Parmalat Porter's Five Forces Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Parmalat Bundle

Parmalat operates in a dynamic dairy and food sector, facing intense competition and fluctuating buyer power. Understanding these forces is crucial for navigating its market landscape.

The complete report reveals the real forces shaping Parmalat’s industry—from supplier influence to threat of new entrants. Gain actionable insights to drive smarter decision-making.

Suppliers Bargaining Power

Parmalat, a significant player in the global dairy industry, depends heavily on a diverse base of milk producers. The degree of supplier concentration, particularly in key operational regions, directly impacts their leverage. For instance, if a substantial portion of Parmalat's milk supply in a particular market originates from a small number of large dairy farms or well-organized cooperatives, these suppliers gain considerable bargaining power.

The ability of these suppliers to form strong cooperatives, as seen in many agricultural sectors, can amplify their collective bargaining strength. In 2024, the dairy cooperative sector continued to be a dominant force in milk procurement for major processors, with some cooperatives representing thousands of individual farmers, giving them significant pricing influence.

When Parmalat faces a limited number of suppliers capable of providing high-quality raw milk that meets its stringent standards in a specific geographic area, the bargaining power of those suppliers naturally escalates. This scarcity of alternatives means Parmalat may have less flexibility in negotiating terms, potentially leading to higher input costs.

Parmalat faces considerable switching costs when changing dairy suppliers. These costs encompass the expense and time involved in negotiating new agreements, reconfiguring supply chain logistics, and potentially modifying production lines to accommodate different milk or ingredient specifications. For instance, in 2024, the average cost for a large food manufacturer to onboard a new primary ingredient supplier was estimated to be around $50,000, not including potential production downtime.

These significant upfront expenses and operational adjustments mean Parmalat is less likely to switch suppliers frequently, even if a competitor offers slightly lower prices. This reliance on existing relationships, coupled with the investment required for integration, grants suppliers a stronger bargaining position. The complexity of ensuring consistent quality and regulatory compliance across different sources further entrenches this dynamic.

While raw milk is often seen as a commodity, suppliers offering specialized dairy ingredients or employing unique farming practices can significantly influence Parmalat. For instance, if a supplier provides organic milk or milk from specific breeds with distinct nutritional qualities, and Parmalat utilizes this for premium product lines, that supplier's leverage grows.

Threat of Forward Integration by Suppliers

Suppliers, particularly large agricultural cooperatives, might integrate forward into dairy processing and distribution, directly competing with Parmalat. This threat is more pronounced if these cooperatives possess existing processing infrastructure and a strong market presence.

For instance, major dairy cooperatives in regions like Europe or North America could leverage their scale and existing relationships to enter the finished product market, potentially undercutting Parmalat or capturing a larger share of the value chain. This forward integration by suppliers could significantly alter the competitive landscape.

- Threat of Forward Integration: Suppliers with processing capabilities could become direct competitors.

- Cooperative Strength: Large agricultural cooperatives are key potential integrators due to their scale and existing infrastructure.

- Market Impact: Forward integration by suppliers could lead to increased competition and pressure on Parmalat's margins.

Importance of Parmalat to Supplier's Business

The bargaining power of suppliers in the dairy and food industry, including those supplying Parmalat, is influenced by their reliance on Parmalat as a customer. If Parmalat constitutes a substantial percentage of a supplier's total revenue, that supplier's leverage diminishes because they risk losing significant business if they push for unfavorable terms. For example, a major dairy farm that sells a large volume of milk exclusively to Parmalat would have less power than if they supplied multiple processors.

Conversely, if Parmalat sources its raw materials and components from a broad base of suppliers, and each supplier's contribution to Parmalat's overall needs is relatively small, then these suppliers individually hold more bargaining power. This is because Parmalat would face greater disruption and cost if it lost even a few of these suppliers. In 2024, the global dairy market saw fluctuations in milk prices, with some regions experiencing increases due to feed costs and weather patterns, potentially strengthening the hand of milk producers who are not heavily dependent on any single buyer.

The bargaining power of suppliers is also shaped by the availability of substitutes and the cost of switching suppliers. If a supplier offers a unique ingredient or a highly specialized service for which there are few alternatives, their bargaining power increases. For instance, a producer of a proprietary enzyme used in cheese making might command higher prices if Parmalat has limited other options. In the broader food sector, ingredient innovation is a constant, and suppliers who can offer unique or cost-saving solutions often find themselves in a stronger negotiating position.

