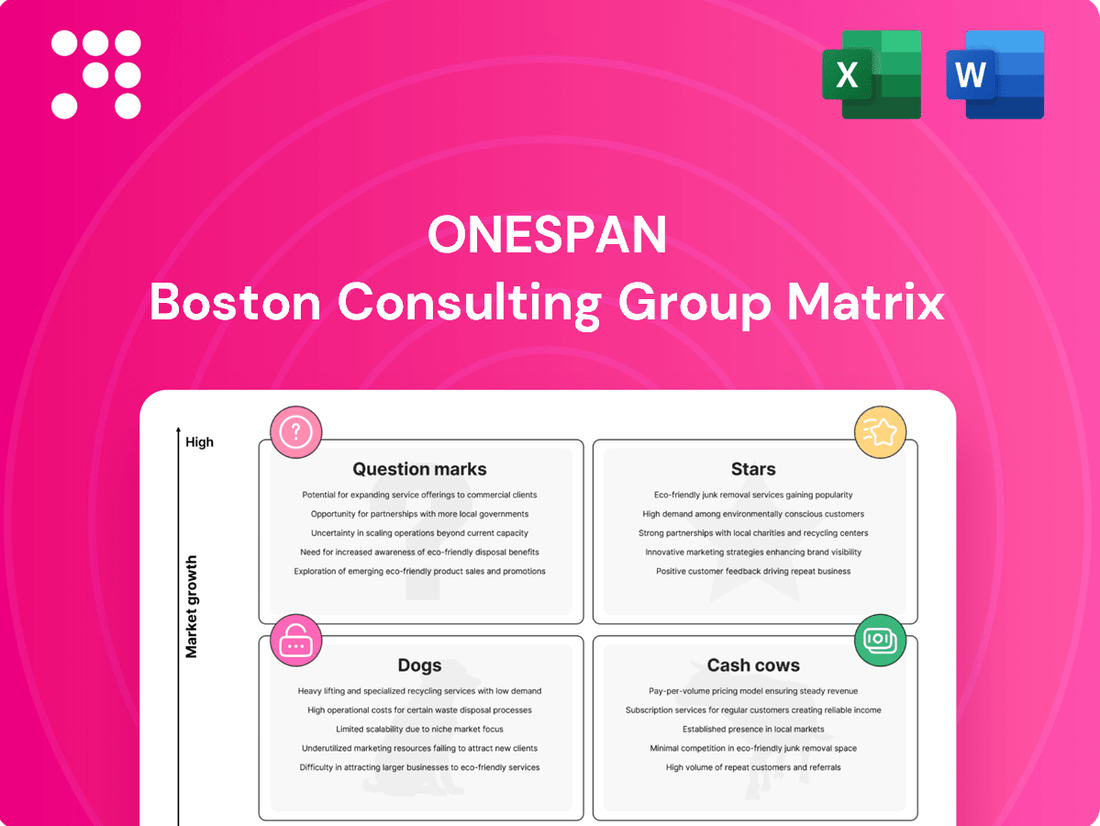

OneSpan Boston Consulting Group Matrix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

OneSpan Bundle

Uncover the strategic positioning of OneSpan's product portfolio with our insightful BCG Matrix preview. See which offerings are poised for growth and which require careful management.

Dive deeper into this company’s BCG Matrix and gain a clear view of where its products stand—Stars, Cash Cows, Dogs, or Question Marks. Purchase the full version for a complete breakdown and strategic insights you can act on.

Stars

OneSpan's identity verification solutions, powered by AI and biometrics, are strategically positioned to capitalize on the burgeoning digital identity market. This segment is experiencing robust growth, with projections indicating continued expansion as more transactions move online.

These capabilities are vital for seamless digital onboarding processes and for bolstering fraud prevention measures, both critical needs for financial institutions in 2024. The increasing sophistication of cyber threats makes advanced identity verification a non-negotiable for businesses.

