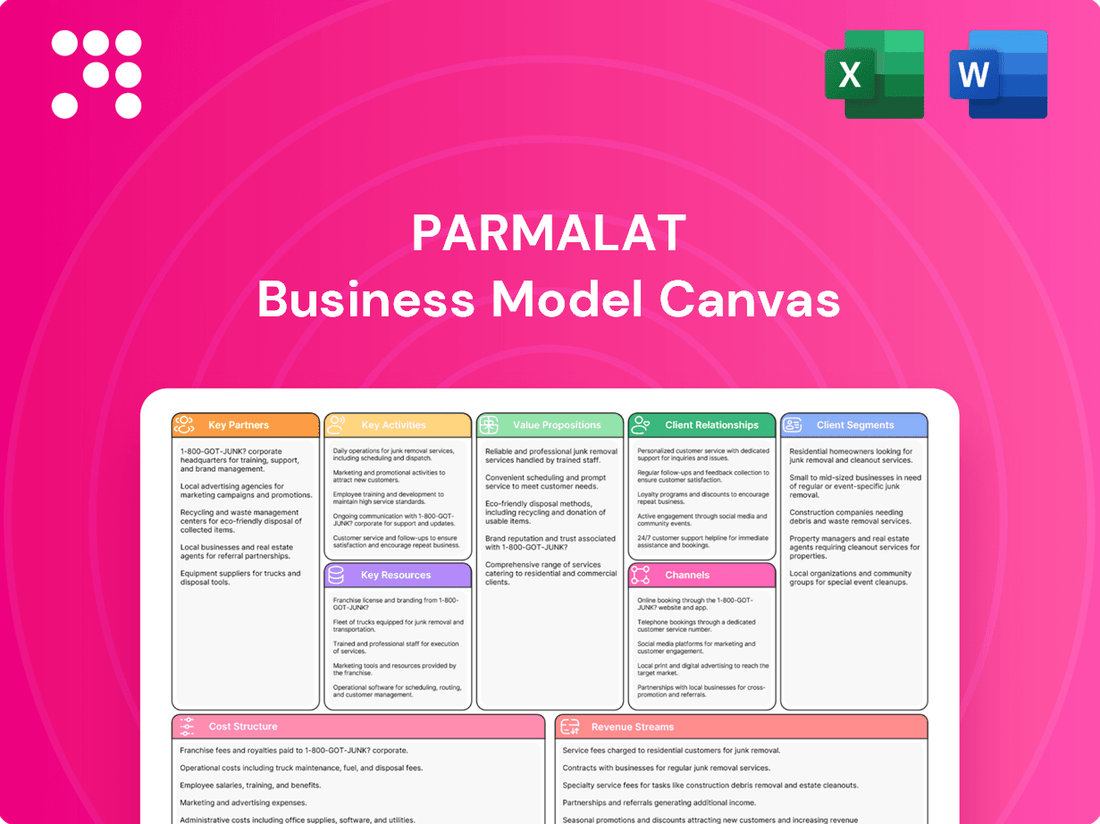

Parmalat Business Model Canvas

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Parmalat Bundle

Unlock the strategic DNA of Parmalat's success with our comprehensive Business Model Canvas. This detailed breakdown reveals how they connect with customers, manage resources, and generate revenue in the competitive dairy and food industry. Understand their value proposition and key activities to inform your own business strategy.

Ready to dissect Parmalat's winning formula? Our full Business Model Canvas provides an in-depth look at their customer relationships, channels, and cost structure, offering invaluable insights for market analysis and strategic planning. Download it now to gain a competitive edge.

Partnerships

Parmalat's operations are fundamentally dependent on dairy farmers and milk suppliers for its core business. These partnerships are crucial for securing a consistent and high-quality supply of raw milk, the primary ingredient for its extensive product range.

Long-term relationships with these suppliers are vital for ensuring both the volume and quality of milk needed for Parmalat's processing. For example, in 2024, Parmalat continued its focus on strengthening these ties, often through agreements that stipulate rigorous quality standards and may include support for farmers adopting more sustainable agricultural practices.

Major retail chains and supermarkets are fundamental to Parmalat's distribution network, ensuring its diverse dairy and fruit beverage portfolio reaches consumers effectively. These vital relationships are built on securing prime shelf space, collaborating on in-store promotions, and optimizing supply chains for consistent product availability. In 2024, Parmalat continued to focus on strengthening its presence within these key retail environments, aiming for maximum product visibility.

Parmalat relies heavily on logistics and distribution companies to move its diverse product range, from fresh dairy to shelf-stable goods, across its extensive international network. These partners are crucial for maintaining product integrity, especially for temperature-sensitive items requiring robust cold chain management. In 2024, Parmalat's global presence necessitates sophisticated supply chain solutions to ensure timely delivery and market availability.

The company leverages its existing, well-established milk and dairy collection and distribution infrastructure, which is a significant asset. This network allows for efficient movement of raw materials and finished products, optimizing costs and reach. By integrating these internal capabilities with external logistics providers, Parmalat ensures a resilient and responsive supply chain capable of meeting fluctuating market demands.

Packaging Suppliers

Parmalat's commitment to sustainability hinges on strong alliances with packaging suppliers. These partnerships are crucial for developing and deploying environmentally friendly packaging, such as bottles made from recycled PET. A prime example is Parmalat's collaboration with Dentis Recycling Italy, aiming for 100% recyclable bottles by 2024.

These collaborations are not just about sourcing materials; they involve co-innovation to push the boundaries of eco-friendly packaging. By working closely with suppliers, Parmalat can integrate advanced recycling technologies and materials into its production lines, ensuring a consistent supply of sustainable packaging solutions.

