Prysmian Porter's Five Forces Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Prysmian Bundle

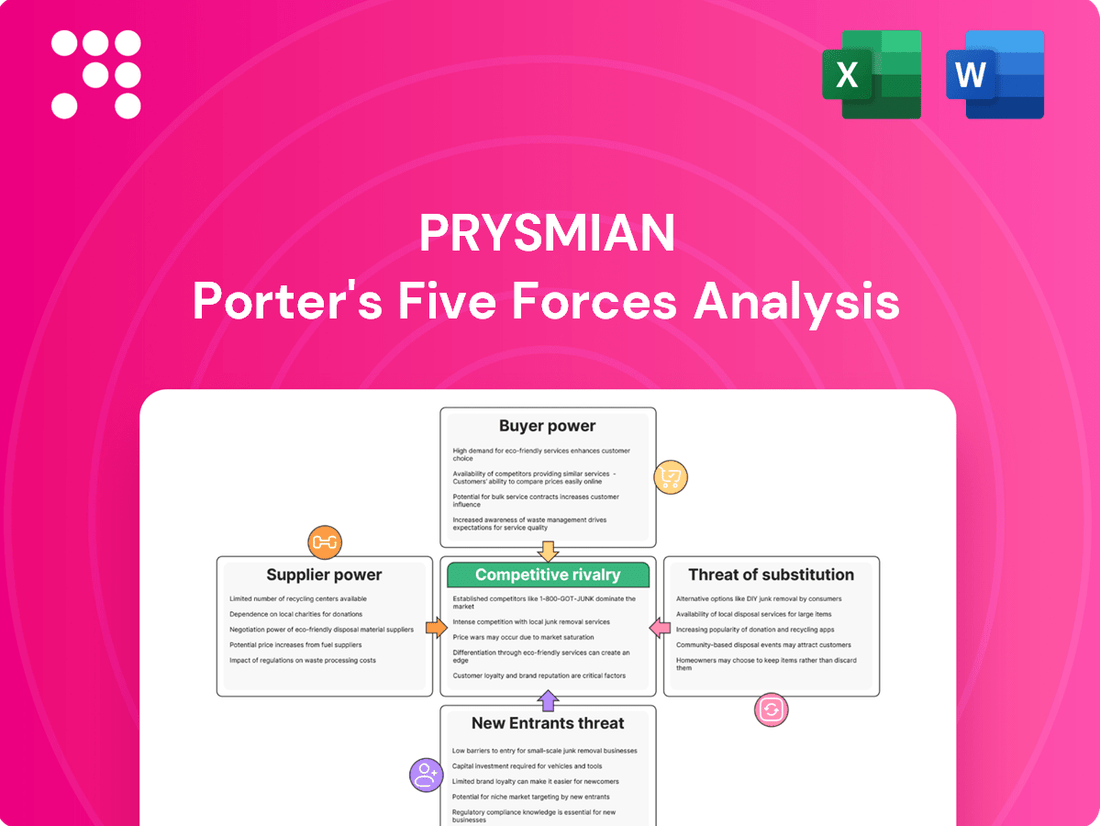

Prysmian operates in a dynamic industry shaped by intense competition, significant buyer power, and the constant threat of new entrants. Understanding these forces is crucial for navigating its market landscape effectively.

The complete report reveals the real forces shaping Prysmian’s industry—from supplier influence to threat of new entrants. Gain actionable insights to drive smarter decision-making.

Suppliers Bargaining Power

Supplier concentration significantly impacts the bargaining power of suppliers in the cable industry. Prysmian, like other cable manufacturers, depends on essential raw materials such as copper, aluminum, and specialized polymers. If the supply of these critical inputs is dominated by a limited number of large producers, these suppliers gain considerable leverage. This can translate into higher material costs for Prysmian, directly affecting its profitability and competitive pricing.

Prysmian's financial disclosures, such as those from Q1 2025, highlight the company's active management of commodity derivatives at fair value. This practice underscores the inherent exposure Prysmian has to the volatility of raw material prices. A concentrated supplier base exacerbates this risk, as fewer entities control the availability and pricing of key components, potentially forcing Prysmian to accept less favorable terms.

