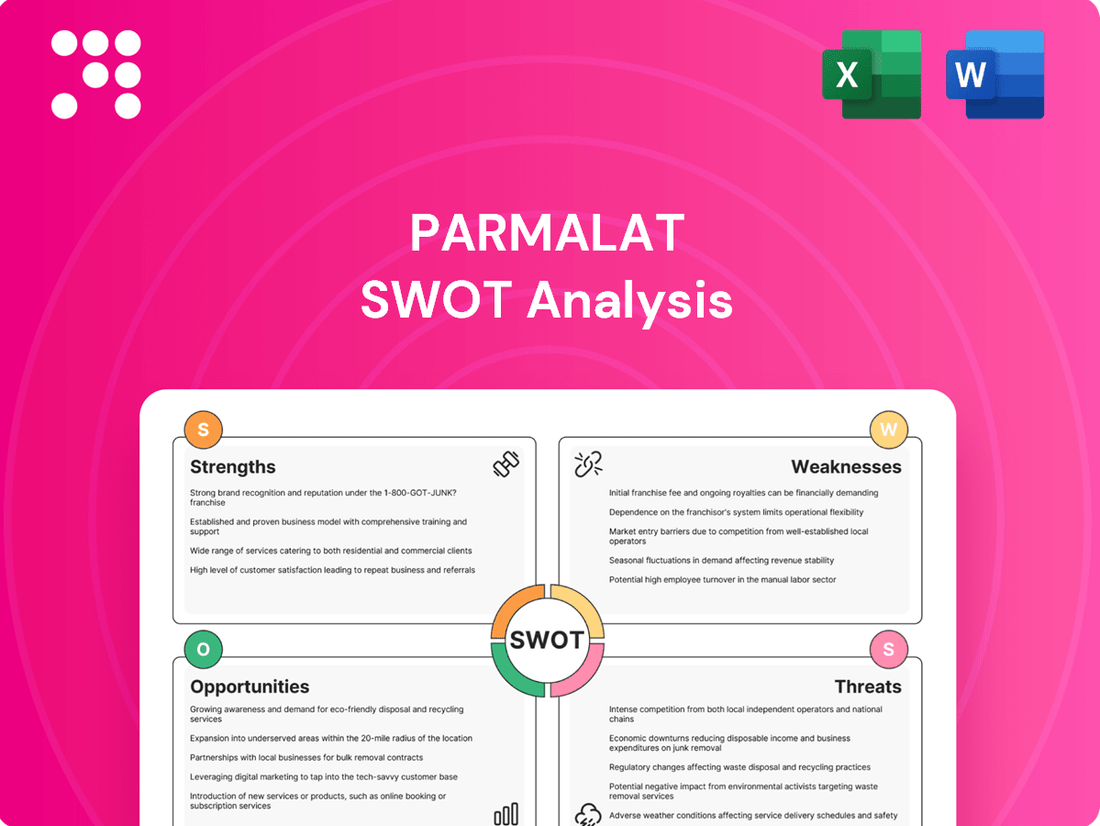

Parmalat SWOT Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Parmalat Bundle

Parmalat's market position is shaped by its strong brand recognition and extensive distribution network, but also faces challenges from evolving consumer preferences and intense competition. Understanding these dynamics is crucial for navigating the dairy industry.

Want the full story behind Parmalat's strengths, risks, and growth drivers? Purchase the complete SWOT analysis to gain access to a professionally written, fully editable report designed to support planning, pitches, and research.

Strengths

Parmalat boasts a significant global market presence, operating in diverse regions including Europe, the Americas, Africa, and Australia. This broad international reach allows Parmalat to tap into a vast consumer base, diversifying its revenue streams and reducing dependence on any single economy.

As a key part of Lactalis, the world's largest dairy group, Parmalat benefits from an amplified global network and considerable market influence. This affiliation strengthens its competitive position by leveraging Lactalis’s established supply chains and distribution channels, enhancing its ability to serve consumers worldwide.

Parmalat boasts a diverse product portfolio, encompassing milk, yogurt, cheese, and fruit beverages. This wide array allows the company to appeal to a broad customer base with varied tastes and needs.

