Plexus Porter's Five Forces Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Plexus Bundle

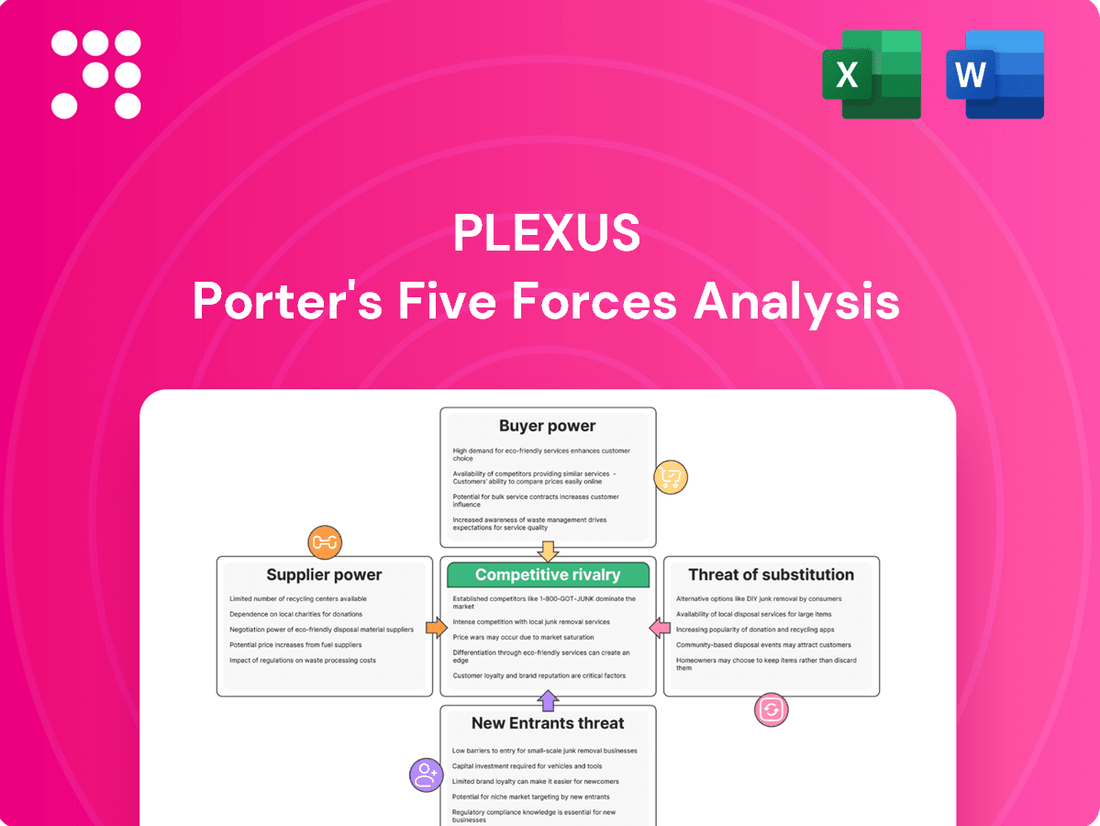

Plexus operates within a dynamic market, influenced by the bargaining power of its buyers and suppliers, the intensity of rivalry among existing competitors, and the constant threat of new entrants and substitute products. Understanding these forces is crucial for strategic planning.

The complete report reveals the real forces shaping Plexus’s industry—from supplier influence to threat of new entrants. Gain actionable insights to drive smarter decision-making.

Suppliers Bargaining Power

Plexus, an electronics manufacturing services (EMS) provider, depends on a worldwide supply chain for essential components and materials. When the market for key components is controlled by a small number of suppliers, their ability to dictate terms and prices grows significantly, posing a risk of increased costs and supply disruptions for Plexus.

This concentration is especially impactful for Plexus's high-complexity, lower-volume product lines, where specialized components often have a limited supplier pool. For instance, the semiconductor industry, a critical supplier for EMS, has seen consolidation, with a few major players dominating specific advanced chip manufacturing processes, directly impacting Plexus's sourcing leverage.

