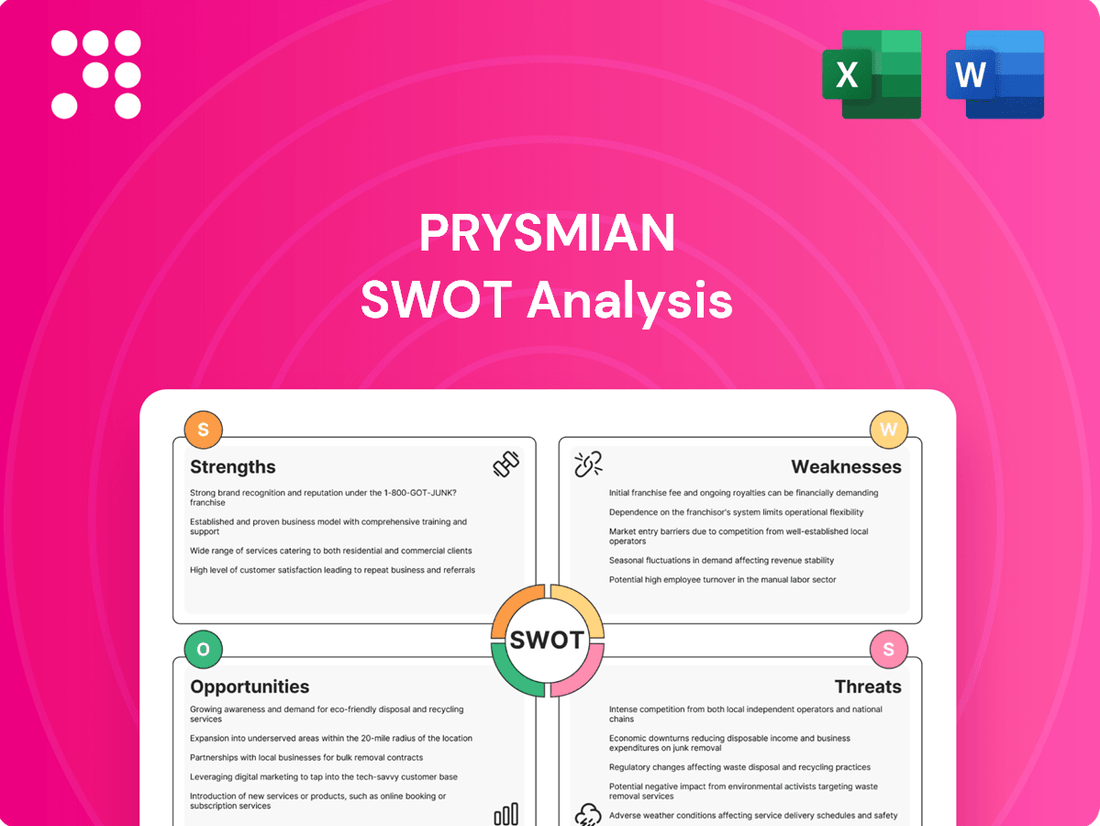

Prysmian SWOT Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Prysmian Bundle

Prysmian's robust global presence and strong brand recognition are significant strengths, while its reliance on raw material prices presents a key vulnerability. The company's innovative product development offers considerable growth opportunities, but intense competition in the energy and telecom sectors poses a notable threat.

Want the full story behind Prysmian's strengths, risks, and growth drivers? Purchase the complete SWOT analysis to gain access to a professionally written, fully editable report designed to support planning, pitches, and research.

Strengths

Prysmian Group stands as a dominant force in the global energy and telecom cable systems sector, a position reinforced by its diversified portfolio. This strategic breadth, spanning Renewable Transmission, Power Grid, Electrification, and Digital Solutions, allows the company to navigate varied market dynamics effectively.

This global leadership isn't just about scale; it's about resilience. By balancing its business across different segments and geographies, Prysmian mitigates risks and capitalizes on opportunities wherever they arise, ensuring a stable foundation for continued strategic growth. For instance, in 2023, Prysmian reported revenues of approximately €15.5 billion, underscoring its significant market penetration.

Prysmian's robust Research and Development (R&D) and innovation capabilities are a significant strength, underscored by its substantial investment of approximately €149 million in 2024. This commitment fuels the development of advanced technologies across its 27 global research centers.

This focus on innovation allows Prysmian to pioneer solutions such as high-depth submarine cables and super-high-density optical fibers. These cutting-edge products are crucial for facilitating the global energy transition, advancing digitalization, and supporting sustainability initiatives, positioning the company at the forefront of these critical sectors.

