Prysmian PESTLE Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Prysmian Bundle

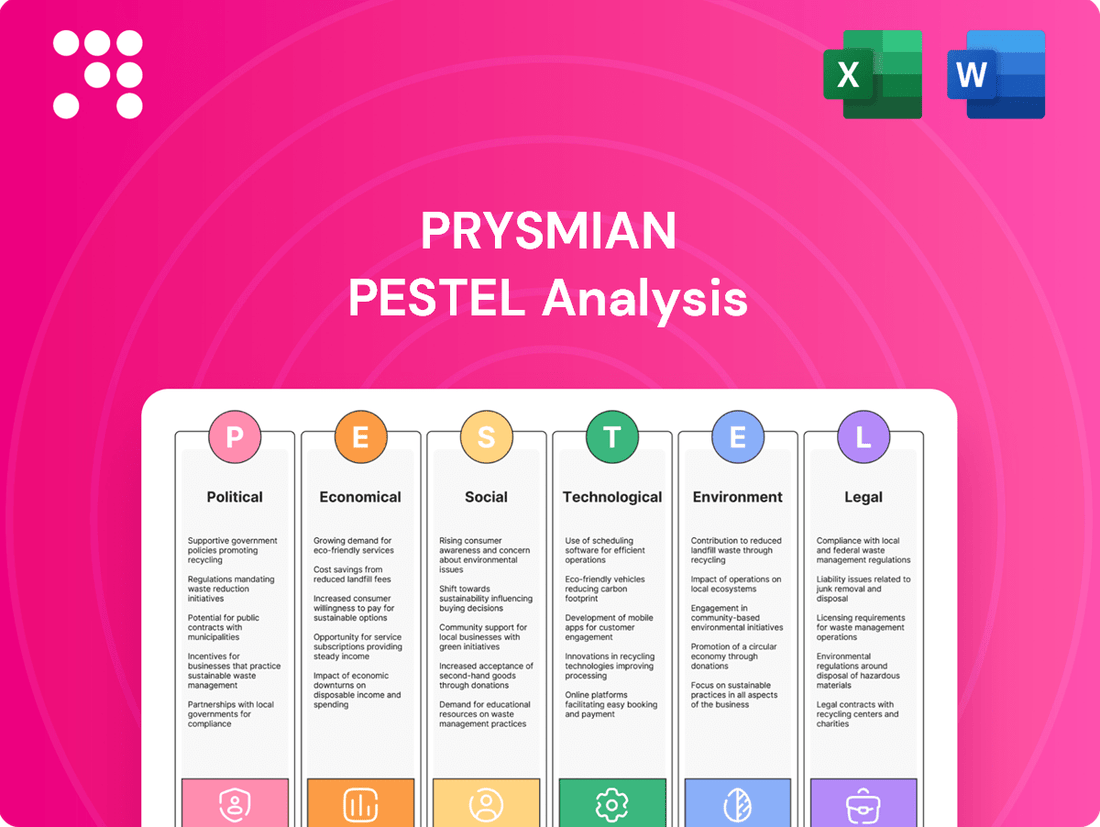

Unlock critical insights into Prysmian's operating environment with our comprehensive PESTLE Analysis. Understand the political, economic, social, technological, legal, and environmental forces that are shaping the company's trajectory. Equip yourself with the knowledge to anticipate challenges and capitalize on opportunities. Download the full analysis now for actionable intelligence and a strategic advantage.

Political factors

Government infrastructure spending is a major driver for Prysmian Group, especially in sectors like energy transmission and telecommunications. When governments invest more in areas such as smart grids, renewable energy integration, and expanding broadband networks, Prysmian sees a direct increase in demand for its cable solutions. This trend is clearly demonstrated by significant projects, like the substantial contracts Prysmian secured for German offshore wind farm grid connections, underscoring the tangible impact of national energy strategies on the company's order book.

Global trade policies, including tariffs and trade agreements, directly influence Prysmian's operational costs and market reach. For instance, the imposition of tariffs on key raw materials like copper or aluminum, or on finished cables, can inflate production expenses and potentially reduce demand in affected markets. Prysmian's extensive international footprint means it navigates a complex web of import and export regulations across numerous countries, making supply chain efficiency a constant challenge.

Geopolitical tensions, a significant political factor, often translate into protectionist trade measures. These can manifest as increased import duties, quotas, or even outright bans on certain goods. Such actions can disrupt Prysmian's established supply chains, forcing the company to seek alternative, potentially more expensive, sourcing or manufacturing locations. This also impacts its competitive standing, as rivals in less affected regions might gain an advantage.

In 2024, ongoing trade disputes and the renegotiation of trade agreements, such as those involving major economies, continue to create uncertainty. For example, the US-China trade tensions, though somewhat evolved, still create ripples in global supply chains for components and finished goods. Prysmian must remain agile, adapting its sourcing and distribution strategies to mitigate the financial impact of these evolving trade landscapes and maintain its market access.

