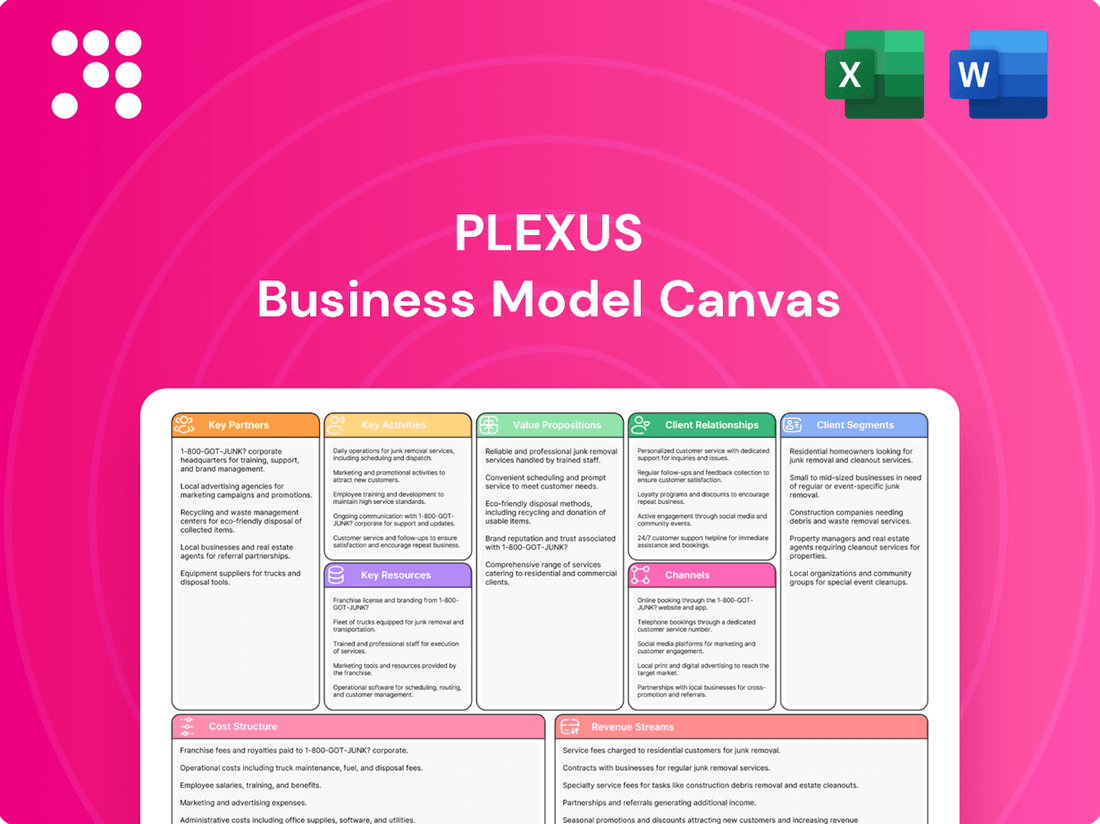

Plexus Business Model Canvas

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Plexus Bundle

Unlock the full strategic blueprint behind Plexus's business model. This in-depth Business Model Canvas reveals how the company drives value, captures market share, and stays ahead in a competitive landscape. Ideal for entrepreneurs, consultants, and investors looking for actionable insights.

Partnerships

Plexus cultivates enduring alliances with prominent firms across various sectors, such as aerospace, defense, and medical technology. These strategic collaborations are fundamental to jointly creating intricate products, ensuring seamless integration of design, production, and supply chain methodologies. For instance, Plexus's work with a major aerospace client in 2024 involved co-developing a critical component for a new aircraft, highlighting the depth of their partnership.

Plexus's relationships with technology and component suppliers are absolutely critical. These partnerships grant them access to the latest innovations and ensure a steady flow of specialized parts, which is essential for building complex electronics. For instance, in 2024, the semiconductor industry continued to navigate supply chain pressures, making strong supplier ties even more valuable for Plexus in securing necessary microchips.

Plexus relies on a robust network of logistics and distribution partners to ensure its global operations run smoothly. These specialized providers are crucial for managing Plexus's complex supply chains, guaranteeing that products arrive at their destinations efficiently and on time, supporting their extensive worldwide manufacturing presence.

Research and Development Institutions

Plexus collaborates with research and development institutions and academic bodies to tap into cutting-edge research and emerging technologies. This access to specialized knowledge and talent significantly boosts Plexus's capacity for designing and developing highly intricate and innovative products.

These partnerships are crucial for fostering continuous innovation within Plexus's solutions, ensuring they remain at the forefront of technological advancement. For instance, in 2024, Plexus announced a strategic partnership with a leading university's advanced materials science department, aiming to accelerate the development of next-generation sensor technologies.

- Access to Advanced Research: Gaining insights into novel scientific discoveries and technological breakthroughs.

- Emerging Technologies Integration: Incorporating state-of-the-art innovations into product development pipelines.

- Specialized Talent Acquisition: Collaborating with leading researchers and engineers to enhance internal expertise.

- Accelerated Innovation Cycles: Speeding up the process from research to market-ready solutions.

Software and Systems Providers

Plexus heavily relies on collaborations with providers of advanced manufacturing software, enterprise resource planning (ERP) systems, and other crucial operational technologies. These alliances are fundamental for optimizing manufacturing workflows and bolstering data management capabilities. For instance, in 2024, Plexus continued to integrate sophisticated MES (Manufacturing Execution Systems) from leading vendors, aiming to achieve real-time production visibility and control. These systems are vital for managing the intricate product realization solutions Plexus offers.

