OneSpan Porter's Five Forces Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

OneSpan Bundle

OneSpan operates in a dynamic digital identity and security market, where the threat of new entrants is moderate due to high R&D costs, but the bargaining power of buyers can be significant given the availability of alternatives. Understanding these forces is crucial for strategic planning.

The complete report reveals the real forces shaping OneSpan’s industry—from supplier influence to threat of new entrants. Gain actionable insights to drive smarter decision-making.

Suppliers Bargaining Power

OneSpan's reliance on specialized software component providers, particularly for niche areas like advanced cryptography and biometric authentication, presents a significant bargaining power challenge. The limited number of highly specialized providers in these critical domains means these suppliers can exert considerable leverage.

These providers often possess proprietary technology that is deeply integrated into OneSpan's unique product offerings. For instance, if a particular SDK is essential for OneSpan's secure element management capabilities, the supplier of that SDK holds substantial power in negotiations.

While specific financial data on OneSpan's dependency on individual software component providers isn't publicly disclosed, the strategic importance of such components is evident in the company's emphasis on security and digital identity solutions. The market for highly specialized cybersecurity software components is characterized by high barriers to entry, further concentrating power among a few key players.

OneSpan, as a digital solutions company, relies heavily on major cloud infrastructure providers like Amazon Web Services (AWS), Microsoft Azure, and Google Cloud. The market for these essential services is quite concentrated, with a few dominant players. This concentration grants these providers significant leverage, allowing them to influence pricing and contract terms. For instance, in 2024, the global cloud computing market was valued at over $600 billion, underscoring the immense scale and power of these providers.

This supplier power directly impacts OneSpan's operational costs and its ability to be flexible with its infrastructure. If these providers increase their rates or impose stricter terms, OneSpan's expenses can rise, potentially squeezing profit margins. The limited number of comparable alternatives means OneSpan has less room to negotiate favorable conditions, making it a critical factor in their cost structure.

The demand for highly skilled talent in cybersecurity, AI, and blockchain is soaring, giving these professionals significant leverage. In 2024, the global cybersecurity workforce gap remained substantial, with millions of unfilled positions, allowing specialists to command premium salaries and dictate terms. This scarcity directly impacts companies like OneSpan, as recruitment firms and individual engineers can exert considerable bargaining power, driving up labor costs and potentially slowing innovation if talent acquisition is challenging.

Hardware Component Manufacturers

The bargaining power of hardware component manufacturers for OneSpan is generally low, as OneSpan primarily operates in the software space. However, if OneSpan relies on specialized hardware for its solutions, such as secure authenticators or specific chips, the manufacturers of these niche components could hold some sway. This is especially true if there are limited alternative suppliers or significant switching costs involved in sourcing these specialized parts.

For instance, a company providing highly specialized secure element chips for multi-factor authentication devices might have leverage. While broad component manufacturers have little power, those supplying critical, proprietary hardware could dictate terms, impacting OneSpan's costs and product availability.

- Limited reliance on specialized hardware: OneSpan's core business is software, reducing dependence on specific hardware component suppliers.

- Availability of alternatives: For most standard hardware needs, multiple suppliers exist, diluting individual manufacturer power.

- Potential for niche component leverage: If OneSpan utilizes unique, patented hardware components, those specific manufacturers could exert greater bargaining power.

Regulatory Compliance and Certification Bodies

OneSpan operates in highly regulated industries such as finance and government, necessitating strict adherence to compliance standards and certifications. Certification bodies and providers of essential auditing, security assessment, and legal services wield considerable influence. Their approval is critical for market entry and sustaining client confidence.

For instance, in 2023, the global regulatory compliance market was valued at approximately $50 billion, with significant growth driven by evolving data privacy laws like GDPR and CCPA, directly impacting companies like OneSpan that handle sensitive customer data.

- Essential Services: Compliance and certification services are non-negotiable for operating in OneSpan's target markets.

- Market Access: Failure to meet regulatory requirements can block access to lucrative financial and government sectors.

- Reputational Risk: Adherence to standards from bodies like ISO or SOC is vital for maintaining customer trust and brand reputation.

