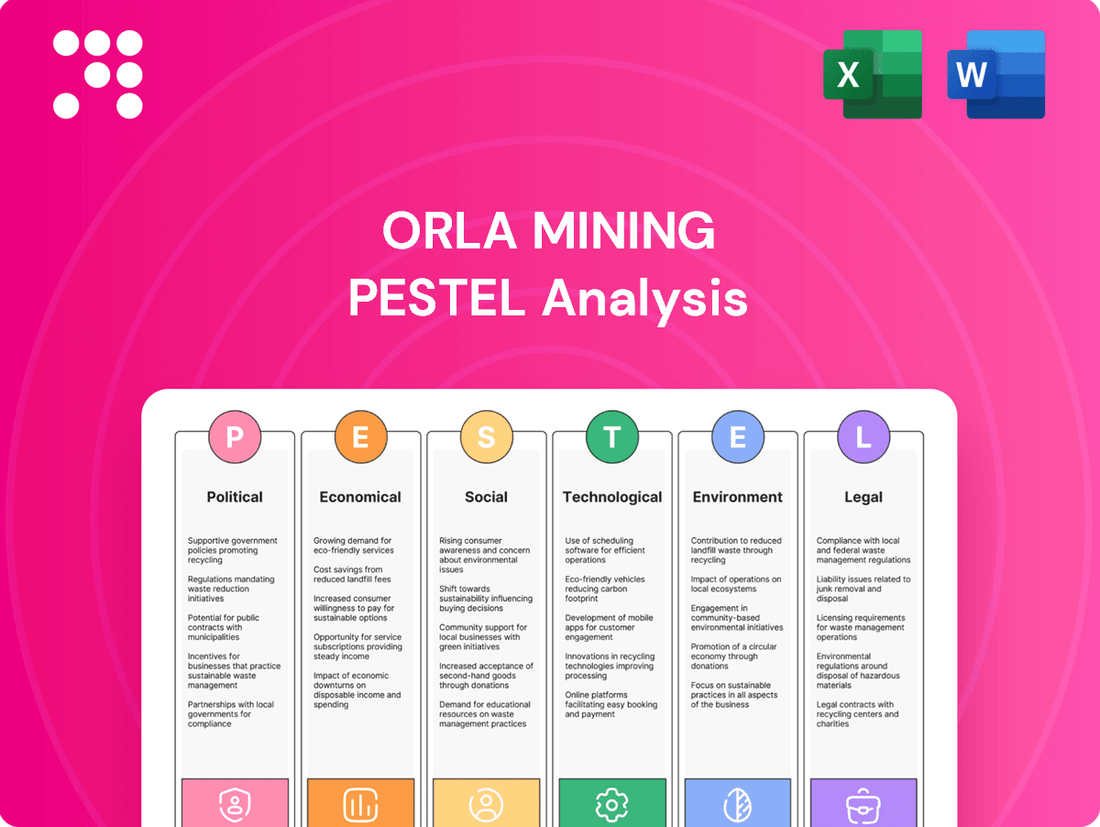

Orla Mining PESTLE Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Orla Mining Bundle

Gain a competitive edge with our comprehensive PESTLE analysis of Orla Mining. Uncover the critical political, economic, social, technological, legal, and environmental factors shaping its operational landscape and future trajectory. Equip yourself with actionable intelligence to navigate market complexities and identify strategic opportunities. Download the full PESTLE analysis now for unparalleled insights.

Political factors

Mexico's government is actively reshaping its mining sector, with proposed duty increases for 2025 potentially impacting companies like Orla Mining. These changes include raising the Special Mining Duty from 7.5% to 8.5% and the Extraordinary Mining Duty from 0.5% to 1.0%.

The stated aim of these adjustments is to better leverage the nation's non-renewable resources. However, such increased fiscal demands could present a challenge, potentially deterring foreign investment in a sector crucial for economic development.

Mexico's new mining policy, enacted under President Claudia Sheinbaum, has imposed a complete moratorium on the approval of new mining concessions. This significant policy shift, effective from late 2024, also mandates a comprehensive review of all existing mining operations, with a particular emphasis on the environmental consequences of open-pit mining practices. This signals a fundamental re-evaluation of how Mexico manages its vast mineral resources.

