Netcompany Porter's Five Forces Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Netcompany Bundle

Netcompany operates in a competitive IT consultancy landscape, where the threat of new entrants and the bargaining power of buyers can significantly influence profitability. Understanding these dynamics is crucial for strategic planning.

The full Porter's Five Forces Analysis reveals the real forces shaping Netcompany’s industry—from supplier influence to threat of new entrants. Gain actionable insights to drive smarter decision-making.

Suppliers Bargaining Power

The bargaining power of suppliers to Netcompany can be significant if the company depends on a limited number of providers for essential IT components, specialized software, or unique talent. For instance, if Netcompany requires highly specific cloud infrastructure or proprietary development tools from only a handful of vendors, those suppliers gain considerable leverage. In 2023, the global IT services market saw continued consolidation, with major cloud providers like Microsoft Azure and Amazon Web Services holding substantial sway over their respective ecosystems, impacting pricing and access for companies like Netcompany.

Netcompany's reliance on highly specialized software, proprietary tools, or unique data sets significantly impacts supplier bargaining power. If these inputs are scarce and available from only a select few providers, those suppliers gain leverage. This is especially true for cutting-edge technologies like advanced AI frameworks or niche industry-specific platforms that are critical for Netcompany's service delivery.

For Netcompany, high switching costs for its suppliers can significantly bolster supplier bargaining power. If Netcompany has deeply integrated a particular supplier's proprietary software or relies on their unique technical expertise, the financial and operational burden of migrating to a new provider becomes substantial. This integration can lock Netcompany into using the existing supplier, even if better alternatives emerge.

Consider the scenario where a supplier provides specialized cloud infrastructure or a unique data analytics platform that is fundamental to Netcompany's service delivery. The cost of retraining staff, reconfiguring systems, and ensuring data integrity during a transition could easily run into millions of Euros. For instance, in 2024, the average cost for enterprise-level software migration projects can range from €100,000 to over €1 million, depending on complexity and scale, making Netcompany hesitant to switch.

Threat of Forward Integration by Suppliers

Suppliers can increase their bargaining power by threatening to integrate forward into the IT services market, directly competing with Netcompany. This means a supplier might start offering its own IT consulting or implementation services to Netcompany's existing client base. While typically less of a concern for providers of basic hardware or commodity software, specialized vendors offering unique platforms or advanced software solutions could potentially make this move.

For instance, a vendor providing a highly integrated cloud platform might develop its own professional services arm to manage client implementations, thereby bypassing Netcompany. This threat is amplified if the supplier possesses proprietary technology or deep client relationships that make them a natural fit for offering these services. In 2024, the trend towards integrated solutions and platform-as-a-service (PaaS) models could incentivize certain software providers to expand their service offerings.

- Forward Integration Threat: Suppliers may threaten to offer IT services directly to Netcompany's clients.

- Competitive Landscape Shift: Specialized software or platform vendors could become direct competitors by offering professional services.

- Incentives for Suppliers: Proprietary technology and strong client relationships can drive suppliers towards forward integration.

- Market Trends: The rise of integrated solutions and PaaS models in 2024 may encourage this behavior.

Importance of Netcompany to Suppliers

The bargaining power of suppliers is a key consideration in Netcompany's competitive landscape. When Netcompany is a significant client for its suppliers, this can effectively diminish the suppliers' leverage. For instance, if a substantial percentage of a supplier's annual revenue comes from Netcompany, that supplier will likely prioritize favorable pricing and service to secure continued business. This dynamic is crucial for Netcompany's cost management and operational efficiency.

Conversely, if Netcompany's purchases represent only a small fraction of a supplier's total sales, the supplier has less incentive to bend on terms. This situation could lead to higher input costs for Netcompany. Understanding the concentration of Netcompany's supplier base is therefore vital. For example, in the IT services sector, where Netcompany operates, reliance on a few key software providers or specialized hardware vendors can amplify supplier power if Netcompany is not a dominant customer for those specific suppliers.

The importance of Netcompany to its suppliers can be quantified by analyzing the proportion of a supplier's revenue derived from Netcompany. While specific figures for Netcompany's supplier relationships are not publicly detailed, general industry trends suggest that large IT service providers often negotiate favorable terms due to their purchasing volume. For example, if Netcompany procures cloud services, the cloud provider's willingness to offer discounts often correlates with the volume of data and services Netcompany consumes.