The bargaining power of suppliers for OneSpan is moderate, influenced by the critical nature of certain software components and cloud services, balanced by the company's strategic focus on software. While general hardware suppliers have little leverage, providers of specialized cryptographic or biometric SDKs can exert significant influence due to proprietary technology and limited alternatives. The concentration in cloud infrastructure, with giants like AWS and Azure dominating, also grants them considerable pricing power, impacting OneSpan's operational costs.

| Supplier Type | Leverage Factor | Impact on OneSpan | 2024 Context |

|---|---|---|---|

| Specialized Software Component Providers (e.g., cryptography, biometrics) | High (proprietary tech, limited alternatives) | Increased costs, potential supply chain risk | Niche cybersecurity software market characterized by high barriers to entry. |

| Cloud Infrastructure Providers (AWS, Azure, Google Cloud) | High (market concentration, essential service) | Significant impact on operational costs and flexibility | Global cloud computing market valued over $600 billion, dominated by a few players. |

| General Hardware Component Manufacturers | Low (software focus, multiple suppliers) | Minimal impact on costs and availability | Standard components readily available from numerous sources. |

| Certification and Compliance Service Providers | Moderate to High (regulatory necessity, market access) | Essential for market entry and client trust, can influence timelines | Global regulatory compliance market ~$50 billion in 2023, driven by evolving data privacy laws. |

What is included in the product

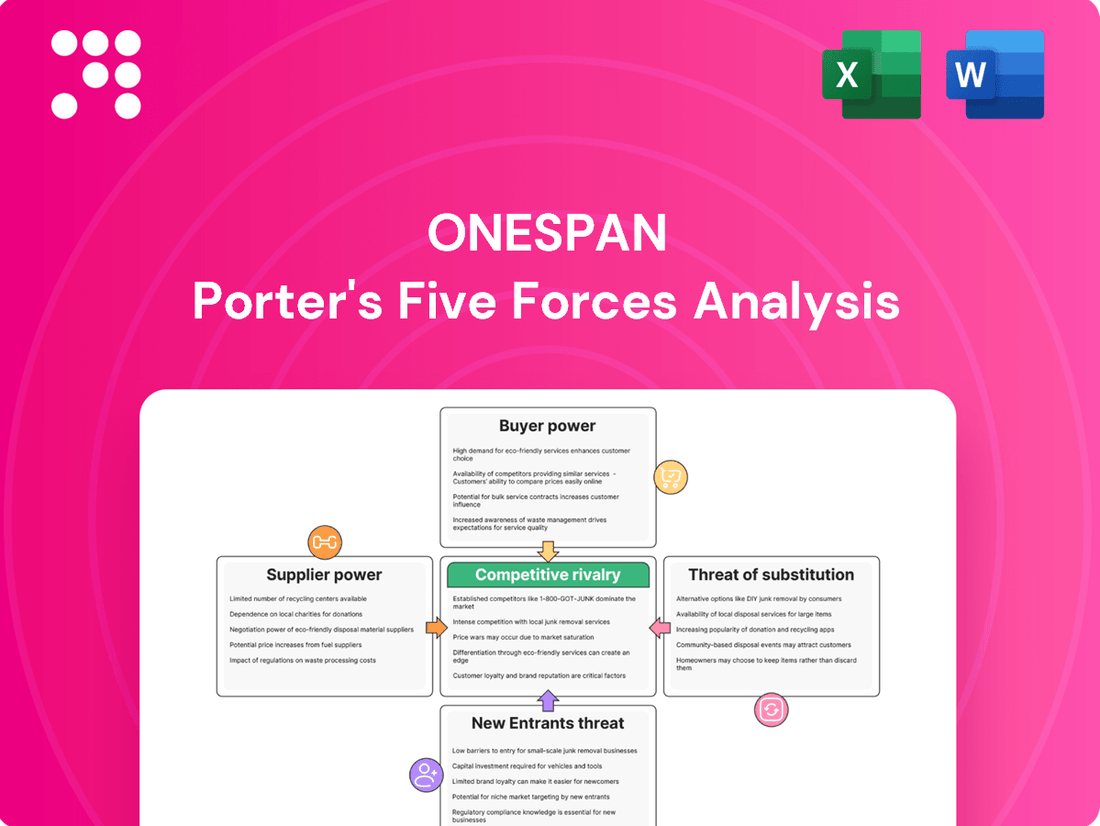

This analysis dissects the competitive forces impacting OneSpan, examining buyer and supplier power, the threat of new entrants and substitutes, and the intensity of rivalry within its market.

