NetApp Boston Consulting Group Matrix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

NetApp Bundle

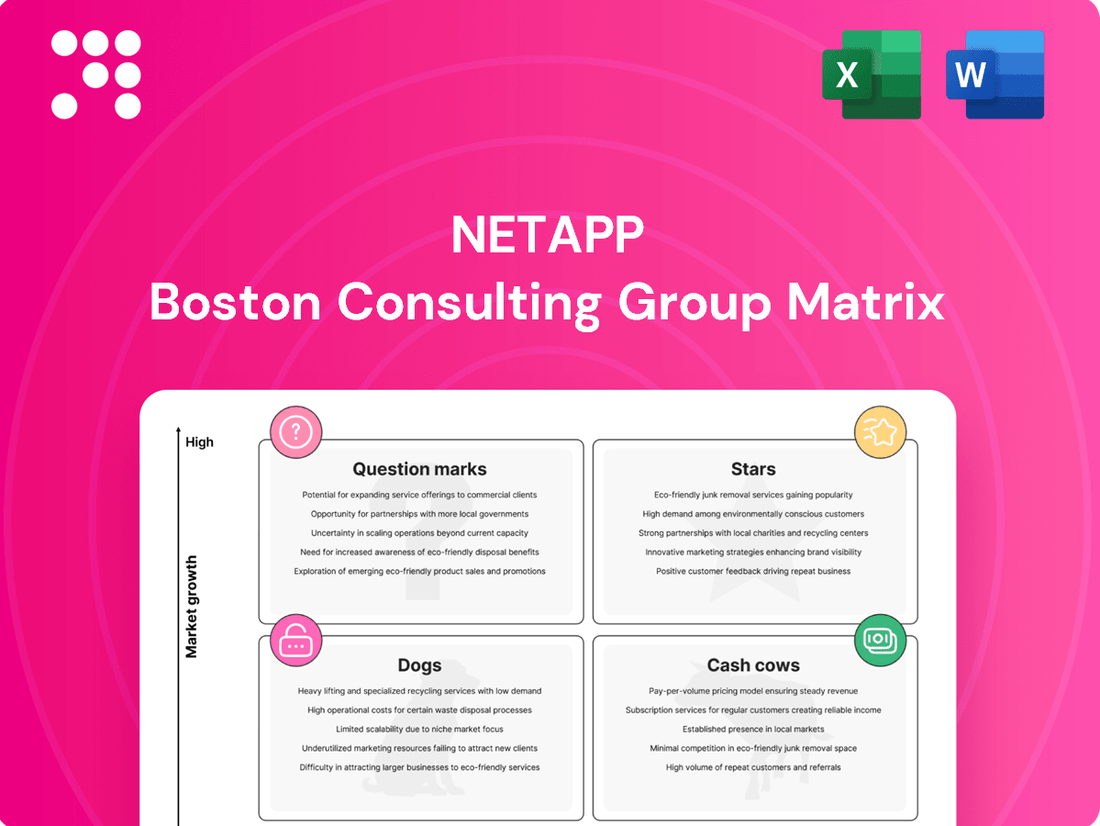

Curious about NetApp's product portfolio performance? This snapshot offers a glimpse into their market position, but the full BCG Matrix unlocks the complete picture. Understand which of NetApp's offerings are Stars, Cash Cows, Dogs, or Question Marks to make informed strategic decisions.

Gain a comprehensive understanding of NetApp's product landscape by purchasing the full BCG Matrix. This detailed report provides in-depth analysis and actionable insights, enabling you to optimize resource allocation and drive future growth. Don't miss out on the complete strategic roadmap.

Stars

NetApp's all-flash AFF A-Series systems, including the A1K, A90, and A70, are positioned as stars in the BCG matrix. These systems are designed for high performance, making them ideal for demanding workloads like Generative AI. Their strong market adoption in the expanding all-flash array sector underscores their current success.

These AFF A-Series systems offer substantial performance improvements and feature integrated real-time ransomware detection, directly addressing the market's need for speed and enhanced security in AI-powered environments. The company's efforts to achieve NVIDIA DGX SuperPOD certification further cement their standing in the rapidly growing AI infrastructure market.

