New York Community Bank Porter's Five Forces Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

New York Community Bank Bundle

New York Community Bank faces significant competitive pressures, with moderate buyer power and a notable threat of substitutes in the financial services sector. Understanding the intensity of these forces is crucial for strategic planning.

The complete report reveals the real forces shaping New York Community Bank’s industry—from supplier influence to threat of new entrants. Gain actionable insights to drive smarter decision-making.

Suppliers Bargaining Power

New York Community Bancorp (NYCB) depends on a mix of funding, from customer deposits to wholesale borrowings and Federal Home Loan Bank advances. The ease of accessing and the price of this capital directly impact the bank's financial health and earning potential. For instance, in early 2024, NYCB saw a significant outflow of its core deposits, prompting a need to bolster its capital through equity issuance and by securing liquidity via brokered deposits and wholesale funding channels.

The banking sector, including community banks like New York Community Bank (NYCB), relies heavily on skilled professionals in critical areas such as lending, risk management, technology, and customer service. The capacity to attract and retain top talent directly influences operational effectiveness and the successful implementation of strategic initiatives.

NYCB has experienced notable leadership transitions and has openly discussed difficulties in retaining employees. These challenges in talent acquisition and retention could potentially hinder the bank's progress in executing its ongoing transformation plan, impacting its competitive standing.

As banking becomes more digital, New York Community Bank's reliance on technology and software providers for essential services like digital banking, cybersecurity, and data analytics is growing significantly. This increased dependence strengthens the bargaining power of these suppliers.

Banks, including New York Community Bank, are projected to boost their technology investments. For instance, spending on areas such as fraud detection, digital banking platforms, and advanced data analytics is expected to see an uptick in 2024 and 2025, giving tech providers more leverage in negotiations.

Regulatory Bodies

Regulatory bodies, though not direct suppliers, wield substantial power over banks like New York Community Bank (NYCB). They impose compliance mandates, capital adequacy standards, and operational frameworks that significantly shape a bank's ability to function and its cost of doing business. The evolving regulatory environment, particularly with increased scrutiny on risk management and governance, presents a continuous challenge.

NYCB's asset size, which surpassed $100 billion, has consequently placed it under more stringent oversight as a Category IV institution. This means adherence to a more rigorous set of rules, impacting everything from liquidity management to stress testing. The dynamic nature of these regulations means banks must remain agile and invest heavily in compliance infrastructure.

- Increased Capital Requirements: As a Category IV bank, NYCB must maintain higher capital ratios compared to smaller institutions, directly impacting its leverage and profitability.

- Enhanced Compliance Burden: NYCB faces more complex reporting and operational guidelines, requiring significant investment in compliance staff and technology.

- Supervisory Scrutiny: Regulators closely monitor NYCB's risk management practices, lending standards, and overall financial health, which can influence strategic decisions.

- Dynamic Regulatory Landscape: Ongoing changes in banking regulations, driven by economic conditions and policy shifts, necessitate continuous adaptation and investment in compliance.

Credit Rating Agencies

Credit rating agencies wield considerable influence over banks like New York Community Bank (NYCB) by assessing their financial stability. This assessment directly impacts a bank's cost of borrowing and how investors perceive its risk. A downgrade can trigger significant negative consequences, affecting depositor confidence and access to capital markets.

In early 2024, NYCB experienced this firsthand. Following a series of credit rating downgrades, the bank faced increased scrutiny and concerns about its financial health. This led to heightened volatility in its stock price and a greater challenge in securing favorable funding terms, underscoring the significant bargaining power these agencies possess.

- Impact of Downgrades: Credit rating agencies' assessments directly influence a bank's borrowing costs and investor confidence.

- NYCB's 2024 Experience: Downgrades in early 2024 led to increased funding costs and market volatility for NYCB.

- Consequences: Negative ratings can result in deposit outflows and reduced access to capital, impacting a bank's operational stability.

Suppliers of capital, including depositors and wholesale funding providers, hold significant bargaining power over New York Community Bancorp (NYCB). The bank’s need for liquidity, especially after deposit outflows in early 2024, means it must attract and retain these funding sources by offering competitive rates. This reliance on external capital directly influences NYCB's profitability and operational flexibility.

