NetApp SWOT Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

NetApp Bundle

NetApp's robust cloud data services and hybrid cloud strategy represent significant strengths, but potential weaknesses in market share concentration and evolving competitive landscapes warrant closer examination. Understanding these dynamics is crucial for navigating the future of data management.

Want the full story behind NetApp’s strengths, risks, and growth drivers? Purchase the complete SWOT analysis to gain access to a professionally written, fully editable report designed to support planning, pitches, and research.

Strengths

NetApp's unified data management platform is a significant strength, offering a single pane of glass for data across hybrid and multi-cloud setups. This integration, powered by its ONTAP software, ensures consistent data operations whether data resides on-premises or in major public clouds like AWS, Azure, and Google Cloud. This simplifies complex IT environments and allows businesses to efficiently leverage their data for critical workloads, including the growing demands of AI.

NetApp holds a commanding position in the all-flash array (AFA) market, a testament to its strategic product development. The company's AFA annualized revenue run rate hit $3.6 billion by Q4 FY24, reflecting a robust 17% year-over-year growth.

This impressive expansion is fueled by the successful launch of more accessible AFA offerings, such as the AFF C-Series and ASA series, which have surpassed sales forecasts. The growing importance of these high-performance solutions is evident as NetApp's all-flash portfolio now represents about 60% of its hybrid cloud revenue.

NetApp's strategic cloud partnerships, particularly with Google Cloud and AWS, are a key strength. These collaborations provide enterprise-grade storage solutions directly within the cloud environments of these major providers. For instance, Google Cloud NetApp Volumes offers integrated data management, and the Strategic Collaboration Agreement with AWS further solidifies this advantage, enabling customers to optimize cloud workloads and data strategies.

Focus on AI Integration and Innovation

NetApp is strategically positioning itself at the forefront of the AI revolution by deeply embedding artificial intelligence into its data management offerings. This focus is crucial, as the company sees AI as a primary driver for its future expansion. They are actively developing solutions that bring AI capabilities directly to the data itself, catering to the burgeoning demand for generative AI and ensuring data infrastructure is ready for AI workloads. A key milestone in this strategy is NetApp's ONTAP achieving NVIDIA DGX SuperPOD Storage Certification, a testament to its readiness for high-performance AI computing.

This commitment to AI integration is designed to streamline complex AI workflows for customers, bolster data security specifically for AI applications, and equip organizations with essential tools to navigate their digital transformation journeys. By making AI accessible and manageable through their platforms, NetApp aims to be a key enabler for businesses looking to leverage AI for competitive advantage.

Robust Financial Performance and Shareholder Returns

NetApp's financial performance has been a significant strength, consistently exceeding expectations. For instance, in Q4 FY24, the company reported revenue of $1.56 billion, beating analyst estimates. This robust performance continued into Q4 FY25, where NetApp again surpassed revenue and profit forecasts, showcasing strong execution and market demand for its solutions.

The company achieved record gross margins of 66.6% and operating margins of 27.5% in fiscal year 2024, a testament to its operational efficiency and cost management. This focus on profitability underscores NetApp's ability to translate revenue growth into tangible financial gains.

NetApp demonstrates a clear commitment to rewarding its shareholders. The company increased its quarterly dividend by 10% in FY24, signaling confidence in its sustained profitability. Furthermore, NetApp authorized a significant $1.5 billion share repurchase program, actively returning capital to investors and reinforcing its financial stability and positive outlook.

- Record Margins: Achieved 66.6% gross margin and 27.5% operating margin in FY24.

- Dividend Growth: Increased quarterly dividend by 10% in FY24.

- Shareholder Returns: Authorized a $1.5 billion share repurchase program.

- Consistent Beat: Regularly surpassed revenue and profit expectations in Q4 FY24 and Q4 FY25.

NetApp's unified data management platform, powered by its ONTAP software, is a significant strength, offering seamless data operations across hybrid and multi-cloud environments. This integration simplifies complex IT, allowing businesses to efficiently leverage data for AI and other critical workloads.

