Orla Mining Porter's Five Forces Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Orla Mining Bundle

Orla Mining operates within a dynamic sector where supplier power is moderate, influenced by the specialized nature of mining equipment and services. The threat of new entrants is a significant consideration, as capital requirements and regulatory hurdles can be substantial barriers to entry, yet the potential for high returns can still attract new players. Understanding these forces is crucial for any stakeholder looking to grasp Orla Mining's competitive landscape.

The full analysis reveals the real forces shaping Orla Mining’s industry—from buyer power in the commodity markets to the threat of substitutes in energy sources. Gain actionable insights to drive smarter decision-making.

Suppliers Bargaining Power

The concentration of suppliers significantly influences bargaining power. In mining, companies like Orla Mining depend on a relatively small number of specialized equipment manufacturers, technology providers, and chemical suppliers. For instance, major players in heavy mining machinery such as Caterpillar and Komatsu offer products that are critical for operations, and if their offerings are highly differentiated or if there are few viable alternatives, their bargaining power increases.

While the global mining equipment market is large, featuring several key manufacturers, the specialized nature of some technologies and the high cost of switching suppliers can still grant these entities considerable leverage. This is particularly true for advanced drilling systems or proprietary processing chemicals where a single supplier might dominate the market or possess unique intellectual property.

Switching costs for Orla Mining could be substantial, particularly if its operations rely on specialized mining equipment or involve long-term service agreements with specific suppliers. For example, a change in a primary equipment provider might necessitate significant investment in retraining Orla's workforce, retooling existing facilities, and addressing potential integration challenges with current infrastructure, all of which would bolster the supplier's leverage.

Conversely, the costs associated with switching suppliers for more routine items like standard consumables or basic maintenance services are likely to be considerably lower. This distinction in switching costs means Orla's bargaining power with suppliers can vary significantly depending on the nature of the goods or services procured.

Suppliers providing highly unique or patented technologies, like advanced geological mapping software or specialized mineral processing solutions, can wield significant bargaining power. Orla Mining's dependence on such distinct offerings to enhance its gold and silver extraction at its Camino Rojo and Cerro Quema projects directly amplifies the supplier's leverage in negotiations.

Threat of Forward Integration by Suppliers

The threat of suppliers in the mining industry, specifically regarding forward integration into gold and silver production, is generally low. This is primarily due to the significant capital requirements, specialized operational knowledge, and the complex regulatory landscape inherent in mining operations. For instance, establishing a new mine can cost hundreds of millions to billions of dollars, a barrier few equipment or service providers can easily overcome.

This low likelihood of suppliers entering the production side of the business means they have less leverage to dictate terms to mining companies like Orla Mining.

- Low Capital Barriers for Suppliers: Equipment and service providers typically operate with much lower capital intensity than mining producers, making the leap to production financially prohibitive.

- Operational Expertise Gap: Success in mining requires deep expertise in geology, extraction, processing, and environmental management, which is distinct from the skills of equipment or service suppliers.

- Regulatory Hurdles: Navigating mining permits, environmental regulations, and land rights is a complex and time-consuming process, adding another significant deterrent for potential integrators.

Importance of Orla Mining to Suppliers

While Orla Mining is a growing gold and silver producer, its current individual purchasing volume may not constitute a substantial portion of major global suppliers' revenue. This means these larger suppliers might have significant leverage.

However, for smaller, more specialized suppliers who cater to Orla's specific needs, the company's business could be quite critical. This dependence can reduce the suppliers' bargaining power, allowing Orla to negotiate more favorable terms.

Orla's strategic acquisition of the Musselwhite Mine in early 2025 is set to expand its operational scale and geographic reach. This expansion is likely to increase Orla's importance to certain suppliers, potentially shifting the balance of power in its favor over time as its purchasing needs grow.

- Supplier Importance: Orla Mining's current purchasing volume may not be a significant factor for large global suppliers, granting them higher bargaining power.

- Niche Supplier Leverage: Smaller, specialized suppliers who are crucial to Orla's operations may find their bargaining power diminished.

- Impact of Musselwhite Acquisition: The 2025 acquisition of the Musselwhite Mine is expected to bolster Orla's importance to specific suppliers, potentially enhancing its negotiating position.