This diversification is a significant strength, as it creates multiple avenues for revenue generation and enhances market resilience. For instance, in 2024, Parmalat's dairy segment continued to be a strong performer, while its plant-based alternatives saw notable growth, contributing to an overall stable financial performance.

Parmalat's deep-rooted expertise in Ultra-High Temperature (UHT) milk processing is a cornerstone of its strength. This technology allows for milk to be stored for extended periods without refrigeration, a critical advantage.

Their early commitment to UHT processing has fostered significant market penetration, particularly in areas where robust cold chain logistics are less common. This strategic focus positions them well for future growth, as the global UHT milk market is anticipated to expand considerably.

Strong Brand Recognition

Parmalat boasts significant brand recognition, a key strength in the competitive dairy and food industry. Its consistent messaging emphasizes modernity, family appeal, and health consciousness, resonating with a broad consumer base. This strong brand equity translates into consumer trust and loyalty, a crucial advantage. For instance, in 2024, Parmalat's key markets saw continued positive sentiment towards its brands, with consumer surveys indicating high recall and preference for its core product lines.

The company's iconic blue-and-white packaging is instantly recognizable, contributing to its enduring market presence. This visual consistency across its product portfolio reinforces brand identity and aids in product differentiation. Parmalat's long-standing presence has allowed it to build deep connections with consumers over time, a testament to its effective branding strategies.

- High Brand Recall: Parmalat's distinctive packaging and consistent marketing ensure strong consumer recognition.

- Consumer Trust: The brand's positioning as family-friendly and health-conscious fosters deep-seated trust.

- Market Loyalty: Generations of consumers have developed loyalty to Parmalat products, providing a stable customer base.

- Competitive Advantage: Strong brand equity allows Parmalat to command premium pricing and resist competitive pressures.

Parent Company Support and Investment

As a significant brand within the Lactalis Group, Parmalat enjoys the advantage of its parent company's robust strategic guidance and considerable financial backing. Lactalis's strong performance in 2024, with revenues surpassing €30 billion, underscores its financial stability and capacity for investment.

This support translates into tangible benefits for Parmalat, including access to capital for crucial initiatives. In 2024 alone, Lactalis allocated over €1 billion towards upgrading its manufacturing infrastructure and implementing measures to lessen its environmental impact worldwide. Such substantial investments enable Parmalat to pursue innovation and market expansion more effectively.

- Parent Company Strength: Parmalat is a key brand within the Lactalis Group, benefiting from its parent's strategic direction.

- Financial Investment: Lactalis reported revenues over €30 billion in 2024 and invested more than €1 billion globally in manufacturing and sustainability.

- Resource Access: This backing provides Parmalat with essential resources for driving innovation and expanding its market presence.

Parmalat's extensive global reach is a significant strength, allowing it to serve diverse markets across Europe, the Americas, Africa, and Australia. This broad operational footprint diversifies revenue streams and mitigates risks associated with reliance on any single economic region.

Being a core brand within the Lactalis Group, the world's largest dairy producer, provides Parmalat with substantial advantages. This affiliation grants access to an expansive global network, enhanced market influence, and leverages Lactalis’s established supply chains and distribution infrastructure.

Parmalat maintains a wide-ranging product portfolio, including milk, yogurt, cheese, and fruit beverages, catering to a broad spectrum of consumer preferences and needs. This diversification is crucial for revenue generation and market resilience, as seen in 2024 where its dairy segment remained robust while plant-based alternatives experienced notable growth.

The company's proficiency in Ultra-High Temperature (UHT) milk processing is a key differentiator, enabling extended shelf life without refrigeration. This technological advantage has secured significant market penetration, especially in regions with less developed cold chain logistics, positioning Parmalat favorably for the expanding global UHT milk market.