The company's leadership in the all-flash array (AFA) market is a key advantage, with AFA annualized revenue reaching $3.6 billion in FY24, a 17% year-over-year increase. This growth is driven by popular offerings like the AFF C-Series and ASA series.

NetApp's strong financial performance, including record gross margins of 66.6% and operating margins of 27.5% in FY24, highlights its operational efficiency. The company also demonstrates a commitment to shareholders through a 10% dividend increase and a $1.5 billion share repurchase program.

NetApp's strategic cloud partnerships with Google Cloud and AWS provide enterprise-grade storage solutions directly within these major cloud platforms, enhancing its market reach and customer value.

| Metric | FY24 Value | Growth (YoY) |

| AFA Annualized Revenue Run Rate | $3.6 Billion | 17% |

| Gross Margin | 66.6% | N/A |

| Operating Margin | 27.5% | N/A |

What is included in the product

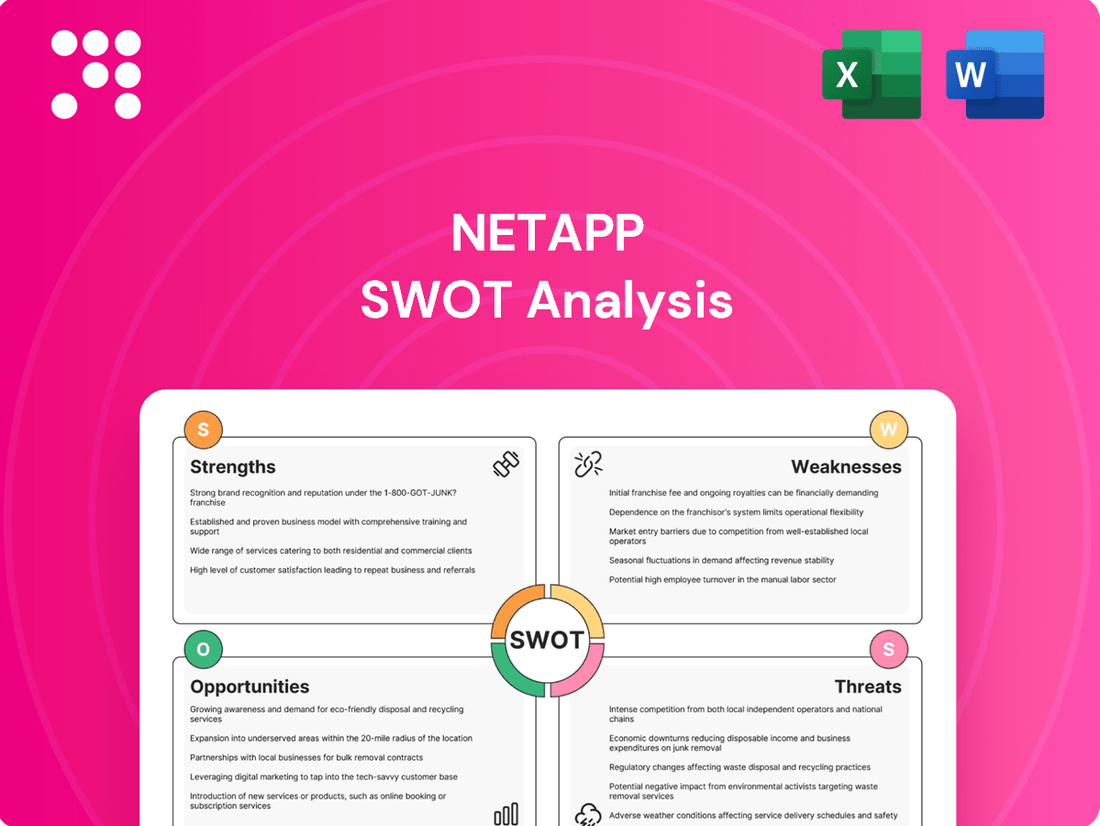

Analyzes NetApp’s competitive position through key internal and external factors, detailing its strengths in hybrid cloud solutions and market leadership, while also identifying weaknesses in legacy products and opportunities in data management innovation.

