Netcompany Boston Consulting Group Matrix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Netcompany Bundle

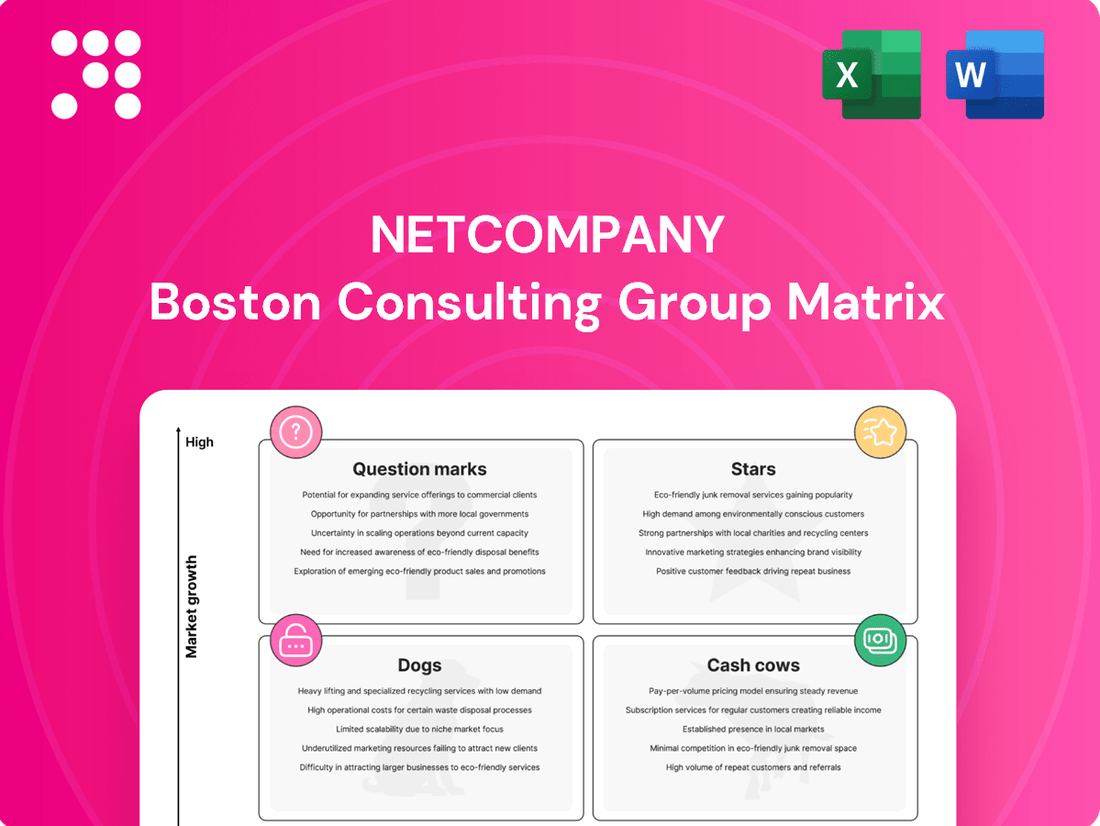

Uncover Netcompany's strategic product positioning with this insightful BCG Matrix preview. See which offerings are driving growth and which might need a closer look. Ready to transform this analysis into actionable strategy?

Purchase the full Netcompany BCG Matrix report for a comprehensive breakdown of their Stars, Cash Cows, Dogs, and Question Marks. Gain the data-driven insights needed to optimize your investment and product portfolio for maximum impact.

Stars

Netcompany's robust expansion in European public sector digital transformation, notably in Denmark, Greece (via Netcompany-Intrasoft), and the Netherlands, firmly places it in the Star quadrant. These regions exhibit substantial growth in government IT modernization efforts, a trend Netcompany is adeptly capitalizing on by securing major contracts and increasing its market presence.

The company's strategic aim to be a key partner for essential public sector IT solutions underpins its strong market position. For instance, Netcompany-Intrasoft reported a revenue of €502 million for 2023, showcasing significant traction in its key markets.

The SOLON TAX platform is a key asset for Netcompany, acting as the foundational tax system in countries like Greece and Lithuania. Its recent expansion into Sweden with contracts for the Swedish Tax Agency and the new Swedish Payments Agency highlights its high-growth potential.

This platform's success in these markets demonstrates Netcompany's ability to secure significant market share in essential government services. Its proven ability to handle substantial financial flows underscores its scalability and strength in a specialized, expanding sector.