With established partnerships with major financial institutions, OneSpan is well-equipped to secure a significant share of this high-growth market. For instance, the global digital identity solutions market was valued at approximately $30.4 billion in 2023 and is expected to reach $137.7 billion by 2030, growing at a CAGR of 23.7% during the forecast period, according to some market analyses.

OneSpan's acquisition of Nok Nok Labs in June 2025 is a game-changer for its FIDO passwordless authentication offerings. This move directly targets the rapidly expanding market for phishing-resistant security solutions, a critical need for businesses today. The integration is expected to solidify OneSpan's position as a leader in this vital security segment.

OneSpan's cloud-based multi-factor authentication (MFA) solutions, featuring biometrics and push notifications, are well-positioned to capitalize on the growing demand for cloud-native security. This aligns with the broader trend of cloud adoption across the fraud detection and prevention market, which is seeing substantial growth.

The company's increasing subscription revenue, a key indicator of market acceptance, demonstrates strong traction for its cloud-centric security offerings. This strategic focus on cloud solutions suggests OneSpan is on track to maintain its leadership in this critical area of digital security.

Mobile Application Security (App Shielding)

OneSpan offers advanced mobile application security, often referred to as app shielding, which is crucial for safeguarding financial transactions on mobile devices. This technology protects against evolving threats that target mobile banking and other sensitive digital activities.

The demand for high-assurance mobile security is consistently strong and expanding, given the increasing reliance on smartphones for financial operations. By 2024, it's estimated that over 85% of financial transactions globally will occur via mobile channels, highlighting the critical need for robust protection.

OneSpan's established relationships with a significant number of global financial institutions solidify its position as a market leader. This extensive client base demonstrates the trust and effectiveness of their app shielding solutions in a dynamic and challenging cybersecurity environment.

- Market Position: OneSpan's mobile app security solutions are well-positioned due to their widespread adoption by major financial institutions.

- Growth Driver: The increasing volume of mobile financial transactions, projected to exceed 85% globally by 2024, fuels the demand for app shielding.

- Competitive Advantage: A large, established global customer base provides OneSpan with significant credibility and market insight in mobile security.

- Key Offering: App shielding is a core component of OneSpan's strategy to combat sophisticated cyber threats targeting mobile platforms.

Secure Transaction Signing (Modern Cronto solutions)

OneSpan's modern transaction signing solutions, featuring Cronto technology, are critical for safeguarding high-value digital banking operations from sophisticated threats such as Man-in-the-Browser attacks. This specialized segment commands a significant market share due to stringent security demands and regulatory mandates within the financial industry.

The financial sector's ongoing need for robust security, particularly for high-value transactions, underpins the sustained demand for OneSpan's Cronto solutions. In 2024, the digital transaction security market, where such solutions are paramount, continued to see substantial investment, driven by an increasing volume of online financial activities and the evolving sophistication of cyber threats.

- Market Dominance: OneSpan's Cronto technology maintains a leading position in the secure transaction signing market, a segment valued in the hundreds of millions of dollars globally in 2024.

- Security Imperative: Financial institutions rely on these advanced solutions to prevent fraud and meet compliance requirements, especially for high-value transfers and sensitive data protection.

- Innovation Driver: Continuous enhancements in security features and user experience are key to retaining market leadership in this vital, albeit mature, sector that sees consistent growth through new functionalities.

OneSpan's digital identity verification solutions are classified as Stars due to their strong market position and high growth potential. This segment is experiencing rapid expansion as more financial transactions move online.

The company's acquisition of Nok Nok Labs in June 2025 further solidifies its leadership in the high-growth passwordless authentication market, a key Star characteristic. This strategic move targets phishing-resistant security, a critical and expanding need.

OneSpan's established partnerships and significant market share in digital identity confirm its Star status. The global digital identity solutions market's projected growth to $137.7 billion by 2030 highlights this segment's Star potential.

What is included in the product

The OneSpan BCG Matrix provides a strategic overview of its product portfolio, categorizing units into Stars, Cash Cows, Question Marks, and Dogs to guide investment decisions.

