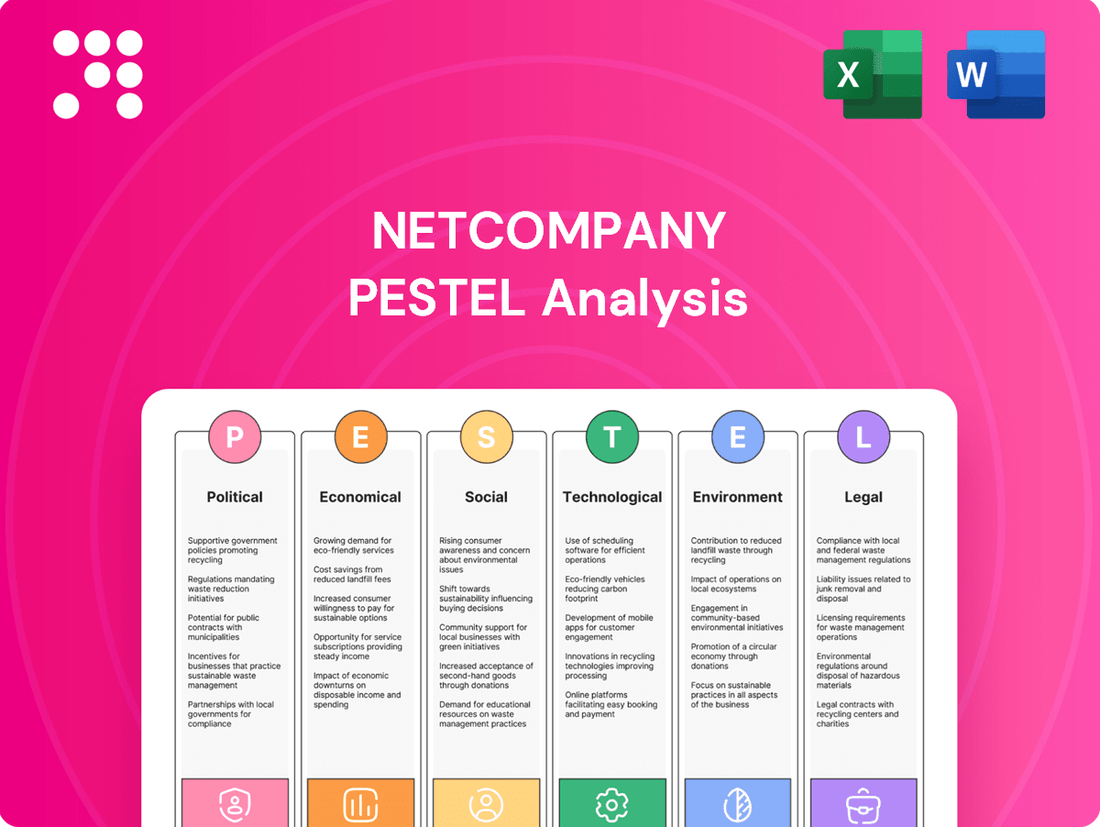

Netcompany PESTLE Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Netcompany Bundle

Navigate the complex external forces impacting Netcompany with our meticulously crafted PESTLE analysis. Understand how political stability, economic fluctuations, and technological advancements are shaping its operational landscape and future growth. Download the full version now and equip yourself with the strategic foresight needed to thrive in this dynamic market.

Political factors

Governments in Europe are actively pushing digital transformation to enhance public services and operational efficiency. This trend directly benefits Netcompany, which has a substantial presence in the public sector, leading to substantial contract wins for essential IT solutions. For instance, in 2023, Netcompany secured a significant contract with the Danish Medicines Agency for a new IT system, valued at approximately DKK 300 million. The ongoing emphasis on e-government, digital identity frameworks, and more streamlined public administration creates a consistent and robust demand for Netcompany's specialized offerings.

The regulatory environment for IT service providers like Netcompany is constantly shifting, with a strong emphasis on data privacy and cybersecurity. Regulations such as the General Data Protection Regulation (GDPR) in Europe and the Digital Operational Resilience Act (DORA), which came into full effect in January 2025, impose strict requirements on how data is handled and secured. These frameworks necessitate robust compliance measures, directly influencing Netcompany's service offerings and operational strategies.

Navigating these complex legal landscapes is crucial for Netcompany's continued success. For instance, DORA mandates specific resilience requirements for critical third-party IT service providers to the financial sector, impacting how services are designed and delivered. Failure to comply can result in significant penalties, but it also creates opportunities for Netcompany to offer specialized compliance and security consulting services, leveraging its expertise to help clients meet these demanding standards.