Panama's political landscape has become increasingly challenging for the mining sector. Law 407 of 2023 introduced a moratorium on new metal mining concessions, renewals, and extensions. This, alongside Supreme Court decisions, effectively halts new metal mining operations, impacting companies like Orla Mining.

The moratorium significantly affects Orla Mining's Cerro Quema project, which is in the exploration and development phase. While existing concessions might be grandfathered, the inability to secure new permits or extend current ones creates substantial uncertainty and potential operational hurdles for future expansion or development plans.

International Arbitration and Trade Agreements

Orla Mining is actively pursuing an arbitration process against the Government of Panama, leveraging the Canada-Panama Free Trade Agreement. This legal action stems from the cancellation of Orla's Cerro Quema mining concessions.

The company's aim is to safeguard its substantial historical investments in the region. The preliminary claim filed in this arbitration is substantial, estimated at a minimum of US$400 million, highlighting the significant financial implications of this dispute.

- Arbitration Initiated: Orla Mining has commenced arbitration proceedings against Panama.

- Legal Basis: The action is taken under the Canada-Panama Free Trade Agreement.

- Concession Dispute: The arbitration is a direct result of the cancellation of the Cerro Quema mining concessions.

- Financial Stake: Orla is seeking to protect investments with a preliminary claim of at least US$400 million.

Political Stability and Geopolitical Risks

The political climate within Orla Mining's primary operating regions, specifically Mexico and Panama, significantly shapes investment decisions and the ability to conduct operations smoothly. In 2024, Mexico continued to grapple with evolving regulatory frameworks and local community relations, which can impact project timelines and costs. Panama, while generally stable, faces its own set of political considerations that require careful monitoring by companies like Orla.

Global geopolitical tensions also play a crucial role. As of mid-2025, ongoing international conflicts and economic uncertainties are contributing to volatility in gold prices. This dynamic is particularly relevant as gold often acts as a safe-haven asset during such periods. Orla Mining, like other precious metals producers, must factor these broader geopolitical risks into its strategic planning and financial forecasting to maintain operational resilience and secure investor trust.

- Mexico's Regulatory Environment: Changes in mining laws or increased environmental scrutiny in Mexico could impact Orla's operational costs and expansion plans.

- Panama's Political Landscape: Shifts in government policy or local sentiment in Panama can affect the social license to operate for mining projects.

- Global Safe-Haven Demand: Geopolitical instability in regions like Eastern Europe and the Middle East in 2024-2025 has historically driven increased investor interest in gold, potentially benefiting Orla's revenue.

- Investor Confidence: Maintaining transparent communication and demonstrating robust risk management strategies are vital for Orla to assure investors amidst political uncertainties.

Mexico's proposed 2025 fiscal changes, including an increase in the Special Mining Duty to 8.5% and the Extraordinary Mining Duty to 1.0%, aim to maximize resource benefits but could deter foreign investment. Furthermore, a moratorium on new mining concessions and a review of existing operations, particularly regarding open-pit mining, signal a significant policy shift under President Claudia Sheinbaum.

Panama's mining sector faces considerable political headwinds, with Law 407 of 2023 imposing a moratorium on new metal mining concessions and renewals. This, coupled with judicial decisions, effectively halts new operations, directly impacting Orla Mining's Cerro Quema project and leading to a minimum US$400 million arbitration claim against the Panamanian government under the Canada-Panama Free Trade Agreement.

Global geopolitical tensions in 2024-2025, such as conflicts in Eastern Europe and the Middle East, have historically boosted gold's status as a safe-haven asset, potentially benefiting Orla Mining's revenue. However, these same tensions contribute to market volatility, necessitating robust risk management and transparent communication to maintain investor confidence.

What is included in the product

This PESTLE analysis provides a comprehensive evaluation of the external macro-environmental factors impacting Orla Mining, covering Political, Economic, Social, Technological, Environmental, and Legal dimensions.

It offers actionable insights for strategic decision-making by identifying opportunities and threats within Orla Mining's operating context.

A clear, actionable PESTLE analysis for Orla Mining that highlights key external factors, transforming complex market dynamics into manageable insights for strategic decision-making.

Economic factors

The price of gold is a crucial economic driver for Orla Mining. Analysts anticipate a strong upward trend, with J.P. Morgan forecasting an average gold price of $3,675 per ounce by Q4 2025, potentially reaching $4,000 by mid-2026. This bullish outlook directly translates to enhanced revenue and profitability for Orla Mining.

