NetApp Porter's Five Forces Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

NetApp Bundle

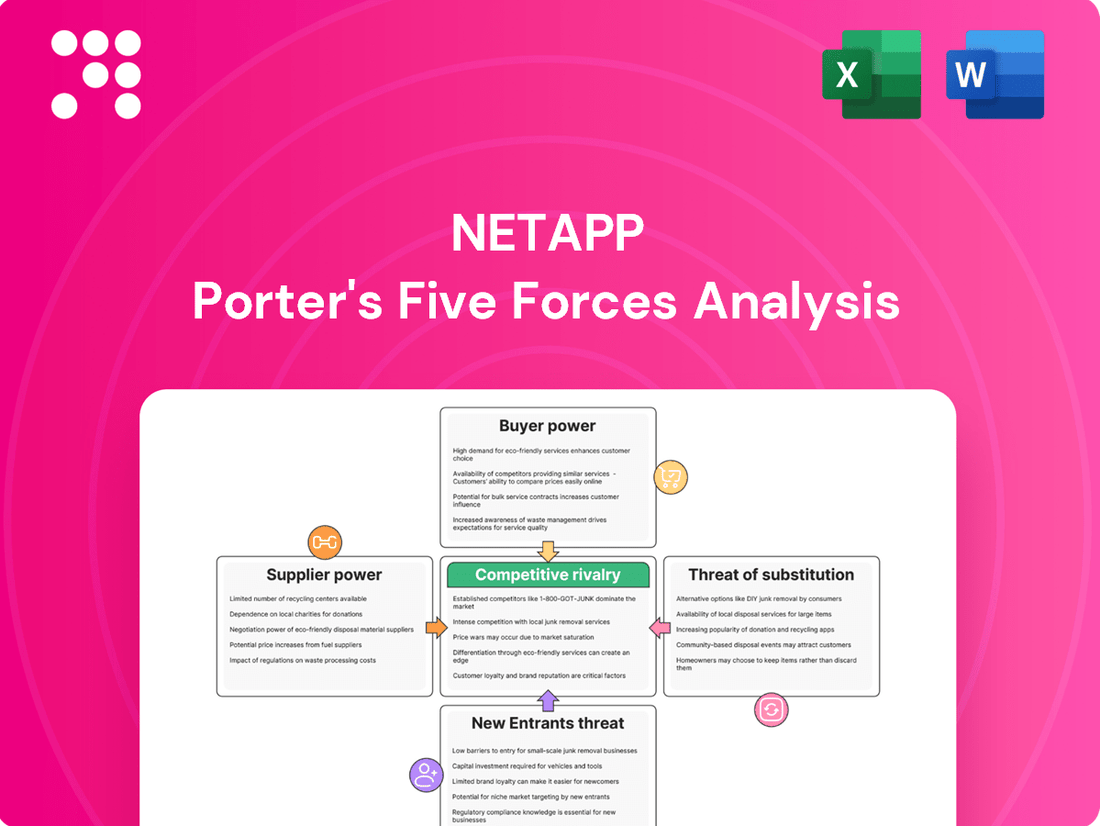

NetApp operates in a dynamic tech landscape, facing moderate threats from new entrants and substitutes due to the evolving nature of cloud storage solutions. Buyer power is significant, as customers often have multiple vendors to choose from, influencing pricing and service demands. The intensity of rivalry within the storage and data management sector is high, with established players constantly innovating.

The complete report reveals the real forces shaping NetApp’s industry—from supplier influence to threat of new entrants. Gain actionable insights to drive smarter decision-making.

Suppliers Bargaining Power

NetApp faces a significant bargaining power from its suppliers due to the concentrated nature of its supply chain for critical hardware. Key components like flash memory, processors, and networking equipment are often sourced from a limited number of specialized manufacturers. This concentration means that if a major supplier decides to increase prices or alter terms, NetApp has fewer immediate alternatives.

The high degree of differentiation in advanced technology components further amplifies supplier power. When NetApp requires cutting-edge processors or high-performance flash memory, the pool of suppliers capable of meeting these specifications shrinks considerably. This scarcity of alternatives for specialized technology grants these key suppliers considerable leverage in negotiations regarding pricing and supply agreements.