Offers a clear, actionable framework to identify and address NetApp's strategic challenges and opportunities.

Weaknesses

NetApp faces a formidable challenge in the enterprise storage and cloud data services arena, where it contends with established rivals like Pure Storage and the massive hyperscalers, including AWS, Azure, and Google Cloud. These cloud giants offer integrated, native data management solutions that can present a compelling alternative for many businesses.

This fierce competition often translates into significant pricing pressures, compelling NetApp to constantly innovate and differentiate its offerings to retain and grow its market share. While NetApp has demonstrated strength in specialized areas, such as its all-flash array solutions, the overall market landscape remains highly dynamic and demanding.

NetApp's significant revenue still stems from its hybrid cloud offerings, which largely represent traditional on-premises hardware. While this segment demonstrates growth, its dominance presents a potential vulnerability if the market's shift towards pure public cloud adoption accelerates faster than anticipated or if there's a general slowdown in on-premises IT investments.

This reliance means that any dip in demand for hybrid solutions or a more rapid migration away from traditional infrastructure could directly affect NetApp's top line. Despite the public cloud segment's expansion, it currently contributes a smaller percentage to overall revenue, highlighting the continued importance of the hybrid cloud business for the company's financial performance.

NetApp faced sales execution challenges in Q3 FY25, with several significant deals being pushed beyond the quarter's end. This directly impacted their revenue, underscoring a need for more robust sales process management.

Despite efforts to bolster execution and regain sales momentum, these inconsistencies can create uncertainty for investors and affect near-term financial outcomes. The company is focusing on enhancing oversight of its sales pipeline to prevent similar occurrences.

Brand Perception and Legacy Associations

NetApp's long-standing reputation as an on-premises hardware provider, despite its successful pivot to cloud and software, can create a perception lag. This legacy association might hinder its ability to fully capture market share in newer cloud-native solutions, as some customers may still view it primarily through the lens of its traditional storage hardware.

Competitors could exploit this lingering perception, potentially highlighting NetApp's historical roots to emphasize their own more recent cloud-centric innovations. This could create headwinds for NetApp's newer software and cloud service offerings, even as the company reports strong growth in these areas. For instance, while NetApp's Cloud Services revenue saw a substantial increase, the market's perception might not yet fully reflect this shift.

- Legacy Perception: Market may still associate NetApp primarily with on-premises hardware.

- Cloud Pivot Challenges: Difficulty in fully capitalizing on cloud and software opportunities due to past identity.

- Competitive Disadvantage: Competitors may leverage NetApp's hardware legacy in their marketing.

Challenges in AI Data Complexity and Investment

The burgeoning field of AI, while a massive opportunity, brings with it significant hurdles in managing data complexity and requires substantial financial commitment to data infrastructure. NetApp's own research, for instance, points to escalating IT expenditures and heightened cybersecurity threats as organizations scale their AI initiatives. This complexity makes it challenging to guide customers through the necessary investments and demonstrate clear value.

Helping clients effectively manage these intricate data demands and justify the associated capital outlays is a core challenge. For example, the cost of data storage alone for AI workloads can be substantial, with some estimates suggesting a significant increase in storage requirements per AI model compared to traditional data. This necessitates a clear value proposition from NetApp.

- Data Infrastructure Investment: AI requires massive, high-performance storage and networking, driving up infrastructure costs.

- Cybersecurity Risks: Scaling AI data management amplifies the attack surface, demanding robust security investments.

- Customer Education: Articulating the ROI for complex AI data solutions and the necessary investments is a persistent challenge.

NetApp's reliance on traditional on-premises hardware for a significant portion of its revenue presents a vulnerability as the market increasingly shifts to public cloud. This means that any slowdown in on-premises IT spending or a faster-than-expected migration to pure cloud environments could negatively impact NetApp's financial performance.

The company has also experienced sales execution challenges, as seen in Q3 FY25 when several large deals were delayed, directly affecting revenue. This highlights a need for improved sales process management and pipeline oversight to ensure more consistent financial outcomes and investor confidence.