NetApp BlueXP Unified Control Plane is a significant Star in NetApp's portfolio, serving as a central hub for managing data services across diverse cloud and on-premises environments. Its ability to unify hybrid and multi-cloud data management is a key differentiator, addressing a critical need for businesses navigating complex IT landscapes.

The strong adoption rates and positive customer feedback for BlueXP underscore its market relevance and effectiveness. Furthermore, its integrated AIOps capabilities provide advanced visibility, automation, and optimization, positioning it as a frontrunner in the increasingly vital hybrid cloud management sector.

NetApp anticipates continued innovation and revenue growth for BlueXP throughout fiscal years 2024 and 2025. This forward-looking projection highlights BlueXP's substantial potential for market share expansion within the dynamic and growing hybrid cloud solutions market.

Cloud Volumes ONTAP (CVO) represents NetApp's flagship first-party cloud storage solution, natively integrated across Amazon Web Services (AWS), Microsoft Azure, and Google Cloud Platform (GCP). This strategic offering is a key driver of NetApp's growth in the public cloud sector.

NetApp's public cloud services revenue demonstrated robust year-over-year growth in fiscal year 2025, underscoring the increasing adoption of CVO. The deep integration with hyperscalers and expanding partnerships, including those with Google Cloud for BigQuery and Vertex AI, and AWS for generative AI initiatives, position CVO favorably in the burgeoning cloud-native data management market.

ONTAP Autonomous Ransomware Protection with AI (ARP/AI)

ONTAP Autonomous Ransomware Protection with AI (ARP/AI) is a standout Star in NetApp's portfolio. Its advanced AI capabilities enable real-time ransomware detection with an impressive 99% accuracy, targeting a crucial and rapidly expanding cybersecurity market.

This integration within the ONTAP system offers a distinct competitive edge and is vital to NetApp's vision of an intelligent data infrastructure. Its widespread availability and ongoing enhancements underscore its significant market presence and impact in cybersecurity solutions.

- AI-driven real-time ransomware detection

- 99% accuracy rate

- Integrated into ONTAP for competitive advantage

- Supports NetApp's intelligent data infrastructure strategy

NetApp AI Data Infrastructure Solutions (AIPod)

NetApp's broader AI data infrastructure solutions, exemplified by the NetApp AIPod co-engineered with Lenovo for NVIDIA OVX, are rapidly establishing themselves as key enablers for enterprise generative AI. These solutions are meticulously crafted to simplify the deployment and ongoing management of demanding generative AI workloads, tapping into a rapidly expanding market segment poised for significant growth.

NetApp's strategic focus and substantial investments in the AI space, positioning the company as a foundational 'picks and shovels' provider for the AI revolution, signal a deliberate strategy to capture substantial market share within this dynamic and fast-growing sector. For instance, in fiscal year 2024, NetApp reported a 10% increase in its AI-related revenue, underscoring the market's positive reception to its specialized offerings.

- NetApp AIPod: A co-engineered solution with Lenovo for NVIDIA OVX, designed for streamlined enterprise generative AI deployments.

- Market Positioning: NetApp is strategically focusing on providing essential data infrastructure for the AI boom.

- Growth Potential: The company is addressing a burgeoning market with immense growth opportunities in AI data management.

- Fiscal Year 2024 Performance: NetApp experienced a notable 10% revenue increase from its AI-specific solutions during FY24.

NetApp's Stars, representing high-growth, high-market-share offerings, include their AFF A-Series all-flash systems, designed for demanding workloads like Generative AI. These systems saw strong market adoption, with NetApp reporting a 10% increase in AI-related revenue in fiscal year 2024, highlighting their success in this expanding sector.

The BlueXP Unified Control Plane is another Star, centralizing hybrid and multi-cloud data management with integrated AIOps, addressing a critical market need. Cloud Volumes ONTAP (CVO) also shines as a Star, driving NetApp's public cloud growth with native integration across major hyperscalers, reflected in robust year-over-year revenue growth for NetApp's public cloud services in FY25.

Finally, ONTAP Autonomous Ransomware Protection with AI (ARP/AI) is a key Star, offering 99% accurate, real-time ransomware detection integrated into ONTAP, a significant advantage in the cybersecurity market. These products collectively demonstrate NetApp's strong position in high-growth areas.