Geopolitical instability, like the ongoing conflicts in Eastern Europe and the Middle East, directly impacts Prysmian's supply chain. These disruptions can escalate the cost of essential raw materials, such as copper and aluminum, and significantly increase logistics expenses, as seen in rising shipping rates in 2024.

Prysmian's success in executing major infrastructure projects, such as those in renewable energy and telecommunications, is heavily dependent on predictable political landscapes. For instance, projects in developing nations with volatile political situations can face delays and cost overruns, impacting the company's financial performance and project timelines.

Energy Transition Policies and Renewable Energy Targets

Governments worldwide are implementing robust policies to accelerate the energy transition, setting aggressive renewable energy targets. For instance, the European Union aims for at least 42.5% renewable energy by 2030, with a push for 45%. This governmental focus directly translates into significant demand for Prysmian's advanced cable solutions, essential for connecting new renewable energy sources to the grid and modernizing power infrastructure.

These policies are not just about targets; they include substantial investments in grid modernization and interconnector projects. Prysmian is well-positioned to capitalize on this, as evidenced by their involvement in major projects like the Viking Link, an 800 MW electricity interconnector between the UK and Denmark, which commenced commercial operation in late 2023. Such initiatives underscore the direct link between political will and Prysmian's market opportunities.

- Government Support for Renewables: Policies like the Inflation Reduction Act in the US provide tax credits and incentives, boosting investment in renewable energy projects that require extensive cabling.

- Grid Modernization Investments: Many nations are earmarking billions for grid upgrades to handle the intermittent nature of renewables, creating a sustained demand for high-voltage and specialized cables from companies like Prysmian.

- Offshore Wind Development: Ambitious offshore wind targets, such as the UK's goal of 50 GW by 2030, necessitate significant investment in subsea cables, a core product area for Prysmian.

- Interconnector Projects: Cross-border electricity interconnector projects, vital for energy security and market integration, are being prioritized by governments, directly benefiting Prysmian’s project pipeline.

Telecommunications Regulatory Frameworks

Telecommunications regulatory frameworks significantly influence Prysmian's Digital Solutions business. Government mandates for fiber-to-the-home (FTTH) deployment, like those seen in the European Union's Digital Decade targets aiming for gigabit connectivity for all households by 2030, directly boost demand for Prysmian's optical fiber cables. Similarly, 5G rollout initiatives, supported by spectrum allocation and infrastructure investment incentives, create substantial opportunities for the company's advanced cable systems.

Favorable regulatory environments are key drivers for Prysmian. For instance, the U.S. government's Infrastructure Investment and Jobs Act, allocating billions to broadband expansion, is projected to accelerate the adoption of fiber optic networks. Policies focused on bridging the digital divide and enhancing network resilience, such as those promoting secure and robust infrastructure, further solidify the market for Prysmian's products.

- FTTH Mandates: EU aims for gigabit connectivity for all households by 2030, driving fiber demand.

- 5G Rollout: Government spectrum allocation and investment incentives accelerate 5G infrastructure needs.

- Digital Divide Initiatives: Policies supporting universal broadband access directly benefit optical fiber deployment.

- Network Resilience: Regulations emphasizing secure and robust telecom infrastructure enhance demand for high-quality cables.

Government infrastructure spending remains a critical driver for Prysmian, particularly in energy and telecommunications. For example, the US Infrastructure Investment and Jobs Act, enacted in 2021, allocates substantial funds to broadband expansion, directly benefiting Prysmian's fiber optic cable business.

Geopolitical tensions and evolving trade policies continue to shape global markets, impacting Prysmian's supply chain and operational costs. The ongoing trade dynamics between major economic blocs create uncertainty, necessitating strategic sourcing and market access adjustments.

Governmental support for the energy transition, including ambitious renewable energy targets and grid modernization initiatives, presents significant opportunities. The EU's goal of at least 42.5% renewable energy by 2030, with a push for 45%, directly fuels demand for Prysmian's advanced cable solutions, essential for integrating new energy sources.

Telecommunications regulatory frameworks, such as the EU's Digital Decade targets for gigabit connectivity by 2030, are boosting demand for optical fiber cables. Prysmian's involvement in projects like the Viking Link interconnector, which commenced operations in late 2023, highlights the tangible impact of government-backed energy infrastructure projects.

| Policy/Initiative | Impact on Prysmian | Example/Data Point |

|---|---|---|

| US Infrastructure Investment and Jobs Act | Boosts demand for fiber optic cables | Allocates billions to broadband expansion |

| EU Renewable Energy Targets | Drives demand for grid connection cables | Goal of at least 42.5% renewables by 2030 |

| EU Digital Decade | Increases demand for optical fiber | Gigabit connectivity for all households by 2030 |

| Viking Link Project | Demonstrates demand for interconnector cables | 800 MW electricity interconnector, operational late 2023 |

What is included in the product

This PESTLE analysis of Prysmian examines the impact of Political, Economic, Social, Technological, Environmental, and Legal factors on its operations and strategy.

Provides a clear, actionable framework for understanding the external forces impacting Prysmian, enabling proactive strategic adjustments to mitigate risks and capitalize on opportunities.