- Reduced Supplier Leverage: Netcompany's significance as a customer can lead to better terms and pricing from suppliers.

- Revenue Dependency: Suppliers who rely heavily on Netcompany for revenue are incentivized to maintain a strong relationship.

- Cost Management: A strong customer position can help Netcompany manage its procurement costs effectively.

- Industry Dynamics: In IT services, large clients often secure more advantageous agreements with software and hardware vendors.

Suppliers' bargaining power is a critical factor for Netcompany, particularly when the company relies on specialized inputs or a limited supplier base. If Netcompany is a major client, it can negotiate better terms, but if its purchases are minor, suppliers hold more sway, potentially increasing Netcompany's costs. In 2024, the IT sector continued to see price adjustments from key component and software providers, impacting companies across the board.

| Factor | Impact on Netcompany | 2024 Relevance |

|---|---|---|

| Supplier Concentration | High concentration increases supplier power. | Continued consolidation in cloud services means fewer major providers. |

| Switching Costs | High switching costs empower suppliers. | Integration of proprietary software can lock Netcompany in. |

| Supplier Importance | Netcompany's significance to suppliers reduces their leverage. | Large procurement volumes can secure better pricing for Netcompany. |

| Forward Integration Threat | Suppliers offering services directly to clients reduces Netcompany's role. | PaaS models may encourage vendors to expand service offerings. |

What is included in the product

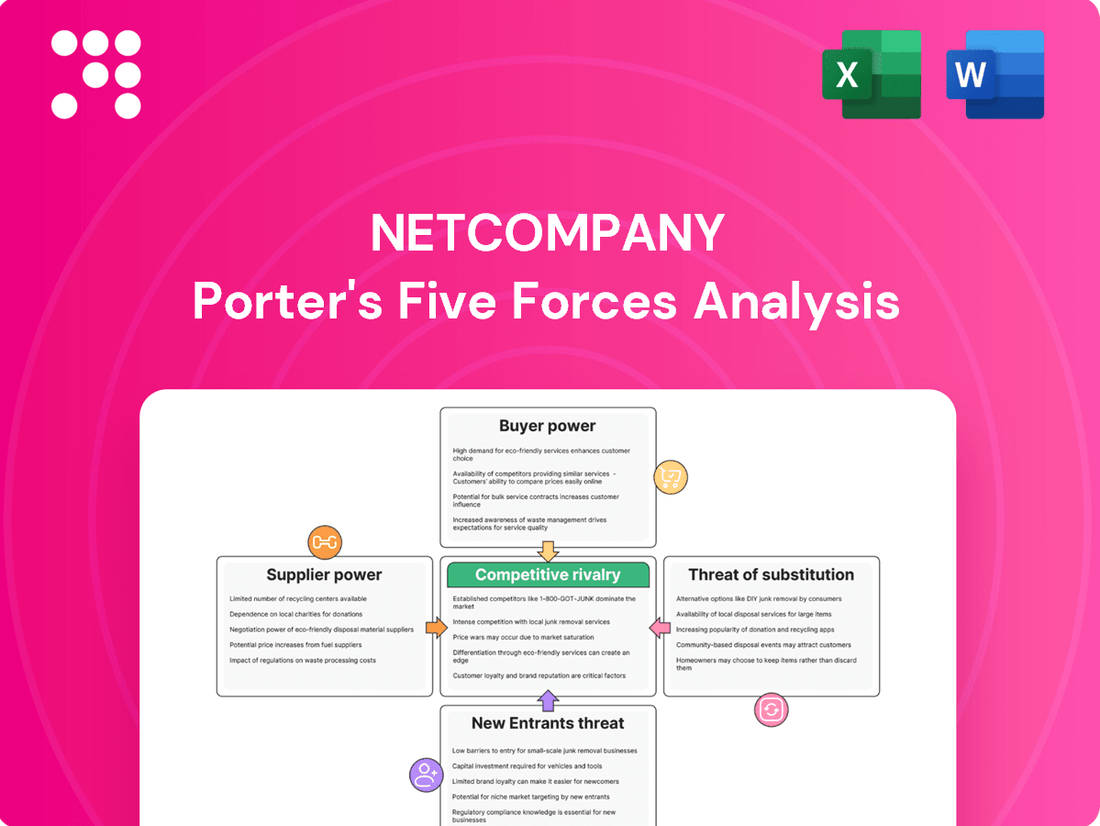

This analysis meticulously examines the five competitive forces impacting Netcompany, providing insights into the intensity of rivalry, the bargaining power of buyers and suppliers, the threat of new entrants, and the availability of substitutes.