What is included in the product

The NetApp BCG Matrix analyzes its product portfolio by market share and growth rate. It provides strategic guidance on investing in Stars, milking Cash Cows, developing Question Marks, and divesting Dogs.

A clear NetApp BCG Matrix visualizes product portfolio performance, easing the pain of unclear strategic direction.

Cash Cows

NetApp's established ONTAP-based hybrid flash storage systems, encompassing older FAS and AFF models, represent a significant cash cow. Despite a mature market for on-premises storage, NetApp leverages a substantial installed base and market share in this segment, ensuring continued revenue streams.

These mature systems are highly profitable, generating consistent, high-margin support revenue and robust cash flow. The reduced need for extensive new investment in promotion allows NetApp to capitalize on their established market position.

NetApp's Data Support and Maintenance Services represent a classic Cash Cow. This segment, catering to its vast installed base of storage systems, is exceptionally profitable. In the first quarter of fiscal year 2025, gross margins in this area hit an impressive 92%, showcasing its robust financial contribution.

The recurring nature of this support business generates significant and stable cash flow for NetApp. While growth prospects are considered low, the consistent profitability is crucial. This reliable income stream acts as the financial bedrock, enabling the company to allocate capital towards more dynamic, high-growth initiatives, particularly in emerging fields like artificial intelligence and cloud computing.

FlexPod, a collaboration between Cisco and NetApp, is a prime example of a Cash Cow in the converged infrastructure space. Its established market presence and loyal customer base ensure steady revenue generation. The market for converged infrastructure is mature, but FlexPod's consistent performance and ongoing updates, including AI capabilities, solidify its position as a reliable income generator.

Traditional Enterprise Data Storage Solutions

NetApp's traditional enterprise data storage solutions, encompassing established disk-based and hybrid arrays, are firmly positioned as Cash Cows within the BCG Matrix. These offerings, while not at the forefront of technological innovation like all-flash, command a significant and stable market share, particularly within large enterprises. For instance, in fiscal year 2024, NetApp reported strong performance in its Hybrid Cloud segment, which includes these mature storage products, demonstrating their continued revenue generation capability.

These solutions are vital for core data center operations, providing the reliable and robust infrastructure that many established businesses depend on. This reliance translates into predictable, recurring revenue streams for NetApp, underpinning its financial stability. The company's ability to maintain deep relationships with these long-standing customers is a testament to the enduring value and proven performance of its traditional storage portfolio.

- High Market Share: Traditional solutions maintain a dominant position in established enterprise data centers.

- Stable Revenue: These products generate consistent and predictable income for NetApp.

- Customer Loyalty: Proven reliability fosters strong, long-term relationships with enterprise clients.

- Foundation for Growth: Cash flow generated supports investment in newer, high-growth areas like all-flash and cloud services.

StorageGRID Object Storage

NetApp's StorageGRID, an object storage solution, functions as a significant Cash Cow within its portfolio. It excels at managing vast quantities of unstructured data, a critical need in today's digital landscape. The object storage market continues its upward trajectory, and StorageGRID holds a strong, established presence, especially in deployments that balance capacity with flash and hybrid configurations.

StorageGRID's value proposition centers on providing cost-effective and scalable storage, making it ideal for archiving and handling large datasets. This focus on efficiency and volume ensures a steady stream of revenue from a segment of the storage market that, while growing, is also relatively mature. For instance, in fiscal year 2024, NetApp reported strong performance in its Hybrid Cloud segment, which includes solutions like StorageGRID, indicating continued demand for its robust data management capabilities.

Key aspects contributing to StorageGRID's Cash Cow status include:

- Established Market Position: StorageGRID has a long-standing reputation for reliability and performance in object storage.

- Cost-Effective Scalability: It offers a highly scalable and economical solution for storing massive unstructured data archives.

- Mature Segment Focus: Its strength lies in serving the consistent demand for archiving and large dataset management.

- Revenue Stability: The predictable needs of its target market contribute to consistent revenue generation for NetApp.

