OneSpan PESTLE Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

OneSpan Bundle

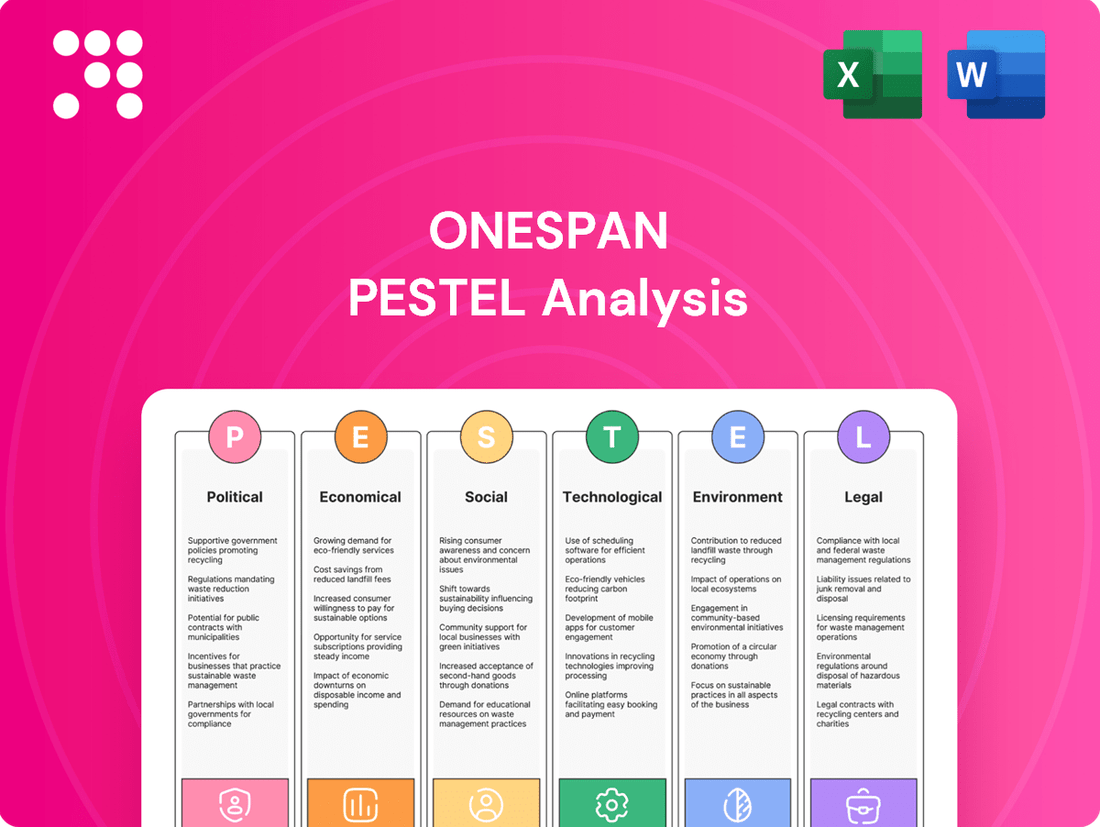

Navigate the complex external forces shaping OneSpan's trajectory with our comprehensive PESTLE analysis. Uncover critical political, economic, social, technological, legal, and environmental factors that influence its operations and market position. Armed with this expert-level intelligence, you can anticipate challenges and seize opportunities. Download the full report now to gain a decisive advantage.

Political factors

OneSpan operates within a heavily regulated landscape, especially when serving financial and government entities. New mandates like the EU's NIS2 and DORA, along with US regulations such as CIRCIA and SEC cybersecurity rules, are increasingly shaping the market. These regulations, which demand enhanced identity verification, fraud prevention, and secure transaction capabilities, directly boost the need for OneSpan's specialized solutions.

Geopolitical tensions, such as ongoing trade disputes and regional conflicts, can significantly impact OneSpan's global operations. These disruptions may affect supply chains and, crucially, the IT and digital transformation budgets of its international clientele, potentially slowing down project timelines or investment in new security solutions.

Political instability in key markets presents another challenge. For instance, heightened political uncertainty in regions where OneSpan operates could lead to a slowdown in digital transformation initiatives, as businesses and governments may adopt a more cautious spending approach. Additionally, increased scrutiny on cross-border data flows, driven by national security concerns, could affect OneSpan's ability to serve clients seamlessly across different jurisdictions.

With a presence in over 100 countries, OneSpan navigates a complex web of diverse political climates. This broad exposure means that local market conditions, influenced by national policies and regulatory environments, can directly impact the adoption rates of its digital identity verification and transaction security solutions. For example, a country implementing stricter data localization laws could necessitate adjustments to OneSpan's service delivery models.

Governments globally are accelerating digital transformation, with a significant focus on digitizing public services and enhancing national identity management systems. For instance, the European Union's eIDAS 2.0 regulation, expected to be fully implemented by 2026, aims to create a pan-European digital identity framework, potentially opening new markets for identity verification solutions.