Suppliers of highly specialized components, like those for advanced optical fibers, can wield considerable influence. For instance, companies providing rare earth materials or unique manufacturing processes essential for high-speed data center cables hold significant leverage. This scarcity allows them to dictate terms, directly affecting Prysmian's manufacturing expenses and its ability to innovate quickly.

Prysmian's strategic investment in Relativity Networks, a company focused on hollow-core optical fiber technology, underscores the critical nature of these specialized inputs. Access to such cutting-edge materials and technologies is not just about cost; it's about securing future competitive advantages in a rapidly evolving market.

High switching costs for Prysmian significantly bolster supplier bargaining power. If transitioning to a new supplier requires substantial investment in re-tooling manufacturing or re-qualifying materials, Prysmian's options become limited, strengthening the position of existing suppliers. For instance, the specialized nature of many cable and connectivity components means that adopting new materials or production methods can incur considerable upfront expenses, potentially running into millions of euros for large-scale operations.

Threat of Forward Integration by Suppliers

Should a supplier possess the capability and incentive to manufacture cables themselves, they gain significant leverage over companies such as Prysmian. This forward integration threat can compel Prysmian to negotiate less favorable terms to preempt direct competition from its own suppliers.

While the cable industry's substantial capital requirements make this a less frequent occurrence, it remains a pertinent theoretical concern, particularly for suppliers of highly specialized materials. For instance, a key supplier of advanced optical fiber, if capable of investing in extrusion and jacketing processes, could potentially disrupt Prysmian's supply chain by entering the market directly.

The bargaining power of suppliers is a critical factor in Prysmian's operational landscape. Consider the raw material costs for cable manufacturing: copper prices, for example, have seen volatility. In 2024, LME copper prices have fluctuated, impacting the cost base for cable producers. If a major copper supplier were to integrate forward, they could dictate terms more aggressively.

- Supplier Capability: Suppliers with existing manufacturing expertise and R&D in related fields are better positioned for forward integration.

- Industry Capital Intensity: High capital requirements in cable manufacturing can act as a barrier to entry for many suppliers.

- Material Specialization: Suppliers of unique or proprietary materials face a lower threat of integration due to their specialized knowledge.

- Market Dynamics: Shifts in demand or technological advancements could incentivize suppliers to explore backward integration.

Importance of Supplier's Input to Prysmian's Cost/Quality

The criticality of a supplier's input directly correlates with their bargaining power. For Prysmian, suppliers of specialized, high-performance conductors and advanced insulation materials wield considerable influence, particularly for their high-voltage and niche cable products.

Prysmian's commitment to innovation, such as their E3X technology designed to minimize energy losses in cables, underscores the substantial value they place on the quality and performance of their suppliers' inputs. This reliance on cutting-edge materials grants these suppliers greater leverage.

- Critical Inputs: Suppliers of specialized conductors and advanced insulation materials have significant bargaining power due to their impact on Prysmian's product performance and cost structure.

- Innovation Dependence: Prysmian's development of technologies like E3X highlights its reliance on suppliers for high-quality, innovative materials, enhancing supplier leverage.

- Market Position: For high-voltage and specialized cables, where material performance is paramount, suppliers of these critical components can command higher prices or more favorable terms.

Suppliers of essential raw materials like copper and aluminum can exert significant pressure on Prysmian due to market concentration and price volatility. For example, copper prices saw notable fluctuations in 2024, impacting cable manufacturers' cost structures. If these key material providers were to integrate forward, they could leverage their position to dictate terms more aggressively.

The bargaining power of suppliers is amplified when Prysmian faces high switching costs, such as the need for extensive re-tooling or material re-qualification. This dependence on specialized components, like those for advanced optical fibers, grants suppliers considerable leverage. Prysmian's strategic investments in new fiber technologies highlight its reliance on these specialized inputs, underscoring the suppliers' influence.

