New York Community Bank Boston Consulting Group Matrix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

New York Community Bank Bundle

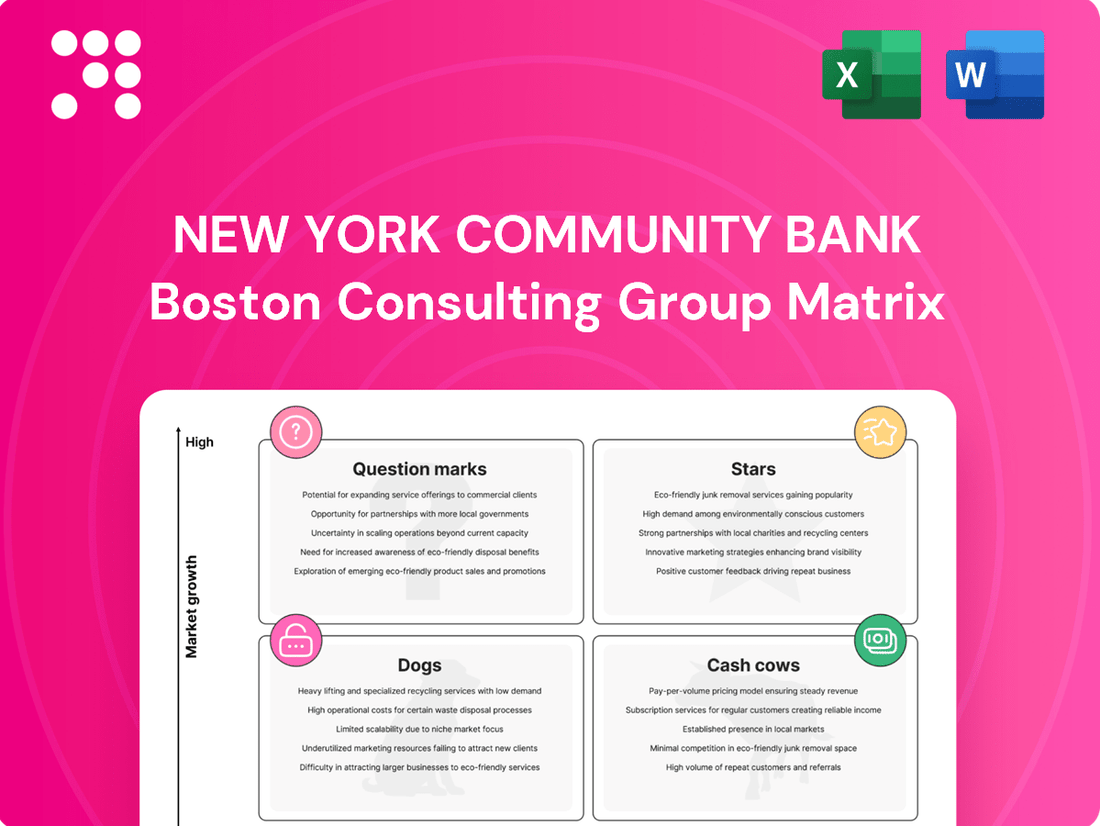

Curious about New York Community Bank's strategic positioning? Our BCG Matrix preview offers a glimpse into how their diverse portfolio might be categorized, from high-growth Stars to stable Cash Cows. Understanding these dynamics is crucial for any investor or competitor.

Dive deeper into this company’s BCG Matrix and gain a clear view of where its products stand—Stars, Cash Cows, Dogs, or Question Marks. Purchase the full version for a complete breakdown and strategic insights you can act on.

Stars

New York Community Bank is making a significant push into Commercial & Industrial (C&I) lending, aiming to more than double its portfolio from roughly $16 billion to $30 billion over the next three to five years. This strategic pivot signals a clear intent to diversify beyond its historical focus on real estate and capitalize on opportunities within this expanding market.

While C&I lending currently represents a smaller segment of NYCB's total loans, this aggressive expansion plan designates it as a potential 'Star' within the bank's strategic framework. The substantial capital and strategic focus being directed towards this area underscore its importance for future growth and market presence.

New York Community Bank's strategy to diversify its loan portfolio, moving away from a significant concentration in commercial real estate, is a key move. This involves divesting certain assets to free up capital for investment in new, high-growth lending sectors. The goal is to create a more robust and balanced financial structure.