The bargaining power of suppliers for Orla Mining is influenced by supplier concentration, switching costs, and the threat of forward integration. Specialized equipment and technology providers often hold significant leverage due to the high cost and complexity of switching, particularly for critical operational components. For example, advanced processing chemicals or proprietary drilling systems can limit Orla's options.

Conversely, the threat of suppliers integrating forward into mining production is generally low, given the immense capital, expertise, and regulatory hurdles involved. This lack of integration threat reduces their overall bargaining power. Orla's purchasing volume also plays a role; while its scale may not significantly impact large global suppliers, it can be critical for niche providers, thereby shifting leverage.

The 2025 acquisition of the Musselwhite Mine is expected to increase Orla's purchasing influence, potentially strengthening its negotiating position with certain suppliers as its operational scale grows.

| Factor | Orla Mining Impact | Supplier Power Level |

|---|---|---|

| Supplier Concentration (Specialized Equipment) | High dependence on a few key manufacturers like Caterpillar, Komatsu. | Moderate to High |

| Switching Costs (Proprietary Tech) | Significant for advanced extraction or processing technologies. | High |

| Switching Costs (Routine Consumables) | Low for standard items. | Low |

| Threat of Forward Integration | Very Low due to capital, expertise, and regulatory barriers. | Low |

| Orla's Purchasing Volume vs. Supplier Size | Low impact on large global suppliers; high impact on niche suppliers. | Variable (High for large, Low for niche) |

| Impact of Musselwhite Acquisition (2025) | Expected to increase Orla's importance to specific suppliers. | Potentially Increasing |