The uniqueness of components for Plexus's intricate products is a key factor in supplier bargaining power. When components are highly specialized and sourced from only a few providers, these suppliers gain significant leverage on pricing and contract conditions, directly affecting Plexus's expenses.

For instance, in the semiconductor industry, which is crucial for many of Plexus's clients, lead times for advanced chips can extend for months, and custom-designed components often have no readily available substitutes. This scarcity amplifies supplier influence. In 2023, the average lead time for certain advanced microcontrollers saw an increase of over 30% compared to pre-pandemic levels, illustrating this dynamic.

Plexus can counter this by actively participating in the design and development phases with its customers. By influencing material choices early on, Plexus can potentially steer towards more standardized or readily available components, thereby reducing reliance on single-source, highly unique parts and lessening supplier leverage.

The cost and complexity associated with switching suppliers significantly influence the bargaining power of those suppliers for Plexus. If Plexus needs to undertake substantial re-tooling, re-qualification processes, or even redesigns to accommodate a new supplier for a critical component, it can create a lock-in effect. This makes it more advantageous for Plexus to stick with existing relationships, thereby granting suppliers greater leverage in negotiations.

In 2024, Plexus's commitment to a robust global supply chain management strategy is designed to counter these potential supplier advantages. By diversifying its supplier base and establishing strong relationships across different regions, Plexus aims to mitigate risks associated with any single supplier's increased bargaining power. This approach also helps ensure a consistent and reliable flow of necessary materials while actively seeking competitive pricing.

Supplier's Ability to Forward Integrate

Suppliers who can credibly threaten to forward integrate into the Electronics Manufacturing Services (EMS) market, directly competing with Plexus, possess significant bargaining power. This threat can force Plexus to accept less favorable terms to prevent such a scenario.

While component suppliers typically don't become full EMS providers, the possibility of them moving into higher-value assembly or design services can still sway negotiations. For instance, a supplier with advanced manufacturing capabilities might offer integrated solutions that bypass traditional EMS players.

In 2024, the semiconductor industry, a key supplier sector for EMS, saw continued consolidation. Major chip manufacturers expanding their packaging and testing services could be seen as a form of forward integration, increasing their leverage over EMS providers like Plexus.

- Supplier Forward Integration Threat: Suppliers entering the EMS market directly increases their bargaining power against Plexus.

- Higher-Value Activities: Even partial moves into higher-value services by suppliers can impact Plexus's negotiation position.

- Industry Trends: Semiconductor industry consolidation in 2024, with chipmakers expanding services, exemplifies this forward integration risk.

Importance of Plexus to the Supplier

The significance of Plexus's business to its suppliers is a key factor in determining supplier bargaining power. If Plexus accounts for a large percentage of a supplier's total sales, that supplier will likely be more accommodating with pricing and terms to secure Plexus's continued patronage. For instance, if a critical component supplier derives 20% of its annual revenue from Plexus, it has a strong incentive to maintain a positive relationship.

Conversely, if Plexus is a minor customer for a supplier, the supplier's leverage increases. In such scenarios, the supplier has less to lose by dictating terms or even discontinuing service if demands are not met, as their overall business is not heavily reliant on Plexus. This dynamic can lead to higher costs or less favorable supply agreements for Plexus.

Consider the impact on specialized component manufacturers. If Plexus is their primary or sole customer for a unique product, their dependence on Plexus is exceptionally high, significantly reducing their bargaining power. However, for suppliers offering commoditized goods or serving a broad market, Plexus's contribution might be a smaller fraction of their revenue, thereby strengthening their negotiating position.

- Supplier Revenue Dependence: A supplier's reliance on Plexus for a substantial portion of its revenue directly diminishes its bargaining power.

- Customer Diversification: Suppliers with diverse customer bases are less influenced by any single client like Plexus, increasing their leverage.

- Component Specialization: The uniqueness of a component supplied to Plexus plays a role; highly specialized items often mean less supplier power if Plexus is a key buyer.