For instance, the global market for high-speed flash memory, crucial for NetApp's data storage solutions, is dominated by a few major players. In 2024, the top three NAND flash memory suppliers accounted for over 70% of the market share, giving them substantial pricing influence. This situation can translate into higher input costs for NetApp, impacting its profit margins if these costs cannot be passed on to customers.

While NetApp's substantial purchasing volume and established, long-term relationships with these suppliers can offer some counterbalance to this supplier power, the fundamental concentration and differentiation in critical component markets remain a key factor influencing its operational costs and supply chain stability.

Switching costs for NetApp to change core hardware or software component suppliers can be high. This is due to the intricate integration required for their unified data management platform, meaning a significant supplier change could demand substantial time, financial investment, and potential operational disruption.

The deep integration of NetApp's solutions means that replacing a key component supplier often necessitates considerable re-engineering and testing. This complexity directly enhances the bargaining power of existing, entrenched suppliers who have already navigated these integration hurdles.

For instance, in 2023, the semiconductor industry experienced ongoing supply chain challenges, with lead times for certain advanced components extending significantly. This situation would amplify the cost and difficulty for NetApp to switch to a new supplier for critical hardware elements, thereby increasing supplier leverage.

While NetApp works to mitigate these costs by diversifying its supply chain and embracing industry-standard components, the inherent complexity of its integrated platform means supplier switching costs remain a notable factor influencing supplier bargaining power.

The threat of forward integration by NetApp's suppliers is generally low. Hardware component manufacturers typically focus on producing parts and do not possess the sophisticated software, extensive service networks, or established customer relationships necessary to compete in NetApp's integrated data management platform market.

While some suppliers might offer basic storage components, they generally lack the capabilities to replicate NetApp's value proposition. This means the likelihood of a supplier attempting to directly enter NetApp's core business by integrating forward is minimal, thereby reducing this specific source of supplier power.

Importance of Supplier's Input to NetApp's Product

The importance of supplier input is absolutely critical for NetApp. Their ability to innovate and perform well hinges directly on the quality and advancements coming from suppliers of key components. Think about things like high-speed storage media and the processing units that power their systems. If these suppliers don't keep up, NetApp's own products can fall behind.

For example, the industry's move towards all-flash arrays (AFA) really highlights this. Suppliers of flash memory are now incredibly vital. Their technology directly impacts NetApp's competitiveness and its ability to capture market share. If a flash memory supplier offers a breakthrough, NetApp can leverage that for a significant advantage.

NetApp's strategic partnerships further emphasize this reliance. Their collaboration with companies like Nvidia for AI infrastructure clearly shows how important specialized inputs are. These partnerships aren't just about buying parts; they're about integrating cutting-edge technology that defines the future of their product offerings.

The bargaining power of these suppliers is therefore quite significant. Consider these points:

- Reliance on Specialized Components: NetApp's advanced data storage and management solutions depend on highly specialized components, such as advanced flash memory and high-performance processors, where a limited number of suppliers often dominate.

- Innovation Pipeline Dependency: NetApp's product roadmap and ability to introduce next-generation technologies, like those for AI workloads, are directly tied to the innovation cycles and technological advancements of its key component suppliers.

- Switching Costs for Key Inputs: The integration of specialized hardware components into NetApp's complex systems can involve substantial engineering effort and testing, making it costly and time-consuming to switch suppliers for critical inputs.

- Supplier Concentration in Niche Markets: In certain high-tech component markets, such as advanced NAND flash or specialized networking interfaces, supplier concentration can be high, giving those suppliers considerable leverage.

Availability of Substitute Inputs

The availability of substitute inputs for NetApp's core technologies can be a mixed bag. While many standard computing components have numerous suppliers, the highly specialized and advanced technologies that underpin NetApp's high-performance storage and data management solutions often have fewer readily available alternatives.

Consider the example of cutting-edge NVMe flash memory or specific high-performance CPUs. These are critical for enabling the speed and efficiency required for demanding workloads like AI and big data analytics. The limited number of manufacturers producing these advanced components can give those suppliers more leverage.

