Orla Mining SWOT Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Orla Mining Bundle

Orla Mining's current SWOT analysis highlights significant strengths in its project pipeline and experienced management, but also points to potential challenges like market volatility and regulatory hurdles. Understanding these dynamics is crucial for navigating the competitive mining landscape.

Want the full story behind Orla Mining's strengths, risks, and growth drivers? Purchase the complete SWOT analysis to gain access to a professionally written, fully editable report designed to support planning, pitches, and research.

Strengths

Orla Mining's operational gold production, particularly at its Camino Rojo Oxide Gold Mine in Mexico, is a significant strength. This active production status means the company generates immediate revenue and cash flow, unlike companies solely focused on exploration.

This operational capability translates into more predictable financial performance, which in turn bolsters investor confidence. For instance, in the first quarter of 2024, Orla Mining reported record gold production of 33,223 ounces from Camino Rojo, demonstrating consistent output and contributing positively to its financial health.

The Camino Rojo Oxide Gold Mine in Zacatecas, Mexico, stands as a cornerstone asset for Orla Mining, offering a robust and stable production platform. In 2023, Camino Rojo contributed significantly to Orla's overall production, with gold sales of approximately 107,000 ounces, demonstrating its consistent output capabilities.

Mexico provides a mature and generally predictable mining jurisdiction, which is a considerable strength. This established regulatory framework, coupled with a history of successful mining operations within the country, allows for a more predictable operational environment, reducing uncertainty for Orla.

The mine benefits from existing infrastructure and a proven production track record, which effectively mitigates early-stage development risks. This established foundation means Orla can focus on optimizing operations rather than overcoming foundational hurdles, contributing to a more efficient and less capital-intensive operational model.

The Cerro Quema Oxide Gold Project in Panama is a significant development asset for Orla Mining, poised to substantially boost future production. This project offers a direct route for the company's organic growth and broadens its asset portfolio.

Advancing Cerro Quema is expected to unlock considerable new value for Orla Mining's shareholders. As of early 2024, preliminary studies indicated a potential for over 100,000 ounces of gold production annually once operational.

Focus on Gold and Silver

Orla Mining's dedicated focus on gold and silver is a significant strength, as these precious metals are widely recognized as safe-haven assets. This positioning offers a natural hedge against economic uncertainties and market volatility, which is particularly appealing to investors during times of inflation or geopolitical tension. For instance, gold prices saw significant gains in early 2024, reflecting ongoing global economic concerns.

The inherent demand for gold and silver, especially during periods of instability, can translate into more predictable or even increasing commodity prices for Orla. This strategic alignment with investor preferences for tangible assets provides a solid foundation for the company's market appeal and potential revenue stability.

- Safe-Haven Assets: Gold and silver provide a buffer against economic downturns and inflation.

- Investor Demand: Tangible assets like precious metals are often sought after during uncertain times.

- Price Support: Demand during inflation or geopolitical instability can bolster commodity prices.

Experienced Management and Responsible Operations

Orla Mining's experienced management team is a significant strength, guiding the company toward delivering shareholder value through efficient and responsible mining practices. This expertise is vital for successfully navigating the intricate landscape of mine development, production, and adherence to stringent regulations.

The company's commitment to responsible operations is a key differentiator, fostering a positive reputation and attracting investors who prioritize ethical and sustainable business conduct. This focus on good governance and operational excellence is particularly important in the mining sector, where environmental and social impact are under constant scrutiny.

For instance, as of early 2024, Orla Mining reported a strong operational performance at its Camino Rojo oxide mine, with production exceeding guidance. This success is a testament to the management's ability to execute effectively.

- Experienced Leadership: A proven track record in mining development and operations.

- Operational Excellence: Focus on efficiency and cost management.

- Responsible Practices: Commitment to environmental, social, and governance (ESG) principles.

- Shareholder Value Focus: Strategy centered on delivering returns through effective resource management.