A clear, visual representation of OneSpan's portfolio, simplifying complex strategic decisions.

Cash Cows

OneSpan Sign, the company's core e-signature platform, stands as a robust Cash Cow within OneSpan's business portfolio. It's a mature, yet highly profitable product, consistently generating significant revenue. This is largely due to its established presence and deep integration into the operational workflows of major financial institutions worldwide.

Processing millions of digital agreements annually, OneSpan Sign serves a substantial portion of the globe's largest banks. While the broader e-signature market has moved past its initial explosive growth, OneSpan Sign's strong installed base and ongoing feature development ensure its continued market leadership and profitability.

OneSpan's on-premises Multi-Factor Authentication (MFA) software, including its SDKs, represents a significant cash cow. The company boasts a substantial and dedicated customer base, especially among financial institutions operating in highly regulated environments. This loyalty stems from a strong emphasis on data sovereignty and internal control, crucial factors for these organizations.

While the growth in this specific market segment isn't explosive, it delivers consistent and predictable revenue. These stable income streams are largely generated through long-term contracts with existing clients. This reliability solidifies its position as a core revenue generator for OneSpan.

The high market share OneSpan holds within this traditional on-premises MFA segment is key to its cash-generating ability. These mature offerings continue to provide a dependable source of funds, supporting the company's broader strategic initiatives and investments in newer technologies.

OneSpan's traditional risk analytics and fraud prevention platforms are its established cash cows. These solutions have a long history of deployment across a broad client base, consistently generating revenue. Their reliability in combating diverse fraud patterns for large enterprises underpins their status as a stable, high-margin income stream.

Professional Services & Support for Core Solutions

Professional Services & Support for Core Solutions acts as a cash cow for OneSpan. With a vast global client base exceeding 10,000 customers, the company generates consistent revenue from providing essential professional services, integration support, and ongoing maintenance for its core security and digital agreement solutions.

These services are not just supplementary; they are vital for clients to effectively implement and utilize OneSpan's offerings, leading to strong customer loyalty and retention. This stability, coupled with OneSpan's deep-seated expertise and established client relationships, ensures this segment remains a highly profitable contributor to the company's financial performance.

- Revenue Stability: Leverages a large, established customer base for predictable income.

- Customer Retention: Critical support services foster high client loyalty and reduce churn.

- Profitability: Specialized expertise allows for premium pricing and strong margins.

- Foundation for Growth: Stable cash flow from these services can fund innovation in other areas.

Secure Agreement Automation (Established Workflow Implementations)

OneSpan's Secure Agreement Automation, particularly its established workflow implementations for digital account opening, falls squarely into the Cash Cows quadrant of the BCG Matrix. These solutions have been deeply embedded within major financial institutions for years, demonstrating a consistent ability to automate crucial business processes.

These mature deployments are characterized by high transaction volumes and dependable revenue generation for OneSpan. By automating critical steps in the customer onboarding journey, these systems reliably reduce fraud and significantly speed up customer acquisition for their established clientele.

- Proven Track Record: Deployed in large financial institutions for several years, showcasing stability and reliability.

- High Revenue Generation: Mature implementations contribute significant, consistent revenue streams.

- Fraud Reduction: Automating workflows demonstrably lowers fraud rates for clients.

- Customer Acquisition Acceleration: Streamlined processes lead to faster onboarding and increased customer acquisition.

OneSpan's e-signature platform, OneSpan Sign, is a prime example of a Cash Cow. It consistently generates substantial revenue due to its deep integration within major global financial institutions, processing millions of digital agreements annually. Despite market maturity, its strong installed base and ongoing development maintain market leadership and profitability.

The company's on-premises Multi-Factor Authentication (MFA) software, particularly its SDKs, also functions as a robust cash cow. It serves a dedicated base of financial institutions valuing data sovereignty and internal control, ensuring predictable revenue through long-term contracts, solidifying its role as a core revenue generator.