Orla Mining's financial health is directly influenced by its operational costs, particularly its All-In Sustaining Costs (AISC), and its ability to meet production targets. While Q1 2025 saw record gold production of 47,759 ounces and an optimistic 2025 production forecast of 280,000 to 300,000 ounces, the company faced financial headwinds.

Despite the production gains, Orla Mining reported a significant net loss of $70 million and fell short of revenue expectations in the first quarter of 2025. This performance underscores the ongoing challenges in effectively managing operational expenses to translate higher output into improved financial results.

Foreign exchange rate volatility, especially between the Mexican Peso (MXN) and the US Dollar (USD), and the Canadian Dollar (CAD) and the US Dollar, directly impacts Orla Mining's operational costs and financial results. For instance, during 2024, the MXN experienced significant fluctuations against the USD, at times trading around 16.5 MXN to 1 USD, which can alter the cost of local inputs for Orla's Mexican operations.

A strengthening USD relative to the MXN would generally decrease Orla's reported costs in USD terms, potentially lowering its All-In Sustaining Costs (AISC). Conversely, a weakening USD against the MXN would increase these costs. These currency shifts are critical for Orla Mining, as they can materially influence its overall profitability and competitiveness in the global market.

Investment Climate and Capital Allocation

The investment climate in Latin America's mining sector is showing resilience, with expectations of stable capital inflows. A notable trend is the focus on expanding and optimizing existing operations rather than solely on new discoveries. This strategic direction is crucial for companies like Orla Mining as they navigate the region's evolving regulatory frameworks.

Orla Mining's acquisition of the Musselwhite Mine from Newmont Corporation in February 2025 is a prime example of this capital allocation strategy. This significant investment of approximately $1.05 billion is designed to bolster Orla's growth trajectory and diversify its operational footprint beyond its existing Mexican assets.

Key aspects of this capital allocation include:

- Strategic Expansion: The Musselwhite acquisition provides Orla with a large, established gold asset in a stable jurisdiction, facilitating future production expansion.

- Diversification: This move reduces Orla's reliance on its Mexican operations, spreading geographical risk and enhancing its overall portfolio.

- Market Confidence: The successful completion of this acquisition, despite potential regulatory headwinds in parts of Latin America, signals investor confidence in Orla's management and strategic vision.

Impact of Increased Taxation on Investment

Mexico's proposed mining duty increases for 2025, designed to bolster government revenue, are expected to dampen new investment in the sector. This fiscal shift could see mining investments in Mexico shrink by approximately $7.0 billion in 2025, presenting a significant hurdle for companies planning expansion.

The potential reduction in investment due to higher taxes could impact Orla Mining's strategic decisions regarding its Mexican operations. Companies may re-evaluate project timelines and capital allocation in response to the altered fiscal landscape.

- Mexico's proposed mining duty increases for 2025 aim to boost government revenue.

- This could lead to an estimated $7.0 billion reduction in mining investments in Mexico for 2025.

- Higher taxes may discourage new investment and expansion for mining companies operating in the country.

The gold price outlook is exceptionally strong, with J.P. Morgan projecting an average of $3,675 per ounce by Q4 2025, potentially hitting $4,000 by mid-2026. This bullish trend directly benefits Orla Mining by increasing potential revenue. However, currency fluctuations, particularly the MXN-USD exchange rate, significantly impact operational costs. For example, a rate around 16.5 MXN to 1 USD in 2024 means a stronger USD lowers Orla's reported costs.

| Economic Factor | Orla Mining Impact | 2024/2025 Data/Outlook |

| Gold Price | Revenue enhancement | Forecast: $3,675/oz (Q4 2025), $4,000/oz (mid-2026) |

| Foreign Exchange (MXN/USD) | Operational cost fluctuation | ~16.5 MXN/USD in 2024; stronger USD lowers costs |

| Investment Climate (Latin America) | Capital inflow stability | Resilient, focus on optimization over new discoveries |

Same Document Delivered

Orla Mining PESTLE Analysis

The preview shown here is the exact document you’ll receive after purchase—fully formatted and ready to use. This comprehensive Orla Mining PESTLE analysis delves into the Political, Economic, Social, Technological, Legal, and Environmental factors impacting the company's operations and strategic decisions.

This is a real screenshot of the product you’re buying—delivered exactly as shown, no surprises. You'll gain a clear understanding of the external forces shaping Orla Mining's landscape, enabling informed strategic planning and risk assessment.

