New York Community Bank PESTLE Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

New York Community Bank Bundle

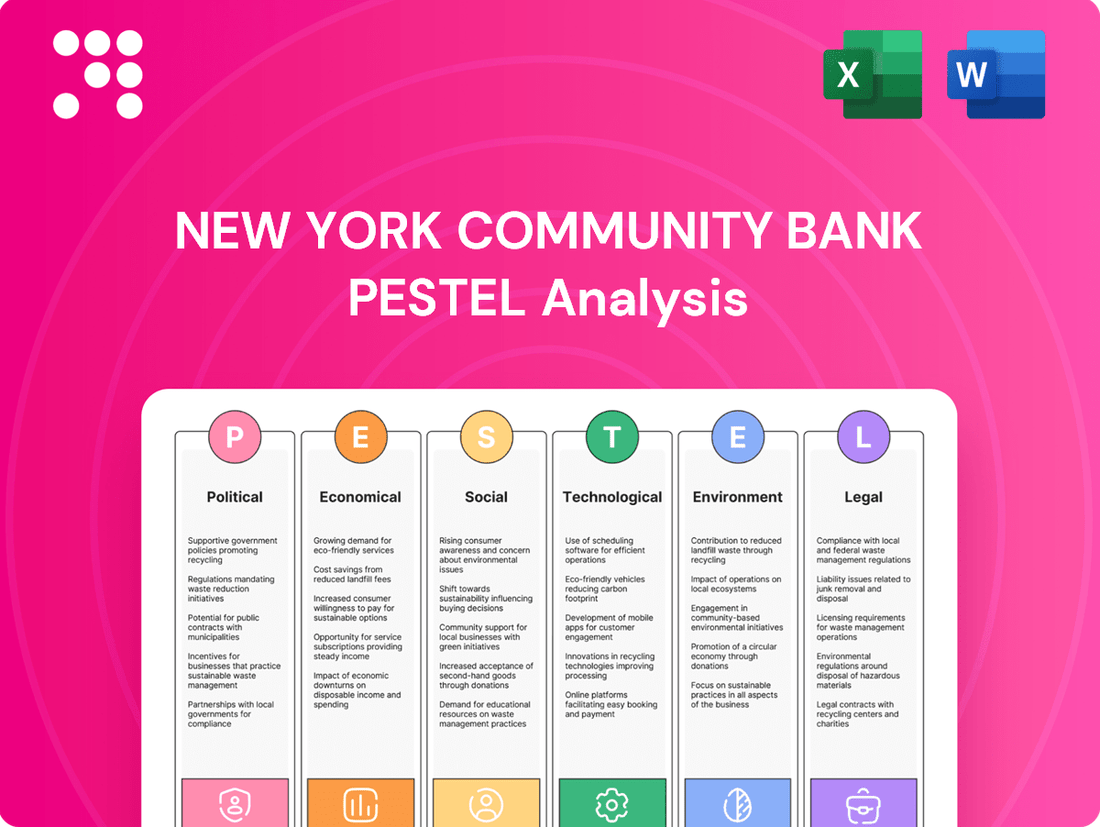

Uncover the critical political, economic, social, technological, legal, and environmental forces shaping New York Community Bank's trajectory. Our expertly crafted PESTLE analysis provides actionable intelligence to anticipate market shifts and identify competitive advantages. Don't be left behind—download the full version now to gain the strategic foresight you need to thrive.

Political factors

New York Community Bancorp's (NYCB) asset threshold crossing $100 billion has triggered a significant shift in its regulatory landscape. This means the bank is now subject to enhanced prudential standards and stricter capital requirements, a common consequence for institutions of this size. For instance, as a Category IV banking organization, NYCB faces more rigorous reporting obligations and must undergo regular capital stress testing to ensure its resilience.

These new regulations demand substantial internal overhauls and will undoubtedly lead to increased compliance costs for NYCB. The bank is actively engaged in developing and implementing new policies, comprehensive programs, and updated systems to align with these more demanding regulatory frameworks. This proactive approach is crucial for navigating the complexities of enhanced oversight.

New York's 2019 Housing Stability and Tenant Protection Act has significantly altered the financial landscape for owners of rent-stabilized properties, a core segment of New York Community Bank's (NYCB) lending business. This law restricts how much landlords can increase rents annually, creating a squeeze for property owners who are also dealing with escalating operating expenses.