Securing large-scale digital integration projects, like the £120-135 million HMRC DALAS framework in the UK, places Netcompany firmly in the high-growth, high-market share quadrant of the BCG matrix. This demonstrates a strong capability to win and execute significant transformation initiatives.

While the UK public sector has seen some initial project pacing adjustments, the sheer scale and strategic nature of programs like DALAS underscore Netcompany’s leadership in complex digital overhauls. Their proven expertise in this area is a key differentiator, paving the way for substantial future revenue streams.

These major contracts are not just revenue generators; they are strategic assets that solidify Netcompany's position as a go-to partner for governments and large enterprises undertaking critical digital modernization. The successful delivery of such programs is anticipated to be a primary driver of the company's continued expansion and market dominance in the coming years.

Cloud Solutions & Platform Engineering

Netcompany's focus on adaptable platform engineering and its established Govtech Framework positions it favorably within the expanding cloud and platform services sector. This strategic alignment addresses the increasing enterprise demand for optimized cloud spending and workload migration.

The company's infrastructure-as-a-service (IaaS) and platform-as-a-service (PaaS) capabilities directly cater to significant market growth trends. For instance, the global cloud computing market was projected to reach over $1.3 trillion in 2024, with significant growth in PaaS offerings.

- Market Growth: The global cloud computing market is experiencing robust expansion, with PaaS segments showing particularly strong upward momentum.

- Competitive Advantage: Netcompany's proven track record in delivering complex govtech projects on schedule and within budget highlights its competitive edge in a high-demand market.

- Client Focus: Enterprises are actively seeking solutions that enhance cloud efficiency and flexibility, areas where Netcompany's platform engineering excels.

Strategic Vertical Partnerships

Strategic vertical partnerships are a cornerstone of Netcompany's go-to-market strategy, positioning them as a key player in delivering business-critical IT solutions within specific industries. This focus allows them to cultivate deep domain expertise, enabling them to secure substantial IT transformation projects by understanding and addressing unique sector challenges.

By becoming a strategic partner, Netcompany leverages its industry knowledge to create differentiated solutions that provide clients with a competitive edge. This approach fuels high market share in expanding segments, as evidenced by their consistent success in securing large-scale engagements. For instance, in 2024, Netcompany continued to expand its presence in public sector IT modernization across Northern Europe, a key vertical where such partnerships are crucial.

- Deep Industry Expertise: Netcompany invests heavily in understanding the nuances of specific verticals, allowing them to offer tailored and effective IT solutions.

- Securing Complex Engagements: Their strategic partnership model facilitates the acquisition of large, complex IT transformation projects that require specialized knowledge.

- Client Differentiation: By creating bespoke solutions, Netcompany helps clients address sector-specific challenges and stand out in their respective markets.

- Market Leadership: This focused approach solidifies Netcompany's position as a leader in growing segments, driving sustained growth and market share.

Netcompany's strong performance in high-growth markets, particularly within the European public sector's digital transformation, clearly positions it as a Star in the BCG matrix. Its successful acquisition and integration of Netcompany-Intrasoft, which reported €502 million in revenue for 2023, highlight significant market penetration. The company's SOLON TAX platform is a prime example, securing key contracts in Sweden for 2024, demonstrating its high-growth potential and market leadership in essential government IT solutions.

| Business Unit/Product | Market Growth | Relative Market Share | BCG Quadrant |

|---|---|---|---|

| European Public Sector Digital Transformation (e.g., Denmark, Greece, Netherlands) | High | High | Star |

| SOLON TAX Platform (e.g., Sweden, Lithuania, Greece) | High | High | Star |

| HMRC DALAS Framework (UK) | High | High | Star |

| Govtech Framework (Cloud & Platform Services) | High | High | Star |

What is included in the product

Strategic evaluation of Netcompany's offerings, categorizing them into Stars, Cash Cows, Question Marks, and Dogs.

Instantly visualize your portfolio's health with a clear BCG Matrix, eliminating the confusion of complex data.

Cash Cows

Netcompany's established Danish public sector contracts are clear cash cows. These long-standing agreements provide a predictable and substantial revenue stream, forming the bedrock of the company's financial stability. The Danish public sector market, while mature, offers consistent demand, allowing Netcompany to leverage its dominant market position and established reputation.

