Parmalat PESTLE Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Parmalat Bundle

Navigate the complex external forces shaping Parmalat's future with our comprehensive PESTLE analysis. Understand how political stability, economic fluctuations, and evolving social trends directly impact its operations and market position. Gain a critical advantage by leveraging these expert insights for your own strategic planning. Download the full analysis now and unlock actionable intelligence.

Political factors

Parmalat, a global dairy leader, navigates a complex web of government regulations, particularly those focused on food safety and quality. These rules are crucial, dictating everything from how milk is processed and what ingredients can be used, to how products are labeled, all to safeguard consumers. For instance, the European Union's General Food Law (Regulation (EC) No 178/2002) sets overarching principles for food safety, which Parmalat must adhere to across its European operations.

Compliance with these mandates is not just about consumer trust; it's a significant operational cost and a barrier to entry in some markets. In 2024, the global food industry, including dairy, faced increased scrutiny on traceability and allergen labeling, with fines for non-compliance potentially reaching millions of euros. Parmalat’s commitment to meeting these evolving standards, such as those around antibiotic residue limits or hygiene protocols, directly impacts its production efficiency and market access.

International trade agreements and potential tariffs significantly shape Parmalat's global market access. For instance, changes in agreements affecting dairy product flows could impact Parmalat's ability to compete in key markets. The competitive landscape, exemplified by the aggressive U.S. pricing for cheese and butter projected for 2025, underscores the sensitivity of Parmalat's margins to trade policy shifts and their influence on import/export costs.

Government support programs and agricultural subsidies in key dairy-producing regions directly impact Parmalat's raw milk costs. For instance, the USDA's fiscal year 2025 budget request proposed $23 million for the Dairy Business Innovation Initiative, a decrease from previous years, potentially affecting value-added product development and market innovation.

Political Stability in Operating Regions

Political stability in Parmalat's operating regions is a cornerstone for its business continuity. In 2024, regions experiencing geopolitical shifts or unrest directly affect the reliability of Parmalat's supply chains and the efficiency of its distribution networks. For instance, disruptions in key agricultural producing nations, often linked to political instability, can lead to price volatility for raw materials like milk, impacting Parmalat's cost of goods sold.

Unstable political environments can significantly alter consumer demand patterns. As observed in several markets during 2024, economic sanctions or trade disputes stemming from political tensions have led to reduced purchasing power and shifts in consumer preferences away from imported or higher-priced goods. This necessitates that Parmalat develops agile strategies to navigate these fluctuating market conditions and maintain revenue streams.

Parmalat must continually monitor political developments to mitigate risks.

- Geopolitical Risk Assessment: Ongoing evaluation of political stability in countries like Brazil, where Parmalat holds a significant market share, is vital. Brazil experienced periods of political uncertainty in recent years, impacting investor confidence and economic growth.

- Regulatory Environment: Changes in food safety regulations, import/export policies, or taxation laws, often driven by political agendas, can directly affect Parmalat's operational costs and market access. For example, shifts in dairy import tariffs in certain African nations where Parmalat operates could impact profitability.

- Government Support and Subsidies: Political decisions regarding agricultural subsidies or support for local dairy industries can create both opportunities and challenges for multinational corporations like Parmalat.

Corporate Governance and Regulatory Scrutiny

Parmalat's corporate governance is heavily influenced by its past financial scandal, leading to stringent regulatory oversight. This means the company must adhere to strict rules on financial reporting and transparency to maintain investor confidence and comply with legal frameworks.

Recent regulatory shifts, such as the EU's Corporate Sustainability Reporting Directive (CSRD), are significantly impacting companies like Parmalat. By 2024, large EU companies are required to report on a wide range of sustainability matters, including environmental, social, and governance (ESG) aspects, adding a layer of complexity to Parmalat's compliance efforts.

- Increased Transparency Demands: Parmalat must provide more detailed and verifiable information on its operations and financial health.

- Focus on ESG Reporting: Compliance with directives like CSRD necessitates robust reporting on sustainability performance, which became mandatory for many companies in 2024.

- Enhanced Audit Requirements: Regulatory bodies are increasing the rigor of audits to prevent future financial irregularities, affecting Parmalat's internal controls.

Political factors significantly shape Parmalat's operational landscape, from food safety regulations to international trade policies. Strict adherence to evolving food safety standards, like the EU's General Food Law, is paramount, with non-compliance risks escalating in 2024 due to increased scrutiny on traceability and allergen labeling. Changes in trade agreements and potential tariffs directly influence market access and pricing competitiveness, as seen in the projected U.S. dairy pricing for 2025, impacting Parmalat's margins.