What is included in the product

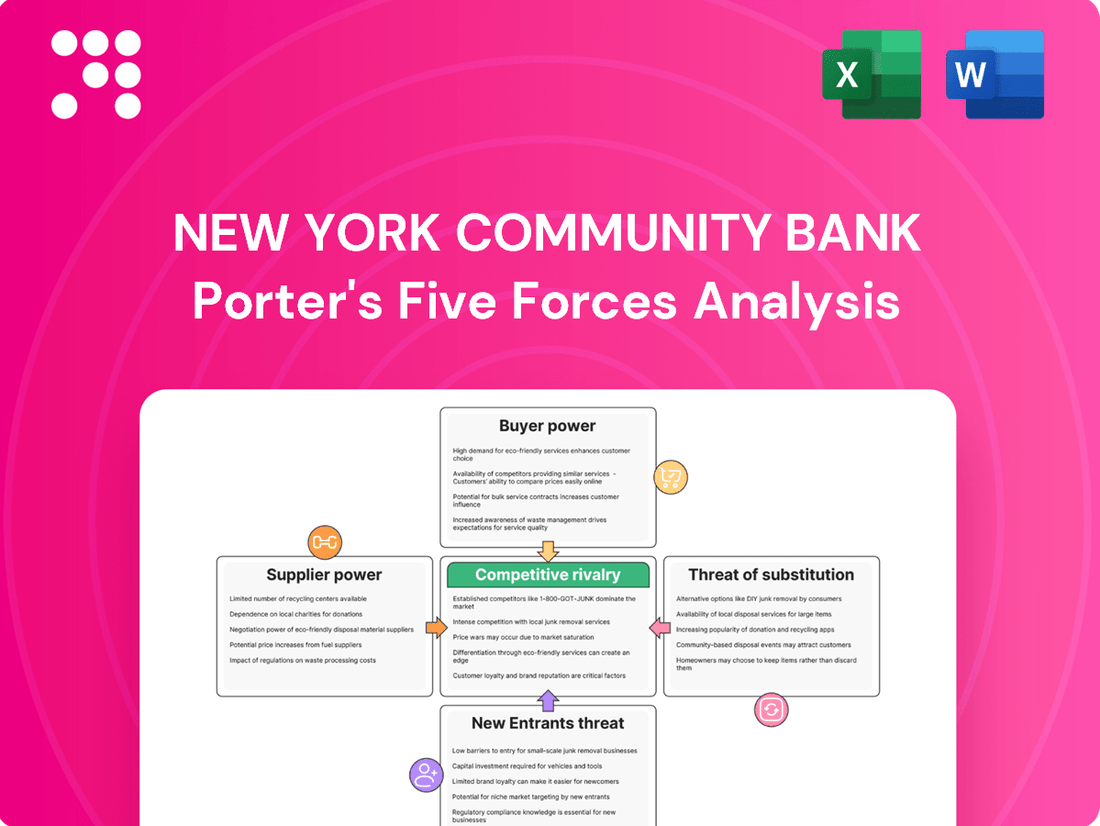

This Porter's Five Forces analysis for New York Community Bank examines the intensity of competition, buyer and supplier power, threat of new entrants, and the impact of substitutes on the banking industry.

Instantly visualize the competitive landscape of the banking industry with a clear, actionable Porter's Five Forces analysis, allowing New York Community Bank to proactively address threats and capitalize on opportunities.

Customers Bargaining Power

Customers, both individuals and businesses, now have more choices than ever for where to park their money, largely due to differences in interest rates and the ease of digital banking. This increased deposit mobility means banks are more attuned to what they offer on deposits, as customers can readily move their funds elsewhere if a better rate is available.

The tendency for deposits to shift has grown over the last twenty years, making banks more sensitive to the interest rates they pay on these funds. This sensitivity was starkly evident for New York Community Bank (NYCB) in early 2024, when they saw a substantial outflow of core deposits, underscoring how quickly customers react to concerns about financial stability and prevailing interest rates.

