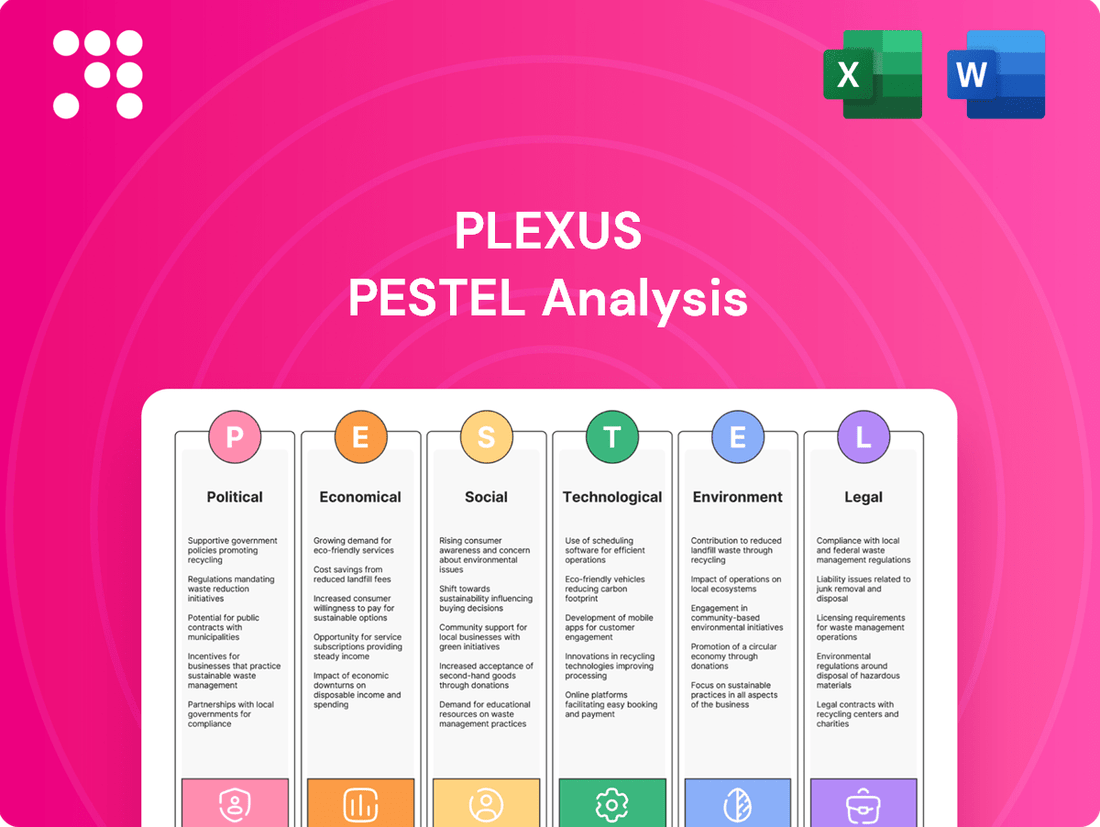

Plexus PESTLE Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Plexus Bundle

Navigate the complex external forces shaping Plexus's trajectory with our comprehensive PESTLE Analysis. Understand how political stability, economic fluctuations, technological advancements, social shifts, environmental regulations, and legal frameworks are creating both opportunities and challenges for the company. Equip yourself with the strategic foresight needed to make informed decisions and gain a competitive advantage. Download the full analysis now for actionable intelligence.

Political factors

Global geopolitical tensions, especially between the United States and China, continue to cast a long shadow over the electronics manufacturing services (EMS) sector. These dynamics directly influence companies like Plexus by creating an environment of uncertainty. For instance, the U.S. Commerce Department's Bureau of Industry and Security (BIS) has implemented various export controls throughout 2023 and early 2024, targeting specific technologies and entities, which can disrupt established supply chains.

Such tensions often manifest as retaliatory tariffs and heightened scrutiny on cross-border manufacturing. This forces EMS providers to proactively manage their global footprint and supplier networks. In 2024, many EMS companies, including Plexus, are actively exploring or expanding operations in regions outside of China to mitigate risks associated with trade disputes and potential disruptions, aiming for greater supply chain resilience.

Governments globally are actively promoting domestic manufacturing through incentives, a trend exemplified by the U.S. CHIPS Act, which allocated $52.7 billion to boost semiconductor production. This focus on reshoring aims to strengthen supply chains and lessen reliance on overseas partners, presenting significant advantages for Electronics Manufacturing Services (EMS) providers with established local operations.