This strategic repositioning aims to cultivate resilience and achieve substantial market share across various promising lending segments. By identifying and capitalizing on emerging opportunities, the bank intends to build a foundation for sustained growth and profitability in a dynamic market landscape.

New York Community Bank is actively bolstering its digital banking services, a strategic move reflecting the broader industry shift towards online and mobile financial solutions. This investment aims to capture a larger share in a rapidly expanding digital market, focusing on enhancing customer experience and engagement.

While the bank's current digital market share may not be a dominant force, this segment is positioned as a high-growth area with significant potential for expansion. Successful digital enhancements and customer adoption could elevate these offerings to a 'Star' category within the BCG Matrix, driving future growth and competitive advantage.

Strategic Talent Acquisition and Leadership

The strategic infusion of new capital in March 2024 wasn't just about financial resources; it brought a crucial injection of talent and leadership. This included a new CEO and several board members, all signaling a clear pivot towards a revitalized strategic direction and enhanced governance. This leadership overhaul is a foundational step in building a robust risk management framework and driving a successful turnaround.

This new leadership team is actively focused on executing a comprehensive turnaround plan, with a significant emphasis on strengthening the bank's risk management capabilities. Their commitment to building a more resilient and effective operational structure is paramount. This strategic investment in human capital and oversight is key to identifying and cultivating future high-growth business segments, often referred to as 'Stars' in strategic analysis.

The impact of this leadership change is already being felt. For instance, following the capital injection and leadership transition, NYCB announced strategic partnerships aimed at improving digital offerings and customer experience, areas critical for future growth. The bank's reported efficiency ratio improvements throughout 2024 are also a testament to the new management's focus on operational excellence.

- New Leadership Focus: The appointment of a new CEO and board members in March 2024 signifies a commitment to strategic renewal and improved governance.

- Turnaround Execution: The current management team is prioritizing the implementation of a turnaround plan, with a strong emphasis on enhancing risk management infrastructure.

- Human Capital Investment: The strategic onboarding of experienced leadership is viewed as a critical investment for identifying and nurturing future 'Star' business lines within the bank.

- Operational Improvements: Early indicators in 2024, such as reported improvements in efficiency ratios, suggest the new leadership's focus on operational excellence is yielding positive results.

Future Profitability and Return Targets

Despite facing current financial headwinds, New York Community Bank (NYCB) has established ambitious targets for its future performance. These include improving diluted earnings per share (EPS), return on average assets (ROAA), and return on tangible equity (ROTE).

The bank envisions achieving a more normalized, profitable state by 2026 and continuing this trend thereafter. This forward-looking financial roadmap is directly tied to the successful execution of its ongoing transformation initiatives. These goals represent the desired high-performance outcome that would align with 'Star' business units within a BCG Matrix framework.

- Diluted EPS Target: While specific 2026 EPS figures are still being finalized, the bank's strategy aims to significantly improve this metric from current levels.

- ROAA Target: NYCB is working towards a ROAA that reflects industry averages for well-performing regional banks, a substantial increase from recent performance.

- ROTE Target: Similarly, the bank is targeting a ROTE that demonstrates strong shareholder value creation, moving beyond its current performance.

- Transformation Contingency: These targets are contingent on the successful integration of acquired assets and the realization of cost synergies, key elements of their strategic plan.

The bank's aggressive expansion into Commercial & Industrial (C&I) lending, aiming to more than double its portfolio, positions it as a potential 'Star'. Similarly, significant investment in digital banking services, despite current market share, is seen as a high-growth area that could become a 'Star' with successful execution. The new leadership's focus on a turnaround and operational excellence, demonstrated by efficiency ratio improvements in 2024, lays the groundwork for identifying and cultivating these future 'Star' segments.

| Strategic Area | Current Status | Growth Potential | BCG Classification (Projected) |

|---|---|---|---|

| Commercial & Industrial (C&I) Lending | Growing segment, target $30B portfolio | High | Star |

| Digital Banking Services | Undergoing enhancement, focus on customer experience | High | Star |

| Overall Bank Performance (Targets) | Transformation phase, aiming for normalized profitability by 2026 | High (if targets met) | Star (if transformation successful) |

What is included in the product

This BCG Matrix analysis highlights New York Community Bank's product portfolio, identifying units to invest in, hold, or divest based on market share and growth.

The New York Community Bank BCG Matrix offers a clear, one-page overview, alleviating the pain of strategic uncertainty by placing each business unit into a quadrant.