The direct consequence for NYCB has been a dramatic rise in loan delinquencies within its multi-family portfolio. Specifically, the bank reported a remarkable 990% increase in delinquencies on multi-family loans linked to rent-regulated buildings. This surge highlights the substantial impact of rent regulation policies on the bank's asset quality and profitability.

Government intervention significantly shapes the U.S. banking landscape. Potential shifts in trade policy, for instance, could ignite trade wars, impacting overall economic growth and, consequently, loan demand and credit quality for institutions like New York Community Bank (NYCB).

The Federal Reserve's monetary policy decisions, particularly regarding interest rates, remain a critical political-economic factor. While rate hikes may have slowed, the Fed's ongoing stance influences borrowing costs and investment strategies across the financial sector.

State-Level Banking Regulations

New York State is tightening its grip on banking regulations, with a significant focus on cybersecurity. The New York Department of Financial Services (NYDFS) is rolling out new rules, many with phased implementation in 2024 and 2025, that will demand financial institutions bolster their defenses.

These updated regulations are designed to fortify cybersecurity programs and improve how banks manage their third-party vendors. This proactive stance by New York often influences regulatory trends across other states and at the federal level, making compliance a critical consideration for institutions operating within its jurisdiction.

- Cybersecurity Enhancement: NYDFS mandates advanced cybersecurity programs for all licensed financial institutions.

- Vendor Management Scrutiny: Stricter oversight of third-party vendor relationships is a key component of the new rules.

- Phased Implementation: Regulations are being introduced with effective dates spanning 2024 and 2025, requiring careful planning.

- Precedent Setting: New York's regulatory actions often serve as a benchmark for other jurisdictions.

Political Stability and Market Confidence

Political stability significantly impacts market confidence in financial institutions. Uncertainty surrounding leadership and regulatory appointments, especially following presidential elections, can create a volatile environment for banks. For instance, the 2024 US presidential election cycle could introduce shifts in banking regulations, affecting perceived risk and investor sentiment towards entities like New York Community Bank (NYCB).

A new administration's approach to financial regulation can materially alter the operational landscape for banks. Changes in capital requirements, lending standards, or consumer protection laws directly influence profitability and risk profiles. Maintaining investor confidence amidst these potential shifts is paramount for NYCB's valuation and strategic planning.

- Regulatory Outlook: The Biden administration's approach to banking regulation, which has seen increased scrutiny on capital adequacy and consumer protection, provides a baseline. Future administrations may either continue or diverge from these policies.

- Economic Policy Alignment: The Federal Reserve's monetary policy, often influenced by political appointments and economic philosophies, directly affects interest rates and credit availability, key drivers for banks like NYCB.

- Geopolitical Stability: Broader geopolitical events can indirectly impact financial markets by affecting investor risk appetite and capital flows, influencing the overall stability of the banking sector.

Political factors significantly influence New York Community Bank's (NYCB) operating environment, particularly through regulatory changes and government policies. The bank's asset threshold crossing $100 billion has subjected it to enhanced prudential standards and stricter capital requirements, impacting its compliance costs and operational strategies. Furthermore, New York State's legislative actions, such as the 2019 Housing Stability and Tenant Protection Act, have directly affected its multi-family loan portfolio, leading to a substantial increase in delinquencies, with a reported 990% rise in delinquencies on rent-regulated multi-family loans.

The ongoing evolution of cybersecurity regulations, with New York leading the charge through the NYDFS, necessitates significant investment in bolstering defenses and vendor management. This proactive stance by New York often sets a precedent for other jurisdictions. Additionally, the political climate, including upcoming elections like the 2024 US presidential election, introduces uncertainty regarding potential shifts in banking regulations, affecting investor sentiment and the bank's risk profile.

The Federal Reserve's monetary policy, influenced by political appointments and economic philosophies, remains a critical factor, directly impacting interest rates and credit availability for institutions like NYCB.

What is included in the product

This PESTLE analysis examines the Political, Economic, Social, Technological, Environmental, and Legal factors impacting New York Community Bank, offering a comprehensive view of its operating landscape.

It provides actionable insights and forward-looking perspectives to guide strategic decision-making for the bank and its stakeholders.