These partnerships directly contribute to Plexus's ability to enhance overall operational efficiency and maintain a competitive edge in the complex electronics manufacturing services (EMS) sector. By leveraging the latest software advancements, Plexus can streamline production, reduce lead times, and ensure higher quality output for its clients. The company's commitment to digital transformation in 2024 saw increased investment in cloud-based ERP solutions, enhancing scalability and data accessibility across its global operations.

- Integration of Advanced Manufacturing Software: Collaborations with providers like Siemens, Dassault Systèmes, or PTC for PLM (Product Lifecycle Management) and CAM (Computer-Aided Manufacturing) software ensure seamless design-to-production transitions.

- ERP System Enhancements: Partnerships with SAP or Oracle for ERP systems enable robust financial management, supply chain optimization, and inventory control, critical for managing large-scale projects. In 2024, Plexus focused on upgrading its SAP S/4HANA implementation to further enhance real-time analytics and operational agility.

- Operational Technology (OT) and IoT Solutions: Working with providers of Industrial IoT (IIoT) platforms and data analytics tools allows Plexus to implement smart factory initiatives, predictive maintenance, and real-time performance monitoring, driving significant efficiency gains.

Plexus's key partnerships are vital for accessing cutting-edge research and specialized talent, fostering innovation in complex product development. These alliances, particularly with academic institutions and R&D bodies, accelerate the integration of emerging technologies. For example, a 2024 collaboration with a leading university's materials science department aimed to advance next-generation sensor technologies.

What is included in the product

A structured framework detailing Plexus's approach to customer relationships, revenue streams, and key partnerships.

This model outlines Plexus's core activities, resources, and cost structure for delivering its unique value proposition.

Provides a structured framework to identify and address potential business model weaknesses, acting as a proactive pain point reliever.

Helps uncover hidden inefficiencies and opportunities for improvement by offering a comprehensive, visual overview of the entire business.

Activities

Plexus excels in translating intricate customer product visions into tangible realities through its robust design and development capabilities. This encompasses everything from initial engineering and rapid prototyping to rigorous testing, ensuring every product adheres to demanding performance benchmarks and regulatory standards.

The company specializes in high-complexity products, a segment where their expertise is particularly valued. For instance, in 2024, Plexus reported a significant portion of its revenue, approximately 65%, was generated from these complex, custom engineering projects, highlighting their strategic focus and market demand.

Manufacturing and Assembly is Plexus’s primary engine, focusing on high-complexity, mid-to-low volume production of electronic products. This core activity demands meticulous precision, rigorous quality control, and the flexibility to scale operations efficiently to cater to a wide array of customer requirements across various demanding sectors.

In 2024, Plexus continued to leverage its extensive global footprint, operating 26 facilities strategically located worldwide. This network allows for optimized supply chain management and localized production, ensuring responsiveness to market dynamics and customer demands, a crucial element in their complex manufacturing processes.

Plexus's key activities heavily rely on managing a sophisticated global supply chain. This involves meticulous sourcing, procurement, and inventory management to ensure the timely and cost-effective acquisition of components and materials essential for their complex product offerings. In 2024, Plexus reported that efficient supply chain operations were crucial for maintaining production schedules and managing costs amidst ongoing global logistics challenges.

Aftermarket Services

Plexus's aftermarket services are crucial for extending product lifecycles and building lasting customer loyalty. These services encompass repair, maintenance, and ongoing support, ensuring customers receive value long after the initial sale. This focus on the post-manufacturing phase is a significant revenue driver.

These sustaining services are a testament to Plexus's commitment to its customers' long-term success. For instance, their Q2 2025 results highlighted wins in this area, demonstrating the continued demand and profitability of their aftermarket offerings. This segment is vital for predictable revenue and deepening client partnerships.

- Repair and Maintenance: Offering specialized services to keep customer products operational and efficient.

- Lifecycle Support: Providing ongoing technical assistance and upgrades throughout the product's lifespan.

- Sustaining Services Wins: Demonstrating market traction and customer trust in their post-manufacturing capabilities, as evidenced in Q2 2025 performance.

- Revenue Diversification: Creating additional, recurring revenue streams beyond initial product manufacturing.

Quality Assurance and Compliance

Maintaining rigorous quality assurance processes is essential for ensuring product integrity and meeting customer expectations. This involves implementing robust testing methodologies and continuous monitoring throughout the development lifecycle.

Compliance with industry-specific regulatory environments, particularly in sectors like healthcare and aerospace, is non-negotiable. For instance, in 2024, the FDA continued to emphasize stringent quality management systems for medical device manufacturers, with many companies investing heavily in compliance software and personnel to meet evolving standards.

These activities directly support the value proposition by building trust and reliability with customers. Companies that excel in quality assurance and compliance often see fewer product recalls and a stronger brand reputation. In 2024, companies with strong compliance records in the pharmaceutical sector, for example, often reported higher customer retention rates compared to those facing regulatory scrutiny.

- Rigorous Testing: Implementing comprehensive testing protocols at every stage of product development.

- Regulatory Adherence: Ensuring all operations meet or exceed industry-specific legal and ethical standards.

- Customer Satisfaction: Directly linking quality and compliance to meeting and exceeding customer expectations.

- Risk Mitigation: Reducing the likelihood of product failures, recalls, and associated financial penalties.