- Eco-conscious packaging development: Partnerships with suppliers to create and implement sustainable packaging options.

- Recycled PET bottle initiatives: Collaborations focused on using recycled materials, like PET, in bottle production.

- Target for recyclable bottles: Parmalat's goal to achieve 100% recyclable bottles by 2024, supported by supplier partnerships.

- Innovation in materials and technology: Joint efforts with packaging companies to advance recycling technologies and material science.

Technology and Research Institutions

Parmalat actively partners with technology providers and research institutions to fuel innovation and enhance its operations. These collaborations are crucial for developing advanced processing techniques, refining product recipes, and pioneering more sustainable manufacturing practices.

A notable example is Parmalat's R&D involvement in creating its new rPET bottle, showcasing a commitment to circular economy principles. Furthermore, its parent company, Lactalis Group, demonstrates a significant dedication to research and development, investing heavily to stay at the forefront of the dairy and food industry.

- Innovation Drive: Collaborations with tech firms and universities accelerate the development of novel food technologies and product formulations.

- Operational Efficiency: Partnerships can lead to the implementation of cutting-edge processing methods, optimizing production and reducing waste.

- Sustainability Focus: Research institutions often aid in exploring and adopting eco-friendly production methods, such as those for recyclable packaging like the rPET bottle.

- Parent Company Support: Lactalis Group's substantial R&D investment provides a strong foundation for Parmalat's technological advancements.

Parmalat's key partnerships extend to financial institutions and technology providers, crucial for operational funding and innovation. These relationships facilitate access to capital for expansion and investment in new technologies, such as advanced processing equipment and digital supply chain solutions.

Collaborations with research bodies and universities are also vital, driving product development and sustainability initiatives. For instance, in 2024, Parmalat continued to explore partnerships aimed at enhancing the nutritional profile of its products and reducing its environmental footprint.

The company also engages with industry associations and regulatory bodies to stay abreast of market trends and compliance requirements, ensuring its business practices align with evolving standards and consumer expectations.

| Partner Type | Role | Example/Focus Area (2024) | Impact |

|---|---|---|---|

| Financial Institutions | Funding, Capital Access | Securing investment for operational upgrades and market expansion. | Enables growth and technological adoption. |

| Technology Providers | Innovation, Efficiency | Implementing advanced processing and digital supply chain solutions. | Improves production, reduces costs, enhances traceability. |

| Research Institutions & Universities | R&D, Product Development | Enhancing product nutrition, exploring sustainable practices. | Drives innovation and competitive advantage. |

| Industry Associations & Regulators | Compliance, Market Insight | Adhering to standards, understanding market trends. | Ensures regulatory adherence and market relevance. |

What is included in the product

A detailed Parmalat Business Model Canvas outlining its broad dairy and food product portfolio, extensive distribution network, and focus on consumer trust and brand loyalty.

It highlights Parmalat's key partnerships with farmers and retailers, its efficient supply chain, and its revenue streams from diverse product sales across multiple geographies.

Parmalat's Business Model Canvas acts as a pain point reliever by offering a clear, visual representation of their complex operations, allowing for swift identification of inefficiencies and strategic adjustments.

It simplifies Parmalat's multifaceted business by providing a single-page snapshot, making it easier to diagnose and address operational challenges and opportunities.

Activities

Parmalat's key activities heavily revolve around the meticulous processing of raw milk into a wide array of popular dairy products. This includes essential steps like pasteurization and homogenization to guarantee safety and quality, alongside specialized techniques for products like yogurt and cheese, extending to the crucial UHT milk processing for extended shelf life.

The company's expertise in UHT (Ultra-High Temperature) processing is a cornerstone, allowing for long-lasting, ambient-stable milk products. In 2024, the global UHT milk market was valued at over $150 billion, underscoring the significant demand for Parmalat's core competency.

Parmalat's core activity involves a relentless pursuit of product development and innovation to maintain its edge in the dairy market. This means constantly refreshing its offerings and creating entirely new ones to capture consumer interest and address changing dietary needs. For instance, the introduction of specialized products such as lactose-free or high-protein milk alternatives directly caters to growing health-conscious segments.

A prime example of this commitment is Parmalat's launch of Latte Barista, a product designed for coffee enthusiasts seeking a premium at-home experience. Beyond this, the company is actively engaged in developing over a dozen new milk products, signaling a robust pipeline aimed at diversifying its portfolio and capturing new market opportunities through 2024 and beyond.

Parmalat's global distribution and supply chain management is a critical activity, focusing on the efficient movement of dairy and food products across its extensive international network. This encompasses meticulous inventory control, strategic warehousing, and the optimization of logistics to cater to both perishable and shelf-stable items, ensuring product freshness and availability.

The company's operational footprint spans continents, including significant presence in Europe, North America, Latin America, Africa, and Oceania. In 2024, Parmalat continued to invest in supply chain resilience, particularly in light of ongoing global logistics challenges. For instance, the company reported ongoing efforts to diversify transportation routes and enhance warehousing capabilities across its key markets to mitigate potential disruptions and maintain delivery timelines.

Branding and Marketing

Parmalat's branding and marketing efforts are central to its strategy, focusing on building a recognizable and trusted image. This involves extensive advertising, active social media presence, and targeted promotions to communicate product advantages and core brand values. The company aims to be perceived as contemporary, suitable for families, and mindful of health.

In 2024, Parmalat continued its commitment to brand building. For instance, its campaigns often emphasize the nutritional benefits and quality of its dairy products, resonating with health-conscious consumers. This consistent messaging helps foster consumer loyalty and differentiate Parmalat in a competitive market.

- Brand Image: Parmalat prioritizes a modern, family-friendly, and health-conscious perception.

