Medline Industries SWOT Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Medline Industries Bundle

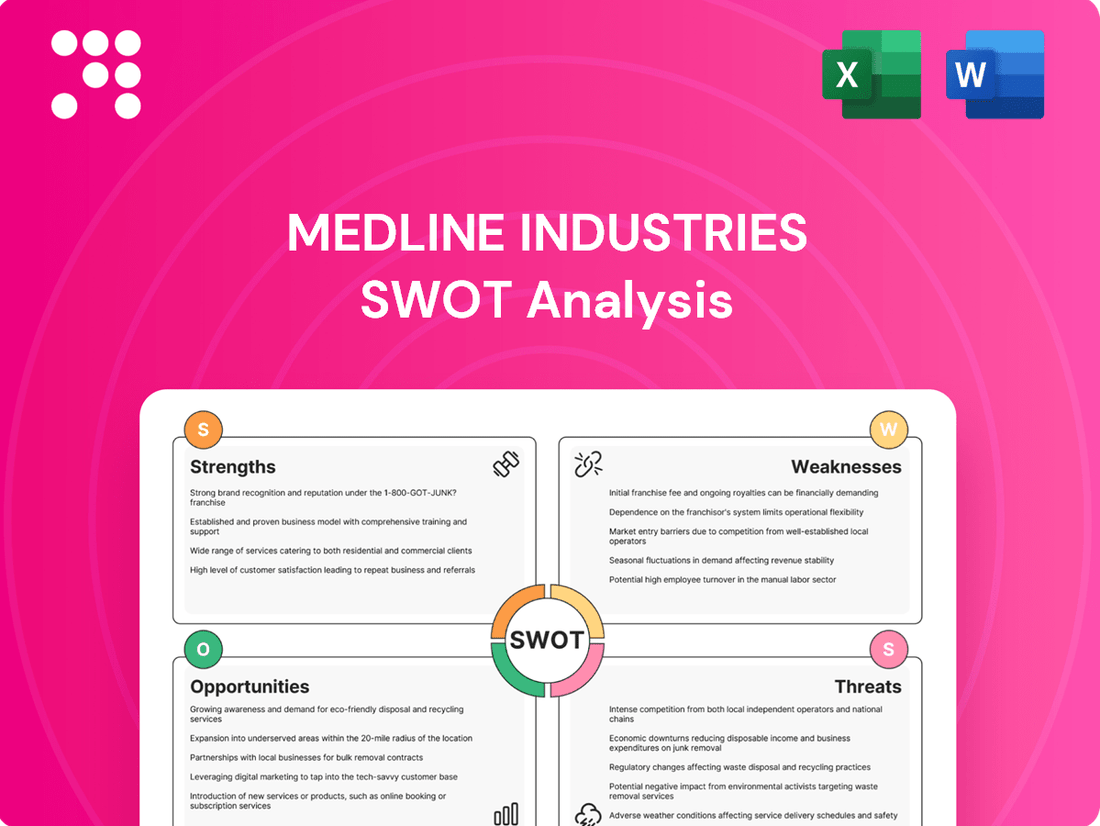

Medline Industries, a giant in healthcare supply, boasts significant strengths in its vast distribution network and broad product portfolio, but faces challenges from intense competition and evolving regulatory landscapes. Understanding these internal capabilities and external pressures is crucial for anyone looking to navigate the healthcare market.

Want the full story behind Medline's market position, its competitive advantages, and potential vulnerabilities? Purchase the complete SWOT analysis to gain access to a professionally written, fully editable report designed to support your strategic planning and investment decisions.

Strengths

Medline Industries offers an exceptionally wide array of medical products, exceeding 335,000 distinct items. This extensive catalog spans everything from fundamental medical supplies to sophisticated surgical instruments, ensuring a comprehensive offering for healthcare providers.

A key strength lies in Medline's significant self-manufacturing capabilities, with over 20 owned and operated production facilities. This allows for greater control over quality and supply for their Medline Brand products, a crucial advantage in the healthcare sector.