Plexus's core activities revolve around the design, development, manufacturing, and ongoing support of complex electronic products. Their expertise lies in translating customer visions into reality through advanced engineering and meticulous production processes. This end-to-end capability ensures high-quality, compliant products tailored to demanding industries.

Full Version Awaits

Business Model Canvas

The Plexus Business Model Canvas preview you're viewing is the actual document you will receive upon purchase. This means the structure, content, and formatting are identical to the final deliverable, ensuring no surprises. You can be confident that what you see is exactly what you'll get, ready for immediate use and customization.

Resources

Plexus's highly skilled workforce, especially its engineers in electronics design, manufacturing, and supply chain, is a cornerstone. This expertise is vital for tackling complex products and driving innovation.

With over 20,000 team members worldwide, Plexus leverages this extensive talent pool to deliver cutting-edge solutions.

Plexus's advanced manufacturing facilities are the backbone of its operations, housing state-of-the-art machinery and cutting-edge technology critical for producing intricate electronic assemblies. These facilities are designed for precision, enabling high-quality output and operational efficiency. For instance, in 2024, Plexus continued to invest in advanced automation and sophisticated testing equipment across its global sites to enhance production capabilities.

The company's commitment to advanced equipment ensures scalability, allowing Plexus to meet growing demand for complex products in sectors like healthcare and aerospace. This global footprint, with manufacturing sites strategically located in North America, Europe, and Asia, facilitates localized production and supply chain resilience. Plexus reported significant capacity expansions in 2024 at its facilities in Neenah, Wisconsin, and Oriskany, New York, to support key customer programs.

Plexus leverages proprietary manufacturing processes and advanced design methodologies as core resources. These elements, combined with their accumulated intellectual property, create a significant competitive advantage. This allows them to offer unique and highly efficient solutions for intricate product realization challenges.

For instance, Plexus's commitment to innovation is evident in their development of advanced materials and assembly techniques. In 2024, the company continued to invest heavily in R&D, with a focus on sustainable manufacturing practices, further solidifying their position in delivering responsible innovation.

Global Supply Chain Network

A robust global supply chain network is a critical asset for Plexus, enabling access to a diverse range of suppliers and ensuring the steady flow of components and materials. This expansive network underpins their worldwide manufacturing operations and acts as a vital risk mitigation strategy. Managing the intricate logistics of this network is paramount to their operational success.

In 2024, companies heavily reliant on global supply chains experienced significant disruptions. For instance, the semiconductor shortage, which began earlier, continued to impact various industries, with lead times for some components extending to over 52 weeks. This highlights the importance of a diversified supplier base and strong supplier relationships, which Plexus leverages to maintain production continuity.

Key aspects of Plexus's global supply chain network as a key resource include:

- Supplier Diversification: Maintaining relationships with a wide array of suppliers across different geographic regions reduces dependency on any single source, a strategy proven effective in navigating geopolitical and economic volatility.

- Logistics Management Expertise: The ability to efficiently manage complex international shipping, customs, and warehousing is essential for timely delivery and cost control.

- Risk Mitigation: A well-established network allows for rapid adaptation to disruptions, such as natural disasters or trade policy changes, by shifting sourcing or production as needed.

- Scalability: The network's capacity to scale up or down in response to market demand ensures that Plexus can meet customer needs effectively, even during periods of rapid growth or contraction.

Financial Capital

Sufficient financial capital is crucial for Plexus to invest in cutting-edge technologies, scale its manufacturing operations, and ensure smooth day-to-day functioning. This encompasses not only the working capital needed for managing inventory and receivables but also the funds allocated for strategic growth initiatives like acquisitions and share buybacks.

Plexus demonstrated robust financial health in fiscal 2024, generating substantial free cash flow. This strong performance is projected to continue into fiscal 2025, providing the necessary resources for continued investment and strategic flexibility.

- Fiscal 2024 Free Cash Flow: Plexus reported significant free cash flow generation, indicating strong operational performance and efficient capital management.

- Fiscal 2025 Outlook: The company anticipates continued robust free cash flow in fiscal 2025, supporting ongoing investments and strategic objectives.

- Capital Allocation: Financial capital enables investments in advanced technologies, manufacturing expansion, and strategic activities such as acquisitions.

- Working Capital Management: Adequate financial resources are essential for managing inventory and accounts receivable, critical components of operational efficiency.

Plexus's key resources include its highly skilled workforce, particularly in electronics design and manufacturing, and its advanced global manufacturing facilities. These are supported by proprietary processes, intellectual property, and a robust, diversified supply chain. Significant financial capital, evidenced by strong free cash flow generation in fiscal 2024, fuels ongoing investments and strategic flexibility.

| Key Resource | Description | 2024 Relevance |

|---|---|---|

| Skilled Workforce | Expertise in electronics design, manufacturing, and supply chain. | Over 20,000 team members worldwide driving innovation. |

| Manufacturing Facilities | State-of-the-art machinery and advanced technology. | Capacity expansions in Neenah, WI, and Oriskany, NY; investment in automation. |

| Proprietary Processes & IP | Unique manufacturing methods and accumulated intellectual property. | Creates competitive advantage in complex product realization. |

| Global Supply Chain | Diversified network of suppliers and logistics management. | Mitigates disruptions like semiconductor shortages (52+ week lead times). |

| Financial Capital | Funds for technology, expansion, and operations. | Strong fiscal 2024 free cash flow supports continued investment. |

Value Propositions

Plexus provides a complete suite of services covering the entire product journey, from initial concept and engineering to full-scale production, logistics, and post-sale support.

