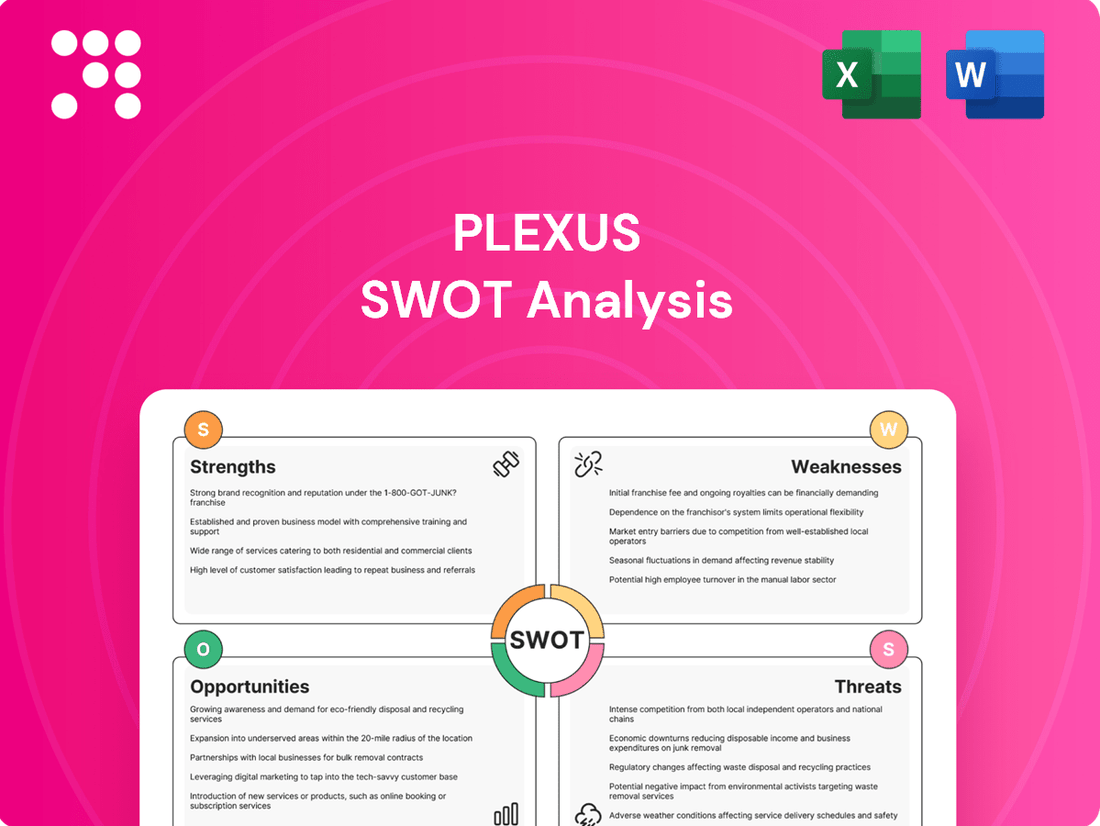

Plexus SWOT Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Plexus Bundle

Plexus showcases notable strengths in its established brand and robust product portfolio, but also faces challenges from intense market competition and evolving consumer preferences. Understanding these dynamics is crucial for anyone looking to invest or strategize within this sector.

Want the full story behind Plexus's strengths, risks, and growth drivers? Purchase the complete SWOT analysis to gain access to a professionally written, fully editable report designed to support planning, pitches, and research.

Strengths

Plexus operates across diverse market sectors, including healthcare/life sciences, industrial/commercial, communications, and aerospace/defense. This broad reach significantly reduces the company's vulnerability to downturns in any single industry, fostering a more resilient financial profile.

The balanced exposure across these vital sectors provides a stable revenue foundation. For example, in the third quarter of 2025, both the Healthcare/Life Sciences and Industrial segments each contributed a substantial 41% to Plexus's overall revenue, highlighting this diversification in action.

Plexus excels by concentrating on intricate, lower-volume products, particularly within regulated sectors like medical devices and aerospace. This strategic focus enables them to secure premium pricing and cultivate robust, long-term relationships with clients who depend on their specialized engineering and advanced manufacturing prowess.

Plexus has shown impressive financial strength, with fiscal Q3 2025 revenue reaching $1.018 billion and a non-GAAP operating margin of 6.0%, beating expectations. This performance highlights the company's ability to generate solid returns.