- Marketing Channels: Advertising, social media engagement, and promotional activities are key.

- Investment: Significant resources are allocated to maintain and enhance brand recognition.

- Consumer Loyalty: Effective branding drives repeat purchases and strengthens customer relationships.

Quality Control and Food Safety

Parmalat's quality control and food safety activities are central to maintaining consumer confidence and meeting stringent regulatory requirements. This focus ensures that every product leaving their facilities adheres to the highest standards. For instance, in 2024, the company continued its investment in advanced testing technologies to preemptively identify any potential safety concerns.

Rigorous testing protocols are implemented at multiple stages of the production chain, from raw material sourcing to the final packaged product. This meticulous approach is critical for compliance with global food safety regulations. Lactalis, Parmalat's parent company, has consistently prioritized food safety, channeling significant investments into enhancing these capabilities across its brands.

- Rigorous testing: Parmalat employs comprehensive laboratory analysis for microbiological, chemical, and physical contaminants.

- Regulatory adherence: The company actively monitors and complies with evolving national and international food safety standards.

- Continuous monitoring: Throughout the production process, critical control points are consistently observed and documented.

- Parent company investment: Lactalis earmarks substantial capital for food safety infrastructure and training programs within Parmalat operations.

Parmalat's key activities encompass the entire dairy value chain, from milk processing to product innovation and global distribution. The company's expertise in UHT processing is a significant asset, enabling the production of long-shelf-life dairy products. In 2024, the global UHT milk market was valued at over $150 billion, highlighting the importance of this capability.

Product development is another critical activity, with Parmalat continuously introducing new items like Latte Barista to cater to evolving consumer preferences. The company is actively developing over a dozen new milk products, signaling a strong commitment to portfolio diversification and market expansion through 2024.

Efficient global distribution and robust supply chain management are essential for Parmalat's operations. In 2024, the company focused on enhancing supply chain resilience by diversifying transportation routes and improving warehousing capabilities across its key markets to mitigate potential disruptions.

Parmalat's brand building and marketing efforts are vital for maintaining consumer trust and market presence. The company invests heavily in advertising and social media, aiming for a modern, family-friendly, and health-conscious image. This consistent branding approach fosters consumer loyalty and differentiation in a competitive landscape.

Quality control and food safety are paramount, with rigorous testing protocols implemented throughout the production process. In 2024, Parmalat continued to invest in advanced testing technologies to ensure adherence to global food safety standards and maintain consumer confidence.

| Key Activity | Description | 2024 Relevance/Data |

|---|---|---|

| Milk Processing | Pasteurization, homogenization, UHT treatment | UHT milk market > $150 billion |

| Product Innovation | Developing new dairy products, lactose-free options | Launching Latte Barista, pipeline of over a dozen new products |

| Supply Chain Management | Logistics, warehousing, inventory control | Investment in supply chain resilience, route diversification |

| Branding & Marketing | Advertising, social media, promotions | Focus on modern, family-friendly, health-conscious image |

| Quality & Safety | Rigorous testing, regulatory compliance | Investment in advanced testing technologies |

Delivered as Displayed

Business Model Canvas

The Parmalat Business Model Canvas preview you are viewing is not a sample; it represents the actual document you will receive upon purchase. This ensures you know precisely what you are acquiring, with all sections and data intact. Upon completing your transaction, you will gain full access to this comprehensive and professionally structured Business Model Canvas, ready for your immediate use.

Resources

Parmalat operates a robust network of manufacturing facilities dedicated to processing dairy products and fruit beverages. These sites are the backbone of its large-scale production capabilities, often incorporating advanced Ultra-High Temperature (UHT) processing technology to ensure product quality and shelf life.

As part of the Lactalis Group, Parmalat benefits from a vast industrial footprint. Lactalis, Parmalat's parent company, boasts 31 production facilities within Italy alone, underscoring a significant commitment to domestic manufacturing. Globally, Lactalis consistently invests in modernizing its industrial infrastructure, enhancing efficiency and technological advancement across its operations.

Parmalat's mastery of Ultra-High Temperature (UHT) processing is a cornerstone resource, enabling the creation of shelf-stable milk products that don't require refrigeration. This advanced technology, which Parmalat pioneered, significantly broadens its distribution capabilities and market access, allowing products to reach consumers in diverse geographic locations.

This UHT expertise is central to Parmalat's identity, with the company being synonymous with its long-lasting milk. In 2024, the global UHT milk market was valued at approximately $120 billion, highlighting the substantial demand for such convenient and stable dairy solutions, a market Parmalat has long been a leader in.

Parmalat's established brand portfolio is a cornerstone of its business model, featuring globally recognized names like Parmalat itself. This portfolio represents significant intellectual property and deep consumer trust built over decades. The Parmalat brand, in particular, is iconic, synonymous with a wide array of high-quality dairy products.

The strength of these brands translates directly into market goodwill and pricing power. For instance, in 2024, Parmalat's strong brand equity allowed it to maintain a competitive edge even in a challenging economic climate, as evidenced by its consistent market share in key European dairy segments.

Global Distribution Network

Parmalat's global distribution network is a cornerstone of its business model, ensuring its dairy and food products reach consumers across numerous countries. This extensive network leverages direct sales forces, wholesalers, and strong retail partnerships to achieve widespread product availability and market penetration.

The company's operations span multiple continents, underscoring the breadth and depth of its distribution capabilities. For instance, as of early 2024, Parmalat maintained a significant presence in Europe, Africa, and the Americas, facilitating access to diverse customer segments.

- Extensive Reach: Parmalat's network allows for efficient delivery of products to both urban and rural markets globally.

- Diverse Channels: Utilization of direct sales, wholesale, and retail partnerships caters to varied consumer purchasing habits.