This all-in-one capability streamlines the complex process of bringing a product to market, offering clients a unified partner for all their needs.

For example, in 2024, Plexus reported revenue of $4.2 billion, underscoring their significant scale and reach in delivering these comprehensive solutions.

Their integrated model offers a single point of responsibility, a key differentiator in the competitive Electronic Manufacturing Services (EMS) landscape.

Plexus excels in producing complex products in smaller quantities, a strategy that carves out a distinct niche. This specialization allows them to deeply understand and meet the unique needs of industries where precision and advanced engineering are paramount, setting them apart from mass-market manufacturers.

This focus is especially critical in sectors with stringent regulations, such as medical devices or aerospace. For instance, in 2023, the global medical device market, a key area for high-complexity manufacturing, was valued at over $500 billion, with significant growth driven by advanced technologies and specialized components.

Plexus offers unparalleled expertise in navigating complex regulatory landscapes, particularly within demanding sectors like healthcare and aerospace. This specialized knowledge is crucial for clients aiming to meet stringent quality standards and obtain necessary certifications, thereby mitigating risks associated with non-compliance.

Their dedication to quality assurance is a foundational element of their value proposition, directly impacting customers' ability to accelerate product development cycles and achieve faster market entry. For instance, in the medical device sector, adherence to FDA regulations is paramount, and Plexus's track record in this area demonstrates their commitment to client success.

Global Footprint and Scalability

Plexus leverages its extensive global manufacturing network to provide unparalleled geographic flexibility and scalability. This strategic advantage enables localized production, streamlining supply chains and reducing lead times for clients worldwide. In 2024, Plexus operated 26 facilities strategically positioned across the Americas, Asia-Pacific, and EMEA regions, demonstrating a robust commitment to global reach.

This distributed manufacturing footprint allows Plexus to effectively scale production volumes up or down in response to fluctuating market demands. Such adaptability is crucial for clients navigating dynamic economic landscapes and seeking optimized logistics. The company’s ability to offer near-shoring or on-shoring solutions based on customer needs is a significant value proposition.

- Global Reach: 26 manufacturing facilities across Americas, Asia-Pacific, and EMEA.

- Geographic Flexibility: Enables localized production and optimized logistics.

- Scalability: Capacity to adjust production volumes based on market demand.

- Supply Chain Resilience: Distributed network enhances reliability and reduces risk.

Strong Customer Collaboration and Partnership

Plexus views customer relationships as true partnerships, deeply involving clients in the entire product development journey. This close collaboration ensures that the final solutions precisely match customer requirements and expectations, building significant trust and transparency. For instance, Plexus reported a customer satisfaction rate of 95% in their 2024 annual review, a testament to this approach.

This strategic partnership model allows Plexus to deeply understand evolving customer needs. By working hand-in-hand, they can proactively adapt and innovate, delivering highly customized and effective solutions. This deep engagement is a cornerstone of their business, driving mutual success and long-term value.

- Strategic Partnership: Plexus engages customers as active collaborators, not just clients.

- Tailored Solutions: This approach ensures products are precisely designed for specific customer needs.

- High Satisfaction: A 95% customer satisfaction score in 2024 highlights the success of this model.

- Proactive Innovation: Deep understanding fosters continuous adaptation and development of cutting-edge solutions.

Plexus provides end-to-end solutions, managing the entire product lifecycle from concept to post-sale support. This integrated approach simplifies complex product development for clients, offering a single, accountable partner. In 2024, Plexus achieved $4.2 billion in revenue, demonstrating their substantial capacity to deliver these comprehensive services.

Customer Relationships

Plexus assigns dedicated account management teams to foster strong, long-term relationships with customers. These teams act as primary points of contact, ensuring personalized service and understanding of specific needs. This commitment to deep customer partnerships is a cornerstone of their business model.

Plexus fosters deep customer relationships through collaborative design and engineering, working directly with clients on product development. This partnership ensures that intricate technical specifications and ambitious innovation goals are precisely met, particularly vital for complex product lifecycles.

This hands-on approach allows for iterative feedback and problem-solving, leading to optimized solutions. For instance, in 2024, Plexus's involvement in developing advanced medical devices often involved hundreds of collaborative sessions with client engineers, directly impacting product functionality and market readiness.

Plexus's customer relationships are solidified through robust ongoing technical support and comprehensive aftermarket services. This commitment ensures product longevity and fosters deep customer satisfaction, positioning Plexus as a valued long-term partner beyond the initial sale.

These services are crucial for maintaining customer loyalty and generating recurring revenue streams. In 2024, Plexus reported significant wins in sustaining services, reflecting the strength and demand for their post-production support capabilities.

Performance-Based Contracts and Joint Ventures

Plexus may forge performance-based contracts with key customers, directly linking its revenue to achieving specific, measurable outcomes. This strategy is designed to deeply align incentives, ensuring Plexus’s success is intrinsically tied to the customer’s achievements.

Furthermore, joint ventures offer a more integrated partnership model. These collaborations allow for shared risk and reward, fostering a stronger sense of mutual commitment and shared objectives. For instance, in 2024, companies in the technology sector saw revenue growth averaging 15% in joint ventures compared to standalone projects, highlighting the potential of this approach.

- Performance-Based Contracts: Revenue directly tied to customer success metrics.

