NetApp Marketing Mix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

NetApp Bundle

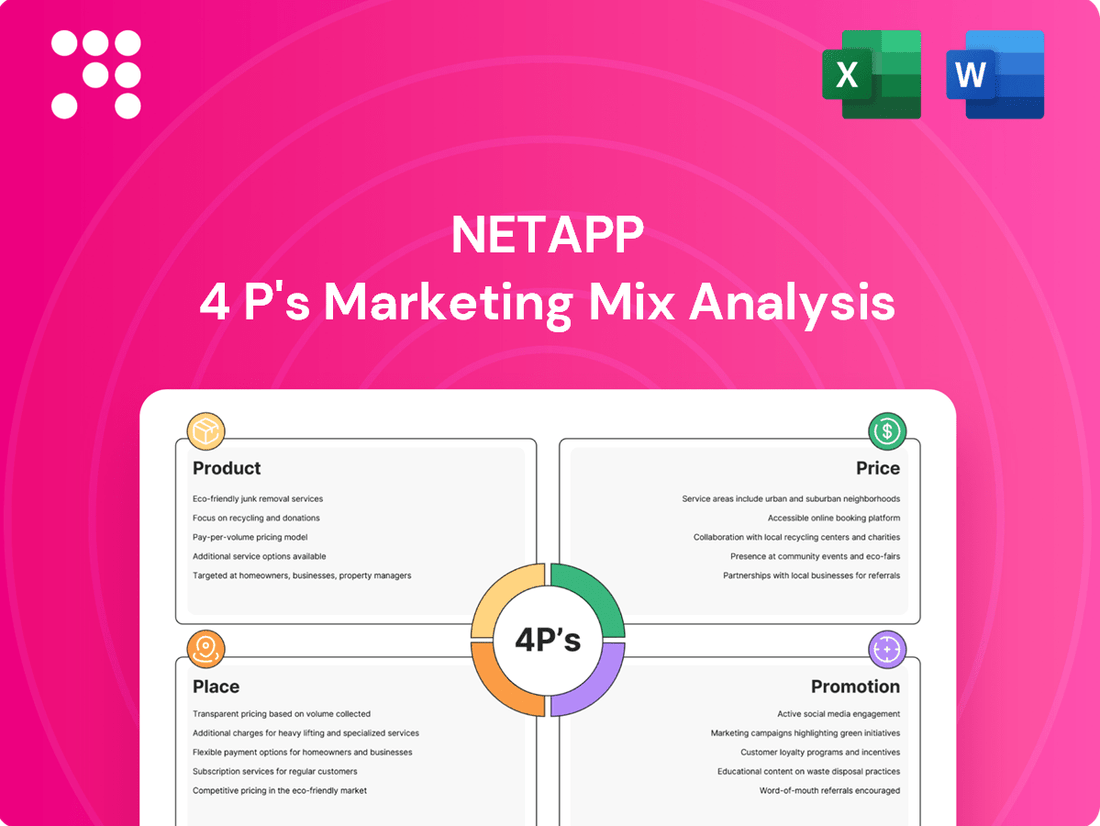

NetApp's marketing success is built on a robust 4Ps strategy, from its innovative data management solutions to its strategic pricing and extensive distribution channels. Understand how their promotional efforts amplify their market presence.

Go beyond the basics—get access to an in-depth, ready-made Marketing Mix Analysis covering NetApp's Product, Price, Place, and Promotion strategies. Ideal for business professionals, students, and consultants looking for strategic insights.

Save hours of research and analysis. This pre-written Marketing Mix report provides actionable insights, examples, and structured thinking—perfect for reports, benchmarking, or business planning.

Product

NetApp's Unified Data Management Platform simplifies the handling of data across on-premises, hybrid, and multi-cloud environments. This integrated solution streamlines data flow and governance, helping businesses eliminate silos and gain a cohesive view of their information. For instance, in 2024, many organizations are prioritizing cloud migration, with Gartner projecting that 80% of enterprises will have migrated their workloads to the cloud by 2025, underscoring the platform's relevance.