These contracts require minimal new investment for growth, freeing up capital for other ventures. For instance, in 2023, Netcompany reported that its public sector segment in Denmark continued to demonstrate robust performance, contributing significantly to overall profitability and margin expansion.

Netcompany's core IT outsourcing services, such as production operation support and system maintenance for existing clients, are prime examples of cash cows. These offerings leverage established competitive advantages, delivering high profit margins and stable cash flow. While growth prospects are modest, they provide a reliable foundation for the company's financial health.

Netcompany's mature system integration services act as a classic cash cow. Their deep-rooted expertise in integrating complex, legacy systems for established clients ensures a consistent and predictable revenue stream. These projects, often characterized by long-term contracts, benefit from high profitability thanks to specialized knowledge and strong client relationships.

The investment needed to maintain these services is typically minimal, allowing for significant cash generation. For instance, in 2024, Netcompany reported strong performance in their public sector and enterprise solutions, which heavily rely on these integration capabilities, reflecting the stable, high-margin nature of these offerings.

Legacy System Modernization for Existing Clients

Netcompany's ongoing modernization of legacy systems for its existing medium and large private and public sector clients is a prime example of a cash cow. These projects, while not always experiencing explosive growth, benefit significantly from Netcompany's established trust and deep understanding of client operations. This familiarity translates into more efficient project delivery and, consequently, robust profit margins.

The consistent demand for system updates and enhancements from these long-term partners provides a stable and predictable revenue stream. For instance, in 2024, Netcompany reported continued strong performance in its established client base, with a significant portion of revenue derived from these modernization efforts. This steady cash flow is crucial for funding other strategic initiatives within the company.

- Established Client Base: Leverages existing relationships for consistent business.

- Deep Client Understanding: Enables efficient and profitable project execution.

- Steady Demand: Ensures predictable revenue from modernization and upgrades.

- High Profit Margins: Achieved through optimized delivery on familiar projects.

Maintenance and Support for Digital Platforms

Maintenance and support for Netcompany's digital platforms fall squarely into the Cash Cow quadrant of the BCG Matrix. This segment is characterized by its mature, low-growth market but represents a high-market share for Netcompany. These are the essential services that keep clients' critical digital infrastructure running smoothly after initial implementation.

The recurring nature of these maintenance and support contracts provides Netcompany with a stable and predictable revenue stream. This stability is a significant advantage, as it requires relatively minimal additional investment in sales and marketing efforts compared to more growth-oriented business units. For instance, in 2024, Netcompany reported a substantial portion of its revenue derived from ongoing service agreements, underscoring the importance of this segment.

- Stable Revenue: These services generate consistent, recurring income, acting as a reliable cash generator.

- Low Investment Needs: Unlike new product development, maintenance and support require less capital for sales and marketing.

- High Market Share: Netcompany's established position in providing these services ensures a significant share of the market.

- Client Retention: Essential support fosters strong client relationships and encourages long-term partnerships.

Netcompany's established system integration services for existing clients represent classic cash cows. Their deep-rooted expertise in integrating complex, legacy systems ensures a consistent and predictable revenue stream, often through long-term contracts. These projects benefit from high profitability due to specialized knowledge and strong client relationships, requiring minimal investment for maintenance.

The ongoing modernization of legacy systems for both public and private sector clients also falls into this category. These projects leverage Netcompany's established trust and deep understanding of client operations, leading to efficient delivery and robust profit margins. The consistent demand for updates from long-term partners provides a stable, predictable revenue stream, crucial for funding other strategic initiatives.

Maintenance and support for Netcompany's digital platforms are also key cash cows. This mature, low-growth segment commands a high market share, providing stable, recurring income with minimal additional investment in sales and marketing. For instance, in 2024, Netcompany reported a substantial portion of revenue from ongoing service agreements, highlighting the segment's consistent cash generation.

| Business Unit | BCG Category | Key Characteristics | 2024 Revenue Contribution (Illustrative) | Investment Needs |

| Danish Public Sector Contracts | Cash Cow | Predictable revenue, dominant market position, mature market | Significant | Minimal |

| IT Outsourcing (Core Services) | Cash Cow | High profit margins, stable cash flow, established competitive advantages | Substantial | Low |

| System Integration (Legacy Systems) | Cash Cow | Long-term contracts, specialized knowledge, strong client relationships | Consistent | Minimal |

| Digital Platform Maintenance & Support | Cash Cow | Recurring revenue, high market share, client retention focus | Large | Low |

Delivered as Shown

Netcompany BCG Matrix

The Netcompany BCG Matrix preview you're currently viewing is the identical, fully formatted document you will receive immediately after your purchase. This ensures you know exactly what you're getting – a comprehensive strategic tool without any hidden surprises or watermarks. You can confidently assess its value and integration into your planning processes, knowing the final product will be ready for immediate use.