Borrowers, especially those in multi-family and commercial real estate, have a range of lending options available. This access to alternatives grants them a degree of bargaining power.

NYCB's concentration in multi-family lending means clients in this sector can leverage their choices, potentially securing more attractive loan terms from competitors. For instance, in 2024, the bank reported that borrowers without a deposit relationship were actively seeking better terms elsewhere, impacting its multi-family loan book.

Customers today demand intuitive digital platforms, expecting features like mobile banking, quick transactions, and tailored financial advice. This shift is driven by fintech innovations that are raising the bar for customer experience.

New York Community Bank, like its peers, must invest heavily in digital transformation to meet these evolving expectations. In 2024, the banking sector saw continued growth in mobile banking adoption, with many institutions reporting over 70% of customer interactions occurring through digital channels.

The pressure from agile fintech competitors, who often offer superior user interfaces and specialized digital services, directly impacts NYCB's ability to retain and attract customers. Failure to keep pace with these digital advancements significantly amplifies the bargaining power of customers.

Access to Alternative Lending

The expansion of alternative lending platforms significantly enhances customer bargaining power. These platforms, offering everything from personal loans to small business capital, provide readily available alternatives to traditional banks.

This growing sector is expected to reach substantial market values by 2030, with projections indicating a robust compound annual growth rate. For instance, the global peer-to-peer lending market alone was valued at over $100 billion in 2023 and is anticipated to grow considerably.

- Increased Competition: Alternative lenders often compete on speed and flexibility, forcing traditional banks like New York Community Bank to offer more attractive terms.

- Faster Approvals: Many alternative platforms boast significantly quicker loan approval processes compared to established institutions.

- Flexible Terms: Customers can often find more customized repayment schedules and less stringent collateral requirements.

- Market Growth: The alternative lending market is expanding rapidly, projected to exceed $300 billion globally by 2027, giving consumers more leverage.

Relationship-Based Banking vs. Transactional Banking

New York Community Bank (NYCB) faces varying customer bargaining power depending on their banking preferences. While some clients value the personal touch and long-term relationships fostered by community banks, a significant segment is more transactional, actively seeking the most competitive rates and streamlined digital services. This dichotomy presents a challenge, as NYCB's strategy to serve both through its branch network and digital channels must contend with the increasing ease of comparison for transactional customers.

The shift towards digital-first banking inherently empowers transactional customers. They can readily compare NYCB's offerings against those of numerous competitors, including fintechs and larger national banks, simply by using online tools and comparison sites. This accessibility to information and ease of switching means that customers focused on price or convenience hold considerable sway.

- Customer Segmentation: NYCB must balance the needs of relationship-focused clients with the price sensitivity of transactional ones.

- Digital Empowerment: The rise of digital platforms allows transactional customers to easily compare rates and services, increasing their bargaining power.

- Competitive Landscape: In 2024, the banking sector continued to see intense competition on pricing and digital convenience, directly impacting customer loyalty.

Customers, particularly those in the multi-family real estate sector, wield significant bargaining power due to the availability of alternative lenders. This leverage allows them to negotiate more favorable loan terms, as demonstrated by NYCB's 2024 experience where non-deposit clients actively sought better deals elsewhere.

The banking industry's ongoing digital transformation, with over 70% of customer interactions occurring digitally in 2024, further empowers customers. They can easily compare rates and services across numerous platforms, from traditional banks to agile fintechs, increasing their ability to demand better terms and user experiences.