Prysmian demonstrates impressive financial strength, evidenced by its Q1 2025 revenue of €4,771 million, a notable increase from the previous year. This robust revenue growth is complemented by a significant rise in Adjusted EBITDA to €527 million, underscoring the company's operational efficiency and profitability.

The company's exceptional cash generation capabilities are a key strength, with its Free Cash Flow LTM reaching approximately €998 million. This strong cash flow provides substantial financial flexibility, enabling Prysmian to fund strategic growth initiatives and deliver value to its shareholders through dividends and buybacks.

Leadership in Sustainability and ESG Initiatives

Prysmian stands out with its strong leadership in sustainability and Environmental, Social, and Governance (ESG) initiatives. This commitment is not just a statement but is reflected in tangible results, with 43.1% of its revenues in 2024 generated from sustainable products, a figure that already exceeds its initial 2025 target. This proactive approach positions Prysmian favorably in a market increasingly prioritizing eco-friendly solutions.

The company has set aggressive climate targets, aiming for a significant 37% reduction in Scope 1 and 2 greenhouse gas (GHG) emissions by 2024, measured against a 2019 baseline. Beyond emission reductions, Prysmian actively champions a circular economy model and emphasizes responsible sourcing throughout its supply chain.

- Pioneering Sustainable Products: 43.1% of 2024 revenues derived from sustainable offerings, surpassing 2025 goals.

- Ambitious Emission Reduction: Target of 37% reduction in Scope 1 and 2 GHG emissions by 2024 (vs. 2019).

- Circular Economy Focus: Active promotion of circular economy principles and responsible sourcing practices.

Strategic Acquisitions and Partnerships

Prysmian actively strengthens its market standing through strategic acquisitions, notably the 2024 acquisition of Encore Wire in the United States. This move significantly bolsters its North American footprint and enhances its sustainability credentials by integrating recycled copper into its operations. The deal valued Encore Wire at approximately $3.9 billion.

Furthermore, Prysmian cultivates vital partnerships to drive innovation and market penetration. Collaborations include a significant alliance with E.ON in Germany aimed at developing greener power grids, and a joint venture with Relativity Networks to advance hollow-core optical fiber technology. These alliances expand Prysmian's technological capabilities and solution portfolio.

- Strategic Acquisition: The $3.9 billion acquisition of Encore Wire in 2024 significantly expanded Prysmian's North American presence.

- Sustainability Focus: The Encore Wire deal integrates recycled copper, enhancing Prysmian's sustainability profile.

- Key Partnerships: Collaborations with E.ON for green energy infrastructure and Relativity Networks for advanced optical fiber technology are crucial.

Prysmian's market leadership is a core strength, particularly in the energy and telecom cable sectors. Its diversified business model, covering renewable transmission, power grids, electrification, and digital solutions, provides significant resilience. This broad market presence was evident in its 2023 revenue of approximately €15.5 billion.

Innovation is a key differentiator, supported by a substantial R&D investment of around €149 million in 2024 across 27 global research centers. This commitment allows Prysmian to develop advanced products like high-depth submarine cables and super-high-density optical fibers, crucial for the energy transition and digitalization efforts.

The company exhibits strong financial health, with Q1 2025 revenue reaching €4,771 million and Adjusted EBITDA climbing to €527 million. Exceptional cash generation, with a Free Cash Flow LTM of approximately €998 million, provides the flexibility for strategic investments and shareholder returns.

Prysmian excels in sustainability, with 43.1% of its 2024 revenues coming from sustainable products, exceeding its 2025 targets. It also aims for a 37% reduction in Scope 1 and 2 GHG emissions by 2024 against a 2019 baseline, demonstrating a strong commitment to ESG principles.

Strategic acquisitions, such as the $3.9 billion purchase of Encore Wire in 2024, bolster its North American presence and sustainability profile through recycled copper integration. Key partnerships, including those with E.ON for green grids and Relativity Networks for optical fiber, further enhance its technological capabilities and market reach.

| Strength | Description | Supporting Data (2023-2025) |

| Market Leadership | Dominant global position in energy and telecom cables. | ~€15.5 billion revenue in 2023. |

| Innovation & R&D | Development of advanced cable technologies. | ~€149 million R&D investment in 2024. |

| Financial Strength | Robust revenue and profitability. | Q1 2025 Revenue: €4,771 million; Adjusted EBITDA: €527 million. |

| Sustainability Focus | Leading ESG initiatives and sustainable product revenue. | 43.1% revenue from sustainable products (2024); 37% GHG reduction target (2024 vs 2019). |

| Strategic Growth | Acquisitions and partnerships expanding market reach. | $3.9 billion Encore Wire acquisition (2024). |

What is included in the product

Delivers a strategic overview of Prysmian’s internal and external business factors, highlighting its market strengths, operational gaps, and potential threats.