The platform's continuous innovation is particularly geared towards the growing demands of AI and hybrid cloud strategies. This focus ensures that businesses can leverage their data effectively for advanced analytics and machine learning initiatives. The global AI market size was valued at over $200 billion in 2023 and is expected to grow significantly, highlighting the critical need for robust data management solutions like NetApp's.

NetApp's enterprise data storage solutions are designed for demanding environments, offering powerful hardware and software to handle mission-critical applications and massive data volumes. These systems prioritize reliability, allowing businesses to scale efficiently and support diverse workloads, from established databases to cutting-edge AI and machine learning projects.

The company's commitment to innovation is evident in its recent product announcements. NetApp unveiled new enterprise storage offerings, including enhancements to its ASA A-Series all-flash block storage, alongside updates for its established FAS and EF-Series systems. These advanced solutions are slated for shipment beginning in March and April of 2025, ensuring customers have access to the latest in storage technology.

NetApp's Cloud Data Services are a cornerstone of its product strategy, enabling customers to manage their data across on-premises environments and major public clouds like AWS, Azure, and Google Cloud. These services offer a unified approach to data mobility, protection, and analytics, allowing businesses to harness cloud advantages without sacrificing control or familiarity.

This strategic focus on cloud integration has yielded significant financial results. For fiscal year 2025, NetApp's Public Cloud segment experienced robust growth, with revenue climbing 43% year-over-year to reach $416 million, underscoring the strong market demand for its cloud data management solutions.

Data Management Software

NetApp's product strategy extends significantly into specialized data management software, complementing its hardware and cloud offerings. This software suite addresses critical needs such as backup, recovery, data protection, compliance, and advanced analytics, aiming to automate and simplify complex data operations. The focus is on ensuring data integrity, robust security, and high availability for businesses.

Recent advancements highlight NetApp's commitment to innovation in this space. For example, the release of NetApp Trident 25.02 software specifically targets Kubernetes storage, a key area for modern application development. Furthermore, enhancements to BlueXP workload factory are being made to better support Generative AI (GenAI) workloads, demonstrating a forward-looking approach to emerging technological demands.

- Specialized Software Solutions: NetApp provides software for backup, recovery, data protection, compliance, and analytics.

- Automation and Streamlining: These solutions automate and simplify essential data management tasks.

- Key Releases: NetApp Trident 25.02 for Kubernetes storage and enhanced BlueXP workload factory for GenAI are notable recent developments.

- Focus Areas: Ensuring data integrity, security, and availability are core objectives of NetApp's software products.

AI/ML and Modern Application Support

NetApp's product strategy is heavily invested in enabling advanced technologies like AI, ML, and cloud-native applications. Their storage solutions are engineered to manage the massive data requirements of AI/ML projects, ensuring efficient performance and scalability. This focus is crucial as the enterprise AI market, particularly GenAI, continues its rapid expansion, with companies seeking intelligent data infrastructure to drive innovation.

NetApp's commitment to modern application support is evident in their offerings for containerized environments, such as Kubernetes. They provide persistent storage solutions that are vital for the stateful applications that power many modern digital services. This capability allows businesses to deploy and manage complex applications with confidence, accelerating their digital transformation journeys.

The company is actively positioning itself as a leader in the enterprise AI space. By emphasizing intelligent data infrastructure for GenAI, NetApp aims to address the unique challenges of this burgeoning field. For instance, in 2024, the global AI market was projected to reach over $200 billion, highlighting the significant opportunity and the need for robust data management solutions.

- AI/ML Data Demands: NetApp's solutions are designed to handle the high-throughput and low-latency needs of AI/ML training and inference.

- Cloud-Native Storage: Persistent storage for Kubernetes and other container orchestration platforms is a core offering, supporting modern application architectures.

