Prysmian Boston Consulting Group Matrix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Prysmian Bundle

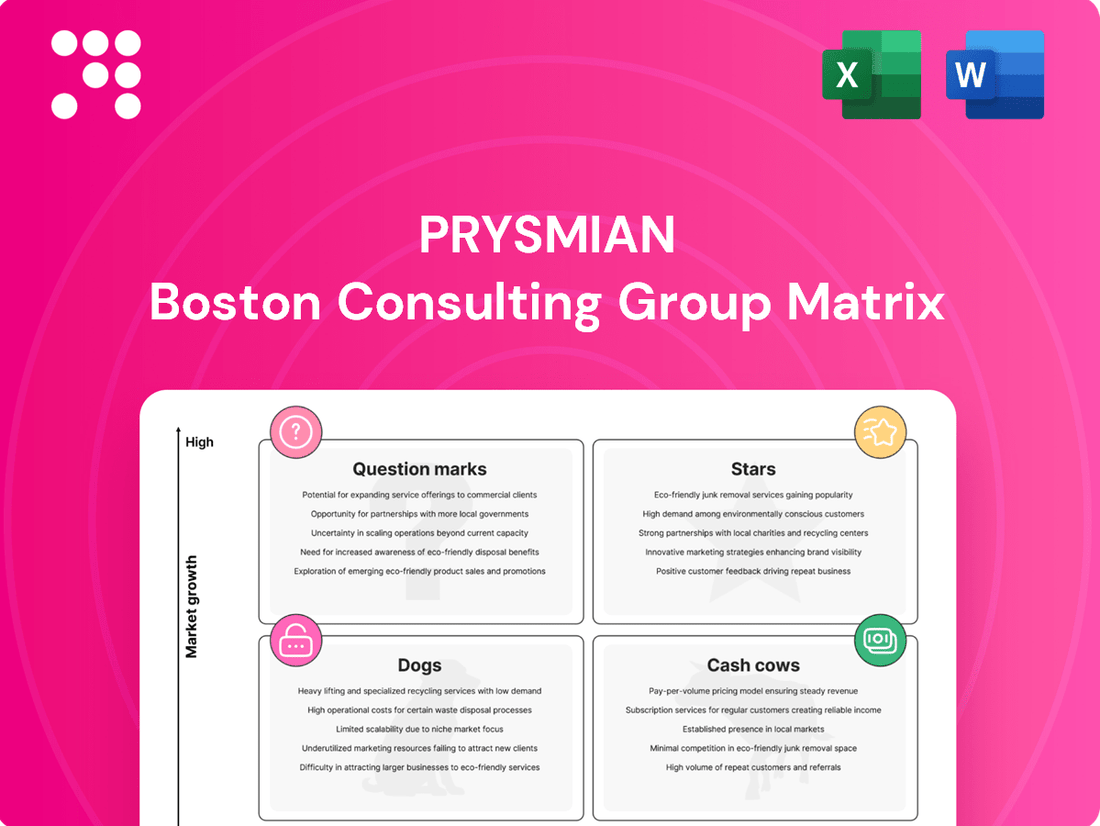

Curious about Prysmian's strategic product portfolio? Our BCG Matrix preview highlights key areas, but the full report unlocks a comprehensive understanding of their Stars, Cash Cows, Dogs, and Question Marks. Purchase the complete BCG Matrix for actionable insights and a clear roadmap to optimize Prysmian's market position.

Stars

Prysmian's high voltage submarine and underground cables, a cornerstone of its Transmission business, are undeniably stars in the BCG matrix. This segment experienced remarkable organic growth of 57.2% in the first quarter of 2025, supported by an impressive €17 billion backlog.

This strong performance is directly linked to Prysmian's strategic focus on electrification infrastructure, crucial for expanding renewable energy grids and offshore wind farms. The company's substantial market share, estimated between 35% and 40%, highlights its dominant position in a market projected to exceed €8 billion annually by 2025.

Offshore wind farm cabling is a star in Prysmian's portfolio, fueled by the global push for renewable energy. Prysmian is heavily investing in this high-growth sector, expanding its Pikkala, Finland facility and planning a significant high-voltage submarine cable plant in Massachusetts, USA. This strategic move positions Prysmian to capture a substantial share of the burgeoning offshore wind market.

Prysmian stands out in interconnection projects, particularly in High Voltage Direct Current (HVDC) technology. A prime example is the Neu Connect project linking Great Britain and Germany, crucial for building a robust trans-European power grid and enhancing energy independence.