- Limited Substitutes for Advanced Components: Specialized technologies like advanced NVMe flash and high-performance CPUs, crucial for NetApp's performance-driven solutions, have fewer alternative suppliers.

- Supplier Leverage: The scarcity of substitutes for these critical components can empower specialized suppliers, potentially increasing their bargaining power.

- NetApp's Mitigation Strategy: NetApp actively works to optimize its product offerings across a diverse range of hardware configurations, aiming to reduce reliance on any single specialized component or supplier.

NetApp's suppliers wield significant power, particularly those providing specialized, high-performance components like advanced flash memory and processors. The limited number of manufacturers capable of producing these cutting-edge technologies, coupled with high switching costs for NetApp due to system integration complexity, grants these suppliers considerable leverage. This is evident in markets like NAND flash, where a few dominant players controlled over 70% of the market share in 2024, influencing pricing and terms.

The dependency on these suppliers for innovation, such as advancements in flash memory crucial for all-flash arrays, further amplifies their influence. Strategic partnerships, like those with Nvidia for AI infrastructure, underscore NetApp's reliance on specialized inputs that define its product competitiveness. While NetApp seeks to mitigate this through diversification and industry standards, the inherent concentration and differentiation in critical component markets remain a key factor.

| Supplier Power Factor | Impact on NetApp | Supporting Data/Example (2024/2023) |

|---|---|---|

| Concentration of Suppliers | Increased leverage for dominant players | Top 3 NAND flash suppliers held >70% market share in 2024. |

| Component Differentiation | Limited alternatives for cutting-edge tech | High-performance CPUs and advanced NVMe flash have few direct substitutes. |

| Switching Costs | High cost and complexity to change suppliers | Complex integration of components into NetApp's platform requires significant re-engineering. |

| Supplier Importance | Critical for NetApp's innovation and product roadmap | Advancements in flash memory directly impact NetApp's competitiveness in all-flash arrays. |

What is included in the product

This analysis dissects the competitive forces impacting NetApp, examining supplier and buyer power, the threat of new entrants and substitutes, and the intensity of rivalry within the data storage and management market.

Instantly identify and prioritize competitive threats with a visually intuitive breakdown of NetApp's market landscape, enabling targeted strategic responses.

Customers Bargaining Power

NetApp's customer base is quite broad, encompassing everything from massive corporations to smaller businesses across sectors like technology, finance, and healthcare. This diversity means that no single customer, or even a small group, holds an overwhelming amount of sway due to their purchase volume.

While some of NetApp's largest enterprise clients do represent significant revenue streams, and thus have some individual influence, the sheer number of customers overall prevents any extreme concentration. This wide distribution of business effectively limits the bargaining power any one customer can exert.

For instance, in fiscal year 2024, NetApp reported that its largest customer accounted for less than 10% of its total revenue. This figure underscores the company's success in maintaining a balanced customer portfolio, thereby mitigating the risk of any single client dictating terms.

Switching costs for NetApp's customers are a significant factor, particularly for organizations heavily invested in its unified data management ecosystem. These costs encompass not just the financial outlay but also the considerable time and expertise required for data migration and IT environment reconfiguration. For instance, a large enterprise moving away from NetApp's ONTAP operating system and its associated cloud data services could face months of planning and execution, potentially impacting business continuity.

Customer price sensitivity for NetApp's offerings varies. For standard storage solutions, which can be seen as more commoditized, price is a significant factor for buyers. However, when customers require specialized features, high performance, or solutions critical for their operations, price sensitivity tends to decrease.

NetApp's strategy emphasizes value beyond just cost. By providing features like robust cyber resilience, enhanced operational efficiency, and capabilities that support Artificial Intelligence (AI) initiatives, NetApp aims to justify its pricing. These advanced functionalities can be more important than minor cost savings for businesses making strategic technology investments.

For instance, in 2024, the increasing demand for AI infrastructure places a premium on solutions that can handle complex data management and processing. NetApp's focus on intelligent data infrastructure for this AI era allows them to position their advanced capabilities as essential, enabling premium pricing for these high-value services.

