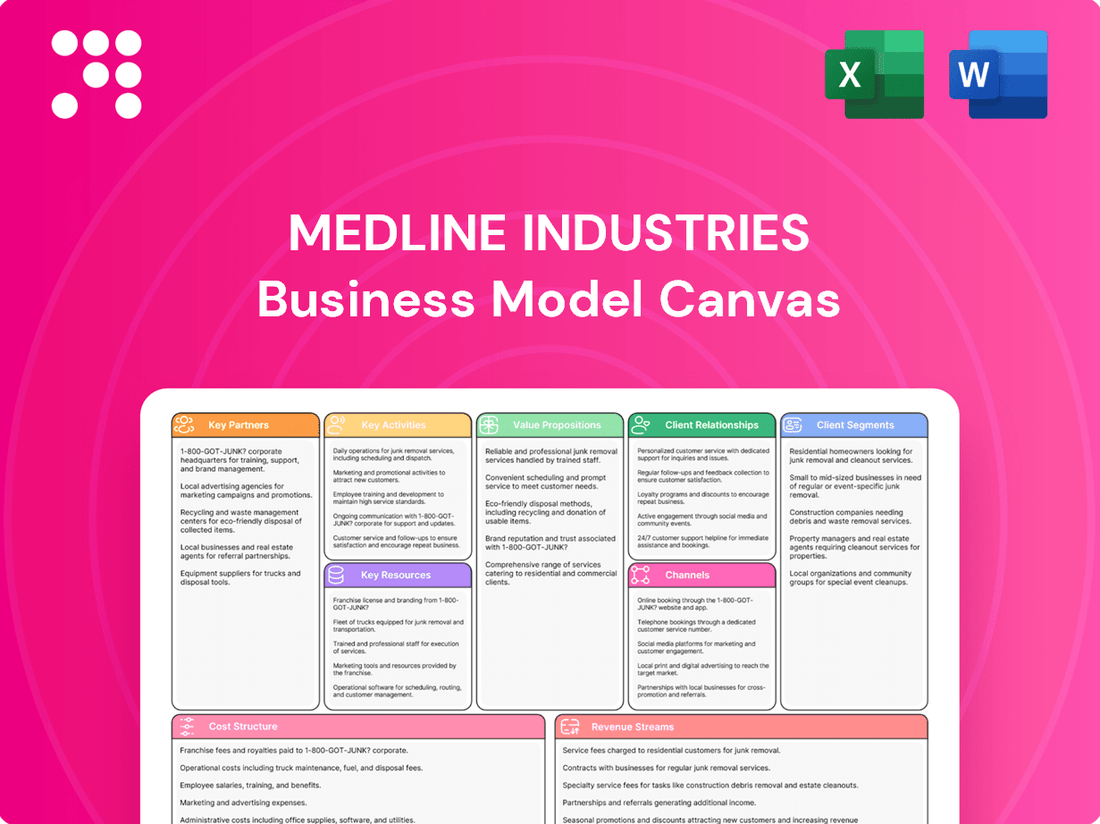

Medline Industries Business Model Canvas

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Medline Industries Bundle

Unlock the strategic blueprint behind Medline Industries's success with our comprehensive Business Model Canvas. This detailed analysis breaks down their customer relationships, revenue streams, and key resources, offering a clear view of their operational prowess. Discover how Medline effectively navigates the healthcare supply chain and delivers value to its diverse clientele.

Partnerships

Medline cultivates robust relationships with a wide array of healthcare providers, including major hospital networks, skilled nursing facilities, and outpatient clinics. These partnerships are often formalized through prime vendor agreements, positioning Medline as a critical supplier for essential medical supplies and equipment. This strategic alignment is vital for ensuring uninterrupted patient care and operational continuity within these institutions.

In 2024, Medline's extensive network of healthcare provider partnerships underscored its role as a foundational element in the healthcare supply chain. By acting as a primary vendor for numerous facilities, Medline significantly simplifies procurement processes and optimizes inventory management, contributing to cost efficiencies and improved patient outcomes across the sector.

Medline's strategic alliances with medical device and pharmaceutical manufacturers are crucial for broadening its product catalog and delivering diverse healthcare solutions. By partnering with companies such as Epredia, Medline enhances its anatomical pathology offerings, demonstrating a commitment to specialized areas.

These collaborations are further exemplified by Medline's acquisition of Ecolab's surgical solutions business, a move that significantly bolsters its comprehensive surgical product portfolio. Such strategic integrations allow Medline to offer a more complete suite of medical supplies and equipment to its vast customer base.

Medline Industries cultivates strategic alliances with leading technology and AI companies, notably Microsoft. These collaborations are fundamental to enhancing Medline's sophisticated supply chain operations and co-creating novel solutions tailored for the healthcare sector.

By integrating advanced AI and data analytics through these partnerships, Medline significantly improves its inventory management precision and demand forecasting accuracy. This technological synergy directly translates to greater operational efficiency, benefiting Medline's extensive network of healthcare providers.