- Supplier Concentration: If a supplier serves a large portion of Parmalat's needs, their bargaining power is reduced due to their dependence.

- Parmalat's Supplier Diversification: When Parmalat sources from many small suppliers, individual suppliers gain more power as Parmalat is less reliant on any single one.

- Market Conditions: In 2024, factors like rising feed costs for dairy farmers could increase their individual bargaining power if they are significant suppliers to Parmalat.

- Switching Costs: Suppliers with unique offerings or high switching costs for Parmalat to replace them possess greater leverage.

Parmalat's bargaining power with its suppliers is significantly influenced by supplier concentration and the availability of alternatives. When a few large dairy cooperatives or farms dominate the milk supply in a region, they can exert considerable pricing power, especially if Parmalat has limited options for sourcing high-quality milk. This was evident in 2024, where strong cooperative structures continued to give farmers collective leverage.

The costs Parmalat incurs to switch suppliers, including logistical and quality assurance adjustments, also bolster supplier leverage. For instance, onboarding a new major ingredient supplier in 2024 could cost upwards of $50,000. Suppliers offering unique ingredients or specialized services further enhance their position, as Parmalat faces higher switching costs and potential disruption.

| Factor | Impact on Supplier Bargaining Power | 2024 Relevance/Example |

|---|---|---|

| Supplier Concentration | High concentration increases supplier power | Dominance of cooperatives in milk procurement |

| Switching Costs | High switching costs empower suppliers | Estimated $50,000+ cost to onboard new ingredient suppliers |

| Supplier Differentiation | Unique offerings increase supplier leverage | Proprietary ingredients for premium products |

| Parmalat's Dependence | Low dependence reduces supplier power | Suppliers selling to multiple buyers have less leverage |