The content and structure shown in the preview is the same document you’ll download after payment. This detailed PESTLE analysis provides actionable insights into the opportunities and threats Orla Mining faces in the current global market.

Sociological factors

Orla Mining's ability to maintain a strong social license to operate is paramount, particularly with its significant operations in Mexico. Positive engagement with local communities, addressing their concerns, and ensuring tangible benefits are shared are critical for sustained operational stability and acceptance.

The recent mining ban in Panama, partly fueled by public outcry and protests, serves as a stark reminder of the importance of community relations. This highlights the direct impact of social sentiment on mining project viability and Orla's need to proactively manage its community impact.

Mexican mining law reforms now mandate prior consultation with indigenous or Afro-Mexican communities for concessions impacting their territories. This means companies like Orla Mining must engage deeply, understand local perspectives, and secure consent, which can affect project timelines and overall feasibility.

For instance, if a proposed mine expansion by Orla Mining in Mexico directly impacts lands traditionally used by an indigenous community, the company is legally obligated to undertake a thorough consultation process. This process, as outlined in recent legal frameworks, requires obtaining free, prior, and informed consent, a step that can add significant time and complexity to project development, potentially delaying operational commencement or requiring project modifications.

Orla Mining's operations, like the Camino Rojo mine, are crucial for job creation in their host communities, offering direct employment and stimulating indirect economic activity. For instance, in 2023, Orla Mining reported approximately 700 employees, with a significant portion of these roles filled by local talent, underscoring the company's commitment to regional development.

The economic health of these regions is closely tied to the mining sector's stability. However, potential shifts in government policy, such as discussions around a ban on open-pit mining in Mexico, could significantly disrupt employment and local economic growth, creating uncertainty for both the company and its workforce.

Workforce Safety and Well-being

Orla Mining recognizes that safeguarding its workforce is a fundamental social duty. This commitment is highlighted by the need for stringent safety measures, especially after events like the pit wall failure at the Camino Rojo mine, which serves as a stark reminder of the potential hazards in mining operations and the critical importance of constant vigilance to prevent accidents and ensure employee health.

The company's dedication extends to fostering a healthy work environment, which is crucial for maintaining morale and productivity. Orla Mining's investments in worker well-being are not just about compliance; they are about building a sustainable and responsible business. For instance, in 2023, Orla Mining reported a Total Recordable Injury Frequency Rate (TRIFR) of 1.86, demonstrating a focus on reducing workplace incidents.

- Workforce Safety: Orla Mining prioritizes comprehensive safety training and the implementation of advanced safety technologies to minimize risks.

- Well-being Programs: The company actively engages in initiatives aimed at supporting the physical and mental health of its employees, recognizing their well-being as a key asset.

- Incident Prevention: Learning from past events, such as the Camino Rojo pit wall incident, Orla Mining continuously refines its operational procedures and risk management strategies.

- Social Responsibility: Maintaining strong community relations and upholding environmental standards are intrinsically linked to ensuring a safe and secure working environment for all personnel.

Corporate Social Responsibility Reporting

Orla Mining places significant emphasis on its social performance, as demonstrated by its commitment to transparent reporting through its annual Sustainability Report. The company is actively working on its 2024 report, which will highlight its community engagement strategies and investments. This focus on social responsibility is crucial for building trust and maintaining a positive reputation with stakeholders, including local communities and investors.

The upcoming 2024 Sustainability Report will provide detailed insights into Orla Mining's adherence to its social commitments. For instance, in 2023, the company reported a total of $3.5 million invested in community development programs and initiatives across its operational areas. This financial commitment underscores their dedication to fostering positive social impact beyond their core mining operations.

Sociological factors, particularly regarding corporate social responsibility (CSR) reporting, are increasingly influencing investor decisions and public perception. Companies like Orla Mining that proactively report on their social performance, including community relations and ethical labor practices, tend to attract more socially conscious investors and enjoy greater social license to operate. For example, a 2024 survey by the Global Sustainable Investment Alliance indicated that over 70% of institutional investors consider ESG (Environmental, Social, and Governance) factors, including CSR, as material to their investment decisions.

- Community Investment: Orla Mining's 2023 investment of $3.5 million in community programs.

- Transparency: The ongoing development of the 2024 Sustainability Report detailing social performance.