The sheer breadth of their product portfolio positions Medline as a one-stop shop for healthcare organizations. This ability to fulfill nearly all medical supply requirements from a single source streamlines procurement and enhances operational efficiency for their clients.

Medline boasts an exceptionally strong global supply chain and distribution network, a significant competitive advantage. Since 2018, the company has poured almost $3 billion into its Healthcare Resilience Initiative, expanding its footprint to over 50 distribution centers across North America, encompassing more than 28 million square feet of vital warehouse space.

This robust infrastructure is further enhanced by cutting-edge technology. Medline is the leading adopter of AutoStore robotic order fulfillment, utilizing nearly 2,000 robots across 20 locations to drive efficiency and precision in its operations. This dedication to supply chain resilience earned Medline a Diamond-level HIRC Resiliency Badge in 2024, a testament to its ability to ensure uninterrupted product delivery.

Medline Industries stands as the largest provider of medical-surgical products and supply chain solutions, a testament to its formidable market position. This leadership is further underscored by an impressive prime vendor customer retention rate, which consistently surpasses 98%, indicating deep-seated customer loyalty and satisfaction.

Commitment to Innovation and Strategic Acquisitions

Medline's commitment to innovation is evident in its continuous introduction of new solutions. For instance, the OptiView Transparent Dressing with HydroCore Technology earned a Chicago Innovation Award in 2024, and the ComfortTemp® Patient Warming System is slated for a 2025 release. These product advancements demonstrate a forward-thinking approach to meeting evolving healthcare needs.

The company also strategically expands its capabilities and market reach through targeted acquisitions. In 2024 alone, Medline acquired Ecolab's global surgical solutions business, United MedCo to strengthen its Health Plans business, and AG Cuffill. These moves bolster its portfolio and competitive positioning.

- Innovation Focus: OptiView Transparent Dressing (2024 Chicago Innovation Award), ComfortTemp® Patient Warming System (2025).

- Strategic Acquisitions (2024): Ecolab's global surgical solutions, United MedCo, AG Cuffill.

- Impact: Enhanced product offerings and expanded market presence.

Solid Financial Performance and Growth Trajectory

Medline Industries showcases a robust financial performance, evidenced by its increasing revenue figures. The company reported revenues of $21.2 billion in 2022, climbing to $23.2 billion in 2023, and projected to reach $25.5 billion in 2024. This consistent upward trend highlights strong market positioning and operational efficiency.

The company's financial health is further underscored by its strategic move towards a potential initial public offering (IPO) in 2025. This offering is anticipated to value Medline at around $50 billion, with plans to raise over $5 billion in capital. Such a significant capital infusion would fuel further growth and strategic investments.

- Consistent Revenue Growth: Revenues grew from $21.2 billion (2022) to $23.2 billion (2023) and are projected at $25.5 billion (2024).

- IPO Potential: Exploring an IPO in 2025 with an estimated valuation of $50 billion.

- Capital Raising: Aims to raise over $5 billion through the potential IPO.

- Financial Strength: Demonstrates a solid financial foundation and capacity for significant expansion.

Medline's expansive product portfolio, exceeding 335,000 items, positions it as a comprehensive supplier for healthcare needs. This breadth is complemented by significant self-manufacturing capabilities, with over 20 production facilities, ensuring quality control and supply chain reliability for its Medline Brand products.

The company's market leadership is solidified by its extensive global supply chain and distribution network, featuring over 50 North American distribution centers totaling more than 28 million square feet. Medline's commitment to operational efficiency is highlighted by its adoption of AutoStore robotic order fulfillment, utilizing nearly 2,000 robots across 20 locations, earning it a Diamond-level HIRC Resiliency Badge in 2024.