Availability of Substitute Products/Services for Customers

Customers have a wide array of substitute products and services available, significantly impacting NetApp's bargaining power. Competitors such as Dell Technologies, HPE, IBM, and Pure Storage offer comparable enterprise storage solutions. Furthermore, the rise of hyperscaler cloud storage services from AWS, Azure, and Google Cloud presents a powerful alternative.

The increasing adoption of multi-cloud strategies by businesses allows them to distribute data across various providers. This creates a highly competitive landscape where customers can readily switch or diversify their storage solutions. For instance, in 2024, many enterprises continued to expand their multi-cloud footprints, seeking flexibility and cost optimization.

NetApp's strategic focus on providing native integration with major cloud providers is a direct response to this dynamic. By facilitating seamless operations within hybrid and multi-cloud environments, NetApp aims to enhance customer stickiness and mitigate the threat of substitution. This approach is crucial as businesses prioritize interoperability and ease of data management across different platforms.

- Customer Alternatives: Enterprise storage from Dell, HPE, IBM, Pure Storage, and cloud storage from AWS, Azure, Google Cloud.

- Multi-Cloud Impact: Businesses increasingly deploy data across multiple providers, increasing competitive pressure.

- NetApp's Strategy: Native cloud integration to retain customers in hybrid and multi-cloud setups.

Customer Information and Product Knowledge

Customers in the enterprise data management sector, like those dealing with NetApp, are generally quite knowledgeable. They often have dedicated IT teams or bring in outside consultants, giving them a deep understanding of products and pricing. This expertise allows them to negotiate better deals.

Large organizations frequently conduct extensive reviews and use their informed position to secure more advantageous contract terms. For instance, in 2024, many large enterprises were seen leveraging competitive bids and detailed technical requirements to push for price concessions from storage vendors.

Despite this high level of customer awareness, the intricate nature of today's data infrastructure and the unique capabilities of NetApp's offerings mean clients still depend on vendor knowledge for effective implementation and ongoing management. This reliance can temper the absolute bargaining power of even the most informed customer.

- Informed Customer Base: Enterprise clients typically possess significant product knowledge, often augmented by IT departments or external consultants.

- Negotiation Leverage: Large enterprises use their expertise and thorough evaluation processes to negotiate favorable pricing and terms.

- Vendor Dependence: The complexity of data solutions means customers often still require vendor expertise for optimal deployment and management, influencing bargaining power.

- 2024 Market Trend: A notable trend in 2024 saw large enterprises actively using competitive sourcing and detailed technical specifications to gain pricing advantages from data storage providers.

NetApp's broad customer base, with its largest customer representing less than 10% of revenue in fiscal year 2024, significantly dilutes individual customer bargaining power.

While switching costs are high for deeply integrated clients, the availability of numerous alternatives from competitors like Dell, HPE, and cloud providers from AWS, Azure, and Google Cloud, coupled with multi-cloud strategies, empowers customers.

Informed customers in 2024 leveraged their expertise and competitive bids to negotiate better terms, though reliance on NetApp's specialized knowledge for complex data solutions can temper this power.

| Factor | NetApp Specifics | Impact on Bargaining Power |

|---|---|---|

| Customer Concentration | Largest customer < 10% of FY24 revenue | Lowers bargaining power |

| Switching Costs | High for integrated ONTAP users | Lowers bargaining power |

| Customer Knowledge | High, often with IT/consultants | Increases bargaining power |

| Availability of Alternatives | Competitors (Dell, HPE), Cloud (AWS, Azure, GCP) | Increases bargaining power |

Preview the Actual Deliverable

NetApp Porter's Five Forces Analysis

This preview shows the exact NetApp Porter's Five Forces Analysis you'll receive immediately after purchase, detailing the competitive landscape, including the threat of new entrants, the bargaining power of buyers and suppliers, the threat of substitute products, and the intensity of rivalry within the storage industry.

The document displayed here is the part of the full version you’ll get—ready for download and use the moment you buy, offering a comprehensive breakdown of how these forces impact NetApp's strategic positioning and profitability.

You're looking at the actual document. Once you complete your purchase, you’ll get instant access to this exact file, providing actionable insights into the competitive dynamics that shape NetApp's market environment.