- GenAI Focus: NetApp is targeting the rapidly growing Generative AI market with specialized intelligent data infrastructure.

- Market Growth: The AI market's projected growth underscores the strategic importance of NetApp's product development in this area.

NetApp's product portfolio centers on its Unified Data Management Platform, offering integrated solutions for data across hybrid and multi-cloud environments. This platform simplifies data flow and governance, crucial for businesses navigating cloud migrations, which Gartner projected would involve 80% of enterprises by 2025. The company also provides robust enterprise data storage solutions, including advanced all-flash systems like ASA A-Series, with new enhancements slated for early 2025 shipments.

Further strengthening its product offering, NetApp delivers specialized data management software for backup, recovery, data protection, and analytics, aiming to automate complex data operations. Recent software releases like NetApp Trident 25.02 for Kubernetes storage and enhanced BlueXP workload factory for Generative AI underscore their commitment to supporting modern and emerging workloads. This strategic focus on AI and cloud integration is reflected in NetApp's fiscal year 2025 Public Cloud segment revenue, which surged 43% year-over-year to $416 million.

| Product Category | Key Offerings | Target Market/Use Case | 2024/2025 Relevance/Data |

|---|---|---|---|

| Unified Data Management | Unified Data Management Platform | Hybrid & Multi-Cloud Data Handling, Cloud Migration | Gartner: 80% of enterprises to migrate workloads by 2025 |

| Enterprise Storage | ASA A-Series, FAS, EF-Series | Mission-critical applications, AI/ML workloads | New enhancements shipping March/April 2025 |

| Data Management Software | Backup, Recovery, Data Protection, Analytics Software | Data integrity, security, availability, automation | NetApp Trident 25.02 (Kubernetes), BlueXP (GenAI) |

| Cloud Data Services | Services for AWS, Azure, Google Cloud | Unified data mobility, protection, analytics in cloud | FY25 Public Cloud segment revenue: $416M (+43% YoY) |

What is included in the product

This NetApp 4P's Marketing Mix Analysis provides a comprehensive overview of their Product, Price, Place, and Promotion strategies, offering actionable insights for strategic decision-making.

It delves into NetApp's actual marketing practices and competitive positioning, making it an invaluable resource for understanding their market approach.

Simplifies complex NetApp marketing strategies into actionable insights, alleviating the pain of understanding and executing across Product, Price, Place, and Promotion.

Provides a clear, concise framework for NetApp's 4Ps, removing confusion and enabling efficient marketing planning and execution.

Place

NetApp's direct sales force is crucial for cultivating deep relationships with large enterprise clients, enabling a nuanced understanding of their complex data management needs. This hands-on approach allows for tailored solutions and dedicated support, ensuring the specific requirements of major accounts are met effectively.

The company's focus on enterprise transactions involves rigorous monitoring of deal progression and closing strategies, reflecting the significant value and strategic importance of these large-scale engagements. For instance, in fiscal year 2024, NetApp reported a significant portion of its revenue derived from its largest customers, underscoring the success of its direct sales model in securing and retaining these key accounts.

NetApp's success hinges on its extensive global partner ecosystem, a crucial element of its go-to-market strategy. This network comprises value-added resellers (VARs), system integrators (SIs), and managed service providers (MSPs) who are instrumental in delivering NetApp's solutions to a broad customer base.

To further strengthen these relationships, NetApp introduced the NetApp Partner Sphere program in fiscal year 2024. This initiative offers partners a more adaptable framework to accelerate digital and cloud transformations, providing enhanced validation, recognition, and incentives for their commitment and contributions.

NetApp strategically utilizes the marketplaces of major public cloud providers like AWS, Azure, and GCP to distribute its cloud data services. This approach offers customers seamless access to NetApp solutions directly within their chosen cloud environments, streamlining both acquisition and integration processes. For instance, NetApp's presence on the AWS Marketplace saw significant customer adoption in 2024, contributing to its robust growth in the public cloud storage sector.