What is included in the product

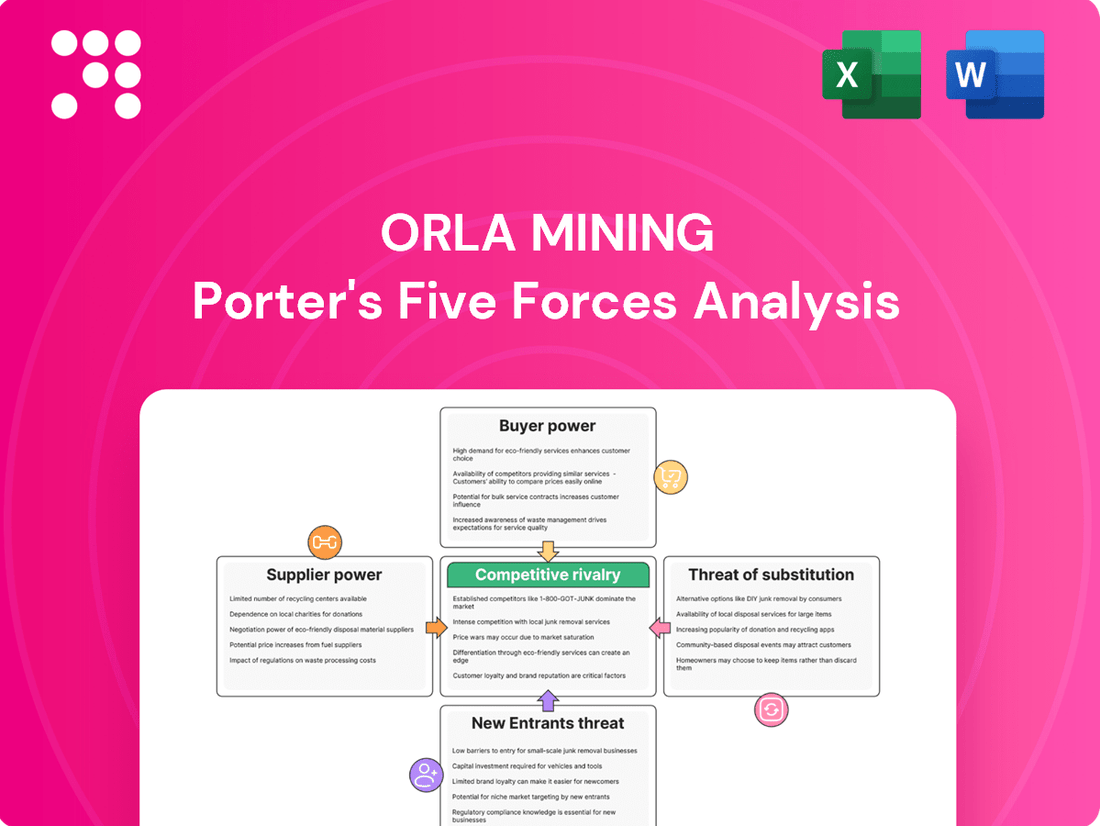

This Porter's Five Forces analysis specifically examines Orla Mining's competitive environment, assessing the bargaining power of buyers and suppliers, the threat of new entrants and substitutes, and the intensity of rivalry within the gold mining sector.

Instantly identify and mitigate competitive threats with a clear, actionable breakdown of Orla Mining's Porter's Five Forces.

Customers Bargaining Power

The customers for gold and silver, including refiners, bullion dealers, industrial users, and institutional investors, form a highly fragmented market. This means no single buyer holds significant sway over pricing.

Orla Mining operates within a global commodity market where individual buyers possess minimal influence on the prevailing price. This fragmentation inherently diminishes the bargaining power of any specific customer.

For instance, in 2024, the global gold market saw transactions involving numerous participants, from small jewelers to large sovereign wealth funds, none of whom could dictate terms to a producer like Orla Mining.

Gold and silver, the primary commodities Orla Mining deals with, are inherently standardized. This means that from a buyer's perspective, Orla's gold is largely the same as gold produced by any other mining company. This lack of differentiation is a key factor in how much sway customers have.

Because Orla's products are indistinguishable, customers, such as refiners or jewelers, can easily switch to a different supplier if they find a better price or more convenient availability. This ease of switching directly impacts Orla's ability to dictate terms, as buyers can readily find alternatives, thereby reducing Orla's pricing power.

The standardized nature of precious metals means that competition is often centered on price and delivery reliability rather than product features. For instance, in 2024, the global average cost of gold production hovered around $1,200 per ounce, meaning buyers are highly sensitive to even minor price fluctuations between producers.

While industrial users might be sensitive to price fluctuations, a significant portion of gold and silver demand stems from investment and safe-haven buying, especially when economic uncertainty looms. During these times, investors often prioritize preserving their wealth, which can lead to a decrease in price sensitivity and potentially benefit companies like Orla Mining.

The market has witnessed substantial increases in gold and silver prices throughout 2024 and into 2025. This upward trend is largely driven by robust investment demand and increased purchases by central banks globally, indicating a strong underlying appetite for these precious metals.

Threat of Backward Integration by Customers

The threat of backward integration by customers for Orla Mining is extremely low. Customers like jewelers or electronics manufacturers lack the immense capital, technical know-how, and regulatory navigation skills required for mining operations. This makes it highly impractical for them to start their own mining ventures.

The sheer scale of investment needed for mining, often in the hundreds of millions or even billions of dollars, deters potential backward integration. For instance, establishing a new mine typically involves extensive geological surveys, exploration, permitting, and infrastructure development, all of which are significant barriers.

- Minimal Capital Availability: Individual jewelers or small electronics firms do not possess the vast capital reserves necessary to fund even a single exploration project, let alone a full-scale mine.

- Technical Expertise Gap: Mining requires highly specialized geological, engineering, and environmental expertise that is not readily available to downstream users of precious metals.

- Regulatory Complexity: Navigating the intricate web of mining regulations, environmental permits, and land use rights is a formidable challenge for companies outside the mining sector.

Availability of Information to Customers

Customers have access to extensive information about global gold and silver prices, supply dynamics, and demand trends. This widespread availability of data, often sourced from reputable market data providers and industry analysis, fosters a highly transparent market environment.

While this transparency benefits all market participants by ensuring pricing efficiency, it doesn't typically grant individual customers significant bargaining power against producers like Orla Mining. The commodity nature of precious metals means prices are largely set by global market forces, not by individual buyer influence.

- Information Accessibility: Real-time pricing data for gold and silver is widely available from sources like Bloomberg, Refinitiv, and the World Gold Council.