Rivalry Among Competitors

The data management and storage market is a crowded arena, featuring a wide array of competitors. This includes established hardware giants like Dell Technologies, Hewlett Packard Enterprise (HPE), and IBM, alongside innovative storage specialists such as Pure Storage. The competitive landscape is further intensified by the presence of cloud hyperscalers like Microsoft Azure, Amazon Web Services (AWS), and Google Cloud Platform (GCP), which offer integrated data services.

The data management industry is experiencing robust growth, fueled by the widespread adoption of hybrid cloud, multi-cloud strategies, and the increasing demands of AI workloads. This expansion presents a dynamic landscape for companies like NetApp.

NetApp's fiscal year 2025 performance highlights this trend, with revenue growth primarily stemming from its all-flash storage solutions and a notable acceleration in its first-party and marketplace storage services. This indicates a strong and expanding market opportunity for advanced data infrastructure.

A significant catalyst for this industry growth is the escalating demand for intelligent data infrastructure specifically designed to support AI applications. This specialized need is driving innovation and investment across the sector.

NetApp stands out by offering a unified data management platform, its ONTAP operating system, and seamless integration with major cloud providers. This approach is particularly attractive for businesses navigating hybrid and multi-cloud setups, especially with advanced features like AI-driven ransomware protection enhancing their cyber resilience.

While NetApp's focus on hybrid and multi-cloud, coupled with robust security features, creates a strong value proposition, the competitive landscape is intense. Competitors are also heavily invested in differentiating their products, leading to a constant drive for innovation in areas like performance, scalability, security, and cloud integration.

Exit Barriers

Exit barriers in the enterprise data storage and management sector are substantial, directly impacting competitive rivalry. Companies like NetApp have made significant capital investments in research and development, alongside building deeply integrated solutions within customer IT infrastructures. This integration creates a sticky environment where switching costs are high for clients, making it challenging for vendors to simply disengage.

The high cost of exiting the market, coupled with the potential for significant financial and reputational damage, strongly discourages companies from withdrawing. Consequently, existing players are incentivized to remain and fight for market share rather than pursue an exit strategy. This dynamic intensifies competition as firms focus on defending their positions.

Several factors contribute to these elevated exit barriers:

- Significant Capital Investments: The enterprise storage market demands continuous, heavy investment in R&D and specialized hardware, making it difficult to recoup these sunk costs upon exit.

- Customer Lock-in: Solutions are often deeply embedded, leading to high switching costs for customers, which in turn makes it difficult for vendors to divest without impacting their client relationships.

- Brand Reputation and Goodwill: Exiting a market where a company has established a strong presence can severely damage its overall brand reputation and future business prospects in other sectors.

Strategic Stakes

The strategic stakes in the data management sector are exceptionally high for NetApp and its rivals. This is because effective data management is absolutely critical for businesses undergoing digital transformation, adopting artificial intelligence, and ensuring their operations can continue without interruption. Companies are fiercely competing to lead in developing areas such as enterprise AI solutions and hybrid cloud data services, which are anticipated to drive substantial future growth.

Success in these cutting-edge fields is not just about market share; it's about securing long-term relevance and profitability. This intense pressure fuels aggressive competitive actions as players strive to capture leadership positions.

- High Stakes in Data Management: Data management is fundamental to digital transformation and AI adoption, making it a critical battleground for tech companies.

- Competition for Emerging Markets: NetApp and its competitors are intensely focused on dominating enterprise AI and hybrid cloud data services, areas poised for massive future expansion.

- Drive for Relevance and Profitability: Achieving leadership in these new domains is essential for sustained competitiveness and financial success in the evolving tech landscape.

Competitive rivalry within the data management sector is fierce, driven by a market ripe for innovation and expansion, especially with the surge in AI workloads. NetApp's fiscal year 2025 results, showing revenue growth from all-flash storage and cloud services, underscore the demand for advanced data infrastructure. Competitors like Dell, HPE, Pure Storage, and cloud giants AWS, Azure, and GCP are all vying for dominance, pushing constant innovation in performance, scalability, and cloud integration.