- Stakeholder Relations: Enhanced reputation building through transparent reporting on social commitments.

- Investor Sentiment: The growing importance of ESG factors, with over 70% of institutional investors considering them material in 2024.

Orla Mining's social license to operate is heavily influenced by its community engagement and the perceived benefits it brings to local populations in Mexico. The company's commitment to job creation, as evidenced by its approximately 700 employees in 2023, directly impacts regional economic stability.

Recent Mexican mining law reforms mandate prior consultation with indigenous communities, requiring Orla to secure free, prior, and informed consent for projects affecting their territories, potentially impacting project timelines and feasibility.

Orla Mining's investment in community development programs reached $3.5 million in 2023, underscoring its dedication to social impact beyond core operations, a factor increasingly considered by investors.

Workforce safety remains a critical sociological factor, with Orla reporting a Total Recordable Injury Frequency Rate (TRIFR) of 1.86 in 2023, reflecting ongoing efforts to maintain a secure working environment.

Technological factors

The mining sector is rapidly integrating automation and artificial intelligence (AI) to boost efficiency, improve safety, and promote sustainability. By 2025, projections indicate that over 60% of new gold mining equipment will incorporate AI-driven automation, leading to optimized resource extraction and minimized waste.

This technological shift includes AI-guided excavators and loaders, which significantly reduce the need for human intervention in hazardous environments, thereby enhancing worker safety and operational reliability.

Modern mining operations increasingly rely on advanced sensors like LIDAR and thermal imaging, alongside sophisticated data analytics, to gain a comprehensive understanding of their environment. These technologies allow for detailed mapping and monitoring, crucial for safety and efficiency.

The widespread adoption of Internet of Things (IoT) devices is creating interconnected mining ecosystems. This connectivity enables real-time diagnostics and predictive maintenance, a critical factor in minimizing costly operational disruptions. For instance, predictive maintenance can reduce equipment downtime by an estimated 15-20% in well-implemented systems.

The integration of robotics and autonomous equipment is revolutionizing mining operations, particularly for companies like Orla Mining operating in remote locations. Self-driving haul trucks and advanced drones are enhancing safety by reducing human exposure to hazardous conditions. For instance, in 2024, the mining industry saw significant investment in automation, with companies reporting up to a 15% increase in operational efficiency through the deployment of autonomous fleets.

These technological advancements enable remote management of mining fleets and detailed site inspections, pushing the industry towards a 'zero-entry' model. This shift is crucial for Orla Mining, allowing for continuous operation and data collection even in challenging terrains. The adoption of these technologies is projected to further decrease operational costs and improve resource extraction accuracy by 2025.

Improved Exploration and Resource Delineation Techniques

Technological advancements are fundamentally reshaping mineral exploration, enabling greater precision and efficiency. Orla Mining is actively leveraging these innovations, notably employing directional drilling at projects like Camino Rojo Sulphides. This method is key to exploring resource extensions and upgrading existing reserves, directly impacting future development potential.

The application of advanced drilling techniques allows Orla Mining to more accurately identify higher-grade mineral zones. This capability is vital for expanding the overall resource potential and de-risking future mining operations. For instance, by understanding the geological structure with greater clarity, the company can optimize its extraction strategies.

- Directional Drilling: Orla Mining uses this to explore beyond current resource boundaries, as seen at Camino Rojo Sulphides.

- Resource Delineation: Advanced techniques improve the accuracy of mapping out mineral deposits, crucial for reserve estimation.

- Grade Identification: Technology helps pinpoint richer sections of ore, enhancing the economic viability of deposits.

- Future Development: Precise exploration data supports informed decisions for mine planning and expansion.

Sustainable Mining Technologies and Processing Innovations

Technological advancements in mining are increasingly prioritizing environmental stewardship alongside operational efficiency. This includes the adoption of fuel-efficient engines for heavy machinery, significantly reducing emissions and operational costs. Innovations in metallurgical processes are also crucial for optimizing mineral recovery rates, making operations more economically viable and environmentally sound.

Orla Mining is actively engaging with these technological trends. The company has indicated plans for further metallurgical test work at its Camino Rojo project, specifically targeting different mineralization styles. This focus on optimizing processing methods demonstrates a commitment to leveraging technology for improved performance and resource utilization.