Strategic Alliances and Technology Partnerships

NetApp actively cultivates strategic alliances with major technology providers and independent software vendors (ISVs). These collaborations are crucial for integrating NetApp's data management solutions and broadening its market reach. For instance, in 2023, NetApp highlighted its deepened integration with Microsoft Azure, enabling seamless hybrid cloud data services.

Partnerships frequently involve joint development efforts, shared marketing initiatives, and bundled product offerings. This approach significantly boosts NetApp's value proposition by delivering more comprehensive, integrated solutions to customers. The company also emphasizes its growing alignment with the go-to-market strategies of major hyperscale cloud providers, ensuring its offerings are readily available and optimized within those ecosystems.

- Key Partnership Drivers: Integration of solutions, market expansion, and enhanced value proposition.

- Examples of Collaboration: Co-development, joint marketing, bundled offerings.

- Hyperscaler Alignment: Strengthening ties with cloud providers' go-to-market motions.

- Recent Focus: Deepened integration with Microsoft Azure for hybrid cloud data services (2023).

Online Resources and Self-Service Portals

While NetApp primarily focuses on an enterprise sales approach, its commitment to customer success extends to robust online resources. These digital platforms are crucial for existing customers and partners, offering a self-service environment for critical functions. For instance, customers can easily access technical documentation, manage their software licenses, and download the latest updates, streamlining their IT operations. This digital infrastructure is key to providing a scalable and efficient customer experience, ensuring users have the information and tools they need readily available.

NetApp's Partner Sphere program further enhances this online ecosystem by providing partners with valuable tools like Partner Intelligence dashboards. These dashboards deliver actionable insights, helping partners better understand market trends, customer needs, and product performance. This data-driven approach empowers partners to offer more strategic advice and tailored solutions, strengthening their relationship with NetApp and their end customers.

- Online Documentation: NetApp provides comprehensive technical documentation, user guides, and best practices accessible through its website, supporting efficient product utilization.

- Self-Service Portals: Customers and partners can manage licenses, access support cases, and download software updates via dedicated portals, reducing reliance on direct support channels.

- Partner Sphere Program: This initiative includes Partner Intelligence dashboards, offering data-driven insights to help partners optimize their sales and support strategies.

NetApp's place strategy leverages a multi-channel approach, combining a direct sales force for large enterprises with an extensive global partner ecosystem. This includes value-added resellers, system integrators, and managed service providers who extend NetApp's reach. Furthermore, strategic utilization of public cloud marketplaces like AWS, Azure, and GCP ensures seamless access to NetApp's cloud data services for customers.

In fiscal year 2024, NetApp's Partner Sphere program, launched to enhance partner engagement, demonstrated the company's commitment to its indirect channels. The company also reported significant customer adoption on the AWS Marketplace in 2024, highlighting the effectiveness of its cloud marketplace strategy.

| Channel | Key Characteristics | Examples/Initiatives | Fiscal Year 2024 Data/Focus |

|---|---|---|---|

| Direct Sales | Enterprise client relationships, tailored solutions | Large account focus, rigorous deal monitoring | Significant revenue from largest customers |

| Partner Ecosystem | VARs, SIs, MSPs, market expansion | NetApp Partner Sphere program | Enhanced partner framework, increased incentives |

| Cloud Marketplaces | Seamless cloud service access, streamlined integration | AWS, Azure, GCP marketplaces | Significant customer adoption on AWS Marketplace |

What You Preview Is What You Download

NetApp 4P's Marketing Mix Analysis

The preview shown here is the actual document you’ll receive instantly after purchase—no surprises. This comprehensive NetApp 4P's Marketing Mix Analysis is fully complete and ready for immediate use, giving you exactly what you need to understand their strategy.