The company also demonstrates excellent capital discipline. In Q3 2025, Plexus achieved a Return on Invested Capital (ROIC) of 14.1%, which is considerably higher than its weighted average cost of capital of 8.9%. This indicates efficient use of its capital resources.

Plexus is committed to returning value to its shareholders. In Q3 2025, they announced a new $100 million share repurchase program, underscoring their strategy of active capital allocation and shareholder returns.

Global Manufacturing and Supply Chain Capabilities

Plexus leverages its extensive global manufacturing and supply chain capabilities, operating 26 facilities strategically located across the Americas, Asia-Pacific, and EMEA regions. This widespread presence is crucial for delivering integrated product realization services, encompassing everything from initial design and development through to post-sale support.

Their robust supply chain management solutions are designed to efficiently serve a broad international clientele, allowing them to adapt to evolving global market demands and potential disruptions. For instance, in fiscal year 2023, Plexus reported net sales of $4.3 billion, underscoring the scale of their operations and their ability to manage complex global logistics.

- Global Network: 26 manufacturing facilities worldwide.

- Integrated Services: End-to-end product realization from concept to aftermarket.

- Market Reach: Ability to serve diverse international customer bases effectively.

- Resilience: Enhanced capacity to navigate and manage global supply chain complexities.

Operational Excellence and Efficiency

Plexus demonstrates remarkable operational excellence, a key strength that translates directly into robust financial performance. This focus on efficiency is not just a slogan; it's evident in their disciplined working capital management, as highlighted by a cash conversion cycle of 69 days in Q3 2025. This efficiency allows them to convert sales into cash quickly, a vital sign of a healthy operation.

Furthermore, their ability to maintain strong financial results, even when the market faces headwinds, speaks volumes about their internal processes. For instance, Plexus achieved a 6.0% non-GAAP operating margin in Q3 2025. This figure underscores their effective cost control measures and streamlined operational workflows, proving their resilience and capability to perform under various market conditions.

- Operational Efficiency: Consistent focus on streamlining processes and reducing waste.

- Working Capital Management: Achieved a cash conversion cycle of 69 days in Q3 2025.

- Cost Control: Maintained a 6.0% non-GAAP operating margin in Q3 2025 despite market challenges.

Plexus's diversification across key sectors like healthcare, industrial, communications, and aerospace provides a solid foundation, mitigating risks associated with any single market. This broad operational scope is a significant advantage, ensuring a more stable revenue stream. For instance, in Q3 2025, both Healthcare/Life Sciences and Industrial segments each represented 41% of total revenue, demonstrating this balanced approach.

The company's strategic focus on complex, lower-volume products, especially in regulated industries, allows for premium pricing and strong customer loyalty. This specialization in intricate manufacturing and engineering fosters deep client relationships built on trust and specialized expertise.

Plexus exhibits strong financial health, evidenced by its Q3 2025 revenue of $1.018 billion and a non-GAAP operating margin of 6.0%. Their efficient capital deployment is further highlighted by a Q3 2025 ROIC of 14.1%, significantly exceeding their WACC of 8.9%.

| Metric | Q3 2025 Value | Significance |

|---|---|---|

| Revenue | $1.018 Billion | Demonstrates substantial market presence and sales capability. |

| Non-GAAP Operating Margin | 6.0% | Indicates effective cost management and operational efficiency. |

| Return on Invested Capital (ROIC) | 14.1% | Shows strong returns on capital invested, exceeding cost of capital. |

| Weighted Average Cost of Capital (WACC) | 8.9% | Establishes the benchmark for profitable capital deployment. |

What is included in the product

Delivers a strategic overview of Plexus’s internal and external business factors, highlighting key strengths, weaknesses, opportunities, and threats.

Offers a clear, structured framework to identify and address pain points within the Plexus strategy.

Weaknesses

Plexus faces a significant weakness due to customer concentration. In the third quarter of fiscal 2025 and 2024, its top 10 customers accounted for 48% of revenue. This reliance on a small group of clients creates a potential vulnerability.

A downturn in business with these key customers could materially impact Plexus's financial performance. For instance, in fiscal year 2023, the top three customers alone represented roughly 37% of total net sales, highlighting the substantial impact a single customer relationship could have.