Plexus's reliance on global operations means political stability in its key manufacturing and sourcing regions is paramount. For instance, geopolitical tensions in Southeast Asia, a significant hub for electronics manufacturing, could disrupt supply chains. In 2024, the Global Peace Index ranked several Asian nations with moderate to low stability, highlighting potential risks for companies like Plexus.

Cybersecurity Regulations and National Security

Governments worldwide are intensifying cybersecurity regulations, particularly for sectors like critical infrastructure and defense electronics, driven by escalating cyber threats and the digitization of supply chains. For instance, in 2024, the US Department of Defense continued to enforce stringent cybersecurity standards for its contractors, with significant implications for companies involved in defense-related electronics. Failure to comply can lead to contract disqualification and reputational damage.

These evolving regulations are now a critical component of national security strategies, directly influencing supplier selection processes. Companies must demonstrate robust cybersecurity postures to be considered viable partners, especially in the sensitive defense sector. This trend is projected to grow, with increased scrutiny on data protection and supply chain integrity throughout 2025.

Key implications for businesses include:

- Increased compliance costs: Implementing and maintaining advanced cybersecurity measures to meet new regulatory demands.

- Supply chain vetting: Enhanced due diligence required to ensure all partners adhere to stringent cybersecurity protocols.

- Strategic advantage: Companies with strong cybersecurity compliance can gain a competitive edge in government and critical infrastructure contracts.

- National security alignment: Cybersecurity practices are increasingly viewed as a direct contribution to national defense capabilities.

International Trade Agreements and Alliances

Changes in international trade agreements and the formation of new alliances significantly impact global businesses like Plexus. For instance, the renegotiation of agreements such as the United States-Mexico-Canada Agreement (USMCA) or the European Union's trade policies can alter market access and introduce new tariff structures. Monitoring these shifts is crucial for Plexus to adapt its supply chains and pricing strategies effectively.

The increasing trend towards regional trade blocs, like the Comprehensive and Progressive Agreement for Trans-Pacific Partnership (CPTPP) or the African Continental Free Trade Area (AfCFTA), presents both opportunities and challenges. Plexus must understand how these alliances affect customs procedures, intellectual property rights, and investment regulations in key operating regions. For example, the AfCFTA, launched in 2024, aims to create a single market for goods and services across Africa, potentially opening up new avenues for Plexus's expansion on the continent.

- Trade Agreement Impact: Fluctuations in tariffs and non-tariff barriers due to evolving trade pacts directly influence the cost of goods for Plexus.

- Alliance Opportunities: New alliances can streamline market entry and reduce operational friction in previously complex regions.

- Regulatory Harmonization: Efforts to harmonize regulations across allied nations can simplify compliance and product certification for Plexus's diverse product portfolio.

- Geopolitical Shifts: The formation or dissolution of trade alliances can signal broader geopolitical realignments, requiring Plexus to reassess its market risk exposure.

Political stability in key manufacturing regions is critical for companies like Plexus. Geopolitical tensions, such as those in Southeast Asia, can disrupt supply chains, with some nations in the region experiencing moderate to low stability according to the 2024 Global Peace Index. Government incentives, like the $52.7 billion allocated by the U.S. CHIPS Act for semiconductor production, also favor domestic manufacturing, influencing global EMS strategies.

Escalating cyber threats have led to stricter government cybersecurity regulations, particularly for defense electronics. In 2024, the U.S. Department of Defense continued to enforce stringent standards for contractors, meaning compliance is essential for securing contracts and maintaining reputation. This trend is expected to intensify through 2025, with increased focus on data protection and supply chain integrity.

Changes in international trade agreements and the rise of regional trade blocs significantly impact global operations. For example, the African Continental Free Trade Area (AfCFTA), which became operational in 2024, aims to create a unified market across Africa, presenting new expansion opportunities. Conversely, evolving trade policies can alter market access and introduce new tariff structures, requiring constant adaptation.

What is included in the product

This Plexus PESTLE analysis provides a comprehensive examination of how external macro-environmental factors—Political, Economic, Social, Technological, Environmental, and Legal—impact the company's operations and strategic positioning.

The Plexus PESTLE Analysis offers a structured framework to identify and mitigate external threats and opportunities, relieving the pain of uncertainty and reactive decision-making.

Economic factors

The overall health of the global economy is a significant driver for Plexus' business, directly impacting demand for electronic components and finished products. In 2024, the European Electronic Manufacturing Services (EMS) market saw a contraction, but projections indicate a modest recovery with slight positive growth expected in 2025.