Suppliers of critical, high-performance materials essential for Prysmian's specialized cables, such as advanced insulation, hold substantial bargaining power. This is particularly true for niche products where material quality directly impacts performance and innovation, like Prysmian's E3X technology. The scarcity and specialized nature of these inputs allow suppliers to command higher prices and more favorable terms.

| Factor | Impact on Prysmian | Example (2024/2025 Data) |

|---|---|---|

| Supplier Concentration | Increased leverage for fewer suppliers | Dependence on limited copper/aluminum producers; LME copper price volatility in 2024 |

| Switching Costs | Reduced flexibility for Prysmian | Millions in re-tooling for new materials; re-qualification of specialized components |

| Criticality of Input | Higher power for specialized material providers | Suppliers of advanced optical fiber for high-speed data cables; insulation for high-voltage products |

| Forward Integration Threat | Potential for suppliers to become competitors | Theoretical risk for specialized material suppliers in optical fiber |

What is included in the product

This analysis delves into the competitive forces shaping Prysmian's industry, examining the threat of new entrants, the bargaining power of buyers and suppliers, the threat of substitutes, and the intensity of rivalry among existing players.

Instantly identify and address competitive threats by visualizing the intensity of each of Porter's Five Forces, allowing for targeted strategic adjustments.

Customers Bargaining Power

Prysmian's customer base includes significant players like large utility companies, national telecom operators, and major infrastructure project developers. The concentration of sales among a few of these large customers can grant them considerable bargaining power. Their substantial purchasing volumes allow them to negotiate more favorable pricing and contract terms, potentially impacting Prysmian's profitability.

The company's Transmission business reported a substantial backlog of €17 billion as of Q1 2025. This impressive figure indicates strong, ongoing relationships with major clients who are committing to large-scale, long-term projects, underscoring the importance of these key customer relationships in Prysmian's revenue generation.

When Prysmian's cables are seen as standard and easily replaceable, customers gain significant bargaining power. This allows them to switch suppliers based solely on price, pushing Prysmian into a cost-driven competition instead of focusing on its innovative offerings. For instance, in the broader electrical components market, price sensitivity can be high, especially for less specialized applications.

Customer switching costs significantly influence their bargaining power. If it's easy and inexpensive for customers to switch from Prysmian to a competitor, their ability to demand lower prices or better terms increases. For instance, if a customer can switch to another cable supplier without incurring substantial costs for system redesign or equipment re-certification, their bargaining power is high.

However, in critical infrastructure projects, these switching costs are often quite high. Redesigning entire electrical grids or re-certifying specialized equipment can be incredibly time-consuming and expensive, thereby reducing the customer's leverage. This is a key factor in Prysmian's favor.

Prysmian's strategic positioning as a solutions provider further elevates these switching costs. By deeply integrating its products and expertise into complex, long-term projects, Prysmian makes it more challenging and costly for clients to disengage. This integration often involves custom specifications and ongoing technical support, making a transition to a new supplier disruptive and financially burdensome.

Threat of Backward Integration by Customers

The threat of backward integration by customers, particularly large utilities and telecom companies, presents a significant bargaining chip. If these major buyers find it economically feasible or strategically beneficial to manufacture certain cable types themselves, they gain considerable leverage over suppliers like Prysmian. This potential for in-house production allows them to negotiate for more favorable pricing and terms, as they can credibly threaten to bring production in-house.

However, for most customers, the high capital investment and specialized technical knowledge required for advanced cable manufacturing make this threat relatively low. For instance, the cost of setting up a state-of-the-art fiber optic cable production facility can run into hundreds of millions of dollars, a barrier most potential integrators find prohibitive.

- Customer Leverage: Large clients like national grid operators or major telecommunication providers can use the *possibility* of backward integration to secure better pricing from Prysmian.

- Cost-Benefit Analysis: Customers will only pursue backward integration if the cost savings and strategic advantages outweigh the significant capital expenditure and operational complexities.

- Industry Barriers: The substantial upfront investment and need for specialized expertise in cable manufacturing generally limit the practical threat of backward integration for the majority of Prysmian's customer base.

Customer Price Sensitivity

The bargaining power of Prysmian's customers is significantly influenced by their price sensitivity. When customers are highly sensitive to price, they exert more pressure on Prysmian to lower its cable costs. This sensitivity often stems from their own market competition, strict budget limitations, or the fact that cable expenses represent a substantial portion of their total project expenditures.