Geopolitical stability significantly impacts government spending, a key driver for IT solutions like those Netcompany provides. Uncertainty can lead to cautious fiscal policies, potentially slowing down IT investment by public sector clients. For instance, ongoing global tensions in 2024 and projected into 2025 could influence budget allocations for digital transformation projects.

Netcompany's 2025 guidance reflects this awareness, noting persistent macro and geopolitical uncertainties. Despite this, the company expresses confidence in its growth trajectory, indicating that its focus on essential digital services for governments provides a degree of resilience against broader geopolitical headwinds. This suggests that demand for Netcompany's core offerings remains robust even amidst external volatility.

Public Sector Spending Trends

Public sector spending on IT, particularly through framework agreements and major projects, directly influences Netcompany's revenue streams. The Danish government's commitment to digital transformation is evident in increased tender activity within its public segment. This trend is further supported by Netcompany's successful bids for substantial contracts, such as those with HMRC in the UK and the Danish Business Authorities, underscoring ongoing government investment in digital infrastructure.

Key trends impacting Netcompany's public sector business include:

- Increased Government IT Budgets: Many governments are prioritizing digital modernization, leading to higher IT spending. For instance, the UK government's digital spending was projected to reach £10.1 billion in 2024, a notable increase from previous years.

- Focus on Cloud and Digital Transformation: Public sector entities are increasingly adopting cloud-based solutions and undertaking large-scale digital transformation projects, creating opportunities for companies like Netcompany.

- Framework Agreements: The use of framework agreements streamlines procurement for public bodies, often leading to longer-term, larger contracts for successful suppliers.

Government Procurement Policies

Changes in government procurement policies, such as increased scrutiny on subcontracting or a push for greater transparency, can significantly impact how IT service companies like Netcompany win and manage public sector contracts. For instance, in the UK, the government's focus on fair payment practices within supply chains, reinforced by the Prompt Payment Code, means companies must demonstrate robust management of their subcontractors to secure and maintain public sector agreements. This increased oversight necessitates a proactive approach to compliance and reporting.

Netcompany's success in the public sector hinges on its agility in adapting to evolving government procurement regulations. A notable trend is the emphasis on value for money and social value, requiring companies to demonstrate not only technical capability but also positive societal impact. For example, many government tenders now include criteria related to carbon reduction targets or local employment, influencing how bids are structured and evaluated. Netcompany's ability to align its service delivery with these broader government objectives is therefore paramount for sustained growth in this vital market segment.

- Increased Scrutiny on Subcontracting: Governments are increasingly examining how prime contractors manage their supply chains, leading to stricter requirements for subcontractor vetting and payment terms.

- Push for Transparency: Policies promoting open government and data sharing can affect how IT service providers disclose their operational details and contract performance.

- Focus on Value and Social Impact: Procurement frameworks are evolving to incorporate non-financial metrics, such as environmental sustainability and community benefits, which Netcompany must address.

- Digital Frameworks and Framework Agreements: The use of centralized digital procurement platforms and framework agreements by governments, such as the UK's Government Digital Service (GDS) standards, dictates the process for bidding on public IT projects.

Government initiatives promoting digital transformation are a primary driver for Netcompany, especially in the public sector where significant IT modernization is underway. For instance, the UK government's digital spending was projected to reach £10.1 billion in 2024, illustrating the scale of investment. This focus on e-government and cloud adoption creates a strong, consistent demand for Netcompany's specialized IT solutions, underpinning its revenue growth.

Regulatory changes, particularly concerning data privacy and cybersecurity, directly shape Netcompany's operational strategies and service offerings. The implementation of DORA in January 2025, for example, mandates stringent resilience requirements for IT providers serving the financial sector, presenting both compliance challenges and opportunities for specialized consulting services.

Geopolitical stability influences government IT spending, with ongoing global tensions in 2024 potentially impacting budget allocations for digital transformation projects. Despite these macro uncertainties, Netcompany's focus on essential government services provides a degree of resilience, as highlighted by its 2025 guidance.

| Factor | Impact on Netcompany | Supporting Data/Trend (2024-2025) |

|---|---|---|

| Digital Transformation Push | Increased demand for IT solutions in public sector | UK Gov Digital Spending projected at £10.1bn (2024) |

| Regulatory Environment | Need for robust data privacy & cybersecurity compliance | DORA effective Jan 2025, impacting financial sector IT |

| Geopolitical Uncertainty | Potential impact on government IT budget allocation | Ongoing global tensions influencing fiscal policies |

What is included in the product

The Netcompany PESTLE analysis provides a comprehensive examination of the external macro-environmental factors influencing the company's operations across Political, Economic, Social, Technological, Environmental, and Legal dimensions.