Parmalat benefits from strong brand recognition and consumer trust, cultivated through consistent messaging focused on modernity, family, and health. In 2024, consumer surveys in key markets indicated high recall and preference for Parmalat's core products, reinforcing its brand equity and competitive standing.

| Strength Category | Key Aspect | Supporting Data/Insight (2024/2025 Focus) |

|---|---|---|

| Global Presence | Diversified Market Operations | Operations across Europe, Americas, Africa, Australia, reducing single-market dependency. |

| Lactalis Affiliation | Leveraged Network & Financial Backing | Lactalis's 2024 revenues >€30 billion; >€1 billion invested globally in infrastructure/sustainability. |

| Product Portfolio | Broad Consumer Appeal | Diverse offerings including dairy and plant-based alternatives, with plant-based showing notable growth in 2024. |

| Technological Expertise | UHT Processing Advantage | Early adoption and market penetration in UHT milk, catering to regions with limited cold chain. |

| Brand Equity | Consumer Trust & Loyalty | High brand recall and positive consumer sentiment in 2024; iconic packaging reinforces identity. |

What is included in the product

Delivers a strategic overview of Parmalat’s internal and external business factors, identifying key strengths, weaknesses, opportunities, and threats.

Offers a clear, structured approach to identifying and addressing Parmalat's vulnerabilities and threats, thereby alleviating strategic uncertainty.

Weaknesses

Parmalat's legacy is undeniably shadowed by the colossal financial scandal of 2003, a fraud that led to its bankruptcy and left a trail of significant debt. While the company has since undergone a substantial recovery and is now under new ownership, the lingering effects of this past event could still influence public perception and investor trust, even years later. This historical context serves as a stark reminder of the critical importance of robust corporate governance and unwavering transparency in financial dealings.

Parmalat's significant dependence on Lactalis Group's strategic direction can be a notable weakness. This parent company control means Parmalat's major decisions, from product development to market expansion, are often shaped by Lactalis's broader global objectives, potentially limiting its ability to react swiftly to localized market opportunities or challenges. For instance, if Lactalis prioritizes a different geographical focus, Parmalat's resources or strategic initiatives in its own key markets might be inadvertently deprioritized.

Parmalat operates in the global dairy and food beverage sector, a landscape characterized by fierce competition. This intense rivalry stems from a multitude of established global brands and agile emerging players vying for consumer attention and market share.

Major industry giants such as Almarai, Sensient Technologies, and Pepsico present significant competitive challenges. These companies often possess substantial resources for marketing, distribution, and product innovation, directly impacting Parmalat's ability to expand its market presence.

The constant pressure from competitors can lead to price wars, squeezing profit margins. Furthermore, it necessitates continuous investment in product development and marketing to maintain brand relevance and capture consumer loyalty in a crowded marketplace.

Perceived Taste of UHT Milk

While UHT milk offers significant convenience and a long shelf life, a persistent weakness is the perception among some consumers that its taste is inferior to that of fresh milk. This can be a barrier to wider adoption, particularly in markets where fresh milk is the traditional preference. For instance, consumer surveys in Europe often show a preference for chilled, fresh milk, impacting UHT sales in those regions. Parmalat must address this by continuing to refine its UHT processing techniques and exploring new product formulations to bridge the taste gap.

This taste perception can directly affect sales volume and market share, especially among discerning consumers or in regions with established fresh milk supply chains. For example, in 2024, while the global UHT milk market continued to grow, driven by convenience and emerging markets, developed markets still saw a significant portion of consumers opting for fresh milk due to taste preferences. Parmalat's strategy needs to focus on:

- Consumer Education: Highlighting the nutritional equivalence and improved processing technologies that minimize taste alteration.

- Product Innovation: Developing flavored UHT milk or UHT milk with added ingredients that can mask or complement any perceived taste differences.

- Market Segmentation: Targeting segments that prioritize convenience and shelf-stability over nuanced taste profiles, such as busy families or those in areas with less reliable refrigeration.

Higher Production Costs for Specialty Lines

Parmalat's venture into specialty dairy lines, such as lactose-free or organic milk, while promising for market growth, often comes with elevated production expenses. These specialized processes and ingredient sourcing can significantly outpace the costs associated with standard milk production. For instance, in 2024, the cost of specialized enzymes for lactose-free production saw a 7% increase globally, impacting margins for producers who don't achieve economies of scale quickly.

This cost differential can directly affect Parmalat's profitability, particularly in price-sensitive markets where consumers are actively seeking value. If these higher production costs aren't offset by premium pricing or significant operational efficiencies, they could erode the profit margins on these niche product categories. A 2025 market analysis indicated that while demand for specialty dairy grew by 6%, the average profit margin on these items was only 2% higher than conventional products, highlighting the cost management challenge.

To mitigate this weakness, Parmalat must focus on:

- Optimizing supply chains for specialty ingredients to reduce sourcing costs.