For instance, in the construction sector, where project margins can be tight, buyers of Prysmian's products might actively seek out the lowest-priced suppliers. This dynamic was evident in 2024, with many infrastructure projects facing budget reviews due to rising material costs across the board, potentially increasing customer demand for competitive pricing from cable manufacturers.

Prysmian's strategic shift from merely manufacturing cables to offering integrated solutions is a direct response to this challenge. By providing higher-value, differentiated services and products, Prysmian aims to reduce its customers' focus on price alone. This approach seeks to build loyalty based on overall value rather than solely on the per-unit cost of cables.

- Customer Price Sensitivity: Higher sensitivity increases customer bargaining power, pressuring Prysmian for lower prices.

- Drivers of Sensitivity: Competitive pressures, budget constraints, and the relative cost of cables within a project budget are key factors.

- Prysmian's Strategy: Moving towards a solutions provider model aims to reduce price sensitivity by offering differentiated, higher-value offerings.

- Market Context (2024): Budget reviews on infrastructure projects due to rising material costs likely heightened customer price sensitivity in the cable market.

The bargaining power of Prysmian's customers is substantial, particularly among large utility companies and telecom operators who represent significant purchasing volumes. These major clients can leverage their scale to negotiate favorable pricing and contract terms, directly impacting Prysmian's profitability. For instance, Prysmian's Transmission business reported a substantial backlog of €17 billion as of Q1 2025, highlighting the critical nature of these large customer relationships.

Customers gain leverage when Prysmian's products are perceived as standard and easily substitutable, leading to price-based competition. High customer price sensitivity, driven by their own market pressures or tight project budgets, further amplifies this power. In 2024, rising material costs led to budget reviews for many infrastructure projects, likely increasing demand for competitive pricing from cable suppliers.

Switching costs for customers are a key moderating factor. While low switching costs empower customers, Prysmian's strategy of providing integrated solutions, especially in critical infrastructure, significantly raises these costs. This makes it difficult and expensive for clients to switch suppliers, thereby reducing their bargaining leverage.

| Factor | Impact on Prysmian | Example/Data Point |

|---|---|---|

| Customer Concentration | High | Large utility/telecom clients can negotiate better terms due to volume. |

| Product Substitutability | Moderate to High | Standard cables invite price competition. |

| Switching Costs | Low to High (Project Dependent) | High for integrated solutions, low for standard products. |

| Price Sensitivity | High | Budget constraints and market competition increase pressure for lower prices (e.g., 2024 infrastructure project reviews). |

| Threat of Backward Integration | Low | High capital and expertise barriers deter most customers. |

Same Document Delivered

Prysmian Porter's Five Forces Analysis

This preview showcases the complete Prysmian Porter's Five Forces Analysis, detailing the competitive landscape for the cable and wire industry. You're viewing the actual document, which will be instantly available for download upon purchase, providing a comprehensive understanding of buyer power, supplier power, the threat of new entrants, the threat of substitutes, and industry rivalry.

Rivalry Among Competitors

The global cable market features a mix of substantial, well-established companies such as Nexans, Sumitomo Electric, and LS Cable & System, alongside a multitude of smaller, regionally focused competitors. This diverse competitive landscape, with many strong players, significantly heightens rivalry as firms battle for market share across different product categories and geographical areas.

Prysmian consistently holds a position among the leading global cable manufacturers, indicating its direct engagement with these significant rivals. For instance, in 2023, Prysmian reported revenues of €15.3 billion, demonstrating its scale against competitors like Nexans, which posted €6.7 billion in revenue for the same year, highlighting the substantial size of key players in this intensely competitive sector.

In industries with slower growth, companies often intensify their competition as they vie for existing market share. However, the global wire and cable market, a sector where Prysmian operates, presents a different picture.

This market is anticipated to expand at a compound annual growth rate of 6.28% between 2025 and 2034. This robust growth, fueled by the expansion of renewable energy, ongoing urbanization, and the acceleration of digital transformation, creates opportunities for companies to grow organically rather than solely through aggressive competitive tactics, which can temper intense rivalry.