This detailed evaluation is designed to equip stakeholders with actionable insights, highlighting both potential threats and emerging opportunities within Netcompany's operating landscape.

Provides a concise version that can be dropped into PowerPoints or used in group planning sessions, making complex PESTLE insights readily actionable.

Economic factors

Global and regional economic expansion is a key driver for IT spending across both public and private sectors, directly impacting companies like Netcompany. Strong economic performance generally translates to increased investment in digital transformation and IT solutions.

Despite a backdrop of economic uncertainty in 2024, Netcompany demonstrated resilience, achieving continued growth. This suggests that demand for their specialized IT services remained robust even amidst broader economic headwinds.

Looking ahead to 2025, Netcompany projects revenue growth in the range of 5% to 10%. This forecast reflects a cautiously optimistic economic outlook, anticipating a stable to moderately growing market for IT services.

Inflationary pressures in 2024 and into 2025 pose a significant challenge for Netcompany, potentially increasing operational costs such as employee salaries and expenses related to suppliers. The company's strategic focus on margin improvement and operational efficiency, highlighted in its 2024 performance, is crucial for mitigating these impacts and maintaining profitability.

Fluctuations in interest rates directly impact Netcompany's cost of borrowing and the willingness of its clients to invest in new projects. For instance, if central banks raise benchmark rates, the cost of servicing existing debt and securing new financing increases, potentially squeezing profit margins or delaying strategic investments. This is particularly relevant as Netcompany's recent acquisition of SDC was financed via existing credit facilities, underscoring the reliance on accessible and affordable capital.

The company's financial strategy, as demonstrated by the SDC acquisition, relies on maintaining a healthy debt leverage and benefiting from favorable financing conditions. In 2024, the European Central Bank's monetary policy, including its interest rate decisions, will be a key determinant of Netcompany's capital costs. A stable or declining interest rate environment would support continued investment and growth, while rising rates could necessitate a more cautious approach to leveraging debt for expansion.

Industry-Specific Market Growth

The IT services market, particularly within financial services and digital transformation, offers substantial growth avenues. Netcompany's strategic acquisition of SDC is designed to bolster its presence in the Nordic financial services sector, a market anticipated to surpass DKK 44 billion by 2025, exhibiting an annual growth rate exceeding 10%.

This expansion into a high-growth segment is crucial for Netcompany's continued market penetration and revenue generation.

Key growth drivers include the increasing demand for cloud migration, cybersecurity solutions, and data analytics within financial institutions.

- Nordic financial services market projected to exceed DKK 44 billion in 2025.

- Anticipated annual growth rate for this sector is over 10%.

- Netcompany's SDC acquisition targets strengthening its position in this lucrative market.

- Digital transformation initiatives are a primary catalyst for IT services demand.

Currency Exchange Rate Fluctuations

Currency exchange rate fluctuations present a significant factor for Netcompany, an international firm with operations across various nations. Changes in exchange rates can impact reported revenue, making it harder to gauge the true growth of its core business.

To address this, Netcompany often reports its financial results using constant currencies. This method adjusts for currency variations, providing a more transparent view of underlying operational performance. For instance, in their 2023 annual report, Netcompany highlighted that reported revenue growth was influenced by currency movements, but their constant currency growth offered a clearer perspective on organic expansion.

- International Exposure: Netcompany's global presence means its financial results are inherently sensitive to currency volatility.

- Constant Currency Reporting: The company utilizes constant currency figures to present a more accurate picture of its underlying business performance, stripping out the effects of exchange rate movements.

- Impact on Revenue: Fluctuations can either boost or diminish reported revenue, depending on the strength of the Danish Krone against other operating currencies.

- Strategic Hedging: While not always detailed publicly, companies like Netcompany may employ hedging strategies to mitigate some of the financial risks associated with currency fluctuations.