What is included in the product

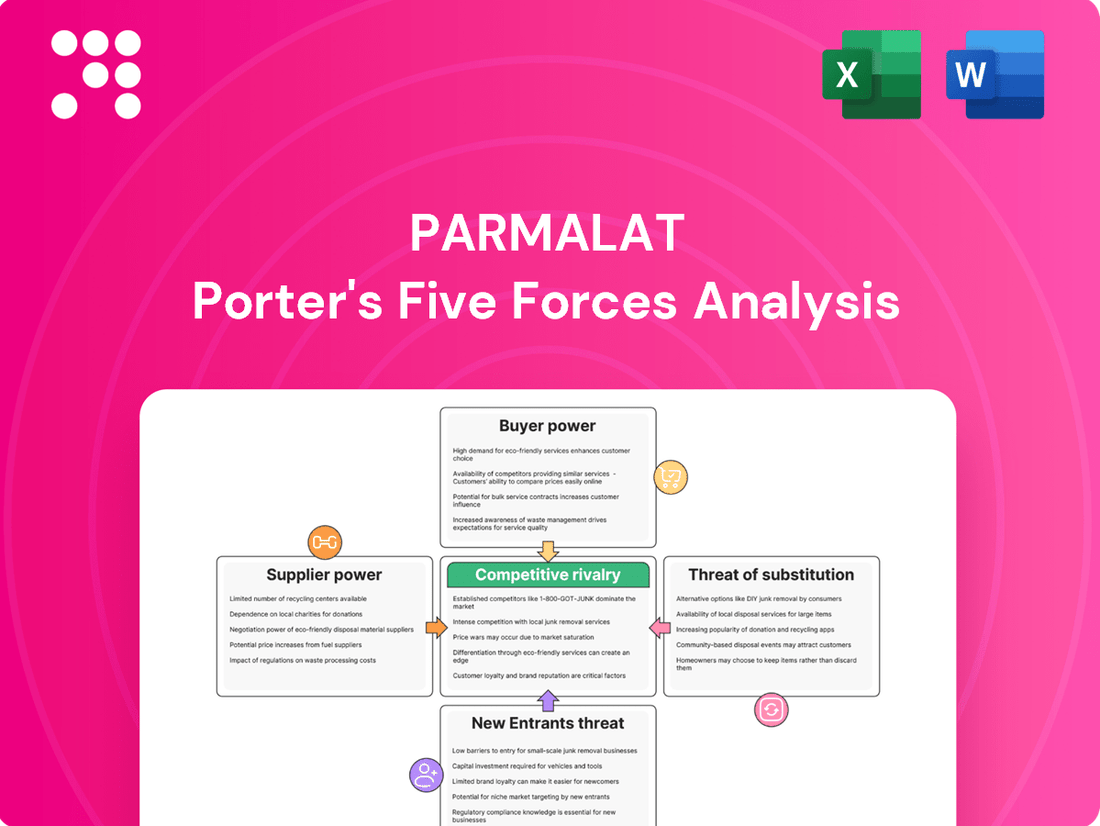

Analyzes the intensity of competition, buyer and supplier power, threats of new entrants and substitutes, specifically for Parmalat within the dairy industry.

Instantly identify and mitigate competitive threats by visualizing the intensity of each Porter's Five Forces on Parmalat's market landscape.

Customers Bargaining Power

Parmalat's customer base is broad, encompassing retail consumers, food service providers, and industrial clients. This diversification helps mitigate the impact of any single customer group.

However, the bargaining power of customers escalates significantly when Parmalat deals with a few major buyers who purchase in substantial volumes. Large supermarket chains or major food manufacturers, for instance, can leverage their purchasing power to negotiate lower prices or more favorable terms. This concentration means these key clients hold considerable sway over Parmalat's profitability.

The increasing trend of private label brands also amplifies customer bargaining power. As consumers increasingly prioritize affordability, retailers are more inclined to push their own brands, often demanding lower wholesale prices from suppliers like Parmalat to remain competitive.

The bargaining power of customers in the dairy industry is significantly amplified by the sheer abundance of substitutes available. Parmalat faces intense competition not only from other dairy producers but increasingly from a burgeoning market of plant-based alternatives. For instance, the global plant-based food market was valued at approximately $29.7 billion in 2023 and is projected to reach $169.8 billion by 2031, indicating a substantial shift in consumer preferences and a growing array of choices.

This proliferation of dairy-free options, ranging from almond and soy milk to oat and coconut-based products, provides consumers with readily accessible and often comparable alternatives. The continuous innovation and expansion of product portfolios within the plant-based sector, driven by consumer demand for healthier and more sustainable options, further empower customers by offering a wider selection and potentially lower price points, thereby increasing pressure on traditional dairy companies like Parmalat.

Consumer price sensitivity is a significant factor for Parmalat, particularly in the dairy sector, which often features staple products. Global inflation and ongoing economic pressures in 2024 have intensified this sensitivity, forcing consumers to scrutinize every purchase.

This heightened focus on affordability directly impacts purchasing decisions, often leading consumers to favor lower-cost alternatives. For instance, in 2023, private label brands saw continued growth across many grocery categories as consumers actively sought value, a trend expected to persist into 2024.

Customer Information and Transparency

Customers today have unprecedented access to information, allowing them to scrutinize product ingredients, nutritional content, and a company's sustainability efforts. This transparency directly impacts their purchasing choices. For instance, a 2024 survey indicated that 78% of consumers consider ingredient transparency a key factor when choosing food products.

Brands that effectively communicate clear health benefits and product clarity resonate more strongly with consumers, especially those who are time-poor and budget-aware. Parmalat, by highlighting its commitment to product quality and nutritional value, can leverage this trend. In 2023, companies with strong sustainability claims saw an average revenue growth of 4% compared to those without.

- Increased Information Access: Consumers actively seek details on ingredients, nutrition, and ethical sourcing.

- Informed Decision-Making: Transparency empowers customers to align purchases with personal values and health goals.

- Brand Appeal: Clear communication of health benefits and product integrity enhances brand attractiveness.

- Market Trends: A significant portion of consumers prioritize ingredient transparency, influencing purchasing habits.

Threat of Backward Integration by Customers

Large retail customers, particularly major supermarket chains, possess the potential to integrate backward into dairy processing. While this is less likely for highly complex dairy products, the underlying threat remains significant. This threat is amplified if these retailers have the financial capacity and strategic impetus to develop and manufacture their own private label dairy items.