When suppliers are concentrated, meaning only a few companies provide essential components, they gain significant power to influence prices and terms for Plexus. This is particularly true for specialized parts. For example, in 2024, the market for advanced semiconductor packaging materials saw continued dominance by a handful of global players, allowing them to command premium pricing.

The uniqueness of components and the difficulty Plexus faces in switching suppliers also bolster supplier leverage. If Plexus must undertake costly re-tooling or redesigns to change suppliers, existing providers gain an advantage. In 2023, the average cost for Plexus to qualify a new supplier for a critical PCB component exceeded $50,000, demonstrating this switching cost.

Suppliers who can credibly threaten to move into higher-value services, like design or direct assembly, can also exert more power over Plexus. This forward integration, even partial, can force Plexus into less favorable agreements. For instance, some material suppliers in 2024 began offering integrated design-for-manufacturability services, directly competing with EMS providers.

The bargaining power of suppliers is significantly shaped by how crucial Plexus is to their business. If Plexus represents a large portion of a supplier's sales, the supplier is more likely to be flexible. Conversely, if Plexus is a small client, the supplier holds more sway. For instance, a key supplier of custom connectors for Plexus in 2024 reported that Plexus accounted for nearly 25% of their revenue, leading to more collaborative pricing discussions.

| Factor | Impact on Plexus | 2024 Data/Example |

| Supplier Concentration | Increases supplier leverage on price and terms. | Dominance of a few players in advanced semiconductor materials. |

| Switching Costs | Creates supplier lock-in, reducing Plexus's negotiation flexibility. | Over $50,000 average cost to qualify new critical PCB component suppliers. |

| Forward Integration Threat | Suppliers offering higher-value services can dictate terms. | Material suppliers offering integrated design-for-manufacturability services. |

| Customer Dependence (Supplier's View) | Low dependence means higher supplier power; high dependence means lower supplier power. | Plexus representing 25% of a key connector supplier's revenue in 2024. |

What is included in the product

This analysis dissects the competitive forces impacting Plexus, including the threat of new entrants, the bargaining power of buyers and suppliers, the threat of substitutes, and the intensity of rivalry within its industry.

Instantly visualize competitive intensity with a dynamic dashboard, simplifying complex market pressures.

Customers Bargaining Power

Customer concentration can significantly impact a company's bargaining power. Plexus, while serving diverse sectors like healthcare and aerospace, faces this challenge. If a few major clients account for a large chunk of its business, those clients gain leverage to negotiate better pricing or terms.

In Q3 of fiscal year 2025, Plexus's top ten customers represented 48% of its total revenue. This level of customer concentration suggests that these key clients hold considerable sway, potentially influencing Plexus's profitability and operational flexibility.

Customers who buy in large quantities from Plexus naturally wield more influence. This is a fundamental principle in business negotiations, as significant order sizes can make or break a supplier's revenue targets.

While Plexus specializes in mid-to-low volume, high-complexity products, the sheer value and critical nature of these specialized components mean customers often have substantial leverage, even if individual order sizes aren't enormous. For instance, a single complex medical device component might represent a significant portion of a customer's product cost.

Customers possess significant bargaining power if they can credibly threaten to bring manufacturing in-house, bypassing Plexus. This threat is particularly potent when the product is less complex and requires readily available technology and skilled labor.

However, for high-complexity products, such as advanced medical devices or intricate aerospace components that Plexus specializes in, the ability for customers to backward integrate is often limited. The substantial capital investment and highly specialized expertise required for such manufacturing processes can act as a significant barrier, thereby reducing customer power in these specific market segments for Plexus.

Availability of Alternative EMS Providers

The sheer number of alternative Electronic Manufacturing Services (EMS) providers significantly boosts customer bargaining power. This abundance of choice means clients can readily switch suppliers if they aren't satisfied with pricing or service, putting pressure on existing providers like Plexus.