- Fuel Efficiency: New mining equipment is incorporating advanced engine technologies to lower fuel consumption and greenhouse gas emissions.

- Metallurgical Innovations: Advancements in processing techniques aim to maximize the recovery of valuable minerals from ore, reducing waste.

- Orla's Strategy: Orla Mining is investing in further metallurgical studies at Camino Rojo to refine its processing methods for various ore types.

- Environmental Focus: The drive for sustainable mining technologies reflects a broader industry shift towards minimizing environmental impact.

Technological advancements are critical for Orla Mining, driving efficiency and safety. The company's use of directional drilling at Camino Rojo Sulphides, for example, enhances resource exploration and reserve upgrades. This precision in identifying higher-grade mineral zones is vital for future mine planning and economic viability.

The mining sector is rapidly integrating automation and AI, with over 60% of new gold mining equipment expected to feature AI by 2025. This includes AI-guided excavators that reduce human exposure in hazardous areas, bolstering worker safety. Furthermore, IoT devices create interconnected mining ecosystems, enabling real-time diagnostics and predictive maintenance, which can cut equipment downtime by 15-20%.

Robotics and autonomous equipment are transforming operations, with companies reporting up to a 15% increase in efficiency through autonomous fleets in 2024. Orla Mining leverages these technologies for remote management and detailed site inspections, moving towards a zero-entry model. These innovations are projected to further decrease operational costs and improve resource extraction accuracy by 2025.

Environmental stewardship is also a key technological focus, with fuel-efficient engines reducing emissions and advanced metallurgical processes optimizing mineral recovery. Orla Mining's commitment to further metallurgical test work at Camino Rojo underscores its strategy to leverage technology for improved performance and resource utilization.

| Technology | Impact | Orla Mining Application | Projected Benefit (by 2025) |

|---|---|---|---|

| AI & Automation | Increased efficiency, improved safety | AI-guided excavators, autonomous fleets | 60% of new gold mining equipment |

| IoT & Data Analytics | Real-time diagnostics, predictive maintenance | Interconnected mining ecosystems | 15-20% reduction in equipment downtime |

| Directional Drilling | Precision exploration, resource upgrading | Camino Rojo Sulphides | Enhanced future development potential |

| Metallurgical Innovations | Optimized recovery, reduced waste | Targeting different mineralization styles at Camino Rojo | Improved economic viability and environmental soundness |

Legal factors

Mexico's recent legislative overhaul, effective May 2023, has significantly reshaped the mining landscape. Reforms to the Mining Law and National Waters Law impose stricter environmental regulations and reduce concession durations from 50 to 30 years.

These changes, including more stringent water extraction permits, directly impact operational parameters for mining companies. For instance, the reduced concession terms necessitate more focused strategic planning for long-term resource management and investment recovery.

A proposed constitutional reform in Mexico seeks to ban open-pit mining and hydraulic fracturing, signaling a strong governmental push towards environmental preservation. This legislative initiative, if passed, would introduce significant legal hurdles for mining operations relying on these methods.

While the ban is not yet law, its potential passage creates considerable legal uncertainty for existing and planned open-pit mines. For companies like Orla Mining, whose Camino Rojo Oxide Mine primarily utilizes open-pit techniques, this represents a substantial legal risk that could impact future operations and profitability.

Panama's legal landscape for mining underwent significant shifts in 2023 with Law 407. This law imposed a moratorium on new metal mining concessions, renewals, and extensions. This action was a direct consequence of Supreme Court decisions deeming prior mining contracts unconstitutional, fundamentally altering the operating environment for mining companies.

This legal upheaval directly impacted Orla Mining, leading to the cancellation of its Cerro Quema project concessions. This cancellation has plunged Orla into a complex legal dispute, highlighting the heightened regulatory and legal risks associated with mining operations in Panama following these legislative changes.

International Investment Arbitration

Orla Mining has initiated international investment arbitration against Panama, filing a Request for Arbitration under the Canada-Panama Free Trade Agreement. This action is a direct response to the Panamanian government's cancellation of Orla's Cerro Quema concessions, underscoring the critical role of such treaties in safeguarding foreign investments from unexpected policy shifts. The company is seeking compensation for this adverse action.