A PESTLE analysis for New York Community Bank offers a clear, summarized version of external factors, acting as a pain point reliever by providing easy referencing for strategic discussions and decision-making.

Economic factors

The interest rate environment significantly impacts banks like New York Community Bank (NYCB). While the Federal Reserve is anticipated to implement gradual rate reductions through 2025, the cost of deposits is expected to stay high. This persistent elevated deposit cost will continue to squeeze banks' net interest income, which is the profit banks make from lending money at a higher rate than they pay on deposits.

Consequently, banks will need to re-evaluate their income generation strategies. A key focus will likely be on increasing noninterest income, which includes fees from services like wealth management, account maintenance, and transaction processing. This diversification becomes crucial when net interest income faces pressure.

Managing the delicate balance between loan rates and deposit rates remains a core challenge for asset and liability management. For instance, if NYCB cannot raise its loan yields sufficiently to offset increasing deposit costs, its net interest margin will compress further. This dynamic requires careful forecasting and strategic adjustments to optimize profitability in a fluctuating rate landscape.

The New York City real estate market is poised for a rebound in 2025, with buyer activity expected to increase following a period of slower sales. Despite this anticipated recovery, the supply of available properties is projected to remain constrained, and high price points will continue to challenge affordability for many potential buyers.

New York Community Bank's (NYCB) significant involvement in multi-family lending, particularly for rent-regulated buildings, means it is directly influenced by these market conditions. This sector has experienced a downturn, with some property values declining and loan-to-value ratios on existing loans rising, potentially impacting the bank's loan portfolio.

New York Community Bank (NYCB) has grappled with significant credit quality issues, especially within its multi-family and commercial real estate segments. This has directly translated into substantial loan losses and a marked increase in provisions set aside for potential credit losses.

The bank reported a notable $280 million loss for the third quarter of 2024 and projects continued losses throughout 2025. These elevated provisioning levels are expected to persist in the short term before gradually normalizing in 2025 and 2026.

Overall Economic Growth and Consumer Spending

The U.S. economy is anticipated to experience a slowdown in 2025, with Gross Domestic Product (GDP) growth projected to reach around 1.5% in a baseline forecast, a decrease from the anticipated stronger growth in 2024. This deceleration is largely attributed to moderating consumer spending, a potential uptick in unemployment, and subdued business investment, all of which could collectively dampen overall economic expansion.

This economic cooling could potentially impact consumer credit quality, although current projections suggest that bank consumer delinquency rates are likely to see only a marginal increase.

- Projected U.S. GDP Growth (2025 Baseline): 1.5%

- Key Factors Affecting Growth: Moderating consumer spending, rising unemployment, weak business investment.

- Impact on Consumer Credit: Potential for slight increase in bank consumer delinquency rates.

Portfolio Diversification and Lending Strategies

New York Community Bank (NYCB) is strategically repositioning its lending activities to enhance portfolio resilience. Facing headwinds in its commercial real estate (CRE) sector, the bank is actively pursuing diversification, aiming to significantly reduce its exposure to this historically concentrated area.

A key element of this strategy involves a substantial increase in Commercial and Industrial (C&I) lending. NYCB has set an ambitious target to grow its C&I loan book from roughly $16 billion to $30 billion over the next three to five years. This pivot is designed to mitigate risks and create a more balanced and robust lending profile.

- Loan Portfolio Diversification: NYCB is shifting focus away from CRE to a more balanced lending approach.

- C&I Lending Growth Target: The bank aims to nearly double its C&I loan portfolio from $16 billion to $30 billion.

- Strategic Rationale: This move is critical for reducing reliance on CRE and managing associated sector-specific risks.

- Timeline: The projected timeframe for this significant portfolio adjustment is three to five years.