Economic factors

Global economic growth is a significant driver for Prysmian, as its cable and system solutions are crucial for infrastructure development. In 2024, the International Monetary Fund (IMF) projected global growth at 3.2%, a steady rate that supports demand for construction and energy projects. This translates to increased opportunities for Prysmian in sectors reliant on robust industrial output and infrastructure investment.

Industrial output directly correlates with Prysmian's performance. A healthy manufacturing sector requires significant energy and telecommunications infrastructure, both areas where Prysmian is a key supplier. For instance, the manufacturing PMI in advanced economies remained above 50 in early 2024, indicating expansion and a positive outlook for industrial demand.

Economic downturns, however, pose a challenge. Reduced government spending on infrastructure and lower private sector investment during recessions can directly impact Prysmian's order book. For example, a slowdown in construction activity, as seen in some regions during past economic contractions, would naturally lead to decreased demand for Prysmian's energy and telecom cables.

Prysmian's core inputs, like copper and aluminum, are subject to significant price swings. For example, copper prices saw considerable volatility in late 2023 and early 2024, influenced by global demand and supply chain disruptions, directly impacting Prysmian's cost structure.

These commodity market fluctuations can directly affect Prysmian's cost of goods sold, potentially squeezing profit margins if not managed carefully. In 2024, the energy transition's demand for copper is projected to increase, further contributing to price uncertainty.

To counter this, Prysmian relies on robust hedging strategies and optimized procurement processes. By securing raw materials at favorable prices and managing inventory efficiently, the company aims to insulate its financial performance from the unpredictable nature of commodity markets.

Rising inflation in 2024 and projected into 2025 presents a significant challenge for Prysmian, potentially increasing operational expenses. For instance, the cost of raw materials like copper and aluminum, crucial for cable manufacturing, has seen volatility. This upward pressure on input costs directly impacts Prysmian's ability to maintain profit margins without passing on increased prices to customers.

Concurrent trends of higher interest rates, a likely response to inflation, could dampen demand for Prysmian's products. Higher borrowing costs for utilities and construction firms, key Prysmian clients, may lead to a slowdown in large-scale infrastructure investments, such as power grid upgrades or renewable energy projects. For example, a 2024 interest rate scenario might see project financing costs rise by 0.5% to 1%, impacting project viability.

Currency Exchange Rate Fluctuations

Prysmian, as a global entity with a presence in many nations, is directly impacted by currency exchange rate volatility. Fluctuations, especially concerning the Euro against currencies like the US Dollar, can significantly alter reported revenues, expenses, and overall profitability when financial outcomes from foreign operations are translated back into Prysmian's primary reporting currency.

For instance, if the Euro strengthens considerably against the US Dollar, Prysmian's reported earnings from its US-based activities would appear lower when converted to Euros. Conversely, a weaker Euro would inflate those same earnings. This dynamic necessitates careful financial management and hedging strategies to mitigate potential negative impacts on the company's consolidated financial statements.

- Impact on Revenue: A stronger Euro can decrease the reported value of sales made in US Dollars.

- Impact on Costs: Conversely, a weaker Euro can increase the cost of imported raw materials or components priced in foreign currencies.

- Profitability: Net profit margins can be squeezed or enhanced depending on the net exposure to different currency movements.

- 2024/2025 Outlook: Analysts are closely watching the Euro-Dollar exchange rate, with projections for 2024 and 2025 suggesting continued volatility due to global economic uncertainties and differing monetary policies. For example, the Euro traded around 1.08 against the US Dollar in early 2024, a level that could see significant shifts throughout the year.

Investment Cycles in Utilities and Infrastructure

Prysmian's financial performance is intrinsically linked to the ebb and flow of investment in utilities and infrastructure projects. These large-scale, long-term undertakings are the bedrock of demand for Prysmian's cable and connectivity solutions. The company's success hinges on its capacity to tap into these cyclical investment patterns effectively.

Several key drivers fuel these investment cycles. The urgent need to replace aging infrastructure, particularly in mature economies, creates a steady demand. Furthermore, the global push towards grid modernization, incorporating renewable energy sources and smart grid technologies, necessitates significant upgrades and new installations. The ongoing expansion of telecommunications networks, including 5G deployment and fiber-to-the-home initiatives, also represents a substantial growth area for Prysmian.

For instance, in 2024, global infrastructure spending is projected to reach trillions, with a significant portion allocated to energy and telecommunications upgrades. Reports from industry analysts in late 2023 and early 2024 indicated a robust pipeline of projects, particularly in Europe and North America, focused on energy transition and digital infrastructure. Prysmian's strategy often involves securing multi-year contracts, which provide a degree of revenue predictability amidst these cyclical investments.

- Infrastructure Investment Growth: Global infrastructure investment is anticipated to see continued growth through 2025, driven by government stimulus and private sector initiatives.

- Renewable Energy Focus: The transition to renewable energy sources is a major catalyst, requiring substantial investment in new transmission and distribution infrastructure.

- Digitalization Demand: The increasing demand for high-speed internet and 5G connectivity is accelerating investments in fiber optic networks.