This legal maneuver by Orla Mining highlights the increasing reliance on international investment arbitration as a mechanism for dispute resolution when governments take actions detrimental to foreign investors. The Canada-Panama Free Trade Agreement, like many similar treaties, provides a framework for investors to seek redress for alleged breaches of investment protections. As of early 2024, the landscape of international investment law continues to evolve, with ongoing discussions about the efficacy and fairness of these arbitration systems.

- Arbitration Filing: Orla Mining formally requested arbitration against Panama under the Canada-Panama Free Trade Agreement.

- Concession Dispute: The arbitration stems from the cancellation of Orla's Cerro Quema concessions in Panama.

- Treaty Protection: This case demonstrates how international investment treaties serve as a safeguard for foreign investors against government policy changes.

- Compensation Sought: Orla Mining is pursuing financial compensation for the loss of its concessions.

Compliance with Environmental and Social Regulations

Mining companies like Orla Mining face growing legal pressure concerning environmental protection and social accountability. Mexico's recent reforms, for instance, mandate comprehensive Mine Restoration, Closure, and Post-closure Programs, requiring financial guarantees. Failure to comply with these environmental regulations can lead to the revocation of mining concessions.

Orla Mining must therefore maintain rigorous adherence to these evolving legal frameworks. This includes ensuring all operations align with environmental standards and social responsibility commitments mandated by Mexican law. The company's ability to secure and maintain its concessions hinges on its proactive compliance strategy.

- Mandatory Programs: Mexico's reforms require detailed Mine Restoration, Closure, and Post-closure Programs.

- Financial Guarantees: These programs necessitate the provision of associated financial guarantees to cover potential liabilities.

- Concession Risk: Environmental non-compliance carries the significant risk of concession revocation.

- Strategic Imperative: Strict adherence to these legal factors is crucial for Orla Mining's operational continuity and strategic planning.

Mexico's updated mining laws, effective May 2023, shortened concession terms to 30 years and tightened environmental regulations, impacting long-term planning for companies like Orla Mining. Furthermore, a proposed constitutional reform in Mexico to ban open-pit mining presents a significant legal risk to Orla's Camino Rojo Oxide Mine, which primarily uses this method.

Panama's Law 407 in 2023 halted new metal mining concessions and renewals, leading to the cancellation of Orla Mining's Cerro Quema project concessions and initiating an international investment arbitration under the Canada-Panama Free Trade Agreement. Orla is seeking compensation for this adverse action, highlighting the growing importance of treaty protections for foreign investors.

Mexico's environmental reforms mandate comprehensive mine restoration and closure programs, requiring financial guarantees, with non-compliance risking concession revocation. This necessitates rigorous adherence to legal frameworks for Orla Mining to ensure operational continuity.

Environmental factors

Orla Mining navigates a complex web of environmental regulations, especially in Mexico, where recent reforms have significantly tightened controls. These new rules emphasize enhanced environmental protection and mandate sustainable resource management practices, directly impacting operational planning and compliance costs.

Securing and retaining federal environmental permits, often requiring coordination with state authorities, is a fundamental requirement for Orla Mining's ongoing operations. For instance, the company's Camino Rojo mine expansion in 2024 is subject to rigorous environmental impact assessments and permitting processes, reflecting the heightened regulatory scrutiny.

New Mexico's mining regulations mandate comprehensive Mine Restoration, Closure, and Post-closure Programs. These laws also require companies to provide financial guarantees, ensuring funds are available for site rehabilitation once mining operations conclude.

These stringent requirements mean that companies like Orla Mining must meticulously plan for closure and rehabilitation from the outset, factoring in substantial financial commitments to address environmental impacts and ensure responsible land stewardship.

Water management is a critical environmental factor for mining, particularly in dry climates like those found in many of Orla Mining's operational areas. Mexico's recent legal changes have tightened regulations around water extraction permits, meaning companies must be extremely diligent in how they manage their water resources. For instance, in 2024, water scarcity remains a significant concern across several Mexican states where mining is active.

Effective rainwater diversion is also crucial for mining safety, directly impacting the stability of pit walls. Failure to manage water runoff can lead to structural issues and operational disruptions. This is a key consideration for Orla Mining as they navigate the 2024-2025 regulatory landscape.

Impact of Open-Pit Mining and Land Use

The environmental impact of open-pit mining is drawing significant attention, especially in Mexico, where a legislative proposal aims to prohibit these operations. Orla Mining's Camino Rojo project utilizes this method, making it crucial for the company to showcase responsible land management and effective mitigation of its environmental impact to navigate these evolving regulatory landscapes.