Instantly identify and quantify competitive threats with a dynamic, interactive model that highlights key pressure points within the industry.

Customers Bargaining Power

Netcompany's engagement with large-scale projects, particularly within the public sector, significantly amplifies customer bargaining power. Government entities, by virtue of the immense scope and critical nature of these IT solutions, can leverage their position to negotiate favorable terms and conditions, often through competitive public tender processes.

The sheer size of these contracts, as evidenced by Netcompany's Q1 2025 revenue visibility of DKK 5,628.9 million, grants public sector clients considerable leverage. This financial scale allows them to dictate specifications, pricing structures, and service level agreements, directly impacting Netcompany's profit margins and operational flexibility.

Customers wield more influence when numerous IT service providers offer comparable solutions. This abundance of choice means clients can readily switch if they find better pricing or service elsewhere.

The global IT services market is a significant and growing sector. Projections indicate it will reach USD 3703.41 billion by 2025, highlighting a competitive environment where customers have a wide array of providers to choose from.

For large organizations, the ability to develop IT solutions internally, or insource, presents a significant bargaining lever against IT service providers like Netcompany. While this route can be expensive and intricate, it serves as a latent threat, particularly for simpler or more standardized IT requirements.

In 2023, the global IT outsourcing market was valued at approximately $390 billion, indicating a substantial reliance on external providers. However, the increasing availability of advanced internal IT capabilities and cloud-based development tools means that more companies can realistically consider insourcing, especially for projects that don't demand highly specialized or unique expertise.

Price Sensitivity of Customers

Customers who are highly price-sensitive will exert greater pressure on Netcompany to lower its service fees. This is often more prevalent in less specialized or commoditized IT services, whereas for highly customized, business-critical solutions, the focus might shift from pure cost to value and expertise.

For instance, in 2024, the IT services market saw continued competition, with many clients seeking cost optimization. Netcompany's ability to demonstrate tangible ROI and unique value propositions becomes crucial in mitigating this price sensitivity, especially for its more complex and integrated solutions.

- Price Sensitivity Impact: High price sensitivity among customers can force Netcompany to reduce its profit margins on services.

- Service Differentiation: The degree of price sensitivity often correlates with the level of customization and specialization of Netcompany's offerings.

- Market Trends: In 2024, the demand for cost-effective IT solutions remained strong, intensifying the need for Netcompany to justify its pricing through superior value.

Switching Costs for Customers

The bargaining power of customers is significantly influenced by switching costs. When it's difficult or expensive for clients to change IT service providers, their ability to negotiate better terms with Netcompany diminishes. This is particularly true if Netcompany's services are deeply integrated into a client's core business processes and IT infrastructure.

For instance, a client might incur substantial costs related to data migration, retraining staff on new systems, and potential downtime during the transition. These complexities directly increase Netcompany's leverage. For example, in the IT services sector, the average cost of switching providers can range from 10% to 20% of annual contract value, according to industry analyses from 2024.

- High Integration: Netcompany's deep integration into client systems creates a barrier to switching.

- Data Migration Costs: Moving data between IT providers can be expensive and time-consuming.

- Training and Disruption: Clients face costs for retraining staff and potential operational disruptions.

- Reduced Negotiation Leverage: These factors collectively reduce a customer's power to demand lower prices or better terms.

The bargaining power of customers is a key factor for Netcompany, especially given its focus on large public sector projects. When customers, particularly governments, have significant spending power and can choose from multiple providers, their ability to negotiate favorable terms increases. This is further amplified if Netcompany's services are easily substitutable or if clients possess the capability to develop solutions in-house.

Netcompany's strong revenue visibility, DKK 5,628.9 million in Q1 2025, highlights the scale of its client relationships, which can translate into considerable customer leverage. In 2024, the IT services market continued to see clients prioritizing cost optimization, making Netcompany's demonstration of value and ROI critical.

