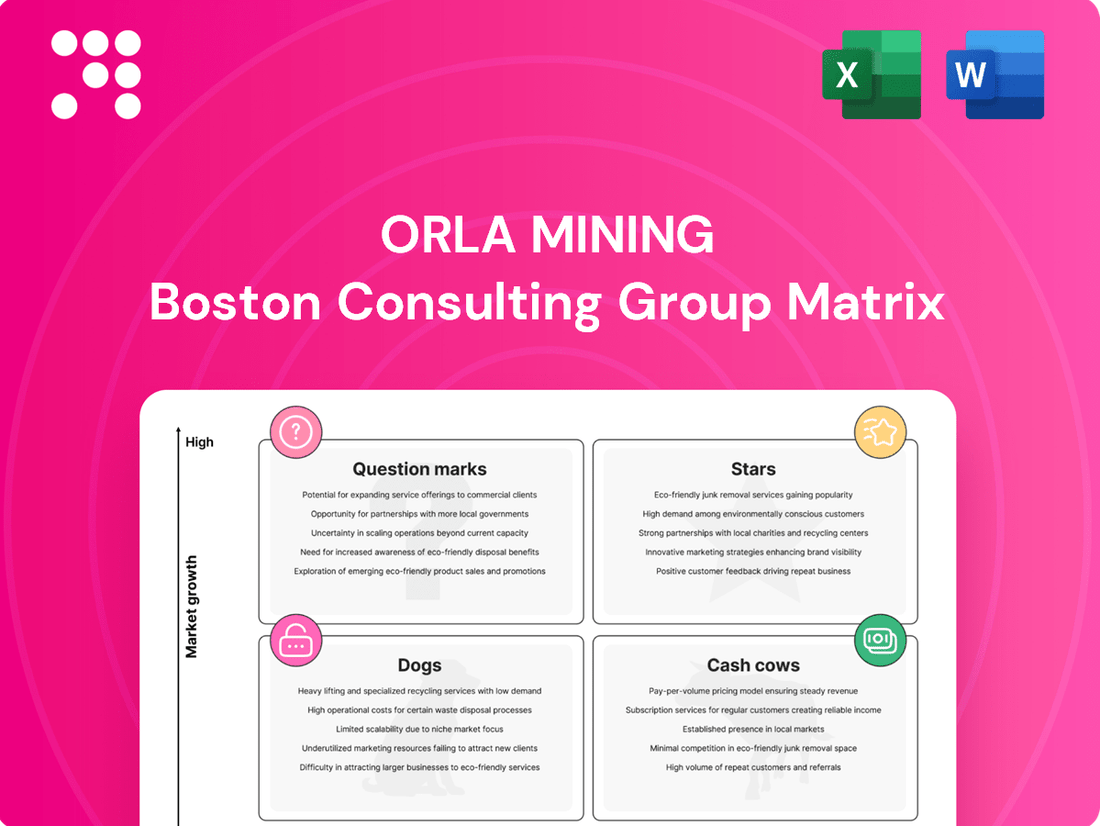

Orla Mining Boston Consulting Group Matrix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Orla Mining Bundle

Uncover the strategic heartbeat of Orla Mining with our comprehensive BCG Matrix analysis. See which of their ventures are poised for explosive growth (Stars), which are reliably generating cash (Cash Cows), and which might be holding them back (Dogs). This preview is just the beginning; purchase the full report to gain a clear, actionable roadmap for optimizing Orla Mining's portfolio and driving future success.

Stars

The acquisition of the Musselwhite Mine in February 2025 marked a pivotal moment for Orla Mining, significantly expanding its production capabilities and reinforcing its position in the gold market. This strategic move is projected to drive substantial growth in the company's overall gold output.

For 2025, Musselwhite is forecasted to yield between 170,000 and 180,000 ounces of gold, making it a cornerstone asset for Orla's market share expansion within the dynamic gold sector. The successful integration and planned capital expenditures underscore its critical role as a premier asset.

The Camino Rojo Oxide Gold Mine is a significant driver of Orla Mining's production growth, particularly in a favorable gold market. Its robust output in 2024 contributed to Orla achieving record annual gold production, exceeding earlier projections.

This sustained high performance and its crucial role in meeting Orla's consolidated production goals for 2025 firmly position Camino Rojo as a 'Star' asset within the company's portfolio.