While basic cable products can become commodities, Prysmian distinguishes itself by offering highly specialized and innovative solutions. Examples include their advanced high-voltage submarine cables essential for offshore wind farms and cutting-edge optical fibers for high-speed data transmission. This product differentiation, built on technology and performance, directly lessens intense price competition.

Prysmian's commitment to research and development is a key driver of this differentiation. In 2023, the company continued to invest significantly in innovation, focusing on sustainable materials and enhanced performance for its cable systems. This strategic focus on high-value, technologically advanced products allows Prysmian to command premium pricing and build stronger customer loyalty, thereby reducing direct rivalry based solely on cost.

High Fixed Costs and Exit Barriers

The cable manufacturing sector, including companies like Prysmian, is characterized by substantial upfront investment in specialized plants, advanced machinery, and ongoing research and development. This creates significant barriers to entry and makes it challenging for companies to scale back or exit the industry. For instance, Prysmian's ongoing investments in new production facilities, such as its expansion projects in North America, underscore the capital-intensive nature of the business.

These high fixed costs necessitate high operational capacity to spread expenses and achieve cost efficiencies. Consequently, companies often engage in aggressive pricing to maintain sales volumes, especially during economic slowdowns. This dynamic intensifies competitive rivalry as firms strive to utilize their capacity fully, making it difficult for any single player to withdraw without incurring substantial losses.

- Significant Capital Investment: The cable industry requires large sums for manufacturing facilities and technology, estimated in the hundreds of millions of dollars for major players.

- Economies of Scale Imperative: Operating at high capacity is crucial for profitability, driving down per-unit costs and enabling competitive pricing.

- Exit Barriers: Specialized assets and high decommissioning costs mean exiting the market is financially punitive, trapping firms in a competitive environment.

- Prysmian's Capacity Expansion: Prysmian's strategic investments, like the recent capacity increases in its submarine cable business, demonstrate a commitment to leveraging scale despite the inherent risks.

Diversity of Competitors

The competitive landscape for optical fiber and cable manufacturers is characterized by a wide array of players, each pursuing distinct strategic paths. These companies may prioritize market share growth, profitability, or specific geographic regions, leading to varied responses to market dynamics. This diversity in objectives and strategies makes competitive behavior less predictable, as different firms react to industry shifts and competitor actions in unique ways, contributing to a complex and ever-changing market environment.

In 2024, the optical fiber and cable sector experienced heightened competition. This intensification was largely driven by a contraction in global demand, forcing companies to compete more aggressively for a shrinking pool of business. For instance, reports indicated that while overall demand softened, key markets still saw significant investment, creating pockets of intense rivalry among suppliers vying for these contracts.

- Diverse Strategic Objectives: Competitors may focus on aggressive market share acquisition or prioritize higher profit margins, influencing their pricing and investment decisions.

- Geographic Specialization: Some firms concentrate on specific regional markets, developing tailored product offerings and distribution networks to serve local needs.

- Unpredictable Responses: The varied strategic orientations mean that industry participants might react differently to price changes, technological advancements, or new market entrants.

- Impact of Demand Contraction: In 2024, a global slowdown in demand intensified rivalry as companies fought harder for existing projects and contracts.

The competitive rivalry within the cable industry, where Prysmian operates, is substantial due to the presence of numerous strong global and regional players. This intense competition is further shaped by factors like market growth, product differentiation, and significant barriers to entry.

While the overall market is growing, the intensity of rivalry can fluctuate. In 2024, a slowdown in global demand led to more aggressive competition as companies fought for fewer projects, highlighting how demand shifts can amplify rivalry. However, Prysmian's focus on specialized, high-value products, such as advanced submarine cables for offshore wind, allows it to differentiate and mitigate direct price wars, a strategy supported by its significant R&D investments.