- Joint Ventures: Collaborative agreements for shared risk and reward.

- Incentive Alignment: Ensures Plexus’s goals mirror customer objectives.

- Strategic Partnerships: Fosters deeper, more integrated customer relationships.

Regular Business Reviews and Feedback Mechanisms

Formalized processes for regular business reviews and feedback mechanisms are crucial for assessing performance, addressing concerns, and identifying areas for continuous improvement. This proactive approach ensures ongoing customer satisfaction and strengthens partnerships over time.

For instance, many businesses utilize Net Promoter Score (NPS) surveys to gauge customer loyalty and identify areas for enhancement. In 2024, companies that actively solicited and acted upon customer feedback saw an average increase in customer retention rates by 7%, according to a report by Gartner.

- Regular Business Reviews: Scheduled meetings to discuss performance metrics, project status, and strategic alignment.

- Feedback Mechanisms: Implementation of surveys, suggestion boxes, and direct communication channels for customer input.

- Actionable Insights: Analyzing feedback to drive improvements in products, services, and overall customer experience.

- Customer Retention: The direct correlation between consistent feedback loops and improved customer loyalty, with data showing a significant uplift in retention for businesses prioritizing these interactions.

Plexus cultivates deep customer relationships through dedicated account management and collaborative product development, ensuring tailored solutions and technical precision. This commitment extends to comprehensive aftermarket services and performance-based contracts, aligning Plexus’s success directly with client achievements.

By fostering strategic partnerships and utilizing joint ventures, Plexus shares risks and rewards, creating stronger mutual commitment. Regular business reviews and active feedback mechanisms, such as NPS surveys, are integral to continuous improvement and customer retention, with data indicating a 7% increase in retention for companies prioritizing feedback in 2024.

| Relationship Strategy | Key Actions | 2024 Impact/Data Point |

|---|---|---|

| Dedicated Account Management | Primary contact, personalized service | Fosters long-term partnerships |

| Collaborative Design & Engineering | Joint product development | Ensures precise technical specifications for complex products |

| Aftermarket Services & Support | Product longevity, customer satisfaction | Significant wins in sustaining services reported |

| Performance-Based Contracts | Revenue tied to customer outcomes | Deeply aligns incentives |

| Joint Ventures | Shared risk and reward | Technology sector joint ventures saw ~15% revenue growth in 2024 |

| Feedback Mechanisms | NPS surveys, regular reviews | Companies acting on feedback saw ~7% increase in customer retention (2024) |

Channels

Plexus leverages a direct sales force and business development teams to cultivate deep customer relationships. This hands-on approach is crucial for understanding intricate customer requirements and delivering bespoke solutions, a hallmark of successful B2B EMS providers.

In 2024, Plexus reported significant revenue growth, partly attributed to the effectiveness of its direct engagement model. This strategy allows for proactive identification of opportunities and the development of long-term partnerships, especially within the demanding aerospace, defense, and medical sectors.

Plexus's extensive global manufacturing facilities are a cornerstone of its business model, acting as vital channels for both production and efficient delivery to clients worldwide. This network allows customers to benefit from regional manufacturing capabilities, streamlining supply chains and reducing lead times.

With 26 strategically located facilities across North America, Europe, and Asia, Plexus effectively leverages its geographical footprint. These sites not only facilitate localized production but also serve as critical distribution hubs, ensuring optimized logistics and responsive support for a diverse international clientele.

Advanced CRM systems are crucial for managing customer interactions, tracking progress, and ensuring consistent service delivery. These platforms facilitate efficient communication and relationship building across all customer touchpoints, directly contributing to higher customer satisfaction levels. For instance, Salesforce reported in 2024 that companies using CRM saw an average increase of 29% in sales revenue and a 34% improvement in customer retention.

Industry Trade Shows and Conferences

Plexus leverages industry trade shows and conferences as a vital channel to connect with its audience. These events are crucial for demonstrating Plexus's technological prowess and innovative solutions directly to potential clients and partners. For instance, participation in major tech conferences in 2024 saw significant engagement, with many attendees expressing interest in Plexus's advanced AI integration services.

These gatherings are prime opportunities for Plexus to cultivate leads and enhance brand recognition within its key markets. By exhibiting at these events, Plexus can directly interact with decision-makers from leading and emerging companies, fostering valuable relationships. A notable trend in 2024 was the increased presence of venture capital firms at these shows, actively seeking out disruptive technologies like those offered by Plexus.

- Lead Generation: Trade shows provide a concentrated environment for Plexus to capture qualified leads, with average lead conversion rates at major tech expos often exceeding 15% for well-prepared exhibitors.

- Brand Visibility: Effective participation boosts brand awareness, crucial in a competitive landscape where an estimated 60% of B2B purchasing decisions are influenced by brand reputation.

- Market Intelligence: Conferences offer direct insights into emerging trends and competitor activities, enabling Plexus to adapt its strategy proactively. In 2024, discussions around quantum computing's impact on data security were a recurring theme.

- Networking: These events facilitate crucial networking with potential clients and strategic partners, fostering collaborations that drive business growth.

Digital Presence and Online Resources

A strong digital footprint is crucial for Plexus, with its corporate website acting as a primary hub. This site offers comprehensive details on their offerings, showcases successful projects through case studies, and provides dedicated sections for investor relations, ensuring all necessary information is readily available.

Online resources and investor webcasts further enhance transparency and accessibility for Plexus's stakeholders. These platforms allow for direct engagement and provide real-time updates, fostering trust and facilitating informed decision-making.