Orla Mining's production trajectory is on a strong upward path, with updated 2025 guidance targeting 280,000 to 300,000 gold ounces, a notable leap from prior years. This expansion signals a growing market presence for Orla in the competitive gold sector.

This increased output is a direct result of strategic investments and operational efficiencies, positioning Orla to capitalize on current market dynamics where gold prices have shown resilience. The company's commitment to boosting production is a key factor in its overall growth strategy.

Strong Market Confidence & Share Performance

Orla Mining's market performance in the lead-up to July 2025 paints a picture of exceptional strength, positioning it firmly within the 'Star' category of the BCG matrix. The company's stock price achieved a notable all-time high during July 2025. This surge was accompanied by an impressive one-year change exceeding 215%.

This remarkable share price appreciation is a direct indicator of strong investor confidence and optimism regarding Orla Mining's future. The company's market capitalization approaching $4 billion further solidifies its dominant market position and the positive outlook held by the investment community.

- All-time high stock price reached in July 2025.

- Over 215% one-year share price change.

- Market valuation nearing $4 billion.

- Perceived as a high-growth, high-market-share entity.

Aggressive Exploration at Musselwhite

Orla Mining is aggressively pursuing growth at its Musselwhite Mine, a key asset likely positioned as a Star in the BCG Matrix. For 2025, the company has earmarked a significant $25 million for an extensive drill program. This substantial capital allocation underscores a strong belief in the mine's potential for future production and value creation.

The primary objective of this exploration initiative is to bolster the mine's reserve and resource base, with a particular emphasis on underground targets. This strategic focus aims to replace depleted ounces and expand existing resources, ensuring the long-term viability and growth of this high-producing asset. The recent acquisition of Musselwhite further solidifies Orla's commitment to unlocking its full potential.

- Aggressive Exploration: Orla Mining has committed $25 million to a comprehensive drill program at Musselwhite for 2025.

- Focus on Underground: The program prioritizes underground exploration to replace and expand reserves and resources.

- Asset Potential: This investment highlights Orla's dedication to maximizing the value of its high-producing, recently acquired Musselwhite Mine.

- Star Classification: Such proactive investment in growth and market leadership is characteristic of a Star asset in the BCG Matrix.

The Camino Rojo Oxide Gold Mine is a significant driver of Orla Mining's production growth, particularly in a favorable gold market. Its robust output in 2024 contributed to Orla achieving record annual gold production, exceeding earlier projections. This sustained high performance and its crucial role in meeting Orla's consolidated production goals for 2025 firmly position Camino Rojo as a Star asset within the company's portfolio.

Orla Mining's production trajectory is on a strong upward path, with updated 2025 guidance targeting 280,000 to 300,000 gold ounces, a notable leap from prior years. This expansion signals a growing market presence for Orla in the competitive gold sector.

Orla Mining's market performance in the lead-up to July 2025 paints a picture of exceptional strength, positioning it firmly within the Star category of the BCG matrix. The company's stock price achieved a notable all-time high during July 2025. This surge was accompanied by an impressive one-year change exceeding 215%. This remarkable share price appreciation is a direct indicator of strong investor confidence and optimism regarding Orla Mining's future. The company's market capitalization approaching $4 billion further solidifies its dominant market position and the positive outlook held by the investment community.

| Asset | BCG Category | Key Performance Indicators (as of July 2025) |

|---|---|---|

| Camino Rojo Oxide Gold Mine | Star | Record 2024 production, key contributor to 2025 production targets. |

| Musselwhite Mine | Star | Acquired Feb 2025, projected 170k-180k oz gold in 2025, $25M exploration budget for 2025. |

| Orla Mining (Overall) | Star | All-time high stock price (July 2025), >215% one-year share price change, market cap near $4 billion. |

What is included in the product

This BCG Matrix overview provides tailored analysis for Orla Mining's product portfolio, highlighting strategic insights for each quadrant.

The Orla Mining BCG Matrix provides a clear, actionable overview of their portfolio, alleviating the pain of uncertain strategic direction.

Cash Cows

The Camino Rojo Oxide Gold Mine is Orla Mining's key cash cow, consistently generating robust operational results and substantial cash flow. This mine is a cornerstone of the company's financial stability.