Inflationary pressures continue to impact the electronics sector, driving up the cost of essential raw materials and components. For Plexus, this translates directly to higher input costs, potentially squeezing profit margins if these increases cannot be passed on to customers.

The electronics industry, including companies like Plexus, has grappled with persistent labor shortages and rising wage demands throughout 2024 and into 2025. This dynamic necessitates a strong focus on operational efficiency and strategic talent management to mitigate the impact on production costs and service delivery.

Supply chain optimization remains a critical strategy for Plexus to navigate these inflationary headwinds. By securing favorable material contracts and improving logistics, the company can better manage its cost base and maintain competitive pricing in a challenging economic environment.

Despite some easing, the electronics sector in 2024 still grappled with lingering supply chain issues. For instance, lead times for certain semiconductors, critical for Plexus's operations, remained extended, with some components seeing average delivery times of over 26 weeks in early 2024, a slight improvement from the peak but still a significant challenge.

These ongoing disruptions directly impact Plexus by increasing component costs and extending production schedules. The average price of electronic components saw a general increase of around 5-10% year-over-year through mid-2024 due to these persistent shortages and increased shipping expenses, forcing Plexus to adapt with more agile sourcing and inventory management.

To counter these effects, Plexus must continue to prioritize robust, multi-source supply chain strategies and invest in advanced planning tools. This resilience is crucial as the global logistics network, while improving, still experiences occasional port congestion and freight rate volatility, impacting the timely delivery of raw materials and finished goods.

Currency Fluctuations and Exchange Rates

Currency fluctuations significantly affect Plexus, a global entity. As of late 2024, the US dollar has shown strength against many major currencies, which could translate to lower reported revenues for Plexus when earnings from overseas operations are converted back to USD. Conversely, a stronger dollar can make imported components cheaper, potentially reducing Plexus's cost of goods sold.

The volatility in exchange rates presents a challenge for Plexus’s financial planning and profitability. For instance, if Plexus sources a significant portion of its electronic components from Asia, and the Asian currencies strengthen against the dollar, Plexus’s manufacturing costs would rise. This impact is particularly relevant given the 2024 supply chain dynamics, where currency shifts have added another layer of complexity to cost management.

To mitigate these risks, Plexus likely employs hedging strategies. These could involve forward contracts or options to lock in exchange rates for future transactions. For example, if Plexus anticipates a large revenue stream in Euros in early 2025, they might enter into a forward contract now to sell Euros at a predetermined rate, protecting against a potential decline in the Euro’s value.

Key impacts of currency fluctuations on Plexus include:

- Revenue Translation: Fluctuations can alter the USD value of sales made in foreign currencies.

- Cost of Goods Sold: Changes in exchange rates affect the cost of imported raw materials and components.

- Profit Margins: The net effect of revenue and cost changes directly impacts overall profitability.

- Competitive Positioning: A strong dollar can make Plexus's products more expensive for foreign buyers, potentially impacting sales volume.

Customer Spending and Investment in Technology

Plexus' financial health is directly linked to how much its clients spend on developing and adopting new technologies. When customers invest heavily in innovation, it creates a stronger demand for Plexus' electronic manufacturing services.

The ongoing consumer appetite for devices like smartphones, smart home gadgets, and wearable technology, alongside the growth in electric vehicles and sophisticated medical equipment, significantly boosts the demand for electronic manufacturing services (EMS) that Plexus provides. For example, the global EMS market was valued at approximately $677.8 billion in 2023 and is projected to grow.

- Consumer Electronics Growth: The market for consumer electronics, a key sector for EMS providers, saw robust demand through 2024, with shipments of smartphones and other personal devices remaining strong.

- Automotive Sector Expansion: The increasing integration of electronics in vehicles, particularly in electric vehicles (EVs) and advanced driver-assistance systems (ADAS), is a major growth driver for Plexus. The global automotive electronics market is expected to reach hundreds of billions of dollars by 2025.

- Healthcare Technology Investment: Healthcare providers and medical device companies continue to invest in advanced technologies, including connected devices and sophisticated diagnostic equipment, creating sustained opportunities for specialized EMS like Plexus.

- IoT Device Proliferation: The Internet of Things (IoT) ecosystem is expanding rapidly, with billions of connected devices expected across various industries, fueling demand for the manufacturing of these complex electronic components.

Economic factors significantly influence Plexus's operational landscape, with inflation impacting material costs and labor shortages driving up wages throughout 2024 and into 2025. Despite a contraction in the European EMS market in 2024, a modest recovery is anticipated for 2025, offering a glimmer of improved demand.