- Aging Infrastructure Replacement: Many developed nations face a critical need to upgrade or replace outdated power grids and communication lines.

Global economic growth provides a stable environment for Prysmian's infrastructure solutions. In 2024, the IMF projected global growth at 3.2%, supporting demand for energy and telecom projects. This steady economic pace translates to continued opportunities for Prysmian in key sectors.

Industrial output directly influences Prysmian's performance, as manufacturing expansion requires robust energy and telecommunications infrastructure. The manufacturing PMI in advanced economies remained above 50 in early 2024, signaling growth and increased demand for Prysmian's products.

Commodity price volatility, particularly for copper and aluminum, impacts Prysmian's cost structure. Copper prices experienced significant fluctuations in late 2023 and early 2024, driven by global demand and supply chain issues, directly affecting Prysmian's input costs.

Inflationary pressures in 2024 and into 2025 increase operational expenses for Prysmian, especially for raw materials. Higher interest rates, a likely response to inflation, could slow down large infrastructure investments by Prysmian's clients, potentially impacting project financing costs by 0.5% to 1% in 2024.

| Economic Factor | 2024 Projection/Data | Impact on Prysmian |

|---|---|---|

| Global GDP Growth | 3.2% (IMF) | Supports infrastructure demand |

| Manufacturing PMI (Advanced Economies) | >50 (Early 2024) | Indicates expansion, increasing demand |

| Copper Price Volatility | Significant in late 2023/early 2024 | Affects cost of goods sold |

| Inflation | Rising in 2024/2025 | Increases operational expenses |

| Interest Rate Impact (Project Financing) | Potential 0.5%-1% increase in 2024 | May dampen investment in large projects |

Preview the Actual Deliverable

Prysmian PESTLE Analysis

The preview shown here is the exact Prysmian PESTLE Analysis document you’ll receive after purchase—fully formatted and ready to use for your strategic planning.

This is a real screenshot of the product you’re buying—delivered exactly as shown, no surprises, providing a comprehensive overview of Prysmian's external environment.

The content and structure shown in the preview is the same Prysmian PESTLE Analysis document you’ll download after payment, offering actionable insights.

Sociological factors

Global urbanization continues at a rapid pace, with projections indicating that by 2050, 68% of the world's population will live in urban areas, up from 55% in 2023. This surge in city dwellers creates an immense demand for enhanced and new infrastructure, particularly in energy distribution and telecommunications networks. Prysmian's cable systems are fundamental to meeting these evolving needs, supporting the expansion and modernization of urban power grids and digital connectivity.

The ongoing development of smart cities and interconnected communities directly fuels the market for Prysmian's advanced cable solutions. As urban centers grow and integrate more technology, the need for reliable, high-capacity power and data transmission becomes critical. For instance, investments in smart grid technologies, a key area for Prysmian, saw significant global growth in 2024, driven by the push for more resilient and efficient urban energy systems.

Societal awareness and investor scrutiny around Environmental, Social, and Governance (ESG) factors are increasingly shaping Prysmian's operational landscape and strategic direction. Stakeholders, from consumers to institutional investors, are demanding tangible proof of strong environmental stewardship, fair labor practices, and robust corporate governance.

This heightened consciousness translates into direct pressure on Prysmian to invest in sustainable product development, actively reduce its carbon footprint, and ensure ethical conduct throughout its supply chain. For instance, Prysmian's commitment to sustainability is reflected in its 2023 ESG performance, where it reported a 15% reduction in Scope 1 and 2 greenhouse gas emissions compared to 2019, aligning with growing investor expectations for climate action.

The relentless pace of digital transformation is fundamentally reshaping industries and daily life, driving an insatiable appetite for dependable, high-speed internet. This societal shift directly translates into a robust demand for the very infrastructure Prysmian specializes in, particularly advanced fiber optic cables and the foundational elements for 5G networks. These technologies are not just conveniences; they are becoming essential utilities for everything from remote work and education to advanced manufacturing and smart cities.

Prysmian's Digital Solutions segment is at the forefront of this wave, providing critical components that enable this global digitalization. For instance, the ongoing expansion of 5G networks globally, with significant investments projected through 2025 and beyond, underscores the critical need for high-capacity fiber backhaul. Prysmian's role in supplying these cables is paramount to ensuring the seamless flow of data that underpins these advancements.

Workforce Availability and Skill Gaps

Prysmian's operations are significantly influenced by the availability of a skilled workforce, particularly in niche areas like high-voltage cable installation and advanced manufacturing processes. Skill gaps in these specialized fields can directly affect operational efficiency and the timely execution of critical projects, such as those in renewable energy infrastructure development.

Attracting and retaining top engineering and technical talent is paramount for Prysmian to sustain its technological edge and meet demanding project schedules. For instance, the global demand for skilled technicians in the offshore wind sector, a key growth area for Prysmian, has intensified. Reports from industry bodies in late 2024 indicated a shortage of over 50,000 skilled workers globally for offshore wind projects alone, a trend that directly impacts companies like Prysmian.