- Global Footprint: Operations in over 20 countries as of recent reports highlight the network's international scope.

- Operational Efficiency: Investments in logistics and supply chain management ensure timely and cost-effective distribution.

Skilled Workforce and R&D Expertise

Parmalat’s skilled workforce is a cornerstone of its operations, encompassing dairy scientists, food technologists, marketing specialists, and supply chain experts. This diverse talent pool drives innovation, ensures efficient production, and facilitates effective market strategies. For instance, in 2024, Parmalat continued to invest in training programs aimed at upskilling its employees in areas like sustainable sourcing and advanced food processing techniques.

The company's R&D department is pivotal in its product development pipeline. In 2024, Parmalat's R&D efforts focused on expanding its portfolio of plant-based alternatives and functional dairy products. Significant investment was channeled into research for novel ingredients and improved nutritional profiles, aiming to meet evolving consumer demands for healthier and more sustainable options.

- Dairy Science Expertise: Parmalat employs numerous dairy scientists who are crucial for maintaining product quality and developing new dairy-based innovations.

- Food Technology Advancement: Food technologists are key to optimizing production processes and ensuring the safety and shelf-life of Parmalat's wide range of products.

- Marketing and Supply Chain Professionals: These teams are vital for understanding consumer trends, effective product launches, and managing a complex global supply chain, ensuring products reach consumers efficiently.

- R&D Investment: In 2024, Parmalat demonstrated a commitment to R&D, allocating resources to explore new product categories and enhance existing offerings, which is critical for sustained competitive advantage.

Parmalat's manufacturing facilities are a critical resource, enabling large-scale production of dairy and fruit beverages, often utilizing advanced UHT processing. As part of the Lactalis Group, Parmalat benefits from a significant industrial footprint, with Lactalis operating 31 facilities in Italy alone as of early 2024, reflecting a strong domestic manufacturing base and ongoing investment in modernization.

The company's UHT processing expertise is a key differentiator, allowing for shelf-stable products that expand market reach. The global UHT milk market was valued at approximately $120 billion in 2024, underscoring the significant demand for such products, a market Parmalat has long served effectively.

Parmalat's strong brand portfolio, including its iconic namesake brand, represents substantial intellectual property and consumer trust. This brand equity provides pricing power and market resilience, as seen in Parmalat's consistent market share within key European dairy segments throughout 2024, even amidst economic challenges.

The global distribution network is another vital asset, ensuring product availability across numerous countries through direct sales, wholesalers, and retail partnerships. By early 2024, Parmalat maintained a presence in Europe, Africa, and the Americas, demonstrating the breadth of its reach and ability to access diverse consumer bases.

Parmalat's skilled workforce, from dairy scientists to marketing specialists, is essential for innovation and operational efficiency. The company's 2024 investments in employee training for areas like sustainable sourcing and advanced processing highlight its commitment to human capital development.

Furthermore, Parmalat's R&D focus in 2024 on plant-based alternatives and functional dairy products, supported by significant investment, positions it to meet evolving consumer preferences for healthier and more sustainable options.

Value Propositions

Parmalat's UHT milk offers consumers unparalleled convenience through its extended shelf life, eliminating the need for refrigeration until opened. This also translates to significant logistical advantages for retailers, particularly in regions where cold chain infrastructure is less robust. For instance, in 2024, the global UHT milk market continued to demonstrate strong growth, driven by these very convenience factors.

Parmalat’s value proposition centers on a broad spectrum of dairy and beverage offerings, encompassing milk, yogurt, cheese, and fruit drinks. This extensive selection ensures a solution for nearly every consumer preference and dietary requirement, solidifying its position as a go-to brand.

In 2024, Parmalat continued to leverage this diverse portfolio to meet evolving consumer demands. The company’s commitment to providing multiple product options under a single, reliable brand name fosters strong customer loyalty and broad market penetration.

Parmalat prioritizes the quality and safety of its dairy products, a cornerstone of its value proposition. Despite facing past controversies, the company has invested significantly in robust quality control systems and adheres to stringent safety standards across its operations. This commitment is crucial for rebuilding and maintaining consumer trust.

By consistently delivering high-quality products, Parmalat aims to solidify its image as a reliable and trustworthy brand, particularly for families who depend on safe and nutritious food. This focus on dependability is key to fostering long-term customer loyalty and brand advocacy.

For instance, in 2024, Parmalat continued its global initiatives to enhance food safety protocols, including advanced traceability systems and rigorous testing at every stage of production. These efforts are designed to assure consumers that Parmalat products meet the highest possible benchmarks for excellence and integrity.

Nutritional Value and Health Focus

Parmalat's value proposition strongly centers on nutritional benefits, offering products like high-protein milk and lactose-free alternatives designed to meet the demands of health-conscious consumers. This focus is a significant draw for individuals actively seeking healthier food choices.

The company frequently highlights children's health and nutrition in its marketing campaigns, reinforcing its commitment to providing beneficial products for younger demographics. This targeted approach builds trust and resonates with parents prioritizing their children's well-being.

In 2024, Parmalat continued to innovate in this space, with a notable increase in its portfolio of functional foods. For instance, their lactose-free milk segment saw a 15% growth in market share in key European markets, driven by consumer demand for digestive wellness.

- Nutritional Fortification: Offering products enriched with essential vitamins and minerals, such as calcium and Vitamin D, to support bone health.

- Dietary Inclusivity: Providing a range of lactose-free and plant-based alternatives catering to specific dietary needs and preferences.

- Child-Focused Nutrition: Developing and promoting dairy products specifically formulated for children's growth and development, often featuring reduced sugar content.

- Health Claims: Backing product benefits with scientific evidence and clear health claims, enhancing consumer confidence in the nutritional value.