This global push presents a prime opportunity for OneSpan, as its expertise in identity verification and secure digital agreements aligns perfectly with these government modernization efforts. The development of digital ID wallets and the drive for more efficient online citizen services directly translate into a demand for robust, secure, and trusted digital interaction platforms.

Anti-Money Laundering (AML) and Know Your Customer (KYC) Policies

The global regulatory landscape for Anti-Money Laundering (AML) and Know Your Customer (KYC) continues to intensify, creating a direct tailwind for OneSpan. As financial institutions grapple with increasingly complex compliance mandates, the need for sophisticated identity verification and fraud prevention solutions escalates. This trend is particularly pronounced in 2024 and 2025, with regulators worldwide emphasizing stricter oversight.

For instance, the U.S. Financial Crimes Enforcement Network (FinCEN) has been expanding the scope of entities requiring robust AML/Counter-Terrorist Financing (CFT) programs. This broadening of requirements means more businesses, including investment advisers, must invest in advanced compliance technologies. OneSpan is well-positioned to capitalize on this by providing the tools necessary to meet these evolving, stringent demands and combat illicit financial activities effectively.

- Increased Regulatory Scrutiny: Global AML/KYC regulations are becoming more stringent, driving demand for compliance solutions.

- Demand for Identity Verification: Financial institutions require advanced solutions to verify customer identities and prevent fraud.

- Expanded Compliance Scope: New regulations, like those from FinCEN, are bringing more entities under AML/CFT program requirements.

- OneSpan's Strategic Advantage: The company's offerings directly address the growing need for robust compliance and fraud prevention tools.

Data Localization and Sovereignty Laws

Increasingly, nations are enacting data localization and data sovereignty laws. These regulations mandate that data be stored and processed within a country's borders. For OneSpan, this means their cloud-based security solutions might need to adapt their infrastructure to comply with these diverse geographical requirements.

This trend directly affects how OneSpan delivers its services, potentially requiring adjustments to their data center strategies and operational models to ensure compliance. For instance, by the end of 2024, many countries in the Asia-Pacific region, including India and Indonesia, have strengthened their data localization mandates, impacting global cloud service providers.

- Data Residency Requirements: Laws in countries like Vietnam and Thailand, for example, are pushing for local data storage for certain sensitive information, affecting OneSpan's global service deployment.

- Compliance Costs: Adapting infrastructure to meet these varied legal frameworks can incur significant costs for OneSpan, potentially impacting profitability for specific markets.

- Market Access and Trust: Adherence to these data sovereignty laws is critical for OneSpan to maintain market access and build trust with customers in regulated industries worldwide.

Governments worldwide are prioritizing digital identity and transaction security, creating a favorable environment for OneSpan. New regulations like the EU's NIS2 and DORA, alongside US cybersecurity mandates, directly increase the demand for OneSpan's solutions in areas like identity verification and fraud prevention.

The push for digital transformation in public services, exemplified by the EU's eIDAS 2.0 initiative aiming for a pan-European digital identity by 2026, opens significant market opportunities for OneSpan's expertise in secure digital agreements and identity verification.

Intensifying global AML/KYC regulations, with bodies like FinCEN expanding compliance scopes in 2024 and 2025, necessitate advanced solutions, positioning OneSpan to benefit from increased demand for its fraud prevention and identity verification tools.

Data localization laws are also on the rise, with countries like India and Indonesia strengthening mandates by the end of 2024, requiring OneSpan to adapt its infrastructure and service delivery models to comply with varying geographical data storage requirements.

What is included in the product

This OneSpan PESTLE analysis comprehensively examines the Political, Economic, Social, Technological, Environmental, and Legal forces impacting the company, providing a strategic overview of the external landscape.

The OneSpan PESTLE Analysis provides a structured framework to identify and address external threats and opportunities, alleviating the pain point of navigating complex and unpredictable market landscapes.

Economic factors

Global economic growth directly impacts OneSpan's top-line performance. A healthy economy generally translates to increased enterprise and financial institution spending on digital transformation initiatives, including cybersecurity and digital identity solutions, which are core to OneSpan's offerings. For instance, projections for global GDP growth in 2024 and 2025, estimated around 2.7% and 2.8% respectively by the IMF as of early 2025, indicate a generally supportive environment for such investments.

OneSpan's strategic pivot to higher-margin software and subscription-based revenue models is intrinsically linked to the digital transformation trend. While the company reported a slight revenue dip in Q1 2025, this shift is designed to capitalize on the sustained demand for digital solutions. This strategy aligns with the broader market trend where businesses are increasingly prioritizing cloud-based and recurring revenue software for enhanced security and customer experience.