Government support, such as agricultural subsidies, affects raw material costs, with USDA initiatives for dairy innovation in fiscal year 2025 showing a potential shift. Political stability is crucial for supply chain reliability; geopolitical shifts in key markets like Brazil in recent years have demonstrated the impact on operations and investor confidence. Furthermore, political tensions can alter consumer demand, forcing agile strategies to navigate economic sanctions and trade disputes that affect purchasing power, as observed in various markets during 2024.

Parmalat's corporate governance is under heightened regulatory scrutiny following past scandals, demanding strict financial reporting and transparency. The EU's Corporate Sustainability Reporting Directive (CSRD), mandatory for many companies by 2024, adds complexity, requiring extensive reporting on ESG performance and increasing audit rigor to prevent future irregularities.

What is included in the product

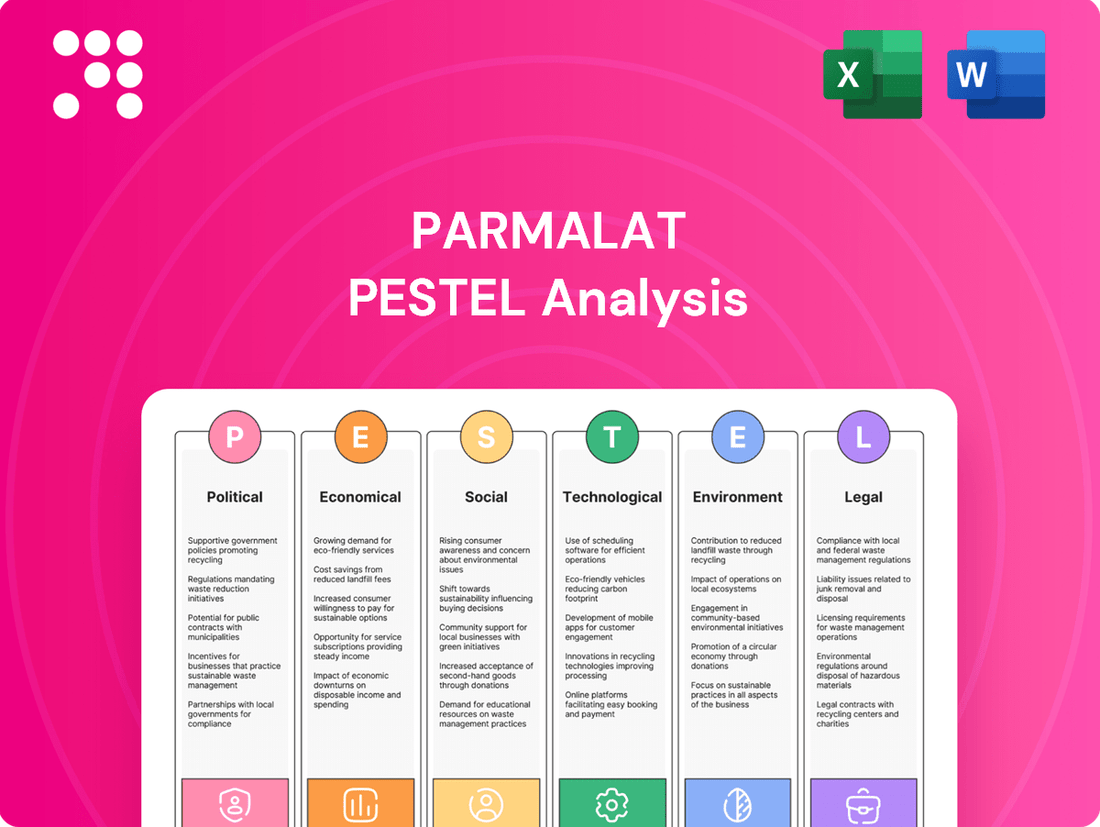

This Parmalat PESTLE analysis examines the influence of political, economic, social, technological, environmental, and legal factors on the company's operations, providing a comprehensive overview of its external macro-environment.

A clean, summarized Parmalat PESTLE analysis provides a crucial pain point reliever by offering easily digestible insights into the complex external factors impacting the company, streamlining strategic decision-making.

