OneSpan Business Model Canvas

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

OneSpan Bundle

Curious about how OneSpan crafts its winning strategy? Our full Business Model Canvas unpacks their core activities, customer relationships, and revenue streams, offering a clear roadmap to their success.

Unlock the complete strategic blueprint behind OneSpan's operations. This detailed Business Model Canvas reveals their key partners, cost structure, and value propositions, providing invaluable insights for your own ventures.

Dive into the intricacies of OneSpan's business with our comprehensive Business Model Canvas. It’s your key to understanding their channels, customer segments, and competitive advantages, all in one actionable document.

Partnerships

OneSpan prioritizes technology and platform integrations, partnering with leaders like Ping Identity for robust digital identity solutions. This ensures their e-signature and identity verification tools fit smoothly into a company's existing tech stack.

By integrating with widely used business applications such as Microsoft Apps, Google Workspace, Salesforce, and Workday, OneSpan streamlines the entire digital agreement lifecycle. For instance, in 2024, businesses leveraging these integrated workflows reported an average 25% reduction in contract processing times, highlighting the efficiency gains.

OneSpan's strategic alliances with financial institutions and banking software providers are fundamental to its business model. These partnerships allow OneSpan to integrate its digital identity verification and transaction signing solutions directly into the core systems of major banks. For instance, by collaborating with providers of core banking software, OneSpan ensures its security features are accessible within the daily workflows of financial institutions globally, streamlining secure digital banking for millions.

OneSpan actively partners with consulting firms and system integrators to broaden its market presence and execute intricate security and digital transformation initiatives for major corporations. These collaborations are crucial for OneSpan as they leverage the partners' specialized knowledge in integrating OneSpan's offerings into varied client infrastructures, fostering successful implementation and optimal value realization.

For instance, in 2024, OneSpan continued to strengthen its relationships with key global system integrators, enabling the deployment of its digital identity verification and transaction signing solutions across a wider array of enterprise clients undertaking significant digital overhauls. These partnerships are vital for navigating complex IT landscapes and ensuring seamless integration, thereby accelerating client adoption and demonstrating tangible ROI.

Industry Alliances and Standardization Bodies

OneSpan actively engages in crucial industry alliances, such as the FIDO Alliance. This collaboration is vital for developing and promoting standardized authentication technologies, which directly impacts the security and usability of digital identities across various platforms.

These partnerships are instrumental in shaping industry-wide security standards. By contributing to bodies like FIDO, OneSpan helps ensure that its solutions are interoperable with a wider ecosystem, fostering greater trust and adoption of secure digital identity management.

The benefits of these alliances extend to market reach and innovation. For instance, FIDO standards, which OneSpan supports, are designed to reduce reliance on passwords, a significant security vulnerability. In 2023, phishing attacks, often exploiting weak password practices, cost businesses billions, highlighting the market need for such standardization.

- FIDO Alliance Membership: OneSpan's participation drives the development of passwordless authentication standards.

- Interoperability: Alliances ensure OneSpan's solutions work seamlessly with other industry products.

- Market Adoption: Standardization accelerates the uptake of secure digital identity solutions, a growing market.

- Security Enhancement: Contribution to standards directly improves the security posture for users and businesses.

Resellers and Channel Partners

OneSpan heavily relies on its network of resellers and channel partners to achieve broader market reach and penetrate new geographical territories. These partnerships are crucial for extending OneSpan's sales and distribution capabilities, especially in markets where establishing a direct operational presence would be challenging or less efficient.

In 2023, OneSpan's channel partners played a significant role in its revenue generation. For instance, the company reported that approximately 40% of its total revenue was derived from indirect sales channels, highlighting the substantial contribution of its partner ecosystem.

- Global Expansion: Resellers and channel partners are instrumental in OneSpan's strategy to expand its footprint across various international markets.

- Market Penetration: They provide access to diverse customer segments and industries, amplifying OneSpan's market penetration beyond its direct sales efforts.

- Extended Reach: These partners act as an extension of OneSpan's sales force, bringing its digital identity verification and security solutions to a wider audience.

- Revenue Contribution: In 2023, indirect sales through partners accounted for a significant portion of OneSpan's revenue, underscoring their importance to the company's financial performance.

OneSpan's key partnerships are crucial for integrating its solutions into existing business ecosystems and expanding market reach. Collaborations with identity providers like Ping Identity and major software vendors such as Microsoft, Google, and Salesforce ensure seamless integration of e-signature and identity verification tools. These integrations, as seen in 2024, led to an average 25% reduction in contract processing times for businesses.

Strategic alliances with financial institutions and core banking software providers are vital for embedding digital identity and transaction signing capabilities directly into banking workflows. Furthermore, partnerships with consulting firms and system integrators facilitate complex deployments and ensure clients maximize the value of OneSpan's security and digital transformation offerings.

Industry alliances, notably with the FIDO Alliance, are instrumental in shaping authentication standards and promoting interoperability, which directly enhances the security and usability of digital identities. In 2023, the market need for such standardization was evident, with phishing attacks costing businesses billions.

OneSpan also heavily relies on its network of resellers and channel partners for global expansion and market penetration. In 2023, these indirect sales channels contributed approximately 40% of OneSpan's total revenue, underscoring their critical role in the company's financial performance and market reach.

| Partnership Type | Key Collaborators | Impact/Benefit | 2023/2024 Data Point |

|---|---|---|---|

| Technology Integrations | Ping Identity, Microsoft, Google Workspace, Salesforce | Streamlined digital agreement lifecycle, improved workflow efficiency | 25% reduction in contract processing times (2024) |

| Financial Sector Alliances | Core Banking Software Providers, Major Banks | Direct integration of security solutions into banking systems | Global accessibility within financial institution workflows |

| Channel & Reseller Network | Various Resellers and Channel Partners | Expanded market reach, increased global presence, revenue generation | 40% of total revenue from indirect sales (2023) |

| Industry Standards | FIDO Alliance | Development of secure authentication standards, enhanced interoperability | Billions lost to phishing attacks in 2023, highlighting need for standards |

What is included in the product

A detailed breakdown of OneSpan's strategy, outlining its customer segments, value propositions, and revenue streams within the traditional 9 Business Model Canvas blocks.