Instantly assess competitive threats and opportunities with a visual breakdown of all five forces, simplifying complex market dynamics.

Customers Bargaining Power

Large financial institutions and government agencies represent a significant customer segment for OneSpan. These sophisticated clients possess considerable bargaining power due to their substantial purchasing volume and intricate needs, often demanding tailored solutions and competitive pricing. For instance, major banks frequently negotiate for customized security features and integration services, directly impacting OneSpan's cost of goods sold and service delivery models.

While initial negotiations might favor customers, once OneSpan's digital identity or anti-fraud solutions are deeply integrated into a customer's critical IT infrastructure, the costs and disruptions associated with switching to an alternative provider become prohibitively high. This lock-in effect significantly reduces customer bargaining power over the long term.

OneSpan's solutions are absolutely vital for its customers, acting as the backbone for fraud prevention, regulatory adherence, and secure digital interactions. This criticality means customers hold significant sway.

Because OneSpan's services are indispensable, customers can demand top-tier reliability and robust security. Any disruption to these services could result in substantial financial losses and severe damage to a customer's reputation, giving them considerable bargaining power.

Availability of Competing Solutions

The availability of numerous competing solutions significantly amplifies customer bargaining power. Customers can readily explore alternatives offered by specialized digital identity and anti-fraud vendors, broad cybersecurity providers, or even consider developing solutions internally. This competitive landscape means customers aren't locked into a single provider and can leverage other options to negotiate better terms or features with OneSpan. For instance, if a customer finds a competitor offering similar functionality at a lower price point, they can use this as leverage.

The presence of viable alternatives empowers customers to credibly threaten to switch if their demands are not met. This threat is particularly potent in the digital identity and fraud prevention space, where integration costs, while present, are often manageable compared to the potential savings or improved features offered elsewhere. In 2024, the cybersecurity market continued to see robust competition, with new entrants and established players constantly innovating, further strengthening the customer's position.

- Customer Choice: Customers have a wide array of options, from niche digital identity specialists to comprehensive cybersecurity suites, and even the possibility of in-house solutions.

- Negotiating Leverage: The availability of these alternatives allows customers to negotiate more effectively with OneSpan, pushing for better pricing or enhanced service offerings.

- Switching Threat: Customers can credibly threaten to move to a competitor if OneSpan's offerings or terms do not align with their expectations, especially given the evolving competitive landscape in 2024.

Demand for Customization and Integration

The demand for customization and integration significantly boosts customer bargaining power. Large enterprises often operate with complex, legacy IT infrastructures, necessitating tailored solutions from OneSpan. This requirement allows customers to influence product features, API specifications, and project schedules, giving them leverage.

Customers' ability to demand specific functionalities and integration pathways directly impacts OneSpan's development and deployment efforts. For instance, in 2024, a significant portion of OneSpan’s enterprise deals likely involved custom integration projects, reflecting this customer-driven customization trend. This need for bespoke solutions means clients can negotiate terms more favorably, especially when their unique requirements are critical for adoption.

- Customization Needs: Enterprises require solutions that fit their existing IT ecosystems, not the other way around.

- Integration Complexity: Seamless integration with legacy systems is a non-negotiable for many large clients.

- Negotiating Leverage: The ability to dictate specific features and timelines grants customers considerable power.

- Impact on Development: Customer demands shape OneSpan's product roadmap and resource allocation.

The bargaining power of customers for OneSpan is substantial, driven by the availability of numerous alternatives and the critical nature of their digital identity and fraud prevention solutions. In 2024, the cybersecurity market's competitive intensity meant clients could readily compare offerings and negotiate for better terms, leveraging the threat of switching to specialized vendors or even in-house development.

Large financial institutions, a key customer segment, wield significant influence due to their purchasing volume and complex needs, often demanding customized features and integration. This customization requirement, as seen in many enterprise deals throughout 2024, directly impacts OneSpan's development and pricing, giving clients considerable leverage.