- Workforce Availability: Prysmian relies on a specialized talent pool for its complex projects, particularly in renewable energy and grid modernization.

- Skill Gaps: Shortages exist in high-voltage cable technicians and advanced manufacturing engineers, impacting project timelines and costs.

- Talent Retention: Retaining experienced engineers and technicians is crucial for maintaining Prysmian's competitive advantage and operational continuity.

- Industry Demand: The rapid expansion of renewable energy projects, especially offshore wind, is creating intense competition for skilled labor, as evidenced by projected global shortages in the sector.

Evolving Consumer Behavior Towards E-mobility

Societal attitudes are increasingly favoring electric vehicles (EVs), fueled by growing environmental awareness and rapid technological progress. This shift presents significant opportunities for Prysmian, particularly in supplying essential components for the burgeoning EV charging infrastructure sector. By 2024, the global EV market is projected to see continued strong growth, with charging infrastructure needing to keep pace.

Prysmian is well-positioned to capitalize on this trend. The company designs and manufactures specialized cables and connectivity solutions specifically for EV charging stations, directly supporting the expansion of this dynamic market. This focus aligns with the increasing demand for reliable and efficient charging solutions.

- Global EV sales surpassed 10 million units in 2023, a significant increase from previous years, indicating strong consumer adoption.

- The number of public charging points worldwide is expected to reach several million by 2025, requiring substantial investment in infrastructure.

- Consumer surveys in 2024 consistently show a preference for sustainable transportation options, with EVs topping the list for many demographics.

Societal shifts towards sustainability and digitalization are profoundly impacting Prysmian's market. Growing consumer and investor demand for environmentally friendly products and ethical business practices is pushing Prysmian to innovate in green technologies and transparent supply chains. Simultaneously, the relentless digital transformation, exemplified by the 5G rollout and smart city initiatives, creates substantial demand for Prysmian's advanced connectivity solutions, particularly fiber optic cables.

Technological factors

Continuous innovation in cable materials, like advanced polymers and composites, alongside manufacturing process improvements, is key to developing more efficient, durable, and sustainable products. Prysmian's commitment to R&D fuels the creation of cutting-edge solutions, such as fully recyclable cables and those with a reduced environmental footprint.

These technological leaps not only boost product performance but also contribute to lowering production costs. For instance, Prysmian's focus on material science could lead to cables with improved conductivity or fire resistance, directly impacting their utility and safety in various applications.

The ongoing evolution of smart grid technologies, designed to optimize energy distribution and bolster grid resilience, necessitates sophisticated cable systems. These advanced systems must seamlessly integrate with digital monitoring and control infrastructure, a key area where Prysmian's expertise shines. For instance, Prysmian's involvement in projects like the development of advanced underground cable networks for smart city initiatives in Europe directly supports the digitalization of power grids, contributing to more efficient energy management and significant loss reduction, with some studies suggesting potential reductions of up to 10-15% in transmission losses through smarter grid operations.

Ongoing advancements in fiber optic technology, like the development of hollow-core optical fiber, coupled with the global rollout of 5G networks, are significantly boosting the demand for Prysmian's advanced telecom cables. These technologies are the backbone of modern digital infrastructure, requiring increasingly sophisticated connectivity solutions.

Prysmian is actively investing in creating ultra-low latency and high-density fiber optic solutions. This focus directly addresses the escalating data transmission needs driven by 5G, the Internet of Things (IoT), and cloud computing, ensuring their product portfolio remains competitive.

The global fiber optic cable market was valued at approximately $25 billion in 2023 and is projected to grow at a compound annual growth rate (CAGR) of over 10% through 2030, largely fueled by 5G deployments. Prysmian, as a leading player, is well-positioned to capitalize on this expansion.

E-mobility Charging Infrastructure Development

Technological advancements in electric mobility are directly fueling the demand for sophisticated charging infrastructure, a key area where Prysmian's expertise in specialized cables becomes paramount. The ongoing evolution of charging speeds and connector types requires continuous innovation in cable design to ensure safety, efficiency, and durability across diverse applications.

Prysmian is actively engaged in developing a comprehensive range of charging solutions, catering to everything from home charging units to high-power charging stations for public and commercial use. This focus is essential for facilitating the broader adoption of electric vehicles by ensuring reliable and accessible charging points.

The global e-mobility market is experiencing significant growth. For instance, the electric vehicle market is projected to reach over 300 million vehicles by 2030, with a corresponding expansion in charging infrastructure. Prysmian's role in this ecosystem is vital:

- Market Growth: The global charging infrastructure market was valued at approximately $30 billion in 2023 and is expected to grow at a compound annual growth rate (CAGR) of over 25% through 2030, creating substantial opportunities for cable manufacturers.

- Technological Integration: Prysmian's cables are designed to support advanced charging technologies, including DC fast charging, which requires high-performance materials and construction to handle increased power loads and thermal management.

- Standardization Efforts: As charging standards evolve, Prysmian's ability to adapt its product offerings to meet new specifications, such as those related to higher voltage and current ratings, will be critical for market penetration and success.