The industry's capital-intensive nature, with high fixed costs and economies of scale, compels firms to maintain high operational capacity. This often results in price competition to secure sales volumes, especially when demand softens, as seen in 2024.

| Competitor | 2023 Revenue (EUR billions) | Key Product Focus |

|---|---|---|

| Prysmian | 15.3 | High-voltage cables, optical fibers, energy cables |

| Nexans | 6.7 | Power cables, data communications, industrial applications |

| Sumitomo Electric | (Data not directly comparable in EUR for cable segment) | Optical fibers, power cables, automotive wiring |

| LS Cable & System | (Data not directly comparable in EUR for cable segment) | Power cables, telecom cables, industrial cables |

SSubstitutes Threaten

While traditional cables remain the backbone of electricity transmission, alternative technologies are emerging. Advancements in wireless power transfer, though still in early stages for large-scale applications, could eventually reduce the need for extensive cable networks in certain scenarios. For instance, by 2024, the global wireless power transfer market was projected to reach over $20 billion, indicating growing interest and development in this area.

Distributed generation, such as rooftop solar installations, also lessens reliance on centralized grid infrastructure and the associated transmission cables. By the end of 2023, global renewable energy capacity additions were expected to reach nearly 510 GW, a significant increase that diversifies energy sources. However, this expansion also fuels demand for specialized cables to connect these new sources to the grid.

Alternative communication technologies pose a significant threat to traditional fiber optic cables. For instance, satellite internet providers like Starlink are expanding their reach, offering broadband access in areas where laying fiber is challenging or uneconomical. By the end of 2023, Starlink had over 2.3 million active subscribers globally, demonstrating a growing market presence.

The continuous advancement of wireless technologies, such as 5G and the anticipated 6G, also presents a substitute. These networks can handle increasing data demands wirelessly, potentially reducing the need for extensive fiber deployments for certain consumer and business applications. Global 5G subscriptions were projected to surpass 1.5 billion by the close of 2024, indicating strong adoption of wireless alternatives.

Emerging technologies like quantum communication, while still in early development, could eventually offer entirely new paradigms for secure data transmission, potentially bypassing the need for physical cables altogether in highly specialized contexts. Prysmian's strategic investment in hollow-core optical fiber, a technology designed for ultra-low latency and high bandwidth crucial for applications like AI, shows a forward-looking approach to evolving communication needs and potential competitive pressures.

While direct substitutes for the fundamental function of electrical cables are limited, advancements in material science present a potential threat. Innovations in composite materials or advanced polymers could emerge, offering comparable conductivity or insulation properties to traditional copper and aluminum. This could impact demand for specific cable types, particularly in sectors prioritizing weight reduction or specialized performance characteristics.

Cost-Effectiveness and Performance of Substitutes

The threat of substitutes for traditional cable systems, like those Prysmian produces, hinges significantly on their cost-effectiveness and performance. If alternative technologies can match or exceed the capabilities of cables while offering a lower overall cost, including installation and upkeep, they pose a greater risk. For instance, advancements in wireless communication technologies could eventually offer viable alternatives for certain data transmission needs, though currently, wired solutions often retain an edge in reliability and capacity for major infrastructure projects.

While emerging technologies are constantly being developed, traditional fiber optic and copper cables still hold a strong position due to their proven track record. For example, in 2024, the global telecommunications infrastructure market, a key sector for Prysmian, continued to see substantial investment in fiber optic deployment, underscoring its current dominance for high-speed, reliable connectivity. This indicates that while substitutes are a consideration, their ability to displace established cable solutions is still limited in many critical applications.

- Cost-Effectiveness: The total cost of ownership for substitutes, encompassing installation, maintenance, and operational expenses, is a crucial factor.

- Performance Comparison: Alternatives must demonstrate comparable or superior data transmission speeds, reliability, and capacity to traditional cables.

- Market Adoption: The rate at which customers adopt substitute technologies for large-scale infrastructure projects will determine the level of threat.

- Technological Advancements: Ongoing innovation in areas like wireless networking could eventually present more compelling substitute options.

Switching Costs to Adopt Substitutes

The significant capital outlay required to establish new cable infrastructure, such as for power distribution or telecommunications, presents a substantial barrier for customers considering alternative technologies. This high initial investment in existing networks effectively locks in customers, making it economically unfeasible for them to switch to substitutes, especially in critical sectors like energy grids and core telecom networks.