While deep integration can create switching costs, the sheer number of viable competitors in 2024 ensured customers retained the ability to seek more favorable pricing or enhanced functionalities from alternative providers, thereby maintaining their bargaining power.

Customers' demand for tailored solutions, particularly with complex legacy IT systems, allows them to influence product specifications and project timelines, a trend that was prominent in 2024 and directly translates to increased client negotiation power.

| Factor | Impact on OneSpan | 2024 Market Context |

|---|---|---|

| Availability of Alternatives | Reduces OneSpan's pricing power; increases negotiation leverage for customers. | Robust competition from specialized and broad cybersecurity providers. |

| Customer Switching Costs | Can mitigate bargaining power once integrated, but initial competition remains high. | Integration complexity is a factor, but competitive pressures offset long-term lock-in. |

| Criticality of Solutions | Customers demand high reliability and security, granting them leverage. | Essential services mean customers can dictate terms for uninterrupted operation. |

| Customization & Integration Needs | Empowers customers to dictate features, timelines, and pricing. | Significant portion of enterprise deals in 2024 involved custom integration projects. |

Same Document Delivered

OneSpan Porter's Five Forces Analysis

This preview showcases the comprehensive Porter's Five Forces Analysis for OneSpan, detailing the competitive landscape across threat of new entrants, bargaining power of buyers, bargaining power of suppliers, threat of substitute products or services, and the intensity of rivalry among existing competitors. The document displayed here is the part of the full version you’ll get—ready for download and use the moment you buy. This in-depth analysis provides actionable insights into OneSpan's strategic positioning and potential challenges within its industry.

Rivalry Among Competitors

The digital identity and anti-fraud sector is a hotbed of innovation, driven by ever-changing cyber threats. Companies must constantly update their offerings to stay ahead, making this a highly competitive space.

Competitors are pouring resources into research and development. This includes creating better fraud detection systems, exploring new biometric technologies, and leveraging artificial intelligence. For instance, as of early 2024, many cybersecurity firms reported significant increases in R&D spending, with some allocating over 20% of their revenue to innovation to gain a competitive edge.

This relentless pursuit of technological superiority fuels intense rivalry. Firms are locked in a race to capture market share by offering the most advanced and effective solutions to combat sophisticated fraud schemes.

In the anti-fraud and digital identity sector, a single security lapse can trigger devastating financial losses, irreparable damage to a company's reputation, and significant regulatory fines for its clients. This reality compels customers to prioritize the most dependable and battle-tested solutions available. For instance, in 2023, the average cost of a data breach reached $4.45 million globally, a figure that underscores the critical importance of robust security for OneSpan's clientele.

This intense customer demand for unwavering reliability directly fuels fierce competition among providers like OneSpan. Every vendor is pushed to showcase not just advanced technology, but also a history of proven performance and an unshakeable commitment to trust. Companies are constantly investing in research and development to stay ahead, with the cybersecurity market projected to grow significantly, reaching an estimated $376 billion by 2029, indicating the high stakes involved.

The digital security market is a complex mosaic, populated by highly specialized niche players focusing on specific solutions, alongside established enterprise security vendors offering broader portfolios. Furthermore, large technology conglomerates are increasingly entering this arena, seeking to integrate security into their wider offerings. This diverse competitive landscape fuels intense rivalry as companies vie for new customer acquisitions and strive to retain their existing client base across all market segments.

Pressure on Pricing and Value Proposition

Customers in the digital security space, while prioritizing robust protection, are also keenly aware of their budgets. This dual focus creates a significant price sensitivity, forcing companies like OneSpan to carefully calibrate their offerings. The need to deliver high-value, feature-rich solutions while remaining competitively priced often triggers intense bidding wars. This dynamic directly impacts profit margins across the sector.

The competitive landscape for digital security solutions, including those offered by OneSpan, is characterized by a constant tension between feature innovation and affordability. For instance, in the identity verification market, while advanced biometric capabilities are desirable, the cost of implementation can be a significant barrier for many businesses. This leads to a situation where companies must constantly innovate to offer superior value without pricing themselves out of the market.

- Price Sensitivity: Despite the critical nature of security, budget constraints significantly influence purchasing decisions.