These significant undertakings highlight Prysmian's advanced capabilities and strong market position in essential energy infrastructure. The company's investment in specialized vessels, such as the Leonardo da Vinci, further solidifies its leadership in this sector.

The global market for transmission infrastructure is projected to reach €15-20 billion annually from 2025 to 2030, with Europe leading this growth, underscoring the strategic importance of Prysmian's HVDC interconnector projects.

Extra High Voltage (EHV) Cables for Grid Modernization

The market for Extra High Voltage (EHV) cables is seeing significant expansion, fueled by the global push for grid modernization and the demand for dependable, efficient power transmission. This growth is essential for upgrading aging infrastructure and accommodating the increasing load from renewable energy sources.

Prysmian stands out in the EHV cable sector, delivering products known for their exceptional performance and reliability. These qualities are crucial for improving grid efficiency and meeting the rising energy needs of economies worldwide. The company's strategic direction is closely tied to substantial investments in infrastructure upgrades and the integration of clean energy technologies.

As of early 2024, the global EHV cable market is projected to reach approximately $25 billion, with a compound annual growth rate (CAGR) of around 5-6% expected through 2030. This upward trend is directly linked to government initiatives and utility spending on grid enhancements and expansion projects, particularly in emerging markets and developed nations undertaking significant infrastructure renewal.

- Market Growth Drivers: Increased demand for grid modernization, expansion of renewable energy infrastructure, and the need for enhanced power transmission reliability are key factors boosting the EHV cable market.

- Prysmian's Position: Prysmian is a leading global supplier of EHV cables, recognized for its technological innovation, product quality, and extensive project experience in high-voltage applications.

- Investment Trends: Significant global investment in energy infrastructure, estimated to be in the hundreds of billions of dollars annually, includes substantial allocations for upgrading and expanding high-voltage transmission networks.

- Future Outlook: The EHV cable market is expected to continue its strong growth trajectory, supported by ongoing energy transition efforts and the development of smart grids designed for greater efficiency and resilience.

Advanced Fiber Optic Cables for High-Capacity Networks

Prysmian's advanced fiber optic cables are a prime example of a Star in the BCG Matrix, catering to the booming demand in FTTH and FTTA applications. These high-capacity solutions are crucial for supporting the expansion of 5G networks and the ever-growing needs of data centers. The company's strategic focus on these areas positions it to benefit significantly from the massive increase in data consumption and mobile usage.

Prysmian's commitment to innovation is evident in its investments in cutting-edge technologies like hollow-core optical fiber. This forward-looking approach ensures they remain at the forefront of the industry, ready to meet future connectivity demands. The market for these advanced fiber optic solutions is experiencing robust growth, driven by digital transformation initiatives worldwide.

- Market Growth: The global fiber optic market is projected to reach over $13 billion by 2027, with a compound annual growth rate (CAGR) of approximately 10%.

- 5G Deployment: The ongoing rollout of 5G infrastructure requires a significant increase in fiber optic deployments, estimated to drive substantial demand for high-bandwidth cables.

- Data Center Expansion: Data center construction and upgrades, fueled by cloud computing and big data, are a major driver for advanced fiber optic solutions, with global data center market revenue expected to exceed $500 billion in 2024.

- Hollow-Core Fiber: This emerging technology promises ultra-low latency and higher bandwidth, positioning Prysmian as a leader in next-generation optical networking.

Prysmian's high-voltage submarine and underground cables are clear stars, driven by electrification and renewable energy expansion. The company's Q1 2025 organic growth hit 57.2%, backed by a substantial €17 billion backlog, solidifying its dominant market share between 35% and 40% in a market exceeding €8 billion annually by 2025.

Offshore wind farm cabling is another star, propelled by global renewable energy initiatives. Prysmian's strategic investments in facilities like Pikkala, Finland, and a planned high-voltage submarine cable plant in Massachusetts, USA, position it to capture significant growth in this sector.

Prysmian excels in interconnection projects, particularly with High Voltage Direct Current (HVDC) technology, exemplified by the Neu Connect project. This focus on critical energy infrastructure, supported by specialized vessels like the Leonardo da Vinci, highlights its leadership in a transmission infrastructure market projected between €15-20 billion annually from 2025 to 2030.