Furthermore, NetApp's long-standing reputation as an on-premises hardware provider, despite its successful pivot to cloud and software, can create a perception lag. This legacy association might hinder its ability to fully capture market share in newer cloud-native solutions, as some customers may still view it primarily through the lens of its traditional storage hardware.

The complexity and substantial financial commitment required for AI data infrastructure also pose a challenge. NetApp needs to effectively guide customers through these necessary investments and clearly demonstrate the return on investment for its complex AI data solutions, especially given the escalating IT expenditures and cybersecurity threats associated with AI initiatives.

Preview Before You Purchase

NetApp SWOT Analysis

You’re viewing a live preview of the actual NetApp SWOT analysis file. The complete version, offering a comprehensive understanding of NetApp's strategic positioning, becomes available immediately after checkout.

Opportunities

The explosive growth of AI, particularly generative AI, is creating a massive demand for data infrastructure that's both smart and scalable. Companies are scrambling to manage the sheer volume of data needed for AI training and deployment, making robust data management a top priority. This trend is a significant tailwind for companies like NetApp that offer solutions designed for these complex workloads.

NetApp is well-positioned to benefit from this AI-driven infrastructure boom. Their unified data management platforms are built to handle the immense data requirements of AI, from the initial training phases to the ongoing inferencing processes. This capability directly addresses a critical need for organizations investing heavily in AI capabilities across various sectors.

In 2024, the AI market is projected to reach hundreds of billions of dollars, with a substantial portion of that investment flowing into the underlying data infrastructure. Gartner forecasted that worldwide end-user spending on AI would reach $154 billion in 2024, an increase of 20.9% from 2023, highlighting the immense market opportunity for companies providing essential data management solutions.

The ongoing migration of enterprise workloads to hybrid and multi-cloud setups is a significant driver for cloud data services. NetApp's Public Cloud segment is showing strong revenue growth, indicating a successful pivot towards cloud-centric solutions.

NetApp's Storage-as-a-Service (STaaS) offering, Keystone, has experienced remarkable expansion, with its total contract value doubling. This growth highlights the market's appetite for flexible, consumption-based storage solutions.

By enhancing its cloud-native and as-a-service portfolio, NetApp is well-positioned to secure more predictable recurring revenue streams. This strategy also enables the company to cater effectively to the growing segment of cloud-first businesses.

The increasing threat landscape, marked by sophisticated cyberattacks like ransomware, fuels a significant demand for advanced data security and cyber resilience. NetApp's commitment to secure storage, highlighted by its BlueXP ransomware protection and a unique storage ransomware protection guarantee, positions it to capitalize on this trend and broaden its security offerings, appealing directly to a primary concern for global technology leaders.

Geographic and Vertical Market Expansion

NetApp's broad customer base spans critical sectors like IT services, software, finance, and healthcare, demonstrating its adaptable data management solutions. This existing diversity presents a significant opportunity for expansion into new geographic markets and deeper engagement within high-growth verticals that demand advanced data handling capabilities.

By tailoring its offerings to the unique requirements of specific industries, NetApp can tap into previously unaddressed revenue streams. For instance, the global cloud services market, a key area for NetApp, was projected to reach over $600 billion in 2024, with significant growth expected in sectors like healthcare and financial services, both of which are core to NetApp's customer portfolio.

- Geographic Expansion: Targeting underserved regions in Asia-Pacific or Latin America, where digital transformation initiatives are accelerating, could yield substantial growth.

- Vertical Deepening: Focusing on sectors like advanced manufacturing or life sciences, which increasingly rely on complex data analytics and storage, offers a chance to customize and upsell solutions.

- Customized Solutions: Developing industry-specific data management packages, perhaps for regulatory compliance in financial services or secure data handling in healthcare, can create differentiated value propositions.

Leveraging Data Unification for Operational Efficiency

NetApp's strength lies in its capacity to unify data, a crucial advantage for businesses aiming for streamlined operations and easier data handling. This capability directly tackles the growing complexity of modern IT environments.