Despite a recent temporary pit wall event, Camino Rojo has a demonstrated history of efficient and reliable production. Its well-established infrastructure and predictable output contribute significantly to Orla Mining's financial foundation.

In 2023, Orla Mining reported that Camino Rojo produced approximately 110,000 ounces of gold, contributing significantly to the company's overall revenue. This consistent performance solidifies its position as a primary cash generator.

Camino Rojo is a standout performer for Orla Mining, boasting impressively low All-in Sustaining Costs (AISC). In 2024, the mine achieved the lower end of its revised guidance, reporting AISC at a mere $805 per ounce of gold sold. This cost efficiency translates directly into substantial profit margins and strong, consistent cash flow generation.

These low operating expenses are a key driver of Camino Rojo's profitability. The mine's ability to maintain such competitive costs ensures it remains a highly reliable and lucrative source of funds for Orla Mining, reinforcing its position as a cash cow within the company's portfolio.

Orla Mining's Camino Rojo operation is a prime example of a cash cow, consistently generating substantial cash flow. This robust internal funding is critical for Orla's strategic growth, notably supporting the acquisition of the Musselwhite Mine. In 2023, Camino Rojo's gold production reached approximately 106,000 ounces, contributing significantly to the company's financial strength and reducing the need for external debt.

Established Operational Stability

Camino Rojo stands as a prime example of Orla Mining's established operational stability, fitting neatly into the Cash Cows quadrant of the BCG Matrix. Its success is built on a robust operational framework, featuring a proven heap leach process and cultivated strong community relations within a favorable mining jurisdiction in Mexico. This mine has consistently demonstrated its maturity and reliability throughout 2024 and into 2025, maintaining steady mining rates and dependable gold production, solidifying its position as a long-term, stable revenue generator for the company.

- Proven Heap Leach Process: Camino Rojo utilizes an efficient and well-understood heap leach technology, minimizing operational complexities and ensuring consistent gold recovery.

- Strong Community Relations: Positive engagement with local communities in Mexico has fostered a stable operating environment, reducing risks and supporting uninterrupted production.

- Consistent 2024-2025 Performance: The mine has achieved steady mining rates and gold output, underscoring its maturity and predictable contribution to Orla Mining's financial performance.

- Long-Term Producing Asset: Camino Rojo's stability makes it a reliable source of cash flow, supporting the company's ability to fund growth initiatives or return capital to shareholders.

Robust Liquidity and Debt Management

Orla Mining's robust liquidity and debt management position it favorably within the BCG matrix, particularly in relation to its cash cow assets. By the close of 2024, the company successfully eliminated its debt, a significant achievement bolstered by the consistent and strong cash flows generated from its key operating assets, most notably Camino Rojo.

This strategic financial maneuver leaves Orla Mining in a strong position with a healthy cash balance and readily available, undrawn credit facilities. This substantial liquidity is crucial, enabling the company to navigate its financial obligations with ease and providing the flexibility to capitalize on promising growth avenues.

- Debt-Free Status: Orla Mining achieved a debt-free balance sheet by the end of 2024.

- Cash Generation: Strong cash flow from operations, particularly from Camino Rojo, was the primary driver for debt repayment.

- Liquidity Position: The company maintains a robust cash balance and access to undrawn credit lines, ensuring significant financial flexibility.

- Strategic Advantage: This financial strength empowers Orla to effectively manage capital and pursue strategic growth initiatives.

Camino Rojo's consistent low-cost production, exemplified by its 2024 All-in Sustaining Cost (AISC) of $805 per ounce, firmly establishes it as Orla Mining's primary cash cow. This operational efficiency translates into substantial profit margins and reliable cash flow generation, a critical component for the company's financial health. The mine's ability to generate significant internal funding is further demonstrated by its contribution to Orla Mining's debt-free status by the end of 2024.

| Metric | 2023 (Approx.) | 2024 (Guidance/Actual) | Significance for Cash Cow Status |

| Gold Production (oz) | 106,000 | ~110,000 (Revised Guidance) | Demonstrates consistent output volume. |

| All-in Sustaining Costs (AISC) ($/oz) | N/A (Not explicitly stated for 2023 in provided text) | $805 | Indicates strong profitability and cash generation potential. |

| Debt Status | N/A | Debt-Free (End of 2024) | Highlights the cash flow strength supporting financial stability. |

Delivered as Shown

Orla Mining BCG Matrix

The Orla Mining BCG Matrix preview you see is the identical, fully formatted report you will receive upon purchase, ensuring no surprises and immediate strategic utility. This document is meticulously prepared, offering a clear, actionable analysis of Orla Mining's portfolio without any watermarks or demo content. Once you complete your purchase, this comprehensive BCG Matrix will be instantly available for your use in strategic planning, investor presentations, or internal discussions. You are viewing the exact, professional-grade BCG Matrix that will be delivered to you, ready for immediate integration into your business operations.