The rate at which businesses and financial institutions invest in digital transformation is a critical driver for OneSpan. As of early 2025, global spending on digital transformation was anticipated to exceed $2 trillion annually, with cybersecurity and identity management being key components. This robust investment climate provides a fertile ground for OneSpan to expand its market share by offering solutions that address critical digital security needs.

Rising inflation in 2024 and 2025 directly impacts OneSpan's operational expenses. This includes higher costs for talent, essential technology components, and the logistics of their supply chain. For instance, the U.S. Consumer Price Index (CPI) saw a notable increase throughout 2024, impacting various business inputs.

To counter these pressures, OneSpan prioritizes robust cost management and operational efficiency. This focus is crucial for safeguarding profitability amidst an inflationary economic landscape. The company's commitment to streamlining operations is a key strategy for navigating these economic headwinds.

OneSpan's dedication to optimizing its cost structure yielded significant results in Q1 2025. The company reported record operating income and robust cash generation, underscoring the effectiveness of their efficiency initiatives in a challenging economic climate.

As a global player in over 100 countries, OneSpan's financial results are inherently sensitive to currency exchange rate fluctuations. When earnings generated in foreign currencies are translated back into its reporting currency, significant movements can impact reported revenues and profitability. For instance, a strengthening US dollar against other major currencies could lead to lower reported revenues from international operations.

These shifts also influence the price competitiveness of OneSpan's digital identity verification and transaction security solutions in various international markets. If the local currency weakens considerably, its offerings might become more expensive for customers in that region, potentially affecting sales volumes. Managing this foreign currency exposure remains a critical ongoing task for the company to ensure stable financial performance.

In 2024, the volatility in major currency pairs like EUR/USD and USD/JPY continued to present challenges. For example, the average EUR/USD exchange rate in early 2024 hovered around 1.08, a notable shift from previous periods, directly influencing OneSpan's European revenue translation.

Market Demand for Digital Identity and Anti-Fraud Solutions

The escalating frequency of identity theft and digital fraud globally is a powerful driver for OneSpan's digital identity and anti-fraud solutions. This trend directly translates into robust market demand for the company's core products.

The digital identity market is experiencing a significant growth spurt. Projections suggest the global digital identity market will reach approximately $60 billion by 2025, with financial services being a primary contributor to this expansion. This sustained economic tailwind is particularly beneficial for OneSpan, given its strong focus on this sector.

- Growing Market: The digital identity market is expanding rapidly, driven by increasing digital transactions and security concerns.

- Fraud Impact: Rising identity theft incidents directly boost demand for OneSpan's anti-fraud technologies.

- Financial Services Focus: The financial sector, a key market for OneSpan, is a major revenue generator in the digital identity space.

- Economic Tailwind: This sustained demand provides a strong economic advantage for OneSpan's business model.

Shift to Subscription-Based Models

OneSpan's strategic shift towards subscription-based models is a significant economic driver. This move away from traditional hardware authentication is designed to create a more stable and predictable revenue stream. The company reported a 9% year-over-year increase in Annual Recurring Revenue (ARR) in the first quarter of 2025, highlighting the success of this pivot.

This transition to software and subscription services aligns with widespread industry trends favoring Software-as-a-Service (SaaS) adoption. While there might be initial revenue impacts in older hardware segments, the long-term financial outlook is strengthened by recurring revenue. This strategy is expected to yield higher profit margins over time.

Key aspects of this economic factor include:

- Recurring Revenue Growth: OneSpan's ARR climbed 9% year-over-year in Q1 2025, demonstrating the economic benefit of subscription models.

- Industry Alignment: The pivot mirrors a broader market trend towards SaaS, enhancing OneSpan's competitive positioning.

- Margin Improvement: Subscription services generally offer higher and more consistent profit margins compared to hardware sales.

- Financial Stability: The predictable nature of recurring revenue contributes to greater long-term financial stability and valuation.

Global economic growth directly impacts OneSpan's revenue. A stronger economy generally means more spending by businesses and financial institutions on digital transformation, including cybersecurity and digital identity solutions. For instance, the IMF projected global GDP growth around 2.7% for 2024 and 2.8% for 2025, indicating a supportive environment for these investments.

Rising inflation in 2024 and 2025 affects OneSpan's operating costs, such as talent and technology components. The U.S. CPI showed a notable increase throughout 2024, impacting business inputs. To manage this, OneSpan focuses on cost management and operational efficiency, which contributed to record operating income and strong cash generation in Q1 2025.

Currency fluctuations also play a role, as OneSpan operates globally. A stronger US dollar can reduce reported revenues from international operations when translated back. For example, the EUR/USD rate averaged around 1.08 in early 2024, impacting European revenue translation.