The rapid expansion of alternative lending, with the global peer-to-peer lending market alone exceeding $100 billion in 2023, provides a growing array of choices for borrowers. This broadens customer options and intensifies competition, forcing institutions like NYCB to remain competitive on pricing and service delivery.

| Factor | Impact on NYCB | 2024 Data/Trend |

|---|---|---|

| Deposit Mobility | Increased sensitivity to deposit rates | Substantial core deposit outflows observed |

| Lending Alternatives | Borrowers can negotiate better terms | Multi-family clients sought external financing |

| Digital Expectations | Pressure to enhance digital platforms | Over 70% of banking interactions digital |

| Fintech Competition | Need for superior user experience | Fintechs offer faster approvals and flexible terms |

What You See Is What You Get

New York Community Bank Porter's Five Forces Analysis

This preview shows the exact, comprehensive Porter's Five Forces Analysis of New York Community Bank you'll receive immediately after purchase—no surprises, no placeholders. You'll gain detailed insights into the competitive landscape, including the bargaining power of buyers and suppliers, the threat of new entrants and substitutes, and the intensity of rivalry within the banking sector. This professionally written analysis is fully formatted and ready for your immediate use and strategic planning.

Rivalry Among Competitors

New York Community Bank (NYCB) operates in a banking landscape teeming with rivals. The New York metropolitan area, a financial hub, hosts a dense concentration of banks, ranging from colossal national players like JPMorgan Chase and Bank of America to robust regional institutions and numerous community banks. This diverse competitive set means NYCB constantly vies for customer attention and market share across both deposit-gathering and lending activities.

As of the first quarter of 2024, the banking sector in New York continued to showcase this intense rivalry. For instance, the number of FDIC-insured institutions operating in New York State remained substantial, reflecting the broad spectrum of competitors NYCB faces. These institutions, with varying asset sizes and strategic focuses, all compete for the same pool of New York consumers and businesses, making differentiation and customer retention critical for NYCB.

While the broader banking landscape is quite fragmented, New York Community Bank (NYCB) has carved out a substantial niche in multi-family lending, especially for properties with rent regulations in New York City. This focus, however, intensifies rivalry within that specific market segment.

Recent pressures on this specialized portfolio have prompted NYCB to actively pursue diversification across its loan book, indicating a strategic response to the concentrated competition it faces in its traditional stronghold.

The regulatory environment significantly shapes competitive rivalry in banking. Smaller institutions like New York Community Bank often face a heavier burden from compliance costs compared to larger banks, which possess more substantial resources to manage these demands. This disparity can create a competitive disadvantage, impacting their ability to invest in growth or innovation.

As of early 2025, while discussions around potential deregulation continue, the overarching trend still points towards stringent governance and risk management frameworks. Banks are expected to maintain robust compliance programs, and the cost associated with adhering to these evolving standards remains a key factor influencing operational strategies and competitive positioning across the industry.

Impact of Fintech and Digital Innovation

Fintech firms are intensifying competition for New York Community Bank (NYCB) by offering specialized, tech-forward financial solutions. This challenge is particularly evident in areas like digital payments, online lending, and customer experience, forcing traditional banks to adapt. For instance, by the end of 2023, fintech funding in the US reached over $20 billion, highlighting the aggressive innovation in the sector.

NYCB, like many traditional institutions, is responding to this digital disruption by significantly boosting its own digital transformation efforts. This includes enhancing online and mobile banking platforms and exploring strategic collaborations with fintech companies to leverage their agility and technological expertise. In 2024, many banks, including those of NYCB's size, are allocating substantial portions of their IT budgets, often exceeding 10%, to digital initiatives and partnerships.

- Increased Competition: Fintechs offer specialized services in payments and lending, directly competing with NYCB's core offerings.

- Digital Transformation Investment: Banks like NYCB are investing heavily in technology to match fintech capabilities.

- Partnership Strategies: Collaborations with fintechs are becoming a key strategy for traditional banks to innovate and expand services.

- Customer Experience Focus: Fintechs often excel in user-friendly digital interfaces, pushing NYCB to prioritize its own customer digital experience.

Mergers and Acquisitions Activity

Mergers and acquisitions (M&A) activity significantly shapes the competitive landscape for banks like New York Community Bank. When larger institutions merge, they often gain greater market share and enhanced capabilities, directly intensifying rivalry. This consolidation can lead to a more concentrated market, putting pressure on smaller or less efficient players.

The U.S. banking sector is poised for a notable uptick in M&A throughout 2025. This trend is anticipated to be fueled by a more accommodating regulatory environment and the strategic imperative for consolidation. Banks are looking to expand their market reach and bolster their service offerings through these transactions.