Economic factors

Fluctuations in global milk and dairy commodity prices directly impact Parmalat's cost of goods sold and profitability. While dairy markets remained somewhat soft in early 2025, prices and income over feed costs (IOFC) held up better than anticipated, with global average milk prices for January 2025 reported at approximately $0.42 per liter, a slight decrease from late 2024 but still above historical averages.

Inflationary pressures in 2024 and early 2025 are directly impacting consumer purchasing power, a critical factor for Parmalat. Rising costs for everyday goods mean consumers have less disposable income, potentially shifting demand towards more budget-friendly options. This necessitates Parmalat's focus on its core promise of delivering healthy, tasty, and affordable products to retain market share.

For instance, in the European Union, inflation averaged 5.4% in 2024, a notable increase from previous years, impacting food prices significantly. Parmalat's strategy of offering value for money becomes even more crucial in these price-sensitive markets. The company's ability to manage its supply chain and production costs efficiently will be key to maintaining competitive pricing and, consequently, consumer demand for its dairy and food products.

Parmalat, as a global food and beverage company, faces significant risks from currency exchange rate volatility. Fluctuations in exchange rates directly affect the value of its international revenues and the cost of imported raw materials or finished goods. For instance, if the Euro strengthens against the currencies of key markets like Brazil or Indonesia, Parmalat's reported earnings from those regions would translate into fewer Euros, impacting its overall financial performance.

To manage these risks, Parmalat employs various financial hedging strategies, such as forward contracts and options, to lock in exchange rates for future transactions. As of late 2024, major currency pairs like EUR/USD have seen considerable swings, with the Euro trading in a range that necessitates proactive risk management. For example, a 10% adverse movement in the exchange rate could substantially alter the reported profitability of Parmalat’s operations in countries where it generates a significant portion of its revenue.

Investment in Processing Capacity

Significant investments in new dairy processing capacity, especially for cheese, are a key economic factor in 2025. This expansion aims to meet growing demand and improve efficiency. For example, major dairy cooperatives have announced multi-million dollar expansions in cheese-making facilities throughout 2024 and into 2025.

This surge in processing capability is projected to boost Class III milk utilization rates. Increased demand for cheese production means more milk is being channeled into this sector. By late 2025, it's anticipated that Class III utilization could reach levels not seen in several years, potentially impacting milk supply dynamics.

The enhanced processing capacity could eventually exert downward pressure on Class III milk prices. As more milk is processed into cheese, the supply available for other Class III products may become more abundant. This could lead to a more competitive milk pricing environment for processors by the end of 2025 and into 2026.

- Increased Cheese Production Capacity: Investments in new dairy processing plants and upgrades to existing ones are a major trend for 2025, particularly focused on cheese.

- Higher Class III Milk Utilization: The expansion in cheese making is directly linked to an anticipated rise in the utilization of Class III milk.

- Potential Price Pressure: Greater processing capacity for cheese could lead to increased competition for milk, potentially lowering Class III milk prices in the medium term.

- Market Rebalancing: These investments represent a strategic move by the industry to rebalance milk supply and demand, favoring value-added products like cheese.

Market Demand and Export Opportunities

Despite domestic economic uncertainties, the U.S. dairy sector is experiencing robust demand for its products, both at home and abroad. This resilience in consumer appetite, even amidst potential economic headwinds, offers a stable foundation for dairy producers and processors.

Competitive U.S. pricing for key dairy commodities like cheese and butter, coupled with a strong global appetite for butterfat, presents a significant, often overlooked, export opportunity. For companies like Parmalat, which operate within or source from these markets, this competitive edge can translate into enhanced profitability and market share expansion.

- U.S. Dairy Exports: In 2024, U.S. dairy exports, particularly cheese and butter, have shown strength, benefiting from favorable global pricing relative to other major dairy-producing regions.

- Butterfat Demand: Global demand for butterfat, driven by consumer preferences for higher-fat dairy products and its use in various food applications, has remained a key export driver for U.S. suppliers.

- Price Competitiveness: U.S. dairy producers have maintained a competitive price point for butter and cheese throughout 2024, making them attractive options for international buyers.

Global milk prices in early 2025 hovered around $0.42 per liter, a slight dip from late 2024 but still above historical norms, impacting Parmalat's cost of goods sold. Inflation in the EU averaged 5.4% in 2024, squeezing consumer purchasing power and making Parmalat's value-for-money strategy critical. Currency fluctuations, particularly the Euro's movement against currencies in markets like Brazil, pose a significant risk to Parmalat's reported international earnings.