The economic outlook for 2025 suggests a slowdown, with U.S. GDP growth projected at 1.5%. This deceleration, driven by moderating consumer spending and business investment, could lead to a slight uptick in consumer delinquency rates for banks. NYCB's strategic shift towards Commercial and Industrial (C&I) lending, aiming to grow its portfolio from $16 billion to $30 billion over three to five years, is a direct response to these economic pressures and a move to de-risk its balance sheet.

| Economic Factor | 2025 Projection | Impact on NYCB |

|---|---|---|

| U.S. GDP Growth | 1.5% | Potential slowdown in loan demand, increased credit risk. |

| Consumer Spending | Moderating | Could impact revenue from consumer-facing services. |

| Business Investment | Subdued | May affect demand for commercial loans. |

| Interest Rate Environment | Gradual Reductions, High Deposit Costs | Continued pressure on Net Interest Income (NII), need for fee income diversification. |

What You See Is What You Get

New York Community Bank PESTLE Analysis

The preview shown here is the exact document you’ll receive after purchase—fully formatted and ready to use. This PESTLE analysis of New York Community Bank provides a comprehensive overview of the Political, Economic, Social, Technological, Legal, and Environmental factors impacting its operations. Understand the critical external forces shaping the bank's strategy and future success.

Sociological factors

New York City's population, consistently one of the densest in the United States, continues to experience urbanization. This trend fuels a sustained demand for multi-family housing, a key segment for New York Community Bank (NYCB). As of recent estimates, NYC's population hovers around 8.3 million, with ongoing development projects in areas like Brooklyn and Queens indicating a continued focus on rental properties.

Population dynamics within the broader metropolitan area directly impact NYCB's lending landscape. For instance, the growth of neighboring urban centers such as Jersey City and Hoboken, which have seen significant residential development, expands the bank's potential market reach but also introduces new competitive pressures. These shifts in where people choose to live and work are crucial for understanding the stability and growth of the bank's core lending business.

Housing affordability remains a critical challenge in New York City, impacting both sales and rental markets. As of late 2024, average rents in Manhattan continued to hover around $4,000 per month, while median home prices exceeded $750,000, pushing many towards co-ops which offer a more accessible entry point due to their lower price points compared to condominiums.

New York Community Bank's substantial portfolio of rent-regulated properties means tenant financial health is directly linked to loan performance. For instance, if tenants struggle with increased utility costs or stagnant wage growth within the confines of rent stabilization laws, their ability to pay rent on time can be affected, potentially leading to increased delinquencies for NYCB.

Consumer preferences are shifting dramatically towards digital channels. In 2024, a significant portion of new bank accounts were opened with fintech and digital-only banks, reflecting a strong demand for convenient, around-the-clock access. This trend is driven by a desire for hyper-personalized services and seamless user experiences.

NYCB's strategy of serving diverse customer segments through both branches and digital platforms needs to aggressively address this digital-first mentality. By the end of 2024, it's estimated that over 70% of banking interactions will occur digitally, making a robust and intuitive online and mobile banking experience paramount for customer retention and acquisition.

Financial Inclusion and Community Impact

New York Community Bank (NYCB) plays a significant role in the social fabric of its operating regions, contributing through tax revenues and job creation. In 2023, community banks nationwide, including NYCB, facilitated billions in small business lending, a critical component for local economic growth.

The broader financial health of U.S. households underscores the importance of institutions like NYCB. As of late 2024, a notable percentage of Americans still face challenges with traditional banking, highlighting the persistent need for accessible services and protection against issues like overdraft fees and fraud.

- Community Investment: NYCB's lending activities directly support local economies, with community banks in 2023 originating over $1.7 trillion in loans, many to small businesses.

- Financial Well-being: Data from late 2024 indicated that approximately 15% of U.S. adults were unbanked or underbanked, emphasizing the ongoing need for accessible financial services.

- Economic Support: Community banks are crucial for local job creation and small business survival, often providing capital where larger institutions may not.

Socio-economic Challenges in Rent-Regulated Sector

The 2019 rent laws in New York have created significant financial strain for owners of rent-regulated properties. These owners, often families who have held properties for generations, are increasingly subsidizing operations from personal savings to avoid distress. This reality directly impacts the socio-economic fabric of communities where these properties are located.

The financial pressure on these property owners has direct implications for New York Community Bank (NYCB). As a significant lender in the multi-family housing sector, the bank's asset quality is intrinsically linked to the financial health of these owners. When owners struggle, it can lead to increased loan delinquencies and defaults.

Operating costs for these properties have also climbed, exacerbating the challenges posed by rent regulations. For instance, property taxes and utility costs continue to rise, creating a widening gap between income and expenses. This financial squeeze is not just an economic issue but a social one, as it affects the long-term viability of affordable housing stock.