Economic growth fuels IT investment, and Netcompany's projected 5% to 10% revenue growth for 2025 indicates a positive, albeit cautious, outlook for the IT services market. However, persistent inflation in 2024 and 2025 presents a challenge, potentially increasing operational costs for Netcompany. Interest rate decisions by central banks, like the European Central Bank, will also influence Netcompany's borrowing costs and client investment capacity, especially after its SDC acquisition was financed through credit facilities.

| Economic Factor | 2024 Impact | 2025 Outlook | Netcompany Relevance | Data Point |

| Economic Growth | Resilient despite uncertainty | Projected 5-10% revenue growth | Drives IT spending and demand for services | Nordic financial services market > DKK 44 billion by 2025 |

| Inflation | Increased operational costs | Continued pressure on margins | Requires focus on efficiency and margin improvement | N/A (General economic trend) |

| Interest Rates | Impact on borrowing costs | Influences client investment decisions | Affects cost of capital for acquisitions and operations | ECB monetary policy key for capital costs |

Same Document Delivered

Netcompany PESTLE Analysis

The preview shown here is the exact document you’ll receive after purchase—fully formatted and ready to use. This comprehensive Netcompany PESTLE analysis covers all critical external factors impacting the company's strategic decisions. You'll gain valuable insights into Political, Economic, Social, Technological, Legal, and Environmental influences.

Sociological factors

The availability of skilled IT professionals is a significant hurdle for Netcompany, as its business model depends on a substantial, highly capable workforce to deliver intricate IT solutions. The ongoing digital skills gap means competition for talent is fierce, directly impacting Netcompany's ability to scale and innovate.

Netcompany's proactive approach to talent acquisition and retention, which includes robust formal training programs, hands-on on-the-job experience, and collaborative peer-to-peer mentoring, is essential for bridging this gap. For instance, in 2024, the company continued to invest heavily in its employee development, aiming to equip its staff with the cutting-edge competencies demanded by the evolving tech landscape.

The ongoing shift towards flexible work, including remote and hybrid models, significantly impacts how companies like Netcompany organize their operations and client engagements. A 2024 study indicated that over 60% of knowledge workers prefer hybrid arrangements, a trend Netcompany is navigating.

While adopting these flexible models, Netcompany acknowledges the continued value of its physical office spaces. These environments are crucial for fostering internal learning, professional development, and spontaneous collaboration, which are key to innovation and team cohesion.

Public trust is a cornerstone for Netcompany's success, particularly as it digitizes critical public sector services. A 2024 survey by the European Digital Trust Observatory found that 65% of citizens consider data privacy a top concern when engaging with government digital platforms, highlighting the immediate need for strong security and transparent data handling practices.

Negative incidents, such as the 2023 data breach affecting a major European city's digital services (though not directly linked to Netcompany, it impacted general public perception), underscore the reputational risks. Such events can erode confidence, making ongoing investment in advanced cybersecurity and clear communication about data protection absolutely essential for maintaining public acceptance.

Societal Demand for Digital Services

Societies are increasingly expecting seamless and efficient digital experiences across all aspects of life, from healthcare to education and government services. This growing demand directly fuels the need for sophisticated IT solutions that can power these transformations. Netcompany is well-positioned to capitalize on this trend by developing and implementing digital platforms that meet these evolving societal expectations.

For instance, the push for digital public administration is significant. In Denmark, where Netcompany has a strong presence, the government's commitment to digitalization has been a key driver. By 2023, over 90% of citizen interactions with public authorities were expected to be digital, highlighting the critical role of companies like Netcompany in building these essential infrastructures.

This societal shift also impacts other sectors:

- E-health: The demand for accessible online health portals and digital patient records is surging, with projections indicating continued growth in digital health spending throughout 2024 and 2025.

- Online Education: The adoption of digital learning platforms and remote education tools has accelerated, with a significant portion of students now engaging with educational content online.

- Digital Public Administration: Governments worldwide are investing heavily in digitalizing services to improve efficiency and citizen engagement, creating substantial opportunities for IT providers.

Ethical Considerations in AI and Technology Adoption

As artificial intelligence becomes more integrated into business operations, ethical considerations surrounding its responsible deployment, potential biases, and broader societal impact are increasingly critical. Netcompany's proactive engagement in developing a shared roadmap for responsible AI use underscores a commitment to addressing these evolving societal expectations.

This focus on ethical AI is not merely a compliance issue but a strategic imperative. For instance, a 2024 report by the World Economic Forum highlighted that 60% of organizations surveyed believe ethical AI practices are crucial for maintaining customer trust and brand reputation. Netcompany's efforts align with this trend, aiming to build confidence in their technological solutions.

- Responsible AI Frameworks: Netcompany's participation in industry-wide initiatives to define ethical guidelines for AI development and deployment.