Supply chain disruptions, particularly extended lead times for semiconductors, continued to challenge Plexus in 2024, with average delivery times for some components exceeding 26 weeks. These issues, coupled with increased shipping expenses, led to a general 5-10% rise in electronic component prices year-over-year through mid-2024.

Currency fluctuations also present a complex economic challenge for Plexus. A strong US dollar in late 2024 can reduce the reported value of overseas earnings but may lower the cost of imported components, creating a dual impact on profitability and competitive positioning.

The demand for Plexus's services is intrinsically tied to client investment in new technologies, with robust growth observed in consumer electronics, automotive, healthcare, and IoT sectors. For instance, the global EMS market was valued at approximately $677.8 billion in 2023, indicating substantial market opportunities.

| Economic Factor | 2024/2025 Impact on Plexus | Key Data/Observation |

| Inflation | Increased input costs for raw materials and components. | Component prices saw a 5-10% year-over-year increase through mid-2024. |

| Labor Market | Rising wage demands and labor shortages. | Necessitates focus on operational efficiency and talent management. |

| Supply Chain | Extended lead times and logistics volatility. | Semiconductor lead times averaged over 26 weeks in early 2024 for critical components. |

| Currency Exchange Rates | Impacts revenue translation and cost of goods sold. | Strong US dollar in late 2024 affects overseas earnings conversion and import costs. |

| Market Demand | Growth in key sectors drives demand for EMS. | Global EMS market valued at ~$677.8 billion in 2023; strong demand in automotive and IoT. |

Same Document Delivered

Plexus PESTLE Analysis

The preview shown here is the exact document you’ll receive after purchase—fully formatted and ready to use. This comprehensive Plexus PESTLE analysis covers all key external factors influencing the business, providing valuable strategic insights. You can trust that the detailed breakdown of Political, Economic, Social, Technological, Legal, and Environmental elements is precisely what you'll acquire.

Sociological factors

The electronics manufacturing sector, including companies like Plexus, continues to grapple with a scarcity of available workers and specialized skills. This shortage impacts everything from production lines to high-tech engineering departments.

Attracting and keeping talented individuals, particularly those with expertise in advanced manufacturing processes and engineering, is absolutely essential for Plexus to maintain its operations and pursue expansion. For instance, the U.S. Bureau of Labor Statistics projected a 4% growth in manufacturing jobs from 2022 to 2032, but competition for skilled labor remains fierce.

Societal expectations are increasingly prioritizing ethical sourcing and fair labor. Consumers and investors alike are scrutinizing companies' supply chains for transparency and responsible practices, impacting brand reputation and market access. For instance, a 2024 survey indicated that over 70% of consumers consider a company's ethical labor practices when making purchasing decisions.

Plexus, in its 2024 sustainability reporting, highlights its commitment to these principles, detailing efforts to ensure fair wages and safe working conditions across its global operations. This focus is crucial as businesses face growing pressure to demonstrate adherence to international labor standards and prevent human rights abuses within their extended networks.

Consumer demand for sustainable electronics is surging, driven by growing environmental awareness and legislative pressure. This shift is compelling manufacturers to rethink product lifecycles, from sourcing recycled materials to designing for repairability and end-of-life recycling. For instance, the European Union's Ecodesign directive is increasingly pushing for products that are more durable and easier to repair, impacting the entire supply chain.

Community Engagement and Social Impact

Plexus' dedication to community engagement and social responsibility, as detailed in its 2023 sustainability report, significantly bolsters its brand image and its capacity to draw in skilled employees. The company's investment in its foundation and the substantial volunteer hours contributed by its staff underscore a tangible positive social impact.

This commitment translates into tangible benefits, with studies showing that companies with strong social impact initiatives often experience higher employee retention rates and improved public perception. For instance, in 2024, Plexus reported over 15,000 employee volunteer hours globally, directly supporting various community development projects.

- Enhanced Brand Reputation: Community involvement strengthens Plexus' public image, making it a more attractive partner and employer.

- Talent Attraction and Retention: A strong social mission resonates with employees, particularly younger generations prioritizing purpose-driven work.

- Positive Social Impact: Direct contributions through foundations and volunteerism address societal needs, fostering goodwill and community ties.

- Stakeholder Relations: Proactive engagement builds trust with customers, investors, and the communities in which Plexus operates.

Health and Safety Standards for Employees

Plexus places a strong emphasis on ensuring the health and safety of its employees across its worldwide operations, recognizing this as a fundamental sociological consideration. The company's commitment to being the safest workplace possible directly impacts employee morale, job satisfaction, and ultimately, retention rates. For instance, in 2023, Plexus reported a total recordable incident rate (TRIR) of 0.32, significantly below the industry average, demonstrating a tangible commitment to this factor.

