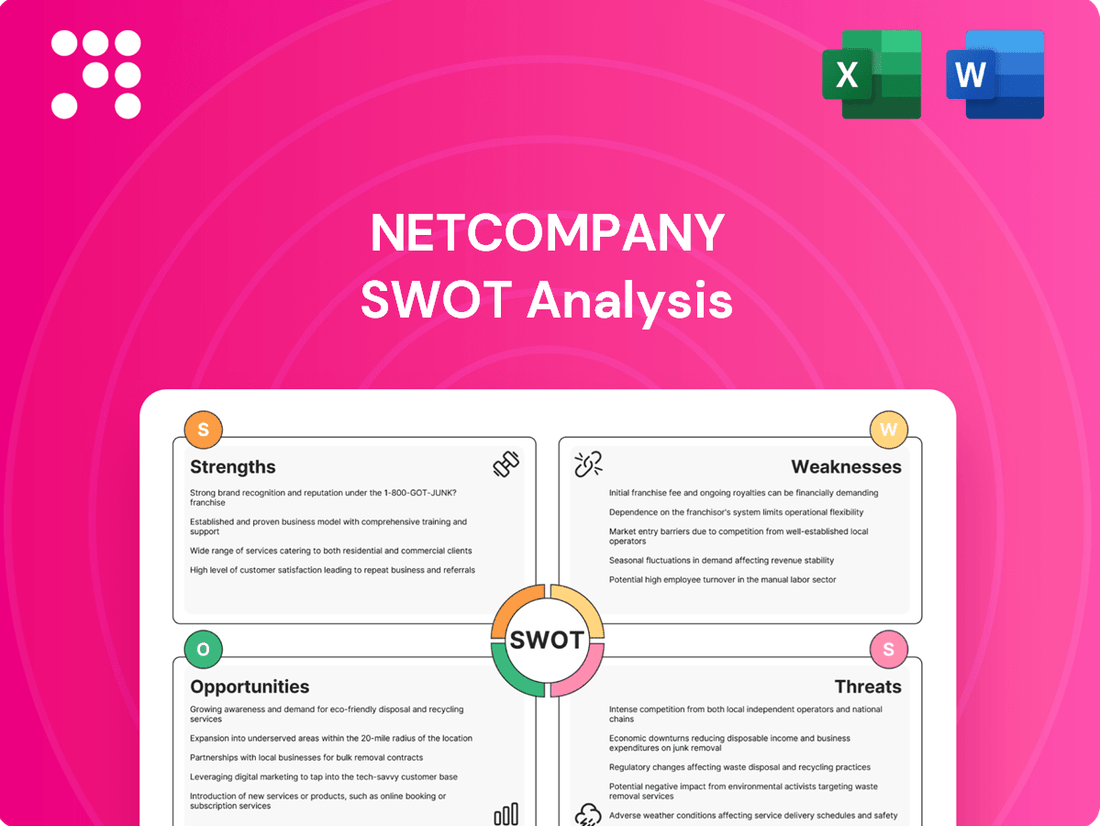

Netcompany SWOT Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Netcompany Bundle

Netcompany's agility in adapting to digital transformation trends and its strong client relationships are key strengths. However, the competitive landscape and potential economic downturns present significant challenges that warrant a deeper look.

Want the full story behind Netcompany’s strengths, risks, and growth drivers? Purchase the complete SWOT analysis to gain access to a professionally written, fully editable report designed to support planning, pitches, and research.

Strengths

Netcompany boasts a substantial and deeply ingrained presence within the public sector, especially in its home market of Denmark. The company is entrusted with managing vital IT solutions for numerous government bodies, a testament to its reliability and expertise in handling complex, society-critical projects.

This specialization translates into a stream of stable, long-term contracts, bolstering Netcompany's revenue predictability. Their proven ability to deliver these demanding projects on schedule and within financial parameters has cemented a strong reputation, making them a preferred partner for public sector IT initiatives.