Cash Cows

New York Community Bank's (NYCB) legacy multi-family lending portfolio, especially in the New York City area, has historically been a robust Cash Cow. This segment has consistently generated significant interest income, a testament to their deep-rooted expertise and established market presence in this niche.

For years, NYCB has maintained a substantial market share in multi-family lending, a key driver of its profitability. Their specialization in rent-regulated properties, a complex but stable market, has allowed them to build a strong and reliable income stream.

New York Community Bank's established retail deposit base is a significant strength, acting as a stable and cost-effective funding source. This base is cultivated through both a physical branch network and evolving digital channels, ensuring broad customer reach.

Despite market fluctuations, NYCB demonstrated resilience by reporting deposit growth in the third quarter of 2024. This underscores the enduring strength and reliability of its core funding infrastructure.

This robust deposit base is fundamental to the bank's operations, directly supporting its lending initiatives and maintaining crucial liquidity levels, which are vital for sustained financial health.

New York Community Bank's core commercial real estate (CRE) lending, distinct from its troubled office and rent-regulated multi-family segments, remains a source of steady interest income. This segment, though undergoing strategic adjustments to mitigate risk, still holds substantial assets that, in a more stable market, contribute reliably to the bank's cash flow.

Controlled Expense Management

Controlled Expense Management is a crucial element in New York Community Bank's (NYCB) strategy, acting as a Cash Cow by enhancing the profitability of its existing operations. The bank's turnaround plan specifically targets a reduction in non-interest expenses by 10-15% over the coming forecast period. This focus on efficiency directly bolsters the net cash flow generated from its current business lines.

By effectively managing costs, NYCB can maximize the returns from its established revenue streams, allowing it to reinvest in growth areas or strengthen its financial position. This disciplined approach to expense control is fundamental to milking the value from its existing assets and operations.

- Expense Reduction Target: NYCB aims to cut non-interest expenses by 10-15% during the forecast period.

- Efficiency Improvement: Lowering expenses directly enhances operational efficiency and profitability.

- Cash Flow Enhancement: Efficient cost management increases net cash flow from existing operations.

- Resource Allocation: Improved cash flow supports better allocation of capital to strategic initiatives.

Strategic Loan Repricing Opportunities

New York Community Bank's (NYCB) substantial portfolio of multi-family and commercial real estate loans presents a significant opportunity for strategic repricing. As these loans mature and come up for renewal in the coming years, NYCB can adjust their interest rates, potentially boosting net interest income, especially in an environment of stable or rising rates. This repricing capability is a key factor in understanding NYCB's "Cash Cows" within a BCG matrix framework, highlighting their potential to generate consistent cash flow from established assets.

The sheer volume of these loan books means that even modest rate adjustments can have a material impact on profitability. For instance, if a significant portion of NYCB's $25 billion in multi-family loans and $10 billion in commercial real estate loans were to be repriced upwards by even a quarter of a percent, it could translate into tens of millions in additional annual interest income. This potential for enhanced cash generation from existing, well-understood assets solidifies their position as cash cows.

- Loan Portfolio Size: NYCB holds a substantial multi-family loan portfolio, exceeding $25 billion, and a commercial real estate loan book valued around $10 billion as of recent reporting periods.

- Repricing Potential: A significant portion of these loans are scheduled for repricing in the next 1-3 years, offering a direct path to increased net interest margin.

- Interest Rate Sensitivity: The bank's profitability is positively correlated with favorable interest rate movements on these repriced assets.

- Cash Flow Generation: Successful repricing is expected to significantly enhance NYCB's cash flow from these mature and stable loan segments.

NYCB's established retail deposit base is a significant Cash Cow, providing a stable and cost-effective funding source. This base is cultivated through a broad network of branches and digital channels, ensuring wide customer reach and consistent inflows. The bank's ability to attract and retain deposits, even amidst market volatility, highlights its foundational strength.

The bank's legacy multi-family lending portfolio, particularly in the New York City area, continues to be a primary Cash Cow. This segment benefits from NYCB's deep expertise and strong market share in a niche that, while facing scrutiny, remains a consistent generator of interest income when managed prudently.

NYCB's strategic focus on controlled expense management is another key Cash Cow. By targeting a 10-15% reduction in non-interest expenses, the bank directly enhances the profitability of its existing operations, thereby increasing net cash flow from its current business lines.