- Rising Operating Costs: Property taxes in New York City saw an average increase of 2% in 2024, adding to the financial burden on property owners.

- Impact on Family Ownership: Many rent-regulated properties are owned by families who have managed them for decades, facing pressure to maintain them despite profitability challenges.

- Bank Asset Quality: The stress on these owners directly translates to potential risks within NYCB's multi-family loan portfolio, affecting its overall financial stability.

Sociological factors significantly influence New York Community Bank's (NYCB) operational environment, particularly concerning housing affordability and community engagement. The bank's substantial portfolio of rent-regulated properties means tenant financial health is directly linked to loan performance, with rising operating costs for properties further straining owners. As of late 2024, the persistent need for accessible financial services is highlighted by approximately 15% of U.S. adults remaining unbanked or underbanked.

Technological factors

The banking sector is rapidly embracing digital transformation, aiming to automate manual tasks and boost efficiency. New York Community Bank must consistently invest in updated IT systems and platforms to sharpen its operational edge and stay competitive in this evolving landscape.

This drive for modernization is key to both elevating customer interactions and refining internal operations. For instance, many banks reported significant investments in cloud computing and AI in 2024, with projections showing continued growth in these areas through 2025 to meet customer demand for seamless digital services.

Cybersecurity remains a critical concern for New York Community Bank (NYCB), as threats to financial institutions are ever-present and can be existential. Robust data security and effective incident response are not just best practices but necessities for survival in the current digital landscape.

New York State has significantly tightened its cybersecurity regulations, with crucial updates becoming effective in November 2024 and further enhancements scheduled for 2025. These new rules impose more stringent requirements on banks, necessitating a proactive approach to compliance.

To meet these evolving demands, NYCB must ensure its Chief Information Security Officer (CISO) provides regular reports on security incidents. Furthermore, the bank needs to prioritize the encryption of all non-public data and continuously update its incident response plans to align with the latest regulatory mandates.

The financial landscape is rapidly shifting with fintechs and digital-only banks aggressively acquiring customers by offering tailored, user-friendly services. New York Community Bank (NYCB) faces a substantial competitive threat from these agile players who are adept at meeting evolving consumer demands for seamless digital experiences. For instance, by the end of 2024, digital banks are projected to hold over $2 trillion in assets, highlighting their growing market presence.

To counter this, NYCB must prioritize enhancing its digital infrastructure and service portfolio. This includes embracing open banking principles and developing robust mobile solutions to ensure it remains competitive and avoids ceding valuable market share to these digitally native institutions.

Leveraging Artificial Intelligence (AI)

Artificial intelligence is rapidly becoming a critical technological advancement for community banks in 2025, enabling them to compete more effectively with larger financial institutions. New York Community Bank (NYCB) can harness generative AI to deliver highly personalized customer service 24/7, streamline content creation, and achieve greater operational agility and efficiency. For instance, AI can automate routine customer inquiries, freeing up human staff for more complex issues, a significant advantage in customer satisfaction.

The adoption of AI can significantly enhance NYCB's operational effectiveness across multiple domains. This includes refining risk management processes by identifying potential fraud patterns with greater accuracy and improving customer engagement through tailored product recommendations and proactive support. By integrating AI, NYCB can expect to see improvements in areas like loan application processing times and customer retention rates.

- Enhanced Customer Service: Generative AI can power chatbots that provide instant, personalized responses to customer queries, improving satisfaction and reducing wait times.

- Operational Efficiency: AI can automate repetitive tasks in areas like data entry, compliance checks, and fraud detection, freeing up valuable human resources.

- Personalized Marketing: AI algorithms can analyze customer data to deliver highly targeted marketing campaigns and product offers, increasing conversion rates.

- Risk Management: AI tools can improve credit scoring models and identify potential financial risks more effectively, strengthening the bank's stability.

Innovation in Lending and Payment Technologies

New York Community Bank (NYCB) is actively embracing innovation in lending and payment technologies. A prime example is their strategic investment and partnership with FinTech firms like Figure Technologies, Inc. This collaboration focuses on leveraging blockchain technology for payments and lending, signaling NYCB's commitment to modernizing its operations.