Promotion

NetApp places significant emphasis on content marketing and thought leadership, a key component of its promotion strategy. The company consistently produces a wealth of resources, including whitepapers, e-books, detailed case studies, informative blog posts, and educational webinars. This robust content creation effort is designed to establish NetApp as a leading voice and expert in critical areas like data management, hybrid cloud environments, and the rapidly evolving field of artificial intelligence.

This approach serves a dual purpose: to thoroughly educate its target audiences about complex industry challenges and to build strong credibility for NetApp. By offering valuable insights and practical solutions, the company effectively generates qualified leads. For instance, NetApp's '2024 Cloud Complexity Report' directly showcases its understanding of current industry trends and reinforces its expertise in navigating these intricate landscapes.

NetApp leverages industry events and conferences as a crucial promotional tool, fostering direct interaction with customers, partners, and industry analysts. These gatherings provide a platform to showcase innovations and gather market intelligence.

The company’s flagship event, NetApp INSIGHT, is a cornerstone of its promotional strategy. INSIGHT 2025, slated for October 13-15, 2025, will highlight advancements in data management and cloud technologies, drawing significant attention from the tech community.

Beyond its own events, NetApp actively participates in major industry gatherings. For 2025, this includes presence at Ai4 2025, focusing on artificial intelligence, and TechNet Augusta 2025, a key event for defense and technology professionals, underscoring a broad reach across critical sectors.

NetApp leverages digital advertising across professional networks like LinkedIn and industry-specific sites to precisely target IT decision-makers and C-suite executives. These campaigns deliver customized messaging that resonates with their specific roles and interests, ensuring efficient reach. For instance, their 'Flash Forward' promotion in 2024 offered significant incentives for new storage solutions, driving adoption among key enterprise clients.

Public Relations and Analyst Relations

NetApp prioritizes public relations and analyst relations by actively engaging with technology journalists and industry analysts. This strategy aims to secure positive media coverage and favorable analyst reports, thereby shaping market perception and influencing purchasing decisions through independent validation of its solutions and market leadership.

This proactive approach is crucial for building brand reputation in the competitive storage market. NetApp's commitment to transparency and communication with key influencers is a cornerstone of its marketing efforts.

NetApp's success in this area is underscored by its recognition as a 2025 Gartner Peer Insights Customers' Choice for Primary Storage Platforms. This accolade reflects strong customer satisfaction and market validation, directly attributable to effective PR and AR initiatives.

- Media Engagement: NetApp consistently works with technology journalists to highlight product innovations and strategic partnerships.

- Analyst Influence: Favorable reports from firms like Gartner and IDC help validate NetApp's market position and technological advancements.

- Brand Perception: Positive coverage and analyst endorsements contribute significantly to shaping a strong and trustworthy brand image.

- Customer Validation: Being named a 2025 Gartner Peer Insights Customers' Choice demonstrates the impact of these efforts on real-world customer perception.

Partner Marketing and Co-Marketing Programs

NetApp actively engages its vast channel partner ecosystem through collaborative marketing efforts. They provide partners with essential marketing collateral, financial incentives, and dedicated support for joint promotional activities. This strategy harnesses the partners' established local market influence and customer connections, effectively extending NetApp's market penetration and fostering mutual pipeline growth.

The NetApp Partner Sphere program is designed to equip partners with specialized marketing campaigns and comprehensive enablement resources. These initiatives often focus on specific solutions, ensuring partners are well-versed in promoting NetApp's offerings. For instance, in fiscal year 2024, NetApp reported significant growth in partner-driven revenue, with co-marketing initiatives contributing to a substantial portion of new customer acquisition.

- Partner Enablement: NetApp provides partners with marketing assets, funding, and support for joint campaigns.

- Market Reach Amplification: Co-marketing leverages partners' local presence and customer relationships to broaden NetApp's reach.

- Pipeline Generation: These programs are designed to create shared opportunities and generate new business for both NetApp and its partners.