Dogs

The Cerro Quema Oxide Gold Project in Panama faces significant hurdles, primarily stemming from the cancellation of its mining concessions and a government-mandated moratorium on new mining operations. This has effectively frozen any progress, resulting in a minimal market share and no current or anticipated production.

Orla Mining has suspended further investment in Cerro Quema, awaiting clearer regulatory conditions. This stagnation places the project firmly in the 'Dog' category of the BCG matrix, characterized by low growth and low market share, with no immediate prospect of improvement.

Orla Mining's US$400 million arbitration against Panama for the Cerro Quema concession highlights a 'Dog' in their portfolio. This legal pursuit indicates a strategy to recover invested capital from an asset that is no longer viable for development, rather than generating future returns.

By seeking arbitration, Orla Mining is essentially attempting to divest itself of a non-performing asset that has tied up significant capital. This action is a clear indicator of moving away from a project that is not contributing to the company's growth or profitability, a hallmark of a 'Dog' in the BCG matrix.

The future of Orla Mining's Cerro Quema project is shrouded in significant uncertainty. Its progression to a producing asset hinges on the resolution of intricate legal disputes and the potential evolution of mining regulations within Panama. This ambiguity regarding its path to production, coupled with elevated operational risks, means the project currently holds no market share and a minimal growth outlook for Orla.

No Current or Planned Investment for Development

Orla Mining has made a clear decision to halt further investment in the development of its Cerro Quema Project. This pause is directly linked to the ongoing uncertainty surrounding legal and fiscal stability within Panama.

This strategic withholding of capital means Cerro Quema is not currently contributing to Orla's growth or expanding its market share. The project, therefore, represents a potential drain on resources, especially if any ongoing management or oversight is still necessary.

- Project Status: Cerro Quema is classified as a 'Dog' in Orla Mining's BCG Matrix due to the suspended development.

- Investment Stance: Orla Mining has explicitly stated no current or planned investment for development.

- Market Impact: The project is not contributing to growth or market share expansion.

- Resource Allocation: Represents a potential drain on company resources without active development.

Historical Investment Risk

Orla Mining's Cerro Quema project represents a significant historical investment, with substantial capital deployed for a pre-feasibility study. However, current political and legal uncertainties in Panama have placed these past expenditures in jeopardy.

The inability to generate returns on this capital, coupled with the absence of any ongoing operational revenue from Cerro Quema, positions it squarely within the question mark quadrant of the BCG matrix. This classification highlights the project's high market growth potential but low relative market share, compounded by its current status as a cash consumer with uncertain future prospects.

- Historical Investment: Over $30 million invested in Cerro Quema's pre-feasibility study.

- Risk Factor: Political and legal instability in Panama creates significant risk to capital recovery.

- BCG Classification: Question Mark due to high potential but current cash drain and uncertain future.

- Operational Status: No current operational contribution or revenue generation from the project.

The Cerro Quema project, due to its suspended development and lack of market share, is firmly categorized as a 'Dog' in Orla Mining's BCG Matrix. Orla has ceased further investment, recognizing its current inability to contribute to growth or profitability. The company is pursuing a US$400 million arbitration against Panama, signaling an effort to recover capital from this underperforming asset rather than foster future returns.

| Project | BCG Category | Market Share | Growth Rate | Orla's Stance |

|---|---|---|---|---|

| Cerro Quema | Dog | Low (Nil) | Low (Nil) | Suspended Investment, Arbitration |

Question Marks

The South Railroad Project in Nevada represents a significant development-stage asset for Orla Mining, poised for substantial future gold production within a highly prospective geological area.

As it's currently in the development phase and not yet producing, the project has no existing market share. However, it operates within the gold market, which is generally considered to be a high-growth sector, driven by various economic and geopolitical factors.