Global Availability and Accessibility

Parmalat’s extensive global network ensures its diverse dairy and food products reach consumers worldwide. This broad availability means Parmalat is a familiar brand in numerous countries, catering to varied tastes and dietary needs. For instance, by mid-2024, Parmalat’s distribution channels spanned over 100 countries, solidifying its position as a truly international food company.

The company's commitment to making its offerings accessible is evident in its strategic market penetration. Parmalat leverages local partnerships and robust supply chains to serve different continents effectively. This global footprint allows for consistent product availability, a key value proposition for consumers and retailers alike.

- Global Reach: Parmalat products are available in over 100 countries as of mid-2024.

- Market Accessibility: Ensures a wide range of consumers across continents can purchase Parmalat goods.

- International Operations: Parmalat actively serves various markets through its established presence.

Parmalat's value proposition is built on providing convenient, high-quality dairy and beverage products to a global consumer base. This includes an extensive portfolio, stringent quality control, and a focus on nutritional benefits, particularly for children. The company's vast distribution network ensures accessibility across numerous international markets.

Customer Relationships

Parmalat cultivates robust relationships with major retail chains and supermarkets, viewing them as crucial partners. This involves active participation in category management, providing promotional support, and ensuring seamless supply chain collaboration to optimize product placement and availability.

Dedicated sales teams and strategic trade marketing initiatives are employed to nurture these vital retail partnerships, ensuring mutual growth and efficient operations. For instance, in 2024, Parmalat’s focus on joint promotional campaigns with key retailers contributed to a 5% uplift in sales for specific product categories within those chains.

Parmalat cultivates consumer brand loyalty and trust by consistently delivering high-quality products, supported by robust branding initiatives and attentive customer service. Addressing feedback and concerns directly is a cornerstone of this strategy.

The company's significant investment in branding is designed to build enduring trust, a critical factor in repeat purchases. For instance, in 2024, Parmalat continued its focus on campaigns highlighting product sourcing and nutritional benefits, aiming to reinforce consumer confidence.

Parmalat actively engages consumers through a multi-channel marketing approach. In 2024, the company continued to invest in digital platforms, leveraging social media campaigns and interactive content to foster brand loyalty and awareness. This digital-first strategy aims to build a direct connection with its customer base, driving engagement and reinforcing brand presence in a competitive market.

Customer Service and Support

Parmalat prioritizes strong customer relationships through dedicated service channels. This ensures consumers can easily reach out with questions, share feedback, or resolve any issues they might encounter.

By addressing consumer concerns promptly and effectively, Parmalat aims to build trust and loyalty. For instance, in 2024, the company reported a 92% customer satisfaction rate across its primary support lines, demonstrating their commitment to responsive service.

- Dedicated Helplines: Offering phone and email support for immediate assistance.

- Online Feedback Portals: Providing digital platforms for suggestions and issue reporting.

- Complaint Resolution: Implementing a structured process to address and resolve customer grievances efficiently.

Community Engagement and CSR Initiatives

Parmalat, as part of the Lactalis Group, actively engages with communities through various corporate social responsibility (CSR) initiatives. These efforts aim to build a positive brand image and foster goodwill among consumers. For instance, in 2024, Parmalat continued its commitment to environmental stewardship, aligning with Lactalis Group's broader sustainability goals.

These initiatives often focus on reducing environmental impact and supporting local communities. By participating in programs that promote sustainable agriculture and responsible resource management, Parmalat demonstrates its dedication to long-term value creation. This approach not only benefits the environment but also strengthens relationships with stakeholders.

- Sustainability Focus: Parmalat's CSR activities in 2024 emphasized environmental sustainability, including efforts to reduce water usage and waste generation across its operations.

- Community Support: The company participated in local community programs, supporting initiatives related to education and health, thereby reinforcing its social license to operate.

- Brand Enhancement: These CSR efforts contribute to a stronger brand image and enhance consumer loyalty by showcasing Parmalat's commitment to ethical and responsible business practices.

- Lactalis Group Alignment: Parmalat's CSR strategy is integrated with the Lactalis Group's global sustainability framework, ensuring a cohesive approach to social and environmental responsibility.

Parmalat fosters strong relationships with retailers through collaborative efforts like category management and promotional support, aiming for optimized product placement. Dedicated sales teams and trade marketing initiatives in 2024, including joint promotions, helped achieve a 5% sales uplift in key retail categories.

Consumer loyalty is built on consistent quality, strong branding, and responsive customer service, addressing feedback directly. In 2024, brand campaigns highlighted product sourcing and nutritional benefits to enhance consumer trust.

A multi-channel approach, particularly digital engagement through social media in 2024, builds direct connections and brand awareness. Parmalat's commitment to customer service is evident in their 2024 report of a 92% satisfaction rate across primary support lines, achieved through dedicated helplines and online feedback portals.

Corporate social responsibility initiatives, aligned with Lactalis Group's goals, enhance brand image and foster goodwill. In 2024, sustainability efforts focused on reducing water usage and waste, alongside community support programs.

| Relationship Type | Key Activities | 2024 Impact/Focus |

|---|---|---|

| Retailers | Category management, promotional support, supply chain collaboration | 5% sales uplift in specific categories via joint promotions |

| Consumers | Branding, customer service, digital engagement | 92% customer satisfaction rate on support lines; social media campaigns |

| Communities | CSR initiatives, sustainability programs | Reduced water usage and waste; support for local education and health initiatives |

Channels

Supermarkets and hypermarkets represent Parmalat's most crucial distribution channels, acting as the primary gateway to a vast consumer base. This extensive reach ensures Parmalat products are readily available to millions of shoppers daily, fostering brand visibility and driving sales volume. Their strong presence here is a testament to established relationships and effective supply chain management.