Such a move would directly diminish their dependence on established dairy producers like Parmalat, potentially leading to reduced purchasing volumes or increased price pressure. For instance, a large European retailer with a substantial private label program could invest in its own UHT milk or yogurt production facilities. In 2024, major European retailers continued to expand their private label offerings, with dairy products being a key category, indicating a growing capability and willingness to control more of the supply chain.

- Retailer Private Label Growth: In 2024, private label dairy products continued to gain market share across key European markets, with some retailers reporting over 40% of their dairy sales coming from their own brands.

- Investment in Processing: While direct backward integration into complex dairy processing is costly, investment in simpler processing for high-volume items like milk and yogurt is more feasible for large retail groups.

- Negotiating Leverage: The credible threat of backward integration provides significant negotiating power to large retail customers, allowing them to demand lower prices or more favorable terms from suppliers like Parmalat.

Parmalat's customer bargaining power is elevated by the widespread availability of substitutes, including a rapidly growing plant-based alternatives market. For example, the global plant-based food market reached approximately $29.7 billion in 2023. This trend, coupled with heightened consumer price sensitivity in 2024 due to inflation, forces Parmalat to compete on price, especially with staple dairy products. Furthermore, major retail buyers can exert significant influence by demanding lower prices or threatening to develop their own private label brands, a strategy increasingly seen in 2024 European dairy markets.

| Factor | Impact on Parmalat | Supporting Data (2023/2024) |

|---|---|---|

| Substitutes (Plant-Based) | Increases customer power | Global plant-based market valued at ~$29.7 billion in 2023. |

| Price Sensitivity | Drives demand for lower-cost options | Inflationary pressures in 2024 heightened consumer focus on affordability. |

| Private Label Brands | Empowers retailers to negotiate terms | Retailers expanding private label dairy offerings in 2024, some exceeding 40% of dairy sales. |

| Information Access | Enables informed consumer choices | 78% of consumers in a 2024 survey prioritized ingredient transparency. |

What You See Is What You Get

Parmalat Porter's Five Forces Analysis

This preview showcases the complete Porter's Five Forces Analysis for Parmalat, detailing the competitive landscape and strategic implications for the dairy giant. You're looking at the actual document; once you complete your purchase, you’ll get instant access to this exact, professionally formatted file, ready for your strategic planning.

Rivalry Among Competitors

The global dairy industry is a crowded space, featuring a multitude of large multinational corporations alongside a vast number of smaller, regional players. This intense competition means Parmalat faces rivals on multiple fronts, from global giants to localized businesses.

Key competitors for Parmalat include established dairy powerhouses such as Danone, Nestlé, Arla Foods, and its own parent company, Lactalis. The presence of so many significant entities, each with substantial market share and resources, intensifies the rivalry and necessitates continuous innovation and efficiency for Parmalat to maintain its competitive edge.

The dairy products and alternatives sector anticipates sluggish value growth in 2024, a trend that typically fuels more intense competition among existing players vying for a larger slice of a smaller pie. This heightened rivalry can manifest in price wars or increased marketing spend.

However, the outlook brightens beyond 2024, with global milk production projected to resume growth in 2025. This anticipated expansion could ease some competitive pressures as the market size increases, offering more opportunities for all participants.

While basic milk can be seen as a commodity, Parmalat actively differentiates its products. They leverage Ultra-High Temperature (UHT) processing to offer extended shelf life, a significant advantage for consumers. Furthermore, Parmalat develops functional dairy options, such as high-protein or lactose-free varieties, and products fortified with vitamins and probiotics, catering to specific health needs and preferences.

Exit Barriers

Parmalat, like many in the dairy sector, faces substantial exit barriers. The immense capital investment in dairy processing plants, which often feature highly specialized equipment and intricate, established supply chains, makes it incredibly costly for a company to simply shut down operations. This financial entanglement means that even when market conditions are unfavorable and profitability dips, firms may be compelled to continue operating to avoid realizing massive losses on their fixed assets.

These high exit barriers directly contribute to intensified competitive rivalry. Companies are less likely to leave the market, even when facing losses, which keeps the number of players high. This sustained presence of multiple competitors, all burdened by their sunk costs, creates a more aggressive pricing environment and a constant struggle for market share. For instance, in 2024, the European dairy industry continued to grapple with fluctuating milk prices and increased operational costs, forcing many producers to operate on thin margins due to these very exit barriers.

- High Capital Investment: Dairy processing requires significant upfront investment in specialized machinery and infrastructure, creating a substantial financial hurdle for exiting.