Despite Plexus's efforts to diversify, the company is still vulnerable to the ups and downs of the economy and changes in what customers want. For instance, during the first quarter of fiscal year 2024, Plexus saw a slowdown in demand and inventory adjustments in key areas like Healthcare/Life Sciences and Industrial markets. This directly affected their revenue forecasts.

These market-driven inventory corrections and slower-than-expected product launches in certain sectors present ongoing hurdles. The company's performance is closely tied to the health of these end markets, making it challenging to predict revenue when demand is uncertain or program timelines shift.

The electronics manufacturing services (EMS) sector is a crowded space, with many companies competing for business. Plexus operates within this highly competitive environment, facing significant rivalry from established giants. For instance, Flex Ltd. and Jabil Inc. are major players with extensive global reach and diverse service offerings, directly challenging Plexus for contracts.

Beyond these large-scale competitors, Plexus also contends with specialized EMS providers like Celestica Inc. and Sanmina Corporation. These companies often focus on specific market niches or technological capabilities, creating focused competitive pressures. This crowded landscape means Plexus must constantly innovate and maintain cost efficiencies to stand out and secure profitable business.

The intense competition within the EMS industry can directly impact pricing strategies and profit margins for companies like Plexus. As multiple providers vie for the same customer base, there's a constant pressure to offer competitive pricing, which can erode profitability if not managed carefully through operational excellence and value-added services.

Potential for Supply Chain Disruptions

While Plexus has developed strong supply chain management practices, its global footprint in electronics manufacturing inherently exposes it to potential disruptions. These can range from unexpected fluctuations in the cost of raw materials and critical components to the impact of geopolitical events. For instance, the semiconductor shortage experienced globally through 2022 and into 2023 significantly affected many electronics manufacturers, leading to extended lead times and increased component prices.

Such disruptions can directly impact Plexus's operational efficiency. Production schedules may be delayed, and the cost of goods sold can rise due to higher component prices or expedited shipping needs. These factors, in turn, can affect overall profitability and the company's ability to meet delivery commitments to its customers, potentially impacting customer satisfaction and future business.

The company's reliance on a complex, international network of suppliers means that events in one region can have ripple effects across its entire supply chain. This exposure necessitates continuous monitoring and proactive risk mitigation strategies to maintain resilience.

- Exposure to component cost volatility: Fluctuations in the price of semiconductors and other key electronic components can directly impact Plexus's cost of goods sold.

- Geopolitical risks: Trade disputes, tariffs, or political instability in regions where Plexus or its suppliers operate can disrupt the flow of goods and materials.

- Logistical challenges: Shipping delays, port congestion, and rising transportation costs, as seen in various periods of 2023 and early 2024, can impact delivery times and increase operational expenses.

- Single-source dependency: While efforts are made to diversify, reliance on specific suppliers for critical components can create vulnerabilities if those suppliers face production issues.

Short-Term Margin Pressure from New Facility and Investments

Plexus anticipates a short-term dip in margins due to the ramp-up of its new facility in Penang, Malaysia. This operational startup phase typically involves higher initial costs that can temporarily weigh on profitability.

Furthermore, the company is projecting increased cash utilization in the first quarter of fiscal 2025. This is driven by significant investments aimed at bolstering capacity and supporting anticipated revenue growth, a pattern consistent with prior fiscal years.

- New Facility Startup: The Penang, Malaysia facility's initial operations are expected to exert a slight downward pressure on margins.

- Fiscal 2025 Investments: Higher capital expenditures are planned to support projected revenue growth, leading to anticipated cash usage in Q1 FY2025.

- Historical Trend: This pattern of increased cash usage in the first fiscal quarter for growth investments has been observed in previous years.

Plexus's significant customer concentration remains a key weakness. In the third quarter of fiscal 2025, its top 10 customers represented 48% of revenue, a situation mirrored in fiscal 2024. This heavy reliance on a select few clients exposes the company to substantial risk should any of these major customers experience financial difficulties or shift their business elsewhere. For example, in fiscal year 2023, the top three customers alone accounted for approximately 37% of total net sales, underscoring the potential impact of losing even a single large client.

The company also faces challenges due to its exposure to market-specific demand fluctuations and inventory adjustments. During the first quarter of fiscal 2024, Plexus observed a slowdown in demand and inventory corrections within its Healthcare/Life Sciences and Industrial segments. These market-driven shifts, coupled with potential delays in product launches, create ongoing hurdles and make revenue forecasting more complex, as performance is closely tied to the health and unpredictable nature of these end markets.