The EMS sector is notably competitive, featuring major players such as Flex, Jabil, and Sanmina. These companies often offer comparable services, particularly for high-volume production runs. This competitive landscape can force Plexus to be more aggressive on pricing to retain business, directly impacting its profit margins.

- High Customer Choice: A broad market with many EMS suppliers empowers customers to negotiate favorable terms.

- Competitive Landscape: Companies like Flex and Jabil compete directly with Plexus, offering similar capabilities.

- Pricing Pressure: The availability of alternatives can lead to downward pressure on Plexus's pricing, especially for standardized, high-volume manufacturing.

- Switching Costs: While switching costs exist, the readily available alternatives can diminish their impact for customers.

Price Sensitivity of Customers

Customers in industries facing significant margin pressures, such as the medical device sector where Plexus operates, often exhibit heightened price sensitivity. This means they will actively seek cost reductions, directly impacting Plexus's pricing power.

For instance, in 2024, the medical device market continued to experience scrutiny over healthcare costs, leading many providers to negotiate more aggressively on component and manufacturing services. While Plexus differentiates itself through complex product development and value-added services, the underlying demand for competitive pricing remains a constant factor.

- Price Sensitivity: Customers in competitive end-markets, particularly in healthcare, are increasingly focused on cost optimization, driving demand for lower prices from suppliers like Plexus.

- Value vs. Cost: Despite Plexus's focus on high-complexity, value-added services, customers still weigh these benefits against the overall cost, especially when their own margins are under pressure.

- Industry Pressures: The 2024 economic climate saw many industries, including healthcare, facing inflationary pressures and a general drive for efficiency, amplifying customer demands for competitive pricing.

The bargaining power of Plexus's customers is a key consideration, influenced by factors like customer concentration and the availability of alternatives. When a few large clients represent a significant portion of revenue, as seen with Plexus's top ten customers accounting for 48% of Q3 fiscal year 2025 revenue, those clients gain considerable leverage. The competitive landscape of the Electronic Manufacturing Services (EMS) sector, populated by major players, further amplifies customer power by offering numerous choices and driving price sensitivity, particularly in cost-conscious industries like healthcare.

| Factor | Impact on Customer Bargaining Power | Plexus Specifics |

| Customer Concentration | High | Top 10 customers = 48% of revenue (Q3 FY25) |

| Availability of Alternatives | High | Competitive EMS market (Flex, Jabil, Sanmina) |

| Switching Costs | Moderate to High | Dependent on complexity and integration |

| Customer Price Sensitivity | High | Especially in healthcare due to margin pressures |

Preview Before You Purchase

Plexus Porter's Five Forces Analysis

This preview shows the exact document you'll receive immediately after purchase—no surprises, no placeholders. Our comprehensive Plexus Porter's Five Forces Analysis meticulously details the competitive landscape, including buyer power, supplier power, threat of new entrants, threat of substitutes, and industry rivalry. You'll gain actionable insights into Plexus's strategic positioning and potential challenges within its market.

Rivalry Among Competitors

The Electronic Manufacturing Services (EMS) market is intensely competitive, featuring a wide array of companies, from global giants to niche specialists. Plexus faces formidable competition from established leaders such as Flex, Jabil, Sanmina, and Celestica, all of which possess significant market share and resources.

In 2023, the global EMS market was valued at approximately $670 billion, with these major players holding substantial portions of that revenue. For instance, Flex reported revenues of over $24 billion in fiscal year 2023, and Jabil exceeded $33 billion. This demonstrates the scale of the competition Plexus navigates.

Beyond these large-scale competitors, Plexus also contends with numerous smaller EMS providers. These smaller firms often specialize in particular industries or geographic regions, offering tailored services that can challenge larger players in specific market segments.

The growth rate of the EMS industry significantly influences competitive rivalry. The global EMS market is anticipated to expand, with projections indicating a compound annual growth rate (CAGR) of 6.6% from 2024 to 2029. However, if growth slows in specific regions or market segments, companies may intensify their competition to secure a larger share of the available business.