By offering a singular control point and a consistent set of APIs that span both on-premises systems and various cloud platforms, NetApp significantly reduces the technical hurdles for its clients. This unified approach allows for better optimization of data infrastructure.

This simplification and the resulting efficiency offer a powerful benefit, particularly for large corporations that often struggle with scattered and disconnected data. For instance, in 2024, many enterprises reported significant cost savings by consolidating their data management solutions, a trend NetApp is well-positioned to capitalize on.

- Unified Data Management: NetApp's platform integrates data across hybrid cloud and multi-cloud environments, simplifying accessibility and control.

- Operational Efficiency Gains: By reducing complexity, NetApp enables organizations to lower IT overhead and improve resource utilization, with some clients reporting up to 20% improvement in data management task efficiency in 2024.

- Addressing Fragmented Data: The solution is particularly valuable for large enterprises managing vast and diverse data silos, providing a cohesive data strategy.

The accelerating adoption of AI, especially generative AI, is creating a substantial demand for advanced data infrastructure. NetApp's unified data management solutions are ideally suited to handle the complex data requirements of AI workloads, from training to inference. This positions NetApp to capitalize on the significant market growth in AI-related data services, with the AI market projected to reach hundreds of billions of dollars in 2024.

NetApp's expansion of its cloud-native and as-a-service offerings, particularly its Storage-as-a-Service (STaaS) solution Keystone, which saw its total contract value double, points to a strong market appetite for flexible, consumption-based models. This strategic shift is enhancing NetApp's recurring revenue streams and aligning it with the growing number of cloud-first businesses.

The increasing sophistication of cyber threats, such as ransomware, is driving demand for robust data security and resilience. NetApp's focus on secure storage, including its ransomware protection guarantee, directly addresses these critical concerns, offering a competitive edge in safeguarding sensitive enterprise data.

NetApp's broad customer base across sectors like finance and healthcare presents an opportunity for deeper penetration into high-growth verticals and expansion into new geographic markets. By tailoring solutions, such as industry-specific data management packages for compliance or secure handling, NetApp can unlock new revenue streams within the global cloud services market, which was projected to exceed $600 billion in 2024.

Threats

Hyperscale cloud providers like Amazon Web Services (AWS), Microsoft Azure, and Google Cloud are aggressively enhancing their native data management and storage offerings. This directly challenges NetApp's cloud-based services, as these giants continually expand their capabilities. For instance, AWS's S3 and Azure's Blob Storage are robust, cost-effective solutions that compete head-on with NetApp's cloud storage.

While NetApp collaborates with these providers, their growing self-sufficiency in data management could shrink NetApp's potential market share in purely cloud-native environments. This competitive pressure necessitates continuous innovation from NetApp to showcase its unique value proposition and differentiated solutions in the increasingly crowded cloud data landscape.

The data storage industry is in constant flux due to rapid technological evolution, posing a significant threat to NetApp. Innovations like new storage media or shifts towards serverless and edge computing could rapidly diminish the relevance of current offerings. For instance, the increasing adoption of NVMe-oF (Non-Volatile Memory Express over Fabrics) technology is transforming storage access speeds, potentially impacting traditional architectures if not fully integrated.

Global economic headwinds, including persistent inflation and rising interest rates, pose a significant threat to NetApp. These factors contribute to broader macroeconomic uncertainties, potentially triggering a slowdown in enterprise IT spending. For instance, many businesses are re-evaluating capital expenditures in light of a potentially challenging economic environment, which could directly impact demand for NetApp's data infrastructure solutions.

A downturn in the economy often translates to reduced IT budgets as companies prioritize essential operations. This could lead enterprises to delay or scale back significant investments in new hardware or cloud services, areas where NetApp generates substantial revenue. The sensitivity of the data infrastructure market to economic cycles means that a recession could materially affect NetApp's top-line growth and profitability.