A key indicator of this strength is Netcompany's impressive win rate, securing over 65% of the public tenders it pursues. This high success rate underscores a significant competitive advantage and deep understanding of public sector procurement needs and technical requirements.

Netcompany has shown a strong ability to grow its income year after year. In 2024, the company saw its revenue increase by 7.6% on a constant currency basis, reaching 7.4%. This consistent upward trend in revenue, coupled with an adjusted EBITDA margin of 16.8% (16.9% constant), highlights the company's solid financial health and operational efficiency.

The positive financial momentum continued into the first quarter of 2025, with Netcompany reporting a 9.1% rise in revenue. Furthermore, the company managed to improve its EBITDA margin to 17.6% during the same period. These figures suggest effective cost control and a robust business model capable of delivering improved profitability even amidst challenging economic conditions.

Netcompany's product and platform-centric go-to-market strategy is a significant strength, enabling them to deliver scalable and repeatable solutions. This focus has been instrumental in securing new business and fostering growth, as evidenced by their successful expansion into international markets.

In 2024, this strategy facilitated Netcompany's entry and development in key regions. For instance, their presence in Norway saw continued project wins, leveraging their established platforms for public sector digitalization. Similarly, their Greek operations have benefited from this approach, allowing for efficient deployment of their core offerings.

This product-based approach translates to enhanced efficiency and improved project execution. By standardizing solutions, Netcompany can reduce development time and costs, leading to more predictable outcomes for clients and a stronger competitive position in the market.

High Cash Conversion and Strong Financial Position

Netcompany demonstrates exceptional cash flow generation, highlighted by a free cash flow of DKK 821.1 million in 2024. This strong performance is further evidenced by a remarkable cash conversion ratio of 147.1%, indicating efficient management of its earnings into actual cash.

The company's financial health is robust, with Q1 2025 free cash flow showing a significant improvement, reaching DKK 67.9 million compared to a negative DKK 4.9 million in Q1 2024. This upward trend in cash flow, coupled with a debt leverage ratio that improved to 1.2x, underscores Netcompany's solid financial standing.

- Strong Free Cash Flow: DKK 821.1m in 2024.

- High Cash Conversion: 147.1% in 2024.

- Improved Q1 2025 Cash Flow: DKK 67.9m vs. DKK -4.9m in Q1 2024.

- Reduced Debt Leverage: Improved to 1.2x.

Talent Acquisition and Retention

Netcompany excels in attracting and keeping top IT talent, a crucial strength in today's competitive market. In 2024 alone, they onboarded more than 1,700 new employees, boosting their total workforce to over 8,250 individuals. This consistent growth highlights their appeal as an employer, especially among new IT graduates, who increasingly view Netcompany as a preferred workplace.

Their success in talent acquisition and retention directly fuels their ability to deliver innovative and high-quality solutions. By nurturing a strong pipeline of skilled IT professionals, particularly younger talent, Netcompany ensures it maintains a competitive edge and the capacity to meet client demands effectively.

- Talent Magnet: Recognized as a preferred employer for IT graduates.

- Significant Growth: Welcomed over 1,700 new employees in 2024.

- Expanded Workforce: Total employee count now exceeds 8,250.

- Competitive Advantage: Strong talent pool supports high-quality solution delivery.

Netcompany's deep expertise in the public sector, particularly in Denmark, is a core strength, leading to stable, long-term contracts. Their proven track record in delivering complex, society-critical IT projects on time and within budget has built significant trust and a strong reputation.

This market position is validated by an impressive public tender win rate exceeding 65%, demonstrating a clear competitive advantage and a thorough understanding of public sector needs.

The company's financial performance is robust, with revenue growth of 7.6% in 2024 (constant currency) and an adjusted EBITDA margin of 16.8%. This momentum continued into Q1 2025 with a 9.1% revenue increase and an improved EBITDA margin of 17.6%, reflecting strong operational efficiency and cost management.

Netcompany's platform-centric approach enables scalable and repeatable solutions, driving successful international expansion and efficient project execution. This strategy has been key to securing new business and fostering growth, as seen in their Norwegian and Greek markets.

