchasing and holding diverse inventory, securing and maintaining warehouse facilities, establishing robust logistics networks, and implementing essential technology for operations and customer service.

These considerable capital requirements act as a strong deterrent for potential new competitors. For instance, in 2024, the average initial investment for a mid-sized packaging distributor could easily range from $5 million to $15 million, covering everything from fleet acquisition to warehouse leases and initial stock. This high barrier to entry significantly limits the number of new players that can realistically challenge established firms like Richards Packaging.

Established players like Richards Packaging benefit significantly from economies of scale in purchasing, manufacturing, and distribution. This allows them to negotiate better prices for raw materials and spread fixed costs over a larger production volume, leading to lower per-unit costs. For instance, in 2024, the packaging industry continued to see consolidation, with larger firms leveraging their scale to absorb price fluctuations more effectively than smaller, newer companies.

New entrants face a substantial hurdle in matching these cost efficiencies. They would need to invest heavily to achieve comparable production volumes and purchasing power, making it difficult to compete on price from the outset. This cost disadvantage deters many potential new players from entering the market, thereby reducing the threat of new competition.

Richards Packaging boasts an impressive distribution network spanning North America, coupled with deep-rooted relationships with over 18,000 customers. This established infrastructure presents a formidable barrier for any new player aiming to enter the market.

New entrants would find it incredibly difficult to replicate Richards Packaging's extensive reach and secure the necessary customer loyalty. Building comparable distribution channels and earning the trust of a large customer base requires substantial time, investment, and proven reliability, which are significant hurdles to overcome.

Product Differentiation and Brand Loyalty

While packaging might seem like a standard product, Richards Packaging distinguishes itself through its value-added services and custom design options. This ability to tailor solutions and build strong customer relationships creates a barrier for newcomers. For instance, in 2023, Richards Packaging reported approximately $1.9 billion in sales, indicating a significant market presence built on these differentiating factors.

The threat of new entrants is somewhat mitigated by the established brand loyalty Richards Packaging has cultivated. Customers often stick with suppliers who consistently deliver quality and reliable service, making it challenging for new companies to gain traction. This loyalty is often built over years of successful partnerships and a proven track record.

- Brand Reputation: Richards Packaging benefits from a long-standing reputation for quality and service, which new entrants struggle to replicate quickly.

- Customization Capabilities: Offering bespoke packaging designs and solutions provides a competitive edge over generic offerings.

- Customer Relationships: Strong, long-term relationships with clients foster loyalty, making switching to a new supplier less appealing.

- Scale of Operations: As a large player, Richards Packaging can often achieve economies of scale, offering competitive pricing that new, smaller entrants may find difficult to match.

Government Policy and Regulations

Government policies and regulations significantly shape the threat of new entrants in the packaging industry. Strict rules concerning packaging materials, safety protocols, and environmental sustainability, particularly in sectors like healthcare and food and beverage, create substantial hurdles. New companies must invest heavily in understanding and complying with these complex requirements, which can deter potential market entrants.

Richards Packaging operates within these regulated markets, meaning compliance is a constant factor. For instance, in 2024, the European Union continued to advance its Circular Economy Action Plan, with new regulations on packaging waste and recycled content impacting all players. Companies like Richards Packaging must adapt their operations and product offerings to meet these evolving standards, adding a layer of complexity for any new competitor aiming to enter.

The financial commitment to meet these regulatory demands can be a substantial barrier. New entrants might face significant upfront costs for research and development, specialized manufacturing equipment, and legal counsel to ensure adherence to all applicable laws. This financial burden, coupled with the need for ongoing monitoring of regulatory changes, can make the packaging sector less attractive for smaller, less capitalized new businesses.

- Regulatory Compliance Costs: New entrants must factor in substantial expenses for meeting safety, material, and environmental standards.

- Industry-Specific Regulations: Packaging for food, beverage, and healthcare sectors faces particularly stringent rules, increasing entry barriers.

- Evolving Environmental Policies: Ongoing legislative changes, such as those related to plastic reduction and recycled content mandates, require continuous adaptation and investment.

- Capital Investment for Compliance: Meeting these standards often necessitates significant capital expenditure on new technologies and processes.

The threat of new entrants into the packaging distribution sector is generally low for Richards Packaging. Significant capital requirements for inventory, logistics, and technology, estimated between $5 million and $15 million for a mid-sized distributor in 2024, create a substantial initial barrier. Furthermore, established players leverage economies of scale, achieving lower per-unit costs that new entrants struggle to match, especially as industry consolidation in 2024 favored larger firms.

Porter's Five Forces Analysis Data Sources

Our Richards Packaging Porter's Five Forces analysis is built upon a foundation of reliable data, including their annual reports, investor presentations, and industry-specific market research from firms like IBISWorld and Statista. We also incorporate insights from financial news outlets and competitor disclosures to provide a comprehensive view of the competitive landscape.