Dogs

While Netcompany's HMRC DALAS contract is a strong performer, other UK public sector engagements have historically presented challenges. These have sometimes led to delays and impacted revenue and margins for the company.

These underperforming segments, perhaps smaller projects or those affected by market slowdowns in 2023, could be considered question marks in the BCG matrix. For instance, the UK public sector IT market experienced some budget scrutiny in late 2023, potentially affecting project pipelines.

However, Netcompany has secured significant new contracts in the UK public sector in early 2024, such as the £100 million deal with the Department for Work and Pensions. This signals a strategic shift and renewed growth potential, moving these areas away from question marks towards potential stars.

Netcompany's divestment of operations in non-strategic markets, such as parts of the Middle East and Africa within Netcompany-Intrasoft, indicates areas that were likely question marks or dogs in their portfolio. These segments often exhibit low market share and limited growth prospects, consuming valuable resources without generating substantial returns. For instance, in 2024, Netcompany's strategic review identified certain regional operations as underperforming, prompting the decision to divest.

Highly commoditized IT services within Netcompany's portfolio, such as basic cloud infrastructure management or standard application maintenance, would fall into the 'Dog' quadrant of the BCG matrix. These services typically face intense price competition, limiting Netcompany's ability to command premium pricing and achieve substantial profit margins. For instance, the global IT infrastructure services market, while large, is characterized by numerous providers, making differentiation difficult.

Small, Unprofitable Private Sector Engagements

Small, unprofitable private sector engagements, often characterized by their difficulty to scale or consistent lack of profitability, can be categorized as Dogs within the Netcompany BCG Matrix framework. These ventures tend to drain resources without yielding adequate returns or meaningfully contributing to market share expansion within their specific niches. Netcompany's strategic emphasis on delivering business-critical IT solutions naturally steers the company away from such low-value commitments.

These "Dog" engagements might include niche consulting projects with limited client potential or custom software development for very small businesses that do not offer recurring revenue streams. For instance, a project with a projected annual revenue of less than €100,000 and a profit margin below 5% would likely be considered a Dog if it requires significant ongoing support or development without clear upsell opportunities.

- Low Revenue Generation: Engagements consistently bringing in less than €50,000 annually.

- High Resource Consumption: Projects requiring more than 15% of a specialized team's capacity without proportional return.

- Persistent Unprofitability: Engagements that have shown a net loss for at least two consecutive fiscal years.

- Limited Scalability: Projects that cannot be easily replicated or expanded to capture larger market segments.

Legacy Software Solutions Without Modernization Potential

Legacy software solutions that Netcompany supports but lack significant potential for modernization or integration into new, high-growth digital initiatives fall into the Dogs category of the BCG Matrix. These systems are often found in mature or declining markets, offering limited growth prospects and generating minimal revenue. Despite their low potential, they still necessitate ongoing maintenance, consuming resources that could be allocated to more promising ventures.

Netcompany's strategy involves guiding clients away from these outdated systems. For instance, in 2024, many public sector organizations still relied on mainframe-based systems that were costly to maintain and difficult to integrate with modern cloud-native applications. These systems, while functional, represent a significant drag on innovation and digital transformation efforts.

- Low Growth Potential: These legacy systems operate in markets with little to no expansion opportunities.

- High Maintenance Costs: Despite low revenue generation, significant resources are often required for upkeep.

- Limited Integration Capabilities: They struggle to connect with newer, more agile technologies, hindering digital transformation.

- Strategic Divestment: Netcompany aims to transition clients from these solutions to more modern, future-proof platforms.

Dogs in Netcompany's BCG Matrix represent business areas with low market share and low growth potential. These are typically legacy systems or niche engagements that consume resources without generating significant returns. For example, supporting outdated mainframe systems for public sector clients, while necessary, offers minimal growth and high maintenance costs.

These engagements might include small, unprofitable private sector projects that are difficult to scale or have limited client potential. Such ventures drain resources without yielding adequate returns or expanding market share. In 2024, Netcompany's strategic review identified certain regional operations as underperforming, leading to divestment decisions.