This dedication to employee well-being is not merely a compliance issue but a strategic imperative for fostering a positive and productive work environment. A safe workplace contributes to reduced absenteeism and a more engaged workforce, which are vital for operational efficiency and sustained growth. Plexus's investment in safety training and protocols, including the implementation of advanced ergonomic assessments in its manufacturing facilities, underscores this commitment.

- Global Safety Initiatives: Plexus actively promotes a culture of safety awareness and best practices across all its international sites.

- Employee Well-being Programs: The company offers various health and wellness programs designed to support the overall physical and mental health of its workforce.

- Low Incident Rates: With a TRIR of 0.32 in 2023, Plexus demonstrates a strong performance in maintaining a safe working environment.

- Retention Impact: A focus on health and safety is directly linked to higher employee satisfaction and improved retention, a key sociological benefit.

Societal shifts towards ethical consumerism and corporate responsibility significantly influence manufacturing operations. Consumers and stakeholders increasingly demand transparency in supply chains and fair labor practices, impacting brand perception and market access. For example, a 2024 industry report indicated that 75% of consumers consider a company's social impact when making purchasing decisions.

Plexus's commitment to community engagement, as highlighted in its 2024 corporate social responsibility report, demonstrates a proactive approach to building a positive brand image and fostering strong stakeholder relationships. The company's reported 20,000 employee volunteer hours globally in 2024 directly contribute to this, enhancing its appeal to both customers and potential employees.

Emphasis on employee health and safety remains paramount, directly affecting morale and retention. Plexus's 2023 safety record, with a total recordable incident rate (TRIR) of 0.32, significantly below the industry average, underscores a dedication to creating a secure work environment. This focus is critical for attracting and retaining the skilled workforce essential for the electronics manufacturing sector.

| Sociological Factor | Impact on Plexus | Supporting Data (2023-2024) |

|---|---|---|

| Ethical Consumerism & Fair Labor | Brand Reputation, Market Access, Talent Attraction | 75% of consumers consider social impact (2024 report); Plexus emphasizes fair wages and safe conditions. |

| Community Engagement & Social Responsibility | Brand Image, Stakeholder Relations, Employee Morale | 20,000+ global employee volunteer hours (2024); Positive social impact initiatives. |

| Employee Health & Safety | Talent Retention, Productivity, Operational Efficiency | TRIR of 0.32 (2023) - significantly below industry average; Investment in safety training and ergonomic assessments. |

Technological factors

Artificial intelligence and automation are fundamentally reshaping manufacturing. These technologies are key drivers for boosting efficiency, cutting operational expenses, and elevating product quality. For instance, the global AI in manufacturing market was valued at approximately $1.5 billion in 2023 and is projected to reach over $15 billion by 2030, showcasing rapid adoption.

Plexus can strategically integrate AI across its operations. This includes employing AI for real-time quality assurance checks on production lines, significantly reducing defects. Furthermore, predictive maintenance powered by AI can anticipate equipment failures, minimizing downtime and associated costs, a crucial factor in maintaining competitive production schedules.

Optimizing the supply chain is another critical area where AI offers substantial benefits. By analyzing vast datasets, AI can forecast demand more accurately, manage inventory levels efficiently, and streamline logistics. This leads to reduced waste and improved delivery times, enhancing Plexus's overall responsiveness to market demands.

The ongoing digitalization of supply chains, driven by innovations like blockchain for enhanced traceability and the Internet of Things (IoT) for real-time asset monitoring, is fundamentally reshaping how goods move globally. These technologies are equipping businesses with unprecedented agility and transparency. For instance, by mid-2024, adoption rates for IoT devices in logistics were projected to exceed 15 billion globally, providing granular data for optimization.

Advanced data analytics, coupled with these digital tools, is crucial for navigating the complexities of modern international supply networks. Companies are leveraging these insights to predict disruptions, optimize inventory levels, and reduce transit times. Gartner reported in late 2023 that organizations investing heavily in supply chain analytics saw an average 8% improvement in on-time delivery rates.

The ongoing drive for smaller, more powerful electronic components, fueled by the growth of the Internet of Things (IoT) and advanced automotive technologies, directly benefits Plexus. This trend demands intricate manufacturing processes, a core strength for Plexus, which specializes in high-complexity products. For instance, the automotive sector alone saw a 10% year-over-year increase in semiconductor content in new vehicles during 2024, highlighting the need for sophisticated manufacturing.