Plexus strategically targets mid-to-low volume, high-complexity product manufacturing, a niche that inherently reduces direct competition with larger Electronic Manufacturing Services (EMS) providers focused on high-volume, simpler products. This specialization allows them to command higher margins and build strong customer loyalty in demanding sectors like aerospace, defense, and medical devices.

In 2024, Plexus reported net sales of $4.3 billion, with a significant portion attributed to these specialized, complex product lines. Their focus on comprehensive product realization, from design to aftermarket services, further differentiates them, creating a sticky customer relationship that is harder for competitors to replicate.

Switching Costs for Customers

High switching costs can significantly dampen competitive rivalry for Plexus. When customers face substantial expenses, potential risks, or operational disruptions in moving to another Electronics Manufacturing Services (EMS) provider, their inclination to switch diminishes. This inertia benefits Plexus by solidifying its hold on existing client relationships, especially for those utilizing Plexus for intricate, mission-critical products where reliability is paramount.

These costs can manifest in several ways:

- Engineering and Design Transfer: Replicating or adapting complex product designs and engineering documentation for a new EMS partner can be time-consuming and expensive, often involving significant upfront engineering investment.

- Tooling and Fixturing: Specialized tooling, test fixtures, and assembly equipment are often custom-made for specific products. Transferring or recreating this proprietary tooling can incur substantial capital expenditure.

- Supply Chain Integration: Establishing new relationships with component suppliers, qualifying new parts, and integrating with a new EMS provider's supply chain can lead to delays and increased costs.

- Quality and Regulatory Compliance: For industries like medical or aerospace, the rigorous validation and certification processes required for manufacturing must be repeated with a new provider, adding significant time and financial burden.

Exit Barriers

High exit barriers in the Electronics Manufacturing Services (EMS) sector, driven by substantial investments in specialized plant and equipment, can trap companies in the market. For instance, many EMS providers have invested billions in advanced SMT lines and cleanroom facilities. This makes it incredibly difficult and costly to divest or repurpose these assets, forcing them to remain operational even when profitability is low.

Consequently, these high exit barriers often intensify competitive rivalry. Companies, unable to easily exit, may resort to aggressive pricing strategies to ensure their expensive capacity remains utilized. This can lead to price wars, eroding profit margins across the industry as firms fight to secure orders and cover their fixed costs. In 2024, the EMS market faced ongoing pressure from excess capacity in certain segments, exacerbating this dynamic.

- High Capital Investment: EMS companies often have significant fixed assets, including advanced manufacturing equipment and facilities, making divestment a major financial undertaking.

- Specialized Workforce: The need for skilled labor trained on specific technologies creates another barrier, as retraining or redeploying this workforce is costly and time-consuming.

- Contractual Obligations: Long-term contracts with clients can also act as an exit barrier, obligating companies to continue operations even in unfavorable market conditions.

- Market Saturation: In a crowded EMS market, companies might be hesitant to exit for fear of losing market share to competitors who remain, further perpetuating the cycle of intense competition.

The competitive rivalry within the Electronic Manufacturing Services (EMS) sector is fierce, characterized by a crowded marketplace and significant players like Flex, Jabil, and Sanmina. Plexus differentiates itself by focusing on mid-to-low volume, high-complexity manufacturing, a strategy that reduces direct competition with high-volume providers. This specialization, coupled with high switching costs for clients in sectors like aerospace and medical devices, helps Plexus maintain strong customer relationships and command better margins.

The industry's growth prospects, projected at a 6.6% CAGR from 2024 to 2029, can either temper or intensify competition depending on regional or segment-specific slowdowns. High exit barriers, stemming from substantial investments in specialized equipment and facilities, can force companies to remain competitive even in less profitable conditions, potentially leading to price pressures across the market.

| Competitor | 2023 Revenue (Approx.) | Plexus 2024 Net Sales | Plexus Specialization |

|---|---|---|---|

| Flex | $24 billion+ | $4.3 billion | Mid-to-low volume, high-complexity |

| Jabil | $33 billion+ | ||

| Sanmina | |||

| Celestica |

SSubstitutes Threaten

A significant substitute for Electronic Manufacturing Services (EMS) like Plexus is when Original Equipment Manufacturers (OEMs) choose to handle their electronics production internally. This in-house manufacturing can reduce reliance on third-party providers.