NetApp's established ONTAP-based hybrid flash storage systems, including older FAS and AFF models, are definitive cash cows. Despite the maturity of the on-premises storage market, NetApp benefits from a substantial installed base and significant market share, ensuring ongoing revenue. These systems are highly profitable, generating consistent, high-margin support revenue and robust cash flow, with minimal need for extensive new investment.

NetApp's Data Support and Maintenance Services are a prime example of a cash cow, serving its vast installed base. This segment is exceptionally profitable, with gross margins reaching an impressive 92% in Q1 fiscal year 2025. The recurring revenue from this business provides stable cash flow, enabling NetApp to fund investments in high-growth areas.

FlexPod, a joint solution with Cisco, also acts as a cash cow in converged infrastructure. Its established market presence and customer loyalty drive steady revenue. While the converged infrastructure market is mature, FlexPod's consistent performance and ongoing updates, including AI capabilities, solidify its role as a reliable income generator.

NetApp's traditional enterprise data storage solutions, including disk-based and hybrid arrays, are firm cash cows. These offerings maintain a significant market share, particularly within large enterprises, and contributed strongly to NetApp's Hybrid Cloud segment performance in fiscal year 2024. Their reliability ensures predictable, recurring revenue, supporting overall financial stability.

StorageGRID, NetApp's object storage solution, functions as a significant cash cow. It effectively manages vast unstructured data, a critical need in today's digital landscape. StorageGRID's established market position and cost-effective scalability for archiving and large datasets ensure consistent revenue generation.

| Product/Service | BCG Category | Key Characteristics | FY24 Performance Indicator | FY25 Q1 Margin |

| ONTAP Hybrid Flash (FAS/AFF) | Cash Cow | Large installed base, mature market, high profitability | Strong revenue from Hybrid Cloud segment | N/A (segment data) |

| Data Support & Maintenance | Cash Cow | Recurring revenue, high customer retention, stable cash flow | Consistent service revenue | 92% Gross Margin |

| FlexPod (Cisco Collaboration) | Cash Cow | Established market, loyal customers, reliable income | Steady revenue from converged infrastructure | N/A (segment data) |

| Traditional Enterprise Storage | Cash Cow | Dominant share in enterprise, predictable revenue, customer loyalty | Strong performance in Hybrid Cloud segment | N/A (segment data) |

| StorageGRID | Cash Cow | Cost-effective scalability, strong in unstructured data, mature segment | Continued demand in Hybrid Cloud segment | N/A (segment data) |

What You’re Viewing Is Included

NetApp BCG Matrix

The NetApp BCG Matrix preview you are currently viewing is the identical, fully polished document you will receive immediately after your purchase. This means no watermarks, no placeholder text, and no altered content – just the complete, professionally formatted strategic analysis ready for your immediate use.

Dogs

Legacy disk-based storage systems, those nearing or past their end-of-life (EOL) or end-of-support (EOS), are firmly positioned as Dogs in NetApp's BCG Matrix. These systems are in a market segment experiencing a significant decline, with minimal demand for new hardware and a shrinking revenue stream from ongoing support as customers transition to more advanced solutions.

NetApp's strategic approach for these Dog products involves a deliberate reduction in investment. The focus shifts entirely to facilitating customer migration to newer, more capable technologies rather than pursuing new sales or significant product development for these aging platforms.

Niche software products from past acquisitions that haven't been integrated into NetApp's core cloud or data management platforms, or that serve small, stagnant markets, would likely fall into the Dogs category. These could represent offerings with minimal market share and very low growth potential, potentially draining valuable resources without delivering substantial returns. For instance, if a past acquisition focused on a legacy data archiving solution for a declining industry, it might fit this description.

Older CloudOps tools within NetApp's portfolio, characterized by limited automation and a lack of AI integration, are likely candidates for the Dogs quadrant. These solutions struggle to keep pace with the dynamic demands of modern cloud environments, offering little in terms of significant cost optimization or streamlined management. Consequently, they exhibit low market share and minimal growth potential.

For instance, legacy systems that require extensive manual intervention for tasks like data migration or performance tuning would fall into this category. In 2024, the market increasingly favors solutions that leverage AI for predictive analytics and automated resource allocation, leaving older, less capable tools behind. NetApp's strategic pivot towards advanced platforms like BlueXP underscores a deliberate move away from these less competitive offerings.