- Sunk Costs in Supply Chains: Established relationships with farmers and distribution networks represent sunk costs that are difficult to recover upon exit.

- Operational Continuity Pressure: The need to avoid realizing losses on fixed assets often forces companies to continue operations even during periods of low profitability, intensifying competition.

- Industry Consolidation Trends: While exit barriers are high, ongoing consolidation in the global dairy market, as seen with acquisitions in late 2023 and early 2024, can sometimes alleviate competitive pressure by reducing the number of independent players, though the underlying barriers remain.

Switching Costs for Rivalry

While switching costs for basic dairy products are typically low, allowing consumers to easily move between brands, Parmalat works to mitigate this by fostering brand loyalty. This is achieved through a consistent focus on product quality, introducing innovative new offerings, and maintaining robust distribution channels that ensure product availability.

The ease with which consumers can switch between brands for many standard dairy items, such as milk or yogurt, intensifies the competitive rivalry. For instance, in 2024, the global dairy market saw continued price competition, with brands leveraging promotions and product variety to attract and retain customers. Parmalat's strategy is to make the perceived cost or effort of switching higher through these brand-building initiatives.

- Low Switching Costs: Consumers can readily switch between brands for many commodity dairy products.

- Brand Loyalty Initiatives: Parmalat focuses on quality, innovation, and distribution to reduce customer churn.

- Competitive Intensity: Easy product substitutability in the dairy sector drives rivalry.

- Market Dynamics: Price promotions and product variety are key competitive tools in 2024.

Competitive rivalry in the dairy sector is fierce, driven by numerous players and slow market growth in 2024, which forces companies like Parmalat to compete aggressively on price and innovation. Despite high exit barriers that keep firms in the market, Parmalat differentiates itself through UHT processing and functional products to build brand loyalty and counter low consumer switching costs.

| Competitor | Estimated 2024 Market Share (Global Dairy) | Key Product Categories |

|---|---|---|

| Danone | ~8-10% | Yogurt, Plant-based alternatives, Water |

| Nestlé | ~5-7% | Infant Nutrition, Coffee, Water, Confectionery (includes dairy ingredients) |

| Lactalis (Parmalat's Parent) | ~10-12% | Milk, Cheese, Butter, Yogurt |

| Arla Foods | ~3-4% | Milk, Butter, Cheese, Yogurt |

SSubstitutes Threaten

The threat from substitutes for Parmalat's dairy products, particularly milk, is substantial and continues to rise. Plant-based alternatives like oat, almond, soy, and pea milk are gaining significant market share. These alternatives are not only improving in taste and functionality, offering options like high protein content, but are also becoming more competitive on price, directly challenging traditional dairy.

In 2024, the plant-based milk market saw continued robust growth. For example, oat milk, a key substitute, has seen its market size expand considerably, with projections indicating further expansion. This trend is driven by consumer preferences for perceived health benefits and environmental sustainability, directly impacting the demand for conventional milk products offered by companies like Parmalat.

Customer propensity to substitute is increasing significantly for Parmalat. Growing health consciousness, with concerns around lactose intolerance and cholesterol, pushes consumers towards alternatives. For instance, the global plant-based milk market was valued at approximately $14.5 billion in 2023 and is projected to reach over $30 billion by 2030, indicating a strong shift away from traditional dairy.

Environmental and ethical considerations also fuel this substitution trend. Consumers are increasingly aware of the environmental impact of dairy farming and animal welfare issues, leading them to seek out plant-based or other ethically sourced beverages. This heightened awareness directly translates into a greater willingness to switch from established dairy products.

Technological advancements are significantly enhancing the threat of substitutes for Parmalat, particularly within the dairy industry. Ongoing innovation in the plant-based sector is leading to improved taste, texture, and functionality of alternative products, making them more appealing to a broader consumer base. For instance, by 2024, the global plant-based milk market was projected to reach over $30 billion, indicating substantial consumer adoption and continued investment in product development.

Furthermore, significant investment is being channeled into fermentation technologies for producing animal-free dairy alternatives. Companies are developing precision fermentation methods to create dairy proteins like casein and whey without cows, offering a direct substitute for traditional dairy products. This area saw substantial venture capital funding in 2023 and is expected to continue its growth trajectory, directly challenging Parmalat's core offerings.