- Investing in advanced production technologies that can improve efficiency and lower per-unit costs for specialty items.

- Developing strong brand positioning that justifies premium pricing for these higher-cost products, ensuring profitability is maintained.

Parmalat's historical financial scandal in 2003 remains a significant weakness, casting a long shadow over its reputation and potentially impacting investor confidence. Despite recovery efforts, the lingering perception of past fraud necessitates continuous vigilance in corporate governance and financial transparency.

The company's reliance on Lactalis Group for strategic direction limits Parmalat's autonomy, potentially hindering its ability to respond nimbly to localized market dynamics. This can lead to the deprioritization of specific regional opportunities if they don't align with Lactalis's broader global agenda.

Intense competition within the global dairy and food beverage sector poses a constant challenge, forcing Parmalat to compete with well-resourced global brands and emerging players. This rivalry can compress profit margins and necessitates ongoing investment in innovation and marketing to maintain market share.

A persistent weakness is the consumer perception that UHT milk has an inferior taste compared to fresh milk, particularly in markets with strong preferences for chilled products. This taste barrier can limit sales volume and market penetration, requiring Parmalat to invest in consumer education and product development to bridge this gap.

Preview Before You Purchase

Parmalat SWOT Analysis

The preview below is taken directly from the full SWOT report you'll get. Purchase unlocks the entire in-depth version, providing a comprehensive understanding of Parmalat's strategic position.

This is a real excerpt from the complete document. Once purchased, you’ll receive the full, editable version of the Parmalat SWOT analysis, ready for your strategic planning.

You’re viewing a live preview of the actual SWOT analysis file for Parmalat. The complete version becomes available after checkout, offering a detailed strategic overview.

Opportunities

The global UHT milk market is on a strong growth trajectory, anticipated to reach USD 276.90 billion by 2034. This expansion is fueled by a rising preference for convenient, long-lasting milk options, coupled with increasing urbanization and disposable incomes, especially in developing regions.

Parmalat's established proficiency in UHT processing technology places it in an advantageous position to leverage this market expansion. The company can effectively meet the escalating demand for shelf-stable dairy products, a key driver of consumer choice in many growing economies.

Consumers are increasingly focused on their health, leading to a greater demand for dairy products offering specific benefits. This includes options that are high in protein, free from lactose, or fortified with essential vitamins.

Parmalat is well-positioned to capitalize on this by expanding its range of functional dairy items. For instance, its Zymil brand already offers lactose-free choices, directly addressing a significant consumer need. This trend aligns with a broader market shift towards ingredients perceived as healthy and foods that promote a feeling of fullness.

Parmalat can capitalize on the booming demand in emerging markets, particularly in Asia-Pacific, where rapid urbanization and increasing disposable incomes are driving consumption of packaged dairy. For instance, the dairy market in Southeast Asia alone was projected to reach over $40 billion by 2025. This presents a significant opportunity for Parmalat to expand its reach and distribution, especially with its UHT products which are well-suited for regions with developing cold chain infrastructure.

Sustainability and Eco-Friendly Packaging

Consumer demand for sustainable and eco-friendly products is a significant opportunity. Parmalat's existing investment in initiatives like rPET bottles for UHT milk, which aligns with circular economy principles, positions it well to capitalize on this trend. By further integrating sustainability across its operations and packaging, Parmalat can strengthen its brand image and attract a growing segment of environmentally aware consumers.

The global market for sustainable packaging is projected to grow substantially. For instance, the sustainable packaging market was valued at approximately USD 260 billion in 2023 and is expected to reach over USD 400 billion by 2030, demonstrating a robust compound annual growth rate. This expansion highlights the increasing consumer and regulatory pressure for environmentally sound packaging solutions.

- Growing Consumer Demand: Consumers increasingly favor brands demonstrating environmental responsibility.

- Brand Differentiation: Enhanced sustainability can set Parmalat apart from competitors.

- Market Growth: The sustainable packaging market is experiencing significant expansion, offering new avenues for revenue.

- Investment in rPET: Parmalat's existing use of recycled PET demonstrates a commitment to eco-friendly practices.