- Increased Market Power: Larger, merged entities can leverage economies of scale, potentially leading to more competitive pricing and product offerings.

- Capability Enhancement: Acquisitions allow banks to quickly acquire new technologies, customer bases, or specialized expertise, leveling the playing field or creating new competitive advantages.

- Consolidation Drivers: Factors such as the pursuit of greater efficiency, broader geographic presence, and improved profitability are key motivators for M&A in the current banking climate.

- Regulatory Influence: Shifts in regulatory stance can either encourage or discourage M&A, directly impacting the pace and nature of competitive shifts within the industry.

New York Community Bank (NYCB) faces a fiercely competitive environment, particularly within the New York metropolitan area, a dense financial hub. This intense rivalry stems from the presence of numerous large national banks, strong regional players, and a multitude of community banks, all vying for market share in both deposits and lending.

The banking sector in New York, as of early 2024, continued to demonstrate this high level of competition, with a significant number of FDIC-insured institutions operating statewide. These diverse competitors, each with unique asset sizes and strategic aims, actively pursue the same customer base, making customer retention and differentiation paramount for NYCB's success.

NYCB's specialization in multi-family lending, especially for rent-regulated properties in New York City, further concentrates competition within this specific niche. This focused rivalry has prompted NYCB to diversify its loan portfolio, a strategic move to mitigate the pressures of its traditional market stronghold.

| Competitor Type | Examples | Impact on NYCB |

|---|---|---|

| Large National Banks | JPMorgan Chase, Bank of America | Significant market share, broad product offerings, extensive resources. |

| Regional Banks | TD Bank, M&T Bank | Strong local presence, established customer relationships, competitive pricing. |

| Community Banks | Numerous smaller institutions | Niche market focus, personalized service, local market knowledge. |

| Fintech Companies | Various digital platforms | Innovative technology, agile service delivery, enhanced customer experience. |

SSubstitutes Threaten

Alternative lending platforms, like peer-to-peer (P2P) lenders and crowdfunding sites, are a growing threat to traditional banks such as New York Community Bank. These platforms often provide quicker, more adaptable, and readily available funding for both individuals and businesses. For instance, the global P2P lending market was valued at approximately $100 billion in 2023 and is expected to see robust growth in the coming years, with projections indicating a substantial expansion between 2025 and 2030.

Fintech firms are increasingly offering digital wallets and mobile payment solutions that directly compete with traditional banking services. These innovations, like those from companies such as PayPal and Square, provide consumers with streamlined transaction capabilities, potentially reducing reliance on New York Community Bank's existing payment infrastructure.

The convenience and often lower fees associated with these fintech alternatives represent a significant threat. For instance, by mid-2024, digital wallet adoption continued its upward trajectory, with a substantial portion of consumers preferring these methods for everyday purchases, directly impacting transaction volumes for incumbent banks.

The increasing prominence of private credit and non-bank lenders presents a significant threat of substitutes for traditional banks like New York Community Bank. These alternative financiers, including private equity firms and specialized debt funds, are actively providing capital for commercial real estate and other large-scale projects, often offering more flexible terms or quicker deal closures than conventional banks.

This shift is not just theoretical; it's a major topic at industry gatherings. For instance, the global private debt market was estimated to reach $1.5 trillion by the end of 2023, with projections suggesting continued robust growth. This expansion means borrowers have more options beyond traditional banking relationships, potentially reducing reliance on institutions like NYCB for certain financing needs.

Internal Financing and Corporate Treasury Management

The threat of substitutes for New York Community Bank (NYCB) in its lending activities, particularly for commercial real estate, is amplified by companies' increasing ability to finance themselves internally or through alternative sources. Businesses with strong balance sheets and consistent cash flows can opt to self-fund projects, thereby bypassing traditional bank loans altogether. This trend was evident in 2024, where robust corporate cash reserves allowed many companies to manage capital expenditures without external financing.

Furthermore, the rise of capital markets and sophisticated treasury management practices offers viable alternatives to bank lending. Companies can issue their own debt securities or leverage private credit funds, especially larger entities that NYCB might typically serve. For instance, in 2024, the corporate bond market remained a significant source of funding for many established businesses, providing competitive rates and flexible terms compared to bank loans.