- Bias Mitigation: Strategies to identify and address potential biases within AI algorithms, ensuring fairness and equity in their applications.

- Societal Impact Assessment: Evaluating the broader consequences of AI adoption on employment, privacy, and social structures.

- Transparency and Accountability: Establishing clear lines of responsibility and promoting transparency in how AI systems operate.

Societal expectations for seamless digital experiences are driving demand for Netcompany's IT solutions, particularly in public administration. For example, Denmark aimed for over 90% of citizen interactions with authorities to be digital by 2023, showcasing the need for robust digital infrastructure.

The increasing focus on digital public services, e-health, and online education creates significant opportunities for Netcompany. Projections for 2024 and 2025 indicate continued growth in digital health spending, reinforcing the market's trajectory.

Public trust is paramount, especially with government digitalization. A 2024 survey revealed that 65% of citizens consider data privacy a top concern for digital government platforms, emphasizing Netcompany's need for strong cybersecurity and transparent data handling.

Ethical AI is a growing societal concern, with 60% of organizations in a 2024 World Economic Forum report deeming ethical AI crucial for customer trust. Netcompany's proactive approach to responsible AI development and bias mitigation aligns with these evolving expectations.

Technological factors

The IT services sector is undergoing a significant shift driven by the rapid evolution and integration of artificial intelligence and machine learning. Netcompany is actively participating in this transformation, notably with the introduction of Feniks AI. This AI-powered solution is designed to streamline the complex process of legacy system modernization, promising substantial reductions in IT expenditure and faster project timelines for its clients.

The relentless move to cloud computing and the imperative to update outdated IT systems are significant drivers for Netcompany. These trends directly fuel the demand for their expertise in migrating existing systems to cloud environments and building new, adaptable platforms.

This aligns perfectly with broader industry spending patterns, as organizations increasingly invest in robust cloud infrastructure. For instance, global public cloud spending was projected to reach over $600 billion in 2024, a figure expected to continue its upward trajectory.

The escalating complexity of cyber threats, from ransomware to sophisticated phishing attacks, directly fuels a persistent need for advanced cybersecurity solutions. This trend translates into continuous demand for specialized IT security services, a market segment where Netcompany operates.

Netcompany must prioritize the ongoing enhancement of its security product portfolio and rigorously fortify its internal systems against potential breaches. This imperative is underscored by the increasing frequency of data theft incidents globally and the intensifying regulatory oversight, such as GDPR, which imposes significant penalties for non-compliance.

For instance, in 2024, the average cost of a data breach reached $4.73 million, a 15% increase over two years, according to IBM's Cost of a Data Breach Report. This highlights the substantial financial and reputational risks associated with inadequate cybersecurity, a direct challenge and opportunity for Netcompany.

Digital Platform Development and Integration

Netcompany's core strength lies in its sophisticated digital platform development and integration capabilities. Their expertise in crafting custom software, exemplified by platforms like AMPLIO, AMI, and PULSE, allows them to deliver highly adaptable and future-proof solutions. This technological prowess is central to their business model, enabling them to meet the complex and evolving needs of a wide range of clients.

The company's investment in and development of proprietary platforms signifies a strategic focus on building scalable and integrated digital ecosystems. For instance, AMPLIO is designed to streamline public sector operations, enhancing efficiency and citizen engagement. This commitment to in-house technology development positions Netcompany to offer end-to-end digital transformation services, a critical factor in today's increasingly digitized business landscape.

In 2023, Netcompany reported significant growth, with revenue reaching DKK 10,704 million, up 12% compared to 2022. This financial performance underscores the market's demand for their advanced digital solutions. The company's ability to continuously innovate and integrate new technologies into their platforms is a key driver of this sustained success.

Key technological factors influencing Netcompany include:

- Platform Adaptability: Netcompany's platforms are built for flexibility, allowing customization for various client needs, from public administration to private sector digital transformation.

- Integration Expertise: A core competency is the seamless integration of new and existing systems, ensuring clients can leverage their digital investments effectively.

- Proprietary Technology: Development of in-house platforms like AMPLIO and AMI provides a competitive edge, offering unique functionalities and control over the technology stack.

- Future-Proofing: The emphasis on creating scalable and adaptable solutions ensures clients remain competitive in a rapidly changing technological environment.

Automation and Low-Code/No-Code Platforms

The growing adoption of automation and the emergence of low-code/no-code (LCNC) platforms are significantly reshaping how IT services are delivered. These advancements enable faster development cycles and can streamline operations, directly impacting traditional IT service models.