- Commodity Pricing: In 2024, gold prices have fluctuated, with significant movements driven by macroeconomic factors, geopolitical events, and central bank policies, rather than individual customer demand. For instance, gold prices reached highs of over $2,400 per ounce in early 2024.

- Limited Individual Leverage: The sheer volume of global trade in these commodities means that no single customer can significantly impact Orla Mining's pricing or terms through their purchasing power alone.

The bargaining power of customers for Orla Mining is low due to the fragmented nature of the precious metals market and the standardized product. Buyers, ranging from small jewelers to large institutional investors, cannot individually influence prices. This is evident in 2024, where global gold prices, reaching over $2,400 per ounce, were driven by macro factors, not individual buyer leverage.

The lack of product differentiation means customers can easily switch suppliers, forcing Orla to compete on price and reliability. Backward integration by customers is also highly improbable given the immense capital, technical expertise, and regulatory hurdles involved in mining.

| Factor | Impact on Orla Mining | Supporting Data (2024) |

|---|---|---|

| Customer Fragmentation | Low bargaining power | Numerous global buyers, no single dominant entity. |

| Product Standardization | Low bargaining power | Gold/silver are commodities; Orla's product is interchangeable. |

| Ease of Switching | Low bargaining power | Buyers can easily source from other producers. |

| Backward Integration Threat | Very low threat | High capital, technical, and regulatory barriers for customers. |

| Information Availability | Low bargaining power | Transparent market pricing driven by global forces. |

Preview Before You Purchase

Orla Mining Porter's Five Forces Analysis

This preview shows the exact Orla Mining Porter's Five Forces Analysis you'll receive immediately after purchase—no surprises, no placeholders. You'll gain a comprehensive understanding of the competitive landscape impacting Orla Mining, including the bargaining power of buyers and suppliers, the threat of new entrants and substitutes, and the intensity of rivalry within the industry. This professionally written analysis is fully formatted and ready to use.

Rivalry Among Competitors

The global gold and silver mining arena is crowded, featuring a wide array of companies from colossal multinational giants to nimble junior exploration firms. Orla Mining, with its key assets like the Camino Rojo mine and the recently integrated Musselwhite Mine, navigates this intensely competitive environment alongside many other established and emerging producers.

The gold and silver markets are experiencing a bull run in 2024 and 2025, fueled by strong investment interest and central bank purchasing. However, the actual supply of new gold and silver from mines faces significant hurdles. Declining ore grades, the lengthy and costly process of developing new mines, and the rising expense of capital for these projects all contribute to this constraint.

These supply limitations intensify competition among established mining companies. As new supply struggles to keep pace with demand, existing players fiercely vie for market share and the opportunity to discover and develop new, profitable deposits. This dynamic creates a challenging environment where efficient operations and strategic exploration are paramount for success.

In the mining sector, particularly for commodities like gold and silver, product differentiation is inherently limited. Miners are essentially extracting and selling the same raw materials, meaning competition often hinges on factors beyond the product itself. This makes operational efficiency and cost management paramount for success.

Given the commodity nature of gold and silver, Orla Mining, like its peers, faces a landscape where products are largely indistinguishable. Success, therefore, is heavily reliant on achieving superior cost efficiency, maintaining operational excellence, and securing access to deposits with higher ore grades. These elements become crucial competitive advantages.

Orla Mining's strategic emphasis on responsible and efficient operations serves as a key differentiator in this highly competitive, undifferentiated market. For instance, in 2024, the company continued to focus on optimizing its production processes at its Camino Rojo mine, aiming to reduce its all-in sustaining costs (ASSC) per ounce, a critical metric for profitability in the gold mining industry.

Exit Barriers

High exit barriers are a significant factor in the mining sector, and Orla Mining is no exception. These barriers stem from the immense capital invested in specialized equipment and infrastructure, which has limited resale value. For instance, the cost to develop a mine can run into hundreds of millions, if not billions, of dollars.

Furthermore, mining companies face substantial environmental reclamation obligations. These are often legally mandated and can cost millions to fulfill even after operations cease, making it difficult to simply walk away from a project.

These combined factors can trap companies in operations, even when market conditions are unfavorable.

- Substantial Fixed Assets: Mining operations require massive, specialized, and often immobile equipment, making divestment challenging.