This inherent inertia in adopting new technologies significantly shields Prysmian from the immediate threat of widespread substitution. For instance, the lengthy lifecycles of power transmission infrastructure mean that substantial upgrades or replacements are infrequent, reinforcing the dominance of established cable systems.

The continuous global demand for upgrading and expanding electrical grids, driven by factors like renewable energy integration and increasing power consumption, further solidifies the position of traditional cable solutions. In 2024, investments in grid modernization are projected to reach hundreds of billions of dollars globally, underscoring the sustained need for cable products.

- High Infrastructure Investment: Customers face substantial costs when considering alternatives to established cable networks, creating a strong disincentive to switch.

- Customer Lock-in: Existing investments in large-scale projects like power grids and telecom backbones make switching to substitutes difficult and expensive.

- Inertia in Established Markets: Sectors with long asset lifecycles, such as energy infrastructure, exhibit resistance to rapid technological substitution.

- Ongoing Demand for Grid Modernization: The global push to upgrade and expand power grids in 2024 continues to drive demand for cable solutions, mitigating the threat of substitutes.

While direct substitutes for the fundamental function of electrical cables are limited, advancements in material science present a potential threat. Innovations in composite materials or advanced polymers could emerge, offering comparable conductivity or insulation properties to traditional copper and aluminum. This could impact demand for specific cable types, particularly in sectors prioritizing weight reduction or specialized performance characteristics.

The threat of substitutes for traditional cable systems, like those Prysmian produces, hinges significantly on their cost-effectiveness and performance. If alternative technologies can match or exceed the capabilities of cables while offering a lower overall cost, including installation and upkeep, they pose a greater risk. For instance, advancements in wireless communication technologies could eventually offer viable alternatives for certain data transmission needs, though currently, wired solutions often retain an edge in reliability and capacity for major infrastructure projects.

The continuous global demand for upgrading and expanding electrical grids, driven by factors like renewable energy integration and increasing power consumption, further solidifies the position of traditional cable solutions. In 2024, investments in grid modernization are projected to reach hundreds of billions of dollars globally, underscoring the sustained need for cable products.

The significant capital outlay required to establish new cable infrastructure, such as for power distribution or telecommunications, presents a substantial barrier for customers considering alternative technologies. This high initial investment in existing networks effectively locks in customers, making it economically unfeasible for them to switch to substitutes, especially in critical sectors like energy grids and core telecom networks.

Entrants Threaten

Entering the energy and telecom cable systems industry demands substantial capital for state-of-the-art manufacturing plants, advanced machinery, and ongoing research and development. These significant upfront costs act as a formidable barrier, deterring smaller or less capitalized companies from entering the market. For instance, Prysmian's 2024 capital expenditures are projected to be around €1.1 billion, highlighting the scale of investment needed.

Established players like Prysmian benefit from significant economies of scale in production, procurement, and distribution, allowing them to spread fixed costs over a larger output. For instance, in 2023, Prysmian's revenue reached €15.3 billion, indicating a substantial operational footprint.

New entrants would struggle to achieve similar cost efficiencies without substantial volume, making it difficult to compete on price from the outset. This creates a significant cost disadvantage for smaller or new players entering the cable and systems market.

The intricate design, manufacturing, and installation of advanced cable systems, such as high-voltage submarine cables and specialized optical fibers, are protected by complex proprietary technologies, patents, and significant technical expertise. Newcomers would face substantial hurdles, requiring massive investment and considerable time to develop or acquire this specialized knowledge. Prysmian's commitment to research and development, evident in its numerous innovation centers, further solidifies this barrier to entry.

Established Distribution Channels and Customer Relationships

Prysmian benefits from deeply entrenched relationships with key players in the energy and telecommunications sectors, including major utilities and governmental agencies across the globe. These long-standing partnerships, cultivated over years, provide Prysmian with privileged access to critical distribution channels and a loyal customer base.