Offers a clear, actionable framework for identifying and addressing strategic challenges.

Weaknesses

Prysmian experienced a notable dip in net profit during the first quarter of 2025, falling to €155 million from €190 million in the same period of 2024, despite a general upward trend in revenue and an improved EBITDA. This contraction in profitability, even with top-line growth, highlights underlying pressures on the company's bottom line.

The primary drivers behind this decline in net profit are increased depreciation and amortization charges, which are common after significant acquisitions. Additionally, adverse movements in commodity derivative valuations and higher net finance costs, largely a consequence of the recent Encore Wire acquisition, further squeezed Prysmian's net earnings in early 2025.

While Prysmian's Transmission and Digital Solutions segments reported robust organic growth in the first quarter of 2025, other areas presented a more challenging picture. The Power Grid and Electrification segments, in particular, saw slight organic revenue declines during the same period. This indicates a degree of unevenness in the company's performance across its diverse business units, with some experiencing headwinds.

Specifically, the Industrial & Construction and Specialties businesses within the Electrification division experienced a slow start to 2025. This suggests that these particular segments are facing some operational or market-related slowdowns, contributing to the overall contraction observed in certain parts of Prysmian's portfolio. These performance variations highlight the need for careful management and strategic adjustments to address the specific issues affecting these segments.

Prysmian's business is significantly tied to the price swings of key commodities like copper, aluminum, and lead. While they use adjusted EBITDA at standard metal prices to smooth out these effects, substantial price drops or spikes can still create headwinds for their financial results.

High Net Financial Debt Post-Acquisitions

Prysmian's net financial debt saw a substantial jump, reaching €4,884 million by the first quarter of 2025. This increase, up from €1,693 million in the first quarter of 2024, is primarily attributed to the recent acquisition of Encore Wire. While such strategic moves are intended to bolster growth, they can place a temporary burden on the company's financial structure, leading to higher leverage and increased interest expenses.

The significant increase in debt post-acquisition presents a key weakness for Prysmian:

- Elevated Financial Leverage: The substantial rise in net financial debt to €4,884 million in Q1 2025, a sharp increase from €1,693 million in Q1 2024, indicates a higher reliance on borrowed funds following the Encore Wire acquisition.

- Increased Interest Burden: A larger debt load typically translates to higher interest payments, which can reduce profitability and cash flow available for other strategic initiatives or shareholder returns.

- Potential Strain on Creditworthiness: While acquisitions can be beneficial long-term, a sudden and significant increase in debt may temporarily impact the company's credit rating or borrowing capacity.

- Integration Risks: The financial strain from the acquisition is coupled with the inherent risks of integrating a new entity, Encore Wire, which could further complicate financial management if not executed smoothly.

Intense Competition in Key Markets

Prysmian operates in a fiercely competitive global cable market, facing formidable rivals such as Nexans, Fujikura, and Sumitomo Electric. This intense rivalry, particularly in high-growth sectors like renewable energy infrastructure and advanced smart grids, demands substantial and ongoing investment in research and development to stay ahead. For instance, the demand for high-voltage subsea cables for offshore wind farms, a key growth area, sees these major players vying for significant project wins, putting pressure on margins and requiring continuous technological advancement.

The pressure to innovate and invest is a constant challenge. Prysmian's ability to maintain its market position and profitability hinges on its capacity to outpace competitors in developing and deploying next-generation cable technologies. This includes advancements in materials science for higher performance and durability, as well as digital integration for enhanced grid management capabilities. In 2023, the global power cable market was valued at approximately $160 billion, with significant portions driven by these technologically advanced segments, highlighting the stakes involved in this competitive arena.

Prysmian's profitability took a hit in early 2025, with net profit dropping to €155 million from €190 million in Q1 2024, despite revenue growth. This squeeze is largely due to increased depreciation, amortization, and higher finance costs stemming from the Encore Wire acquisition. Some segments, like Industrial & Construction and Specialties, experienced revenue declines, indicating uneven performance across the company's diverse business units.

Full Version Awaits

Prysmian SWOT Analysis

The preview you see is the actual Prysmian SWOT analysis document you’ll receive upon purchase. This ensures you know exactly what you're getting—a comprehensive and professionally structured report.

You’re viewing a live preview of the actual SWOT analysis file for Prysmian. The complete, in-depth report becomes available immediately after checkout, offering full access to all insights.