Advanced fiber optic cables for FTTH and FTTA applications are also stars, meeting the demand for 5G and data centers. Prysmian's investment in technologies like hollow-core optical fiber ensures it leads in the rapidly growing digital connectivity space, with the global fiber optic market projected to exceed $13 billion by 2027.

| Product Segment | BCG Category | Key Growth Drivers | Prysmian's Position | Market Data (approx.) |

|---|---|---|---|---|

| High Voltage Submarine & Underground Cables | Star | Electrification, Renewable Energy Grid Expansion | 35-40% Market Share | Market > €8 Billion (2025) |

| Offshore Wind Farm Cabling | Star | Global Renewable Energy Push | Strategic Investments in Capacity | N/A (High Growth Sector) |

| HVDC Interconnector Projects | Star | Trans-European Grid Development, Energy Independence | Leading Technology Provider | Transmission Infrastructure Market €15-20 Billion (2025-2030) |

| Advanced Fiber Optic Cables | Star | 5G Deployment, Data Center Expansion, FTTH/FTTA | Innovation in Hollow-Core Fiber | Global Fiber Optic Market > $13 Billion (by 2027) |

What is included in the product

The Prysmian BCG Matrix offers a strategic framework for analyzing its diverse product portfolio based on market growth and share.

It guides investment decisions by categorizing products into Stars, Cash Cows, Question Marks, and Dogs.

Clear visualization of Prysmian's portfolio, identifying Stars and Cash Cows to focus resources.

Cash Cows

Prysmian's Power Grid segment, which includes power distribution and overhead lines, remains a consistent performer, generating steady profits. In the first quarter of 2025, this division achieved a strong adjusted EBITDA margin of 15.2%.

This segment's resilience, even with a minor dip in organic revenue, highlights its position in a mature market. Prysmian's significant market share here translates into reliable cash flow, a vital contributor to the company's overall financial health.

The Industrial & Construction Cables segment, a key player within Prysmian's Electrification business, generated substantial revenue, reaching €1,923 million in the first quarter of 2025. This segment, while seeing a minor organic sales dip, demonstrated improved adjusted EBITDA, signaling strong profitability.

This performance highlights the mature nature of the industrial and construction cable market. Prysmian's robust market position and operational excellence allow it to consistently generate healthy cash flows from this segment, focusing on maintaining high productivity and efficiency.

Standard telecommunication cables, a legacy segment for Prysmian, likely represent a Cash Cow within its BCG Matrix. These products, while not experiencing explosive growth, benefit from Prysmian's established high market share in a mature, stable market.

This stability translates into consistent, predictable revenue streams that significantly contribute to Prysmian's overall profitability. The mature nature of this market means that promotional investments are relatively low, further enhancing the profitability of these offerings.

Specialty Cables (excluding high-growth niches)

Specialty Cables, a segment within Prysmian's Electrification business, generally exhibits stable profitability. While some areas, like automotive, have faced headwinds, the broader specialty cable market provides consistent cash flow. This stability is driven by Prysmian's robust brand reputation and deep-rooted customer connections, particularly in niche industrial applications that may not be high-growth but are essential.

The enduring strength of this business lies in its established competitive advantages, not rapid market expansion. Prysmian's ability to secure steady demand for these specialized products ensures reliable revenue streams, even in mature markets.

- Stable Profitability: The segment contributes consistent earnings despite some sector-specific challenges.

- Brand Loyalty & Relationships: Strong customer ties and brand recognition ensure sustained demand.

- Niche Market Focus: Catering to specific industrial needs provides a reliable, albeit not high-growth, revenue base.

- Competitive Advantage: Success is built on existing strengths rather than market share gains in rapidly expanding sectors.

Cable Accessories and Components for Established Grids

Prysmian's cable accessories and components, including joints, terminations, and insulators, are critical for the upkeep and expansion of established power grids. These products are indispensable for maintaining the reliability and efficiency of existing transmission and distribution networks.

The demand for these essential components is fueled by the continuous requirement for grid maintenance, repairs, and gradual upgrades. This segment of the market is characterized by its stability, reflecting the ongoing need for robust electrical infrastructure. In 2023, the global cable accessories market was valued at approximately USD 15 billion, with a projected compound annual growth rate (CAGR) of around 4.5% through 2030, underscoring its consistent demand.

Prysmian's commanding global leadership in this sector translates into a reliable stream of cash flow. The company's established presence and extensive product portfolio allow it to consistently generate revenue from these fundamental components, which are vital for the operation of mature infrastructure worldwide.

- Market Stability: Driven by ongoing grid maintenance and upgrade needs.

- Product Essentiality: Joints, terminations, and insulators are critical for power systems.

- Prysmian's Position: Global leader generating consistent cash from mature infrastructure components.