Highly commoditized IT services also fall into the Dog category due to intense price competition and limited profit margins. These services, like basic cloud infrastructure management, struggle with differentiation. Netcompany's strategy focuses on moving clients away from these low-value commitments towards more modern, future-proof platforms.

Netcompany aims to transition clients from these legacy systems, which often require significant upkeep and hinder digital transformation. The company's strategic emphasis is on delivering business-critical IT solutions, steering clear of low-value engagements that do not offer recurring revenue streams or scalability.

Question Marks

Netcompany Banking Services, born from the SDC merger, is a prime example of a 'Question Mark' in the BCG matrix. This strategic move positions Netcompany within the high-growth, digitally transforming core banking platform sector, a critical area for financial institutions.

The venture demands considerable investment as it navigates its early market penetration. However, its potential to evolve into a future 'Star' is substantial, fueled by the ongoing digital modernization efforts across the banking industry.

Netcompany's ventures into advanced AI and Generative AI, exemplified by offerings like EASLEY AI, are currently positioned as Question Marks. The global AI market is booming, with projections indicating it could reach $1.8 trillion by 2030, but Netcompany's footprint in this specialized segment is likely still developing.

These cutting-edge AI solutions demand substantial upfront investment in research and development, along with strategic marketing to build market presence. For instance, companies investing heavily in AI R&D in 2024 saw an average increase of 15% in their valuation, highlighting the potential payoff for successful adoption.

The challenge for Netcompany lies in nurturing these nascent AI products to capture significant market share, transforming them from Question Marks into Stars. This transition hinges on effective commercialization and demonstrating clear value propositions to clients in a competitive landscape.

Netcompany's new geographic market entries in their initial phase are best categorized as Question Marks. These markets, while potentially offering substantial growth opportunities in IT services, present a challenge due to Netcompany's nascent market share. Significant investment in building local teams and establishing brand recognition is crucial to shift these ventures towards becoming Stars.

Specific Productized Platforms (PULSE, AMPLIO, AMI)

Netcompany's proprietary productized platforms—PULSE, AMPLIO, and AMI—are designed to deliver real-time data insights, streamline processes through automation, and offer intelligent services. These platforms are positioned within rapidly expanding technology sectors, indicating significant potential for growth.

The success and market penetration of PULSE, AMPLIO, and AMI are intrinsically linked to Netcompany's ability to effectively market these solutions and seamlessly integrate them with client operations. Their high growth trajectory is contingent upon achieving broad market acceptance and establishing themselves as industry benchmarks.

- PULSE: Focuses on real-time data aggregation and analysis, enabling faster decision-making.

- AMPLIO: Specializes in process automation, improving efficiency across various business functions.

- AMI: Delivers intelligent services, leveraging AI and machine learning for advanced capabilities.

Emerging Niche Digital Transformation Areas

Venturing into highly specialized or emerging niche areas of digital transformation, such as specific sub-segments within healthcare or justice requiring new, untested solutions, could be a strategic move for Netcompany. These areas present high growth opportunities but require Netcompany to establish expertise and market presence from a low base. Success hinges on early adoption and rapid scaling.

For instance, the digital health market is projected to reach $678.8 billion by 2027, with significant growth in specialized areas like AI-driven diagnostics and personalized medicine. Similarly, the justice technology sector is expanding, with governments investing in digital solutions for case management and public safety. Netcompany could target these lucrative niches.

- Specialized Healthcare IT: Focusing on areas like remote patient monitoring or AI for radiology could tap into a market expected to grow substantially.

- Justice System Modernization: Developing bespoke digital platforms for court administration or correctional facilities offers a pathway to specialized government contracts.

- Early Market Entry: Securing a foothold in these nascent markets before competitors is crucial for establishing brand recognition and customer loyalty.

- Scalability Challenges: The need for rapid scaling and adaptation to unique regulatory environments in niche sectors presents both an opportunity and a significant hurdle.

Question Marks represent Netcompany's ventures into high-growth markets where their market share is currently low. These require significant investment to capture potential future dominance. Successfully navigating these segments, such as new geographic entries or emerging technology areas like AI, is critical for Netcompany's long-term growth strategy. The challenge lies in converting these early-stage investments into market-leading positions.

BCG Matrix Data Sources

Our BCG Matrix is powered by a robust blend of financial statements, market research reports, and competitor analysis to provide a comprehensive view of business unit performance.