High switching costs, such as data migration and retraining, can mitigate customer power. However, the IT services sector's competitive landscape, projected to reach USD 3703.41 billion by 2025, means customers often have viable alternatives, limiting Netcompany's pricing freedom.

| Factor | Impact on Netcompany | 2024 Context |

|---|---|---|

| Customer Size & Public Sector Focus | Amplifies bargaining power due to large contract values and competitive tenders. | Netcompany's significant revenue visibility underscores client scale. |

| Availability of Alternatives | Reduces Netcompany's leverage if clients can easily switch providers. | Global IT services market growth indicates a competitive provider landscape. |

| Insourcing Capability | Acts as a latent threat, especially for less specialized IT needs. | Advancements in cloud tools enable more companies to consider internal development. |

| Price Sensitivity | Pressures Netcompany to lower prices, potentially impacting margins. | Continued demand for cost-effective solutions in 2024 intensified this. |

| Switching Costs | Mitigates customer power when integration and transition are complex. | Average switching costs in IT services can be 10-20% of contract value. |

What You See Is What You Get

Netcompany Porter's Five Forces Analysis

This preview showcases the complete Netcompany Porter's Five Forces Analysis, offering a detailed examination of competitive pressures within its industry. The document you see here is precisely what you'll receive, fully formatted and ready for immediate use upon purchase, ensuring no discrepancies or missing information.

Rivalry Among Competitors

The IT services market is highly fragmented, featuring a broad spectrum of competitors from global behemoths to specialized niche players. Netcompany contends with this diverse landscape, encountering both large, established firms and smaller, more agile entities, especially within the burgeoning digital transformation consulting sector.

In 2024, the global IT services market was valued at approximately $1.3 trillion, underscoring the sheer volume of companies vying for market share. This includes major players like Accenture, IBM, and Capgemini, alongside numerous regional and specialized providers, creating intense competitive pressure.

The digital transformation consulting market is poised for robust expansion, with forecasts indicating a significant upward trajectory from 2024 through 2033. This healthy growth, while appealing to market entrants, naturally fuels intensified competition among existing players vying for a larger slice of the expanding pie.

The broader global IT services market is also demonstrating strong growth, underscoring the overall demand for digital solutions and services. For instance, the IT services market was valued at approximately $1.3 trillion in 2023 and is projected to reach over $2.3 trillion by 2030, according to various industry reports.

Netcompany distinguishes itself through highly specialized platforms and profound industry knowledge, particularly within the public sector and financial services. This focus on niche areas and business-critical solutions reduces the pressure of direct price competition.

The company's commitment to custom software development and tailored digital platforms creates unique offerings that are difficult for competitors to replicate directly, thereby fostering a less commoditized market environment.

Netcompany's proven success in delivering complex, mission-critical projects, such as their work with Danish municipalities and financial institutions, builds significant customer loyalty and a strong reputation, further insulating them from intense rivalry.

High Fixed Costs and Exit Barriers

The IT services sector, including companies like Netcompany, often contends with substantial fixed costs. These are tied to acquiring skilled IT professionals, maintaining advanced technological infrastructure, and investing in ongoing research and development to stay competitive. For instance, in 2024, the demand for specialized cloud engineers and cybersecurity experts continued to drive up talent acquisition costs significantly.

High exit barriers further intensify competitive rivalry. These can manifest as long-term client contracts that are costly to break or investments in highly specialized, non-transferable assets. Companies are thus incentivized to fiercely compete for and retain clients to ensure their existing capacity is utilized, rather than face the financial repercussions of exiting the market.

- Significant fixed costs in IT services include talent acquisition, technology infrastructure, and R&D.

- High exit barriers, such as long-term contracts and specialized assets, trap companies in the market.

- These factors lead to intense competition as firms strive to maintain client relationships and asset utilization.

Strategic Acquisitions and Partnerships

Netcompany's strategic acquisitions, like its merger with SDC, significantly reshape the competitive landscape within the financial services sector. This consolidation of market share and capabilities directly intensifies rivalry among the remaining players, forcing them to adapt their strategies to maintain or gain ground.

These strategic moves can lead to a more concentrated market, where fewer, larger entities possess greater influence. For instance, the SDC merger aimed to bolster Netcompany's offerings in the Nordic financial market, a move that would naturally increase pressure on competitors to innovate or seek their own consolidation opportunities.