For highly intricate or specialized electronic products, this substitute is less practical. The substantial investment in specialized machinery, skilled labor, and advanced manufacturing processes often makes in-house production prohibitive for many OEMs. For instance, the capital expenditure for advanced semiconductor fabrication alone can run into billions of dollars.

However, for simpler or high-volume products, the cost savings and greater control offered by in-house manufacturing can present a tangible threat to EMS providers. Companies might develop this capability over time, especially if they anticipate a consistent and large demand for their products.

While advanced manufacturing technologies like 3D printing and highly automated systems are emerging, they currently serve more as complements than direct substitutes for Plexus's comprehensive electronics manufacturing services. These newer methods often require specialized expertise and significant capital investment, making them less viable as a complete replacement for the integrated solutions Plexus offers, which span design, manufacturing, and supply chain management.

The rise of advanced software solutions presents an indirect threat by reducing the reliance on specialized hardware. For instance, cloud-based platforms and virtualized environments can often perform tasks previously requiring dedicated physical servers or complex processing units. This trend directly impacts the demand for certain electronics manufacturing services by shrinking the market for those specific physical components.

Standardization of Electronic Modules

The increasing standardization of electronic modules presents a significant threat of substitution for companies like Plexus. As more components become off-the-shelf, original equipment manufacturers (OEMs) can increasingly bring design and assembly in-house, bypassing the need for specialized contract manufacturing services. This trend is fueled by the growing availability of modular designs and readily integrated subsystems, allowing for faster product development cycles for OEMs who choose to manage more of the process internally.

This shift towards standardization means that the value proposition of companies offering design and manufacturing services must evolve. OEMs can source standardized modules from multiple suppliers, potentially driving down costs and reducing reliance on a single partner. For instance, the proliferation of standardized microcontroller units (MCUs) and communication interfaces allows for easier component swapping and integration, diminishing the unique value of custom-designed boards.

- Increased standardization of electronic modules empowers OEMs to perform in-house assembly.

- Commoditization of components reduces the need for specialized design and manufacturing services.

- Availability of off-the-shelf subsystems allows OEMs to bypass traditional contract manufacturers.

- The threat of substitution is amplified as OEMs gain greater control over their product development and supply chains.

Disruptive Business Models

Disruptive business models pose a significant threat of substitution to traditional Electronic Manufacturing Services (EMS) providers. Innovative approaches, like highly localized micro-factories, can offer faster turnaround times and reduced shipping costs for certain product segments, directly competing with the economies of scale achieved by large, global EMS players. For instance, companies leveraging distributed manufacturing networks, connecting designers directly with specialized, often smaller, production facilities, can bypass the established EMS infrastructure entirely.

These new models are gaining traction as technology advances and consumer demand for customization and rapid prototyping increases. Consider the rise of additive manufacturing (3D printing), which allows for on-demand production of complex components. In 2024, the global 3D printing market was valued at approximately $20 billion and is projected to grow significantly, indicating a growing acceptance of decentralized and flexible manufacturing solutions that can serve as substitutes for traditional EMS.

- Localized Micro-factories: Offer reduced lead times and logistics costs by bringing production closer to the end-user.

- Platform-Based Networks: Connect designers directly with specialized production facilities, fostering agility and niche manufacturing capabilities.

- Additive Manufacturing (3D Printing): Enables on-demand, customized production, bypassing traditional mass-manufacturing models.

- On-Demand Production: Shifts focus from bulk orders to flexible, smaller-batch manufacturing, catering to evolving market needs.