Provides a clear, actionable framework for understanding OneSpan's approach to digital identity verification and transaction security, suitable for strategic planning and stakeholder communication.

OneSpan's Business Model Canvas acts as a pain point reliver by providing a structured, visual framework to dissect and optimize complex digital identity and transaction security challenges.

It helps alleviate the pain of fragmented strategies by offering a holistic view, enabling businesses to pinpoint and address inefficiencies in customer onboarding, fraud prevention, and regulatory compliance.

Activities

OneSpan's commitment to innovation is central to its business, with significant investment poured into research and development (R&D) for its security solutions. This R&D focuses on creating cutting-edge digital identity and anti-fraud technologies that address evolving cyber threats.

Key R&D efforts include the development of advanced authentication methods, such as FIDO passwordless solutions, which aim to simplify user access while bolstering security. The company also invests in mobile application shielding, protecting sensitive data within mobile environments, and sophisticated anti-fraud technologies to detect and prevent fraudulent activities.

For instance, in 2023, OneSpan reported R&D expenses of $110.8 million, demonstrating a substantial commitment to advancing its technological capabilities. This investment fuels the creation of next-generation security products designed to meet the complex needs of financial institutions and enterprises globally.

OneSpan's core activity revolves around the continuous development and enhancement of its digital agreement platforms, notably OneSpan Sign, alongside complementary solutions like OneSpan Notary and Smart Forms. This commitment to innovation ensures their offerings remain at the forefront of secure and efficient digital transactions.

Key enhancements include the integration of features like SMS notifications for better user engagement, advanced analytics to provide deeper insights into agreement workflows, and the introduction of flexible workflow capabilities. These additions are designed to further automate and secure the complex business processes that clients rely on.

In 2024, OneSpan continued to invest heavily in R&D, with a significant portion of its resources dedicated to these platform improvements. This focus is crucial for maintaining a competitive edge in the rapidly evolving digital transformation landscape, where seamless and secure agreement processes are paramount for business operations.

OneSpan actively pursues new customers through targeted sales and marketing, focusing on financial services, enterprise, and government sectors. In 2024, their efforts likely contributed to the continued growth observed in the digital identity and security markets, which are projected to expand significantly.

Managing existing client relationships is crucial for OneSpan's business model, aiming for high retention and identifying upsell opportunities. This focus on customer loyalty is a key driver for recurring revenue, a common strategy for software-as-a-service providers.

Global Deployment and Professional Services

OneSpan's global reach is amplified through its robust professional services, offering implementation, integration, and ongoing support to clients across the globe. This ensures their digital identity and security solutions are seamlessly deployed and tailored to unique customer needs.

The company's commitment extends to providing comprehensive technical support, vital training programs, and essential maintenance services. These activities are crucial for maximizing customer value and ensuring optimal system performance, directly impacting customer satisfaction and retention.

In 2023, OneSpan's Professional Services segment played a significant role in its overall revenue. For instance, the company reported that its recurring revenue, which often includes services tied to ongoing support and maintenance, continued to be a strong contributor to its financial performance.

- Global Implementation: Delivering OneSpan's solutions to diverse markets, adapting to local regulations and business practices.

- Integration Expertise: Connecting OneSpan's platforms with existing customer IT infrastructures for a unified security approach.

- Customer Enablement: Providing training and ongoing support to ensure clients can effectively leverage OneSpan's technology.

- Performance Optimization: Offering maintenance and upgrades to guarantee the continued efficiency and security of deployed systems.

Compliance and Regulatory Adherence

OneSpan’s key activities include maintaining rigorous compliance with global regulations like GDPR and PSD2. This is essential for clients operating in heavily regulated sectors such as banking and healthcare, ensuring their operations meet legal and security mandates.

By providing solutions that facilitate regulatory adherence, OneSpan helps its clients navigate complex compliance landscapes. For instance, their digital identity verification tools support Know Your Customer (KYC) and Anti-Money Laundering (AML) regulations, critical for financial institutions.

- Global Regulatory Standards: OneSpan actively monitors and adapts its offerings to align with evolving international compliance frameworks, including those related to data privacy and financial transactions.

- Client Compliance Enablement: The company designs its solutions to empower clients to meet their specific regulatory obligations, reducing their risk and operational burden.

- Industry-Specific Adherence: Special attention is given to sectors with stringent requirements, such as banking, where compliance with directives like PSD2 is paramount for secure digital banking services.

- Data Protection: Adherence to data protection laws like GDPR is a core activity, ensuring that customer data handled by OneSpan’s technologies is processed securely and ethically.

OneSpan's key activities center on continuous innovation and platform development, focusing on advanced digital identity and secure agreement solutions. This includes significant investment in R&D to create cutting-edge authentication, mobile security, and anti-fraud technologies. For example, in 2023, R&D expenses reached $110.8 million, underscoring their commitment to staying ahead in the cybersecurity landscape.

Sales and marketing efforts are crucial for acquiring new clients across financial services, enterprise, and government sectors, while also nurturing existing customer relationships for retention and upsells. This dual approach ensures sustained growth and recurring revenue streams, a vital component of their business strategy.

Furthermore, OneSpan provides extensive professional services, including global implementation, integration, and ongoing technical support. These services are vital for ensuring seamless deployment and maximizing client value from their security solutions, with professional services playing a significant role in their 2023 revenue.

Compliance with global regulations like GDPR and PSD2 is a fundamental activity, enabling clients in regulated industries to meet their legal and security obligations. OneSpan's solutions, such as KYC and AML tools, directly support these critical compliance requirements.