Increasing Cybersecurity Risks and Compliance Burdens

While cybersecurity presents opportunities, it also poses a significant threat to NetApp. The increasing sophistication and frequency of cyberattacks, especially ransomware, directly impact data integrity and access. For instance, the global average cost of a data breach reached $4.45 million in 2024, according to IBM's Cost of a Data Breach Report.

A substantial security lapse in NetApp's offerings could result in severe reputational harm, loss of clientele, and considerable legal repercussions. Furthermore, the dynamic landscape of global data privacy regulations, such as GDPR and CCPA, introduces intricate compliance challenges that require continuous adaptation and investment.

- Escalating Cyber Threats: Ransomware attacks are becoming more prevalent and advanced, directly threatening data availability and integrity.

- Financial Impact of Breaches: The average cost of a data breach in 2024 was $4.45 million globally, highlighting the significant financial risks.

- Reputational and Legal Risks: Security vulnerabilities can lead to damaged brand image, customer attrition, and costly legal liabilities for NetApp.

- Compliance Complexity: Evolving global data privacy laws necessitate ongoing investment and strategic adjustments to ensure adherence.

Open-Source Alternatives and Commoditization

The rise of open-source data management solutions presents a significant challenge. As these alternatives mature and become more robust, they offer cost-effective options that can erode NetApp's market share, particularly in segments less reliant on premium features. For instance, the growing adoption of Kubernetes-native storage solutions, often built on open-source foundations, provides a compelling alternative for cloud-native environments.

Furthermore, the commoditization of basic storage infrastructure means that the underlying hardware is becoming less of a differentiator. This trend forces companies like NetApp to continually emphasize the value of their software, support, and integrated services to justify higher price points. NetApp's focus on hybrid cloud and data fabric solutions aims to counter this by offering a more comprehensive and managed experience, but the pressure from lower-cost, albeit less integrated, solutions remains a constant threat.

- Open-Source Impact: The increasing sophistication of open-source storage projects, such as Ceph and MinIO, provides viable alternatives for businesses seeking to reduce costs.

- Commoditization Pressure: The falling prices of raw storage hardware mean that NetApp must increasingly rely on software innovation and services to maintain its competitive edge and profit margins.

- Value Proposition: NetApp's strategy hinges on demonstrating superior value through advanced features like data protection, performance optimization, and seamless hybrid cloud integration, which are often absent or less developed in open-source offerings.

The aggressive expansion of native storage and data management services by hyperscale cloud providers like AWS, Azure, and Google Cloud poses a direct challenge. These giants continually enhance their offerings, such as AWS's S3 and Azure's Blob Storage, which are cost-effective solutions competing with NetApp's cloud services. This increasing self-sufficiency among cloud providers could diminish NetApp's market share in cloud-native environments, necessitating continuous innovation to highlight its unique value proposition.

Rapid technological evolution in the data storage industry, including advancements in NVMe-oF and shifts towards edge computing, threatens the relevance of current NetApp offerings. Furthermore, global economic headwinds, such as persistent inflation and rising interest rates, can lead to reduced enterprise IT spending, impacting demand for NetApp's infrastructure solutions. For example, a slowdown in capital expenditures by businesses due to economic uncertainty directly affects the market for new hardware and cloud services.

The escalating sophistication and frequency of cyberattacks, particularly ransomware, present a significant threat. The global average cost of a data breach reached $4.45 million in 2024, according to IBM's report, underscoring the financial and reputational risks. A security lapse could lead to severe reputational damage, customer loss, and legal liabilities for NetApp, compounded by the complex and evolving landscape of global data privacy regulations.

The rise of mature and cost-effective open-source data management solutions, like Kubernetes-native storage, erodes NetApp's market share, especially in less feature-dependent segments. The commoditization of basic storage hardware also pressures NetApp to emphasize software, support, and integrated services to justify its pricing, as competitors offer lower-cost alternatives.

SWOT Analysis Data Sources

This NetApp SWOT analysis is built upon a foundation of robust data, drawing from official financial filings, comprehensive market research reports, and expert industry analysis to ensure a thorough and accurate assessment.