Medline demonstrates strong financial performance with revenues growing from $21.2 billion in 2022 to $23.2 billion in 2023, projected at $25.5 billion for 2024. The company is also exploring a significant IPO in 2025, aiming to raise over $5 billion and achieve a valuation of approximately $50 billion, signaling robust financial health and expansion plans.

| Metric | 2022 | 2023 | 2024 (Projected) |

|---|---|---|---|

| Revenue | $21.2 Billion | $23.2 Billion | $25.5 Billion |

| Distribution Centers (North America) | ~50+ | ~50+ | ~50+ |

| Robotic Fulfillment Systems | ~2,000 Robots (across 20 locations) | ~2,000 Robots (across 20 locations) | ~2,000 Robots (across 20 locations) |

| HIRC Resiliency Badge | N/A | N/A | Diamond (2024) |

What is included in the product

Delivers a strategic overview of Medline Industries’s internal and external business factors, highlighting its market strengths, operational gaps, and potential threats.

Offers a clear breakdown of Medline's market position, identifying opportunities and mitigating threats for strategic advantage.

Weaknesses

Despite significant investments in fortifying its supply chain, Medline's extensive global reach still presents inherent vulnerabilities. Events like the molybdenum-99 shortage in late 2024 highlighted how geopolitical tensions and specific material scarcity can disrupt operations, affecting product availability and pricing.

The sheer complexity of managing a worldwide network means that unforeseen disruptions, from natural disasters to trade policy shifts, can still pose challenges. Even with advanced resilience strategies, the inherent risks of a globalized supply chain cannot be entirely mitigated, potentially impacting Medline's ability to consistently meet demand.

Medline's commitment to expanding its distribution network and upgrading manufacturing facilities, as seen in its ongoing investments, requires significant upfront capital. For instance, in 2023, the company continued to invest heavily in its infrastructure, although specific figures for capital expenditure were not publicly disclosed for that year, it's understood to be in the hundreds of millions annually to support its growth strategy.

These substantial capital outlays, while crucial for maintaining a competitive edge and supporting future demand, can strain immediate financial flexibility. This necessitates careful financial planning to ensure adequate liquidity and manage the impact on short-term profitability as these investments mature.

Medline's growth strategy often involves acquiring companies to broaden its product offerings and market reach, as seen with the 2024 acquisitions of United MedCo and Ecolab's surgical solutions business. However, the process of merging these new entities, including their disparate IT systems, unique company cultures, and varied operational procedures, presents significant integration hurdles.

Successfully integrating these acquisitions requires substantial time and resources, which could potentially strain existing operations or divert management attention from core business functions. For instance, the successful integration of United MedCo, a significant move in 2024, will be critical to realizing its full strategic value.

Dependence on Private Equity Exit Strategy

Medline's current ownership by private equity firms Blackstone, Carlyle, and Hellman & Friedman highlights a significant dependency on their exit strategy, with an initial public offering (IPO) anticipated in 2025. This reliance means strategic decisions may be heavily influenced by the private equity owners' demand for substantial returns, potentially impacting long-term growth initiatives. The success and valuation of this upcoming IPO are also subject to the volatile nature of market conditions, creating inherent uncertainty for the company's future capital structure and strategic flexibility.

The pressure for a lucrative exit for its private equity backers could lead to a focus on short-term profitability over sustained innovation or market expansion. For instance, if market sentiment turns unfavorable leading up to the 2025 IPO, Medline might face pressure to cut costs or delay crucial investments, directly impacting its competitive positioning. This dependence creates a vulnerability where external market forces, beyond Medline's direct control, can significantly shape its strategic trajectory and financial health.

Intense Competition in a Fragmented Market

Medline faces fierce rivalry in the healthcare distribution sector, contending with giants such as Cardinal Health and McKesson Corporation. This crowded landscape often translates to significant pricing pressures, potentially squeezing profit margins as healthcare providers actively pursue cost-saving measures. For instance, in the first quarter of 2024, the healthcare distribution market saw average price increases of 2.5% for medical supplies, a trend Medline must navigate.