By exploring and adopting advanced technologies, NYCB aims to bolster its product suite, enhance the security of its transactions, and unlock new avenues for revenue generation. This proactive approach is crucial for maintaining competitiveness and driving future growth in the rapidly digitizing financial sector.

NYCB's strategic focus on FinTech, particularly in areas like blockchain-based solutions, aligns with broader industry trends. For instance, the global FinTech market size was valued at approximately $1.1 trillion in 2023 and is projected to grow significantly in the coming years, driven by demand for digital payments and innovative lending platforms.

The bank's engagement with Figure Technologies, which has developed platforms for mortgage origination and servicing using blockchain, demonstrates a concrete step towards integrating these cutting-edge solutions. This can lead to more efficient processes, reduced operational costs, and improved customer experiences.

Technological advancements are reshaping the banking industry, pushing institutions like New York Community Bank (NYCB) towards greater digital integration and efficiency. NYCB's investments in areas like AI and blockchain, exemplified by its partnership with Figure Technologies, aim to enhance customer service and streamline operations, reflecting a broader industry trend where digital banks are projected to hold over $2 trillion in assets by the end of 2024.

Legal factors

New York Community Bancorp's (NYCB) expansion past $100 billion in assets has placed it under enhanced regulatory scrutiny as a Category IV banking organization. This means NYCB must now adhere to more rigorous standards for capital stress testing, liquidity risk management, and overall internal controls. For instance, in its Q1 2024 earnings, the bank reported $1.2 billion in non-interest expense, with a significant portion attributed to compliance and remediation efforts.

The bank has specifically acknowledged material weaknesses in its internal controls concerning loan review processes. Addressing these weaknesses is a critical focus for NYCB as it navigates the heightened regulatory environment. This remediation is essential for ensuring operational stability and meeting the expectations of regulators, which could impact future growth and profitability.

The 2019 Housing Stability and Tenant Protection Act in New York has created substantial legal and financial headwinds for owners of rent-stabilized properties, a significant segment within New York Community Bank's (NYCB) loan book. This legislation has demonstrably contributed to an uptick in loan delinquencies and non-accrual assets for the bank.

As of the first quarter of 2024, NYCB reported that its portfolio of loans secured by rent-stabilized properties experienced a notable increase in non-performing loans. This trend has necessitated a corresponding rise in the bank's loan loss provisions, directly impacting profitability and capital reserves.

The long-term legal and economic sustainability of these rent-regulated real estate assets remains a key area of scrutiny for NYCB, directly influencing the perceived quality and risk profile of its overall loan portfolio.

New York Community Bank (NYCB) is currently entangled in securities fraud class-action lawsuits. These legal challenges allege that the bank misrepresented crucial information, specifically by not disclosing the true extent of increased net charge-offs, a declining performance within its office property portfolio, and the probability of facing greater loan losses and thus needing to boost its allowance for credit losses.

Such litigation poses significant risks, potentially leading to substantial financial penalties for NYCB. Beyond the direct monetary costs, these lawsuits can inflict considerable damage on the bank's reputation, impacting investor confidence and its ability to conduct business smoothly.

Evolving Cybersecurity Regulations

New York Community Bank faces evolving cybersecurity regulations, particularly from the New York State Department of Financial Services (NYDFS). Critical compliance deadlines are set for late 2024 and extend into 2025.

These updated rules mandate key actions for financial institutions. They must appoint a Chief Information Security Officer (CISO), ensure non-public data is encrypted, and refine incident response plans. Demonstrating strong business continuity and disaster recovery capabilities is also paramount.

Failure to adhere to these stringent requirements can result in significant penalties, impacting the bank's financial standing and operational integrity.

- CISO Appointment: Requirement for a dedicated CISO to oversee cybersecurity strategy.

- Data Encryption: Mandate for encrypting all non-public customer data.

- Incident Response: Updated and robust plans for handling data breaches and cyber incidents.

- Business Continuity: Demonstrated resilience through comprehensive business continuity and disaster recovery plans.