This is the same Prysmian SWOT analysis document included in your download. The full content, detailing every aspect of the company's strategic position, is unlocked after payment.

Opportunities

The global push for renewable energy sources, like offshore wind, is a major growth area. Prysmian's expertise in high-voltage cables is crucial for connecting these new energy sources to the grid. For instance, the company secured a significant contract in early 2024 to supply submarine power cables for the Gigastack project in the UK, a key development in offshore wind energy.

Grid modernization and the expansion of smart grids are also creating substantial demand for advanced cabling solutions. As countries invest in upgrading their electricity networks to handle increased renewable integration and improve efficiency, Prysmian's advanced cable technologies are in high demand. This trend is supported by government initiatives worldwide aiming to bolster energy infrastructure resilience and capacity.

The insatiable appetite for data, fueled by cloud computing, streaming services, and the Internet of Things, is a significant tailwind. Global internet traffic is projected to reach 292 exabytes per month by 2026, a substantial increase from previous years, according to Cisco's Annual Internet Report.

This surge necessitates robust digital infrastructure, leading to the rapid expansion of data centers and the widespread deployment of 5G networks. These developments directly translate into a heightened demand for Prysmian's core offerings in optical fibers and advanced connectivity solutions.

Prysmian's strategic investments in high-capacity optical fibers and innovative technologies like hollow-core fiber position it to capitalize on this trend. The company's ability to deliver cutting-edge solutions for high-speed data transmission makes it a key player in enabling the digital economy's continued growth.

Government stimulus programs, like the Inflation Reduction Act in the US and REPowerEU in Europe, are creating significant tailwinds for Prysmian. These initiatives, totaling hundreds of billions of dollars, are heavily focused on modernizing energy grids and expanding renewable energy infrastructure. This directly translates into substantial opportunities for Prysmian to secure large-scale contracts for its cable and system solutions.

Expansion into High-Growth Geographic Markets

Prysmian is well-positioned to capitalize on the burgeoning demand for energy and telecom infrastructure in key growth regions. The company’s existing global network provides a strong foundation for expanding its market share in North America and Asia-Pacific. These areas are experiencing significant urbanization and infrastructure upgrades, driving a substantial increase in the need for advanced cabling solutions.

The company's strategic focus on these dynamic markets is supported by several favorable trends:

- North American Market Growth: The United States, in particular, is investing heavily in grid modernization and renewable energy projects, creating substantial opportunities for Prysmian's energy cable segment. For instance, projected investments in US electricity infrastructure could reach trillions of dollars over the next decade, as highlighted by various industry reports in 2024.

- Asia-Pacific Demand Surge: Rapid economic development and increasing internet penetration in countries across Asia-Pacific are fueling demand for high-speed telecommunication cables. Prysmian's ability to supply advanced fiber optic solutions is crucial here. The region's digital transformation initiatives are expected to continue driving double-digit growth in the telecom cable market through 2025.

- Leveraging Existing Infrastructure: Prysmian's established manufacturing and distribution capabilities in various global locations allow for efficient and cost-effective expansion into these high-growth territories, minimizing lead times and enhancing customer service.

Leveraging Sustainable Product Portfolio and Circular Economy

Prysmian can capitalize on the growing demand for sustainable solutions by expanding its portfolio of eco-friendly cables. This includes developing products that are fully recyclable and incorporating recycled materials into manufacturing. For instance, in 2023, Prysmian reported a significant portion of its sales came from products with enhanced sustainability features, demonstrating market traction for these offerings.

Embracing circular economy principles presents a chance for Prysmian to innovate and reduce its environmental footprint. This can translate into cost savings through material efficiency and a stronger brand image among environmentally conscious customers. The company's commitment to reducing CO2 emissions in its production processes, as outlined in its 2024 sustainability report, further aligns with this opportunity.

- Expand fully recyclable cable offerings: Target markets with strong environmental regulations and consumer preferences for sustainable goods.

- Increase use of recycled materials: Invest in R&D to optimize the performance of cables made with recycled content.

- Promote eco-sustainable production: Highlight energy efficiency and waste reduction initiatives to enhance brand reputation and attract ESG-focused investors.

- Develop circular economy business models: Explore cable take-back and recycling programs to create closed-loop systems.

Prysmian is strongly positioned to benefit from the global transition to renewable energy, particularly in offshore wind projects. The company's expertise in high-voltage submarine cables is critical for grid connections, as evidenced by its early 2024 contract for the UK's Gigastack project. This trend is further amplified by government incentives like the US Inflation Reduction Act and Europe's REPowerEU, which are channeling billions into grid modernization and renewables, creating substantial contract opportunities.