The fragmented nature of the market means Medline must constantly innovate and offer competitive pricing to retain and grow its customer base. Success hinges on its ability to differentiate its offerings beyond mere product availability, focusing on value-added services and supply chain efficiency to stand out against competitors. As of late 2024, industry reports indicate that over 60% of hospital purchasing decisions are influenced by total cost of ownership, not just unit price, highlighting the need for comprehensive value propositions.

- Intense Competition: Medline competes directly with major players like Cardinal Health and McKesson Corporation.

- Pricing Pressures: The competitive environment can lead to reduced profit margins due to provider demands for cost efficiencies.

- Market Fragmentation: A large number of smaller distributors also contribute to the competitive intensity.

- Differentiation Imperative: Maintaining market share requires ongoing efforts in service innovation and cost-effective solutions.

Medline's extensive global operations, while a strength, also create inherent weaknesses. Disruptions like the molybdenum-99 shortage in late 2024 demonstrated how geopolitical issues and material scarcity can impact product availability and pricing, a risk amplified by its worldwide reach.

The company's significant capital investments in infrastructure, continuing through 2023 and expected to be in the hundreds of millions annually, while necessary for growth, can strain immediate financial flexibility. This focus on infrastructure development, alongside acquisitions like United MedCo in 2024, requires careful management to avoid impacting short-term profitability and liquidity.

Medline's reliance on private equity ownership, with an anticipated 2025 IPO, creates a vulnerability tied to exit strategies and market conditions. This dependence can influence strategic decisions towards short-term gains, potentially affecting long-term innovation and expansion plans.

The healthcare distribution sector is intensely competitive, with companies like Cardinal Health and McKesson Corporation exerting considerable pricing pressure. This environment, where over 60% of hospital purchasing decisions in late 2024 were influenced by total cost of ownership, necessitates constant innovation and efficient cost management for Medline to maintain its market position.

Full Version Awaits

Medline Industries SWOT Analysis

This is the actual SWOT analysis document you’ll receive upon purchase—no surprises, just professional quality. It details Medline Industries' internal Strengths and Weaknesses, alongside external Opportunities and Threats.

The preview below is taken directly from the full SWOT report you'll get. Purchase unlocks the entire in-depth version, providing a comprehensive understanding of Medline's strategic position.

This is a real excerpt from the complete document. Once purchased, you’ll receive the full, editable version, allowing you to tailor the insights to your specific needs.

Opportunities

The global healthcare market is on a significant upward trajectory, projected to reach approximately $13.26 trillion by 2027, according to Statista. This expansion is fueled by an aging global population and the rising incidence of chronic illnesses, creating a sustained demand for medical supplies and services across various healthcare environments.

Medline, with its extensive portfolio of medical products and solutions, is strategically positioned to benefit from this burgeoning market. The company's broad reach and diverse offerings allow it to cater to the increasing needs of hospitals, long-term care facilities, and other healthcare providers.

The healthcare sector is increasingly embracing technologies such as AI, automation, and digital health. Medline's collaboration with Microsoft to create Mpower™, an AI-driven predictive supply chain solution for healthcare, highlights its forward-thinking strategy.

By further embedding these advanced technologies, Medline can significantly boost its operational efficiency, drive product innovation, and elevate its customer service offerings. For instance, AI in supply chain management can predict demand with greater accuracy, potentially reducing stockouts and waste, a critical factor in healthcare where timely delivery of supplies is paramount.

The healthcare landscape is increasingly moving away from traditional hospitals towards outpatient and home-based care. This trend creates a substantial opportunity for Medline to broaden its reach by supplying essential medical products and services to ambulatory surgery centers, home healthcare agencies, and long-term care facilities. These non-acute settings represent a rapidly expanding market segment.

Medline's strategic acquisition of United MedCo in 2024 directly addresses this opportunity, bolstering its capabilities within the health plans sector, particularly those serving Medicare Advantage and Managed Medicaid beneficiaries. This move positions Medline to capitalize on the growing demand for coordinated care and medical supplies within these specific government-sponsored healthcare programs.