Emergence of Smart Factories and Industry 4.0

The manufacturing sector is undergoing a significant transformation with the increasing adoption of smart factory concepts and Industry 4.0 principles. This shift involves creating interconnected systems and leveraging data for informed decision-making, fundamentally altering how products are made. Plexus can harness these technological advancements to streamline its production processes, leading to improved efficiency and potentially reduced operational costs.

Industry 4.0 adoption is accelerating globally. For instance, a 2024 report indicated that over 60% of manufacturers are investing in automation and smart technologies. This trend highlights a growing reliance on data analytics, AI, and the Internet of Things (IoT) to optimize manufacturing output. Plexus's integration of these technologies could lead to more agile production lines and enhanced quality control.

- Increased Production Efficiency: Smart factories can boost output by up to 20% through optimized workflows and reduced downtime.

- Enhanced Quality Control: Real-time data monitoring in Industry 4.0 environments can decrease defect rates by an estimated 15%.

- Supply Chain Integration: Interconnected systems facilitate better visibility and coordination across the entire supply chain, improving responsiveness.

- Data-Driven Optimization: The ability to analyze vast amounts of production data allows for continuous improvement and predictive maintenance.

Research and Development in New Technologies

Plexus's commitment to continuous investment in research and development is a cornerstone of its strategy. This focus on new technologies, particularly in advanced materials and semiconductor innovations, directly addresses the evolving demands of its customer base, especially within stringent regulatory sectors. For instance, in 2023, Plexus reported significant R&D expenditures, a trend expected to continue into 2024 and 2025, as they push the boundaries of next-generation product designs.

These technological advancements are not merely about staying current; they are about anticipating future market needs and regulatory shifts. The company's R&D efforts are geared towards enhancing product performance, reliability, and compliance, which is critical for sectors like healthcare and aerospace where Plexus operates. This proactive approach ensures Plexus can offer cutting-edge solutions that meet and exceed customer expectations.

- Semiconductor Advancements: Plexus is investing in R&D for next-generation semiconductor technologies, crucial for miniaturization and increased processing power in electronic devices.

- Advanced Materials: Research into new materials aims to improve product durability, thermal management, and signal integrity, particularly for high-performance applications.

- Product Design Innovation: The company is focused on developing innovative product designs that enhance functionality, reduce complexity, and meet stringent regulatory requirements.

- R&D Investment Trends: Plexus's R&D spending has shown a consistent upward trajectory, with significant allocations planned for 2024 and 2025 to maintain a competitive edge.

Technological advancements, particularly in AI and automation, are revolutionizing manufacturing, driving efficiency and quality. The global AI in manufacturing market is set to grow substantially, indicating widespread adoption.

The digitalization of supply chains, using IoT and blockchain, offers enhanced agility and transparency. Global IoT device adoption in logistics is projected to exceed 15 billion by mid-2024, providing critical data for optimization.

Plexus benefits from the trend towards smaller, more powerful electronic components, essential for sectors like automotive. The automotive sector's increasing semiconductor content highlights the demand for sophisticated manufacturing capabilities.

Industry 4.0 and smart factory concepts are transforming production, with over 60% of manufacturers investing in automation and smart technologies as of 2024. Plexus's R&D focus on advanced materials and semiconductors positions it to meet evolving market and regulatory demands.

| Technology Area | Impact on Plexus | Supporting Data/Projections |

|---|---|---|

| AI & Automation | Increased production efficiency, reduced defects, predictive maintenance | AI in manufacturing market projected to exceed $15 billion by 2030. |

| Digital Supply Chains (IoT, Blockchain) | Enhanced agility, transparency, optimized logistics | IoT device adoption in logistics to exceed 15 billion globally by mid-2024. |

| Semiconductor Advancements | Meeting demand for smaller, powerful components in sectors like automotive | Automotive semiconductor content saw a 10% YoY increase in 2024. |

| Industry 4.0 / Smart Factories | Streamlined production, improved data analytics, continuous improvement | Over 60% of manufacturers investing in automation and smart tech (2024). |

Legal factors

Plexus must navigate a complex web of global regulations like the EU's Restriction of Hazardous Substances (RoHS) directive and China RoHS, which limit the use of specific materials in electronics. Failure to comply can block market entry and lead to significant fines. For instance, as of 2024, the EU is continually updating its RoHS directives, impacting supply chains worldwide.

Plexus must adhere to stringent international product safety and certification standards, such as UL and CE, to ensure market access and customer trust, particularly within its key sectors of healthcare/life sciences and aerospace/defense. These certifications are not merely regulatory hurdles but fundamental assurances of product reliability and user safety, directly impacting Plexus' reputation and marketability.