Investments in new dairy processing, especially for cheese, are a major 2025 trend, aiming to meet rising demand and boost efficiency. This expansion is expected to increase Class III milk utilization rates, potentially leading to more competitive milk pricing for processors by late 2025. The U.S. dairy sector, meanwhile, shows robust domestic and export demand, with competitive pricing for cheese and butter in 2024 driving export opportunities.

Full Version Awaits

Parmalat PESTLE Analysis

The preview shown here is the exact document you’ll receive after purchase—fully formatted and ready to use, detailing Parmalat's PESTLE analysis.

This is a real screenshot of the product you’re buying—delivered exactly as shown, no surprises, providing a comprehensive look at the Political, Economic, Social, Technological, Legal, and Environmental factors affecting Parmalat.

The content and structure shown in the preview is the same document you’ll download after payment, offering an in-depth understanding of the external forces shaping Parmalat's strategic landscape.

Sociological factors

Consumers are increasingly seeking dairy products that cater to specific health needs and dietary trends, driving demand for options like plant-based milks and lactose-free dairy. Parmalat's Zymil brand directly targets the lactose-free segment, a market experiencing significant growth.

The global dairy alternatives market was valued at approximately $22.5 billion in 2023 and is projected to reach over $70 billion by 2030, highlighting the substantial shift in consumer preferences towards these alternatives.

Consumers are increasingly prioritizing health and wellness, which directly impacts demand for dairy products offering specific nutritional advantages. This shift is prompting companies like Parmalat to develop innovative offerings, such as high-protein milk options. For instance, Parmalat's Latte Barista line is designed to cater to consumers seeking specific functional benefits from their dairy consumption.

Demographic shifts and population growth significantly shape the demand for dairy products globally. Emerging economies, particularly in Asia, are experiencing robust population growth and a rising middle class, driving increased consumption of dairy. For instance, India's population is projected to reach 1.4 billion by 2024, with dairy consumption expected to grow substantially.

Parmalat's global footprint positions it well to capitalize on these trends. While mature markets in Europe and North America may see slower growth, Parmalat can leverage its presence in rapidly expanding markets like China, where dairy consumption is on an upward trajectory, to offset any stagnation elsewhere.

Ethical Consumerism and Animal Welfare

Growing consumer consciousness around ethical sourcing and animal welfare significantly impacts purchasing choices in the dairy sector. For instance, a 2024 survey indicated that 65% of consumers consider animal welfare when buying dairy products, a notable increase from previous years.

Companies like Parmalat are increasingly integrating responsible farming and animal welfare into their corporate social responsibility frameworks. This focus is becoming a key differentiator, with many consumers actively seeking out brands that can prove their commitment to higher ethical standards.

- Consumer Demand: A significant portion of consumers now prioritize animal welfare in their purchasing decisions for dairy products.

- Corporate Responsibility: Demonstrating ethical farming practices and robust animal welfare policies is becoming a core component of corporate strategy.

- Market Influence: Brands that proactively address these concerns often see improved customer loyalty and market share.

- Regulatory Scrutiny: Increased public awareness also leads to greater scrutiny from regulatory bodies and advocacy groups.

Changing Retail and Consumption Habits

The retail environment is transforming, with consumers increasingly utilizing online marketplaces and niche stores alongside traditional supermarkets. This shift means Parmalat needs to adjust its distribution networks and marketing efforts to effectively connect with shoppers across these diverse touchpoints. For instance, e-commerce sales in the grocery sector saw significant growth, with global online grocery sales projected to reach over $2 trillion by 2025, indicating a substantial opportunity and challenge for established food companies.

Consumer preferences are also evolving, leaning towards convenience, health-conscious options, and sustainable sourcing. Parmalat's product development and branding must reflect these changing demands. Surveys in 2024 indicated that over 60% of consumers are willing to pay more for products with clear sustainability claims, a trend Parmalat can leverage by highlighting its environmental initiatives.

Key shifts in retail and consumption include:

- Growth of E-commerce: Online grocery sales continue to expand rapidly, demanding robust digital strategies from food manufacturers.

- Demand for Convenience: Ready-to-eat meals and convenient packaging solutions are gaining popularity, reflecting busy lifestyles.

- Focus on Health and Wellness: Consumers are actively seeking products with reduced sugar, healthier fats, and functional benefits.

- Sustainability Awareness: Ethical sourcing and environmentally friendly packaging are becoming significant purchasing drivers for a growing segment of the population.