Strategic Benefits from a Potential IPO

Medline's anticipated IPO in 2025 presents a significant chance to secure substantial capital, with projections suggesting over $5 billion could be raised. This influx of funds is earmarked for fueling expansion, bolstering research and development efforts, and pursuing strategic acquisitions that align with the company's long-term vision.

Becoming a publicly traded entity can also elevate Medline's profile, enhancing its brand recognition and credibility. This increased visibility is likely to attract valuable new partnerships and top-tier talent, further solidifying its market position.

- Capital Infusion: Potential to raise over $5 billion in 2025 to fund growth, R&D, and acquisitions.

- Enhanced Visibility: Public listing can boost brand recognition and market reputation.

- Talent Acquisition: Increased appeal to potential employees and strategic partners.

- Market Access: Provides access to public equity markets for future funding needs.

Meeting the Increasing Demand for Supply Chain Resilience

The healthcare sector's amplified emphasis on supply chain resilience, particularly following the COVID-19 pandemic, presents a significant opportunity for Medline. This heightened focus translates into a robust demand for companies like Medline that have demonstrated expertise in navigating and strengthening supply chains.

Medline's strategic investments in developing resilient and transparent supply chain operations position it favorably to meet this growing need. Healthcare providers actively seeking to minimize risks associated with future disruptions are likely to view Medline as a trusted and capable partner.

- Increased Demand: The global healthcare supply chain market is projected to grow, with resilience being a key driver. For instance, reports from 2024 indicate a sustained push for diversified sourcing and advanced inventory management solutions within healthcare.

- Medline's Advantage: Medline's established infrastructure and experience in managing complex medical supply networks, including its significant warehousing and distribution capabilities, directly address the industry's concerns about stockouts and delivery reliability.

Medline is well-positioned to capitalize on the growing demand for healthcare services outside traditional hospital settings. The company's acquisition of United MedCo in 2024 strengthens its presence in serving Medicare Advantage and Managed Medicaid beneficiaries, a key growth area. Furthermore, Medline's anticipated 2025 IPO could inject over $5 billion in capital, fueling expansion and innovation. This public offering also promises to enhance Medline's brand visibility and attract top talent.

Threats

The healthcare distribution sector is intensely competitive, with both seasoned companies and emerging businesses actively seeking market share. This dynamic environment often translates into substantial pricing pressures, compelling Medline to adopt competitive pricing models that could potentially affect its profit margins.

Medline faces the threat of customers switching to competitor products, particularly during supply chain disruptions or product shortages. For instance, in early 2024, widespread shortages of certain medical supplies led some healthcare providers to explore alternative distributors, a trend that could erode Medline's revenue if not managed proactively through robust inventory and supplier relationships.

Changes in healthcare policies and regulations, such as the ongoing evolution of value-based care models and adjustments to Medicare Advantage policies, present a significant challenge for Medline. These shifts can directly impact revenue streams and operational strategies by altering reimbursement rates and quality metrics.

Furthermore, Medline, like many global companies, must navigate the complexities of international trade policies and potential tariffs. For instance, changes in import duties on medical supplies could increase Medline's cost of goods sold, affecting profitability and potentially necessitating price adjustments for its customers in 2024 and beyond.

Medline's reliance on a global supply chain, while efficient, exposes it to significant risks from geopolitical tensions and trade disputes. For instance, the ongoing conflicts in Eastern Europe and the Red Sea have already demonstrated the fragility of shipping routes, leading to increased transit times and surcharges for many companies. In 2024, the cost of ocean freight saw a notable uptick due to these disruptions, directly impacting logistics expenses for companies like Medline.

Rising Operational Costs and Inflationary Pressures

The healthcare sector is grappling with substantial inflation, impacting everything from staffing and raw materials to the cost of moving goods. For Medline, this translates to increased operational expenses that could squeeze profit margins if not offset by improvements or price increases. Navigating these cost pressures in a competitive landscape presents a significant challenge.