The increasing frequency of identity theft and digital fraud globally is a significant driver for OneSpan's solutions. The digital identity market is projected to reach approximately $60 billion by 2025, with financial services being a key contributor.

| Economic Factor | Impact on OneSpan | Data Point/Example |

| Global Economic Growth | Drives demand for digital transformation and security solutions. | IMF projected global GDP growth of 2.7% (2024) and 2.8% (2025). |

| Inflation | Increases operating expenses. | U.S. CPI showed notable increases throughout 2024. |

| Currency Exchange Rates | Affects reported international revenues and pricing competitiveness. | EUR/USD averaged around 1.08 in early 2024. |

| Digital Fraud Trends | Boosts demand for digital identity and anti-fraud solutions. | Digital identity market projected to reach ~$60 billion by 2025. |

Preview Before You Purchase

OneSpan PESTLE Analysis

The preview shown here is the exact document you’ll receive after purchase—fully formatted and ready to use. This comprehensive OneSpan PESTLE analysis delves into the Political, Economic, Social, Technological, Legal, and Environmental factors impacting the company. It provides a strategic overview to inform your business decisions.

Sociological factors

Societal trust in digital transactions is a significant driver for OneSpan. As people increasingly use online platforms for banking, shopping, and even government services, the need for secure digital interactions grows. This trend directly boosts demand for OneSpan's identity verification and fraud prevention solutions.

By mid-2024, global e-commerce sales were projected to reach over $6.3 trillion, highlighting the massive shift towards digital commerce. This widespread adoption means more users are engaging with digital platforms, making robust security measures, like those offered by OneSpan, essential for maintaining consumer confidence and facilitating these transactions.

Societal shifts are significantly impacting the demand for robust digital security. A growing public consciousness regarding cybersecurity threats and data privacy is fueling the adoption of sophisticated security technologies. For instance, a 2024 survey indicated that 75% of consumers are more concerned about their data privacy than they were a year prior, directly translating into a higher demand for solutions that protect personal and financial information.

This heightened awareness translates into a tangible market opportunity for companies like OneSpan. There's an increasing need for strong authentication methods, secure electronic signatures, and reliable identity verification processes. OneSpan's commitment to securing digital interactions and communications positions it well to capitalize on these evolving societal expectations, as evidenced by their continued investment in identity verification solutions which saw a 15% year-over-year growth in demand in early 2025.

Consumers now demand digital interactions that are not only easy and quick but also ironclad in their security. This shift means businesses, especially in finance, must prioritize platforms that offer a smooth user journey without compromising on safety. For instance, a 2024 Juniper Research report highlighted that 70% of consumers consider security a top priority when choosing a digital service provider.

This growing expectation for intuitive yet robust digital engagement directly influences how companies like OneSpan develop their offerings. Their focus on making digital processes, from signing up new customers to completing transactions, both user-friendly and highly secure addresses this key consumer trend. By integrating advanced security measures with simple interfaces, they aim to meet the market's demand for a frictionless yet protected online environment.

Demographic Shifts and Digital Inclusion

Demographic shifts significantly impact digital service adoption. For instance, by 2025, the global population aged 65 and over is projected to reach over 750 million, many of whom are increasingly engaging with digital platforms for banking and communication. OneSpan's offerings must therefore be designed for intuitive use across a wide spectrum of digital literacy, from tech-savvy Gen Z to digitally emerging seniors.

Younger generations, born into a digital world, expect seamless online experiences. In 2024, over 90% of individuals aged 18-29 in developed economies use smartphones daily, driving demand for secure yet user-friendly digital identity verification. OneSpan's ability to adapt to these evolving user expectations is crucial for market penetration.

Expanding digital inclusion initiatives can unlock new market segments for digital identity solutions. As of early 2025, an estimated 1.5 billion people globally still lack reliable internet access, representing a significant untapped market. By developing accessible and affordable digital identity tools, OneSpan can address this gap and broaden its customer base.

- Aging Population Adoption: By 2025, over 750 million people globally will be aged 65+, with increasing digital engagement.

- Digital Native Expectations: Over 90% of 18-29 year olds in developed nations are daily smartphone users in 2024, demanding seamless digital interactions.

- Untapped Market Potential: Approximately 1.5 billion individuals globally still lack reliable internet access as of early 2025, presenting an opportunity for inclusive digital identity solutions.

Impact of Social Engineering and Deepfake Fraud

The increasing prevalence of sophisticated social engineering tactics, amplified by AI-powered deepfake technology, is fundamentally altering societal trust in digital communications. This evolution poses a significant challenge, as distinguishing genuine interactions from fraudulent ones becomes increasingly difficult for individuals and organizations alike.

These advanced fraud methods necessitate more robust security measures, highlighting the critical role of companies like OneSpan. Their advanced fraud detection and liveness verification solutions are essential to combatting these evolving threats, as conventional security protocols often fall short against AI-driven deception.

The societal impact is substantial, with reports indicating a sharp rise in AI-driven scams. For instance, in 2023, the FBI's Internet Crime Complaint Center (IC3) reported a 300% increase in complaints related to AI-enabled scams compared to the previous year, underscoring the urgency for effective countermeasures.