- Value vs. Cost: Competitors are compelled to balance advanced features with accessible pricing structures.

- Aggressive Bidding: The market frequently sees intense price competition, impacting overall industry profitability.

- Margin Pressure: The need to remain competitive often leads to reduced profit margins for security solution providers.

Global Reach and Regulatory Compliance Complexity

Operating globally means juggling a patchwork of regulations like GDPR in Europe and CCPA in California. Companies that master this complexity, offering solutions compliant across different regions, stand out. This ability to navigate varied jurisdictional needs intensifies competition, especially for multinational clients seeking unified digital identity and security solutions.

The challenge of global regulatory compliance significantly shapes competitive rivalry. For instance, financial institutions must adhere to stringent data protection laws and digital transaction regulations that differ by country. In 2024, the ongoing evolution of these frameworks, such as updates to PSD2 in Europe or new data privacy laws emerging in Asia-Pacific markets, demands continuous investment in compliance infrastructure and expertise.

- Navigating Diverse Regulations: Companies must invest heavily to understand and implement compliance with varying international laws, impacting product development and market entry strategies.

- Cross-Border Client Advantage: Firms with robust global compliance capabilities can offer seamless solutions to multinational corporations, creating a significant competitive edge.

- Increased R&D for Compliance: The need to meet diverse regulatory demands drives innovation but also increases research and development costs, as solutions must be adaptable and secure across multiple legal landscapes.

- Impact on Market Share: Companies that fail to adapt to evolving global compliance requirements risk losing market share to more agile competitors, particularly in sectors like digital banking and secure authentication.

The competitive rivalry within the digital identity and anti-fraud sector is exceptionally high, driven by rapid technological advancements and the critical need for robust security solutions. Companies like OneSpan face pressure from a diverse range of competitors, from specialized niche players to large technology conglomerates, all vying for market share by offering innovative and reliable products.

SSubstitutes Threaten

For some organizations, especially smaller ones or those with less demanding digital needs, traditional identity verification methods can act as substitutes for advanced digital solutions. These might include in-person document checks or authentication via call centers.

While these manual processes are often less efficient and don't scale as easily, they bypass the investment and complexity associated with sophisticated digital identity verification platforms. This makes them a viable, albeit less technologically advanced, alternative for certain business contexts.

Large financial institutions with substantial IT resources, like JPMorgan Chase and Bank of America, increasingly develop in-house digital identity and fraud prevention solutions. This allows them to bypass third-party vendors, offering a competitive edge through highly customized security protocols. For example, many major banks actively invest millions in their cybersecurity infrastructure, aiming to reduce reliance on external providers for core identity verification and authentication processes.

Organizations may opt to bolster their existing security systems rather than invest in new digital identity platforms. This often involves upgrading or integrating legacy infrastructure, such as older firewalls and access management tools, with custom solutions or patches. For example, a significant portion of businesses still rely on on-premises security solutions, which can be enhanced to meet evolving threats, potentially delaying the adoption of cloud-native identity platforms.

Simpler, Point-Solution Security Tools

Simpler, point-solution security tools present a significant threat to integrated platforms like those offered by OneSpan. For organizations with less demanding security requirements or very specific needs, these standalone solutions can be a more cost-effective and easier-to-implement alternative. For instance, a business needing only basic identity verification might opt for a simple MFA app rather than a comprehensive digital identity platform.

These point solutions can effectively substitute for broader offerings by addressing a single, critical security function. This is particularly true in 2024, where the market is flooded with specialized security applications. The availability of these niche tools means customers don't always need to invest in a full suite of services, thereby reducing the perceived value of integrated solutions.

- Market Penetration of Specialized Security Tools: In 2024, the cybersecurity market saw a surge in specialized tools, with an estimated 40% of businesses adopting at least one point solution to address a specific vulnerability.

- Cost-Effectiveness of Alternatives: Many point solutions are priced significantly lower than comprehensive security platforms, making them attractive to small and medium-sized enterprises (SMEs) with tighter budgets.

- Ease of Integration for Niche Needs: For straightforward security tasks, such as basic multi-factor authentication, point solutions often offer simpler integration pathways compared to complex enterprise-wide systems.