Orla Mining's core strength lies in its operational gold production, primarily from the Camino Rojo Oxide Gold Mine in Mexico. This mine consistently contributes to revenue and cash flow, providing a stable financial base. In the first quarter of 2024, Camino Rojo achieved record gold production of 33,223 ounces, showcasing its reliable output.

The company also boasts the Cerro Quema Oxide Gold Project in Panama as a key growth asset. This project is anticipated to significantly increase future production, with early 2024 estimates suggesting potential for over 100,000 ounces of gold annually once operational.

Orla's strategic focus on gold and silver, recognized safe-haven assets, offers a natural hedge against economic volatility. This positioning appeals to investors, especially during inflationary periods, as seen with gold price appreciation in early 2024.

An experienced management team, committed to operational excellence and responsible practices, further solidifies Orla's strengths. This leadership ensures efficient development and production, as evidenced by Camino Rojo exceeding production guidance in early 2024.

| Asset | Location | Status | Q1 2024 Production (oz Au) | 2023 Production (oz Au) |

| Camino Rojo | Mexico | Producing | 33,223 | ~107,000 |

| Cerro Quema | Panama | Development | N/A | N/A |

What is included in the product

Delivers a strategic overview of Orla Mining’s internal and external business factors, examining its strengths, weaknesses, opportunities, and threats.

Offers a clear, actionable framework to identify and address Orla Mining's strategic challenges and opportunities.

Weaknesses

Orla Mining's operations are heavily concentrated in Mexico and Panama, with the Camino Rojo mine in Mexico being a primary contributor. This geographic focus means that any political instability, changes in mining regulations, or social unrest in these specific countries could significantly disrupt Orla's production and future development plans. For instance, in 2023, Mexico's mining sector faced discussions around potential reforms that could impact operational costs and permits, a risk directly amplified by Orla's substantial presence there.

As a producer of gold and silver, Orla Mining's financial health is directly tied to the unpredictable swings in commodity prices. For instance, in late 2023 and early 2024, gold prices experienced notable volatility, trading within a range that significantly impacts revenue streams for companies like Orla. A substantial decline in these precious metal prices can directly shrink Orla's earnings, squeeze profit margins, and even cast doubt on the financial feasibility of existing or planned mining operations.

This dependence on market price fluctuations introduces a significant challenge for Orla Mining when it comes to accurately forecasting its future revenues. The unpredictable nature of gold and silver markets means that the company must constantly adapt its financial planning to account for potential price downturns, which can complicate investment decisions and operational budgeting.

The development of Orla Mining's Cerro Quema project in Panama, like all mining ventures, faces significant challenges due to intricate and time-consuming permitting and regulatory approval processes. Delays in obtaining these crucial permits can push back project schedules and inflate expenses. For instance, in 2023, the mining industry globally saw an average of 10-15 years for a new mine to go from discovery to production, with regulatory hurdles being a major contributor to this timeline.

Operational and Technical Risks

Orla Mining faces inherent operational and technical risks common in the mining sector. These include geological uncertainties that can impact ore grades and reserve estimates, as well as unforeseen technical challenges during extraction and processing. For instance, in 2024, the company continued to navigate the complexities of its Camino Rojo oxide project, where optimizing throughput and managing water usage are ongoing technical considerations.

Equipment failures and operational disruptions can also lead to significant setbacks. A major breakdown or an unexpected issue with processing facilities, like those encountered at Camino Rojo during its ramp-up phase, can directly affect production volumes and increase costs. Orla's ability to maintain its fleet and implement robust preventative maintenance programs is therefore crucial for operational stability.

- Geological Uncertainties: Fluctuations in ore grade at Camino Rojo could impact projected recovery rates.

- Technical Challenges: Optimizing the heap leach process for consistent gold recovery remains a key operational focus.

- Equipment Reliability: Maintaining efficient operation of mining and processing equipment is vital to avoid costly downtime.

- Operational Disruptions: Potential for unforeseen events, such as weather or supply chain issues, could impact production schedules.