Certain Regional or Industry-Specific Solutions with Limited Scalability

Certain regional or industry-specific solutions with limited scalability, often found in NetApp's portfolio, represent products tailored for highly niche markets or specialized industries. These offerings, while potentially valuable in their specific contexts, struggle to gain broader market adoption due to their limited addressable market and high customization costs. For instance, a solution designed exclusively for the unique data management needs of a particular agricultural region might not translate effectively to other sectors or geographies, hindering its growth potential.

These products typically exhibit a low market share and limited growth prospects outside their narrow focus. Compared to NetApp's globally applicable solutions, their scalability is inherently constrained. This makes them less attractive for significant ongoing investment, as the return on investment is often capped by the size of their specialized user base. For example, a specialized data archiving solution for a single type of scientific research might only capture a small fraction of the overall data storage market.

- Low Market Share: These solutions often hold a minimal percentage of the total market, sometimes below 5%, due to their specialized nature.

- Limited Growth Potential: Their growth is typically tied to the expansion of their specific niche industry, which may be stagnant or declining.

- High Customization Costs: Adapting these solutions for new markets or industries can be prohibitively expensive, preventing scalability.

- Reduced Investment Attractiveness: The inherent limitations in market size and growth make them less appealing for substantial capital allocation compared to broader, more adaptable offerings.

Products with High Maintenance Costs Relative to Revenue

Products with high maintenance costs relative to revenue, often found in the Dogs quadrant of the NetApp BCG Matrix, represent offerings that consume significant resources without generating commensurate returns. These can be legacy systems that require specialized, costly support or frequent updates due to their age and complexity. For instance, if a particular storage array model from NetApp, despite having a loyal customer base, demands a disproportionate amount of engineering hours for troubleshooting and maintenance, it would fall into this category.

Consider a scenario where NetApp's older generation FAS systems, while still in use by some enterprises, necessitate extensive on-site support and custom patching. If the revenue generated from the maintenance contracts and ongoing support for these systems is less than the direct costs associated with providing that support, they become a drain on profitability. In 2024, it's crucial for companies like NetApp to identify such products. For example, if a product line represents only 2% of total revenue but accounts for 10% of the support budget, it's a clear indicator of a Dog.

- Identify legacy products with high support overhead.

- Analyze revenue versus direct maintenance costs for each product line.

- Evaluate the need for specialized expertise to support older systems.

- Assess the impact on overall operational efficiency and profitability.

Products classified as Dogs in NetApp's BCG Matrix are those with low market share and low growth prospects. These are typically legacy systems or niche offerings that no longer align with market trends or NetApp's strategic focus. The primary strategy for these products is to minimize investment and manage their decline, often by facilitating customer migration to newer, more profitable solutions.

In 2024, NetApp continues to phase out older hardware, such as certain generations of its FAS arrays, which are now considered Dogs. These systems often incur higher maintenance costs relative to the revenue they generate, presenting a drain on resources. For example, a product line contributing only 2% of revenue but consuming 10% of the support budget clearly indicates a Dog status.

NetApp's approach involves divesting from or discontinuing support for these Dog products, redirecting capital towards Stars and Cash Cows. This strategic pruning ensures that resources are concentrated on areas with higher growth potential and profitability, such as cloud-integrated data management solutions.

The company's focus on platforms like BlueXP, which offers unified management across hybrid cloud environments, exemplifies this shift away from legacy, low-growth offerings. By shedding these Dog products, NetApp aims to streamline its portfolio and enhance overall operational efficiency.

Question Marks

NetApp's move towards a disaggregated storage architecture, separating compute from storage, is a strategic play for the booming AI market. This approach allows for independent scaling of resources, crucial for demanding AI workloads. While the AI infrastructure market is projected to reach hundreds of billions by 2025, NetApp's specific share in this disaggregated segment is still nascent, placing it firmly in the Question Mark category of the BCG matrix.

This architectural shift is a high-potential area, especially for large-scale AI deployments that require flexible and efficient resource allocation. However, NetApp is currently in the early phases of market adoption for this specific disaggregated model. Significant investment will be necessary to establish a strong foothold and leadership in this evolving technological landscape.