Orla Mining's 2024 outlook highlights the continued advancement of the South Railroad Project, with significant capital allocation planned for its progression. For instance, in early 2024, Orla announced an updated technical report for South Railroad, outlining a projected average annual gold production of approximately 150,000 ounces over the initial 11 years of its mine life. This project requires substantial investment to transition from its current development stage to full operational status.

Orla Mining is making significant strides in advancing the permitting and feasibility studies for its South Railroad Project. The company is aiming for a Record of Decision, the final permitting hurdle, by mid-2026. This timeline reflects a focused effort to move the project forward.

Furthermore, Orla plans to unveil an updated Feasibility Study by the close of 2025. These developments underscore the company's dedication to the project's progression.

These crucial pre-production activities, while essential for future operations, represent cash outflows with no immediate revenue generation, a characteristic often associated with projects in the 'question mark' phase of the BCG matrix.

The Camino Rojo Sulphides, especially the Zone 22 discovery, highlight Orla Mining's potential for future underground operations, boasting high-grade mineralization. Aggressive exploration and resource definition are actively underway to solidify this significant long-term growth prospect.

While Zone 22 presents a compelling opportunity in a robust market, it's crucial to note its current status as a non-producing asset. Significant capital investment will be necessary for its eventual underground development and realization of its full value.

Aggressive Exploration Investment

Orla Mining is demonstrating aggressive exploration investment by allocating a significant portion of its capital to high-potential, early-stage projects. For 2025, the company has outlined an exploration budget of $30 million, primarily focused on Mexico and Nevada. This substantial commitment aims to identify and advance new resource opportunities, thereby building a pipeline for future production.

- Aggressive Exploration: Orla's $30 million exploration budget for 2025 signals a strong commitment to discovering and developing new mineral assets.

- Strategic Focus: The investment is concentrated on defining and de-risking future production, particularly with a 15,000-meter drilling program at Camino Rojo Sulphides.

- Portfolio Expansion: This approach positions these early-stage, high-potential projects as Stars within the BCG matrix, indicating a need for continued investment to fuel growth and future revenue streams.

Future Production Timeline

Future production timelines for Orla Mining are centered on projects with significant growth potential but currently absent from revenue generation. The South Railroad Project, slated for its first gold production potentially in 2027, represents a key future contributor. Similarly, the Camino Rojo Sulphides project is in its nascent development stages, with a recent underground mineral resource estimate marking a crucial step forward.

These projects, characterized by long lead times to market and substantial upside, are classified as question marks within the BCG framework. This classification necessitates ongoing investment and careful strategic planning to navigate their development path and eventual transition to cash-generating assets.

- South Railroad Project: Anticipated first gold production as early as 2027.

- Camino Rojo Sulphides: Early-stage development with a recently delivered underground mineral resource estimate.

- BCG Classification: Both projects are considered question marks due to their future production profiles and current non-contributing status.

- Strategic Focus: Requires continued investment and strategic decision-making to advance towards production.

Orla Mining's South Railroad Project and Camino Rojo Sulphides are prime examples of question marks in the BCG matrix. They represent significant future potential in a growing market but require substantial investment and have no current market share or revenue generation.

The South Railroad Project, with its updated technical report in early 2024 projecting 150,000 ounces of gold annually for 11 years, is a key focus. Similarly, the Zone 22 discovery at Camino Rojo Sulphides offers high-grade potential for future underground operations.

These projects are in development stages, demanding considerable capital for permitting, feasibility studies, and eventual construction. Orla's commitment is evident in its $30 million exploration budget for 2025, primarily targeting advancement of these very assets.

The strategic imperative is to nurture these question marks, investing wisely to de-risk them and position them to become future stars in Orla's portfolio, with South Railroad potentially commencing production as early as 2027.

| Project | BCG Classification | Market Growth | Current Market Share | Investment Need | Projected Production Start |

|---|---|---|---|---|---|

| South Railroad | Question Mark | High (Gold Market) | None | High (Development, Permitting, Feasibility) | 2027 (Est.) |

| Camino Rojo Sulphides (Zone 22) | Question Mark | High (Gold Market) | None | High (Exploration, Underground Development) | TBD |

BCG Matrix Data Sources

Our BCG Matrix is built on verified market intelligence, combining financial data, industry research, and official reports to ensure reliable, high-impact insights.