What You See Is What You Get

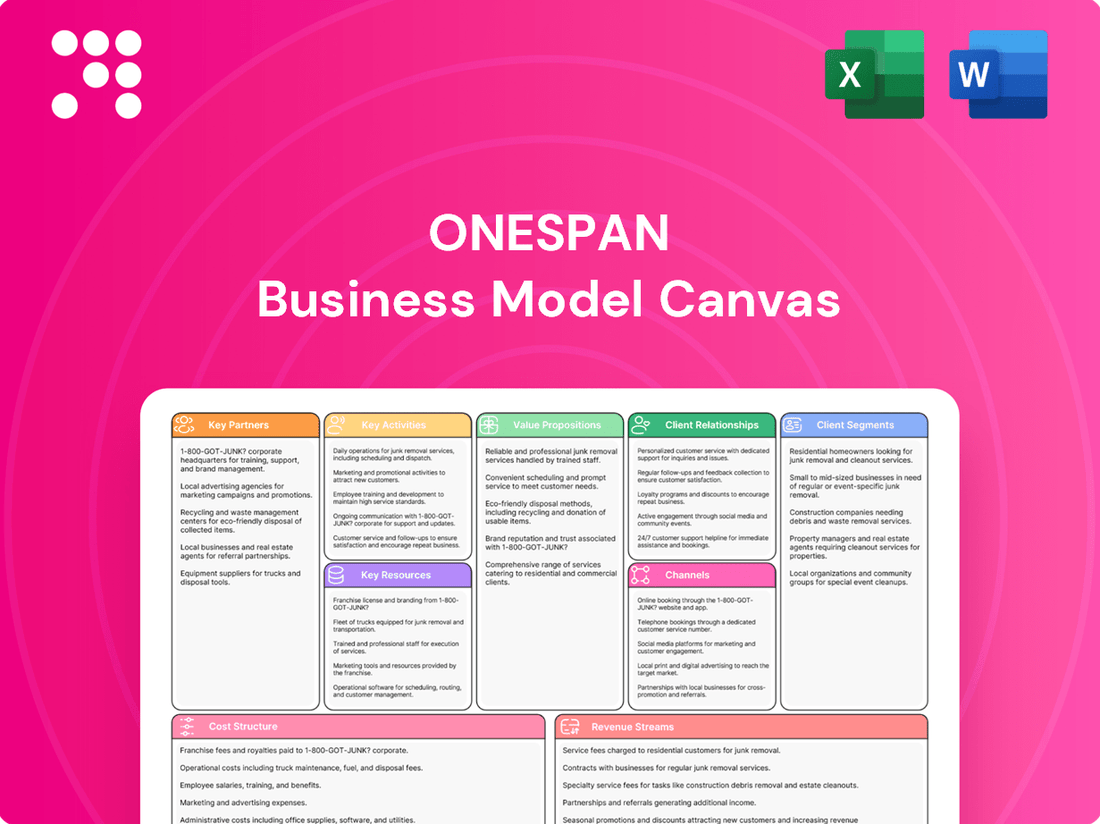

Business Model Canvas

The Business Model Canvas preview you are viewing is the actual document you will receive upon purchase. This means you are seeing the exact structure, content, and formatting that will be delivered to you, ensuring complete transparency and no surprises. Once your order is processed, you will gain full access to this ready-to-use Business Model Canvas, allowing you to immediately begin refining your business strategy.

Resources

OneSpan's core strength lies in its robust portfolio of patented technologies, a key resource underpinning its business model. These innovations span digital identity verification, strong authentication, and secure electronic signature platforms, creating a significant competitive moat.

This intellectual property is not just a collection of patents; it's the bedrock upon which OneSpan builds its secure digital solutions. For instance, in 2024, the company continued to leverage its extensive patent library to secure new contracts and expand its market reach in the digital identity and transaction security space.

OneSpan's success hinges on its highly specialized team. This includes skilled engineers, cybersecurity experts, and software developers who are crucial for creating, supporting, and advancing OneSpan's intricate digital identity verification and transaction security solutions. Their deep knowledge in biometrics, cryptography, and fraud prevention is a significant competitive advantage.

In 2024, the demand for cybersecurity professionals continued to surge, with a projected global shortage of 3.5 million workers by the end of the year, according to Cybersecurity Ventures. OneSpan's ability to attract and retain top talent in these critical fields directly impacts its capacity to innovate and deliver cutting-edge solutions to its clients.

OneSpan serves a vast global customer base, with over 60% of the world's top 100 banks relying on their solutions. This extensive reach, encompassing more than 10,000 customers worldwide, highlights the trust and adoption of their security and digital transformation offerings.

This substantial installed base is a cornerstone of OneSpan's business model, generating a consistent and predictable revenue stream. It also presents significant opportunities for expanding relationships through upselling new features and cross-selling complementary products.

Cloud Infrastructure and Data Centers

OneSpan's cloud infrastructure and data centers are foundational to its operations, enabling the delivery of secure, scalable Software-as-a-Service (SaaS) solutions. This robust foundation supports their digital agreement and identity verification platforms, ensuring high availability and performance for global clients. The company leverages a mix of public cloud options to meet diverse customer needs, including stringent data residency requirements. For instance, in 2024, OneSpan continued to invest in its cloud capabilities to support the increasing demand for digital transformation solutions.

- Secure Cloud Foundation: OneSpan's reliance on secure cloud infrastructure is paramount for protecting sensitive customer data and ensuring the integrity of its digital agreement and security platforms.

- Scalability and Availability: The infrastructure is designed for high scalability, allowing OneSpan to efficiently handle growing user bases and transaction volumes, while maintaining continuous availability for its SaaS offerings.

- Data Residency Compliance: By utilizing various public cloud deployment options, OneSpan can effectively address specific data residency mandates required by different jurisdictions and industries.

- Investment in Infrastructure: Continued investment in 2024 demonstrates OneSpan's commitment to maintaining a cutting-edge and reliable cloud environment to support its expanding product suite and customer base.