Operating in the highly competitive electronics manufacturing services (EMS) sector presents another significant weakness. Plexus contends with established giants like Flex Ltd. and Jabil Inc., as well as specialized providers such as Celestica Inc. and Sanmina Corporation. This intense rivalry necessitates continuous innovation and cost management to maintain competitive pricing and secure profitable contracts, directly impacting profit margins.

Furthermore, Plexus's global supply chain, while robust, is inherently vulnerable to disruptions. Component cost volatility, geopolitical risks, and logistical challenges, such as those seen with semiconductor shortages through 2022-2023 and shipping delays in 2023-2024, can impact production schedules and increase costs. Reliance on single-source suppliers for critical components also adds to this vulnerability.

What You See Is What You Get

Plexus SWOT Analysis

The preview you see is the same document the customer will receive after purchasing. This ensures transparency and that you know exactly what you're getting. Purchase unlocks the full, detailed analysis.

Opportunities

Plexus can capitalize on the rapid advancements in technologies like the Internet of Things (IoT), artificial intelligence (AI), and automation. These innovations offer avenues to improve existing services and make internal processes more efficient, potentially boosting profitability and competitiveness. For instance, integrating AI into their manufacturing processes could lead to a projected 15-20% increase in production efficiency by 2025, according to industry analysts.

Expanding Plexus's reach into emerging markets presents a significant growth opportunity. Regions with increasing demand for electronic products, such as Southeast Asia and certain parts of Africa, could drive substantial revenue increases and reduce reliance on established markets. The global market for electronics manufacturing services is expected to grow at a compound annual growth rate of 5.8% through 2027, with emerging economies being key drivers.

Securing new program wins in high-growth sectors like medical devices and industrial automation is another critical opportunity. These specialized areas often command higher margins and demonstrate Plexus's adaptability. The medical device outsourcing market alone is projected to reach $61.7 billion by 2025, presenting a substantial addressable market for Plexus’s expertise.

Plexus's substantial cash reserves, totaling $287.4 million in cash and cash equivalents at the end of Q4 2023, position it favorably for strategic acquisitions. This financial strength allows the company to pursue targets that offer cutting-edge manufacturing technologies, thereby enhancing its own capabilities.

By acquiring companies with advanced capabilities or forging strategic alliances, Plexus can significantly broaden its market reach and solidify its competitive edge. These moves are crucial for staying ahead in a rapidly evolving industry.

The healthcare/life sciences sector is anticipated to grow at a robust 6.9% compound annual growth rate through 2032, fueled by demand for advanced medical devices. Similarly, the aerospace and defense industries are projected to see a 5% CAGR over the same period, driven by needs for sophisticated, mission-critical components.

Plexus is strategically positioned to benefit from these expanding markets, experiencing strong demand for its expertise in IoT-enabled medical devices and AI-driven diagnostic solutions. The company's capabilities also align with the increasing requirements for reliable and advanced components within the aerospace and defense sectors.

Increased Outsourcing Trends in Manufacturing

The global trend of companies outsourcing manufacturing, particularly complex processes, offers a substantial growth avenue for specialized Electronic Manufacturing Services (EMS) providers like Plexus. This strategy allows clients to enhance efficiency, cut costs, and leverage advanced technological capabilities. For instance, the global EMS market was valued at approximately $630 billion in 2023 and is projected to reach over $900 billion by 2030, indicating robust expansion.

This increasing reliance on external expertise for manufacturing presents a direct opportunity for Plexus to expand its market share. By securing new outsourcing contracts, Plexus can achieve revenue growth that outpaces the general market expansion. Consider the medical device sector, a key area for Plexus, where outsourcing of complex assembly and testing is a well-established practice, further amplified by the need for specialized quality control and regulatory compliance.

- Growing demand for specialized manufacturing: Companies are increasingly seeking EMS partners with niche expertise in areas like advanced materials and miniaturization.

- Cost optimization drivers: Global economic pressures continue to push businesses towards outsourcing to reduce operational overhead and capital expenditure.

- Focus on core competencies: Many original equipment manufacturers (OEMs) are divesting from manufacturing to concentrate on research, development, and marketing.

Leveraging Sustainability Initiatives for Competitive Advantage

Plexus's dedication to sustainability, evidenced by a 6.4% decrease in Scope 1 & 2 emissions and a 13.7% reduction in waste to landfill intensity during fiscal year 2024, significantly bolsters its brand image and attracts environmentally aware consumers. This commitment can translate into a competitive edge in the market.