Switching Costs for Consumers

Switching costs for consumers moving from traditional dairy products to substitutes are typically quite low. This often boils down to a simple choice made at the grocery store aisle, with minimal effort or financial outlay required to try a new option. This ease of switching significantly amplifies the threat of substitutes for Parmalat's conventional dairy portfolio.

For instance, the burgeoning plant-based milk market, a key substitute, saw significant growth. In 2024, oat milk sales alone were projected to reach over $4 billion in the U.S., demonstrating a clear consumer willingness to explore alternatives without substantial barriers.

- Consumers can easily switch between dairy milk and plant-based alternatives like almond, soy, or oat milk without incurring significant financial penalties or needing to retool their habits.

- The low switching cost means that if a substitute product offers a better price, perceived health benefits, or aligns more with consumer trends, Parmalat's traditional dairy products face immediate pressure.

- This accessibility to alternatives directly impacts consumer loyalty to established dairy brands, as the perceived risk of trying something new is minimal.

Marketing and Promotion of Substitutes

The threat of substitutes for Parmalat's dairy products is amplified by aggressive marketing and promotion from plant-based alternatives. These companies frequently emphasize health benefits, environmental sustainability, and ethical considerations to sway consumer preferences.

For instance, the global plant-based food market, including dairy alternatives, was valued at approximately $29.0 billion in 2023 and is projected to reach $162.1 billion by 2030, demonstrating significant growth and consumer adoption. This surge directly challenges traditional dairy producers like Parmalat.

- Aggressive Marketing: Producers of plant-based alternatives are investing heavily in advertising campaigns that highlight perceived advantages over dairy.

- Consumer Perception: Marketing often focuses on health trends, environmental impact, and animal welfare, influencing a growing segment of consumers.

- Market Growth: The expanding market share of plant-based options indicates a tangible shift in consumer behavior, posing a direct competitive threat.

The threat of substitutes for Parmalat's dairy products remains a significant challenge, primarily driven by the expanding plant-based alternatives market. These substitutes offer consumers choices based on perceived health benefits, environmental concerns, and ethical considerations, all while becoming increasingly competitive in taste and price.

In 2024, the plant-based milk sector continued its upward trajectory, with oat milk alone showing substantial growth. This trend is fueled by consumer demand for healthier and more sustainable options, directly impacting the market share of traditional dairy producers like Parmalat.

The low switching costs associated with plant-based alternatives mean consumers can easily opt for these substitutes without significant financial or behavioral barriers. This ease of transition, coupled with aggressive marketing by alternative brands, puts continuous pressure on Parmalat's conventional dairy offerings.

| Substitute Category | 2023 Market Value (Approx.) | 2024 Projected Growth Factor | Key Consumer Drivers |

|---|---|---|---|

| Plant-Based Milk (Global) | $14.5 billion | 15-20% | Health, Sustainability, Ethics |

| Oat Milk (US) | N/A (significant growth) | Projected > $4 billion sales | Taste, Versatility, Health Perception |

| Animal-Free Dairy Proteins | Emerging Market | High Venture Capital Investment | Innovation, Sustainability, Novelty |

Entrants Threaten

The dairy industry, particularly for global players like Parmalat, demands immense capital. Establishing state-of-the-art processing facilities, investing in advanced UHT technology for extended shelf life, and building robust cold chain logistics represent significant upfront costs. For instance, a new large-scale dairy plant can easily cost tens to hundreds of millions of dollars, a substantial hurdle for potential new competitors.

Established dairy giants like Parmalat leverage significant economies of scale, particularly in production and raw material procurement. This allows them to achieve lower per-unit costs, making it difficult for newcomers to compete on price. For instance, Parmalat's extensive network of suppliers and optimized manufacturing processes in 2024 likely contribute to substantial cost advantages over smaller, less integrated operations.

New companies entering the dairy and food industry face significant hurdles in securing shelf space and reaching consumers. Parmalat, with its established global network, has cultivated strong relationships with major retailers and food service providers. This makes it exceptionally difficult for new entrants to gain comparable market access and visibility, a critical factor for success in this competitive landscape.