Exceptional cash flow generation is another significant strength, with DKK 821.1 million in free cash flow in 2024 and a remarkable cash conversion ratio of 147.1%. The company also improved its debt leverage ratio to 1.2x, indicating solid financial health.

Netcompany excels at attracting and retaining IT talent, onboarding over 1,700 new employees in 2024 to reach a total workforce of more than 8,250. This growth, particularly among IT graduates, reinforces their appeal as an employer and their capacity to deliver high-quality solutions.

| Metric | 2024 | Q1 2025 |

|---|---|---|

| Revenue Growth (Constant Currency) | 7.6% | 9.1% |

| Adjusted EBITDA Margin | 16.8% | 17.6% |

| Free Cash Flow (DKK Million) | 821.1 | 67.9 |

| Cash Conversion Ratio | 147.1% | N/A |

| Debt Leverage Ratio | 1.2x | N/A |

| New Employees Onboarded | >1,700 | N/A |

| Total Employees | >8,250 | N/A |

What is included in the product

Delivers a strategic overview of Netcompany’s internal and external business factors, highlighting key strengths like its proprietary platform and market opportunities in digital transformation, while also addressing potential weaknesses in scalability and threats from intense competition.

Streamlines Netcompany's strategic planning by highlighting key strengths and opportunities while addressing potential weaknesses and threats.

Weaknesses

Netcompany's significant reliance on the public sector, which accounted for a substantial portion of its revenue in 2023, presents a notable weakness. This dependence makes the company particularly vulnerable to shifts in government procurement policies and budget allocations.

Furthermore, the company's strong geographic concentration, with Denmark representing 71% of its revenue in 2023, exposes it to risks stemming from economic downturns or political instability within that specific region.

Netcompany's UK operations faced significant headwinds in 2024 due to a major delay in a large strategic project within the public sector. This setback resulted in an 8.7% drop in revenue for Netcompany UK, directly impacting the company's profitability in the region and potentially straining client relationships, especially given the nature of fixed-price contracts where delays can erode margins.

These project delays not only affect immediate revenue recognition but also have a ripple effect on future earnings and operational efficiency. For a company heavily reliant on project-based revenue, such disruptions can create a challenging environment for forecasting and maintaining consistent financial performance.

Netcompany operates within a landscape marked by significant macroeconomic and geopolitical uncertainty. While the company has demonstrated adaptability, a sustained downturn or unexpected global events could dampen client investment in IT services, impacting tender pipelines and overall expansion. For instance, the ongoing inflationary pressures and interest rate hikes seen throughout 2023 and into early 2024, coupled with geopolitical tensions in Eastern Europe, create a challenging operating environment that could slow decision-making for large IT projects.

Potential Dilutive Impact from Acquisitions

Netcompany's acquisition strategy, while aimed at expansion, carries a potential weakness in its dilutive impact on earnings. The acquisition of SDC, for instance, is projected to negatively affect Earnings Per Share (EPS) in 2025, primarily due to the costs associated with integrating the new entity. This means that while the company might be growing its footprint, the immediate financial returns for existing shareholders could be reduced.

This initial dilution is a common challenge when integrating acquired businesses. The process often involves significant upfront costs for harmonization of systems, rebranding, and restructuring, which can temporarily depress profitability. Even though these integrations are strategic for long-term growth and market share, they can strain Netcompany's financial performance and operational capacity in the short term.

- Dilutive Effect: SDC acquisition expected to dilute EPS in FY2025.

- Integration Costs: High upfront expenses associated with merging acquired companies.

- Short-Term Strain: Potential pressure on financial performance and operational resources during integration.

- Strategic Trade-off: Balancing immediate EPS impact with long-term growth objectives.

Challenges in Maintaining Utilization Rates

Netcompany faced challenges in maintaining consistent workforce utilization rates across all its operating regions in 2023. While the company achieved overall margin enhancements, certain geographies saw reduced utilization, which consequently put pressure on gross profit margins. This highlights the critical importance of keeping the workforce efficiently engaged to ensure profitability.