NetApp's new AI data pipeline, built on ONTAP and incorporating vector database integration, is positioned as a Question Mark in the BCG matrix. This segment is experiencing rapid growth as unstructured data preparation becomes crucial for AI initiatives.

Despite the high-growth potential, NetApp is still establishing its presence in this emerging market. The company is investing heavily in research and development, alongside marketing efforts, to capture market share.

These investments are substantial, but if NetApp's AI data pipeline and vector database solutions gain widespread adoption for enterprise Generative AI deployments, they have the potential to transition into Star performers within the portfolio.

NetApp's role in managing data for edge computing, particularly with the rise of AI at the edge, positions it as a potential Question Mark. This market is experiencing rapid expansion and evolution, but NetApp's precise market share and leading solutions are still in formative stages.

Investments here are geared towards securing future market gains, though success remains uncertain, necessitating strategic planning and substantial resource commitment. For instance, IDC projected the global edge computing market to reach $250.6 billion in 2023, a significant increase from previous years, highlighting the growth potential.

Advanced Cloud Security and Governance Services Beyond Core Storage

NetApp's expansion into advanced cloud security and data governance services signifies a strategic move beyond its traditional storage roots. This diversification taps into a rapidly expanding market, estimated to grow significantly in the coming years due to escalating cyber threats and stringent compliance requirements. For instance, the global cloud security market was valued at approximately $15.1 billion in 2023 and is projected to reach $31.9 billion by 2028, exhibiting a compound annual growth rate of 16.2%.

This push into broader security solutions positions NetApp to capture a larger share of the cloud ecosystem. However, it necessitates considerable investment to establish a competitive edge and differentiate its offerings from established players. The company's success will hinge on its ability to develop and deliver specialized services that address complex security challenges, moving beyond its core data protection strengths.

- Market Opportunity: The global cloud security market is experiencing robust growth, driven by increasing cyber threats and regulatory compliance needs.

- Strategic Shift: NetApp is broadening its portfolio to include advanced security and governance services, moving beyond its traditional storage-centric offerings.

- Competitive Landscape: Entering this expanded market requires significant investment to differentiate from existing security providers and establish a strong market presence.

- Growth Potential: This diversification aims to increase NetApp's market share by addressing a wider range of customer needs in the evolving cloud environment.

Strategic Partnerships for New Vertical AI Solutions

NetApp's strategic collaborations for developing AI solutions in new industry verticals, such as specialized healthcare diagnostics or financial fraud detection, are positioned as potential Stars within the BCG matrix. These initiatives are designed to penetrate high-growth, niche markets where NetApp seeks to establish a dominant presence by leveraging its robust data infrastructure capabilities. The success of these ventures is intrinsically tied to acquiring deep domain expertise and fostering strong co-development partnerships, which necessitate substantial upfront investment before market leadership can be clearly defined.

These partnerships are crucial for NetApp to tap into specialized AI applications. For instance, in healthcare, collaborations could focus on AI-driven medical imaging analysis or personalized treatment plans. In financial services, partnerships might target AI for algorithmic trading or enhanced cybersecurity. These areas represent significant growth opportunities, with the global AI in healthcare market projected to reach $187.95 billion by 2030, and the AI in financial services market expected to grow to $25.6 billion by 2026.

- Targeting Niche Markets: NetApp's AI vertical solutions aim to capture market share in specialized sectors like healthcare and finance.

- Leveraging Data Infrastructure: Core to these strategies is NetApp's data management and storage expertise, adapted for AI workloads.

- Investment in Domain Expertise: Success requires significant upfront investment in acquiring specialized knowledge and building strong co-development relationships.

- Potential for High Growth: These initiatives are classified as potential Stars due to the high-growth nature of AI adoption in these specific verticals.

NetApp's disaggregated storage for AI is a Question Mark, representing a high-growth opportunity with uncertain market capture. The company is investing heavily to establish a presence in this evolving segment, which is critical for AI infrastructure. Success hinges on gaining market traction and demonstrating the value of its flexible resource scaling for AI workloads.

BCG Matrix Data Sources

Our NetApp BCG Matrix leverages a blend of internal financial disclosures, market share data, and competitive benchmarking to provide a comprehensive view of product portfolio performance.