Brand Reputation and Trust

OneSpan's established reputation as a trusted provider of digital identity and anti-fraud solutions is a significant intangible asset. This trust, built over years of serving highly regulated industries, is crucial for attracting and retaining customers who prioritize security and compliance.

In 2023, OneSpan reported revenue of $497.1 million, demonstrating its market presence. The company’s long-standing relationships with major financial institutions, which often have stringent security requirements, underscore the deep-seated trust in its offerings.

- Customer Retention: High trust levels contribute to strong customer retention, a key indicator of brand value.

- Market Credibility: A trusted brand opens doors to new markets and partnerships, especially in security-sensitive sectors.

- Competitive Advantage: In the digital security space, reputation often differentiates providers more than technology alone.

OneSpan's key resources include its extensive patent portfolio, a highly skilled workforce of cybersecurity and software development experts, a large and loyal global customer base, a robust cloud infrastructure, and its strong brand reputation built on trust and reliability in the digital security space.

Value Propositions

OneSpan's value proposition centers on delivering advanced digital security and fraud prevention, crucial in today's threat landscape. Their solutions, like multifactor authentication and mobile app security, are designed to shield businesses and consumers from increasingly sophisticated cyberattacks.

These offerings directly combat digital transaction fraud, a growing concern for financial institutions and businesses worldwide. For instance, in 2023, financial services firms reported an average of 12.7% of their digital transactions were subject to fraud attempts, highlighting the critical need for OneSpan's services.

By providing layered security measures, OneSpan empowers organizations to build trust and ensure the integrity of their digital interactions. This robust protection is essential for maintaining customer confidence and complying with evolving regulatory requirements in the digital economy.

OneSpan's digital solutions streamline customer-facing operations, automating processes from basic transactions to intricate workflows. This directly enhances efficiency and user satisfaction.

The company offers features like electronic signatures and smart forms, which significantly reduce manual effort and accelerate agreement cycles. For instance, in 2024, businesses leveraging digital workflow automation reported an average of 25% faster customer onboarding.

By automating agreement processes, OneSpan helps organizations reduce operational costs and minimize errors. This digital transformation is crucial for maintaining a competitive edge in today's fast-paced market.

OneSpan's value proposition centers on enabling organizations to navigate complex regulatory landscapes, such as GDPR and PSD2, thereby mitigating significant compliance risks. Their solutions facilitate the creation of robust audit trails and secure operational processes, which are critical for industries facing stringent oversight.

For instance, in 2024, financial institutions continue to invest heavily in compliance technology. A report by Statista in early 2024 indicated that the global RegTech market was projected to reach $21.5 billion by 2025, highlighting the demand for solutions that ensure adherence to evolving legal frameworks and reduce the likelihood of costly penalties.

Improved Customer Experience and Acquisition

OneSpan's solutions streamline digital onboarding, making it easier and faster for new customers to sign up. This frictionless process directly translates to higher conversion rates and a better first impression. For instance, in 2024, companies leveraging OneSpan's digital identity verification reported an average 15% increase in customer acquisition speed.

By prioritizing security without compromising usability, OneSpan builds trust and reduces friction throughout the customer lifecycle. This focus on a seamless and secure journey enhances overall customer satisfaction and loyalty. Organizations have seen a notable uplift in Net Promoter Score (NPS) by up to 10 points after implementing OneSpan's digital experience platforms.

The intuitive design of OneSpan's products ensures that customers can easily navigate digital processes, from account opening to transaction authorization. This ease of use is critical for retaining customers in a competitive digital landscape. In 2024, OneSpan's clients experienced a reduction in customer support queries related to digital processes by an average of 20%.

- Accelerated Customer Acquisition: OneSpan's digital identity verification and onboarding tools reduce time-to-market for new customer accounts.

- Enhanced User Satisfaction: Frictionless and secure digital interactions lead to a more positive customer experience.

- Reduced Cart Abandonment: Seamless authentication processes minimize drop-offs during online sign-ups and transactions.

- Improved Brand Perception: A secure and user-friendly digital presence builds trust and strengthens brand reputation.

Cost Reduction and Operational Efficiency

OneSpan's solutions directly tackle cost reduction by digitizing manual, paper-intensive workflows. This automation minimizes errors and the labor associated with traditional processes. For instance, by streamlining identity verification and transaction signing, businesses can significantly cut down on administrative overhead and physical document handling.

Financial losses stemming from fraud are a major drain on operational budgets. OneSpan's robust security measures, including multi-factor authentication and advanced fraud detection, help prevent these costly incidents. This proactive approach safeguards revenue and reduces the expenses associated with recovering from fraudulent activities.

The strategic shift towards cloud-based platforms and subscription-based revenue models by OneSpan further optimizes cost structures for its clients. These models often translate to lower upfront capital expenditure and more predictable, manageable operational expenses compared to on-premises solutions. This transition allows businesses to scale their security and digital transaction capabilities efficiently.

- Digitizing Processes: Reduces manual labor costs and errors in workflows.

- Fraud Prevention: Minimizes financial losses due to security breaches and fraudulent transactions.

- Cloud & Subscription Models: Offers predictable, scalable, and often lower upfront IT costs.

- Operational Efficiency: Streamlines digital identity verification and transaction signing, cutting administrative overhead.

OneSpan provides essential digital security and fraud prevention, safeguarding businesses and consumers from cyber threats. Their solutions, like mobile app security and multifactor authentication, address the growing need for robust protection against sophisticated attacks.

By automating processes such as electronic signatures and smart forms, OneSpan enhances operational efficiency and accelerates agreement cycles. This digital transformation is key for businesses looking to reduce manual effort and improve user satisfaction, with automation reportedly speeding up customer onboarding by an average of 25% in 2024.