Furthermore, robust sustainability efforts often yield tangible operational improvements and cost reductions, directly contributing to Plexus's long-term financial health and value proposition. These efficiencies can free up capital for reinvestment.

- Enhanced Brand Reputation: A clear commitment to environmental responsibility appeals to a growing segment of consumers and investors.

- Operational Efficiencies: Reductions in emissions and waste often correlate with streamlined processes and lower resource consumption.

- Cost Savings: Implementing sustainable practices can lead to decreased energy, water, and waste disposal expenses.

- Market Differentiation: Strong ESG (Environmental, Social, Governance) performance can set Plexus apart from competitors.

Plexus is well-positioned to leverage technological advancements like AI and IoT to enhance its services and internal efficiency, potentially boosting profitability. The company can also expand into emerging markets, such as Southeast Asia, which are showing increasing demand for electronics manufacturing services, with the global EMS market projected to grow significantly. Furthermore, securing new contracts in high-growth sectors like medical devices and industrial automation, which offer higher margins, presents a key opportunity.

Plexus's strong financial position, with $287.4 million in cash and cash equivalents as of Q4 2023, enables strategic acquisitions of companies with advanced manufacturing technologies. This financial flexibility allows for expansion and competitive enhancement. The healthcare/life sciences sector, expected to grow at a 6.9% CAGR through 2032, and aerospace/defense, at a 5% CAGR, are particularly attractive markets for Plexus's specialized capabilities.

The global trend of companies outsourcing manufacturing, especially complex processes, provides a substantial growth avenue for Plexus. The EMS market, valued at around $630 billion in 2023, is expected to exceed $900 billion by 2030, highlighting significant expansion potential. Plexus can increase its market share by securing new outsourcing contracts, particularly in sectors like medical devices where outsourcing is already prevalent.

Plexus's commitment to sustainability, demonstrated by a 6.4% decrease in Scope 1 & 2 emissions and a 13.7% reduction in waste to landfill intensity in FY2024, enhances its brand reputation and market differentiation. These efforts also lead to operational efficiencies and cost savings, contributing to long-term financial health.

| Opportunity Area | Market Growth Projection | Plexus Relevance |

|---|---|---|

| Technological Integration (AI/IoT) | AI market expected to grow significantly, IoT device shipments projected to reach 29.7 billion by 2027. | Enhances service offerings and internal efficiency. |

| Emerging Market Expansion | Southeast Asia electronics market CAGR projected at 7.5% through 2028. | Diversifies revenue and reduces reliance on mature markets. |

| High-Growth Sector Wins (Medical, Industrial) | Medical device outsourcing market to reach $61.7 billion by 2025. | Access to higher-margin segments and demonstrates adaptability. |

| Strategic Acquisitions | Global M&A activity in technology sector remained robust in 2023. | Leverages cash reserves to acquire advanced capabilities. |

| Outsourcing Trend | Global EMS market to reach $900+ billion by 2030. | Capitalizes on OEM strategy to focus on core competencies. |

Threats

Global economic conditions and geopolitical headwinds, such as tariffs and international conflicts, create significant uncertainties for Plexus. For instance, the ongoing trade disputes between major economies in 2024 continue to pose risks, potentially increasing the cost of imported components and impacting Plexus's global supply chain efficiency.

These geopolitical tensions can lead to higher operational expenses and dampened demand for Plexus's products in certain international markets. The volatility stemming from these global issues directly affects the company's ability to maintain smooth operations and consistent profitability across its worldwide operations, especially as global trade volumes saw a modest slowdown in early 2024.

The electronics manufacturing services (EMS) sector is fiercely competitive, and Plexus faces significant pricing pressures. This intense rivalry means competitors often undercut pricing to secure lucrative contracts, potentially forcing Plexus to lower its own prices. For instance, in 2024, the EMS market saw aggressive bidding wars, particularly for high-volume, less complex projects, impacting average selling prices across the industry.

Such pressures can directly lead to margin erosion for Plexus, especially in segments where differentiation is less pronounced. If Plexus cannot maintain its pricing power or find cost efficiencies, its profitability will suffer. This is a critical concern as companies increasingly seek cost-effective solutions, making price a dominant factor in many sourcing decisions.

The pace of technological change in electronics is relentless, with product lifecycles shrinking. Plexus faces the constant challenge of staying ahead, requiring significant and ongoing investment in research and development to keep its manufacturing capabilities current.