OneSpan's offerings directly address this societal concern by providing the technological infrastructure to verify identity and detect anomalies in real-time, thereby safeguarding individuals and businesses from the pervasive threat of deepfake fraud and social engineering.

- Erosion of Trust: Deepfakes and advanced social engineering tactics undermine confidence in digital identities and communications.

- Increased Fraud Sophistication: AI enables more convincing and personalized fraudulent schemes, overwhelming traditional security.

- Demand for Advanced Solutions: There's a growing societal need for technologies that can accurately verify identity and detect synthetic media.

- Societal Impact: The rise in AI-enabled scams, with a reported 300% increase in FBI complaints in 2023, demonstrates the tangible societal consequences.

Societal trust in digital transactions is a significant driver for OneSpan, as people increasingly use online platforms for banking, shopping, and government services, boosting demand for secure digital interactions and fraud prevention solutions.

A growing public consciousness regarding cybersecurity threats and data privacy is fueling the adoption of sophisticated security technologies, with 75% of consumers in a 2024 survey expressing increased concern about data privacy.

Demographic shifts, such as the growing elderly population engaging with digital platforms and digital natives expecting seamless online experiences, influence the design of user-friendly yet secure digital identity solutions.

The rise of AI-powered deepfakes and social engineering tactics is eroding trust in digital communications, leading to a 300% increase in AI-enabled scam complaints reported to the FBI in 2023, underscoring the need for advanced verification technologies.

| Societal Factor | Trend/Impact | Relevance to OneSpan | Supporting Data (2024/2025) |

|---|---|---|---|

| Digital Trust & Adoption | Increasing reliance on digital platforms for daily activities. | Drives demand for secure identity verification and fraud prevention. | Global e-commerce sales projected over $6.3 trillion by mid-2024. |

| Cybersecurity Awareness | Heightened consumer concern over data privacy and online threats. | Increases demand for robust security measures and identity protection. | 75% of consumers more concerned about data privacy in 2024. |

| Demographic Shifts | Aging population becoming more digitally active; digital natives' expectations. | Requires intuitive and accessible digital security solutions for all age groups. | Over 750 million people globally aged 65+ by 2025; 90%+ of 18-29 year olds daily smartphone users in 2024. |

| Sophisticated Fraud Tactics | AI-driven deepfakes and social engineering undermine digital communication trust. | Necessitates advanced fraud detection and liveness verification capabilities. | 300% increase in AI-enabled scam complaints to FBI in 2023. |

Technological factors

The swift progress in artificial intelligence (AI) and machine learning (ML) is revolutionizing how fraud is detected, allowing for much smarter pattern identification and forecasting. This means systems can now spot anomalies and predict fraudulent activities with greater accuracy than ever before.

OneSpan can harness these AI/ML breakthroughs to significantly boost its anti-fraud offerings. This will make its solutions more adept at catching new and tricky threats, such as convincing deepfakes and intricate fraudulent schemes that are increasingly common.

For instance, by mid-2024, financial institutions were reporting that AI-powered fraud detection systems were reducing false positives by up to 40%, a critical improvement for customer experience and operational efficiency. Integrating these advanced AI capabilities into OneSpan's platforms is therefore essential for maintaining its competitive edge in the evolving cybersecurity landscape.

The industry's move towards passwordless authentication, championed by standards like FIDO, poses both a hurdle and a chance for OneSpan. This shift is driven by the need for stronger security and a smoother user journey, as traditional passwords are often weak points.

OneSpan's strategic acquisition of Nok Nok Labs, a key player in FIDO passwordless authentication, clearly signals its intent to be at the forefront of this evolution. This move positions them to offer advanced solutions that address the growing demand for more secure and user-friendly login methods.

By integrating FIDO standards into its broad authentication offerings, OneSpan can effectively leverage this trend. This integration promises to deliver superior security and an improved user experience, aligning with market demands and enhancing their competitive edge in the digital identity space.

The widespread adoption of cloud computing by businesses, including financial institutions, is a significant technological driver. This trend fuels the demand for security solutions built for cloud environments and digital agreement platforms. For instance, Gartner predicted in 2024 that worldwide enterprise IT spending on cloud services would reach $679 billion, up from $608 billion in 2023, highlighting the scale of this shift.

OneSpan's strategic move towards a software and subscription-based model, delivering its offerings as Software-as-a-Service (SaaS), directly capitalizes on this trend. This SaaS approach makes their solutions more accessible and adaptable, mirroring the flexibility clients expect from cloud-based technologies.

Cloud deployments offer critical advantages like enhanced scalability, allowing businesses to adjust resource usage easily, and greater flexibility in how they integrate new technologies. This is crucial for financial firms needing to rapidly adapt to evolving digital landscapes and regulatory requirements.

Development of Digital Identity Wallets and Decentralized Identity

The rise of digital identity wallets and decentralized identity solutions, like the EU's eIDAS 2.0 regulation which aims for widespread adoption by 2026, presents a significant technological shift. OneSpan's established capabilities in identity verification and secure digital transactions are well-suited to capitalize on this trend, enabling more user-centric control over personal data and simplifying verification workflows.