Capital Intensive Nature of Mining

The mining industry, and by extension Orla Mining, is inherently capital intensive. This means that significant financial resources are needed for every stage, from finding new mineral deposits to actually digging them up and processing them. For instance, bringing a new mine into production can cost hundreds of millions, if not billions, of dollars.

Orla Mining's operations, including exploration, developing new sites like the Camino Rojo Sulfide project, and maintaining existing ones, demand substantial and continuous investment. In 2023, Orla Mining reported capital expenditures of approximately $156 million, with a significant portion allocated to advancing its projects.

This heavy reliance on capital means Orla Mining must frequently access financial markets. This can create risks. If the company needs to raise funds by issuing new shares, existing shareholders' ownership stakes can be diluted.

- High Upfront Costs: Developing a mine from exploration to production requires massive capital outlays, often exceeding hundreds of millions of dollars.

- Ongoing Investment Needs: Sustaining capital expenditures for equipment, infrastructure, and exploration are constant requirements for mining companies like Orla.

- Financing Risk: Dependence on capital markets for funding exposes Orla to fluctuations in financing costs and potential equity dilution if new shares are issued.

- Project Development Expenses: Advancing projects such as the Camino Rojo Sulfide expansion requires significant capital, as seen in Orla's 2023 expenditures of around $156 million.

Orla Mining's significant concentration in Mexico and Panama exposes it to country-specific political and regulatory risks. Changes in mining laws or social unrest in these regions could directly impact production and future development, as seen with potential reforms discussed in Mexico's mining sector in 2023.

The company's financial performance is highly sensitive to gold and silver price volatility. For example, the price fluctuations observed in late 2023 and early 2024 directly affect Orla's revenue streams and profit margins, making financial forecasting challenging.

Complex and lengthy permitting processes for projects like Cerro Quema in Panama present a considerable weakness. Global mining projects often take 10-15 years from discovery to production due to regulatory hurdles, a timeline Orla must contend with.

Operational and technical risks, including geological uncertainties impacting ore grades and equipment reliability, are inherent. Optimizing the heap leach process at Camino Rojo and managing equipment maintenance are ongoing challenges for Orla, with 2023 capital expenditures of approximately $156 million highlighting the need for continuous investment in these areas.