Sociological factors significantly influence Parmalat's market position, driven by evolving consumer preferences towards health, convenience, and ethical sourcing. Demographic shifts, particularly in emerging economies, are boosting dairy consumption, while mature markets see a rise in demand for specialized products like lactose-free or high-protein options. These trends necessitate agile product development and marketing strategies.

Consumer awareness regarding animal welfare is a growing concern, with a significant percentage of shoppers considering ethical practices when making purchasing decisions. Parmalat's commitment to responsible farming and transparency in its supply chain is crucial for maintaining brand reputation and customer loyalty. This focus on ethical considerations is increasingly becoming a competitive advantage in the dairy sector.

The retail landscape's digital transformation, marked by the surge in e-commerce, requires Parmalat to adapt its distribution and engagement strategies. Meeting consumer demand for convenience and health-conscious products, alongside a growing emphasis on sustainability, are key challenges and opportunities for the company's future growth.

| Sociological Factor | Impact on Parmalat | Supporting Data (2024/2025 Projections) |

|---|---|---|

| Health & Wellness Trends | Increased demand for specialized dairy products (lactose-free, high-protein). | Global dairy alternatives market projected to exceed $70 billion by 2030. |

| Demographic Shifts | Growth in dairy consumption in emerging economies; stable to declining in mature markets. | India's population growth driving significant dairy demand. |

| Ethical Consumerism | Consumer prioritization of animal welfare and sustainable sourcing. | 65% of consumers consider animal welfare in dairy purchases (2024 survey). |

| Retail Channel Evolution | Need for robust e-commerce presence and omnichannel strategies. | Global online grocery sales projected to reach over $2 trillion by 2025. |

Technological factors

Parmalat's strategic use of Ultra-High Temperature (UHT) processing has been a cornerstone of its extended shelf-life products, offering a significant competitive edge. Ongoing advancements in UHT technology, alongside other novel processing methods, are vital for Parmalat to sustain superior product quality and expand its market presence, even in regions lacking widespread refrigeration infrastructure.

The dairy sector is seeing a significant uptake in automation, robotics, and AI. These technologies are key to boosting efficiency, cutting labor expenses, and maintaining high product quality across the board. For instance, by 2024, dairy farms globally are expected to see a 15% increase in the adoption of robotic milking systems, according to industry reports.

These advancements streamline every stage of production, from the initial milking process to the final packaging. AI-driven analytics offer real-time insights, allowing for immediate adjustments to optimize yields and resource allocation, a trend that has already contributed to an average 10% reduction in operational costs for early adopters in 2023.

Technological advancements are significantly reshaping Parmalat's product development landscape, particularly in dairy. Precision fermentation, a key innovation, enables the creation of animal-free milk proteins. This technology is crucial for developing new product categories that closely replicate traditional dairy offerings, thereby attracting a wider consumer base interested in alternative protein sources.

Sustainable Packaging Innovations

Parmalat is actively embracing sustainable packaging, exemplified by its introduction of the first certified white rPET bottle for UHT milk, incorporating 50% recycled plastic. This strategic move directly addresses the growing consumer and regulatory demand for environmentally responsible product presentation.

This innovation aligns with broader industry shifts towards circular economy principles, aiming to minimize waste and lessen the overall environmental impact of packaging materials. For instance, by 2025, the EU aims for all packaging to be reusable or economically recyclable. Parmalat’s adoption of rPET directly contributes to this objective.

- Recycled Content: Parmalat's 50% rPET bottle sets a precedent for increased recycled material usage in the dairy sector.

- Circularity Focus: The initiative supports a closed-loop system for plastic, reducing reliance on virgin materials.

- Market Alignment: This innovation positions Parmalat favorably amidst increasing consumer preference for sustainable brands.

Supply Chain Digitalization

The digitalization of Parmalat's supply chain, incorporating advanced logistics and robust cold chain management, is a critical technological enabler for its global operations. These digital solutions are vital for maintaining product integrity and meeting diverse consumer needs across different regions. For instance, by 2024, the global cold chain logistics market was projected to reach over $300 billion, highlighting the significant investment and reliance on these technologies within the food and beverage sector.

These advancements directly boost operational efficiency, improve product traceability from farm to fork, and allow for quicker adaptation to fluctuating market demands. Parmalat's adoption of such technologies is key to ensuring product quality and reducing waste. By 2025, it's estimated that investments in supply chain visibility technologies, including IoT and blockchain, will continue to grow, with many food and beverage companies prioritizing these for enhanced safety and compliance.