Changes in Accounting Standards for Credit Losses

New York Community Bancorp (NYCB) must adapt to evolving accounting standards for credit losses, such as the Current Expected Credit Losses (CECL) methodology. This framework, implemented by the Financial Accounting Standards Board (FASB), requires financial institutions to estimate and reserve for expected credit losses over the life of their loans, rather than just incurred losses. For instance, as of the first quarter of 2024, banks have continued to refine their CECL models, with many reporting increased allowance for credit losses compared to previous periods due to macroeconomic forecasts. NYCB's ability to accurately implement these standards will directly affect its reported earnings and regulatory capital ratios, influencing investor confidence and its overall financial health.

The implications of these accounting shifts are significant. Changes in how NYCB calculates its allowance for credit losses can impact its reported net income and its capital adequacy ratios, which are closely watched by regulators and investors. For example, a more conservative estimation of future losses under CECL could lead to higher provisions, thereby reducing reported profits in the short term. This necessitates robust internal controls and sophisticated modeling capabilities to ensure compliance and maintain financial transparency. The bank's strategic planning must account for the ongoing refinement and potential future adjustments to these credit loss accounting rules.

Key considerations for NYCB include:

- Adherence to CECL: Ensuring consistent and compliant application of the CECL standard in estimating future loan losses.

- Impact on Capital: Understanding how changes in the allowance for credit losses affect regulatory capital requirements and overall financial stability.

- Transparency: Maintaining clear and accurate reporting of credit loss estimations to stakeholders and regulatory bodies.

- Model Refinement: Continuously updating and validating internal models used for credit loss forecasting in response to market conditions and regulatory guidance.

NYCB's status as a Category IV bank means stricter oversight, impacting capital stress testing and liquidity management, with Q1 2024 non-interest expenses showing $1.2 billion, partly due to compliance. The bank is actively addressing material weaknesses in its loan review processes, a crucial step for regulatory adherence and operational stability.

The 2019 Housing Stability and Tenant Protection Act in New York has negatively affected NYCB's rent-stabilized property loans, leading to increased delinquencies and non-accrual assets. This trend has forced the bank to raise its loan loss provisions, impacting profitability and capital reserves as of Q1 2024.

NYCB faces securities fraud class-action lawsuits alleging misrepresentation of net charge-offs and office property portfolio performance, posing financial and reputational risks. Furthermore, evolving cybersecurity regulations, particularly from NYDFS, require significant compliance by late 2024 and into 2025, including CISO appointment and data encryption.

The bank must also adapt to the CECL methodology for credit losses, impacting reported earnings and capital ratios. As of Q1 2024, many banks, including potentially NYCB, have seen increased allowances for credit losses due to macroeconomic forecasts, requiring robust internal controls and model refinement.

Environmental factors

Climate change presents significant physical risks to real estate, impacting property values and long-term viability, especially in vulnerable coastal regions like New York City. Extreme weather events, such as increased flooding and storm intensity, directly threaten properties.

New York Community Bank (NYCB) holds substantial exposure to multi-family and commercial real estate loans. This necessitates a thorough assessment of the environmental conditions affecting these mortgaged properties.

For instance, a 2023 report highlighted that properties in NYC's flood zones could see significant value depreciation due to rising sea levels and more frequent extreme weather. NYCB's loan portfolio must account for these potential future impacts on collateral.

Financial institutions like New York Community Bank (NYCB) face growing demands to showcase their dedication to environmental, social, and governance (ESG) principles. This push is driven by investors and regulators alike, seeking transparency in corporate responsibility.

While NYCB contributes positively to societal infrastructure and job creation, its operations also generate negative environmental impacts, notably greenhouse gas (GHG) emissions and effects on biodiversity. Addressing these areas is crucial for improving its overall ESG standing.

For instance, by actively reducing its carbon footprint and implementing biodiversity protection initiatives, NYCB can significantly boost its ESG score. This enhancement is vital for attracting the growing segment of investors who prioritize sustainability in their portfolio decisions, especially as ESG investing continues its upward trend into 2024 and 2025.

The increasing emphasis on sustainability and clean energy is opening up new avenues for bank lending. The New York Green Bank, a key player, is channeling significant investments into decarbonization efforts, such as electrifying buildings and developing electric vehicle infrastructure throughout New York State.

New York Community Bank (NYCB) could strategically broaden its financial products to encompass green loans or provide financing for eco-friendly development projects. This move would directly align with and capitalize on the state's proactive environmental strategies and the growing demand for sustainable investments.