Subsea Cable Technology for Intercontinental Connectivity and Offshore Wind

Prysmian Group is a recognized leader in subsea cable technology, particularly in high-voltage direct current (HVDC) systems. This expertise is crucial for intercontinental connectivity, allowing for efficient, long-distance power transmission with minimal loss. For instance, Prysmian’s involvement in projects like the Viking Link, connecting the UK and Denmark, highlights their capability in this area, with the project’s total length exceeding 760 kilometers.

Furthermore, Prysmian is at the forefront of developing dynamic cables specifically designed for floating offshore wind farms. These cables must withstand constant movement and harsh marine environments, a critical technological hurdle for the expansion of offshore wind. The company’s investment in research and development for these specialized cables directly supports the growth of renewable energy by enabling the deployment of wind turbines in deeper waters, further from shore.

- HVDC Systems: Prysmian’s HVDC technology is vital for intercontinental power grids, enabling efficient energy transfer over vast distances.

- Dynamic Cables: Innovation in dynamic cables is key for the burgeoning floating offshore wind sector, allowing turbines to operate reliably in challenging conditions.

- Project Examples: The Viking Link project, a significant interconnector utilizing Prysmian's cables, demonstrates the practical application of their advanced subsea technology.

- Market Impact: These technological advancements position Prysmian to capitalize on the global demand for subsea power transmission and offshore renewable energy infrastructure.

Technological advancements are pivotal for Prysmian, driving innovation in cable materials and manufacturing processes to create more efficient and sustainable products. The company's R&D focus on advanced polymers and composites, for example, enables the development of cables with enhanced durability and reduced environmental impact, directly addressing market demands for greener solutions.

The expansion of smart grids and the global rollout of 5G networks are creating significant demand for Prysmian's sophisticated cable systems. Their expertise in fiber optics, particularly in developing ultra-low latency and high-density solutions, positions them to capitalize on the increasing data transmission needs driven by these technologies. The global fiber optic cable market, projected to exceed $25 billion in 2023 with a CAGR over 10%, underscores this opportunity.

Prysmian is also leveraging technological advancements in electric mobility and subsea power transmission. Their development of specialized cables for EV charging infrastructure and dynamic cables for floating offshore wind farms addresses key growth sectors. The global charging infrastructure market, expected to grow at a CAGR of over 25% through 2030, highlights the potential for Prysmian's solutions.

| Technology Area | Key Advancements | Market Impact/Opportunity | Prysmian's Role |

|---|---|---|---|

| Advanced Cable Materials | New polymers, composites, recyclability | Improved durability, efficiency, sustainability | R&D in material science for next-gen cables |

| Smart Grids & 5G | Digital integration, low-latency fiber | Enhanced grid efficiency, increased data demand | Supplying advanced telecom and grid cables |

| Electric Mobility | High-power charging cables | Growth in EV adoption and charging infrastructure | Developing specialized EV charging cables |

| Subsea Power & Renewables | HVDC, dynamic cables for offshore wind | Efficient long-distance power transmission, offshore wind expansion | Leading provider of subsea and dynamic cables |

Legal factors

Prysmian must navigate a complex web of international standards and certifications to ensure its cable products meet global safety and quality benchmarks. Compliance with regulations like IEC (International Electrotechnical Commission) standards, which cover everything from voltage ratings to fire performance, is non-negotiable for market access. For instance, the IEC 60332 series dictates requirements for flame propagation, a critical safety feature for cables used in buildings and infrastructure.

Failure to adhere to these legal frameworks, which also include regional certifications like CE marking in Europe or UL listing in North America, can result in significant penalties and market exclusion. In 2024, Prysmian's commitment to these standards underpins its ability to supply critical infrastructure projects worldwide, reinforcing its reputation for reliability and safety in a highly regulated industry.

Prysmian operates within a complex web of environmental compliance regulations. These laws dictate how the company manages waste, handles hazardous materials like those covered by the RoHS and WEEE directives, and controls its carbon emissions. For instance, in 2024, the European Union continued to strengthen its Green Deal initiatives, imposing stricter limits on industrial emissions and promoting circular economy principles, which directly impact Prysmian's manufacturing and supply chain operations.

These legal frameworks are not merely burdens; they actively shape Prysmian's strategic direction. By adhering to these environmental mandates, the company is compelled to innovate in product design, adopt cleaner manufacturing processes, and invest in sustainable materials. This regulatory pressure is a significant driver for Prysmian's commitment to reducing its environmental footprint and enhancing its long-term sustainability performance, a trend that is expected to accelerate through 2025.

Prysmian's global operations, spanning over 50 countries, necessitate strict adherence to a complex web of national and international labor laws. These regulations cover critical areas such as worker safety, minimum wages, and working conditions, all of which are paramount for responsible business conduct.

Failure to comply with these diverse legal frameworks can lead to significant risks, including costly legal disputes and damage to Prysmian's reputation. For instance, in 2023, the International Labour Organization reported a 7% increase in reported workplace accidents globally, highlighting the ongoing importance of robust safety compliance.