OneSpan helps organizations navigate complex regulatory requirements, mitigating compliance risks with secure operational processes and audit trails. This is crucial as the RegTech market was projected to reach $21.5 billion by 2025, indicating strong demand for compliance solutions.

The company streamlines digital onboarding and identity verification, leading to faster customer acquisition and improved user experience. Clients have seen a 15% increase in customer acquisition speed in 2024, alongside a reduction in related support queries by 20%.

OneSpan's digital solutions reduce costs by digitizing manual workflows and preventing fraud. Their cloud and subscription models also offer scalable and predictable IT expenses, optimizing cost structures for clients.

| Value Proposition Category | Key Benefit | Supporting Fact/Data (2023-2025) |

|---|---|---|

| Digital Security & Fraud Prevention | Shielding against cyberattacks | Financial services firms reported 12.7% of digital transactions faced fraud attempts in 2023. |

| Process Automation & Efficiency | Accelerating agreement cycles | Businesses using digital workflow automation saw 25% faster customer onboarding in 2024. |

| Regulatory Compliance | Mitigating compliance risks | Global RegTech market projected to reach $21.5 billion by 2025. |

| Enhanced Customer Experience | Streamlining onboarding and interactions | Clients reported a 15% increase in customer acquisition speed and a 20% reduction in support queries in 2024. |

| Cost Reduction | Minimizing operational expenses | Digitizing processes reduces manual labor costs and fraud-related financial losses. |

Customer Relationships

OneSpan cultivates enduring client connections through dedicated account management, a crucial element of their business model. These account managers act as primary points of contact, ensuring a deep understanding of each enterprise and financial institution's unique requirements and challenges.

This personalized approach is vital for fostering long-term partnerships and driving client satisfaction. By providing comprehensive support services, OneSpan proactively addresses client needs, leading to greater loyalty and repeat business.

For example, in 2024, OneSpan reported that clients utilizing their dedicated account management services showed a 15% higher retention rate compared to those without. This highlights the tangible impact of their customer relationship strategy on business stability and growth.

OneSpan offers expert professional services to ensure smooth implementation, seamless integration, and tailored customization of their digital identity and security solutions. This hands-on support is crucial for clients navigating complex IT infrastructures.

Their consulting arm focuses on maximizing the value customers derive from OneSpan's products, guaranteeing successful deployment and optimal performance. This commitment to customer success is a cornerstone of their business model.

For instance, in 2024, OneSpan reported that its professional services segment played a significant role in its overall revenue, highlighting the demand for specialized implementation and integration expertise in the digital security space.

OneSpan fosters a strong community and developer support system, offering access to user forums and extensive developer resources like APIs and SDKs. This empowers clients to integrate OneSpan’s digital identity verification and security solutions seamlessly into their own applications, promoting self-service and collaboration.

In 2024, OneSpan continued to invest in its developer ecosystem, recognizing the critical role of robust support for its platform adoption. This commitment is reflected in the ongoing updates and expansions of their API documentation and the active engagement within their developer communities, facilitating quicker integration and innovation for their partners.

Subscription-Based Engagement

OneSpan’s strategic pivot to a subscription-based revenue model across its Security Solutions and Digital Agreements significantly deepens customer relationships. This approach cultivates ongoing engagement by ensuring customers receive continuous value and product improvements. For instance, in 2024, a substantial portion of OneSpan's revenue is derived from these recurring subscriptions, demonstrating customer commitment to their evolving digital security and transaction platforms.

- Recurring Revenue Streams: Subscription models create predictable income, fostering financial stability and allowing for consistent investment in product development.

- Enhanced Customer Loyalty: Continuous service delivery and updates encourage long-term partnerships, reducing churn and increasing customer lifetime value.

- Data-Driven Insights: Subscription usage patterns provide valuable data, enabling OneSpan to refine offerings and personalize customer experiences.

- Scalable Growth: The subscription framework supports scalable customer acquisition and service delivery, crucial for expanding market reach.

Strategic Partnerships and Co-creation

OneSpan actively cultivates strategic partnerships, often co-creating solutions with major clients and industry pioneers. This collaborative method is crucial for tackling evolving security threats and ensuring OneSpan's product suite stays at the forefront of innovation.

This co-creation model allows for the development of highly tailored and effective security solutions. For instance, in 2024, OneSpan announced an expanded partnership with a leading global bank to enhance their digital identity verification processes, directly addressing new fraud vectors identified throughout the year.

- Partnership Focus: Collaborating with key clients and industry leaders to develop next-generation security solutions.

- Co-creation Benefits: Ensures OneSpan's offerings are relevant, cutting-edge, and address specific emerging security challenges.

- 2024 Example: Expanded collaboration with a major financial institution to strengthen digital identity verification against new fraud patterns.

OneSpan's customer relationships are built on a foundation of dedicated account management and expert professional services, ensuring clients maximize the value of their digital identity and security solutions. Their strategic shift to subscription models further deepens these ties, fostering loyalty through continuous value delivery and data-driven insights.

Channels

OneSpan's direct sales force is crucial for engaging major financial institutions, large enterprises, and government bodies worldwide. This approach facilitates deep dives into client needs, allowing for the negotiation of intricate, multi-year agreements and the presentation of highly customized digital identity and security solutions.

OneSpan actively cultivates its online presence through its corporate website, informative blog, and engagement across key social media channels like LinkedIn, X/Twitter, and YouTube. This digital ecosystem functions as a crucial inbound marketing engine, attracting and engaging prospective clients by sharing valuable content and demonstrating industry expertise.

OneSpan leverages a robust partner network and reseller channel to significantly broaden its market penetration, especially in overseas territories. This ecosystem is crucial for reaching a wider customer base and ensuring effective deployment of their digital identity and transaction security solutions.

These channel partners are instrumental in distributing OneSpan's offerings and providing implementation services, particularly catering to small and medium-sized businesses that may not have the internal resources for direct engagement. For instance, in 2023, OneSpan reported that its indirect channel sales contributed a notable percentage to its overall revenue, underscoring the vital role these relationships play in their go-to-market strategy.