This scrutiny is particularly relevant given the global trend towards more sustainable mining practices. For Orla, demonstrating a commitment to minimizing ecological disruption, including water management and biodiversity protection, will be key to maintaining its social license to operate and investor confidence. The company's 2024 sustainability reports, for instance, will likely detail its initiatives in these areas.

Key considerations for Orla Mining regarding land use include:

- Reclamation efforts: Detailing plans and progress in restoring mined areas.

- Water management: Implementing strategies to minimize water consumption and prevent contamination.

- Biodiversity impact: Assessing and mitigating effects on local flora and fauna.

- Community engagement: Ensuring transparency and addressing local environmental concerns.

Environmental Incidents and Risk Management

Environmental incidents, such as the recent pit wall failure at Orla Mining's Camino Rojo Oxide Mine in Mexico, underscore the critical need for proactive risk management. This event, triggered by substantial rainfall, fortunately resulted in no reported environmental damage, but it serves as a stark reminder of the inherent geological and weather-related risks in mining operations.

Effective risk mitigation requires a multi-faceted approach. This includes rigorous geotechnical assessments to understand slope stability, continuous monitoring of pit walls using advanced technologies, and the implementation of comprehensive response plans. For instance, in 2024, many mining companies increased investment in AI-driven monitoring systems to predict potential failures with greater accuracy.

- Geotechnical Assessments: Orla Mining's Camino Rojo operation relies on detailed geological surveys to identify potential instability zones.

- Monitoring Systems: Investment in real-time pit wall monitoring technology is crucial for early detection of movement.

- Rainfall Impact: Significant rainfall events, like those experienced in Mexico, can dramatically increase the risk of slope failures.

- Risk Management Strategies: Developing and regularly updating emergency response protocols is vital for minimizing impact.

Orla Mining operates under increasingly stringent environmental regulations, particularly in Mexico, where reforms in 2024 have amplified requirements for sustainable resource management and protection. The company must secure and maintain federal environmental permits, a process that involves rigorous impact assessments and coordination with state authorities, as seen with the Camino Rojo mine expansion plans. These regulations necessitate meticulous planning for mine closure and rehabilitation, including substantial financial guarantees to ensure responsible land stewardship post-operation.

Water management is a critical environmental challenge, especially in arid regions where Orla Mining operates. Mexico's tightened water extraction regulations in 2024 demand diligent resource management, with water scarcity remaining a significant concern across mining states. Effective rainwater diversion is also vital for operational safety and pit wall stability, a key consideration for Orla Mining amidst the 2024-2025 regulatory landscape.

The environmental impact of open-pit mining, such as Orla's Camino Rojo project, faces growing scrutiny, with legislative proposals in Mexico aiming to restrict such operations. Demonstrating responsible land management and effective mitigation strategies is crucial for maintaining social license and investor confidence, with sustainability reports in 2024 likely detailing these efforts.

Environmental incidents, like the recent pit wall failure at Camino Rojo Oxide Mine due to heavy rainfall, highlight the importance of proactive risk management. This event, while causing no reported environmental damage, underscores the need for robust geotechnical assessments, continuous monitoring, and comprehensive response plans, with many companies increasing investment in AI-driven monitoring systems in 2024.

| Environmental Factor | Key Considerations for Orla Mining (2024-2025) | Impact/Mitigation |

| Regulatory Compliance | Adherence to Mexico's tightened environmental protection laws and permitting processes. | Increased compliance costs, need for detailed environmental impact assessments. |

| Water Management | Strict adherence to water extraction permits and efficient rainwater diversion. | Operational planning must account for water scarcity; risk of pit wall instability due to inadequate diversion. |

| Land Use & Reclamation | Minimizing impact of open-pit mining and implementing comprehensive reclamation plans. | Potential legislative restrictions on open-pit mining; need to showcase responsible land stewardship. |

| Risk Management (Slope Stability) | Robust geotechnical assessments and advanced monitoring systems for pit walls. | Mitigation of risks associated with rainfall events to prevent failures and environmental damage. |

PESTLE Analysis Data Sources

Our PESTLE Analysis for Orla Mining is built upon a robust foundation of data from official government publications, reputable financial news outlets, and industry-specific market research reports. This ensures a comprehensive understanding of the political, economic, social, technological, legal, and environmental factors impacting the company.