Emerging Decentralized Identity Technologies (e.g., Blockchain-based DID)

Emerging decentralized identity technologies, particularly those leveraging blockchain, pose a significant threat of substitution. These solutions, like Self-Sovereign Identity (SSI), aim to give individuals greater control over their digital identities, potentially bypassing traditional centralized identity verification services. While enterprise adoption is still in its early stages, the underlying technology offers a fundamentally different approach to identity management.

The potential for these decentralized systems to reduce reliance on established identity providers is a key concern. For instance, blockchain-based Decentralized Identifiers (DIDs) allow users to create and manage their own digital identifiers without a central authority. This shift could diminish the value proposition of current identity verification and management solutions offered by companies like OneSpan, especially as the technology matures and regulatory frameworks adapt.

- Blockchain-based DIDs offer users control over their digital identities, reducing reliance on third-party providers.

- While enterprise adoption is nascent, the underlying technology represents a potential disruptive substitute for centralized identity management.

- The global blockchain market is projected to grow significantly, indicating increasing interest and investment in related technologies. For example, Grand View Research estimated the global blockchain market size at USD 12.17 billion in 2023 and projected it to expand at a compound annual growth rate (CAGR) of 42.5% from 2024 to 2030.

- This growth suggests a future where decentralized identity solutions could become more prevalent, challenging existing business models.

Traditional, manual identity verification methods remain a substitute, particularly for smaller businesses or those with less complex digital needs. These methods, like in-person checks or call center authentication, bypass the investment in sophisticated digital platforms, offering a simpler alternative despite lower efficiency.

Major financial institutions are increasingly developing in-house digital identity solutions, reducing reliance on third-party vendors like OneSpan. This strategy allows for highly customized security protocols and competitive advantages. For instance, many large banks invest heavily in their cybersecurity infrastructure to manage identity verification internally.

The market for specialized, point-solution security tools presents a significant threat. These standalone applications address specific security functions more cost-effectively than comprehensive platforms. In 2024, the cybersecurity landscape saw a surge in these niche tools, with approximately 40% of businesses adopting at least one point solution to target specific vulnerabilities.

Emerging decentralized identity technologies, such as Self-Sovereign Identity (SSI) leveraging blockchain, offer a fundamentally different approach. These solutions empower individuals with greater control over their digital identities, potentially bypassing centralized services. The global blockchain market's projected growth, with an estimated size of USD 12.17 billion in 2023 and a CAGR of 42.5% from 2024 to 2030, indicates a rising trend towards decentralized solutions.

| Substitute Type | Description | Key Consideration | 2024 Market Trend |

| Manual Verification | In-person checks, call center authentication | Lower investment, less efficient | Viable for smaller/less complex needs |

| In-house Solutions | Custom-built digital identity platforms by large institutions | Control, customization, competitive edge | Increasing adoption by major financial players |

| Point Solutions | Specialized, single-function security tools | Cost-effective, easier integration for niche needs | High market penetration, ~40% of businesses use at least one |

| Decentralized Identity (Blockchain) | SSI, DIDs | User control, potential disruption to centralized models | Nascent enterprise adoption, strong market growth projections (e.g., blockchain market CAGR 42.5% from 2024-2030) |

Entrants Threaten

Developing advanced digital identity and anti-fraud solutions requires significant upfront investment. Companies like OneSpan invest heavily in research and development, aiming for cutting-edge technology. For instance, in 2023, OneSpan reported R&D expenses of $130.7 million, highlighting the substantial resources needed to stay competitive.

Building and maintaining the necessary technology infrastructure, including secure data centers and cloud platforms, also incurs considerable costs. This creates a high barrier to entry, as new players must secure substantial funding to match existing capabilities and ensure robust security and scalability.

The financial services and government sectors are heavily regulated, demanding new entrants to navigate intricate compliance frameworks, secure numerous certifications, and prove robust security measures. For instance, in 2024, the cost of regulatory compliance for financial institutions globally continued to rise, with many reporting significant investments in areas like data privacy and anti-money laundering (AML) systems.

These substantial legal and compliance expenditures act as a significant barrier, deterring potential new players from entering the market. The need for specialized legal counsel and ongoing investment in compliance technology creates a high cost of entry that smaller or less capitalized firms find difficult to overcome.