Preview the Actual Deliverable

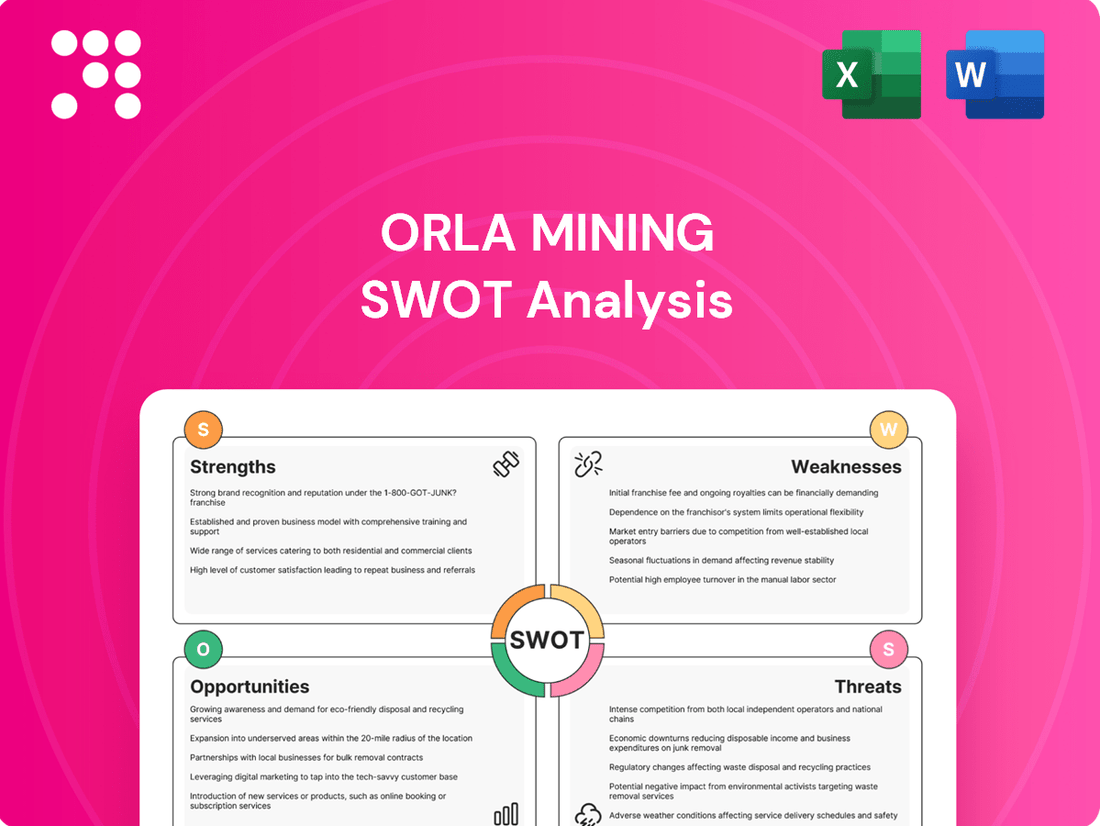

Orla Mining SWOT Analysis

This preview reflects the real document you'll receive—professional, structured, and ready to use. You're seeing the actual Orla Mining SWOT analysis, providing a clear overview of its strategic position. Purchase unlocks the complete, in-depth report for your analysis.

Opportunities

A sustained period of elevated gold prices, such as the upward trend observed through early 2024, presents a prime opportunity for Orla Mining. This favorable pricing environment directly translates to enhanced revenue and profitability from its producing assets, like the Camino Rojo mine. For instance, with gold prices consistently trading above $2,000 per ounce in early 2024, Orla's production becomes significantly more valuable.

Furthermore, strong gold prices bolster the financial viability of Orla's development pipeline. Projects that might have been marginal at lower price points can become economically attractive, potentially accelerating their advancement. This improved economic outlook for future endeavors can lead to increased investor confidence and a stronger balance sheet.

Orla Mining has a significant opportunity to unlock further value at its existing Camino Rojo and Cerro Quema properties. Exploration efforts could reveal additional gold and silver deposits, extending the mine life and boosting reserves. This organic growth approach capitalizes on established infrastructure, potentially leading to substantial long-term value creation.

Orla Mining could significantly bolster its resource base and operational capabilities by strategically acquiring other mineral properties or even entire companies. This inorganic growth strategy offers a faster path to expansion than purely organic exploration. For instance, acquiring a property with advanced processing technology could immediately improve Orla's operational efficiency.

Forming partnerships or joint ventures presents another avenue for growth, allowing Orla to share the substantial costs and risks associated with developing new mining projects. This collaborative approach can accelerate market penetration and unlock value in projects that might be too capital-intensive for Orla to undertake alone. As of early 2024, the junior mining sector has seen increased M&A activity, presenting potential opportunities for Orla to leverage this trend.

Optimization and Efficiency Improvements

Implementing advanced technologies and operational best practices at Orla Mining's Camino Rojo mine presents a significant opportunity. For instance, adopting automated drilling and blasting systems could reduce cycle times and improve ore fragmentation, leading to lower processing costs. Focusing on continuous improvement initiatives can directly boost profitability by increasing gold recovery rates, potentially by a few percentage points, which significantly impacts the bottom line. These optimizations are key to enhancing the mine's overall economic viability and extending its operational lifespan, directly contributing to higher profit margins.

Further opportunities lie in refining energy management and water usage at Camino Rojo. By investing in more energy-efficient processing equipment and optimizing water recycling systems, Orla Mining can achieve substantial reductions in operating expenses. For example, a 5% reduction in energy consumption could translate to millions in annual savings. These efficiency gains not only improve profitability but also align with growing environmental, social, and governance (ESG) expectations from investors and stakeholders.