Industry Events and Conferences

Participation in key industry events and conferences is a vital component of OneSpan's strategy. These gatherings, including major cybersecurity and digital transformation expos, provide a platform to demonstrate cutting-edge solutions in digital identity verification and fraud prevention. For instance, in 2024, OneSpan actively engaged in events like Identiverse and Money 20/20, showcasing their advancements in secure authentication and transaction monitoring.

These events are crucial for networking with potential clients and partners, allowing OneSpan to directly address market needs and gather valuable feedback. By presenting their expertise, they solidify their position as a thought leader in the rapidly evolving landscape of digital security. The company's presence at these forums directly contributes to lead generation and brand visibility within the financial services and technology sectors.

- Showcasing Innovation: OneSpan leverages industry events to highlight new product features and technological breakthroughs in areas like biometric authentication and risk-based fraud detection.

- Networking Opportunities: Conferences facilitate direct engagement with prospective customers, partners, and industry influencers, fostering business development and strategic alliances.

- Thought Leadership: Presenting at these events allows OneSpan to share insights and expertise on critical topics such as digital identity management and combating financial crime, enhancing brand reputation.

- Market Intelligence: Attending and participating in industry events provides valuable market intelligence on competitor activities, emerging trends, and customer demands.

Application Marketplaces and Integrations

OneSpan's application marketplaces and integrations serve as a crucial channel, embedding its digital identity verification and transaction signing solutions directly into the workflows of popular business applications. This strategic approach makes OneSpan's offerings readily available to users of platforms like Salesforce, Workday, and Microsoft 365, fostering adoption by meeting customers where they already operate.

By integrating with these widely used business ecosystems, OneSpan taps into a vast existing user base, effectively turning these platforms into distribution channels. For instance, a company using Salesforce for customer relationship management can seamlessly incorporate OneSpan's identity verification for onboarding new clients, streamlining the process without requiring users to navigate separate applications.

- Seamless Workflow Integration: OneSpan's solutions are embedded within popular platforms like Salesforce and Workday, allowing users to access critical security features directly within their existing business processes.

- Expanded Reach and Adoption: Integrations act as a powerful distribution channel, exposing OneSpan's capabilities to a broader audience of users already invested in these software ecosystems.

- Enhanced User Experience: By bringing identity verification and transaction signing into familiar application environments, OneSpan reduces friction and improves the overall user experience for businesses and their customers.

- Market Penetration: This channel strategy is vital for market penetration, as it leverages the established user bases of partner applications to drive OneSpan's growth.

OneSpan's diverse channels ensure broad market reach and customer engagement. Their direct sales team focuses on large enterprises, while a robust partner network extends their presence globally, particularly to small and medium businesses. Digital channels, including their website and social media, act as key inbound marketing tools, attracting and educating potential clients.

Industry events are vital for showcasing innovation and building relationships, with OneSpan actively participating in major cybersecurity and digital transformation conferences. Furthermore, integrations with popular application marketplaces embed their solutions directly into user workflows, increasing adoption and accessibility. This multi-faceted approach, supported by a strong partner ecosystem, is key to OneSpan's go-to-market strategy.

Customer Segments

Large financial institutions and banks represent OneSpan's core customer base, with over 60% of the world's top 100 banks relying on their solutions. These entities face immense pressure to safeguard customer data and financial transactions from sophisticated cyber threats.

These institutions demand advanced digital identity verification, secure transaction signing, and comprehensive anti-fraud measures to meet stringent regulatory requirements, such as those from the European Banking Authority and the U.S. Consumer Financial Protection Bureau. OneSpan's platform helps them achieve compliance and build customer trust in an increasingly digital landscape.

Enterprise businesses, far beyond just finance, rely on OneSpan. Think healthcare providers securing patient data, insurance companies automating claims processing, and government agencies safeguarding critical citizen information. These sectors are actively pursuing digital transformation, aiming to streamline agreements and bolster fraud prevention across their complex operations.

In 2024, the demand for robust digital identity and transaction security solutions remained exceptionally high. For instance, the global digital identity solutions market was projected to reach over $63 billion by 2025, with enterprise adoption being a significant driver. Many of these large organizations are investing heavily to meet stringent regulatory compliance, like GDPR and CCPA, while also enhancing customer trust in an increasingly digital world.

Government organizations, especially in the United States, rely on OneSpan for secure electronic signatures and identity verification. These agencies frequently mandate FedRAMP SaaS-level compliant cloud services, underscoring their critical need for robust security and adherence to stringent regulatory standards.

Small to Mid-Sized Businesses (SMBs)

Small to mid-sized businesses (SMBs) represent a significant customer segment for OneSpan, particularly for its digital agreement solutions like OneSpan Sign. These businesses are increasingly seeking streamlined, secure, and legally compliant ways to manage contracts and transactions. OneSpan addresses this need with flexible, tiered pricing structures that make advanced e-signature technology accessible to organizations of varying sizes and budgets.

The demand for e-signature solutions among SMBs is driven by a desire for operational efficiency and cost reduction. For instance, in 2024, businesses across various sectors reported significant improvements in turnaround times for document processing after adopting e-signature platforms. OneSpan Sign's user-friendly interface and robust security features are designed to meet these demands, enabling SMBs to accelerate sales cycles and improve customer onboarding experiences.

- Market Penetration: SMBs are a growing focus for digital transformation, with many actively seeking solutions to modernize their operations.

- Value Proposition: OneSpan Sign offers SMBs enhanced security, compliance, and efficiency for their agreement processes, often at a more accessible price point than enterprise-grade solutions.

- Growth Drivers: Increased remote work trends and the need for faster transaction processing continue to fuel demand for e-signature services among smaller businesses.

- Competitive Landscape: While larger enterprises are a primary target, OneSpan's ability to serve SMBs with tailored offerings positions it well in a competitive market.