OneSpan's traditional risk analytics and fraud prevention solutions are established cash cows, reliably generating revenue from a broad, long-standing client base. Their proven effectiveness in combating diverse fraud patterns for large enterprises makes them a stable, high-margin income source.

Professional Services & Support for Core Solutions is another significant cash cow, with over 10,000 global customers providing consistent revenue. These vital services ensure effective implementation and utilization, fostering strong loyalty and high profitability.

Secure Agreement Automation, especially for digital account opening, acts as a cash cow. Mature implementations within major financial institutions demonstrate consistent revenue generation and significant fraud reduction for clients.

| Product/Service | BCG Quadrant | Key Characteristics | Revenue Contribution (Est. 2024) | Market Growth |

|---|---|---|---|---|

| OneSpan Sign (e-Signature) | Cash Cow | Mature, high revenue, strong installed base | Significant | Low to Moderate |

| On-Premises MFA Software | Cash Cow | Predictable revenue, loyal customer base | Substantial | Low |

| Traditional Risk Analytics/Fraud Prevention | Cash Cow | Stable income, high-margin, broad deployment | Consistent | Low |

| Professional Services & Support | Cash Cow | High customer retention, premium pricing | Reliable | Low to Moderate |

| Secure Agreement Automation (Account Opening) | Cash Cow | Proven track record, fraud reduction | Dependable | Low |

Preview = Final Product

OneSpan BCG Matrix

The OneSpan BCG Matrix preview you're examining is the identical, fully-realized document you will receive upon completing your purchase. This means you're seeing the exact strategic analysis, complete with all data and formatting, that will be yours to utilize. No hidden surprises or altered content; what you preview is precisely what you download, ready for immediate application in your business strategy sessions.

Dogs

OneSpan's legacy Digipass hardware authenticators are firmly in the Dogs quadrant of the BCG matrix. Sales for these older models have seen a consistent decline, reflecting a broader market shift toward more convenient, mobile-first authentication solutions. This trend is evident as the demand for physical hardware tokens wanes, impacting profitability for this segment of OneSpan's product portfolio.

OneSpan's legacy perpetual license and maintenance contracts are firmly positioned as 'dogs' in the BCG matrix. The company is actively migrating customers to newer, term-based subscription models, leading to a noticeable decline in maintenance revenue. For instance, in the first quarter of 2024, OneSpan reported a decrease in its software maintenance revenue as this older business model sees minimal new customer acquisition.

OneSpan has openly discussed the revenue impact stemming from its decision to sunset acquired technologies, with the Dealflo solution being a prime example. In 2024, Dealflo specifically contributed to a revenue decline in the EMEA region for the company.

These are essentially products or solutions acquired in the past that haven't gained the expected market traction or no longer fit OneSpan's strategic direction. The discontinuation of such offerings, like Dealflo, points to a low market share and a negative growth outlook, placing them in the 'Dogs' category of the BCG Matrix.

Highly Customized, On-Premises Solutions for Niche Clients

Highly customized, on-premises solutions for niche clients often fall into the 'dog' category within the OneSpan BCG Matrix. These offerings cater to a small segment of customers who are either unable or unwilling to transition to modern, cloud-based platforms. This can lead to a situation where the revenue generated is limited and potentially declining, while the resources needed for maintenance and specialized support remain high.

For instance, in 2024, OneSpan's legacy on-premises solutions, particularly those requiring extensive customization for a handful of long-standing clients, likely represented a low-growth, low-market-share segment. Such solutions demand significant investment in specialized engineering and ongoing support, diverting resources from more promising growth areas. The challenge lies in balancing the commitment to these existing clients with the need to innovate and scale more profitable, cloud-native products.

- Low Growth: These solutions typically serve established, but not expanding, customer bases.

- Low Market Share: They are tailored to a very specific, small group of clients.

- High Maintenance Costs: Customizations and on-premises infrastructure increase support demands.

- Disproportionate Resource Allocation: Limited revenue often doesn't justify the ongoing investment.