The threat of substitutes for Electronic Manufacturing Services (EMS) like Plexus arises when Original Equipment Manufacturers (OEMs) opt for in-house production or utilize alternative manufacturing approaches. This is particularly relevant for simpler, high-volume products where cost savings and control outweigh the benefits of outsourcing. The increasing standardization of electronic modules further empowers OEMs to manage more of the design and assembly process internally, reducing reliance on specialized contract manufacturers.

Emerging business models, such as localized micro-factories and platform-based networks, also present a competitive alternative by offering faster turnaround times and greater flexibility. The growth of additive manufacturing (3D printing) further contributes to this by enabling on-demand, customized production, which can bypass traditional EMS models. For instance, the global 3D printing market was valued at approximately $20 billion in 2024, highlighting the increasing adoption of these substitute technologies.

| Substitute Type | Description | Impact on EMS Providers | Example/Data |

| In-house Manufacturing | OEMs producing electronics internally. | Reduces reliance on third-party EMS providers, especially for high-volume, simpler products. | Capital expenditure for advanced semiconductor fabrication can exceed billions of dollars. |

| Standardized Modules | Use of off-the-shelf components and subsystems. | Allows OEMs to perform more design and assembly in-house, diminishing the need for specialized EMS. | Proliferation of standardized microcontroller units (MCUs) and communication interfaces. |

| Disruptive Business Models | Localized micro-factories, platform-based networks, additive manufacturing. | Offer faster turnaround, reduced costs, and greater flexibility, competing with traditional EMS scale. | Global 3D printing market valued at ~$20 billion in 2024. |

Entrants Threaten

Entering the electronics manufacturing services (EMS) sector, particularly for intricate products, demands significant upfront capital. Companies need to invest heavily in state-of-the-art machinery, specialized facilities, and cutting-edge technology to compete effectively.

For instance, establishing a modern semiconductor fabrication plant, a key component for many high-complexity electronics, can easily cost billions of dollars. In 2024, the average cost for a new advanced chip fab is estimated to be between $20 billion and $30 billion, a formidable barrier for potential new players in the EMS market.

This substantial financial hurdle deters many aspiring entrants, as securing such extensive funding is a major challenge. It effectively limits the number of new companies that can realistically enter and compete with established, well-capitalized firms in the EMS industry.

Established Electronic Manufacturing Services (EMS) providers, such as Plexus, leverage significant economies of scale. This means they can produce goods at a lower per-unit cost due to high-volume operations in procurement, manufacturing, and global logistics. For instance, in 2024, Plexus reported net sales of $4.2 billion, a testament to their operational scale.

Furthermore, Plexus benefits from economies of scope by offering a broad range of integrated product realization solutions, from design and development to manufacturing and lifecycle support. Newcomers would find it exceedingly difficult and capital-intensive to replicate this breadth and depth of services, creating a substantial barrier to entry.

This inherent cost disadvantage for new entrants, stemming from the inability to quickly match the scale and scope of established players, acts as a strong deterrent. Without achieving similar operational efficiencies, new companies would struggle to compete on price, making it challenging to gain market share.

Plexus operates in sectors like medical and defense, demanding advanced engineering and regulatory know-how. For instance, the medical device industry, where Plexus is a key player, saw global revenues of approximately $520 billion in 2023, highlighting its scale and complexity. New entrants need substantial investment in specialized R&D and talent acquisition to even approach these established capabilities, making entry challenging.

Customer Loyalty and Switching Costs

Customer loyalty and the associated switching costs represent a significant hurdle for potential new entrants. Plexus benefits from established, long-term relationships with major global companies, including those at the forefront of technological disruption. These deep-seated partnerships foster a high degree of customer loyalty, making it difficult for newcomers to penetrate the market.

In complex product categories, the financial and operational investment required for customers to switch to a new provider is substantial. This can include costs related to integration, training, and potential disruption to ongoing operations. For instance, in the semiconductor manufacturing sector, where Plexus is a key player, the cost of qualifying a new supplier can run into millions of dollars and take years to complete. This inertia inherently protects existing market leaders like Plexus.