- Strategic Consolidation: Mergers and acquisitions, such as Netcompany's integration with SDC, consolidate market share.

- Intensified Rivalry: This consolidation increases competitive pressure on remaining players in the financial services sector.

- Capability Enhancement: Acquisitions allow companies to gain new capabilities, forcing rivals to respond with similar advancements.

Competitive rivalry within the IT services sector is fierce, driven by a fragmented market and significant growth opportunities, particularly in digital transformation. Companies like Netcompany face pressure from both large, established IT giants and nimble niche players. The sheer size of the global IT services market, estimated at around $1.3 trillion in 2024, highlights the intensity of this competition, with numerous firms vying for market share.

Netcompany's strategy of focusing on specialized platforms and deep industry expertise, especially in public sector and financial services, helps mitigate direct price wars. However, the overall market growth, projected to exceed $2.3 trillion by 2030, attracts new entrants and intensifies competition among existing players. Strategic moves like Netcompany's acquisition of SDC further consolidate the market, forcing competitors to enhance their capabilities or pursue similar consolidation to remain competitive.

| Competitor Type | Market Share Impact | Netcompany's Response |

|---|---|---|

| Global IT Behemoths (e.g., Accenture, IBM) | Significant market presence, broad service offerings | Focus on specialized platforms, niche expertise |

| Niche IT Players | Agile, specialized solutions | Custom software development, tailored digital platforms |

| Consolidated Entities (Post-Merger) | Increased market influence, enhanced capabilities | Strategic acquisitions, capability enhancement |

SSubstitutes Threaten

A significant substitute for Netcompany's offerings is the internal IT department's capacity to handle development and management in-house. Large enterprises, particularly those with substantial budgets and specialized technical teams, might opt to build proprietary software and digital platforms. This is often the case for mission-critical or highly sensitive business operations where complete control is paramount.

For instance, in 2024, many large corporations continued to invest heavily in their internal IT capabilities, seeking to reduce reliance on external vendors for core functionalities. This trend is driven by a desire for greater agility and customization, allowing them to tailor solutions precisely to their unique business needs and maintain tighter control over data security and intellectual property.

Generic off-the-shelf software and SaaS platforms present a viable substitute for Netcompany's custom IT solutions, particularly for common business functions. The growing capabilities of these commercial offerings mean businesses can often achieve their objectives without the expense and time associated with bespoke development. For instance, the global SaaS market was projected to reach over $200 billion in 2024, indicating a strong preference for readily available solutions.

The rise of standardized cloud services from giants like Amazon Web Services (AWS), Microsoft Azure, and Google Cloud presents a significant threat of substitution for Netcompany. These platforms offer readily available Infrastructure as a Service (IaaS), Platform as a Service (PaaS), and Software as a Service (SaaS) solutions that can fulfill many IT infrastructure and outsourcing needs. For instance, in 2024, the global cloud computing market was valued at over $600 billion, demonstrating the sheer scale and accessibility of these alternatives.

Clients, especially those with less complex or non-mission-critical IT requirements, may find these standardized cloud offerings more cost-effective and quicker to implement than bespoke solutions. This can divert potential business away from Netcompany’s core services, as organizations increasingly leverage the scalability and pay-as-you-go models offered by major cloud providers for everything from data storage to application hosting.

Low-Code/No-Code Platforms

The rise of low-code/no-code (LCNC) platforms presents a significant threat of substitutes for traditional custom software development, particularly for less complex business processes. These platforms allow businesses to build applications with minimal or no traditional coding, democratizing software creation. For instance, Gartner predicted that LCNC development would account for over half of new application development by 2024.

This trend means companies might opt for LCNC solutions instead of engaging Netcompany for bespoke development, especially for internal tools or simpler client-facing applications. The accessibility and speed of LCNC can be highly appealing, potentially diverting demand from traditional IT service providers.

- Market Growth: The global low-code development platform market was valued at approximately $21.2 billion in 2023 and is projected to reach $128.2 billion by 2030, showcasing substantial growth.

- Efficiency Gains: LCNC platforms can reduce development time by up to 70% for certain applications compared to traditional coding methods.