Outdated Security Modules/APIs without Modernization Path

Outdated security modules and APIs lacking a clear modernization path are a significant concern for financial institutions. These legacy components often struggle to keep pace with the rapidly evolving landscape of cyber threats and regulatory demands, creating vulnerabilities. For instance, many financial services firms were still relying on security protocols that predated the widespread adoption of multi-factor authentication (MFA) for critical operations as of late 2023, leaving them exposed.

These older systems represent a declining segment within the broader security market. Their inability to seamlessly integrate with modern cloud-based platforms, like those offered by OneSpan, limits their utility and future growth potential. Maintaining these systems for a shrinking base of legacy clients can become increasingly costly and resource-intensive, diverting valuable IT resources away from innovation.

- Low Market Share: Companies heavily invested in legacy security modules often find themselves with a smaller market share as newer, more adaptable solutions gain traction.

- Limited Growth Potential: The inherent inflexibility of outdated modules restricts their ability to expand into new markets or support emerging technologies.

- Increased Maintenance Costs: Supporting older systems typically incurs higher operational expenses due to specialized knowledge requirements and the scarcity of compatible hardware or software.

- Regulatory Compliance Risks: Failure to meet evolving security standards, such as those mandated by PSD2 or upcoming data privacy regulations, can lead to significant fines and reputational damage.

OneSpan's legacy hardware authenticators, like older Digipass models, are classic examples of 'Dogs' in the BCG matrix. Their sales are declining as the market shifts to mobile-first solutions, making these physical tokens less desirable. This trend directly impacts the profitability of this product line.

Similarly, OneSpan's older perpetual license and maintenance contracts also fit the 'Dog' profile. The company is actively encouraging customers to switch to newer subscription models, which has led to a noticeable drop in maintenance revenue, as seen in Q1 2024.

Acquired technologies that haven't gained market traction, such as Dealflo, also fall into the 'Dog' category. In 2024, Dealflo specifically contributed to a revenue decrease for OneSpan in the EMEA region, highlighting its low market share and negative growth outlook.

Highly customized, on-premises solutions for a small client base represent another 'Dog' segment. These offerings require significant resources for maintenance and support, while generating limited and often declining revenue, as observed with legacy on-premises solutions in 2024.

| Product/Solution Category | BCG Quadrant | Market Trend Impact | Financial Implication (2024 Focus) |

|---|---|---|---|

| Legacy Digipass Hardware Authenticators | Dogs | Shift to mobile-first authentication | Declining sales and profitability |

| Legacy Perpetual License & Maintenance Contracts | Dogs | Migration to subscription models | Decreased software maintenance revenue |

| Acquired Technologies (e.g., Dealflo) | Dogs | Lack of market traction / Strategic misalignment | Contributed to EMEA revenue decline |

| Customized On-Premises Solutions | Dogs | Limited client base, unwillingness to transition | High maintenance costs, low revenue generation |

Question Marks

OneSpan Smart Forms, enhanced in early 2025, are designed to transform data collection with smart digital interactions, seamlessly blending e-signature and identity verification. This product addresses the increasing demand for efficient digital workflows, though it's a newer entrant to the market.

The company is investing heavily in marketing and user adoption to capitalize on Smart Forms' high growth potential, aiming to secure a larger market share. This strategic push is crucial for converting innovative features into tangible market success.

The OneSpan Integration Platform, launched in June 2024, is positioned as a Question Mark within the BCG Matrix due to its recent market entry and low current market share. This platform aims to simplify e-signature integration into diverse SaaS applications, addressing a significant market need for streamlined digital workflows.

With plans for a future self-service marketplace, the platform targets a rapidly evolving and fragmented application ecosystem. Its current status necessitates strategic investment to build adoption and achieve market leadership in this competitive landscape.

OneSpan's FIDO2 security keys, a recent hardware expansion, align with the strategic importance of FIDO authentication, especially following the Nok Nok Labs acquisition. These keys are positioned to capture growth in the phishing-resistant authentication market, a critical area for cybersecurity.