Netcompany's strategic direction likely includes integrating automation to boost the efficiency of its service offerings. Furthermore, the company may leverage LCNC platforms to expedite the development of client solutions, offering quicker time-to-market and potentially reducing project costs.

- Automation Efficiency: Gartner projected that by 2024, 70% of new applications developed by organizations would use low-code or no-code technologies.

- LCNC Adoption: The low-code development platform market was valued at approximately $11.8 billion in 2022 and is expected to grow substantially, reaching an estimated $35.7 billion by 2028, according to Mordor Intelligence.

- Netcompany's Approach: Netcompany's focus on delivering efficient and modern digital solutions aligns with the capabilities offered by automation and LCNC, enabling them to adapt to evolving client demands for speed and agility.

Technological advancements, particularly in AI and cloud computing, are reshaping the IT services landscape, creating significant opportunities for Netcompany. The company's focus on proprietary platforms like AMPLIO and AMI positions it to capitalize on the demand for efficient, adaptable digital solutions.

The increasing adoption of automation and low-code/no-code (LCNC) platforms, with LCNC expected to grow substantially in market value, presents a clear path for Netcompany to enhance development speed and efficiency. This strategic alignment with industry trends supports their ability to deliver agile solutions to clients.

Netcompany's commitment to platform adaptability and integration expertise ensures clients can leverage their digital investments effectively, while their proprietary technology offers a distinct competitive advantage. This focus on future-proofing solutions is crucial in a rapidly evolving digital environment.

The company's 2023 revenue growth of 12% to DKK 10,704 million demonstrates strong market demand for their advanced digital transformation services, fueled by continuous technological innovation.

Legal factors

Data protection regulations, such as the General Data Protection Regulation (GDPR), significantly shape Netcompany's business by dictating how it handles sensitive customer and citizen data. Adherence to these stringent rules is critical, as breaches can result in substantial financial penalties and damage to the company's reputation. For instance, the GDPR, implemented in 2018, can levy fines up to 4% of global annual turnover or €20 million, whichever is higher, emphasizing the financial risk associated with non-compliance.

Netcompany's core operations are built upon a foundation of robust contract management, particularly within the public sector. In 2024, the company continued to navigate intricate contract law, ensuring compliance with regulations governing its extensive project portfolio. This focus is essential for maintaining client trust and operational integrity.

Public procurement rules present a dynamic landscape, with varying requirements across jurisdictions. For instance, in Denmark, Netcompany's home market, public tenders often involve detailed specifications and strict evaluation criteria. Failure to adhere to these can lead to disqualification or legal challenges, impacting project pipelines.

The complexity of these legal frameworks necessitates significant investment in legal expertise and compliance systems. In 2024, Netcompany's commitment to these areas aimed to mitigate risks associated with contract disputes and ensure smooth project delivery, a critical factor for its financial performance.

Netcompany's competitive edge hinges on protecting its intellectual property, such as its custom software and proprietary platforms. This necessitates robust legal strategies to safeguard innovations, especially when engaging in collaborations or acquisitions.

Navigating the complex landscape of intellectual property law is crucial for Netcompany. For instance, in 2024, the company continued to invest in securing patents for its unique software solutions, a common practice in the tech sector where IP protection directly impacts market valuation and licensing opportunities.

Competition Law and Mergers & Acquisitions

Netcompany's growth strategy, heavily reliant on mergers and acquisitions, necessitates careful adherence to competition laws. For instance, their 2021 acquisition of SDC, a significant player in the Danish IT sector, required approval from competition authorities to ensure market fairness and prevent undue concentration of power. This process involves detailed scrutiny of market share and potential impacts on consumer choice and pricing.

Regulatory bodies worldwide, including the European Commission and national antitrust agencies, actively monitor M&A activity within the IT and software sectors. These authorities assess whether proposed transactions could substantially lessen competition or lead to monopolistic practices. Failure to comply can result in hefty fines and divestiture orders, impacting Netcompany's strategic flexibility and financial performance.

- Merger Control: Netcompany must secure clearance from relevant competition authorities for acquisitions exceeding certain thresholds, as seen in the SDC deal which involved significant regulatory review.

- Antitrust Scrutiny: Post-acquisition integration must also consider ongoing antitrust compliance to avoid practices that could be deemed anti-competitive.

- Market Dominance: The company's increasing market share in specific IT segments, particularly within public sector digitalization in Northern Europe, attracts closer regulatory attention.

- International Regulations: As Netcompany expands geographically, it must navigate a complex web of differing competition laws in each jurisdiction it operates in.