These advancements are crucial for secure online interactions and are expected to reshape how individuals and businesses manage digital credentials. For instance, the global digital identity solutions market was valued at approximately $29.7 billion in 2023 and is projected to grow substantially, with some forecasts suggesting it could reach over $100 billion by 2030, driven by these very innovations.

- Digital Identity Wallets: Empowering users with self-sovereign control over their digital credentials.

- Decentralized Identity Frameworks: Enabling secure and verifiable digital identity management without central authorities.

- eIDAS 2.0: A key regulatory driver in Europe pushing for cross-border digital identity recognition and wallet solutions.

- Market Growth: The digital identity market is experiencing rapid expansion, indicating strong demand for related technologies and services.

Integration Capabilities and API-First Approaches

The increasing demand for smooth integration of security and e-signature solutions into existing business systems is a key technological driver. OneSpan addresses this by offering strong integration capabilities, including pre-built connections to popular business applications, which significantly boosts its appeal to enterprise clients.

OneSpan's commitment to an API-first strategy is crucial for its technological competitiveness. This approach allows for greater adaptability and wider implementation across various client IT infrastructures, ensuring their solutions can be easily embedded into diverse workflows.

- API-First Strategy: Facilitates flexible integration into diverse enterprise systems.

- Out-of-the-Box Integrations: Streamlines adoption with popular business applications.

- Enhanced Value Proposition: Seamless integration boosts the utility of security and e-signature solutions.

The rapid advancement of AI and machine learning is transforming fraud detection, enabling more sophisticated pattern recognition and predictive capabilities. OneSpan's integration of these technologies enhances its anti-fraud solutions, making them more effective against evolving threats like deepfakes. For instance, by mid-2024, AI-powered fraud detection systems were reducing false positives by up to 40%, a significant improvement for financial institutions.

Legal factors

Data privacy regulations, such as the EU's General Data Protection Regulation (GDPR) and California's Consumer Privacy Act (CCPA), significantly impact companies like OneSpan. These laws mandate strict controls over the collection, processing, and storage of personal data. For instance, GDPR, implemented in 2018, introduced substantial fines for non-compliance, with potential penalties reaching up to 4% of global annual revenue or €20 million, whichever is higher.

OneSpan's identity verification solutions rely heavily on handling sensitive personal information. Therefore, ensuring full compliance with these evolving regulations is paramount for maintaining customer trust and avoiding substantial legal and financial repercussions. These regulations directly influence OneSpan's product development, dictating how data is handled, secured, and how user consent is managed within their platforms.

OneSpan's digital identity verification and transaction security solutions are heavily influenced by global Anti-Money Laundering (AML) and Counter-Terrorist Financing (CTF) regulations. These laws require financial institutions to implement stringent Know Your Customer (KYC) protocols and ongoing transaction monitoring to combat financial crime. For instance, the Financial Action Task Force (FATF) continues to update its recommendations, impacting how companies like OneSpan must design their compliance tools.

By providing advanced identity proofing and fraud detection capabilities, OneSpan directly assists its clients in navigating these complex legal landscapes. This helps financial organizations avoid significant penalties, which can run into millions; for example, in 2023, fines for AML and CTF violations globally exceeded billions of dollars, underscoring the critical need for effective compliance solutions.

The legal validity and enforceability of digital signatures and electronic transactions are absolutely critical for OneSpan's secure agreement automation solutions. These laws, like the eIDAS regulation in the European Union and the ESIGN Act in the United States, form the bedrock upon which OneSpan builds its offerings, ensuring that digital agreements hold the same weight as traditional paper ones.

OneSpan's success hinges on its ability to stay ahead of evolving legal landscapes. For instance, the EU's eIDAS regulation, fully applicable since 2016, continues to be refined, and OneSpan must ensure its platforms align with any updates to recognized electronic signature levels and qualified trust services. Similarly, ongoing interpretations and potential amendments to the ESIGN Act in the US require constant vigilance.

Navigating these diverse international standards and legal interpretations is a continuous challenge. OneSpan's commitment to ensuring the legal integrity of its products means investing in legal expertise and technology that can adapt to varying compliance requirements across different jurisdictions, safeguarding the trust and reliability of its secure transaction platforms.

Cyber Incident Reporting Requirements

New cyber incident reporting laws are emerging globally, creating a complex compliance landscape. For instance, the Cyber Incident Reporting for Critical Infrastructure Act (CIRCIA) in the United States, enacted in 2022, mandates specific reporting timelines for critical infrastructure entities experiencing covered cyber incidents. Failure to comply can result in significant penalties, impacting operational continuity and financial stability.