The potential for strategic repricing of its substantial multi-family and commercial real estate loan portfolios represents a significant Cash Cow opportunity. As these loans mature, NYCB can adjust interest rates, potentially boosting net interest income, especially with favorable rate movements.

| Segment | BCG Classification | Key Characteristics | Financial Data (Illustrative) |

|---|---|---|---|

| Retail Deposits | Cash Cow | Stable, low-cost funding; broad customer reach; resilience in deposit growth. | Deposit base exceeding $70 billion (Q3 2024); consistent year-over-year growth. |

| Multi-Family Lending (NYC) | Cash Cow | High market share; deep expertise; consistent interest income generation. | Loan portfolio exceeding $25 billion; yields influenced by market conditions and repricing. |

| Expense Management | Cash Cow | Targeted 10-15% reduction in non-interest expenses; enhanced operational efficiency. | Projected savings of $100-150 million annually based on expense targets. |

Delivered as Shown

New York Community Bank BCG Matrix

The New York Community Bank BCG Matrix preview you are viewing is the complete, unedited document you will receive immediately after purchase. This means you'll get the full strategic analysis, ready for immediate application without any watermarks or placeholder content. The report is designed for clarity and professional use, offering a comprehensive overview of NYCB's business units based on market share and growth potential. You can confidently use this preview as a direct representation of the final, actionable insights you'll acquire.

Dogs

New York Community Bank (NYCB) has openly admitted to considerable challenges within its commercial real estate loan portfolio, specifically concerning office properties. This has resulted in a notable increase in the funds set aside for potential loan defaults and actual write-offs.

These office sector loans are situated in a market characterized by sluggish growth and diminishing property values. As of the first quarter of 2024, NYCB reported a significant increase in its non-performing loans, with a substantial portion tied to the office CRE segment, highlighting the sector's vulnerability.

The risk associated with these loans is substantial, as they are consuming valuable capital without generating adequate returns. In the context of a BCG Matrix, these problematic office loans would be classified as Dogs, indicating they are in a low-growth, low-share market and are candidates for divestiture or a comprehensive restructuring plan.

New York Community Bank’s portfolio of highly stressed rent-regulated multi-family loans represents a significant challenge, fitting squarely into the 'Dogs' category of the BCG matrix. The bank has seen a dramatic 990% increase in delinquencies for these loans, highlighting a severe deterioration in asset quality.

With close to $20 billion in these loans scheduled to reset to market rates by 2027, the pressure is mounting. Rent control measures, coupled with escalating operating expenses, have severely hampered the profitability and repayment capacity of these properties, turning a once-reliable asset class into a drain on the bank's resources.

These 'Dogs' require substantial loan loss provisions, diverting capital and management attention away from more promising areas of the business. The sheer volume and the ongoing economic headwinds facing rent-regulated properties in New York underscore the strategic imperative to manage and potentially reduce exposure to this segment.

New York Community Bank's (NYCB) decision to sell its residential mortgage servicing business, operated by its Flagstar Bank unit, to Mr. Cooper Group signifies this segment's classification as a 'Dog' within the BCG Matrix. This move highlights the company's strategic pivot away from an asset that posed significant financial and operational risks, particularly in fluctuating interest rate environments. The business was likely consuming more capital than it generated, making its divestiture a logical step to streamline operations and improve overall profitability.

Warehouse Lending Portfolio

New York Community Bank's strategic divestiture of its warehouse lending portfolio, a move completed subsequent to Q2 2024, positions this segment as a 'Dog' within the BCG Matrix. This portfolio, valued at approximately $6 billion in assets, was sold to streamline operations and mitigate associated risks. The decision underscores a focus on enhancing regulatory capital ratios by shedding an asset that was likely consuming resources without generating commensurate returns.

The sale of the warehouse lending portfolio highlights a deliberate effort by New York Community Bank to optimize its business structure. By exiting this segment, the bank aimed to simplify its operational footprint and reduce exposure to potential liabilities. This strategic maneuver is indicative of a broader initiative to bolster financial health and improve overall efficiency.