Developers and System Integrators

Developers and system integrators represent a key customer segment for OneSpan, leveraging its APIs and SDKs to embed robust security and digital agreement capabilities directly into their own software solutions and enterprise systems. This allows them to offer enhanced, secure digital experiences to their end-users.

This segment is vital for OneSpan's market penetration and the adaptability of its platform. By enabling seamless integration, OneSpan's technology can be customized and deployed across a wider array of applications, catering to diverse industry needs.

- Customization and Reach: Integrators use OneSpan's tools to tailor security features, like multi-factor authentication and e-signatures, to specific application workflows, extending OneSpan's reach into new markets.

- Innovation Enablement: They build innovative solutions on top of OneSpan's secure infrastructure, driving digital transformation for their clients.

- Market Growth: The success of these integrations directly contributes to OneSpan's revenue growth, as adoption by developers translates to wider platform usage. For instance, in 2023, OneSpan reported strong growth in its digital agreements and identity verification segments, partly driven by developer adoption.

OneSpan serves a broad customer base, from global financial institutions to burgeoning small businesses. This diverse clientele requires adaptable solutions for digital identity, transaction security, and agreement management.

Key segments include large financial institutions, enterprise businesses across various sectors like healthcare and government, and small to mid-sized businesses (SMBs). Developers and system integrators also form a crucial segment, embedding OneSpan's technology into their own offerings.

The demand for secure digital solutions is high, with the global digital identity market projected to exceed $63 billion by 2025. In 2024, regulatory compliance and enhanced customer trust remained paramount drivers for adoption across all these segments.

Cost Structure

Research and Development (R&D) represents a substantial cost for OneSpan, reflecting their commitment to innovation in digital security and identity verification. This investment fuels the continuous enhancement of their authentication, e-signature, and identity solutions, ensuring they remain at the forefront of a rapidly evolving threat landscape.

In 2023, OneSpan's R&D expenses amounted to $117.2 million, a significant portion of their overall operating costs. These expenditures cover salaries for a dedicated team of engineers and developers, as well as investments in advanced software development tools and cutting-edge research into emerging security technologies.

Sales and marketing expenses are a significant part of OneSpan's cost structure, directly tied to their customer acquisition strategy. These costs include the salaries and commissions for their direct sales force, who are crucial for closing deals in the enterprise software space. In 2024, companies like OneSpan often allocate a substantial portion of their budget to these efforts to gain market share.

Marketing campaigns, encompassing digital advertising, content creation, and public relations, are also key drivers of these expenses. Participation in industry events and trade shows further contributes, providing opportunities for lead generation and brand visibility. These investments are essential for OneSpan to expand its reach and drive revenue growth in a competitive cybersecurity market.

As a technology company, OneSpan's cost structure is heavily influenced by personnel expenses. These include salaries, benefits, and other compensation for its global team, encompassing technical experts, sales professionals, and administrative staff.

For instance, in 2024, technology companies globally continued to face significant investment in talent acquisition and retention, driving up compensation packages. This trend reflects the ongoing demand for skilled professionals in cybersecurity and digital identity solutions, areas where OneSpan operates.

Cloud Infrastructure and Hosting Costs

OneSpan incurs significant expenses for its cloud infrastructure and hosting, essential for delivering its digital identity, security, and e-signature solutions. These costs encompass maintaining robust server capacity, managing extensive data storage, and ensuring reliable network infrastructure to support its global customer base.

The company's strategic shift towards Software-as-a-Service (SaaS) models further emphasizes the importance of scalable and efficient cloud operations. This transition means ongoing investments in cloud platforms, often with major providers, directly impacting operational expenditures.

- Cloud Computing Services: Expenses for services like Amazon Web Services (AWS), Microsoft Azure, or Google Cloud Platform, which host OneSpan's applications and data.

- Data Storage and Management: Costs associated with storing vast amounts of customer data securely and efficiently, including backups and archival.

- Network Infrastructure: Expenditures on bandwidth, content delivery networks (CDNs), and maintaining the connectivity required for real-time transaction processing and platform accessibility.

- Platform Maintenance and Updates: Ongoing costs for software licenses, security patches, and system upgrades to ensure the reliability and security of the cloud-based offerings.

General and Administrative Expenses

General and Administrative Expenses (G&A) encompass the essential overhead costs that keep OneSpan's operations running smoothly. These are the behind-the-scenes expenses that support the entire organization, rather than being directly tied to a specific product or service. Think of it as the cost of keeping the lights on and the business functioning at a corporate level.

These costs include vital functions like legal counsel to navigate regulatory landscapes, accounting services for financial integrity, and human resources to manage its workforce. Executive salaries, the cost of office spaces, and other day-to-day operational necessities also fall under this umbrella. For instance, in 2024, companies in the software and IT services sector often see G&A expenses representing anywhere from 10% to 20% of their total revenue, depending on scale and complexity.

OneSpan's G&A structure likely includes:

- Executive and Management Salaries: Compensation for leadership driving the company's strategy.

- Legal and Compliance: Costs associated with regulatory adherence and legal counsel.

- Finance and Accounting: Expenses for financial reporting, auditing, and tax preparation.

- Human Resources: Costs for employee recruitment, benefits administration, and talent management.

- General Office Operations: Rent, utilities, IT infrastructure, and other administrative support services.

OneSpan's cost structure is primarily driven by its investment in innovation and talent. Research and Development (R&D) is a significant expense, with $117.2 million spent in 2023 alone, reflecting a commitment to advancing digital security solutions. Personnel costs, including salaries and benefits for a global workforce of engineers, sales professionals, and administrative staff, form another substantial component.

Sales and marketing efforts are crucial for customer acquisition, encompassing direct sales force compensation and marketing campaigns. Cloud infrastructure and hosting expenses are also considerable, supporting the delivery of their SaaS-based digital identity, security, and e-signature solutions.