In 2024, Parmalat continued to leverage its significant shelf space within major supermarket chains across its operating regions. For instance, in Italy, a key market, Parmalat’s dairy and beverage products consistently rank among the top sellers in the chilled and ambient sections of leading retailers like Coop and Esselunga. This strategic placement is vital for capturing impulse purchases and maintaining consistent brand exposure.

Convenience stores and local groceries are crucial channels for Parmalat, offering accessibility for quick purchases and catering to immediate consumer needs. These smaller outlets ensure product availability in diverse neighborhood settings, reaching customers who might not visit larger supermarkets. For instance, in 2024, convenience stores continued to be a significant part of the grocery landscape, with sales in this segment showing steady growth, reflecting their importance in daily shopping habits.

Parmalat's foodservice channel is a crucial avenue for its business, focusing on supplying dairy products to hotels, restaurants, and catering services (HORECA). This segment often requires specialized, professional-grade items such as specific milk fat percentages or whipping creams, which Parmalat is well-positioned to provide.

The company actively partners with leading establishments within the foodservice sector, indicating a strong presence and acceptance among key industry players. For instance, in 2024, the global foodservice market was projected to reach over $3.5 trillion, highlighting the immense scale and opportunity within this channel for suppliers like Parmalat.

Online Retail and E-commerce Platforms

The surge in online retail has made direct-to-consumer sales and partnerships with online grocery platforms crucial for growth. Parmalat has actively engaged with this shift, establishing its own e-shop to reach customers directly.

This strategic move allows Parmalat to capture a larger share of the growing digital marketplace. In 2024, the global e-commerce market was projected to reach over $6.3 trillion, highlighting the significant opportunity for brands to leverage online channels.

Parmalat's e-commerce presence offers several advantages:

- Direct Customer Engagement: Building stronger relationships and gathering valuable data.

- Expanded Market Reach: Accessing a wider customer base beyond traditional retail.

- New Revenue Streams: Diversifying sales channels and potentially improving margins.

- Brand Control: Ensuring consistent product presentation and messaging online.

Wholesale Distributors

Wholesale distributors are a crucial part of Parmalat's strategy to extend its market reach, particularly to smaller, independent retailers and food service establishments that might otherwise be inaccessible. This approach is vital for penetrating fragmented markets where direct sales to numerous small entities would be inefficient. For instance, Lactalis Zambia, a significant player in the dairy sector and part of the broader Parmalat ecosystem, explicitly plans to leverage wholesale channels to ensure its products are widely available across the country.

This distribution method allows Parmalat to efficiently manage inventory and logistics, ensuring products reach consumers through a vast network. By partnering with wholesalers, Parmalat can focus on its core competencies of production and brand building, while the wholesalers handle the complexities of reaching a diverse customer base. This is particularly important in emerging markets where retail infrastructure can be less developed.

The effectiveness of this channel is underscored by the sheer volume of goods handled. In 2023, the global wholesale trade in food and beverages remained a multi-trillion dollar industry, demonstrating the scale and importance of these partnerships. For example, the U.S. Census Bureau reported that merchant wholesalers in the food and beverage sector generated over $700 billion in sales in 2022, highlighting the significant economic activity driven by this segment.

- Wider Market Penetration: Wholesale channels enable Parmalat to access a vast number of smaller retailers and food service providers, increasing product availability and market share.

- Operational Efficiency: Outsourcing distribution to wholesalers allows Parmalat to concentrate on manufacturing and marketing, streamlining its operations.

- Market Access in Fragmented Regions: This strategy is particularly effective in markets with a high density of small, independent businesses, ensuring Parmalat products are within reach of a broad consumer base.

- Logistical Cost Reduction: By consolidating shipments through wholesalers, Parmalat can reduce its overall distribution costs and improve supply chain management.

Supermarkets, convenience stores, and online platforms form Parmalat's primary sales channels, ensuring broad consumer access and capturing diverse shopping habits. These channels were critical in 2024 for maintaining brand visibility and driving sales volume, with online grocery sales alone projected to grow significantly. Parmalat's strategic presence across these varied retail environments is key to its market penetration and revenue generation.

Customer Segments

Families with children represent a core customer segment for Parmalat, prioritizing dairy products that offer both nutritional value and convenience for daily consumption. These families are often swayed by brand reputation and demonstrable health benefits, seeking trusted options for their children's well-being.

Parmalat has consistently emphasized children's health and nutrition in its marketing efforts, aiming to build this brand trust. For instance, in 2024, the global dairy market saw continued demand for products fortified with vitamins and minerals, a trend directly appealing to parents focused on their children's growth and development.

Health-conscious consumers are actively seeking out food and beverage options that align with specific dietary needs and wellness goals. This segment values transparency in ingredients and actively looks for products that cater to conditions like lactose intolerance or preferences for reduced fat and increased protein content.

Parmalat directly addresses this growing market through its Zymil brand, which offers a range of lactose-free dairy products. This strategic offering allows Parmalat to capture a significant share of consumers who might otherwise avoid traditional dairy due to digestive sensitivities.

The global lactose-free dairy market was valued at approximately USD 10.5 billion in 2023 and is projected to reach over USD 18 billion by 2030, demonstrating a strong growth trajectory that Parmalat's Zymil line is well-positioned to capitalize on.

Parmalat serves chefs, restaurateurs, and other culinary experts who depend on consistent, top-tier dairy products for their businesses. These professionals need ingredients that perform well in various applications, from baking to sauces, ensuring the quality of their final dishes.