New entrants would find it exceptionally challenging to replicate Prysmian's established network and the trust it has built. Gaining the necessary certifications and approvals to supply these demanding sectors, such as the high-voltage cable market, requires significant time, investment, and demonstrated reliability, creating a substantial barrier.

Prysmian’s strategic alliances and a consistent focus on customer needs further solidify its position. For instance, in 2023, Prysmian secured significant contracts with entities like TenneT for offshore grid connections, demonstrating the depth of these relationships and the difficulty new companies would face in breaking into such established supply chains.

- Established Distribution: Prysmian commands extensive global distribution networks built over decades.

- Customer Loyalty: Long-term relationships with major utilities and telecom firms foster significant customer loyalty.

- Certification Hurdles: New entrants must overcome rigorous certification processes to supply critical infrastructure projects.

- Contract Wins: Prysmian's consistent success in securing large-scale contracts, like those with TenneT, highlights its market dominance and the barriers to entry.

Regulatory Hurdles and Certifications

The threat of new entrants into the cable industry, particularly for energy transmission and critical infrastructure, is significantly diminished by substantial regulatory hurdles and certification requirements. Meeting diverse national and international standards, such as those pertaining to safety, environmental impact, and product performance, demands considerable investment and time. For instance, companies operating in this space must often adhere to frameworks like the Task Force on Climate-related Financial Disclosures (TNFD), which Prysmian, a major player, actively engages with, highlighting the complexity of compliance.

These stringent requirements act as a formidable barrier, making it difficult and costly for newcomers to establish a foothold. The lengthy process of obtaining necessary certifications and demonstrating compliance with evolving regulations can deter potential competitors. This regulatory landscape ensures that only established or well-resourced entities can realistically enter and compete effectively.

- Stringent Safety and Performance Standards: New entrants must prove their products meet rigorous safety and performance benchmarks, often requiring extensive testing and validation.

- Environmental Regulations: Compliance with environmental protection laws and sustainability guidelines adds another layer of complexity and cost to market entry.

- National and International Compliance: Navigating a patchwork of different regulations across various jurisdictions presents a significant challenge for global market access.

- Time and Cost Investment: The cumulative time and financial resources required to achieve regulatory approval and certifications are substantial deterrents.

The threat of new entrants into the energy and telecom cable systems sector is considerably low. High capital requirements for advanced manufacturing and R&D, as evidenced by Prysmian's 2024 projected capital expenditures of approximately €1.1 billion, create a significant financial barrier. Furthermore, established players like Prysmian leverage economies of scale, with 2023 revenues of €15.3 billion, making it difficult for newcomers to compete on cost.

Proprietary technology, patents, and specialized expertise in areas like submarine cables and optical fibers present another substantial hurdle. New entrants would need extensive investment and time to acquire or develop this technical know-how. Prysmian's commitment to R&D and its numerous innovation centers further solidify this advantage.

Existing customer relationships and distribution networks, built over years with major utilities and governmental agencies, are deeply entrenched. Gaining the necessary certifications and approvals, as demonstrated by Prysmian's contract wins with TenneT in 2023, requires significant time, investment, and proven reliability, creating a formidable barrier for potential new competitors.

| Barrier Type | Description | Example/Data Point |

|---|---|---|

| Capital Requirements | Substantial investment needed for advanced manufacturing facilities and R&D. | Prysmian's 2024 projected CAPEX: ~€1.1 billion. |

| Economies of Scale | Lower per-unit costs due to high production volumes. | Prysmian's 2023 revenue: €15.3 billion. |

| Technology & Expertise | Protection of proprietary designs and specialized manufacturing knowledge. | Prysmian's investment in R&D and innovation centers. |

| Distribution & Relationships | Established networks and long-term partnerships with key clients. | Prysmian's contracts with TenneT (2023). |

| Regulatory & Certification | Adherence to stringent safety, environmental, and performance standards. | Compliance with frameworks like TNFD. |

Porter's Five Forces Analysis Data Sources

Our Porter's Five Forces analysis for Prysmian leverages data from Prysmian's annual reports, investor presentations, and competitor filings. We also incorporate industry-specific market research reports and relevant trade publications to provide a comprehensive view of the competitive landscape.