Fluctuations in utilization can indicate underlying issues with how projects are being managed or how resources are being distributed. For instance, if projects are delayed or if there's a mismatch between available skills and project needs, it can lead to periods where employees are not billable, thus lowering utilization.

- Geographic Utilization Disparities: Some regions reported lower utilization rates in 2023, impacting overall financial performance.

- Profitability Linkage: Optimal workforce utilization is directly tied to Netcompany's gross profit margins.

- Operational Indicators: Declining utilization can signal potential weaknesses in project pipeline management or resource allocation efficiency.

Netcompany's significant reliance on the public sector, which accounted for a substantial portion of its revenue in 2023, presents a notable weakness. This dependence makes the company particularly vulnerable to shifts in government procurement policies and budget allocations. Furthermore, the company's strong geographic concentration, with Denmark representing 71% of its revenue in 2023, exposes it to risks stemming from economic downturns or political instability within that specific region.

The acquisition of SDC is projected to dilute Netcompany's Earnings Per Share (EPS) in FY2025 due to integration costs, representing a short-term strain on financial performance. Additionally, Netcompany faced challenges in maintaining consistent workforce utilization rates across all operating regions in 2023, with certain geographies reporting lower rates that put pressure on gross profit margins.

| Weakness | Description | Impact/Data Point |

|---|---|---|

| Public Sector Reliance | High dependence on government contracts. | Substantial revenue share in 2023. |

| Geographic Concentration | Dominance of Danish market. | 71% of revenue from Denmark in 2023. |

| Acquisition Dilution | Negative EPS impact from SDC acquisition. | Projected EPS dilution in FY2025. |

| Workforce Utilization | Inconsistent utilization rates across regions. | Pressure on gross profit margins in certain geographies in 2023. |

Preview the Actual Deliverable

Netcompany SWOT Analysis

This is the actual Netcompany SWOT analysis document you’ll receive upon purchase—no surprises, just professional quality. You can trust that the insights presented here are representative of the full, detailed report. Unlock the complete analysis to gain a comprehensive understanding of Netcompany's strategic position.

Opportunities

Netcompany’s acquisition of SDC in 2023 significantly bolsters its presence in the financial services sector, a key IT services market in Europe with substantial IT spending. This strategic move, coupled with robust growth in the Netherlands and Norway, opens avenues for revenue diversification, lessening dependence on its established markets.

Europe's commitment to responsible digitalization, especially within government bodies, offers a substantial and enduring market for Netcompany. This trend is not a fleeting moment but a strategic shift towards more efficient, citizen-centric digital services.

Netcompany's proven track record in delivering complex, business-critical IT solutions and robust digital platforms directly addresses this growing demand. Their focus on public sector transformation means they are ideally placed to benefit from this sustained push for digital advancement.

For instance, in 2024, European governments are projected to increase their IT spending, with a significant portion allocated to digital transformation initiatives. This aligns perfectly with Netcompany's core competencies, indicating a strong potential for revenue growth and market share expansion.

Netcompany's strategic emphasis on its proprietary products and platforms is a significant driver for scalability. This approach allows them to tackle large, intricate IT transformation projects more efficiently by minimizing the need for custom-built solutions, thereby enhancing project delivery speed and consistency.

By leveraging these self-developed or co-owned assets, Netcompany can achieve greater operational leverage. For instance, their platform-centric model contributed to a strong performance in the first half of 2024, with revenue increasing by 15% year-on-year to DKK 3.5 billion, showcasing the tangible benefits of this strategy.

Strategic Partnerships and Framework Agreements

Netcompany's strategic partnerships, particularly its framework agreements with public sector entities, represent a significant opportunity. These multi-year contracts, such as those with the Danish Business Authorities and the Swedish Tax Agency, offer substantial long-term revenue visibility. This stability allows for more predictable financial planning and resource allocation, bolstering Netcompany's market position.

These agreements are not just about current revenue; they create a platform for further growth. The existing framework provides a streamlined process to secure additional projects within these public bodies. This reduces the sales cycle and cost of acquisition for new business, effectively deepening relationships and expanding the company's footprint within key government sectors.