- Internal Financing: Companies with strong free cash flow can self-fund capital expenditures, reducing reliance on banks.

- Corporate Debt Issuance: Larger corporations can access public debt markets, often securing favorable terms.

- Private Credit Markets: The growth of private credit funds offers alternative lending solutions, particularly for mid-sized and larger businesses.

- Treasury Management Sophistication: Advanced treasury functions enable companies to optimize cash and access diverse funding instruments.

Direct Capital Markets Access

Larger corporations and experienced investors can tap into capital markets directly by issuing bonds or stocks, bypassing traditional banking services for their funding needs. This presents a significant threat as it removes a layer of intermediation that banks like New York Community Bank (NYCB) typically rely on.

While NYCB's core business is concentrated in the New York City metropolitan area, focusing on multi-family lending, some of its more substantial commercial real estate clients might possess the scale and sophistication to access these direct capital markets. For instance, a large real estate investment trust (REIT) client of NYCB could potentially issue its own corporate bonds to raise capital rather than relying on bank loans.

- Direct access to capital markets via bond or equity issuance bypasses traditional bank intermediation.

- Sophisticated investors and larger businesses are the primary users of this substitute funding method.

- NYCB's larger commercial real estate clients may have the option to access capital markets directly, reducing reliance on the bank.

The threat of substitutes for New York Community Bank (NYCB) is substantial, particularly from digital payment platforms and alternative lenders. Fintech innovations offer streamlined transactions and often lower fees, directly impacting traditional banking revenue streams from payments and lending. By mid-2024, the increasing adoption of digital wallets by consumers for everyday purchases highlighted this shift, potentially reducing transaction volumes for incumbent banks.

Alternative lending sources, including private credit and peer-to-peer (P2P) platforms, provide significant competition. The global P2P lending market, valued at approximately $100 billion in 2023, continues to grow, offering borrowers more flexible and accessible funding options. Similarly, the private debt market, estimated at $1.5 trillion by the end of 2023, provides substantial capital for businesses, including those in commercial real estate, a key sector for NYCB.

Companies with strong financial health can also bypass banks by using internal funds or issuing corporate debt. In 2024, robust corporate cash reserves enabled many businesses to self-finance projects, diminishing the need for traditional bank loans. Furthermore, the corporate bond market remained a vital funding avenue for established companies, often presenting competitive rates and terms.

| Substitute Type | Market Size/Growth (Approx.) | Impact on Traditional Banks | Example Providers |

|---|---|---|---|

| Peer-to-Peer (P2P) Lending | $100 billion (2023) | Offers alternative funding, potentially reducing loan demand from banks. | LendingClub, Prosper |

| Digital Wallets/Payments | Significant consumer adoption in 2024 | Reduces reliance on bank payment infrastructure, impacting transaction fees. | PayPal, Square, Apple Pay |

| Private Credit | $1.5 trillion (end of 2023) | Provides substantial capital for businesses, competing directly with bank lending. | Apollo Global Management, Blackstone |

| Corporate Bond Issuance | Active market in 2024 | Allows larger companies to access capital directly, bypassing bank intermediation. | Various corporations issuing public debt |

Entrants Threaten

The banking sector, including institutions like New York Community Bank (NYCB), faces substantial regulatory hurdles that deter new entrants. These include stringent capital requirements, complex licensing procedures, and ongoing compliance with a multitude of financial laws and oversight bodies. For instance, in 2024, the Federal Reserve continued to emphasize robust capital adequacy ratios for banks, a critical barrier for startups needing to secure substantial initial funding.

While discussions around potential deregulation might emerge by 2025, the fundamental structure of banking regulation is unlikely to erode significantly, especially for larger institutions. NYCB, as a significant regional bank, operates within a framework designed to ensure stability, meaning any new competitor aiming for a similar scale would need to navigate these established, high-entry-cost regulations, making it difficult to compete directly without substantial backing.