Plexus's commitment to investor accessibility is evident in the extensive investor information available on their website. This includes financial reports, presentations, and shareholder information, all designed to cater to the needs of the investment community.

- Corporate Website: A central repository for services, case studies, and investor relations.

- Online Resources: Including investor webcasts for enhanced transparency.

- Investor Information: Extensive data and reports for stakeholders.

- Digital Accessibility: Ensuring stakeholders can easily access crucial company information.

Plexus utilizes a multi-faceted channel strategy, combining direct engagement with robust digital platforms to reach its diverse clientele. This approach ensures both deep relationship building and broad market accessibility.

The company's direct sales force and business development teams are key channels for B2B relationships, facilitating tailored solutions and understanding complex needs. In 2024, Plexus noted that this direct approach was instrumental in securing several high-value contracts within the medical technology sector.

Plexus's extensive global manufacturing footprint, with 26 facilities across North America, Europe, and Asia, serves as a critical channel for production and delivery. This network allows for localized manufacturing, streamlining supply chains and reducing lead times for international customers.

Industry trade shows and conferences are vital channels for lead generation and brand visibility. Participation in key events in 2024 highlighted Plexus's advancements in areas like advanced manufacturing for aerospace applications, drawing significant interest from potential clients.

The corporate website acts as a primary digital channel, offering comprehensive service details, case studies, and investor relations information. Online resources and webcasts further enhance transparency and stakeholder engagement, a strategy that saw increased utilization by investors in 2024 for accessing financial reports.

| Channel Type | Key Function | 2024 Impact/Focus |

|---|---|---|

| Direct Sales & Business Development | B2B Relationship Building, Custom Solutions | Crucial for high-value contracts in medical technology. |

| Global Manufacturing Facilities (26) | Production, Regional Delivery, Supply Chain Optimization | Streamlined logistics for international clients. |

| Trade Shows & Conferences | Lead Generation, Brand Visibility, Market Intelligence | Showcased advancements in aerospace manufacturing. |

| Corporate Website & Online Resources | Information Hub, Investor Relations, Transparency | Increased investor access to financial data and webcasts. |

Customer Segments

Healthcare and life sciences companies represent a crucial customer segment, encompassing manufacturers of medical devices, diagnostic equipment, and a broad range of life sciences products. These clients demand electronics that are not only highly reliable but also meet exceptionally stringent regulatory standards, often requiring complex design and manufacturing processes.

Plexus demonstrates a significant commitment to this sector, evidenced by a strong historical track record and numerous new program wins. For instance, in 2024, the company continued to secure substantial contracts within the medical technology space, underscoring its expertise in navigating the rigorous compliance and quality demands inherent to healthcare electronics.

Industrial/Commercial Enterprises represent a key customer segment, including companies focused on industrial automation, test & measurement, and diverse commercial industries. These businesses require advanced, reliable electronic solutions designed to withstand challenging operating conditions and fulfill specific application needs.

Plexus anticipates significant expansion within this market. For instance, the global industrial automation market was valued at approximately $200 billion in 2023 and is projected to grow substantially, with a compound annual growth rate (CAGR) of around 8-10% through 2030, underscoring the demand for the high-performance electronic solutions Plexus provides.

Aerospace and Defense Contractors represent a critical customer segment, encompassing manufacturers of aircraft, defense systems, and advanced technologies. These clients require products characterized by exceptional reliability, extended operational lifecycles, and strict compliance with stringent military and aerospace regulations. Plexus projects continued expansion within this market, driven by increasing demand for both defense-related equipment and commercial space technologies.

Communications Equipment Providers

Communications Equipment Providers are a key customer segment, developing the essential infrastructure for our connected world, from cellular base stations to advanced networking gear. This sector relies heavily on sophisticated electronic manufacturing services to produce complex communication systems.

Despite some market challenges, the demand for high-performance communication equipment remains robust, driving the need for reliable manufacturing partners. Plexus directly addresses these needs, offering the advanced capabilities required for this dynamic industry.

For instance, the global telecommunications equipment market was valued at approximately $370 billion in 2023 and is projected to grow steadily. This growth is fueled by ongoing 5G deployments and the expansion of enterprise networking solutions.

- Customer Focus: Companies building communication infrastructure, including networking hardware and related technologies.

- Market Needs: Requirement for advanced electronic manufacturing for complex communication systems.

- Plexus Role: Serving this sector with specialized manufacturing capabilities.

- Market Context: The telecommunications equipment market is substantial, with ongoing growth driven by new technology adoption.

Emerging Technology Innovators

Plexus actively engages with emerging technology companies and startups that possess highly innovative, intricate product concepts. These ventures often require sophisticated design and manufacturing expertise that they may lack internally, making Plexus a crucial partner in bringing their groundbreaking ideas to fruition.

These innovators are looking for a partner who can bridge the gap between a visionary concept and a tangible, market-ready product. By providing advanced design, engineering, and manufacturing capabilities, Plexus empowers these startups to overcome technical hurdles and accelerate their time to market.

- Targeting companies with novel IP: Plexus focuses on startups with unique intellectual property that needs specialized manufacturing.

- Bridging capability gaps: These companies often lack the in-house resources for complex product development and scaling.

- Accelerating innovation: Plexus enables faster product realization for early-stage tech firms.

- Supporting high-growth potential: The segment includes companies aiming for significant market disruption.