Established companies like OneSpan have cultivated deep customer loyalty and a robust brand reputation over many years, particularly within the highly regulated financial and government sectors. This trust is a significant barrier for newcomers. For instance, in 2023, OneSpan reported a revenue of $495 million, showcasing its established market presence and the scale of operations that new entrants must contend with.

New entrants must invest heavily to build comparable brand recognition and overcome the inherent caution of customers who prioritize security and reliability. This often means lengthy sales cycles and significant marketing expenditures to even be considered as a viable alternative to established players.

Technological Complexity and Intellectual Property

The intricate nature of digital identity, authentication, and fraud prevention technologies presents a substantial hurdle for new companies. These fields rely on advanced cryptography, sophisticated biometrics, cutting-edge artificial intelligence, and secure software engineering. Developing or obtaining the necessary intellectual property for these capabilities requires significant investment and specialized expertise.

For instance, the global biometrics market was valued at approximately $25.3 billion in 2023 and is projected to grow substantially. New entrants need to navigate this complex landscape, often requiring extensive research and development or costly acquisitions to compete. This technological sophistication and the need for robust intellectual property protection act as a strong deterrent against potential new competitors.

- Technological Sophistication: The core technologies in digital identity and fraud prevention are inherently complex, demanding deep expertise in areas like cryptography and AI.

- Intellectual Property Barrier: New entrants must either develop proprietary IP or license existing technologies, both of which are resource-intensive.

- High R&D Investment: The need for continuous innovation in these rapidly evolving fields necessitates significant ongoing investment in research and development.

Network Effects and Data Access for Fraud Detection

The threat of new entrants in the fraud detection market is significantly mitigated by powerful network effects and data access. Established players have built extensive datasets, crucial for training sophisticated machine learning algorithms that identify subtle fraud patterns. For instance, by 2024, leading fraud detection platforms often process billions of transactions annually, creating a rich tapestry of data that is virtually impossible for newcomers to replicate quickly.

New entrants face a substantial hurdle in acquiring the sheer volume and diversity of historical transaction and fraud data needed to compete. This data asymmetry directly impacts their ability to develop fraud detection systems with comparable accuracy and effectiveness. Without this foundational data, new solutions may struggle to identify emerging fraud typologies or offer the same level of protection, making it difficult to gain market traction.

- Data Volume Disparity: Established firms possess years of accumulated transaction data, often in the petabyte range, which is essential for robust AI model training.

- Network Effect Advantage: As more users and transactions are processed, the fraud detection models become more accurate, creating a virtuous cycle that new entrants cannot easily break into.

- Cost of Data Acquisition: For new entrants, acquiring comparable datasets would involve immense investment and time, if even possible due to privacy regulations and proprietary data ownership.

The threat of new entrants in the digital identity and fraud prevention space is considerably low due to several formidable barriers. High upfront investments in research and development, as evidenced by OneSpan's $130.7 million R&D spending in 2023, are essential for developing cutting-edge technology. Furthermore, the need for robust technological infrastructure and navigating complex regulatory landscapes, which saw compliance costs for financial institutions rising globally in 2024, demands substantial financial and legal resources.

Established brand reputation and customer loyalty, built over years of reliable service, present another significant challenge for newcomers. Companies like OneSpan, with $495 million in revenue in 2023, have cultivated deep trust, particularly in sensitive sectors like finance and government. New entrants must overcome lengthy sales cycles and extensive marketing efforts to even be considered alternatives.

The inherent technological sophistication, including advanced cryptography and AI, coupled with the need for proprietary intellectual property, creates a steep learning curve and high development costs. The global biometrics market, valued at approximately $25.3 billion in 2023, highlights the complexity and investment required. Finally, powerful network effects and data access, where established players leverage billions of transactions processed by 2024 to train superior AI models, create an almost insurmountable data advantage for new entrants.

Porter's Five Forces Analysis Data Sources

Our Porter's Five Forces analysis for OneSpan leverages a comprehensive suite of data, including company financial reports, industry analyst assessments, and market intelligence platforms. This approach ensures a robust understanding of competitive dynamics.