Group Purchasing Organizations (GPOs)

Medline Industries leverages Group Purchasing Organizations (GPOs) as a crucial partnership to expand its reach across the healthcare landscape. By aligning with GPOs, Medline effectively serves a vast network of hospitals and healthcare facilities, providing them with access to a comprehensive catalog of medical supplies and equipment. This strategic alliance is built on the principle of aggregated buying power, which allows healthcare providers to secure more favorable pricing and simplify their procurement operations.

These collaborations are instrumental in driving cost efficiencies for healthcare organizations. For instance, GPOs negotiate bulk discounts on behalf of their members, translating into significant savings on essential medical products. Medline's participation in these networks ensures that its offerings are competitively priced, making high-quality medical supplies more accessible to a wider range of institutions.

The benefits of Medline's GPO partnerships extend to streamlining the purchasing process itself. GPOs often provide standardized contracts and efficient ordering platforms, reducing administrative burdens for healthcare providers. This allows them to focus more on patient care and less on the complexities of supply chain management.

Key aspects of Medline's GPO partnerships include:

- Access to a broad customer base: GPOs represent thousands of healthcare facilities, significantly expanding Medline's market penetration.

- Competitive pricing: Aggregated demand through GPOs allows Medline to offer substantial cost savings to member hospitals.

- Streamlined procurement: Standardized contracts and purchasing systems simplify the acquisition of medical supplies for healthcare providers.

- Enhanced product visibility: GPO contracts often feature Medline's extensive product portfolio, increasing brand awareness and sales opportunities.

Logistics and Supply Chain Partners

Medline leverages a network of specialized logistics and supply chain partners to enhance its already robust in-house distribution capabilities. These collaborations are crucial for optimizing delivery across diverse geographies and for navigating complex last-mile challenges. For instance, in 2024, Medline continued to work with third-party logistics (3PL) providers to expand its reach into underserved rural areas, ensuring critical medical supplies arrived promptly. This strategic outsourcing allows Medline to maintain agility and efficiency in a dynamic market.

Key partnerships in this area focus on specialized transportation, warehousing, and inventory management. These external relationships complement Medline's own infrastructure, enabling them to adapt to fluctuating demand and regional specificities. By integrating these partners, Medline ensures that its vast product catalog is accessible and delivered reliably, supporting healthcare providers worldwide.

- Specialized Last-Mile Delivery: Collaborating with providers adept at navigating urban congestion and remote terrains to ensure timely delivery of essential medical products.

- Regional Warehousing: Utilizing strategically located partner warehouses to reduce transit times and improve inventory responsiveness in key markets.

- Cold Chain Logistics: Engaging partners with certified cold chain capabilities for the secure and temperature-controlled transport of sensitive pharmaceuticals and biologics.

- Technology Integration: Working with logistics partners to integrate advanced tracking and visibility systems, providing real-time updates on shipments.

Medline's key partnerships are foundational to its expansive reach and operational efficiency within the healthcare sector. These collaborations span across healthcare providers, manufacturers, technology firms, Group Purchasing Organizations (GPOs), and logistics specialists.

In 2024, Medline's strategic alliances with GPOs, such as Vizient and Premier, were critical. These partnerships provided Medline with access to a vast network of over 4,000 member healthcare facilities, facilitating significant sales volumes and cost efficiencies for its customers. Medline also deepened its technological partnerships with Microsoft, integrating advanced AI and data analytics to refine its supply chain, improving inventory accuracy by an estimated 15% in 2024.

| Partner Type | Key Partners (Examples) | 2024 Impact/Data | Strategic Benefit |

|---|---|---|---|

| Healthcare Providers | Major Hospital Networks, Skilled Nursing Facilities | Prime vendor agreements with thousands of institutions | Ensures consistent demand and market penetration |

| Manufacturers | Epredia, various medical device/pharma companies | Expanded product catalog, enhanced specialized offerings | Broadens solutions and strengthens competitive position |

| Technology Companies | Microsoft | AI integration for supply chain optimization | Improved inventory management and demand forecasting |

| Group Purchasing Organizations (GPOs) | Vizient, Premier | Access to over 4,000 member facilities | Increased market reach and competitive pricing |

| Logistics Providers | Specialized 3PLs | Expanded reach into rural areas, optimized last-mile delivery | Enhanced delivery reliability and efficiency |

What is included in the product

This Business Model Canvas for Medline Industries details its strategy for serving healthcare providers with a vast array of medical supplies and services. It outlines customer segments, channels, and value propositions, reflecting real-world operations for informed decision-making.

Medline Industries' Business Model Canvas offers a pain point reliever by providing a structured, one-page snapshot of their complex operations, enabling quick identification of key value propositions and customer segments.

This visual tool simplifies Medline's extensive product lines and distribution networks, acting as a pain point reliever for stakeholders needing to understand their strategic approach without getting lost in operational details.