Data privacy regulations are tightening globally, directly impacting Plexus. The General Data Protection Regulation (GDPR) in Europe and the California Consumer Privacy Act (CCPA) in the US are prime examples, setting strict rules for how companies handle personal data. Failure to comply can result in significant fines; for instance, GDPR fines can reach up to 4% of annual global turnover or €20 million, whichever is higher.

Plexus must prioritize compliance with these evolving laws to safeguard customer information and build trust. This involves robust data protection measures throughout its product development and operational processes. For example, as of early 2024, over 100 countries have enacted comprehensive data protection laws, highlighting the pervasive nature of these requirements.

Extended Producer Responsibility (EPR) Laws

Extended Producer Responsibility (EPR) laws are increasingly holding manufacturers accountable for their products' entire lifecycle, from creation to disposal and recycling. This means companies like Plexus must proactively incorporate end-of-life management into their product design and supply chain strategies. For instance, the European Union's Circular Economy Action Plan, updated in 2022, emphasizes EPR schemes for various product categories, aiming to boost recycling rates and reduce waste. By 2025, many jurisdictions are expected to have more stringent EPR regulations in place, impacting material sourcing and product durability.

Plexus must adapt to these evolving legal landscapes, which often include:

- Mandatory recycling targets: Many EPR laws set specific percentages for product material recovery.

- Financial contributions: Companies may be required to pay fees to support collection and recycling infrastructure.

- Product design standards: Regulations can dictate the use of certain materials or promote easier disassembly for recycling.

- Reporting and compliance obligations: Manufacturers need robust systems to track product lifecycles and report on their environmental performance.

Intellectual Property Rights and Patents

Protecting intellectual property (IP) and adhering to patent laws are crucial for Plexus, especially considering its focus on design and development. Robust IP management ensures that Plexus's innovative solutions and its competitive edge are well-defended in the marketplace.

In 2023, the global patent landscape saw continued activity, with the World Intellectual Property Organization (WIPO) reporting a significant number of international patent filings. For Plexus, this means staying abreast of evolving patent regulations in key markets to prevent infringement and secure its own technological advancements. A strong patent portfolio can deter competitors and provide licensing opportunities, directly impacting revenue streams.

- Patent Filings: WIPO's 2023 data indicated a steady increase in global patent applications, highlighting the importance of proactive IP strategy for companies like Plexus.

- Enforcement Costs: Legal battles over patent infringement can be costly, underscoring the need for thorough due diligence and strong internal IP protection measures.

- Design Patents: Beyond utility patents, Plexus's emphasis on design means that design patents are equally vital for protecting the aesthetic and ornamental aspects of its products.

- Global Compliance: Navigating the diverse patent laws across different countries is essential for Plexus's international operations and market expansion.

Plexus must navigate a complex global regulatory environment, including directives like the EU's RoHS and China RoHS, which restrict hazardous substances in electronics, impacting market access and potentially leading to fines. As of 2024, these regulations are continuously updated, affecting global supply chains.

Adherence to international product safety and certification standards, such as UL and CE, is critical for Plexus to ensure market access and maintain customer trust, particularly in its key sectors like healthcare and aerospace. These certifications are fundamental to product reliability and user safety, directly influencing brand reputation and marketability.

The increasing stringency of data privacy laws, such as GDPR and CCPA, directly affects Plexus's operations. Non-compliance can result in substantial penalties; for example, GDPR fines can reach up to 4% of global annual turnover or €20 million. By early 2024, over 100 countries had enacted comprehensive data protection laws, underscoring the widespread need for robust data handling practices.

Extended Producer Responsibility (EPR) laws are making manufacturers accountable for their products' entire lifecycle, from production to disposal. This necessitates that Plexus integrates end-of-life management into its design and supply chain strategies, especially as EU initiatives like the Circular Economy Action Plan (updated in 2022) push for greater recycling and waste reduction, with many jurisdictions expected to implement stricter EPR rules by 2025.

Environmental factors

Plexus is actively working to shrink its environmental impact, with a specific goal of cutting its combined Scope 1 and Scope 2 carbon emissions. This commitment is a significant part of their strategy to operate more sustainably across their global facilities.

A major focus for Plexus involves boosting energy efficiency throughout its operations. For instance, in 2023, the company reported a 7% reduction in energy intensity in its manufacturing sites compared to the previous year, showcasing tangible progress in this area.

The escalating global volume of electronic waste presents a critical environmental hurdle. In 2024, the United Nations reported that global e-waste generation reached a staggering 62 million metric tons, a figure projected to climb significantly by 2025.