Key technological factors in Parmalat's supply chain digitalization include:

- Real-time tracking and monitoring systems: Utilizing IoT sensors to ensure optimal temperature and humidity control throughout the distribution network.

- Advanced analytics and AI: Employing data-driven insights for demand forecasting, route optimization, and inventory management to reduce costs and improve delivery times.

- Blockchain technology: Enhancing transparency and traceability, allowing consumers and stakeholders to verify product origin and handling processes.

- Automated warehousing and robotics: Streamlining internal logistics for faster order fulfillment and reduced manual handling errors.

Technological advancements are fundamentally reshaping Parmalat's operational landscape, from processing to packaging and supply chain management. Innovations like precision fermentation are enabling the creation of novel dairy alternatives, tapping into growing consumer interest in plant-based proteins. By 2024, the market for alternative proteins was projected to reach $162 billion globally, underscoring the significant opportunity.

Parmalat's commitment to sustainability is evident in its adoption of advanced packaging solutions, such as the 50% recycled PET bottle for UHT milk, aligning with the EU's 2025 goal for all packaging to be reusable or recyclable. Furthermore, the digitalization of its supply chain, incorporating IoT sensors and AI analytics, is crucial for maintaining product integrity and optimizing logistics. By 2025, investments in supply chain visibility technologies are expected to rise, with food companies prioritizing them for enhanced safety and compliance.

| Technology Area | Impact on Parmalat | Relevant Data/Trends (2024/2025) |

|---|---|---|

| Precision Fermentation | Development of animal-free milk proteins, new product categories | Global alternative protein market projected to reach $162 billion by 2024. |

| Sustainable Packaging | Reduced environmental impact, consumer appeal | EU target: all packaging reusable or recyclable by 2025. Parmalat using 50% rPET bottles. |

| Supply Chain Digitalization (IoT, AI) | Improved traceability, efficiency, cold chain management | Global cold chain logistics market projected over $300 billion by 2024. Investments in visibility tech rising by 2025. |

Legal factors

Parmalat operates under a complex web of food safety and quality regulations across its global markets, covering everything from sourcing ingredients to final product distribution. These rules are designed to protect consumers and ensure product integrity, impacting Parmalat's operational procedures and supply chain management significantly.

A notable incident in late 2023, where glass fragments were found in a Parmalat milk product in Italy, underscored the absolute necessity of robust quality control systems. This event triggered immediate product recalls and intensified scrutiny on Parmalat's compliance, emphasizing the severe reputational and financial risks associated with any lapse in safety standards.

Compliance with these regulations, including standards set by bodies like the European Food Safety Authority (EFSA) and the U.S. Food and Drug Administration (FDA), is paramount. Failure to meet these benchmarks can lead to substantial fines, product seizures, and a loss of consumer trust, directly affecting Parmalat's market position and profitability.

The Parmalat scandal, a massive accounting fraud that collapsed the company in 2003, underscored the vital importance of stringent corporate governance and compliance. This legacy necessitates ongoing vigilance in financial reporting and ethical conduct.

Following its restructuring, Parmalat has focused on rebuilding trust through enhanced transparency and accountability. This includes adopting best practices such as a majority of independent directors on its board and implementing robust internal controls to safeguard against financial irregularities.

As of its acquisition by Lactalis in 2022, Parmalat's financial health and governance practices are subject to the oversight of its new parent company and relevant regulatory bodies, ensuring continued adherence to legal and ethical standards in its operations.

Parmalat, now a significant part of the Lactalis Group, operates under stringent antitrust and competition laws across its global markets. These regulations are designed to prevent monopolies and ensure fair market practices, impacting everything from pricing strategies to mergers and acquisitions.

Lactalis itself has encountered legal scrutiny in this area. For example, in 2023, Lactalis received a fine of €83 million from Spain's National Commission on Markets and Competition (CNMC) for alleged cartel behavior in the milk sector. This case highlights the substantial financial penalties and reputational damage companies can face for violating competition rules.

Navigating these legal frameworks requires constant vigilance and robust compliance programs. Parmalat, under Lactalis, must meticulously adhere to these laws to avoid significant fines, legal challenges, and the potential disruption of its business operations in various jurisdictions.

Labeling and Marketing Regulations

Parmalat operates under stringent labeling and marketing regulations designed to protect consumers and ensure fair competition. These rules cover everything from nutritional information to health claims and advertising practices, directly impacting how Parmalat communicates its product benefits and ingredients.