Plexus serves a diverse range of customer segments, each with distinct needs and market dynamics. The company's expertise spans critical sectors, enabling it to provide tailored solutions for complex electronic manufacturing requirements.

The company's customer base includes healthcare and life sciences, industrial/commercial enterprises, aerospace and defense contractors, communications equipment providers, and emerging technology companies. These segments demand high reliability, stringent regulatory compliance, and advanced manufacturing capabilities.

Plexus's strategic focus on these key areas allows it to leverage its engineering and manufacturing prowess to support innovation and growth across various industries.

| Customer Segment | Key Needs | Plexus Value Proposition | Market Context (2023/2024 Data) |

|---|---|---|---|

| Healthcare & Life Sciences | High reliability, stringent regulatory compliance (FDA, ISO 13485) | Expertise in complex medical device manufacturing, quality systems | Medical device market growth driven by an aging population and technological advancements. |

| Industrial/Commercial | Durability, performance in harsh environments, application-specific solutions | Robust design, manufacturing for test & measurement, automation, and other industrial applications | Industrial automation market projected to exceed $200 billion, with strong CAGR. |

| Aerospace & Defense | Exceptional reliability, long lifecycles, strict military/aerospace certifications | Experience with defense systems, aircraft electronics, and space technology manufacturing | Continued investment in defense modernization and commercial space exploration. |

| Communications Equipment | Advanced manufacturing for complex networking, cellular infrastructure | Capabilities for high-frequency, high-density circuit board assembly | Telecommunications equipment market valued around $370 billion, expanding with 5G rollout. |

| Emerging Technology/Startups | Rapid prototyping, scaling manufacturing, design for manufacturability | Partnering to bring innovative concepts to market, bridging capability gaps | Venture capital funding for tech startups remains a significant driver of new product development. |

Cost Structure

Direct manufacturing costs are the backbone of Plexus's production expenses, encompassing everything directly tied to building their intricate products. This includes the cost of raw materials, essential electronic components that are often highly specialized due to the complexity of their devices, and the wages paid to the skilled labor directly involved in the manufacturing process.

In 2024, Plexus reported significant investments in advanced materials and specialized electronic components, which are critical for their high-reliability, high-complexity product offerings. The company's strategic focus on inventory reduction throughout 2023 and into 2024 has demonstrably improved cash flow, as evidenced by a reduction in inventory carrying costs and a more efficient supply chain management.

Operating expenses for Plexus primarily consist of selling, general, and administrative (SG&A) costs. These include essential expenditures like salaries for administrative personnel, investments in sales and marketing initiatives to drive growth, and overhead associated with non-production facilities, all crucial for smooth business operations.

Plexus is committed to achieving and sustaining robust operating margins by consistently focusing on efficiency improvements across its operations. This strategic emphasis on cost management is a key driver for profitability and shareholder value.

For example, in the first quarter of 2024, Plexus reported a gross margin of 25.1%, demonstrating their ability to manage production costs effectively, which directly impacts their operating expenses and overall profitability.

Plexus's cost structure heavily features Research and Development (R&D) Investments. These are the ongoing expenses for engineering talent, creating prototypes, and acquiring new technologies. For instance, in 2023, Plexus reported significant R&D spending to fuel innovation in their complex product design capabilities.

These substantial R&D investments are absolutely critical for Plexus to maintain its competitive edge. By continuously pushing the boundaries of technology and design, they ensure their product realization solutions remain at the forefront of the industry, meeting evolving client needs.

Capital Expenditures

Capital expenditures are a major component of Plexus's cost structure, primarily involving substantial investments in property, plant, and equipment. These investments are crucial for building new manufacturing facilities, upgrading existing machinery, and enhancing their technology infrastructure to support growth and innovation.

These outlays are directly tied to Plexus's strategy of expanding manufacturing capacity and improving technological capabilities. The company's financial planning, including its free cash flow projections, meticulously accounts for these significant capital expenditure requirements.

- Investments in manufacturing facilities and machinery upgrades

- Enhancements to technology infrastructure

- Capital expenditures factored into free cash flow projections

Supply Chain and Logistics Costs

Plexus's cost structure is significantly influenced by its global supply chain and logistics expenses. These include the costs associated with transporting components, finished goods, and managing warehousing facilities across its international network. For instance, in 2024, the global logistics market saw continued pressure on freight rates, with ocean freight rates experiencing fluctuations. Efficient management of these moving parts is paramount to controlling overall operational expenditure and maintaining competitive pricing.

Optimizing the supply chain is a direct lever for cost efficiency at Plexus. This involves strategic decisions about sourcing, inventory levels, and distribution channels to minimize waste and reduce transit times. The company's ability to navigate complex global trade regulations and manage customs also contributes to these logistical costs. In 2024, many companies focused on nearshoring and diversifying their supplier base to mitigate risks and potentially reduce transportation costs, a trend Plexus likely also considered.

- Transportation: Costs for moving materials and products globally, influenced by fuel prices and carrier availability.

- Warehousing: Expenses for storing inventory in strategically located facilities worldwide.

- Inventory Holding Costs: The cost of capital tied up in inventory, plus expenses for insurance, security, and potential obsolescence.

- Supply Chain Management Technology: Investment in systems for tracking, planning, and optimizing the flow of goods.

Plexus's cost structure is dominated by direct manufacturing costs, including raw materials and specialized components, alongside significant investments in R&D to maintain technological leadership. Operating expenses, primarily SG&A, are managed to ensure robust operating margins, as demonstrated by their Q1 2024 gross margin of 25.1%.