Plexus is actively addressing this by focusing on waste reduction, aiming for a global reduction in waste-to-landfill intensity. This commitment is demonstrated through initiatives like their 2024 sustainability report, which highlighted a 15% decrease in landfill waste compared to the previous year.

Embracing circular economy principles is central to Plexus's manufacturing strategy. By 2025, the company plans to increase the use of recycled materials in its products by 20%, a move that directly supports resource efficiency and minimizes environmental impact.

Water consumption is a significant environmental factor for manufacturers like Plexus, particularly in their complex production processes. Understanding and managing this usage is key to responsible operations.

Plexus is actively engaged in sustainability initiatives, which include a thorough assessment of their water footprint across all facilities. This assessment is designed to identify areas where water usage can be reduced and to create a clear plan for achieving these reductions.

For example, in 2023, the electronics manufacturing services industry, where Plexus operates, faced increasing scrutiny over resource consumption. While specific Plexus water reduction data for 2024-2025 isn't publicly available yet, the industry trend shows a growing emphasis on water efficiency, with companies investing in closed-loop systems and advanced water treatment technologies to minimize their environmental impact.

Sustainable Materials and Sourcing

The push for sustainable materials and ethical sourcing significantly shapes product development and supply chain strategies. Plexus is actively evaluating its worldwide supply chain expenditures against sustainability metrics to ensure alignment with evolving market expectations and regulatory landscapes.

This focus is driven by growing consumer and investor pressure for environmentally sound practices. For instance, by 2024, a significant percentage of global consumers are expected to prioritize purchasing from brands demonstrating strong environmental commitments, influencing Plexus's sourcing decisions and material choices.

- Supply Chain Transparency: Plexus is enhancing visibility into its supply chain to identify and mitigate environmental risks associated with material sourcing.

- Material Innovation: The company is exploring and adopting materials with lower environmental impact, such as recycled content and bio-based alternatives.

- Supplier Audits: Plexus is implementing more rigorous auditing processes for suppliers to verify adherence to sustainability standards in their operations.

- Circular Economy Principles: Efforts are underway to integrate circular economy principles, focusing on material reuse and waste reduction throughout the product lifecycle.

Climate Change and Extreme Weather Events

Climate change and the increasing frequency of extreme weather events pose significant threats to businesses. These disruptions can severely impact manufacturing, leading to production halts and damage to facilities. For instance, the severe flooding in parts of Southeast Asia in late 2024 caused widespread disruption to electronics manufacturing hubs, highlighting supply chain vulnerabilities.

Supply chains are particularly susceptible. Extended droughts can affect agricultural inputs, while severe storms can damage transportation infrastructure, delaying shipments and increasing costs. In 2025, the ongoing El Niño phenomenon is predicted to exacerbate drought conditions in some regions and increase rainfall in others, impacting global commodity flows.

Building resilience against these environmental risks is no longer optional but a critical business imperative. Companies are investing in diversified sourcing, improved logistics planning, and climate-resilient infrastructure. The World Economic Forum's 2025 Global Risks Report identified extreme weather events as the top global risk, underscoring the urgency for proactive adaptation strategies.

- Supply Chain Disruptions: Extreme weather events in 2024 and projected for 2025 are increasingly impacting global logistics and manufacturing output, particularly in sectors reliant on stable weather patterns.

- Increased Operational Costs: Businesses face higher insurance premiums and costs associated with repairing damage from events like floods, hurricanes, and wildfires, impacting profitability.

- Strategic Imperative for Resilience: Proactive investment in climate adaptation measures, diversified supply chains, and robust infrastructure is crucial for long-term business continuity and competitive advantage.

Plexus is actively reducing its environmental footprint by targeting a decrease in Scope 1 and 2 carbon emissions across its global operations, aiming for greater sustainability.

Energy efficiency is a key focus, with a 7% reduction in manufacturing energy intensity achieved in 2023. The company is also tackling the growing e-waste problem, with a 15% reduction in waste-to-landfill intensity reported in 2024, and plans to increase recycled material usage by 20% by 2025.

Water management is critical, and Plexus is assessing its water footprint to identify reduction opportunities, mirroring industry trends towards water efficiency technologies.

The company is also prioritizing sustainable materials and supply chain transparency, driven by consumer demand for environmentally conscious brands, with a focus on ethical sourcing and material innovation.

PESTLE Analysis Data Sources

Our PESTLE Analysis leverages a comprehensive blend of data from reputable market research firms, official government publications, and leading economic indicators. We meticulously gather insights on political stability, economic forecasts, social trends, technological advancements, environmental regulations, and legal frameworks to provide a well-rounded view.