- Market Size (2023): Approximately USD 15 billion, with steady growth expected.

Prysmian's Power Grid segment, a consistent performer, generated a strong adjusted EBITDA margin of 15.2% in Q1 2025, showcasing its resilience in a mature market. Similarly, the Industrial & Construction Cables segment, despite a slight organic sales dip, demonstrated improved adjusted EBITDA, highlighting robust profitability from its established market position. These segments, characterized by mature markets and Prysmian's significant market share, translate into reliable and predictable cash flows, crucial for the company's financial stability.

| Segment | Key Characteristics | Q1 2025 Performance Highlight |

|---|---|---|

| Power Grid | Mature market, high market share, steady profits | 15.2% Adjusted EBITDA Margin |

| Industrial & Construction Cables | Mature market, strong revenue generation, operational excellence | Improved Adjusted EBITDA |

| Standard Telecommunication Cables | Mature, stable market, low promotional investment | Consistent, predictable revenue streams |

| Cable Accessories & Components | Essential for grid maintenance, stable demand | Global leadership, consistent cash generation |

Delivered as Shown

Prysmian BCG Matrix

The Prysmian BCG Matrix document you are previewing is the identical, fully formatted report you will receive immediately after your purchase. This means no watermarks, no altered content, and no hidden surprises – just the comprehensive strategic analysis you need.

Rest assured, the BCG Matrix preview you see is the exact final version that will be delivered to you upon completing your purchase. It's a professionally crafted document, ready for immediate application in your business strategy discussions and planning.

Dogs

Certain very low voltage or highly commoditized cable products, where competition is intense and differentiation is minimal, could fall into the Dogs category of the Prysmian BCG Matrix. These products typically operate in low-growth markets with limited market share potential for Prysmian, offering minimal returns and potentially tying up capital without significant strategic upside. For example, basic building wire segments might exhibit these characteristics. In 2023, the global market for electrical wires and cables was estimated to be around $200 billion, with a significant portion attributed to these more commoditized segments, experiencing growth rates often below 3% annually.

Legacy product lines tied to outdated technologies or industries facing long-term decline could be considered Dogs for Prysmian. These segments typically show low growth and a low market share, meaning they consume valuable resources without generating significant future returns. For instance, if Prysmian still has substantial business in copper wire for older telecommunication infrastructure that is being phased out, this would fit the Dog profile.

In 2023, Prysmian reported a revenue of €15.5 billion, and while specific segment breakdowns for declining product lines aren't always explicitly detailed in public reports, companies often manage these through a strategy of careful resource allocation or divestiture. The focus for such units is usually on minimizing losses rather than growth.

For these Dog segments, businesses are generally advised to consider divestiture. Turn-around plans for products with inherently declining demand are often ineffective and can drain capital that could be better invested in more promising areas of the business. This strategic pruning allows Prysmian to redirect its efforts and financial strength towards its Stars and Question Marks.

Within Prysmian's global portfolio, certain highly specialized regional niche markets exhibit persistently weak performance. These segments, characterized by stagnant demand and limited growth potential, represent areas where the company has struggled to establish a dominant market share. For instance, specific specialty cable segments in certain North American regions have encountered significant headwinds, contributing to their classification as potential cash traps.

Products Displaced by Newer Technologies

Products displaced by newer technologies represent a significant risk for Prysmian, particularly if the company hasn't adapted its portfolio. These are offerings that are becoming obsolete due to advancements in connectivity, materials, or energy transmission. For instance, older copper-based telecommunication cables are facing intense competition from fiber optic solutions, which offer vastly superior bandwidth and speed. Prysmian's success hinges on its ability to shift focus and resources towards these next-generation technologies.

The erosion of market share for such products occurs in markets that are either stagnant or shrinking. This situation is exacerbated by the increasing demand for higher performance and greater efficiency across all sectors. Companies that fail to innovate risk being left behind as competitors embrace more cutting-edge solutions.

- Copper Telecommunication Cables: Facing obsolescence due to the widespread adoption of fiber optics, which offer significantly higher data transmission speeds and capacity. Global fiber optic cable deployment continues to grow, with projections indicating sustained expansion through 2025 and beyond as 5G and broadband initiatives accelerate.

- Older Generation Power Cables: Some traditional power cable designs may be less efficient or durable compared to newer, advanced materials and insulation technologies, especially in demanding environments like renewable energy projects or high-voltage direct current (HVDC) transmission.