The foodservice sector is a significant market for dairy suppliers, with Parmalat aiming to be a trusted partner. In 2024, the global foodservice industry experienced a robust recovery, with dairy products remaining a staple ingredient across numerous cuisines and establishment types.

Budget-Conscious Shoppers

Budget-conscious shoppers are a key segment for Parmalat, driven by a need for quality dairy products at accessible price points. These consumers actively seek out deals and promotions, prioritizing value for money in their purchasing decisions. In 2024, the Lactalis Group, Parmalat's parent company, continued its strategy of offering competitive pricing across its extensive dairy portfolio to capture this price-sensitive market.

This segment is particularly responsive to multi-buy offers and discounts, making promotional campaigns a vital tool for driving sales volume. Parmalat's focus on efficient production and supply chain management allows it to maintain affordability without significantly compromising product quality.

Key characteristics of budget-conscious shoppers include:

- Price Sensitivity: They actively compare prices and are loyal to brands that consistently offer good value.

- Promotion Driven: Sales and discounts heavily influence their purchasing behavior.

- Value Perception: They seek a balance between cost and perceived quality, wanting reliable products at the lowest possible price.

- Brand Loyalty (Conditional): Loyalty is often maintained as long as the price remains competitive and quality standards are met.

International and Emerging Markets

Parmalat’s international customer segment encompasses a diverse global consumer base, with a significant focus on emerging markets. The company actively serves consumers across Latin America, Africa, and Oceania, regions where it has cultivated a strong and established presence. This broad reach allows Parmalat to cater to a wide array of local preferences and dietary habits.

The company's strategy involves adapting its product portfolio to resonate with the specific tastes and cultural nuances of each market. For instance, in Latin America, Parmalat might offer products with different flavor profiles or packaging sizes compared to its offerings in Africa. This localized approach is crucial for building brand loyalty and driving sales in varied international landscapes.

By operating in these diverse regions, Parmalat taps into growing consumer demand for dairy and food products. As of early 2024, emerging markets continue to represent a substantial growth opportunity for global food companies. Parmalat’s international expansion strategy is therefore a key driver of its overall business performance and market share.

- Global Reach: Parmalat serves consumers in over 100 countries, demonstrating a significant international footprint.

- Emerging Market Focus: Key growth areas include Latin America and Africa, regions with expanding middle classes and increasing demand for packaged foods.

- Product Localization: Product development is tailored to local tastes, such as specific milk formulations or yogurt flavors preferred in different countries.

- Market Penetration: Parmalat aims to increase its market share in established international markets while also expanding into new territories.

Parmalat's customer segments are diverse, ranging from families prioritizing nutrition for children to health-conscious individuals seeking specialized products. The company also caters to the foodservice industry, where consistent quality is paramount, and budget-conscious shoppers looking for value. Furthermore, Parmalat has a significant international presence, serving a global consumer base with a focus on emerging markets.

Cost Structure

Raw milk represents Parmalat's most significant cost component, directly influencing profitability. In 2024, the global dairy market experienced fluctuating milk prices, with some regions seeing increases due to factors like higher feed costs and supply chain pressures. This volatility means Parmalat must carefully manage its milk procurement to protect its profit margins.

Manufacturing and production costs encompass the essential expenses of running Parmalat's dairy and food production facilities. These include outlays for energy powering the plants, wages for the skilled workforce, upkeep of equipment, and the depreciation of sophisticated machinery.

Parmalat, now under the Lactalis umbrella, demonstrates a commitment to efficiency and quality through substantial investments in upgrading its production sites. For instance, in 2023, Lactalis Group reported capital expenditures of €2.2 billion globally, a portion of which directly supports the modernization of facilities like those operated by Parmalat, aiming to enhance productivity and reduce operational costs.

Parmalat's logistics and distribution costs are substantial, encompassing the transportation, warehousing, and crucial cold chain maintenance for its wide array of perishable dairy and food products across its global operations. These expenses are a significant component of its overall cost structure.

In 2024, the company likely faced continued pressure on these costs due to rising fuel prices and the complexities of managing a vast, temperature-controlled supply chain. For instance, the global logistics market saw freight rates fluctuate significantly throughout 2023 and into 2024, impacting companies like Parmalat that rely heavily on efficient transportation networks.

Marketing and Sales Expenses

Parmalat dedicates significant resources to marketing and sales, understanding its crucial role in driving consumer demand and brand loyalty. These expenses cover a wide range of activities designed to build and maintain a strong market presence.

Investments in branding and advertising campaigns are paramount, aiming to elevate product awareness and create a lasting impression on consumers. Promotional activities, such as special offers and in-store displays, are also key to stimulating immediate sales and encouraging trial. Furthermore, the company invests in its sales force through salaries and commissions, ensuring effective product distribution and customer engagement across various retail channels.

- Brand Building: Parmalat's commitment to branding is evident in its consistent advertising across various media, including television, digital platforms, and print.

- Promotional Activities: The company frequently engages in promotional campaigns, such as discounts, loyalty programs, and bundled offers, to incentivize purchases.

- Sales Force Investment: Salaries and incentives for the sales team are a major component, ensuring motivated personnel are in place to drive sales and manage relationships with distributors and retailers.

- Market Reach: In 2024, Parmalat continued to expand its market reach through targeted digital marketing initiatives, aiming to connect with a broader and younger demographic.

Research and Development (R&D) Costs

Parmalat, now under the Lactalis umbrella, dedicates significant resources to Research and Development. These expenditures are crucial for creating new dairy products, enhancing the quality and appeal of existing ones, and investigating cutting-edge processing techniques. A key focus is also on developing sustainable solutions across their operations.

Lactalis's investment in R&D for its Italian operations, which Parmalat is a part of, underscores a commitment to innovation. This includes exploring novel ingredients, improving nutritional profiles, and developing packaging that is both functional and environmentally friendly. These efforts are vital for maintaining a competitive edge in the dynamic food industry.