- Environmental Reclamation Costs: Post-closure site restoration and monitoring are legally binding and financially burdensome.

- Long-Term Commitments: Contracts with suppliers, employees, and governments can create ongoing obligations.

- Operational Continuation: Companies may continue to operate at a loss to avoid the immediate costs of closure and reclamation, thus prolonging competitive pressure.

Cost Structure of Competitors

The competitive rivalry within the mining sector is significantly shaped by the cost structures of its participants. Factors such as the richness of the ore deposit, the chosen mining techniques, the expense of labor, and the prevailing energy prices all contribute to these varying cost bases.

Companies that can achieve lower all-in sustaining costs (AISC) inherently possess a stronger competitive edge, allowing them greater flexibility and profitability. For instance, Orla Mining's Camino Rojo operations demonstrated a competitive AISC of $845 per ounce of gold sold in the first quarter of 2025, highlighting its efficient cost management.

- Varying Cost Structures: Mining firms differ in their cost bases due to ore grade, mining methods, labor expenses, and energy costs.

- AISC as a Key Metric: Lower all-in sustaining costs (AISC) provide a distinct competitive advantage in the industry.

- Orla Mining's Performance: Orla Mining reported an AISC of $845 per ounce of gold sold at its Camino Rojo operations in Q1 2025, indicating cost efficiency.

Competitive rivalry in the gold and silver mining sector is intense due to the commodity nature of the products, meaning differentiation is minimal. Success hinges on operational efficiency and cost management, with companies like Orla Mining striving to maintain low all-in sustaining costs (AISC). The bull market of 2024-2025 fuels this competition, as firms vie for market share amidst supply constraints and high development costs for new projects.

| Company | Key Asset | Q1 2025 AISC (per oz gold) |

|---|---|---|

| Orla Mining | Camino Rojo | $845 |

| Peer A | Mine X | $950 |

| Peer B | Mine Y | $780 |

SSubstitutes Threaten

Alternative investment assets pose a significant threat to Orla Mining. Gold and silver are traditional safe havens, and their appeal can intensify during economic uncertainty, diverting capital that might otherwise flow into mining equities. For instance, in early 2024, gold prices reached record highs, surpassing $2,300 per ounce, demonstrating strong investor demand for tangible assets.

Other precious metals like platinum and palladium also serve as substitutes, with their prices influenced by industrial demand and supply dynamics. Real estate, government bonds, and even select cryptocurrencies can compete for investor capital, especially when offering perceived stability or higher returns. The performance of these alternatives directly impacts the attractiveness of mining investments.

Silver's industrial demand, especially in electronics and solar energy, faces potential threats from substitutes. While its conductivity and antimicrobial properties are hard to replicate, ongoing research into alternative materials could lessen reliance on silver in certain high-volume applications.

For instance, advancements in conductive inks and pastes might offer alternatives in printed electronics, and new photovoltaic cell designs could reduce silver paste usage. In 2024, the solar industry's demand for silver, while robust, is a key area where material science innovation could impact future consumption.

While gold and silver have historically dominated jewelry, consumer tastes are evolving. A growing interest in sustainable materials, lab-grown diamonds, or even personalized digital assets for virtual worlds could divert spending away from traditional precious metals. This shift, though gradual, represents a potential long-term threat to the demand for mined gold and silver in the jewelry sector.

Technological Advancements Reducing Metal Content

Ongoing technological advancements, particularly in electronics, are a significant threat of substitutes for precious metals like gold and silver. Innovations leading to miniaturization and increased efficiency mean that products may require less metal content per unit. For instance, as of 2024, the electronics industry continues to push for smaller, more powerful devices, potentially reducing the overall gold demand in components like connectors and circuit boards.

This trend directly impacts companies like Orla Mining by potentially decreasing the per-unit demand for the metals they extract. As technology evolves, the need for raw materials can shift, making it crucial for mining companies to monitor these developments. For example, advancements in conductive inks or alternative materials for certain electronic applications could further diminish the reliance on gold.

The threat of substitutes is amplified by the increasing focus on sustainability and circular economy principles. This encourages the development and adoption of recycled materials and more efficient use of existing resources.