In 2024, Parmalat continued its commitment to transparency by implementing QR codes on its new rPET bottles. This initiative allows consumers to easily access information about the recyclability of the packaging, aligning with growing consumer demand for eco-conscious practices and regulatory pushes for greater product lifecycle transparency.

Key aspects of these regulations for Parmalat include:

- Accurate Nutritional Labeling: Ensuring all product labels clearly and accurately display nutritional information, adhering to standards set by regulatory bodies like the European Food Safety Authority (EFSA) or the U.S. Food and Drug Administration (FDA).

- Truthful Marketing Claims: All marketing materials and product claims, such as "low fat" or "high in calcium," must be substantiated and comply with advertising standards to prevent misleading consumers.

- Packaging and Recycling Information: Regulations increasingly mandate clear information on packaging regarding recyclability and disposal, a trend Parmalat is addressing with its QR code initiatives.

- Allergen Information: Strict rules govern the clear identification of common allergens on product labels to safeguard consumers with food sensitivities.

Labor and Employment Laws

Parmalat's extensive global presence means it must navigate a complex web of labor and employment laws across numerous jurisdictions. These regulations cover critical areas such as minimum wage requirements, working hour limits, workplace safety standards, and the rights of employees to organize and engage in collective bargaining. For instance, in 2023, the International Labour Organization reported that over 170 countries have ratified conventions related to freedom of association and collective bargaining, highlighting the widespread legal framework Parmalat operates within.

The company's operational decisions are directly influenced by these legal mandates. For example, when considering restructuring or plant closures, Parmalat must adhere to specific notice periods, severance pay requirements, and consultation processes with employee representatives, as dictated by local labor legislation. The closure of Lactalis Canada's Sudbury facility in early 2024, which impacted approximately 150 employees, serves as a recent illustration of how economic viability must be balanced with legal obligations concerning workforce reductions and employee entitlements.

- Compliance Burden: Parmalat faces significant compliance costs and administrative burdens to ensure adherence to varied labor laws worldwide.

- Union Relations: Navigating diverse union landscapes and collective bargaining agreements is crucial for maintaining stable operations.

- Workforce Management: Labor laws directly impact Parmalat's flexibility in hiring, firing, and managing its global workforce.

- Reputational Risk: Non-compliance with labor laws can lead to legal penalties, operational disruptions, and damage to Parmalat's brand reputation.

Parmalat's operations are heavily shaped by food safety and quality regulations, with incidents like the 2023 glass fragment discovery in Italy highlighting the critical need for robust compliance. Failure to meet standards set by bodies like EFSA can result in substantial fines and reputational damage.

Antitrust and competition laws are also key, impacting pricing and mergers. Lactalis, Parmalat's parent, faced an €83 million fine in Spain in 2023 for alleged cartel behavior, demonstrating the significant financial and reputational risks of non-compliance.

Labeling and marketing regulations ensure accurate product information, with Parmalat's 2024 QR code initiative on rPET bottles enhancing transparency. These legal frameworks, including allergen information and truthful marketing claims, are essential for consumer trust and fair competition.

Labor laws globally dictate employment practices, with Parmalat needing to adhere to minimum wages, safety, and collective bargaining rights, as evidenced by Lactalis Canada's 2024 facility closure impacting employees.

Environmental factors

Parmalat, now part of the Lactalis Group, is actively pursuing a net-zero emissions goal by 2050, demonstrating a strong commitment to environmental stewardship. This ambitious target drives significant investment in enhancing energy efficiency throughout its production facilities and supply chain.

The company is increasingly adopting renewable energy sources, with solar panel installations being a key component of its strategy to decarbonize operations. These initiatives are designed to directly reduce greenhouse gas emissions across all Parmalat's business segments.

Water management is a critical environmental aspect for dairy companies like Parmalat, given the significant water footprint from farming to processing. The dairy industry uses water for irrigation, animal hydration, cleaning, and cooling.

Parmalat's parent company, Lactalis, is actively investing in water recycling technologies across its global operations, aiming to reduce overall water consumption and improve efficiency. For instance, upgrades in some facilities have shown potential to reduce water intake by up to 20%.

This focus on conservation aligns with increasing regulatory pressures and consumer demand for sustainable practices in the food sector. By implementing advanced water management systems, Parmalat and Lactalis are not only mitigating environmental impact but also potentially lowering operational costs related to water usage and treatment.