- Divested approximately $6 billion in assets

- Completed sale subsequent to Q2 2024

- Aimed to simplify operations and reduce risk

- Intended to enhance regulatory capital ratios

Legacy Non-Performing Assets

Legacy Non-Performing Assets represent a significant challenge for New York Community Bank (NYCB), particularly those stemming from acquisitions such as Signature Bank. These assets, including loans and other financial instruments that are not generating income or are in default, demand substantial capital for management and provisioning. In the first quarter of 2024, NYCB reported a substantial increase in its non-performing loans, reaching $1.1 billion, up from $568 million in the prior quarter, largely due to the integration of Signature Bank's portfolio. This highlights the ongoing impact of these legacy assets on the bank's financial health.

These underperforming assets are essentially cash traps; they tie up capital that could be deployed more effectively in growth areas. NYCB's strategic objective is to de-risk and dispose of these legacy assets to improve its overall financial performance and capital allocation. The bank's management has indicated a focus on shedding these problematic holdings throughout 2024, aiming to reduce their impact on profitability and strengthen the balance sheet.

- Increased Non-Performing Loans: NYCB's non-performing loans surged to $1.1 billion in Q1 2024, a direct consequence of integrating legacy portfolios like Signature Bank.

- Capital Drain: These assets require significant capital for provisioning and management, diverting resources from more profitable ventures.

- Strategic Divestment: The bank is actively pursuing strategies to de-risk and dispose of these underperforming assets throughout 2024.

- Impact on Profitability: Legacy non-performing assets negatively affect the bank's profitability and overall financial efficiency.

New York Community Bank's (NYCB) commercial real estate office loans are firmly in the 'Dog' category of the BCG matrix. These loans are in a low-growth market with declining property values, and as of Q1 2024, NYCB reported a significant increase in non-performing loans tied to this sector.

Similarly, the bank's highly stressed rent-regulated multi-family loans also fit the 'Dog' profile. Delinquencies on these loans saw a dramatic 990% increase, indicating severe asset quality issues and a drain on resources due to rent controls and rising expenses.

NYCB's strategic divestiture of its residential mortgage servicing business and its warehouse lending portfolio (approximately $6 billion) further solidifies these segments as 'Dogs.' These moves aim to streamline operations, reduce risk, and improve regulatory capital ratios by shedding underperforming assets.

Legacy non-performing assets, particularly from the Signature Bank acquisition, also fall into the 'Dog' quadrant. NYCB's non-performing loans surged to $1.1 billion in Q1 2024 due to these integrations, highlighting their capital drain and negative impact on profitability.

| Segment | BCG Classification | Key Challenges | Data Point (as of Q1 2024) |

| Commercial Real Estate (Office) | Dog | Low growth, declining values | Increased non-performing loans in the sector |

| Rent-Regulated Multi-Family Loans | Dog | Rent controls, rising expenses | 990% increase in delinquencies |

| Residential Mortgage Servicing | Dog | Divested to Mr. Cooper Group | Strategic exit due to financial/operational risks |

| Warehouse Lending | Dog | Divested portfolio (~$6 billion) | Sold to streamline operations and enhance capital ratios |

| Legacy Non-Performing Assets (e.g., Signature Bank) | Dog | Integration challenges, capital drain | Non-performing loans reached $1.1 billion |

Question Marks

New York Community Bank's (NYCB) aggressive expansion of its Commercial & Industrial (C&I) lending, aiming to grow from $16 billion to $30 billion, signals a strategic focus on a high-potential market. This segment is categorized as a 'Question Mark' within the BCG matrix due to the significant investments required in talent and infrastructure to capture a larger market share. The bank's 2024 performance in this area will be crucial in determining its future success and profitability.

New York Community Bank (NYCB) is navigating the rapidly evolving digital banking landscape. While the overall digital banking sector is experiencing significant growth, NYCB's current market share in these emerging digital services and its established fintech partnerships are likely modest.

Investments in areas such as real-time payment processing, potentially leveraging technologies like blockchain, are classic examples of 'question marks' in the BCG matrix. These initiatives require substantial capital outlay for development and customer adoption, presenting uncertain but potentially high future returns for NYCB.

New York Community Bank (NYCB) is strategically diversifying beyond its traditional real estate focus into broader commercial banking. This expansion targets nascent, high-growth segments requiring substantial investment in marketing, product innovation, and client acquisition. These ventures are classified as question marks in the BCG matrix due to their high market potential coupled with NYCB's limited current market share.

Strategic Portfolio Rebalancing and De-risking Efforts

New York Community Bank's strategic portfolio rebalancing, particularly its focus on reducing commercial real estate (CRE) concentration, is a critical 'Question Mark' within its BCG Matrix framework. This initiative, while promising reduced risk and enhanced profitability, requires substantial upfront investment and carries inherent execution challenges.