- Solution-Specific Focus: The Partner Sphere program includes targeted campaigns and enablement for specific NetApp solutions.

NetApp's promotional strategy heavily relies on content marketing and thought leadership, evidenced by its extensive creation of whitepapers, e-books, and case studies. This approach aims to position NetApp as an expert in data management and cloud technologies, with initiatives like the '2024 Cloud Complexity Report' reinforcing this goal.

The company actively participates in and hosts key industry events, including its flagship NetApp INSIGHT conference. INSIGHT 2025 is scheduled for October 13-15, 2025, and NetApp will also have a presence at Ai4 2025 and TechNet Augusta 2025, showcasing its broad industry engagement.

Digital advertising on platforms like LinkedIn targets IT decision-makers, while public relations and analyst relations efforts, including securing positive mentions from Gartner, shape market perception. This is validated by NetApp being named a 2025 Gartner Peer Insights Customers' Choice for Primary Storage Platforms.

NetApp also amplifies its reach through its channel partners via the NetApp Partner Sphere program. This program provides marketing collateral and incentives, driving significant partner-driven revenue growth, as seen in fiscal year 2024.

| Promotional Tactic | Key Initiative/Example | Target Audience | Objective | 2024/2025 Data Point |

|---|---|---|---|---|

| Content Marketing & Thought Leadership | Whitepapers, e-books, '2024 Cloud Complexity Report' | IT professionals, business leaders | Establish expertise, generate leads | Consistent production of educational resources |

| Industry Events | NetApp INSIGHT 2025, Ai4 2025, TechNet Augusta 2025 | Customers, partners, analysts | Showcase innovation, market intelligence | INSIGHT 2025: Oct 13-15, 2025 |

| Digital Advertising | LinkedIn campaigns | IT decision-makers, C-suite | Targeted messaging, efficient reach | 'Flash Forward' promotion (2024) for storage solutions |

| PR & Analyst Relations | Media engagement, Gartner reports | Market influencers, potential customers | Build brand reputation, validate leadership | 2025 Gartner Peer Insights Customers' Choice |

| Channel Marketing | NetApp Partner Sphere program | Channel partners | Expand market penetration, drive partner revenue | Significant growth in partner-driven revenue (FY24) |

Price

NetApp's enterprise pricing centers on the substantial value delivered, focusing on ROI through enhanced data efficiency, robust security, and business continuity. This strategy emphasizes the tangible benefits and operational cost savings customers realize, rather than just product features.

This value-based approach is crucial given that enterprise data infrastructure is mission-critical. For instance, in 2024, NetApp's solutions are designed to help businesses manage burgeoning data volumes, with projections indicating a continued surge in global data creation, underscoring the intrinsic value of efficient data management.

NetApp is increasingly offering flexible pricing, with subscription models for its software and consumption-based options for cloud data services. This approach directly addresses the shift in IT spending towards operational expenses, allowing customers to align costs with actual usage.

This strategy is exemplified by offerings like Cloud Volumes ONTAP, which provides monthly payment options and Bring Your Own License (BYOL) flexibility. Such models enhance scalability and cost predictability, reducing the burden of significant upfront capital investment for clients.

NetApp strategically utilizes tiered licensing and feature bundling for its software and services, catering to a diverse customer base. This approach segments the market by offering distinct feature sets, capacity limits, and support tiers, from basic functionalities to comprehensive enterprise solutions.

Pricing for support services is meticulously calculated, factoring in the specific product configuration, the chosen support level, and the agreed-upon duration of the contract. For instance, NetApp's support contracts in early 2024 often range from one to five years, with pricing varying significantly based on the complexity of the deployed solutions.

Channel Partner Pricing and Incentives

NetApp structures its pricing and incentives to foster a strong channel ecosystem, aiming to drive sales and ensure partner profitability. These programs are key to motivating partners to champion NetApp solutions and maintain market competitiveness.