- Enhanced Recovery Rates: Targeting a 2-3% increase in gold recovery at Camino Rojo through process optimization could boost annual revenue by millions, based on projected 2024 production.

- Cost Reduction Initiatives: Implementing new technologies like advanced comminution circuits could lower milling costs by an estimated 5-10%.

- Extended Mine Life: Efficiency improvements can unlock previously uneconomic lower-grade ore, potentially extending the economic life of Camino Rojo by several years.

Advancement of Cerro Quema Project

Successfully advancing the Cerro Quema Oxide Gold Project from permitting through construction and into production presents a significant growth avenue for Orla Mining. This development is poised to substantially boost Orla's gold production, adding valuable diversification to its asset portfolio. The company's ability to bring Cerro Quema online would underscore its capability in executing its development strategy.

In 2024, Orla Mining reported that the Cerro Quema project was progressing towards its construction and production phases, with key permitting milestones achieved. This project is anticipated to contribute an average of 90,000 ounces of gold annually over its initial years of operation, based on feasibility studies. The successful development of Cerro Quema would mark a critical step in Orla's expansion plans, demonstrating robust project execution capabilities.

- Increased Production: Cerro Quema is projected to add significant gold ounces to Orla's annual output, potentially reaching over 90,000 ounces per year in its early production life.

- Asset Diversification: Bringing a second producing asset online reduces reliance on the existing Pinos Altos mine, spreading operational risk.

- Execution Capability: Successfully navigating the permitting and construction phases for Cerro Quema validates Orla's development expertise and its capacity to manage complex projects.

- Financial Impact: The project's development is expected to positively impact Orla's revenue and profitability, enhancing its overall financial standing.

Orla Mining is well-positioned to capitalize on favorable gold prices, with early 2024 seeing gold trading above $2,000 per ounce. This robust pricing environment directly enhances the profitability of its existing operations, such as the Camino Rojo mine, by increasing the value of each ounce produced. Furthermore, sustained high gold prices make Orla's development projects more economically viable, potentially accelerating their advancement and attracting investor interest.

The company has a clear opportunity to expand its resource base through exploration at its current properties, Camino Rojo and Cerro Quema, which could extend mine life and boost reserves. Strategic acquisitions or joint ventures also present a path for growth, allowing Orla to broaden its operational footprint and share development costs. Additionally, implementing advanced technologies and efficiency improvements at Camino Rojo, like optimizing energy and water usage, can significantly reduce operating expenses and boost profitability.

Advancing the Cerro Quema Oxide Gold Project towards production is a key opportunity, expected to add substantial gold ounces to Orla's output and diversify its asset base. Feasibility studies suggest Cerro Quema could contribute around 90,000 ounces of gold annually in its initial years. Successfully bringing this project online would demonstrate Orla's project execution capabilities and enhance its overall financial standing.

Threats

Political and regulatory shifts in Mexico and Panama pose a significant threat to Orla Mining. For instance, a hypothetical increase in mining royalties by 5% in Mexico, a key operating jurisdiction, could directly reduce Orla's net revenue from its Camino Rojo mine. Similarly, new environmental regulations in Panama, where Orla is developing the Cerro Quema project, might necessitate costly operational adjustments, impacting project timelines and budgets.

A significant and sustained downturn in global gold and silver prices presents a direct threat to Orla Mining's revenue and profitability. For instance, gold prices, which averaged around $2,300 per ounce in early 2024, could fall substantially, impacting Orla's ability to generate strong cash flows from its operations.

Lower commodity prices can make current operations less profitable and future projects uneconomical. This could force Orla to re-evaluate its development plans or even lead to asset write-downs, as seen with other miners when prices drop below production costs.

Orla Mining, like many in the industry, faces the significant threat of environmental and social opposition. Concerns over water usage, habitat disruption, and potential pollution can galvanize local communities and environmental organizations. For instance, in 2023, the mining sector globally saw increased scrutiny and activism, with projects facing delays due to these very issues, impacting project timelines and increasing operational costs.