- Framework Agreements Drive Revenue Stability: Netcompany's multi-year framework agreements with entities like the Danish Business Authorities and the Swedish Tax Agency offer predictable, long-term revenue streams.

- Expanded Project Opportunities: These existing agreements provide a clear pathway to secure additional projects, enhancing Netcompany's ability to grow its business within established public sector partnerships.

- Strengthened Market Position: Successful execution of these large-scale public sector contracts solidifies Netcompany's reputation and competitive standing in the digital transformation market.

Potential for Margin Expansion through Operational Efficiencies

Netcompany has a significant opportunity to expand its profit margins by honing its operational efficiencies. The company's ongoing dedication to optimizing resource allocation and streamlining project delivery is a key driver here.

This focus is already yielding positive results, with a notable uptick in EBITDA margins observed throughout 2024 and into the first quarter of 2025. Continued strategic investments in operational infrastructure and a sharp focus on efficient project execution are expected to further bolster profitability.

- Improved EBITDA Margins: Netcompany reported a strengthened EBITDA margin in 2024, building on this positive trend into Q1 2025.

- Operational Optimization: Continued investment in process improvements and technology can unlock further cost savings.

- Project Execution Excellence: Enhancing project delivery efficiency directly translates to higher profitability per contract.

- Resource Utilization: Better alignment of resources with project demands will reduce overhead and boost margins.

Netcompany's strategic acquisitions, such as the 2023 purchase of SDC, significantly expand its reach within the European financial services sector, a market characterized by substantial IT investment. This diversification, alongside strong performance in the Netherlands and Norway, reduces reliance on existing markets and opens new revenue streams.

The ongoing European drive for digitalization, particularly in the public sector, presents a consistent and growing demand for Netcompany's expertise in delivering complex IT solutions. This trend is projected to continue, with European governments increasing IT spending in 2024, specifically targeting digital transformation initiatives, which plays directly into Netcompany's core strengths.

Netcompany's proprietary product and platform strategy enhances scalability and project efficiency, allowing for faster delivery of large-scale IT transformations. This approach, exemplified by a 15% year-on-year revenue increase to DKK 3.5 billion in H1 2024, demonstrates tangible benefits in operational leverage and profitability.

Furthermore, Netcompany's framework agreements with public sector entities, such as those with the Danish Business Authorities and the Swedish Tax Agency, ensure long-term revenue visibility and provide a foundation for securing additional projects, thereby strengthening its market position.

Threats

The IT services sector is notoriously crowded, with a constant influx of new companies challenging established giants. This intense competition means Netcompany must continually innovate and differentiate its offerings to stand out. For instance, in 2024, the global IT services market was valued at approximately $1.3 trillion, with significant growth projected, but this also signifies a vast landscape of competitors, from large consultancies to specialized niche providers.

This competitive environment directly impacts Netcompany by potentially driving down service prices as providers vie for contracts. Furthermore, acquiring new clients becomes more expensive, and retaining skilled employees is a challenge when other firms are actively recruiting. The pressure to offer competitive pricing while maintaining high service quality is a perpetual balancing act for companies like Netcompany in this dynamic market.

Economic slowdowns, including potential recessions or persistent high inflation, pose a significant threat by curbing IT expenditure across both public and private sectors. For instance, if major economies like the Eurozone experience a contraction in GDP, as some forecasts suggested for late 2024 or early 2025, clients might defer or cancel non-essential digital transformation projects.

This reduced IT spending directly impacts Netcompany's revenue streams and the visibility of its project pipeline. A scenario where clients prioritize cost-cutting over strategic IT investments could particularly affect Netcompany's ability to secure new, large-scale contracts, especially those focused on less critical operational upgrades.

The IT sector continues to face a significant talent deficit, a trend expected to persist into 2024 and 2025. This scarcity directly impacts companies like Netcompany, forcing them to contend with escalating wage demands as they compete for qualified professionals. For instance, reports from early 2024 indicated average salary increases for IT roles in Denmark, Netcompany's primary market, were exceeding general inflation rates.