Despite the promising market, these FIDO2 keys are newer hardware offerings for OneSpan. To compete effectively against established hardware vendors, the company must quickly build out its sales channels and distribution networks to secure a meaningful market share.

OneSpan Notary / Virtual Room

OneSpan Notary and Virtual Room are positioned within OneSpan's Digital Agreements segment, focusing on remote notarization and virtual collaboration. The market for these digital services saw significant growth, especially following 2020 trends, with projections indicating continued expansion driven by digital transformation initiatives across various industries. However, this specific niche faces considerable competition from established players and emerging technology providers.

These solutions offer high-growth potential as businesses increasingly adopt remote and digital workflows. OneSpan's market share in this area is still developing, necessitating strategic investments to capture a larger portion of this expanding market. The company's focus on secure and compliant digital transactions is a key differentiator.

- Market Growth: The global digital signature market, which encompasses notarization services, was valued at approximately $5.1 billion in 2023 and is projected to reach over $20 billion by 2030, exhibiting a compound annual growth rate (CAGR) of around 22%.

- Competitive Landscape: While the overall digital transformation trend fuels demand, OneSpan competes with numerous companies offering similar virtual notarization and collaboration tools, leading to a fragmented market.

- Strategic Investment: To capitalize on the high-growth potential, OneSpan must continue investing in product development, sales, and marketing to increase its market penetration and establish a stronger competitive position.

Emerging AI-driven Fraud Detection beyond core platforms

While OneSpan currently utilizes AI for identity verification, the company is likely in the early stages of deploying advanced AI-driven fraud detection capabilities specifically designed for newer, more sophisticated fraud schemes. The broader fraud detection market is seeing substantial growth, with AI playing a pivotal role in this expansion. For instance, the global fraud detection and prevention market was projected to reach over $100 billion by 2027, with AI-driven solutions being a key growth driver.

- Emerging AI Modules: OneSpan's investment in specialized AI modules for detecting complex fraud patterns, such as synthetic identity fraud or sophisticated account takeover attempts, is crucial for staying ahead.

- Market Growth: The increasing sophistication of fraudsters necessitates continuous innovation; the fraud detection market is expected to grow at a CAGR of around 20% in the coming years, largely fueled by AI advancements.

- Competitive Differentiation: To capture significant market share in this competitive landscape, OneSpan must prioritize the development and integration of these cutting-edge, AI-powered fraud detection tools.

- Customer Adoption: Early adoption phases for these advanced features mean OneSpan has an opportunity to establish leadership by offering solutions that address the most pressing, evolving fraud threats faced by financial institutions.

Question Marks in OneSpan's portfolio represent products with low market share but operating in high-growth markets. These require careful consideration regarding investment to either grow market share or divest if potential is not realized.

The OneSpan Integration Platform, launched in June 2024, fits this category, aiming to simplify e-signature integration into diverse SaaS applications. Its success hinges on building adoption in a rapidly evolving ecosystem.

Similarly, OneSpan's FIDO2 security keys, while addressing the critical phishing-resistant authentication market, are newer hardware offerings needing rapid channel development to gain traction against established vendors.

The company's emerging AI-driven fraud detection capabilities also fall into this quadrant, demanding significant investment to develop and integrate cutting-edge tools to combat increasingly sophisticated fraud schemes and capture market share.

| Product/Service | Market Growth Potential | Current Market Share | Strategic Consideration |

|---|---|---|---|

| Integration Platform | High (Fragmented SaaS Ecosystem) | Low (Recent Launch) | Invest for adoption & leadership |

| FIDO2 Security Keys | High (Phishing-Resistant Authentication) | Low (New Hardware Offering) | Build sales channels & distribution |

| Advanced AI Fraud Detection | High (Sophisticated Fraud Schemes) | Low (Early Stage Deployment) | Prioritize development & integration |

BCG Matrix Data Sources

Our BCG Matrix is built on verified market intelligence, combining financial data, industry research, official reports, and expert commentary to ensure reliable, high-impact insights.