This opposition often translates into tangible hurdles such as protests, legal battles, and prolonged permitting processes. These challenges can significantly impede project development and ongoing operations, as seen in various Latin American mining projects where community consultations and environmental impact assessments have become protracted affairs, sometimes adding years to project lifecycles and millions to development budgets.

Securing and maintaining a robust social license to operate is therefore paramount for Orla Mining's long-term success. A failure to effectively engage with stakeholders and address their concerns can lead to substantial financial repercussions, including project cancellations or costly mitigation measures, directly impacting shareholder value and future growth prospects.

Increased Operating Costs

Rising input costs are a significant concern for Orla Mining. Expenses for energy, labor, consumables, and equipment are all on the upswing, which can squeeze profit margins even if gold prices hold steady. For instance, global energy prices saw considerable volatility in late 2024 and early 2025, directly impacting operational expenditures for mining companies.

Inflationary pressures and ongoing supply chain disruptions are further exacerbating these cost increases. These factors can make it more expensive and difficult to secure necessary materials and equipment. These challenges can significantly increase the cost of mining operations, impacting the bottom line.

Orla Mining also faces the threat of unforeseen geological challenges or lower-than-expected ore grades at its projects. Such issues can lead to higher per-ounce production costs, making it less efficient to extract the valuable minerals. For example, if a new vein proves harder to access or contains less gold than initially projected, the cost to produce each ounce will naturally rise.

- Rising energy prices: Global energy benchmarks experienced a notable increase in the latter half of 2024, directly impacting fuel and electricity costs for mining operations.

- Labor cost inflation: The mining sector, like many others, is facing upward pressure on wages and benefits, increasing overall personnel expenses.

- Supply chain volatility: Disruptions in the global supply chain for critical mining consumables and spare parts have led to higher procurement costs and potential delays.

- Ore grade uncertainty: Exploration and development phases always carry the risk of encountering ore bodies with lower-than-anticipated gold grades, directly increasing the cost per ounce produced.

Competition for Resources and Capital

Orla Mining faces significant competition for critical resources and capital within the mining sector. This includes vying with numerous other companies for prime mineral concessions, attracting experienced geologists and engineers, and securing the necessary funding for exploration and development projects. For instance, in 2024, the global mining industry saw continued robust investment, with major players actively pursuing acquisitions and project expansions, making it more challenging for mid-tier companies like Orla to secure capital on the most favorable terms.

The intense competition directly impacts Orla's ability to grow and operate efficiently. Higher demand for exploration land can inflate acquisition costs, as seen in the increasing per-acre prices for promising undeveloped properties in key mining jurisdictions. Furthermore, attracting and retaining top talent in a tight labor market often requires offering more competitive compensation packages, thereby increasing operational expenses. This competitive landscape can constrain Orla's strategic options and put pressure on its profitability.

- Increased Acquisition Costs: Competition drives up the price of acquiring new mineral properties, potentially making expansion more expensive.

- Capital Raising Challenges: Securing financing can become more difficult and costly when competing with larger, established mining entities for investor capital.

- Talent Scarcity: The demand for skilled mining professionals means Orla must compete on compensation and benefits, impacting operational budgets.

- Limited Growth Opportunities: Intense competition for desirable assets can restrict the number of viable expansion or acquisition targets available to Orla.

Political and regulatory shifts in Mexico and Panama present a significant threat, potentially increasing operating costs or delaying projects. A sustained downturn in gold and silver prices, which saw averages around $2,300 per ounce for gold in early 2024, directly impacts revenue. Environmental and social opposition can lead to costly delays and legal battles, as seen with increased activism globally in 2023.

SWOT Analysis Data Sources

This analysis of Orla Mining is built upon a robust foundation of data, drawing from the company's official financial filings, comprehensive market research reports, and insights from industry experts. These sources provide a well-rounded view of Orla Mining's operational performance and market position.