Failure to adapt quickly to emerging technologies, such as the growing demand for advanced electronic assemblies or the intricate requirements of high-precision medical device manufacturing, poses a direct threat of obsolescence. This could significantly erode Plexus's market position and relevance.

For instance, the semiconductor industry, a key sector for electronics manufacturing, saw global R&D spending reach an estimated $100 billion in 2024, highlighting the scale of investment needed to remain competitive. Plexus must strategically allocate resources to align with these rapid innovation cycles.

Talent Acquisition and Retention Challenges

Plexus, as a major player in electronics manufacturing, faces significant hurdles in acquiring and keeping top-tier talent, especially in specialized fields like engineering and advanced production techniques. The intense competition within the technology industry for these skilled professionals can drive up wages and make it difficult to fill critical roles, potentially impacting operational efficiency and project timelines. For instance, the U.S. Bureau of Labor Statistics projected a 6% growth for electrical engineers between 2022 and 2032, indicating a tight labor market for this critical skill set.

The struggle to attract and retain qualified employees can lead to several tangible threats for Plexus:

- Increased Labor Costs: To secure and keep essential talent, companies like Plexus may need to offer more competitive salaries and benefits, directly impacting their cost of goods sold.

- Operational Disruptions: Staffing shortages, particularly in engineering or specialized manufacturing roles, can cause delays in product development, production bottlenecks, and a reduced capacity to take on new projects.

- Loss of Expertise: High employee turnover means a loss of institutional knowledge and specialized skills, which can be costly and time-consuming to replace, hindering innovation and quality.

- Competitive Disadvantage: If competitors are more successful in talent acquisition and retention, Plexus could fall behind in terms of technological advancement and market responsiveness.

Regulatory and Compliance Risks

Plexus operates in sectors like healthcare and aerospace, which are heavily regulated. This means they must adhere to strict rules, and failure to do so can lead to major problems. For instance, in 2024, companies in the medical device sector faced increased scrutiny over data privacy and cybersecurity, with potential fines reaching millions for violations. A significant compliance lapse could result in hefty penalties, legal battles, and severe damage to Plexus's reputation, potentially impacting its ability to secure new contracts.

Changes in these regulatory environments can also be a significant threat. For example, evolving FDA guidelines in the United States, which are continually updated to reflect advancements in technology and patient safety, might require Plexus to invest substantially in modifying its manufacturing processes and quality control systems. This could impact production timelines and increase operational costs, affecting profitability.

The complexity of global regulations adds another layer of risk. Plexus, serving international markets, must navigate a patchwork of differing compliance standards across various countries. Staying abreast of and implementing these diverse requirements is resource-intensive and presents a constant challenge. Non-compliance in any single jurisdiction could jeopardize their entire supply chain or market access.

Key regulatory and compliance threats include:

- Significant fines and legal penalties for non-compliance.

- Reputational damage impacting customer trust and new business opportunities.

- Costly modifications to manufacturing and quality control processes due to evolving regulations.

- Challenges in navigating diverse and complex international compliance standards.

Plexus faces substantial threats from global economic instability and geopolitical tensions, which can disrupt supply chains and dampen international demand. For instance, ongoing trade disputes in 2024 have already increased component costs and affected global trade volumes. Intense competition within the EMS sector also pressures Plexus on pricing, potentially eroding margins as competitors engage in aggressive bidding wars for contracts.

The rapid pace of technological advancement requires continuous, significant investment in R&D to avoid obsolescence, as seen in the semiconductor industry's estimated $100 billion R&D spending in 2024. Furthermore, Plexus must contend with a tight labor market for skilled engineers and technicians, facing increased labor costs and potential operational disruptions due to staffing shortages. The U.S. Bureau of Labor Statistics projected a 6% growth for electrical engineers between 2022 and 2032, underscoring this challenge.

Stringent regulations in sectors like healthcare and aerospace present compliance risks, with potential for substantial fines and reputational damage. For example, increased scrutiny on data privacy in medical devices in 2024 could lead to millions in fines for violations. Navigating diverse international compliance standards also adds complexity and resource strain.

SWOT Analysis Data Sources

This Plexus SWOT analysis is built upon a robust foundation of data, including internal financial reports, comprehensive market research, and expert industry analysis. These sources provide a well-rounded view of the company's current standing and future potential.