The strategic importance of data management for digital transformation and AI adoption elevates the stakes, leading to aggressive competition for leadership in emerging areas. This intense rivalry is further cemented by substantial exit barriers, including significant capital investments and customer lock-in, which encourage existing players to remain and compete rather than withdraw.

| Competitor | Key Offerings | Market Focus |

|---|---|---|

| NetApp | Unified data management, ONTAP OS, hybrid/multi-cloud solutions | Hybrid and multi-cloud data services, AI-ready infrastructure |

| Dell Technologies | Broad portfolio of storage hardware and software | Enterprise IT, cloud integration |

| HPE | Storage solutions, edge computing | Hybrid cloud, data services |

| Pure Storage | All-flash storage, cloud-native solutions | Modern data experience, AI-driven insights |

| AWS, Azure, GCP | Integrated cloud storage and data services | Cloud-native workloads, AI and analytics |

SSubstitutes Threaten

The threat of substitutes for NetApp's offerings primarily stems from alternative data storage and management solutions that present different price-performance profiles. While traditional on-premises storage persists, hyperscaler cloud storage services like Amazon S3, Azure Blob Storage, and Google Cloud Storage have emerged as scalable and frequently more economical options, particularly for unstructured data. For instance, in 2024, the global cloud storage market was projected to reach over $100 billion, highlighting the significant adoption of these alternatives.

Customer propensity to substitute for NetApp's offerings is shaped by cost, ease of use, and specific workload demands. For simpler storage tasks or emerging cloud applications, businesses might find pure cloud solutions or open-source alternatives more appealing.

However, for established enterprise data, critical applications, or hybrid cloud strategies, the inclination to switch from an integrated platform like NetApp's is significantly reduced. This is largely due to substantial switching costs and the necessity of advanced data management features that many alternatives may not readily provide.

The rise of cloud-native solutions from hyperscalers like AWS, Azure, and Google Cloud presents a substantial threat of substitutes for traditional storage providers. These services offer inherent advantages such as scalability on demand and flexible pay-as-you-go pricing, directly competing with NetApp's on-premises and hybrid offerings. For instance, AWS's Elastic File System (EFS) and Azure Files provide managed file storage accessible from cloud virtual machines, directly substituting the need for dedicated hardware solutions.

NetApp actively addresses this threat by embedding its own technology within these cloud environments. Services like Azure NetApp Files and Amazon FSx for NetApp ONTAP allow customers to leverage NetApp's data management capabilities directly within their preferred cloud, effectively turning a substitution threat into an opportunity for integrated solutions. This strategy aims to position NetApp as a key partner within the cloud ecosystem rather than an external competitor.

Open-Source and Software-Defined Storage Alternatives

Open-source storage solutions like Ceph and GlusterFS, along with software-defined storage (SDS) platforms, present a significant threat. These alternatives leverage commodity hardware, offering considerable cost savings and flexibility for organizations. For instance, the global open-source market was projected to reach over $33 billion in 2024, highlighting its growing adoption.

While these solutions demand substantial internal technical expertise for deployment and ongoing management, they appeal to businesses aiming to circumvent vendor lock-in or requiring highly tailored storage environments. This can directly impact NetApp's market share, particularly among tech-savvy companies prioritizing customization over integrated support.

NetApp's competitive advantage often rests on its comprehensive management tools, robust enterprise features, and dedicated customer support. These are areas where many open-source alternatives may fall short, necessitating a careful evaluation of total cost of ownership and operational overhead for potential adopters.

- Cost Savings: Open-source and SDS can reduce hardware acquisition costs by utilizing standard servers.

- Flexibility & Customization: These solutions allow for highly specific configurations to meet unique business needs.

- Vendor Lock-in Avoidance: Organizations can gain more control over their infrastructure by not being tied to a single vendor.

- Expertise Requirement: Successful implementation and maintenance necessitate skilled IT personnel, which can be a barrier for some.

Direct Competition from Hyperscalers

Hyperscale cloud providers such as Amazon Web Services (AWS), Microsoft Azure, and Google Cloud are not merely partners but also formidable competitors. They offer their own comprehensive storage and data management services, which directly substitute for NetApp's solutions. For instance, AWS offers services like Amazon S3 and Amazon EBS, while Azure provides Azure Files and Azure Blob Storage, directly competing with NetApp's hybrid cloud storage offerings.