Brand Loyalty and Differentiation

Parmalat's established brand loyalty, especially for its UHT milk, presents a significant barrier to new entrants. Consumers often stick with familiar brands, making it challenging for newcomers to gain traction. For instance, in 2024, Parmalat's core dairy products continued to hold substantial market share in many European countries, a testament to decades of consumer trust and consistent quality.

New companies entering the dairy market must invest heavily in marketing and product differentiation to overcome Parmalat's strong brand recognition. Without a compelling reason for consumers to switch, new entrants will struggle to build the necessary awareness and loyalty. This is particularly true in markets where Parmalat has a deeply entrenched distribution network and a history of successful product innovation.

The threat of new entrants is therefore moderated by the significant capital and time required to build a comparable brand reputation. Parmalat's long-standing presence means it benefits from:

- Decades of brand building and consumer trust.

- Strong consumer preference for established UHT milk brands.

- High marketing costs for new entrants to achieve comparable awareness.

- Established distribution channels that are difficult for new players to replicate.

Regulatory Hurdles and Food Safety Standards

The dairy industry faces substantial regulatory hurdles, particularly concerning health, safety, and quality. For instance, in the European Union, regulations like those from the European Food Safety Authority (EFSA) mandate strict adherence to hygiene practices and product traceability, requiring significant upfront investment in compliance infrastructure. New entrants must dedicate considerable resources and time to understand and meet these complex requirements, which can act as a significant barrier.

These stringent standards necessitate robust quality control systems, including regular testing and certifications, adding to operational costs. For example, obtaining certifications like ISO 22000 for food safety management is often a prerequisite for market entry, demanding substantial financial commitment and expertise. The cost and complexity associated with meeting these evolving regulatory landscapes can deter potential new players from entering the market.

Navigating these intricate regulatory frameworks, which can differ significantly across regions, presents a formidable challenge. A new entrant might need to invest in legal counsel and specialized personnel to ensure compliance with diverse national and international food safety laws, such as the Food Safety Modernization Act (FSMA) in the United States. This complexity and the associated costs create a considerable barrier to entry.

- Regulatory Complexity: Dairy sector subject to extensive health, safety, and quality regulations globally.

- Investment in Compliance: New entrants require significant capital for quality control, testing, and certifications.

- Time and Expertise: Navigating diverse regulatory landscapes demands specialized knowledge and can be time-consuming.

- Cost Barrier: Compliance costs, including legal and operational expenses, deter potential new market participants.

The threat of new entrants for Parmalat is generally considered moderate. While the dairy industry offers attractive margins, significant barriers exist, including high capital requirements for infrastructure and technology, established economies of scale enjoyed by incumbents, and strong brand loyalty. Newcomers also face challenges in securing distribution and navigating complex regulatory environments.

Capital investment for new dairy operations, including processing plants and logistics, can easily reach tens of millions of dollars. For example, building a UHT milk processing facility with advanced technology requires substantial upfront funding, making it difficult for smaller entities to enter. Parmalat's 2024 financial reports likely show significant assets tied to its production capabilities, reflecting these high entry costs.

Parmalat's established brand recognition and consumer trust, particularly for its core UHT milk products, present a formidable barrier. In 2024, Parmalat maintained a strong market presence across Europe, benefiting from decades of marketing and product consistency. New entrants would need to invest heavily in brand building and differentiation to challenge this ingrained consumer preference.

Regulatory compliance in the dairy sector is stringent, demanding significant investment in quality control, testing, and adherence to food safety standards. For instance, meeting EU regulations requires robust traceability systems and certifications, adding to operational complexity and cost for any new player aiming to compete with established firms like Parmalat.

| Barrier Type | Impact on New Entrants | Parmalat's Advantage |

|---|---|---|

| Capital Requirements | High (e.g., $50M+ for a new plant) | Established infrastructure and economies of scale |

| Brand Loyalty | Significant challenge to overcome | Decades of consumer trust and recognition |

| Distribution Access | Difficult to secure shelf space | Strong relationships with retailers and established networks |

| Regulatory Compliance | Costly and time-consuming | Existing systems and expertise for adherence |

Porter's Five Forces Analysis Data Sources

Our Porter's Five Forces analysis for Parmalat leverages data from Parmalat's official annual reports, financial statements, and investor relations disclosures. We also incorporate industry-specific market research reports and analyses from reputable sources like Statista and IBISWorld to capture broader competitive dynamics.