- Accessibility: Citizen developers, or business users with little to no coding experience, can now build functional applications, expanding the pool of software creators.

- Cost Reduction: For straightforward application needs, LCNC solutions often offer a more cost-effective alternative to hiring specialized development teams.

Consulting from Management Consultancies

Traditional management consultancies are increasingly encroaching on Netcompany's digital transformation advisory space. Firms like Accenture and Deloitte, which historically focused on strategy, now offer end-to-end digital implementation services. This overlap presents a significant threat, as clients may opt for a single, established management consultancy for both strategic guidance and IT execution.

While these broader consultancies might not directly compete on Netcompany's core IT implementation capabilities, their strategic recommendations can steer clients toward alternative solutions. For instance, a management consultancy advising on cloud migration might suggest a vendor-agnostic approach that bypasses Netcompany's specialized platforms. This indirect influence can divert potential projects, impacting Netcompany's market share.

The threat is amplified by the sheer scale and client relationships these large consultancies possess. For example, in 2024, the global management consulting market was valued at over $300 billion, with digital transformation being a significant growth driver. This vast market presence allows them to influence client decisions across the entire technology lifecycle, making them formidable substitutes.

- Broader Service Offerings: Traditional consultancies offer integrated strategy and implementation, presenting a one-stop shop for clients.

- Client Relationships: Established trust and long-term partnerships with clients give these firms an advantage in influencing technology choices.

- Market Dominance: Their significant market share and resources allow them to capture a larger portion of digital transformation budgets.

- Strategic Influence: Advisory services can guide clients towards alternative IT solutions or in-house development, bypassing specialized implementers like Netcompany.

The threat of substitutes for Netcompany is multifaceted, stemming from in-house IT capabilities, generic software, and broad cloud platforms. Businesses increasingly leverage internal teams for custom solutions, especially for mission-critical operations. In 2024, many large enterprises continued to boost their IT departments, seeking greater control and agility.

Generic off-the-shelf software and readily available SaaS platforms offer cost-effective alternatives for common business functions, diverting demand from bespoke development. The global SaaS market's projected growth to over $200 billion in 2024 highlights this trend. Furthermore, major cloud providers like AWS, Azure, and Google Cloud offer scalable, pay-as-you-go services that fulfill many IT outsourcing needs, with the cloud market exceeding $600 billion in 2024.

Low-code/no-code (LCNC) platforms also pose a significant substitute threat, enabling businesses to build applications with minimal coding. Gartner predicted LCNC development would constitute over half of new application development by 2024, with the market valued at $21.2 billion in 2023. Traditional management consultancies also compete by offering integrated strategy and implementation services, influencing clients towards alternative solutions.

| Substitute Type | Key Characteristics | Market Data (2024/Projections) | Impact on Netcompany |

|---|---|---|---|

| In-house IT Departments | Control, customization, data security | Continued investment in internal IT capabilities by large enterprises | Reduced demand for external custom development |

| Generic Software/SaaS | Cost-effectiveness, speed of deployment for common functions | Global SaaS market projected >$200 billion | Diversion of projects for less complex needs |

| Major Cloud Platforms (AWS, Azure, GCP) | Scalability, pay-as-you-go, broad service offerings (IaaS, PaaS, SaaS) | Global cloud market >$600 billion | Substitution for infrastructure and outsourcing services |

| Low-Code/No-Code (LCNC) Platforms | Accessibility, rapid development for simpler applications | LCNC market projected $128.2 billion by 2030 (from $21.2 billion in 2023) | Potential bypass of traditional custom development for internal tools |

| Management Consultancies | Integrated strategy and implementation, client relationships | Global management consulting market >$300 billion | Indirect influence on technology choices, steering clients to alternatives |

Entrants Threaten

New companies entering the IT services market, especially for complex solutions, face a significant hurdle due to the high capital needed. This investment is essential for acquiring top talent, building robust technological infrastructure, and establishing a strong market presence through sales and marketing. Netcompany, for instance, had over 8,150 employees as of Q1 2025, highlighting the human capital investment required in this sector.

Netcompany's formidable brand reputation and deeply ingrained client trust present a significant barrier to new entrants. Years of successful delivery on complex IT projects, particularly within the public and financial sectors, have cemented its position. For instance, Netcompany's extensive work with the Danish government, including digital transformation initiatives, highlights the trust placed in their capabilities. Newcomers would find it exceptionally challenging to replicate this level of credibility and a proven track record, especially when bidding for high-stakes, mission-critical engagements.