NetApp counters this by concentrating on hybrid and multi-cloud strategies. This approach aims to seamlessly connect on-premises data centers with various public cloud environments, positioning NetApp as a key facilitator for integrated data management across diverse IT infrastructures. This strategy is crucial as many enterprises adopt a multi-cloud approach, seeking unified data management across different providers.

NetApp's focus on enabling comprehensive data strategies across these complex environments is a key differentiator. In 2024, the demand for hybrid cloud solutions continues to grow, with many organizations looking to leverage existing on-premises investments while expanding into the cloud. NetApp's ability to provide a consistent data experience across these different locations is vital for its competitive positioning.

- Hyperscaler Competition: AWS, Microsoft, and Google offer direct storage and data management alternatives.

- NetApp's Strategy: Focus on hybrid and multi-cloud solutions to bridge on-premises and cloud.

- Market Trend: Increasing adoption of multi-cloud environments drives demand for unified data management.

- NetApp's Value Proposition: Enabling consistent data experience across diverse infrastructures.

The threat of substitutes for NetApp is significant, primarily from hyperscale cloud providers and open-source solutions. Hyperscalers like AWS, Azure, and Google Cloud offer scalable, pay-as-you-go storage that directly competes with NetApp's hybrid offerings. For instance, in 2024, the global cloud storage market was projected to exceed $100 billion, underscoring the widespread adoption of these alternatives.

Open-source storage platforms and software-defined storage (SDS) also pose a threat by leveraging commodity hardware for cost savings and customization. The growing open-source market, estimated to surpass $33 billion in 2024, indicates a strong preference among some businesses for avoiding vendor lock-in and tailoring their storage environments.

NetApp addresses this by focusing on hybrid and multi-cloud strategies, enabling consistent data management across diverse environments. This approach is crucial as enterprises increasingly adopt multi-cloud architectures, seeking unified data experiences. NetApp's own cloud services, like Azure NetApp Files and Amazon FSx for NetApp ONTAP, integrate its technology within hyperscaler platforms, mitigating direct substitution.

| Substitute Type | Key Characteristics | NetApp's Response/Mitigation | Market Trend Example (2024) |

|---|---|---|---|

| Hyperscale Cloud Storage | Scalability, Pay-as-you-go, Managed services | Hybrid/Multi-cloud integration, Cloud-native services (e.g., Azure NetApp Files) | Global Cloud Storage Market > $100 Billion |

| Open-Source Storage | Cost savings (commodity hardware), Customization, Vendor lock-in avoidance | Focus on enterprise features, support, and integrated management tools | Global Open-Source Market > $33 Billion |

Entrants Threaten

The enterprise data storage and management market demands significant upfront capital. Companies like NetApp invest heavily in research and development for both hardware and software, alongside building a global sales, support, and channel partnership network. For instance, in fiscal year 2024, NetApp reported approximately $6.0 billion in revenue, indicating the scale of operations and investment required to compete effectively.

Developing a comprehensive product suite, encompassing advanced storage systems, cloud data services, and AI-driven management, necessitates substantial financial resources. This high barrier to entry, driven by the need for extensive R&D and infrastructure, effectively deters many potential new competitors from entering the market.

Established players like NetApp leverage substantial economies of scale in manufacturing and procurement, driving down per-unit costs. For instance, in 2023, NetApp reported revenue of $6.03 billion, indicating a significant operational footprint that new entrants would find challenging to match initially.

Economies of scope are also a formidable barrier, as NetApp offers a unified data management platform. This integration of diverse services, from cloud data services to hybrid cloud solutions, creates a complex ecosystem that a new entrant would struggle to replicate quickly or cost-effectively, hindering their ability to compete on breadth of offering.

NetApp benefits from a strong brand identity and deep-seated customer loyalty, especially within large enterprises. These clients have significant investments in NetApp's ecosystem, making its solutions integral to their critical operations. This established trust is a formidable barrier for newcomers.