The bank's commitment to this de-risking effort is underscored by its actions in 2024. For instance, NYCB announced plans to sell approximately $5.7 billion in loans, with a significant portion tied to CRE. This move directly addresses the need to diversify its asset base and mitigate the risks associated with a concentrated CRE portfolio.

- Loan Portfolio Review: NYCB is undertaking a comprehensive review of its entire loan portfolio to identify and address areas of high concentration, such as CRE.

- CRE De-risking: A key component of this strategy is reducing exposure to commercial real estate, a sector that has faced increased scrutiny and potential headwinds.

- Resource Allocation: The significant resources dedicated to this rebalancing effort position it as a 'Question Mark'—an investment with uncertain but potentially high future returns, requiring careful management.

- 2024 Loan Sales: The planned sale of $5.7 billion in loans in 2024 demonstrates tangible progress in executing the de-risking strategy, aiming to improve the bank's risk profile.

Brand Repositioning and Customer Re-engagement

New York Community Bank (NYCB) is actively engaged in brand repositioning and customer re-engagement following a period of financial headwinds and negative market sentiment. This strategic pivot is crucial for rebuilding trust with both investors and its customer base.

The bank’s efforts include enhancing its communication strategies to convey stability and future growth prospects, alongside implementing tangible operational improvements to address past concerns. These initiatives are vital for regaining market share in a competitive banking landscape.

Key aspects of this re-engagement strategy involve:

- Enhanced Digital Platforms: Investing in user-friendly digital banking tools to improve customer experience and accessibility.

- Targeted Marketing Campaigns: Launching campaigns focused on rebuilding confidence and highlighting NYCB's commitment to its community and customers.

- Customer Loyalty Programs: Introducing or revamping loyalty programs to reward existing customers and encourage continued engagement.

- Addressing Customer Feedback: Proactively seeking and acting on customer feedback to demonstrate responsiveness and a commitment to improvement.

These repositioning efforts require significant investment, estimated to be in the tens of millions of dollars, to secure future market share and re-establish a strong foundation of trust. For instance, similar banks undergoing such transitions have seen marketing and technology investments increase by 15-20% in the year following initial challenges.

New York Community Bank's (NYCB) strategic diversification into new, high-growth commercial lending areas, such as technology or healthcare finance, represents a classic 'Question Mark' in the BCG matrix. These ventures demand substantial capital for market penetration and product development, with uncertain but potentially lucrative returns.

NYCB's efforts to build out its digital capabilities and offer innovative fintech solutions also fall into the 'Question Mark' category. While the digital banking market is expanding rapidly, establishing a significant presence requires considerable investment in technology, cybersecurity, and customer acquisition, making its future market share and profitability uncertain.

The bank's ongoing efforts to reduce its concentration in commercial real estate (CRE) by selling approximately $5.7 billion in loans during 2024 highlights a significant 'Question Mark' initiative. This strategic pivot aims to improve the bank's risk profile, but the success of acquiring new, diversified loan portfolios and integrating them effectively remains a key uncertainty.

NYCB's brand repositioning and customer re-engagement strategies, involving significant investment in marketing and digital platforms, are crucial 'Question Marks.' The bank aims to rebuild trust and attract new customers, but the effectiveness of these campaigns in a competitive market and the resulting market share gains are yet to be fully determined.

| Initiative | BCG Category | Key Investment Areas | 2024 Focus/Data | Potential Outcome |

| Commercial & Industrial (C&I) Lending Growth | Question Mark | Talent, Infrastructure, Marketing | Targeting $30B from $16B | Increased market share, higher profitability |

| Digital Banking & Fintech Solutions | Question Mark | Technology Development, Cybersecurity, Customer Acquisition | Modest current market share | Enhanced customer experience, new revenue streams |

| CRE Portfolio De-risking | Question Mark | Loan Sales, Diversification, Risk Management | $5.7B loan sales planned | Reduced risk exposure, improved financial stability |

| Brand Repositioning & Customer Re-engagement | Question Mark | Marketing, Digital Platforms, Customer Service | Tens of millions in investment | Rebuilt trust, increased customer loyalty and market share |

BCG Matrix Data Sources

Our New York Community Bank BCG Matrix is built on verified market intelligence, combining financial data, industry research, and official reports to ensure reliable, high-impact insights.