Specifically, the U.S. Bureau of Labor Statistics reported that the Consumer Price Index (CPI) for medical care services rose 2.1% in the twelve months ending May 2024. This broad increase reflects higher costs across the healthcare supply chain. Furthermore, transportation costs, a critical component for Medline's distribution network, have also seen volatility, with fuel prices fluctuating throughout 2024, impacting delivery expenses.

- Labor Costs: Wage increases for healthcare workers and supply chain personnel are a major driver of rising operational expenses.

- Raw Material Inflation: The cost of medical supplies, plastics, and other essential materials used in Medline's product manufacturing has seen upward pressure.

- Transportation and Logistics: Higher fuel prices and increased demand for shipping services contribute to elevated distribution costs.

Cybersecurity Risks and Data Security Breaches

Medline's growing reliance on digital platforms and its management of extensive sensitive healthcare data expose it to significant cybersecurity risks. A successful cyberattack could lead to operational disruptions and compromise patient and business information.

The financial implications of a data breach are substantial, with potential for significant penalties and reputational damage. For instance, the average cost of a data breach in the healthcare industry reached $10.10 million in 2023, a notable increase from previous years.

- Increased Attack Surface: As Medline expands its digital footprint, more entry points for cyber threats emerge.

- Regulatory Fines: Breaches can trigger hefty fines under regulations like HIPAA, with potential penalties reaching millions of dollars.

- Reputational Damage: Loss of trust from patients and partners can have long-term financial and operational consequences.

Intense competition in healthcare distribution forces Medline to maintain competitive pricing, potentially impacting profit margins. Furthermore, supply chain disruptions in early 2024, like shortages of certain medical supplies, led some providers to seek alternative distributors, a trend that could affect Medline's revenue if not proactively managed. Changes in healthcare policies, such as evolving value-based care models and Medicare Advantage adjustments, also pose a threat by altering reimbursement rates and quality metrics.

Medline's global supply chain is vulnerable to geopolitical tensions and trade disputes, as seen with increased shipping times and surcharges stemming from conflicts in Eastern Europe and the Red Sea in 2024, which raised ocean freight costs. Inflation is another significant threat, driving up operational expenses for staffing, raw materials, and transportation. For example, the CPI for medical care services rose 2.1% by May 2024, and fluctuating fuel prices in 2024 impacted delivery expenses.

Cybersecurity risks are substantial due to Medline's reliance on digital platforms and sensitive data. A breach could cause operational disruptions and data compromise, with the average cost of a healthcare data breach reaching $10.10 million in 2023. Increased attack surfaces, regulatory fines under HIPAA, and reputational damage from loss of trust are significant financial and operational concerns.

| Threat Category | Specific Threat Example | Potential Impact | Relevant Data Point (2024/2025) |

| Competition | Customer switching during supply shortages | Revenue erosion | Shortages in early 2024 prompted some providers to seek alternatives. |

| Regulatory Changes | Evolving value-based care models | Impact on revenue streams and operations | Ongoing policy shifts affect reimbursement rates and quality metrics. |

| Supply Chain/Geopolitics | Increased ocean freight costs due to Red Sea disruptions | Higher logistics expenses | Ocean freight costs saw a notable uptick in 2024. |

| Inflation | Rising transportation and raw material costs | Squeezed profit margins | CPI for medical care services up 2.1% by May 2024; fuel prices volatile. |

| Cybersecurity | Data breach due to expanded digital footprint | Operational disruption, fines, reputational damage | Average healthcare data breach cost $10.10 million in 2023. |

SWOT Analysis Data Sources

This SWOT analysis is built upon a foundation of credible data, including Medline Industries' official financial filings, comprehensive market intelligence reports, and insights from industry experts. These sources provide a robust understanding of the company's operational landscape and competitive positioning.