The company's reputation is further solidified by its recognition as a 2025 Gartner Peer Insights Customers' Choice for Primary Storage Platforms. Notably, 98% of verified users recommend NetApp, underscoring the strength of its customer relationships and the difficulty new entrants face in replicating this level of trust and proven performance.

Access to Distribution Channels

Access to distribution channels presents a significant barrier for new entrants in the enterprise IT sector. Established companies like NetApp have cultivated extensive networks of value-added resellers (VARs), system integrators, and direct sales forces, which are vital for reaching customers and delivering complex solutions. Replicating this established market access and reach is a formidable challenge for newcomers.

NetApp's strategic alliances with major cloud providers, including Amazon Web Services (AWS), Microsoft Azure, and Google Cloud, further solidify its market position. These partnerships are not easily forged and provide new entrants with a significant hurdle to overcome in terms of market penetration and customer acquisition. In 2023, NetApp reported that its cloud services revenue, which is heavily reliant on these partnerships, continued to grow, underscoring the importance of these channels.

- Established Partner Ecosystem: NetApp boasts a robust global partner network, including VARs and system integrators, which is difficult for new entrants to replicate.

- Cloud Provider Alliances: Strategic partnerships with AWS, Azure, and Google Cloud provide critical market access that new companies struggle to gain.

- Market Reach and Adoption: These established channels are essential for widespread adoption of enterprise IT solutions, creating a significant barrier to entry.

Proprietary Technology and Patents

NetApp's robust portfolio of proprietary technologies and patents, especially concerning its ONTAP operating system and data management software, presents a significant hurdle for potential new entrants. These intellectual property assets, including unique hybrid cloud integrations, make it challenging for competitors to replicate NetApp's offerings without substantial R&D investment or the risk of patent infringement. This technological advantage acts as a strong barrier, safeguarding NetApp's established market position.

For instance, NetApp has consistently invested in R&D. In fiscal year 2023, the company reported R&D expenses of approximately $1.06 billion. This ongoing commitment fuels the creation of new patents and reinforces its existing intellectual property, making it harder for newcomers to catch up. The complexity and proven efficacy of NetApp's solutions mean that aspiring competitors must either develop entirely novel approaches or face costly legal battles and lengthy development cycles.

- Proprietary ONTAP OS: NetApp's ONTAP operating system is a key differentiator, offering advanced data management capabilities that are difficult to replicate.

- Patent Portfolio: A substantial number of patents cover NetApp's core technologies, creating a legal and technical barrier for new entrants.

- Hybrid Cloud Integration: NetApp's expertise in seamlessly integrating hybrid cloud environments is a valuable asset that requires significant innovation to match.

- R&D Investment: Continued significant investment in research and development, such as the $1.06 billion in FY23, ensures a pipeline of new technologies and reinforces existing intellectual property.

The threat of new entrants into the enterprise data storage and management market, where NetApp operates, is generally considered low. This is primarily due to the substantial capital requirements for research and development, establishing a global sales and support infrastructure, and building a robust channel partner network. In fiscal year 2024, NetApp achieved approximately $6.0 billion in revenue, illustrating the scale of investment needed to compete effectively.

Moreover, the need for a comprehensive product suite, including advanced storage systems and cloud data services, necessitates significant financial backing and technical expertise, creating a high barrier for aspiring competitors. NetApp's established economies of scale, evident in its $6.03 billion revenue in 2023, allow it to offer competitive pricing that new entrants would struggle to match initially.

The company's strong brand reputation, deep customer loyalty, and extensive network of established distribution channels, including strategic alliances with major cloud providers like AWS, Azure, and Google Cloud, further solidify its market position and deter new market entrants. NetApp's significant R&D investment, which was about $1.06 billion in fiscal year 2023, also creates a technological moat through its proprietary technologies and patents, including its ONTAP operating system.

Porter's Five Forces Analysis Data Sources

Our NetApp Porter's Five Forces analysis is built upon a robust foundation of data, drawing from NetApp's annual reports and SEC filings, alongside industry-specific market research from firms like Gartner and IDC. This ensures a comprehensive understanding of competitive pressures.