The IT services sector, where Netcompany operates, heavily relies on individuals with specific skills in areas like coding, cybersecurity, and cloud computing. New companies entering this market would find it tough to attract and keep the skilled people needed to go head-to-head with established firms.

Netcompany itself saw its workforce grow by 342 full-time equivalents (FTEs) in the first quarter of 2025, reaching a total of 8,150 FTEs. This expansion from 7,808 FTEs in the same period of 2024 highlights the importance of a robust talent pool for growth and competitiveness.

Regulatory and Compliance Hurdles

For companies like Netcompany, which heavily serves the public sector and financial services, regulatory and compliance hurdles present a significant barrier to new entrants. These sectors demand IT solutions that meet rigorous standards, often involving data privacy, security, and specific industry regulations. Navigating this complex web can be a substantial investment in time and resources for newcomers.

For instance, in 2024, the European Union's General Data Protection Regulation (GDPR) continues to shape data handling practices across all sectors, requiring significant compliance efforts. Similarly, financial services firms must adhere to evolving regulations like MiFID II and PSD2, which dictate how financial data is managed and transactions are processed. New entrants must demonstrate a deep understanding and robust implementation of these frameworks from the outset.

- High Compliance Costs: New entrants face substantial upfront costs to understand, implement, and maintain compliance with sector-specific regulations.

- Data Security and Privacy Demands: Meeting stringent data protection requirements, such as those mandated by GDPR, requires significant investment in secure infrastructure and processes.

- Industry-Specific Certifications: Many public sector and financial clients require IT providers to hold specific certifications, which can be time-consuming and costly to obtain.

Network Effects and Ecosystem Lock-in

While not as pronounced as in pure platform businesses, Netcompany benefits from a degree of ecosystem lock-in due to its deep client relationships and extensive experience, particularly within the public sector. New entrants face significant hurdles in replicating this established network and integrating with existing client systems, which often have long-term, recurring contracts. For instance, Netcompany's strong presence in the Danish public sector, with a significant portion of its revenue derived from such contracts, highlights this barrier.

New competitors would struggle to displace Netcompany's established position, which is reinforced by the complexity and integration requirements of its solutions. Overcoming the inertia and trust built over years of successful project delivery is a formidable challenge for any new entrant aiming to capture market share in Netcompany's core areas.

- Ecosystem Lock-in: Netcompany's deep integration with public sector IT infrastructure and long-standing client relationships create a significant barrier to entry.

- Client Inertia: The cost and complexity of switching IT providers for public sector entities are substantial, favoring incumbent solutions.

- Recurring Revenue Streams: Netcompany's reliance on recurring revenue from public sector contracts, a model that provides stability, makes it difficult for new players to gain immediate traction.

The threat of new entrants for Netcompany is generally low, primarily due to the substantial capital investment required for talent acquisition, technology infrastructure, and market development. For instance, Netcompany's workforce exceeded 8,150 employees by Q1 2025, underscoring the human capital demands. Furthermore, the IT services sector necessitates specialized skills, making it difficult for newcomers to attract and retain the necessary expertise to compete effectively against established players.

| Factor | Impact on New Entrants | Netcompany's Position |

|---|---|---|

| Capital Requirements | High investment needed for talent, tech, and market presence. | Established infrastructure and significant human capital. |

| Brand Reputation & Trust | Difficult to replicate years of successful project delivery. | Strong credibility, especially in public and financial sectors. |

| Skilled Workforce | Challenging to attract and retain specialized IT talent. | Large and growing employee base (342 FTEs added in Q1 2025). |

| Regulatory Compliance | Complex and costly to meet sector-specific standards (e.g., GDPR, MiFID II). | Proven track record of navigating regulatory landscapes. |

| Ecosystem Lock-in | Difficult to integrate with existing systems and client networks. | Deep public sector integration and long-term client relationships. |

Porter's Five Forces Analysis Data Sources

Our Porter's Five Forces analysis leverages a robust combination of primary research, including direct interviews with industry experts and customer surveys, alongside secondary data from market research reports, financial statements, and government databases to provide a comprehensive view of competitive forces.