For OneSpan, a provider of digital identity and security solutions, and its clients, understanding and adhering to these evolving regulations is paramount. These laws require timely notification to regulatory bodies, often within hours or days of detecting a significant incident. This necessitates robust internal processes and advanced security tools to identify, assess, and report breaches effectively.

OneSpan's security offerings, by focusing on preventing and detecting cyber threats, can play a crucial role in helping clients meet these stringent reporting obligations. By minimizing the occurrence and impact of incidents, OneSpan's solutions enable clients to better manage their cybersecurity posture and, consequently, their compliance with incident reporting mandates. This proactive approach is essential in today's threat environment.

- CIRCIA mandates reporting within 72 hours for significant cyber incidents affecting critical infrastructure in the US.

- Non-compliance with cyber incident reporting laws can lead to substantial fines, potentially millions of dollars depending on the jurisdiction.

- OneSpan's security solutions aim to reduce the frequency of reportable incidents for their clients, thereby easing compliance burdens.

- The global regulatory landscape for cyber incident reporting is dynamic, with new laws and updates expected frequently through 2025.

Financial Sector-Specific Compliance (e.g., DORA, SOX)

Financial institutions, OneSpan's core clientele, navigate a complex web of sector-specific compliance. Regulations like the EU's Digital Operational Resilience Act (DORA) and the US Sarbanes-Oxley Act (SOX) impose stringent requirements on ICT risk management and operational resilience. OneSpan's offerings directly assist these institutions in meeting these critical legal obligations, ensuring their adherence to evolving financial sector mandates.

The increasing regulatory scrutiny means that non-compliance carries significant financial penalties. For instance, DORA, which came into effect in January 2024, aims to bolster the digital operational resilience of the EU financial sector, impacting how firms manage ICT risks. Similarly, SOX continues to demand robust internal controls over financial reporting, a domain where OneSpan's solutions can provide critical support.

OneSpan's solutions are designed to address these specific regulatory challenges:

- DORA Compliance: Providing tools for ICT risk assessment, incident reporting, and third-party risk management to meet DORA's operational resilience mandates.

- SOX Compliance: Enabling secure digital transaction signing and identity verification, which are crucial for maintaining the integrity of financial reporting and internal controls required by SOX.

- Global Regulatory Alignment: Supporting financial firms in adapting to diverse and evolving legal frameworks across different jurisdictions.

Data privacy laws like GDPR and CCPA are critical for OneSpan, dictating how personal data is handled. Non-compliance can lead to hefty fines, up to 4% of global revenue, impacting OneSpan's operations and client trust. These regulations directly shape OneSpan's product development, ensuring secure data management and consent processes.

AML/CTF regulations, such as those from the FATF, necessitate stringent KYC and transaction monitoring. OneSpan's solutions help clients meet these requirements, preventing significant penalties, as global AML fines in 2023 alone surpassed billions of dollars. This highlights the essential role of OneSpan's compliance tools.

The legal standing of digital signatures is fundamental to OneSpan's secure agreement solutions, supported by laws like the eIDAS regulation and the ESIGN Act. OneSpan must continuously adapt to updates in these frameworks, such as refinements to eIDAS recognized electronic signature levels, to maintain the validity of its digital transaction platforms.

Emerging cyber incident reporting laws, like the US CIRCIA (enacted 2022), require timely breach notifications, with penalties for non-compliance. OneSpan's security solutions assist clients in preventing and managing incidents, thereby easing the burden of these strict reporting mandates and enhancing overall cybersecurity posture.

| Regulation | Key Requirement | Impact on OneSpan | Example Fine/Penalty |

| GDPR | Data privacy & consent | Product design, data handling | Up to 4% of global annual revenue |

| FATF Recommendations | AML/CTF, KYC | Compliance tool development | Billions globally in 2023 |

| eIDAS (EU) | Digital signature validity | Platform adherence to standards | Legal invalidity of transactions |

| CIRCIA (US) | Cyber incident reporting | Client support for compliance | Substantial penalties for non-reporting |

Environmental factors

OneSpan's dedication to Corporate Social Responsibility (CSR) and ESG principles is becoming crucial for maintaining trust with investors and customers, even if these factors don't directly influence its digital security products. The upcoming EU Corporate Sustainability Reporting Directive (CSRD), effective from 2025, will mandate detailed sustainability reporting, pushing OneSpan to actively track and manage its environmental footprint.

OneSpan's increasing reliance on cloud infrastructure for its digital identity verification and transaction security solutions means its energy consumption and carbon footprint are under greater scrutiny. As digital operations expand, the efficiency of data centers powering these services becomes a key environmental consideration.

While OneSpan's direct environmental impact might be less than heavy industry, the energy used by its software and cloud partners is a growing concern for stakeholders. For instance, global data center energy consumption is projected to reach 3,000 terawatt-hours (TWh) by 2026, a significant portion of global electricity use.

This trend incentivizes OneSpan and its partners to adopt more energy-efficient technologies and sustainable operational practices to mitigate environmental impact and meet ESG (Environmental, Social, and Governance) expectations.