- Legacy Data Center Cabling: As data centers demand ever-increasing speeds and lower latency, older copper cabling infrastructure within these facilities is being rapidly replaced by higher-performance alternatives.

Underperforming Segments within Specialties (e.g., Automotive)

The automotive sector within Prysmian's Specialties segment experienced a downturn in FY24, with adjusted EBITDA showing a decrease. This performance indicates potential challenges in this specific market niche.

If this downward trend persists and Prysmian does not implement effective strategies to revitalize this area or if the broader automotive market continues to struggle, the automotive business could be categorized as a 'Dog' in the BCG matrix. This classification stems from the combination of low market growth and Prysmian's potentially declining market share within this segment.

- FY24 Adjusted EBITDA Decline: Prysmian's automotive business reported a decline in adjusted EBITDA for the fiscal year 2024.

- Potential 'Dog' Classification: Continued underperformance without strategic intervention could lead to this segment being classified as a 'Dog' in the BCG matrix.

- Market Share Concerns: A 'Dog' typically exhibits low market share and low market growth, suggesting potential issues for Prysmian's automotive operations if these conditions materialize.

Products in the Dogs category for Prysmian represent areas with low market share in low-growth industries. These are often legacy products that are being phased out by technological advancements or market shifts. For instance, older types of copper telecommunication cables are increasingly being replaced by fiber optics, a trend that has accelerated with the demand for higher bandwidth. In 2023, the global market for fiber optic cables alone was valued at over $12 billion and is projected to continue its strong growth trajectory.

These segments require careful management to avoid becoming cash traps, consuming resources without generating significant returns. Prysmian's strategy for such products typically involves minimizing losses and eventually divesting them to reallocate capital to more promising areas like Stars or Question Marks. The automotive sector within Prysmian's portfolio showed a decline in adjusted EBITDA for FY24, indicating potential challenges that could lead to a Dog classification if not addressed.

The company's overall revenue in 2023 reached €15.5 billion, and while specific figures for declining product lines are not always detailed, the general approach to Dogs is strategic pruning. This focus allows Prysmian to concentrate on innovation and growth in areas with higher potential, such as advanced energy solutions and connectivity technologies.

Products like legacy data center cabling or older generation power cables that are less efficient compared to newer technologies also fall into this category. As the demand for higher performance and efficiency grows across all sectors, companies that fail to adapt risk losing market share in these declining segments.

| Product Category | Market Growth | Prysmian Market Share | Strategic Recommendation |

|---|---|---|---|

| Copper Telecommunication Cables | Low / Declining | Low | Divest or phase out |

| Legacy Data Center Cabling | Low / Stagnant | Low | Divest or transition |

| Older Generation Power Cables | Low / Stagnant | Low | Manage for cash or divest |

| Automotive (FY24 Performance) | Low / Challenged | Potentially Declining | Monitor closely, consider strategic review |

Question Marks

Prysmian's investment in Relativity Networks for hollow-core fiber (HCF) production positions it as a 'Question Mark' in the BCG matrix. This cutting-edge technology offers ultra-low latency, crucial for advanced applications like AI and quantum networking, tapping into a high-growth market. While promising, HCF is still in its nascent stages, meaning its current market penetration is minimal, necessitating significant capital for expansion and market leadership.

Prysmian is actively investing in smart grid technologies, developing advanced cable systems and sensing solutions for improved fault detection, grid monitoring, and overall power management. This focus aims to boost grid reliability and operational efficiency. The global smart grid market was valued at approximately $37.5 billion in 2023 and is projected to reach over $100 billion by 2030, indicating substantial growth potential.

Given the early stage of many of these high-tech solutions and the competitive landscape, Prysmian's current market share in specific smart grid sensing niches is likely modest. These innovative developments represent significant research and development investments, requiring substantial market penetration and customer adoption to transition into mature, high-growth 'Star' categories within the BCG framework.

The e-mobility sector represents a significant growth opportunity, and Prysmian is strategically positioned with its specialized cable solutions. As the global demand for electric vehicles and charging infrastructure continues to surge, Prysmian's proactive development in this area places its e-mobility cable solutions firmly in the 'Question Mark' quadrant of the BCG matrix.

The rapid expansion of the electric vehicle market, projected to reach over 30 million units sold globally in 2024, highlights the immense potential. Prysmian's early and substantial investments in advanced cable technologies for charging and vehicle connectivity are key drivers for this classification. Capturing a dominant market share will necessitate continued, focused investment in innovation and aggressive market penetration strategies.