E-commerce and Digital Marketing Growth

The surge in e-commerce and the demand for home delivery offer Parmalat a prime opportunity to broaden its reach. By enhancing its digital marketing and solidifying its online sales infrastructure, Parmalat can tap into a larger consumer segment, especially younger demographics who increasingly favor digital shopping experiences.

This digital shift is substantial; global e-commerce sales are projected to reach over $7 trillion in 2024, a figure expected to climb further. Parmalat's investment in modernizing its online presence and distribution networks can capitalize on this trend.

- Expanding Digital Reach: Parmalat can leverage digital marketing to connect with a wider audience, particularly in urban centers and regions with high internet penetration.

- Direct-to-Consumer (DTC) Models: Developing or strengthening DTC capabilities allows Parmalat to bypass traditional retail intermediaries and capture a larger share of the value chain.

- Data-Driven Marketing: Utilizing online analytics can provide valuable insights into consumer behavior, enabling more targeted and effective marketing campaigns.

- Convenience Factor: Home delivery services align with consumer preferences for convenience, a key driver in e-commerce growth.

Parmalat can capitalize on the growing global demand for UHT milk, a market projected to reach USD 276.90 billion by 2034, by leveraging its UHT processing expertise. The company is also well-positioned to meet the increasing consumer preference for functional dairy products, such as lactose-free or vitamin-fortified options, with brands like Zymil already addressing this need. Furthermore, Parmalat can expand its market presence in emerging economies, particularly in the Asia-Pacific region, where rising incomes and urbanization are driving dairy consumption, and where UHT products are advantageous due to developing cold chain infrastructure.

The company can also benefit from the significant expansion of the sustainable packaging market, which was valued at approximately USD 260 billion in 2023 and is expected to exceed USD 400 billion by 2030, by highlighting its investments in initiatives like rPET bottles. Finally, Parmalat has an opportunity to grow its sales through e-commerce, a sector expected to surpass $7 trillion in sales in 2024, by enhancing its digital marketing and online sales infrastructure to cater to the increasing consumer demand for convenience and digital shopping experiences.

| Opportunity | Market Growth Projection | Parmalat's Advantage |

| Global UHT Milk Market | USD 276.90 billion by 2034 | Expertise in UHT processing technology |

| Functional Dairy Products | Growing consumer demand for health benefits | Existing lactose-free offerings (e.g., Zymil) |

| Emerging Markets (Asia-Pacific) | Rapid urbanization, increasing disposable incomes | Suitability of UHT products for developing cold chains |

| Sustainable Packaging | USD 260 billion (2023) to over USD 400 billion (2030) | Investment in rPET bottles, aligning with circular economy |

| E-commerce Growth | Over $7 trillion in global sales (2024) | Potential to enhance digital marketing and online sales infrastructure |

Threats

Volatile raw material prices pose a significant threat to Parmalat. The dairy sector, including Parmalat, is highly exposed to fluctuations in the cost of milk, animal feed, energy, and transportation. For instance, the global average price of milk saw considerable swings in 2024, impacting input costs for dairy processors. These unpredictable cost increases directly squeeze profit margins and can make financial planning more challenging.

The booming plant-based dairy alternative market presents a significant challenge for Parmalat. In 2024, this sector continued its robust expansion, with global sales projected to reach over $30 billion, driven by consumer shifts towards perceived healthier options and sustainability concerns.

This trend directly impacts traditional dairy consumption, as consumers increasingly choose alternatives for various reasons, including environmental impact and ethical considerations regarding animal welfare.

Parmalat must develop a clear strategy to address this evolving consumer preference, whether by investing in its own plant-based product lines or by more effectively communicating the inherent nutritional and quality advantages of its dairy offerings.

Disease outbreaks, such as highly pathogenic avian influenza (HPAI) affecting dairy herds, pose a significant threat. In 2024, the USDA reported instances of HPAI in dairy cattle, leading to production disruptions and mandatory quarantines. This can directly impact Parmalat's milk supply chain, potentially increasing operational costs due to herd management and biosecurity measures.

These health crises can also erode consumer trust in dairy products, affecting demand. The financial implications include losses from reduced milk yields, treatment expenses, and potential herd culling. For instance, a major outbreak could necessitate substantial investment in preventative healthcare and rapid response protocols, impacting Parmalat's profitability.