Threats

Ongoing geopolitical tensions, like the conflict in Ukraine and the situation in Israel, present a substantial threat to Prysmian. These conflicts can directly impact raw material sourcing and logistics, potentially increasing costs for essential components. For instance, disruptions in energy markets, often linked to such geopolitical events, can significantly affect Prysmian's manufacturing expenses.

The specter of trade wars, exemplified by potential US tariffs on imported goods, also poses a risk. Such tariffs could make it more expensive for Prysmian to import necessary materials or export finished products, thereby squeezing profit margins and impacting competitiveness. In 2023, global trade experienced significant volatility, underscoring the sensitivity of multinational corporations like Prysmian to these trade policy shifts.

An uncertain macroeconomic outlook, including potential global economic slowdowns or recessions, poses a significant threat by dampening demand for industrial and construction projects. This directly impacts Prysmian's Electrification segment, which relies heavily on infrastructure investment, potentially leading to reduced sales volumes. For instance, a projected slowdown in European GDP growth for 2024, estimated by the IMF at 0.9%, could translate to decreased capital expenditure by utilities and construction firms, affecting Prysmian's order intake.

The cable industry is fiercely competitive, and Prysmian faces constant pressure from rivals engaging in aggressive price wars. This intense competition directly impacts Prysmian's profit margins, forcing the company to carefully balance pricing strategies with its cost structure. For instance, in 2023, Prysmian reported an EBITDA margin of 11.4%, a figure that could be further squeezed if competitors initiate significant price reductions.

Supply Chain Disruptions and Raw Material Availability

Prysmian's reliance on a select group of specialized suppliers for critical, high-performance raw materials presents a significant vulnerability. Any disruption to these sources, whether due to geopolitical events, natural disasters, or supplier-specific issues, could directly impede Prysmian's manufacturing output and its ability to meet customer delivery schedules. For instance, the ongoing global semiconductor shortage, which began impacting various industries in 2020 and continued through 2024, highlights the potential for unforeseen events to create widespread material scarcity and price volatility, even for companies with established long-term supply agreements.

While Prysmian has implemented strategies like long-term contracts to mitigate raw material price fluctuations and ensure availability, these measures are not entirely foolproof against widespread global disruptions. The 2022 energy crisis in Europe, for example, significantly increased the cost of key inputs like copper and aluminum, affecting Prysmian's cost structure despite prior agreements. The company's 2023 financial reports noted that while they had managed to pass on some of these increased costs, the underlying risk to material availability and cost remained a persistent concern for the industry.

- Supplier Concentration: Dependence on a few key suppliers for specialized materials.

- Global Event Impact: Vulnerability to unforeseen global events affecting material supply and pricing.

- Cost Volatility: Risk of increased raw material costs impacting profitability, as seen with energy price spikes in 2022-2023.

Rapid Technological Changes and Need for Continuous R&D

The energy and telecom industries are evolving at breakneck speed, driven by constant technological advancements. Prysmian, like its competitors, must pour significant resources into research and development to stay ahead. For instance, the push towards higher data transmission speeds in telecom and more efficient energy grids requires ongoing innovation in cable technology and materials.

Failing to invest adequately in R&D poses a serious threat. If Prysmian doesn't develop next-generation solutions, it risks falling behind rivals who are quicker to adopt or create new technologies. This could mean losing market share and becoming less relevant in key growth areas.

Consider these key areas impacted by technological change:

- Advancements in optical fiber technology: The demand for higher bandwidth continues to drive innovation in fiber optics, requiring substantial R&D to improve performance and reduce costs.

- Development of advanced materials: New materials are crucial for enhancing cable durability, flexibility, and performance in extreme conditions, particularly in renewable energy and subsea applications.

- Integration of smart grid technologies: The energy sector's move towards smart grids necessitates cables with integrated sensing and communication capabilities, demanding new R&D focus.

- Emerging connectivity standards: Keeping pace with evolving standards like 5G and future iterations requires continuous adaptation and development of compatible cabling solutions.

Intensifying competition from both established players and emerging low-cost manufacturers presents a significant threat to Prysmian's market position and profitability. This competitive pressure can lead to price wars, eroding margins, and necessitates continuous innovation to maintain a competitive edge. For instance, in 2023, the global cable market saw increased activity from Asian manufacturers, particularly in standard product segments, impacting pricing dynamics.

SWOT Analysis Data Sources

This SWOT analysis is built upon a foundation of robust data, drawing from Prysmian's official financial reports, comprehensive market research, and expert industry analysis to provide a well-rounded strategic overview.