This wage inflation, coupled with the ongoing shortage, poses a direct threat to Netcompany's operational costs. Higher personnel expenses can squeeze profit margins, especially if these costs cannot be fully passed on to clients. Furthermore, the difficulty in attracting and retaining top-tier IT talent could lead to delays in project execution, potentially impacting Netcompany's ability to meet client deadlines and maintain its competitive edge.

Cybersecurity Risks and Data Breaches

As an IT services provider handling critical business systems and sensitive client information, Netcompany faces significant cybersecurity risks. A major data breach could severely impact its reputation, leading to substantial financial penalties and a loss of client confidence. For instance, the global average cost of a data breach reached $4.45 million in 2024, according to IBM's Cost of a Data Breach Report, a figure that underscores the potential financial fallout for companies like Netcompany.

The increasing sophistication of cyber threats means constant vigilance and investment in robust security measures are paramount. Netcompany's reliance on digital infrastructure makes it a potential target, and a successful attack could disrupt operations and compromise proprietary data. The company must continuously adapt its defenses to stay ahead of evolving threats.

- Reputational Damage: A breach could erode trust with existing and potential clients, impacting future business.

- Financial Losses: Costs associated with breach remediation, regulatory fines, and potential lawsuits can be substantial.

- Operational Disruption: Attacks can halt services, affecting Netcompany's ability to deliver solutions to its clients.

- Loss of Client Data: Compromise of sensitive client information poses significant legal and ethical challenges.

Integration Risks of Acquisitions

While acquisitions can fuel growth, integrating new entities like SDC presents significant challenges. These can range from clashing company cultures and the complex task of harmonizing disparate IT systems to the ultimate failure in realizing expected financial synergies. For instance, a poorly managed integration could lead to increased operational costs and a dilution of Netcompany's overall financial performance.

The potential for integration risks to derail strategic objectives is substantial. For Netcompany, a key concern in 2024 and into 2025 is ensuring that the promised benefits of acquisitions are actually realized. Failure to do so could mean that the capital invested in these deals does not generate the expected returns, impacting profitability and shareholder value.

- Cultural Misalignment: Differences in work ethics and communication styles can impede collaboration.

- IT System Incompatibility: Merging diverse technological infrastructures often leads to delays and increased costs.

- Failure to Achieve Synergies: Overestimating cost savings or revenue enhancements post-acquisition can lead to disappointing financial outcomes.

- Management Distraction: The integration process can divert key management attention from core business operations.

Intensified competition in the IT services market, valued at approximately $1.3 trillion globally in 2024, poses a threat by potentially driving down prices and increasing client acquisition costs. Netcompany must continuously innovate to differentiate itself amidst a crowded landscape of established players and emerging niche providers.

Economic downturns, such as potential contractions in GDP in major economies like the Eurozone projected for late 2024 or early 2025, could significantly reduce IT spending. This would directly impact Netcompany's revenue and project pipeline as clients may defer or cancel digital transformation initiatives.

The persistent IT talent deficit, with average salary increases for IT roles in Denmark exceeding general inflation in early 2024, escalates Netcompany's operational costs. This wage inflation, coupled with recruitment challenges, can squeeze profit margins and potentially delay project execution.

Cybersecurity risks remain a significant threat, with the global average cost of a data breach reaching $4.45 million in 2024. A breach could lead to substantial financial penalties, reputational damage, and loss of client confidence, impacting Netcompany's operations and client relationships.

Acquisition integration risks, such as cultural misalignment and IT system incompatibility, can lead to increased costs and failure to achieve expected financial synergies. For instance, poorly managed integrations can divert management attention from core operations and dilute financial performance, impacting shareholder value.

SWOT Analysis Data Sources

This Netcompany SWOT analysis is built upon a robust foundation of data, drawing from official financial reports, comprehensive market intelligence, and expert industry analysis to provide a clear and actionable strategic overview.