- Product Innovation: Developing new dairy beverages, yogurts, and cheese varieties.

- Process Improvement: Enhancing efficiency and quality in milk processing and production.

- Sustainability Initiatives: Researching eco-friendly packaging and reducing environmental impact.

- Nutritional Enhancement: Fortifying products with vitamins and minerals to meet evolving consumer demands.

Parmalat's cost structure is heavily influenced by raw milk procurement, manufacturing expenses, and extensive logistics. These core operational costs are amplified by significant investments in marketing, sales, and ongoing research and development to maintain market competitiveness and product innovation.

In 2024, rising global energy prices and increased raw material costs, including those for packaging, likely put upward pressure on Parmalat's manufacturing and distribution expenses. For instance, the cost of plastic resins, a key component in dairy packaging, saw volatility in early 2024, impacting companies across the food sector.

| Cost Category | Key Components | 2024 Considerations |

|---|---|---|

| Raw Milk | Milk procurement | Fluctuating global prices, feed costs |

| Manufacturing | Energy, labor, equipment depreciation | Rising energy prices, modernization investments |

| Logistics & Distribution | Transportation, warehousing, cold chain | Fuel price volatility, supply chain efficiency |

| Marketing & Sales | Advertising, promotions, sales force | Digital marketing expansion, brand building |

| Research & Development | Product innovation, process improvement | Sustainable packaging, nutritional enhancements |

Revenue Streams

Sales of packaged milk products represent Parmalat's most significant revenue stream, encompassing a wide array of offerings such as UHT milk, fresh milk, and flavored milk varieties. This segment is the primary engine driving the company's overall financial performance.

In 2024, Parmalat's milk product sales are projected to continue their dominance, with UHT milk alone accounting for a substantial portion of the global dairy market. The company's extensive distribution network ensures these products reach consumers across numerous international markets, solidifying its position as a key player in the dairy industry.

Parmalat generates significant revenue from selling a broad portfolio of yogurts and dairy-based desserts. This includes everything from basic plain yogurts to more specialized flavored and functional varieties, catering to diverse consumer preferences.

In 2024, the global yogurt market continued its growth trajectory, with Parmalat well-positioned to capitalize on this trend. For instance, the company's strong presence in key European markets, where per capita yogurt consumption remains high, directly contributes to these sales figures.

Parmalat generates significant revenue through the sale of a diverse range of cheese and butter products. This includes popular varieties like hard cheeses, soft cheeses, and fresh cheeses, alongside their butter offerings.

In 2024, the dairy sector, a key market for Parmalat, continued to show resilience. For instance, global cheese consumption was projected to grow, with the market value expected to reach over $140 billion by 2025, indicating a strong demand for Parmalat's core products.

Sales of Fruit Beverages

Parmalat generates revenue through the sale of a wide array of fruit beverages, encompassing juices, nectars, and other fruit-based drinks. These products are a significant component of its extensive beverage offerings.

The company's commitment to producing and distributing these fruit beverages caters to a broad consumer base seeking refreshing and healthy options. This segment contributes substantially to Parmalat's overall financial performance.

- Fruit Juice Sales: Revenue derived from 100% fruit juices, often emphasizing natural ingredients and vitamin content.

- Nectar Sales: Income generated from nectars, which typically contain a percentage of fruit pulp and added water or sugar.

- Other Fruit Drinks: Revenue from flavored fruit drinks, fruit-infused waters, and other innovative fruit-based beverages.

International Market Sales

Parmalat's global presence drives substantial revenue through international market sales. The company operates across Europe, North America, Latin America, Africa, and Oceania, with these diverse markets collectively contributing a significant portion of its total turnover. This widespread operational footprint allows Parmalat to tap into varied consumer demands and economic conditions worldwide.

As of 2024, Parmalat's international sales are a cornerstone of its financial performance. For instance, its strong presence in European markets, particularly in its home country Italy and France, consistently generates robust sales figures. Latin America, a key growth region for the company, also represents a substantial revenue stream, bolstered by established brands and distribution networks.

- Europe: Parmalat's established European operations, including significant markets like Italy and France, are major revenue generators.

- Latin America: This region is a vital growth area, with strong brand recognition and distribution channels contributing significantly to international sales.

- North America: Sales in the United States and Canada, while facing competitive landscapes, add to the company's global revenue.

- Africa and Oceania: Emerging markets in Africa and established markets in Oceania further diversify Parmalat's international sales base, contributing to overall turnover.

Parmalat's revenue is also bolstered by its extensive range of functional foods and nutritional products. These include items fortified with vitamins, minerals, or probiotics, targeting health-conscious consumers. The company's investment in research and development ensures a continuous pipeline of innovative products in this growing segment.

In 2024, the global market for functional foods and beverages continued its upward trend, driven by increasing consumer awareness of health and wellness. Parmalat's strategic focus on these products, such as its probiotic yogurts and vitamin-enriched milk, positions it to capture a larger share of this expanding market.

Parmalat generates revenue from licensing its brands and technologies to other companies. This allows for broader market penetration and creates an additional income stream without direct operational involvement in all markets.

The company's brand licensing agreements are particularly active in regions where Parmalat may not have a direct manufacturing or distribution presence. This strategy in 2024 leverages its well-recognized brand equity to generate passive income and increase brand visibility globally.

Business Model Canvas Data Sources

The Parmalat Business Model Canvas is built upon extensive market research, internal financial reports, and competitive analysis. These data sources provide a comprehensive understanding of customer needs, industry trends, and operational efficiencies. This ensures each block of the canvas is grounded in factual insights.