New Market Entries through Acquisitions (e.g., Channell Commercial Corp.)

Prysmian's acquisition of Channell Commercial Corp. in March 2025 is a strategic move to bolster its presence in the rapidly expanding digital and communication cable markets, particularly for data centers and 5G infrastructure within the United States. This acquisition effectively places Prysmian in segments that were previously considered potential growth areas, perhaps with a more modest market share before the integration.

By acquiring Channell Commercial Corp., Prysmian is aiming to transform these markets into Stars within its portfolio. This involves significant strategic integration and investment to leverage Channell's existing capabilities and customer base, with the ultimate goal of achieving market leadership in these high-demand sectors.

- Market Expansion: Prysmian's 2025 acquisition of Channell Commercial Corp. is designed to significantly expand its footprint in the US market for digital and communication cables.

- Strategic Positioning: This move targets high-growth sectors like data centers and 5G infrastructure, areas where Prysmian can now aim for market leadership.

- Investment Focus: The integration of Channell is expected to require substantial investment to capitalize on synergies and drive growth, transforming these segments into potential Stars.

- 2024 Data Context: Leading up to this acquisition, the US market for data center cabling was projected for robust growth, with reports indicating a compound annual growth rate exceeding 8% through 2024, highlighting the strategic importance of this sector.

Emerging Applications of Nanotechnologies in Cables

Prysmian's exploration of nanotechnologies in cables falls into the 'Question Mark' category of the BCG Matrix. This signifies an area of significant investment in research and development for materials with high future growth potential, such as enhanced conductivity or insulation properties derived from nanomaterials.

While the long-term competitive advantage is substantial, current market penetration and revenue from these advanced cable applications are likely minimal, necessitating continued R&D expenditure to mature the technology and establish market share.

The company's commitment to innovation in materials science, including nanotechnology, is crucial for future differentiation and capturing emerging market demands. For instance, advancements in nanocomposite insulation could lead to cables with improved fire resistance and reduced environmental impact, areas of increasing regulatory and consumer focus.

- Nanomaterial Integration: Prysmian is investigating the use of nanoparticles to enhance cable performance characteristics like electrical conductivity, thermal management, and mechanical strength.

- R&D Investment: Significant capital is allocated to research and development, focusing on translating laboratory-scale nanotechnology breakthroughs into scalable and cost-effective manufacturing processes for cables.

- Market Potential: Emerging applications in high-performance sectors such as electric vehicles, renewable energy infrastructure, and advanced telecommunications offer substantial growth opportunities for nanotechnology-enabled cables.

- Commercialization Challenges: The primary challenge lies in achieving widespread market adoption and profitability, which requires overcoming technical hurdles, regulatory approvals, and competitive pricing against established cable technologies.

Prysmian's ventures into emerging technologies, such as hollow-core fiber and nanotechnology-enhanced cables, represent classic 'Question Mark' scenarios. These innovations hold immense future potential, targeting high-growth markets like AI and advanced telecommunications, but currently possess low market share and require substantial investment to mature.

The company's strategic acquisitions, like that of Channell Commercial Corp. in early 2025, aim to transform these 'Question Marks' into 'Stars' by consolidating market position in high-demand sectors such as data centers and 5G infrastructure.

Significant capital is being channeled into research and development for these nascent technologies, with the expectation that successful market penetration and adoption will drive future revenue and solidify Prysmian's leadership in these evolving segments.

The e-mobility sector, with its rapidly expanding global market, also falls under the 'Question Mark' classification for Prysmian's specialized cable solutions, underscoring the need for continued innovation and market capture.

| Prysmian's BCG 'Question Marks' | Market Potential | Current Market Share | Investment Required | Key Challenges |

|---|---|---|---|---|

| Hollow-Core Fiber (HCF) | Ultra-low latency for AI, quantum networking | Minimal | High (R&D, production scaling) | Nascent technology, market education |

| Smart Grid Sensing Solutions | Grid reliability, fault detection | Modest (in specific niches) | Significant (market penetration) | Competition, customer adoption |

| Nanotechnology Cables | Enhanced conductivity, insulation | Minimal | High (R&D, commercialization) | Scalability, cost-effectiveness |

| E-Mobility Cables | EV charging, vehicle connectivity | Growing, but not dominant | Continued innovation, market capture | Intense competition, evolving standards |

BCG Matrix Data Sources

Our BCG Matrix is built on verified market intelligence, combining financial data, industry research, official reports, and expert commentary to ensure reliable, high-impact insights.