Ensuring compliance not only mitigates legal and reputational risks but also directly contributes to employee well-being and fosters a more productive work environment. Prysmian's commitment to these standards is therefore fundamental to its long-term sustainability and operational integrity.

Anti-trust and Competition Laws

As a dominant player in the global cable and wire industry, Prysmian faces significant scrutiny under anti-trust and competition laws across its key operating regions. These regulations are designed to prevent market manipulation and ensure fair competition, impacting everything from pricing strategies to market access. For instance, in 2023, the European Commission continued its investigations into potential anti-competitive practices within various sectors, a landscape Prysmian actively navigates.

Compliance is particularly critical during strategic growth phases, such as mergers and acquisitions. Prysmian's acquisition of General Cable in 2018, for example, required extensive review by competition authorities worldwide to ensure it did not create undue market concentration. Failure to adhere to these stringent rules can result in substantial financial penalties, operational disruptions, and damage to its market reputation. In 2024, ongoing regulatory reviews in sectors like renewable energy infrastructure and digital connectivity will continue to shape Prysmian's compliance obligations.

- Regulatory Oversight: Prysmian operates under strict anti-trust and competition laws in major markets like the EU, USA, and Asia, requiring careful management of market share and business practices.

- Merger & Acquisition Scrutiny: Significant transactions are subject to thorough review by competition authorities to prevent monopolistic tendencies, as seen in past acquisitions requiring divestitures or behavioral commitments.

- Compliance Costs & Risks: Non-compliance can lead to hefty fines, legal battles, and reputational damage, impacting Prysmian's financial performance and market position. For example, EU competition fines can reach up to 10% of global annual turnover.

- Evolving Landscape: The increasing importance of digital infrastructure and energy transition projects means Prysmian must continuously adapt its strategies to comply with evolving competition frameworks in these dynamic sectors.

Data Privacy and Cybersecurity Regulations

As Prysmian's operations become more digital, especially within its Digital Solutions segment, data privacy and cybersecurity regulations are increasingly critical. Compliance with frameworks such as the EU's General Data Protection Regulation (GDPR) and similar global mandates is essential for safeguarding sensitive customer and operational data. Failure to adhere can lead to significant fines and reputational damage, impacting trust with clients and partners in the increasingly interconnected digital infrastructure landscape.

The evolving regulatory environment necessitates robust data protection strategies. For instance, the GDPR, which came into full effect in 2018, imposes strict rules on how companies collect, process, and store personal data, with penalties for non-compliance reaching up to 4% of global annual revenue or €20 million, whichever is higher. As of 2024, many countries are strengthening their own data privacy laws, mirroring GDPR's principles, which Prysmian must navigate across its diverse international markets.

Prysmian's commitment to cybersecurity is paramount for maintaining operational integrity and customer confidence. The company's investments in secure network infrastructure and data handling practices are crucial. For example, cyberattacks targeting critical infrastructure sectors have been on the rise, with reports indicating significant increases in ransomware attacks against industrial control systems in recent years, underscoring the importance of Prysmian's proactive security measures.

Key considerations for Prysmian include:

- Navigating diverse global data privacy laws: Ensuring compliance with varying regulations in North America, Europe, and Asia.

- Protecting sensitive client data: Implementing advanced cybersecurity measures to prevent breaches in the Digital Solutions segment.

- Maintaining customer trust: Demonstrating a strong commitment to data privacy builds confidence with clients and partners.

- Mitigating regulatory risks: Proactively adapting to new and evolving data protection legislation to avoid penalties and reputational harm.

Prysmian must navigate a complex landscape of international product safety and quality standards, such as IEC standards for fire performance and CE marking for European market access. Adherence to these legal frameworks is crucial for market entry and maintaining a reputation for reliability, with non-compliance resulting in significant penalties and exclusion from key projects in 2024.

Environmental regulations, including those related to waste management, hazardous materials (RoHS, WEEE), and emissions, directly influence Prysmian's manufacturing processes and supply chain. The EU's ongoing Green Deal initiatives in 2024 are pushing for stricter environmental controls, driving innovation in cleaner production and sustainable materials for Prysmian through 2025.

Global operations necessitate strict adherence to diverse labor laws covering worker safety and fair working conditions, with the ILO reporting a 7% increase in workplace accidents globally in 2023. Compliance is vital for employee well-being, productivity, and mitigating legal and reputational risks for Prysmian.

Anti-trust and competition laws in key markets like the EU and USA impact Prysmian's pricing and market access strategies, with significant financial penalties for non-compliance, potentially reaching up to 10% of global annual turnover. The evolving competition landscape in digital infrastructure and energy transition projects requires continuous adaptation of Prysmian's strategies through 2025.

Environmental factors

Global and national carbon emission reduction targets, such as the Paris Agreement's goal to limit warming to 1.5°C, directly shape Prysmian's operational strategies. Many nations have set ambitious net-zero targets, with the EU aiming for 2050 and the US targeting 2050 as well. These commitments create a regulatory landscape that incentivizes Prysmian to invest in cleaner technologies and processes.