Industry-Specific Regulations (e.g., Financial Services)

Netcompany's strategic move into financial services, notably with its acquisition of SDC, means it must navigate a complex web of industry-specific regulations. A prime example is the Digital Operational Resilience Act (DORA), which mandates robust cybersecurity and IT risk management frameworks for financial entities operating within the EU. Failure to adhere to such stringent requirements can lead to significant penalties and reputational damage.

Compliance with these sector-specific laws is not merely a legal obligation but a critical enabler for Netcompany's success in the financial services vertical. For instance, DORA, which became fully applicable in January 2025, imposes strict requirements on third-party IT providers like Netcompany, impacting how they manage digital operational risks for their financial clients. This includes comprehensive risk assessments, incident reporting, and testing of resilience capabilities.

- DORA Compliance: Netcompany must ensure its IT solutions and services meet the stringent operational resilience standards set by DORA for its financial sector clients.

- Data Protection & Security: Adherence to financial data privacy laws, such as GDPR, is paramount, especially given the sensitive nature of data handled in the financial services industry.

- Regulatory Reporting: The company may face increased demands for regulatory reporting on its IT infrastructure and operational performance from financial authorities.

- Cross-Border Operations: Navigating varying financial regulations across different jurisdictions where Netcompany operates or plans to expand is essential for seamless service delivery.

Netcompany's operations are heavily influenced by data protection laws, with GDPR fines potentially reaching 4% of global annual turnover or €20 million. The company's reliance on public sector contracts means navigating complex public procurement rules, which vary significantly by country, impacting its project acquisition process. Intellectual property law is also critical, as Netcompany invests in patenting its unique software solutions to maintain its market edge.

In 2024, Netcompany's growth through acquisitions, such as the 2021 SDC deal, subjected it to merger control regulations, requiring scrutiny from competition authorities to prevent market monopolization. Furthermore, its expansion into financial services necessitates adherence to sector-specific regulations like DORA, which mandates robust IT risk management for EU financial entities, applicable from January 2025.

| Legal Factor | Impact on Netcompany | Example/Data Point |

| Data Protection (GDPR) | Compliance is mandatory; non-compliance incurs severe financial penalties. | Fines up to 4% of global annual turnover or €20 million. |

| Public Procurement | Strict adherence to tender rules is vital for winning public sector contracts. | Detailed specifications and evaluation criteria in Danish tenders. |

| Intellectual Property | Protection of software innovations is key to competitive advantage. | Investment in patenting unique software solutions in 2024. |

| Merger Control | Acquisitions require regulatory approval to ensure fair market competition. | 2021 SDC acquisition underwent significant regulatory review. |

| Financial Sector Regulations (DORA) | IT providers must meet stringent operational resilience for financial clients. | DORA fully applicable from January 2025, impacting IT risk management. |

Environmental factors

Netcompany is increasingly subject to stringent sustainability and ESG reporting requirements. This growing emphasis means the company must provide transparent data on its environmental, social, and governance performance to meet stakeholder expectations and regulatory demands.

The company actively publishes annual sustainability reports, demonstrating its commitment to environmental stewardship. Netcompany's stated aim to align with EU Green Deal regulations highlights a proactive approach to integrating sustainability into its core operations and future strategy, anticipating evolving environmental standards.

The substantial energy demands of IT infrastructure, particularly data centers, are a significant contributor to global carbon emissions. In 2024, data centers alone were projected to consume around 1.4% of global electricity, with this figure expected to rise. This highlights a critical environmental challenge for all technology companies.

As an IT services provider, Netcompany must address the environmental footprint of its own operations and the technologies it implements for clients. This includes evaluating the energy efficiency of cloud services, software development, and hardware deployment. There's a growing market opportunity for Netcompany to offer and champion more energy-efficient IT solutions, aligning with sustainability goals and client demands.

Clients, especially within the public sector, are increasingly making 'green IT' and sustainable digital solutions a key part of their purchasing decisions. This shift means that companies like Netcompany need to demonstrate a strong commitment to environmental responsibility in their offerings.

For Netcompany, the capacity to deliver environmentally sound solutions acts as a significant competitive advantage. For instance, in 2024, a significant portion of government tenders across Europe, including those in Netcompany's operating regions, began incorporating specific sustainability criteria, with some studies suggesting over 30% of public procurement now includes environmental considerations.