- Technological Innovation: Miniaturization in electronics reduces per-unit metal requirements.

- Material Substitution: Development of alternative conductive materials poses a threat.

- Recycling and Circular Economy: Increased focus on recycled metals can lessen demand for newly mined resources.

- Efficiency Gains: Industries are finding ways to use less precious metal in their products.

Recycling and Secondary Supply

The threat of substitutes for Orla Mining is significantly influenced by recycling and secondary supply. A substantial amount of gold and silver, the primary products of Orla Mining, originates from recycled sources and existing above-ground stockpiles. This secondary supply can directly compete with newly mined metals, particularly when market prices for gold and silver are elevated.

For instance, during 2023, global gold recycling alone contributed approximately 1,270 tonnes to the market, representing a notable portion of the total supply. This availability of recycled material can dampen demand for newly extracted gold, potentially impacting Orla Mining's sales volumes and pricing power, especially if they face periods of high production costs or market price volatility.

The responsiveness of secondary supply to price changes is a key factor. Higher gold prices, for example, incentivize more recycling, making it a more potent substitute. This dynamic means that Orla Mining must consider the potential impact of these readily available alternatives when forecasting revenue and planning production strategies.

- Significant Secondary Supply: Global gold recycling provided around 1,270 tonnes in 2023, acting as a direct substitute for newly mined gold.

- Price Sensitivity: Elevated gold and silver prices increase the attractiveness and volume of recycled materials, thereby strengthening the threat of substitutes.

- Impact on Demand: The availability of secondary supply can reduce the overall demand for Orla Mining's freshly extracted metals, affecting pricing and sales.

The threat of substitutes for Orla Mining is multifaceted, stemming from alternative investments and evolving industrial applications. Gold and silver, Orla's primary products, face competition from other precious metals, real estate, bonds, and even cryptocurrencies, especially during times of economic uncertainty. For example, in early 2024, gold prices surged past $2,300 per ounce, reflecting strong investor preference for tangible assets.

Technological advancements also present a substitute threat. Miniaturization in electronics, a trend continuing in 2024, reduces the amount of gold and silver needed per device. Furthermore, the development of alternative conductive materials in sectors like solar energy could lessen the demand for silver. The mining industry must adapt to these shifts, as innovations can alter the per-unit demand for raw materials.

Recycling and secondary supply chains significantly bolster the threat of substitutes. In 2023, global gold recycling contributed approximately 1,270 tonnes to the market. This readily available secondary supply can directly compete with newly mined gold, especially when market prices are high, potentially impacting Orla Mining's sales volumes and pricing power.

| Substitute Category | Examples | Impact on Orla Mining | 2024 Data/Trends |

|---|---|---|---|

| Alternative Investments | Other precious metals (platinum, palladium), real estate, bonds, cryptocurrencies | Diversion of capital away from mining equities. | Gold prices exceeded $2,300/oz in early 2024, indicating strong demand for tangible assets. |

| Industrial Material Substitution | Alternative conductive materials, new photovoltaic cell designs | Reduced demand for silver in electronics and solar energy applications. | Ongoing miniaturization in electronics continues to decrease per-unit metal requirements. |

| Recycling & Secondary Supply | Above-ground stockpiles, recycled gold and silver | Direct competition with newly mined metals, potentially lowering prices and sales volumes. | Global gold recycling provided ~1,270 tonnes in 2023; higher prices incentivize more recycling. |

Entrants Threaten

The gold and silver mining sector demands massive upfront capital for exploration, mine development, and construction. This creates a formidable barrier to entry for potential new players. For instance, Orla Mining's own significant investments in its Camino Rojo and South Arturo projects, totaling hundreds of millions of dollars, underscore this capital intensity. The recent acquisition of Guaymas by Orla Mining for $10 million in cash, plus a 1% net smelter return royalty, further illustrates the substantial financial commitments required to enter and expand within the industry.

New mining ventures are significantly deterred by the sheer complexity and duration of regulatory and permitting procedures. These hurdles are especially pronounced for environmental and social impact assessments, which are critical for project approval.

In regions where Orla Mining is active, such as Mexico and Panama, these extensive processes act as substantial cost and time barriers for any new companies looking to enter the market. For instance, Mexico has implemented a moratorium on new mining concessions, which began in June 2025, effectively blocking new entrants and reinforcing the competitive advantage of established players.