Capital expenditures for facility upgrades and technology are substantial, impacting free cash flow projections, while global supply chain and logistics costs, including transportation and warehousing, are actively optimized for efficiency. In 2024, Plexus continued to focus on inventory reduction, improving cash flow and reducing carrying costs.

| Cost Category | Description | 2024 Focus/Impact |

|---|---|---|

| Direct Manufacturing Costs | Raw materials, specialized electronic components, skilled labor wages. | Investment in advanced materials and components; inventory reduction efforts improved cash flow. |

| Operating Expenses (SG&A) | Salaries, sales & marketing, administrative overhead. | Focus on efficiency for robust operating margins; Q1 2024 gross margin was 25.1%. |

| Research & Development (R&D) | Engineering talent, prototyping, new technology acquisition. | Critical for maintaining competitive edge and innovation in complex product design. |

| Capital Expenditures | Property, plant, equipment, facility expansion, technology infrastructure. | Essential for expanding capacity and technological capabilities; factored into free cash flow. |

| Supply Chain & Logistics | Global transportation, warehousing, inventory holding, management technology. | Optimized for cost efficiency; navigating global trade regulations and considering nearshoring trends. |

Revenue Streams

Plexus generates its primary revenue by offering extensive manufacturing and assembly services for electronic products. This core business focuses on producing items that are intricate and often manufactured in mid-to-low volumes, catering to diverse sectors.

The company's manufacturing program wins are a crucial driver for this revenue stream. For instance, in fiscal year 2023, Plexus secured significant new program wins, contributing to a robust order backlog and future revenue generation.

Plexus generates revenue through fees for its design and engineering services. This encompasses helping clients transform initial product ideas into tangible realities and refining existing product designs for better performance or cost-efficiency.

These design and development services are a fundamental component of Plexus's overall product realization solutions, directly contributing to their financial performance. For instance, in the fiscal year 2023, Plexus reported total revenue of $4.4 billion, with a significant portion stemming from these value-added engineering and manufacturing services.

Plexus generates revenue through supply chain management fees, encompassing services like procurement, inventory control, and logistics. These fees are directly tied to the value Plexus delivers by enhancing operational efficiency for its clients.

These fees underscore Plexus's role in providing end-to-end supply chain solutions, integrating seamlessly with their broader service portfolio to offer comprehensive support.

Aftermarket and Sustaining Services Revenue

Plexus generates revenue through aftermarket and sustaining services, offering ongoing support, repair, and maintenance for its manufactured products. This creates a predictable, recurring revenue stream and fosters deeper, long-term relationships with customers by ensuring the continued optimal performance of their purchased goods.

The company has experienced notable success in securing wins within the sustaining services sector, highlighting its capability to deliver value beyond the initial product sale. For instance, in fiscal year 2024, Plexus reported a substantial increase in its aftermarket services segment, contributing significantly to its overall financial performance.

- Recurring Revenue: Aftermarket services provide a stable and predictable income source, reducing reliance on new product sales alone.

- Customer Retention: Ongoing support strengthens customer loyalty and reduces churn by ensuring product satisfaction and operational continuity.

- Lifecycle Value: This revenue stream captures value throughout the entire product lifecycle, extending the profitability of each customer relationship.

- FY2024 Performance: Plexus's commitment to sustaining services yielded positive results in fiscal year 2024, demonstrating growth in this critical area.

Program Wins and Project-Based Revenue

A substantial part of Plexus's income comes from securing new program wins and undertaking project-based work with their clients. These often translate into significant, long-term agreements for manufacturing intricate electronic goods.

Plexus regularly announces new manufacturing program awards, indicating a steady flow of business from these key engagements. For instance, in the first quarter of fiscal year 2024, the company reported securing significant new programs, contributing to their overall revenue growth.

- New Program Wins: Plexus actively pursues and wins contracts for the production of complex electronic assemblies and finished products.

- Project-Based Revenue: A notable revenue stream originates from these specific, often multi-year, customer projects.

- Customer Engagements: These wins represent deep partnerships with clients requiring specialized manufacturing capabilities.

- Fiscal Year 2024 Performance: The company consistently highlighted new program wins as a driver of financial results throughout the year.

Plexus derives revenue from design and engineering services, helping clients develop and refine electronic products. This stream also includes supply chain management fees, optimizing logistics and procurement for customers. Furthermore, aftermarket and sustaining services provide recurring income through ongoing support and repairs, fostering long-term client relationships.

| Revenue Stream | Description | FY2023 Revenue (Approx.) | FY2024 Outlook |

|---|---|---|---|

| Manufacturing & Assembly | Producing intricate electronic products, often mid-to-low volume. | $3.8 Billion (estimated from total revenue) | Continued growth driven by new program wins. |

| Design & Engineering | Product development and design optimization services. | $300 Million (estimated) | Expanding service offerings to meet evolving client needs. |

| Supply Chain Management | Procurement, inventory control, and logistics services. | $150 Million (estimated) | Focus on efficiency gains and integrated solutions. |

| Aftermarket & Sustaining Services | Repair, maintenance, and ongoing product support. | $150 Million (estimated) | Significant growth expected due to increased installed base. |

Business Model Canvas Data Sources

The Plexus Business Model Canvas is built upon a foundation of comprehensive market analysis, internal operational data, and validated financial projections. These diverse data sources ensure each component of the canvas is grounded in reality and strategically sound.