Environmental Due Diligence in Lending

As environmental concerns gain traction, New York Community Bank (NYCB) will likely see an increased emphasis on environmental due diligence in its real estate lending. This process involves thoroughly evaluating properties for potential environmental hazards, such as soil contamination or exposure to climate-related risks like flooding. For instance, the EPA's Superfund program, which addresses hazardous waste sites, highlights the long-term liabilities associated with contaminated land.

By integrating these environmental risk assessments into its lending framework, NYCB can proactively manage potential financial liabilities and safeguard its reputation. This proactive approach is crucial, especially considering the growing regulatory scrutiny and investor demand for sustainable practices. For example, a 2024 report by S&P Global Ratings indicated that environmental, social, and governance (ESG) factors are increasingly influencing credit ratings, underscoring the financial implications of environmental performance.

NYCB's commitment to robust environmental due diligence can lead to several benefits:

- Risk Mitigation: Identifying and addressing environmental risks upfront can prevent costly cleanups and legal battles down the line.

- Enhanced Reputation: Demonstrating a commitment to environmental stewardship can improve NYCB's standing with customers, investors, and regulators.

- Sustainable Portfolio Growth: Focusing on environmentally sound properties can contribute to a more resilient and future-proof loan portfolio.

Stakeholder Expectations for Environmental Responsibility

Stakeholders, from investors to everyday customers, are increasingly scrutinizing financial institutions like New York Community Bank (NYCB) for their environmental stewardship. This means more than just compliance; it involves transparent reporting on carbon emissions and active strategies to minimize environmental impact.

For NYCB, meeting these rising expectations is crucial for maintaining a positive public image, fostering customer loyalty, and ensuring long-term success in an era where sustainability is a significant market differentiator. For instance, in 2024, many large banks reported significant progress in their ESG (Environmental, Social, and Governance) initiatives, with some setting ambitious targets for reducing their financed emissions.

- Investor Scrutiny: A growing number of institutional investors, managing trillions in assets, are integrating ESG factors into their investment decisions, often favoring banks with strong environmental performance.

- Customer Demand: Consumer preferences are shifting, with a notable percentage of customers indicating they would switch to a bank that demonstrates a commitment to environmental sustainability.

- Regulatory Pressure: Regulators globally are introducing or strengthening environmental disclosure requirements for financial institutions, making proactive environmental management a necessity.

- Reputational Risk: Failure to address environmental concerns can lead to negative publicity and damage a bank's brand, impacting its ability to attract both customers and talent.

Climate change poses a direct threat to NYCB's real estate collateral, with rising sea levels and extreme weather events impacting property values, particularly in coastal areas. Financial institutions are increasingly pressured by investors and regulators to demonstrate strong Environmental, Social, and Governance (ESG) practices, making transparency in environmental impact crucial for NYCB's reputation and market standing.

The growing demand for sustainable investments presents an opportunity for NYCB to expand its offerings into green lending and finance eco-friendly projects, aligning with state initiatives like the New York Green Bank's focus on decarbonization. Integrating environmental due diligence into lending practices is vital for NYCB to mitigate risks, enhance its reputation, and build a more resilient loan portfolio, especially as ESG factors increasingly influence credit ratings.

| Environmental Factor | Impact on NYCB | Data/Trend (2024-2025) |

|---|---|---|

| Climate Change & Physical Risks | Devaluation of real estate collateral, increased insurance costs | Coastal property values in NYC at risk of 10-20% depreciation by 2050 due to sea-level rise. |

| ESG Expectations | Pressure for transparency, potential impact on investor relations and access to capital | Over 60% of institutional investors consider ESG factors in their 2024 investment decisions. |

| Green Finance Opportunities | Potential for new loan products and market share in sustainable development | New York Green Bank committed $1 billion to clean energy projects in 2024. |

| Environmental Due Diligence | Need for robust risk assessment in lending, potential for regulatory scrutiny | S&P Global Ratings noted ESG factors influencing credit ratings for financial institutions in 2024. |

PESTLE Analysis Data Sources

Our PESTLE Analysis for New York Community Bank is built on a foundation of data from reputable sources, including U.S. federal and state government reports, financial regulatory bodies, and leading economic and industry publications. We ensure comprehensive coverage by incorporating insights from market research firms and demographic data providers.