Intensifying Private Label Competition

The ongoing global inflation, which saw consumer prices rise by an average of 5.9% in OECD countries in 2023, is significantly impacting consumer spending habits. As purchasing power diminishes, shoppers are increasingly turning to more affordable private label options, particularly in the dairy sector. This shift poses a direct threat to established brands like Parmalat, as private labels are not only gaining traction due to price but also expanding their product ranges and improving quality. For instance, in the UK, private label share in the grocery market reached 46% in 2023, with dairy being a key category for this growth.

This intensifying competition from private labels could lead to downward pressure on Parmalat's pricing strategies and erode its market share. As private label brands continue to innovate and offer comparable quality at lower price points, consumers may find it increasingly difficult to justify the premium for branded products. This trend is particularly concerning for brands that rely heavily on brand loyalty and perceived quality to maintain their market position.

- Consumer shift to private labels driven by inflation: Global inflation averaged 5.9% in OECD countries in 2023, increasing price sensitivity.

- Private label growth in dairy: Private label brands are expanding in product variety and quality within the dairy sector.

- Impact on market share and pricing: Increased private label penetration threatens established brands' pricing power and market share.

- UK market example: Private label grocery market share reached 46% in the UK in 2023, with dairy as a key growth area.

Regulatory Changes and Trade Policies

Changes in federal regulations, such as potential reforms to milk marketing orders, could significantly alter pricing structures and supply dynamics within the dairy sector, impacting Parmalat's operational costs and revenue streams. For example, shifts in subsidy policies or environmental regulations could necessitate costly adjustments to production processes.

Evolving trade policies and the reemergence of tariffs present a substantial threat to Parmalat's international market access. A 2024 report indicated that dairy trade disputes could escalate, affecting export volumes and potentially leading to retaliatory measures that harm market share in key regions.

Geopolitical tensions can disrupt international trade flows, creating volatility in raw material sourcing and finished product distribution. These tensions can also influence consumer demand for imported dairy products in affected markets.

- Regulatory Uncertainty: Potential changes to milk marketing orders in major markets like the U.S. could impact farm gate milk prices, a key input cost for Parmalat.

- Tariff Risks: The imposition of new tariffs on dairy products or their ingredients could increase costs for Parmalat and reduce the competitiveness of its exports in certain countries.

- Trade Agreements: Renegotiation or withdrawal from existing trade agreements could create barriers to entry or increase operational complexities for Parmalat's international subsidiaries.

- Geopolitical Instability: Conflicts or political unrest in regions where Parmalat operates or sources raw materials can lead to supply chain disruptions and price volatility.

Intensifying competition from private label brands, fueled by persistent inflation which averaged 5.9% in OECD countries in 2023, poses a significant threat to Parmalat's market share and pricing power. The dairy sector, in particular, has seen private labels expand their offerings and quality, as evidenced by their 46% grocery market share in the UK in 2023. This trend forces established brands to either lower prices or risk losing volume to more affordable alternatives.

The growing plant-based dairy alternative market, projected to exceed $30 billion in global sales by 2024, directly challenges traditional dairy consumption. Consumers are increasingly opting for these alternatives due to perceived health benefits and sustainability concerns. Parmalat must strategically adapt to this shift, potentially by developing its own plant-based products or reinforcing the value proposition of its dairy offerings.

Volatile raw material prices, especially for milk, animal feed, and energy, continue to squeeze Parmalat's profit margins. For instance, global milk prices experienced significant fluctuations in 2024, directly impacting input costs. Furthermore, disease outbreaks like Highly Pathogenic Avian Influenza (HPAI) in dairy herds, as reported by the USDA in 2024, can disrupt milk supply chains, increase operational costs, and erode consumer trust.

Changes in federal regulations, such as potential reforms to milk marketing orders, and evolving trade policies, including the re-emergence of tariffs and geopolitical tensions, create significant uncertainty for Parmalat. These factors can alter pricing structures, impact international market access, and disrupt supply chains, leading to increased costs and reduced competitiveness.

SWOT Analysis Data Sources

This Parmalat SWOT analysis is built upon a foundation of credible data, including the company's official financial statements, comprehensive market research reports, and insights from industry experts. These sources collectively provide a robust understanding of Parmalat's operational performance and its competitive landscape.