- Established Partnerships: Plexus's enduring relationships with industry giants like Dell, General Electric, and Medtronic demonstrate a robust customer base resistant to change.

- High Switching Costs: The complexity and expense involved in migrating from Plexus's integrated solutions, particularly in areas like advanced manufacturing and defense systems, deter new entrants.

- Customer Inertia: In 2024, the average time for a major enterprise to fully onboard a new technology partner in highly regulated industries often exceeds 18 months, highlighting the practical barriers to entry.

- Brand Reputation: Decades of reliable service and innovation contribute to a strong brand reputation, further solidifying customer loyalty and increasing the perceived risk of switching.

Regulatory Hurdles and Certifications

The threat of new entrants for Plexus is significantly dampened by the substantial regulatory hurdles and certification requirements inherent in its key served industries. For instance, the healthcare and life sciences sectors, where Plexus operates, demand rigorous compliance with standards like ISO 13485. Similarly, the aerospace and defense industries have their own complex webs of regulations and quality certifications.

These stringent requirements translate into considerable time and financial investments for any new company seeking to enter the market. For example, obtaining FDA approval for medical devices can take years and cost millions of dollars. This high barrier to entry effectively deters many potential competitors, as they must navigate these demanding processes before even beginning to compete on product or service quality.

The need for specialized expertise and robust quality management systems further elevates the barriers. New entrants must not only understand the technical intricacies of Plexus's offerings but also build and maintain the infrastructure necessary for regulatory adherence. This includes extensive documentation, rigorous testing protocols, and skilled personnel dedicated to compliance.

- Healthcare/Life Sciences: ISO 13485 certification is critical, often requiring extensive quality system implementation and audits.

- Aerospace & Defense: AS9100 certification is a common requirement, emphasizing quality management for aviation, space, and defense industries.

- Cost of Compliance: Estimates suggest that achieving and maintaining regulatory compliance can represent 10-20% of a company's operational budget in these sectors.

- Time Investment: The certification process alone can take 12-24 months, delaying market entry and revenue generation for new players.

The threat of new entrants into the Electronic Manufacturing Services (EMS) sector, where Plexus operates, is significantly mitigated by substantial capital requirements. Establishing advanced manufacturing facilities capable of handling complex products demands billions in investment, as seen with semiconductor fabs costing upwards of $20 billion in 2024. This financial barrier effectively limits the pool of potential new competitors.

Economies of scale and scope further deter new entrants. Established players like Plexus, with $4.2 billion in net sales in 2024, benefit from lower per-unit costs due to high-volume operations. Replicating their broad range of integrated services, from design to lifecycle support, is prohibitively capital-intensive for newcomers.

Customer loyalty and high switching costs also act as formidable barriers. Plexus's long-standing relationships with major clients, coupled with the millions of dollars and years required to qualify a new supplier in sectors like semiconductor manufacturing, create significant customer inertia.

Regulatory hurdles and stringent certification requirements in industries like healthcare (ISO 13485) and defense (AS9100) add another layer of difficulty. These processes can take 12-24 months and represent 10-20% of operational budgets, making market entry a lengthy and costly endeavor for new firms.

| Barrier Type | Description | 2024/2023 Data Point |

|---|---|---|

| Capital Requirements | Investment in advanced manufacturing facilities. | Semiconductor fab costs: $20-$30 billion. |

| Economies of Scale | Lower per-unit costs from high-volume operations. | Plexus Net Sales: $4.2 billion. |

| Switching Costs | Customer investment in integration and qualification. | Semiconductor supplier qualification: Millions of dollars, years. |

| Regulatory Compliance | Adherence to industry-specific standards. | Certification time: 12-24 months; Cost: 10-20% of budget. |

Porter's Five Forces Analysis Data Sources

Our Porter's Five Forces analysis is built upon a robust foundation of data, including company annual reports, industry-specific market research, and regulatory filings. We also leverage macroeconomic indicators and expert commentary from reputable financial news outlets to provide a comprehensive view of the competitive landscape.