Waste Management of Electronic Equipment

The lifecycle of IT equipment, from its creation to its eventual retirement, inevitably results in electronic waste, often referred to as e-waste. This is a significant environmental concern globally. For a company like Netcompany, which relies heavily on IT infrastructure, managing this waste responsibly is crucial. While Netcompany isn't a primary manufacturer of hardware, its procurement and use of IT equipment mean it plays a role in the e-waste stream.

Implementing robust waste management practices, such as prioritizing recycling and refurbishment of IT assets, directly impacts Netcompany's environmental footprint. These actions align with growing corporate social responsibility expectations and can mitigate potential regulatory risks associated with improper disposal. For instance, the European Environment Agency reported that in 2020, the EU generated 1.3 million tonnes of e-waste from IT and telecommunications equipment alone.

- E-waste Generation: The constant refresh cycle of IT hardware creates a substantial volume of electronic waste.

- Netcompany's Role: As a significant user of IT equipment, Netcompany's disposal practices contribute to its overall environmental impact.

- Responsible Practices: Recycling and refurbishment are key strategies for minimizing the negative environmental consequences of IT equipment disposal.

- Regulatory Landscape: Stricter regulations on e-waste management are being implemented across various jurisdictions, making compliance essential.

Climate Change Adaptation and Resilience

Climate change, while not a primary driver for IT services, presents indirect risks that demand robust adaptation and resilience strategies. Extreme weather events, such as increased frequency of floods or heatwaves, could impact the physical infrastructure underpinning IT operations, including data centers. Netcompany must integrate climate risk assessments into its business continuity and disaster recovery planning to ensure uninterrupted service delivery.

The IT sector's reliance on energy-intensive data centers makes it susceptible to climate-related policy changes and the transition to renewable energy sources. For instance, in 2023, the European Union continued to push for increased energy efficiency in data centers, with regulations like the Data Act aiming to foster a more sustainable digital economy. Netcompany's commitment to sustainability, including its energy sourcing and cooling technologies, will be crucial for maintaining operational resilience and stakeholder trust.

- Data Center Energy Consumption: Global data center energy consumption was estimated to be around 200-300 terawatt-hours (TWh) annually in recent years, highlighting the significant energy footprint.

- Renewable Energy Targets: Many European nations, where Netcompany operates, have set ambitious renewable energy targets, influencing the cost and availability of power for IT infrastructure.

- Climate Resilience Investments: Companies are increasingly investing in climate resilience, with global spending on adaptation measures projected to rise significantly in the coming decade.

Netcompany faces increasing pressure to adopt sustainable IT practices, driven by evolving regulations and client demand for 'green IT' solutions. The company's proactive stance, demonstrated by its sustainability reports and alignment with initiatives like the EU Green Deal, positions it to capitalize on this trend.

The significant energy consumption of data centers, a core component of IT services, presents a substantial environmental challenge. In 2024, data centers were projected to consume about 1.4% of global electricity, underscoring the need for energy-efficient solutions that Netcompany can provide.

Managing electronic waste (e-waste) is another critical environmental factor. The EU generated 1.3 million tonnes of e-waste from IT and telecommunications equipment in 2020 alone, highlighting the importance of Netcompany's responsible disposal and refurbishment practices.

Climate change poses indirect risks to IT infrastructure, necessitating robust business continuity plans. Furthermore, the IT sector's reliance on energy makes it sensitive to climate policies and the transition to renewables, with many European countries setting ambitious green energy targets.

| Environmental Factor | Impact on Netcompany | Data/Trend |

|---|---|---|

| Sustainability Reporting & ESG | Increased stakeholder and regulatory scrutiny; competitive advantage in public tenders. | Over 30% of public procurement in some European regions now includes environmental considerations (2024). |

| Data Center Energy Consumption | High energy demand contributes to carbon footprint; need for energy-efficient solutions. | Data centers projected to consume ~1.4% of global electricity (2024). |

| E-waste Management | Responsibility for IT equipment lifecycle; need for recycling and refurbishment. | EU generated 1.3 million tonnes of IT e-waste (2020). |

| Climate Change & Renewables | Risk to physical infrastructure; adaptation to energy policies and renewable energy sources. | EU pushing for increased data center energy efficiency (e.g., Data Act, 2023). |

PESTLE Analysis Data Sources

Our PESTLE Analysis for Netcompany is built on a robust foundation of data from reputable sources, including official government publications, leading economic indicators, and respected technology research firms. We meticulously gather insights on political stability, economic trends, societal shifts, technological advancements, environmental regulations, and legal frameworks to provide a comprehensive view.