Parmalat is making significant strides in packaging circularity. A key initiative is their UHT milk bottles, now incorporating recycled PET plastic. This move is designed to cut down virgin plastic usage by thousands of tonnes each year, supporting the group's overarching target of achieving 100% recyclable packaging by 2025.

Sustainable Sourcing and Animal Welfare

Ensuring milk is sourced sustainably and that animals are treated well are becoming crucial environmental and ethical concerns for dairy companies like Parmalat, which is owned by Lactalis. Consumers and regulators are paying more attention to these aspects. Lactalis is actively working to improve these practices across its supply chain.

Lactalis is expanding its animal welfare assessment program to its partner farmers. This initiative aims to promote and support responsible farming methods that prioritize the well-being of dairy cows. By working directly with farmers, Lactalis seeks to embed higher standards throughout its milk sourcing operations.

- Sustainable Sourcing: Growing consumer demand for ethically produced dairy products is pushing companies to adopt more sustainable sourcing strategies for milk.

- Animal Welfare Standards: Adherence to robust animal welfare standards is no longer just a niche concern but a mainstream expectation influencing brand reputation and market access.

- Lactalis's Program: Lactalis's expansion of its animal welfare assessment program to partner farmers in 2024-2025 underscores a commitment to improving practices and ensuring responsible dairy farming.

- Impact on Parmalat: These evolving environmental and ethical considerations directly impact Parmalat's operational strategies and its public image.

Climate Change Impact on Dairy Farming

Climate change presents significant hurdles for the dairy sector, directly affecting Parmalat's operations. Rising global temperatures can disrupt pasture quality and reduce the availability of essential feed crops, impacting milk production efficiency. For instance, prolonged heatwaves in key dairy-producing regions can stress cows, leading to decreased milk yields and potential health issues.

Parmalat, through its parent company Lactalis, is actively exploring solutions to these environmental challenges. Initiatives include research into feed supplements designed to lower methane emissions from cattle. Trials in Italy by Lactalis are a prime example of this commitment, aiming to reduce the carbon footprint associated with dairy farming. The company is investing in sustainable practices to adapt to evolving climate conditions and regulatory pressures.

The dairy industry's environmental impact is under increasing scrutiny. For example, the Food and Agriculture Organization of the United Nations (FAO) reported in 2024 that livestock, including dairy cows, are responsible for a substantial portion of global greenhouse gas emissions. This necessitates proactive strategies from companies like Parmalat to improve sustainability.

Key environmental factors impacting Parmalat's dairy operations include:

- Feed Availability: Climate-induced droughts or floods can severely impact the yield and quality of forage crops, a primary food source for dairy cows.

- Herd Health and Productivity: Extreme weather events, such as heat stress, can negatively affect animal welfare, leading to reduced milk production and increased susceptibility to diseases.

- Regulatory Pressures: Growing awareness of climate change is leading to stricter environmental regulations regarding agricultural emissions, requiring investments in mitigation technologies and sustainable farming practices.

Parmalat's environmental strategy is deeply intertwined with Lactalis's broader sustainability goals, focusing on emissions reduction and resource management. The company is actively working towards a net-zero emissions target by 2050, which involves significant investments in energy efficiency and renewable energy sources like solar power.

Water conservation is a key priority, with Lactalis investing in water recycling technologies that have shown the potential to reduce water intake by up to 20% in some facilities. Packaging circularity is also a major focus, with Parmalat aiming for 100% recyclable packaging by 2025, including the use of recycled PET in its UHT milk bottles.

Climate change poses direct risks to Parmalat's operations, impacting feed availability and herd health through extreme weather events. In response, Lactalis is researching feed supplements to lower methane emissions, with trials underway in Italy, and expanding its animal welfare assessment program to partner farmers in 2024-2025 to promote responsible dairy farming.

The dairy sector's environmental footprint, particularly greenhouse gas emissions from livestock, is under increasing scrutiny, as highlighted by FAO reports in 2024. This pressure necessitates proactive measures from companies like Parmalat to enhance sustainability and comply with evolving environmental regulations.

PESTLE Analysis Data Sources

Our Parmalat PESTLE Analysis is informed by a comprehensive dataset including reports from the European Food Safety Authority (EFSA), the Food and Agriculture Organization of the United Nations (FAO), and national dairy industry associations. We also incorporate economic data from Eurostat and market research firms specializing in the food and beverage sector.