For fiscal year 2025, NetApp's Distribution Partner Program specifically rewards distributors based on their invoiced bookings, directly linking partner success to sales volume.

- Channel Partner Pricing: NetApp offers tiered pricing and special discounts to its channel partners, designed to enable competitive market positioning and healthy margins.

- Incentive Programs: Beyond pricing, NetApp provides various incentive schemes, including rebates and performance-based bonuses, to encourage active selling and support of its product portfolio.

- FY25 Distribution Partner Program: This program directly incentivizes distributors by rewarding them for achieving specific invoiced booking targets, driving focus on sales execution.

- Partner Profitability: The overall strategy aims to ensure that partners are adequately compensated and motivated, thereby strengthening NetApp's go-to-market strategy through its indirect sales channels.

Competitive Pricing and Market Dynamics

NetApp's pricing strategy is deeply intertwined with the competitive arena, constantly evaluating offerings from direct rivals and emerging alternative solutions. The company aims to balance its value proposition with market competitiveness, making adjustments based on demand shifts, economic climates, and its strategic stance against competitors.

For instance, NetApp reported strong financial performance in Q4 FY25, with total revenue reaching $1.6 billion, a 7% increase year-over-year. This growth, achieved amidst a dynamic market, underscores their ability to price effectively and maintain market share.

- Competitive Benchmarking: NetApp actively monitors competitor pricing for similar storage and cloud data services.

- Value-Based Pricing: Pricing reflects the total cost of ownership and the business value delivered to customers.

- Market Responsiveness: Pricing models are flexible to adapt to economic conditions and customer demand fluctuations.

- FY25 Performance: Q4 FY25 saw NetApp's total revenue increase to $1.6 billion, demonstrating pricing effectiveness in a competitive landscape.

NetApp's pricing strategy is anchored in delivering significant value, emphasizing ROI through data efficiency, security, and continuity. This approach aligns costs with usage via subscription and consumption-based models, making IT spending more predictable and manageable for clients.

The company employs tiered licensing and feature bundling to cater to diverse customer needs, from basic to comprehensive enterprise solutions. Support pricing is tailored based on configuration, support level, and contract duration, with typical contracts in early 2024 ranging from one to five years.

NetApp's channel partner strategy includes tiered pricing and special discounts to ensure partner competitiveness and profitability, incentivizing active selling through programs like the FY25 Distribution Partner Program, which rewards distributors for invoiced bookings.

The company continuously benchmarks against competitors, adjusting pricing to remain market-responsive while highlighting the total cost of ownership and business value. This strategy contributed to a strong Q4 FY25 performance, with total revenue reaching $1.6 billion, a 7% year-over-year increase.

| Pricing Aspect | Description | Example/Data Point |

|---|---|---|

| Value-Based Pricing | Focus on ROI, data efficiency, security, and continuity. | Emphasizes tangible benefits and operational cost savings. |

| Flexible Models | Subscription and consumption-based options. | Cloud Volumes ONTAP offers monthly payments and BYOL. |

| Tiered Licensing | Segmentation based on features, capacity, and support. | Caters to basic to comprehensive enterprise needs. |

| Support Pricing | Calculated based on configuration, level, and duration. | Contracts typically 1-5 years (early 2024 data). |

| Channel Incentives | Tiered pricing, discounts, rebates, and performance bonuses. | FY25 Distribution Partner Program rewards invoiced bookings. |

| Market Competitiveness | Continuous benchmarking and responsiveness to demand. | Q4 FY25 revenue of $1.6 billion (7% YoY growth) reflects effective pricing. |

4P's Marketing Mix Analysis Data Sources

Our NetApp 4P's Marketing Mix Analysis is grounded in a comprehensive review of official company disclosures, including SEC filings, investor presentations, and press releases. We also incorporate data from NetApp's corporate website, product documentation, and reputable industry analyst reports to ensure accuracy and relevance.