Climate change, while an indirect factor, presents potential disruptions to digital infrastructure, affecting service availability for OneSpan and its clientele. Extreme weather events, such as severe storms or prolonged heatwaves, can impact data centers and network connectivity, leading to service interruptions.

OneSpan acknowledges that while current climate risks are considered modest relative to other business challenges, there's a recognition of potential long-term consequences. These could affect operational resilience, customer access to services, and the stability of its broader supply chain, necessitating ongoing risk assessment and mitigation strategies.

Waste Management from Hardware Components

OneSpan's history with hardware authentication devices, such as physical tokens, means it has had to consider the environmental impact of electronic waste (e-waste). As the company shifts its focus more towards software-based solutions, the environmental burden associated with manufacturing and disposing of hardware will naturally lessen, supporting its sustainability objectives.

While the move to software reduces future hardware impact, responsible e-waste management remains a key consideration for OneSpan's existing and legacy hardware. This includes ensuring that old devices are disposed of or recycled in an environmentally sound manner, adhering to regulations and best practices.

- E-waste Generation: The global generation of e-waste is a growing concern, with estimates suggesting over 53 million metric tons were produced in 2023, according to the UN's Global E-waste Monitor 2024.

- Recycling Rates: Despite the volume, the global e-waste recycling rate was only around 22.3% in 2023, highlighting the challenge of proper disposal.

- Regulatory Landscape: Many regions are implementing stricter e-waste regulations, such as the EU's Waste Electrical and Electronic Equipment (WEEE) Directive, which OneSpan must comply with for any hardware it continues to manage or support.

- Corporate Responsibility: Companies are increasingly expected to demonstrate robust e-waste management programs, including take-back schemes and partnerships with certified recyclers, to meet stakeholder expectations for environmental stewardship.

Supply Chain Sustainability and Ethical Sourcing

OneSpan's reliance on hardware components and third-party services means its supply chain's sustainability and ethical sourcing are increasingly critical. Customers and regulators are pushing for greater transparency in environmental and labor practices throughout the supply chain. For instance, by the end of 2024, many major corporations are expected to report on Scope 3 emissions, which include supply chain impacts, a trend that will likely accelerate into 2025.

To align with global sustainability trends and meet these evolving expectations, OneSpan's Environmental, Social, and Governance (ESG) strategy must actively incorporate supply chain considerations. This includes vetting suppliers for their environmental impact and labor standards. The growing emphasis on responsible sourcing is reflected in initiatives like the European Union's Corporate Sustainability Due Diligence Directive, which is expected to impact many businesses operating within or supplying to the EU by 2025.

- Supply Chain Scrutiny: Increasing demand for transparency in environmental and labor practices from customers and regulators.

- ESG Integration: Necessity for OneSpan's ESG strategy to encompass supply chain sustainability and ethical sourcing.

- Regulatory Trends: Anticipated impact of directives like the EU's Corporate Sustainability Due Diligence Directive on businesses by 2025.

- Scope 3 Emissions: Growing corporate focus on reporting supply chain emissions, with significant increases expected by the end of 2024 and into 2025.

OneSpan's environmental considerations are increasingly tied to its digital operations and supply chain. The company's reliance on cloud infrastructure means energy consumption and carbon footprint are under scrutiny, with global data center energy use projected to reach 3,000 TWh by 2026. This drives a need for energy-efficient technologies to meet growing ESG expectations.

The shift from hardware authentication devices to software solutions is reducing OneSpan's direct e-waste impact. However, responsible management of existing hardware remains important, especially given that global e-waste reached over 53 million metric tons in 2023, with only 22.3% recycled.

OneSpan's supply chain sustainability is also critical, with a growing demand for transparency in environmental and labor practices. By 2025, directives like the EU's Corporate Sustainability Due Diligence are expected to increase scrutiny on Scope 3 emissions, pushing companies to vet suppliers for their environmental impact.

| Environmental Factor | Relevance to OneSpan | Key Data/Trend |

|---|---|---|

| Energy Consumption (Cloud) | Powers digital identity and transaction security solutions. | Global data center energy use projected to hit 3,000 TWh by 2026. |

| E-waste Management | Legacy hardware and component disposal. | Global e-waste generation exceeded 53 million metric tons in 2023; recycling rate was 22.3%. |

| Supply Chain Sustainability | Sourcing of hardware components and third-party services. | Increasing focus on Scope 3 emissions reporting by end of 2024/early 2025. |

| Climate Change Impact | Potential disruption to digital infrastructure and service availability. | Extreme weather events can impact data centers and network connectivity. |

PESTLE Analysis Data Sources

Our PESTLE analysis is meticulously crafted using data from reputable sources including government publications, international economic bodies, and leading industry research firms. This ensures a comprehensive understanding of political, economic, social, technological, legal, and environmental factors impacting OneSpan.