Prysmian is actively pursuing its own net-zero commitments, focusing on reducing Scope 1, 2, and 3 greenhouse gas (GHG) emissions. For instance, the company aims to cut its Scope 1 and 2 emissions by 40% by 2030 compared to a 2019 baseline. This involves enhancing energy efficiency across its manufacturing sites and increasing the proportion of renewable energy in its consumption mix, which stood at 36% in 2023.

These efforts are crucial for aligning with global climate goals and are increasingly important for stakeholder relations and market access. Companies demonstrating strong environmental performance, like Prysmian's focus on reducing its carbon footprint, are often viewed more favorably by investors and customers alike, especially as sustainability reporting becomes more standardized and scrutinized.

Prysmian is increasingly prioritizing resource efficiency, with a significant push towards circular economy principles. This focus is driving innovation in how they use materials and reduce waste across their operations. For instance, in 2023, Prysmian reported a 15% increase in the use of recycled materials in their cable production, a key step in minimizing their environmental footprint.

The company is actively working to enhance the recyclability of its products and packaging. Their goal is to incorporate more recycled content and design cables that are easier to recycle at the end of their life cycle. This commitment extends to their packaging, aiming to reduce plastic usage and increase the use of sustainable alternatives, thereby contributing to a more sustainable value chain.

Effective waste management and recycling of cable materials, especially valuable metals like copper and aluminum, are paramount for Prysmian's environmental stewardship. The company actively invests in advanced recovery and reuse processes, significantly reducing landfill waste and conserving precious natural resources.

Prysmian's commitment to material circularity not only addresses environmental concerns but also provides a strategic advantage by mitigating the impact of volatile raw material prices. For instance, in 2023, the global copper market experienced significant price fluctuations, underscoring the financial benefit of internal material recovery.

Impact of Extreme Weather Events on Infrastructure Projects

The escalating frequency and severity of extreme weather events, a direct consequence of climate change, present significant challenges for infrastructure projects. Prysmian's cable systems, crucial for energy and telecommunications, must be engineered for enhanced resilience against these environmental stressors, ensuring operational continuity even in adverse conditions.

For instance, in 2024, the global economic impact of weather-related disasters was substantial, with insured losses alone projected to be in the tens of billions of dollars, highlighting the vulnerability of infrastructure. Prysmian's project planning must proactively incorporate robust safety protocols and contingency measures to mitigate potential delays and damages caused by events like floods, hurricanes, or extreme temperatures.

- Increased operational costs: Repairing or reinforcing infrastructure damaged by extreme weather can lead to significant, unforeseen expenses for Prysmian and its clients.

- Supply chain disruptions: Severe weather can impede the transportation of raw materials and finished cable products, affecting project timelines and delivery schedules.

- Demand for resilient solutions: The growing threat of climate change drives demand for advanced, weather-resistant cable technologies, creating opportunities for Prysmian to innovate and lead in this segment.

Sustainable Sourcing of Raw Materials

Ensuring the sustainable and ethical sourcing of key raw materials like copper, aluminum, and plastics is a critical environmental consideration for Prysmian. The company actively pursues responsible procurement to lessen the environmental and social footprint linked to their extraction and production.

Prysmian's commitment to responsible sourcing aligns with its overarching sustainability objectives, aiming to reduce impacts throughout the supply chain. For instance, in 2023, Prysmian reported that 87% of its copper procurement was compliant with its Responsible Sourcing Policy, demonstrating tangible progress towards ethical material acquisition.

- Responsible Procurement: Prysmian prioritizes sourcing raw materials like copper, aluminum, and plastics from suppliers who adhere to environmental and social standards.

- Impact Reduction: The company's strategy focuses on minimizing the ecological and social consequences associated with the extraction and processing of these essential components.

- Sustainability Alignment: Responsible sourcing practices are integrated into Prysmian's broader sustainability framework, reinforcing its commitment to corporate responsibility.

- Progress in 2023: A significant portion of Prysmian's copper procurement, specifically 87%, met the company's Responsible Sourcing Policy criteria, highlighting a focus on ethical supply chains.

Prysmian's environmental strategy is heavily influenced by global climate targets and its own net-zero commitments, aiming for a 40% reduction in Scope 1 and 2 emissions by 2030 from a 2019 baseline, with renewable energy usage at 36% in 2023. The company is also driving resource efficiency through circular economy principles, increasing recycled material usage by 15% in 2023 and enhancing product recyclability. Furthermore, Prysmian is committed to responsible sourcing, with 87% of its copper procurement meeting its Responsible Sourcing Policy in 2023, underscoring a focus on ethical supply chains amidst increasing scrutiny of environmental performance.

PESTLE Analysis Data Sources

Our Prysmian PESTLE Analysis is meticulously constructed using a blend of publicly available data from international organizations like the IMF and World Bank, alongside reports from leading market research firms and industry-specific publications. This ensures a comprehensive understanding of the political, economic, social, technological, legal, and environmental factors impacting Prysmian.