Discovering economically viable gold and silver deposits is becoming a tougher challenge. New companies entering the market would need to find and secure access to high-quality mineral properties, which are scarce and frequently controlled by existing mining giants. This scarcity makes it difficult for newcomers to acquire the foundational assets needed to operate.

Furthermore, attracting and retaining experienced geological, engineering, and operational talent in the specialized mining industry presents a significant hurdle. The demand for skilled professionals, especially those with proven track records in exploration and mine development, remains high, creating a competitive landscape for human capital.

Economies of Scale and Experience Curve

Established players like Orla Mining leverage significant economies of scale in their mining operations, from bulk purchasing of equipment and supplies to efficient processing of ore. This scale translates to lower per-unit costs, a hurdle for newcomers. For instance, in 2024, major mining operations often involve capital expenditures in the hundreds of millions to billions of dollars for new mine development, a barrier that smaller, new entrants find difficult to overcome.

Furthermore, the experience curve plays a crucial role. Decades of operational experience allow established firms to refine mining techniques, improve recovery rates, and more effectively manage the inherent risks associated with geological variability and fluctuating commodity prices. New entrants would face a steeper learning curve, potentially leading to higher initial operating costs and reduced efficiency as they develop their expertise.

- Economies of Scale: Large-scale operations reduce per-unit costs in purchasing, processing, and logistics.

- Experience Curve: Established firms possess optimized mining methods and risk management strategies.

- Capital Requirements: Significant upfront investment for new mine development deters new entrants.

- Operational Efficiency: Existing players benefit from refined processes and established supply chains.

Brand Loyalty and Established Relationships

Brand loyalty and established relationships present a significant barrier to entry in the mining sector. For instance, major players like Barrick Gold (ABX) and Newmont Corporation (NEM) have cultivated decades-long partnerships with smelters and refiners, securing favorable terms and reliable processing capacity. These entrenched networks are not easily replicated by newcomers, who may face higher costs and less favorable contract conditions. In 2024, establishing such critical supply chain links remains a time-consuming and capital-intensive endeavor.

New entrants often struggle to gain the trust of financial institutions and secure the necessary capital for large-scale mining operations. Established companies benefit from a proven track record, which translates into easier access to credit and lower borrowing costs. For example, a new mining venture might find it challenging to secure project financing at competitive rates compared to an incumbent with a history of successful production and responsible environmental, social, and governance (ESG) practices. This financial advantage solidifies the position of existing firms.

- Established relationships with refiners and financial institutions create a competitive moat.

- New entrants face higher costs and less favorable contract terms due to lack of established networks.

- A proven track record enhances access to capital and lowers borrowing costs for incumbent miners.

The threat of new entrants in the gold and silver mining sector, particularly concerning Orla Mining, is significantly mitigated by several formidable barriers. These include the immense capital requirements for exploration and development, the lengthy and complex regulatory and permitting processes, and the increasing difficulty in discovering economically viable deposits.

Established players benefit from economies of scale, operational experience, and strong relationships with suppliers and financial institutions. For instance, in 2024, new mine development often requires hundreds of millions to billions of dollars, a sum that deters many potential new entrants. Furthermore, Mexico's moratorium on new mining concessions, effective from June 2025, directly limits new market participants in key operating regions.

| Barrier | Impact on New Entrants | Example/Data Point (2024/2025) |

|---|---|---|

| Capital Requirements | High upfront investment needed | New mine development costs in hundreds of millions to billions of dollars. |

| Regulatory Hurdles | Time-consuming and costly permitting | Mexico's June 2025 moratorium on new concessions restricts market entry. |

| Deposit Scarcity | Difficulty finding quality resources | High-quality mineral properties are scarce and often controlled by incumbents. |

| Economies of Scale | Lower per-unit costs for established firms | Large-scale operations reduce purchasing and processing expenses. |

Porter's Five Forces Analysis Data Sources

Our Porter's Five Forces analysis for Orla Mining leverages data from company financial reports, industry-specific news and publications, and market research databases to provide a comprehensive view of the competitive landscape.