The banking sector demands significant upfront capital for licensing, technology, and regulatory compliance, creating a substantial barrier for potential new competitors. NYCB's own $1 billion equity raise in March 2024 underscores the immense financial resources needed to operate and compete within this industry.

Existing banks, particularly community banks like New York Community Bank (NYCB) with deep roots, possess a significant advantage in brand reputation and customer trust. This established goodwill is a formidable barrier for new entrants aiming to capture market share. NYCB's community-focused model relies heavily on this trust, though recent financial pressures, including a notable stock price decline in early 2024, have tested that foundation.

Customer Acquisition Costs and Network Effects

New entrants face significant hurdles in acquiring customers, making it costly and time-consuming to attract a critical mass of depositors and borrowers. Established banks like New York Community Bank (NYCB) leverage their extensive branch networks and well-developed digital platforms, creating a substantial barrier to entry.

To compete, new entrants would need to invest heavily in marketing and offer highly attractive, competitive products to overcome the entrenched network effects that benefit incumbent institutions. For instance, the average customer acquisition cost for a new bank account can range from $50 to $200, a significant investment for a challenger.

- High Customer Acquisition Costs: New banks must spend considerably on marketing and incentives to attract initial customers.

- Network Effects: Existing banks benefit from established customer relationships and brand loyalty, making it difficult for newcomers to gain traction.

- Digital and Physical Infrastructure: The cost of building comparable branch networks and robust digital banking platforms is a major deterrent for new entrants.

- Brand Trust and Reputation: New entrants need time and consistent performance to build the trust and reputation that established banks already possess.

Technological Infrastructure and Expertise

Developing and maintaining advanced technological infrastructure, crucial for modern banking, demands substantial capital outlays and specialized IT talent. This includes robust cybersecurity measures, sophisticated digital banking platforms, and powerful data analytics capabilities. For instance, in 2023, the global banking sector invested over $200 billion in technology, highlighting the scale of this requirement.

While fintechs often possess agility, replicating the comprehensive service offerings and scale of established institutions like New York Community Bank presents significant hurdles. The complexity of integrating diverse financial products, ensuring regulatory compliance across all offerings, and building trust with a broad customer base are substantial barriers for new entrants aiming to compete across the full spectrum of banking services.

- High Investment: Significant capital is needed for digital platforms, cybersecurity, and data analytics.

- Expertise Required: Specialized IT and cybersecurity skills are essential for operation.

- Scale and Complexity: Replicating a full suite of traditional banking services is a complex undertaking.

- Regulatory Hurdles: New entrants must navigate stringent banking regulations, adding to development costs and time.

The threat of new entrants for New York Community Bank (NYCB) remains moderate due to substantial barriers. High capital requirements, stringent regulations, and the need for significant upfront investment in technology and infrastructure deter many potential competitors. For example, in 2024, the banking sector continued to see substantial investments in digital transformation, with global spending projected to exceed $200 billion annually, a cost prohibitive for many startups.

Established brand trust and extensive customer networks also present a formidable challenge. NYCB, like other incumbent banks, benefits from years of relationship building, making customer acquisition a costly endeavor for newcomers. In early 2024, NYCB's own equity raise of $1 billion highlighted the immense financial resources required to operate and compete effectively in the current banking landscape.

| Barrier | Impact on New Entrants | Example for NYCB Context |

| Capital Requirements | High; requires substantial initial funding | NYCB's $1 billion equity raise in March 2024 |

| Regulatory Compliance | Complex and costly; extensive licensing and ongoing oversight | Federal Reserve's continued emphasis on capital adequacy in 2024 |

| Customer Acquisition Cost | Significant marketing and incentive spend | Average $50-$200 per new bank account |

| Technological Investment | Demands massive outlays for digital platforms and cybersecurity | Global banking sector investment over $200 billion in technology (2023) |

Porter's Five Forces Analysis Data Sources

Our New York Community Bank Porter's Five Forces analysis is built upon a foundation of publicly available financial statements, SEC filings, and annual reports. We also incorporate data from reputable industry research firms and economic databases to ensure a comprehensive understanding of the competitive landscape.