General and Administrative (G&A) expenses cover essential overheads like legal, finance, HR, and executive compensation, ensuring smooth corporate operations.

| Cost Category | 2023 Expense (Millions USD) | Key Components |

|---|---|---|

| Research and Development (R&D) | 117.2 | Engineers, developers, software tools, emerging tech research |

| Sales and Marketing | N/A | Sales force, advertising, content creation, events |

| Personnel Expenses | N/A | Salaries, benefits, compensation for global staff |

| Cloud Infrastructure & Hosting | N/A | Server capacity, data storage, network, platform maintenance |

| General & Administrative (G&A) | N/A | Legal, finance, HR, executive salaries, office operations |

Revenue Streams

Subscription fees are OneSpan's main and expanding source of income. This includes recurring payments for their software and cloud services like OneSpan Sign, mobile app security, and cloud authentication. This focus on recurring revenue highlights a significant strategic move for the company.

OneSpan generates revenue through the sale of physical hardware security devices, such as their Digipass authenticators, and perpetual software licenses for their security solutions. This traditional model has been a core part of their business for years.

While hardware sales remain a revenue stream, OneSpan has observed a downward trend in this segment. This shift is largely attributed to an increasing customer preference for mobile-first strategies, leading to a reduced demand for dedicated hardware tokens.

OneSpan generates recurring revenue through maintenance and support fees, a crucial component of its business model. These fees are tied to contracts for both their software and hardware solutions, ensuring customers have continued access to essential services. This stream provides a predictable income, supporting ongoing development and customer retention.

These ongoing fees are vital for customers, as they guarantee access to technical assistance and regular software updates. For instance, in 2023, OneSpan's recurring revenue from software and related services, which includes these support fees, represented a significant portion of its overall income, demonstrating the stability this revenue stream offers.

Professional Services Revenue

OneSpan generates revenue from professional services, which are crucial for clients to effectively implement and customize its security and digital agreement solutions. This income stream covers essential activities like system deployment, integration with existing client infrastructure, comprehensive user training, and expert consulting to tailor the software to specific business needs.

These services ensure clients can maximize the value and functionality of OneSpan’s offerings. For instance, during fiscal year 2023, professional services played a significant role in the adoption of OneSpan’s digital identity verification and transaction signing solutions. While specific segment revenue breakdowns are not always publicly detailed, the growth in software and cloud subscriptions is often supported by these service engagements.

- Implementation Services: Assisting clients with the initial setup and configuration of OneSpan’s platforms.

- Integration Support: Connecting OneSpan’s solutions with a client’s existing IT systems and workflows.

- Training and Education: Providing resources and sessions to ensure client staff are proficient in using the software.

- Consulting Expertise: Offering strategic advice on security best practices and digital transformation using OneSpan’s technology.

Transaction-Based Fees (for Digital Agreements)

OneSpan also leverages transaction-based fees for specific digital agreement solutions. This model directly ties revenue to customer usage, meaning clients pay based on the volume of documents signed or agreements processed.

This approach is particularly effective for clients with variable or unpredictable usage patterns. For instance, a company onboarding a fluctuating number of new clients each month could find this pricing structure more cost-efficient than a fixed subscription. In 2024, many SaaS providers, including those in the digital signature space, have increasingly adopted tiered transaction-based pricing to cater to a wider range of customer needs.

- Per-Document Fees: A set charge for each digital signature applied or document finalized.

- Volume-Based Tiers: Reduced per-transaction costs as the volume of processed agreements increases.

- Usage-Based Licensing: Revenue tied directly to the number of digital agreements executed within a given period.

Subscription fees form the bedrock of OneSpan's revenue, encompassing recurring income from their cloud-based security solutions and software. This strategic emphasis on subscriptions, including offerings like OneSpan Sign and mobile app security, underscores a commitment to predictable and scalable revenue generation.

While hardware sales, such as Digipass authenticators, and perpetual software licenses represent a traditional revenue stream, OneSpan is experiencing a notable shift. Customer preference is increasingly leaning towards mobile-first strategies, which has consequently led to a decline in demand for physical hardware security tokens.

Maintenance and support fees are integral to OneSpan's revenue model, providing a consistent income stream tied to both software and hardware contracts. These fees ensure customers retain access to critical technical assistance and regular software updates, fostering customer loyalty and supporting ongoing product development.

Professional services contribute significantly to OneSpan's revenue, covering essential client needs like system implementation, integration, training, and tailored consulting. These services are vital for clients to fully leverage OneSpan’s digital identity and transaction signing solutions, with growth in software subscriptions often paralleled by these service engagements.

OneSpan also generates revenue through transaction-based fees for its digital agreement solutions, where income is directly linked to customer usage, such as the volume of documents signed. This flexible model benefits clients with variable usage patterns, and in 2024, tiered transaction-based pricing is becoming more common in the digital signature market to accommodate diverse customer needs.

| Revenue Stream | Description | Trend/Notes |

|---|---|---|

| Subscription Fees | Recurring income from cloud services and software (e.g., OneSpan Sign, mobile security). | Primary and growing revenue source. |

| Hardware & Perpetual Licenses | Sale of physical security devices (e.g., Digipass) and one-time software licenses. | Traditional stream, with hardware showing a downward trend due to mobile preference. |

| Maintenance & Support Fees | Ongoing fees for technical assistance and software updates on existing contracts. | Provides predictable income and supports customer retention. |

| Professional Services | Revenue from implementation, integration, training, and consulting for security solutions. | Crucial for client adoption and maximizing solution value. |

| Transaction-Based Fees | Income tied to the volume of digital agreements processed or documents signed. | Flexible model for clients with variable usage; increasingly common in 2024. |

Business Model Canvas Data Sources

The OneSpan Business Model Canvas is meticulously constructed using a blend of internal financial data, customer feedback, and competitive landscape analysis. This multi-faceted approach ensures a robust and actionable framework for strategic planning.