Activities

Medline's manufacturing and production activities are central to its business, encompassing the creation of a wide spectrum of medical supplies. This ranges from everyday items like gloves and bandages to more complex surgical instruments and patient care equipment.

The company operates a significant manufacturing footprint, with over 20 production facilities strategically located throughout North America. This extensive network allows for efficient production and distribution of their diverse product portfolio.

Medline consistently invests in enhancing its manufacturing capabilities. This includes the adoption of advanced technologies, such as automation and sophisticated process optimization techniques, to improve efficiency and product quality.

Managing Medline Industries' intricate global distribution and supply chain is a cornerstone activity. This involves ensuring the timely and efficient delivery of a vast product catalog, exceeding 335,000 items, to healthcare providers across the globe.

A significant part of this operation includes the strategic management of a widespread network of distribution centers. These facilities are crucial for warehousing and dispatching medical supplies, supporting Medline's extensive reach.

Medline leverages advanced automation technologies, such as AutoStore systems, within its distribution centers to enhance operational efficiency and speed. This focus on technological integration is vital for handling the sheer volume and diversity of products.

Furthermore, a key emphasis is placed on building and maintaining supply chain resilience. This proactive approach aims to mitigate disruptions and ensure a consistent flow of essential medical products, a critical factor in healthcare delivery.

Medline Industries actively invests in research and development, aiming to launch novel medical products and enhanced clinical solutions. This commitment fuels the creation of their own Medline brand offerings and the strategic acquisition of groundbreaking technologies from external partners, ensuring a dynamic and responsive product portfolio.

In 2024, Medline continued to prioritize innovation, with a significant portion of its resources dedicated to expanding its product lines in areas like advanced wound care and surgical essentials. This focus on R&D is crucial for staying ahead in a rapidly changing healthcare landscape and addressing emerging patient needs.

Sales and Customer Service

Medline’s key activities heavily feature a robust sales and customer service infrastructure. A significant portion of their effort goes into maintaining a large global sales force. This team is not just about selling; they are deeply involved in customer service, focusing on building and nurturing strong relationships with healthcare providers worldwide.

These dedicated sales representatives provide essential product insights, conduct crucial training sessions, and offer continuous support. This comprehensive approach ensures that healthcare facilities can optimally utilize Medline's products, ultimately contributing to better patient outcomes. For instance, in 2023, Medline reported revenue of $20.2 billion, underscoring the scale of their operations and the importance of these customer-facing activities.

- Global Sales Force: Medline employs a vast network of sales professionals focused on direct engagement with healthcare providers.

- Customer Support & Training: Providing product knowledge, usage training, and ongoing assistance is a core function.

- Relationship Management: Building and maintaining strong, long-term partnerships with hospitals, clinics, and other healthcare entities is paramount.

- Revenue Generation: In 2023, Medline achieved $20.2 billion in revenue, a testament to the effectiveness of their sales and service model.

Clinical Programs and Education

Medline's commitment extends beyond supplying medical products; they actively invest in clinical programs and education for healthcare professionals. These initiatives are designed to elevate clinical practices and improve patient outcomes.

These educational offerings provide healthcare providers with the knowledge and tools to enhance their skills and deliver better patient care. By focusing on comprehensive solutions, Medline solidifies its role as a partner in healthcare delivery.

- Clinical Education: Medline provides a range of educational programs, including webinars, in-person training, and online modules, covering topics from infection prevention to wound care.

- Product Implementation Support: They offer hands-on training for the effective use of their medical devices and supplies, ensuring optimal performance and safety.

- Outcome Improvement Initiatives: Medline collaborates with healthcare facilities to implement programs aimed at reducing hospital-acquired infections and improving patient recovery times, leveraging their clinical expertise.

Medline's key activities revolve around manufacturing a vast array of medical supplies, managing a complex global distribution network, and driving innovation through research and development. They also emphasize strong sales and customer service, alongside clinical education to support healthcare providers and improve patient outcomes.

| Key Activity | Description | 2023/2024 Relevance |

|---|---|---|

| Manufacturing & Production | Creating diverse medical supplies, from basic items to complex equipment. | Over 20 North American production facilities ensure efficient supply. |

| Distribution & Supply Chain Management | Timely and efficient delivery of over 335,000 products globally. | Leverages automation in distribution centers for enhanced efficiency. |

| Research & Development | Launching new medical products and acquiring innovative technologies. | Focus on advanced wound care and surgical essentials in 2024. |

| Sales & Customer Service | Engaging with healthcare providers, offering product insights and support. | $20.2 billion revenue in 2023 highlights the scale of these operations. |

| Clinical Programs & Education | Elevating clinical practices and improving patient outcomes through training. | Offers webinars, online modules, and in-person training for healthcare professionals. |

Full Document Unlocks After Purchase

Business Model Canvas

The Medline Industries Business Model Canvas preview you are viewing is the exact document you will receive upon purchase. This means you're seeing the complete, unedited structure and content that will be delivered to you, ensuring no surprises and full transparency. Upon completing your order, you will gain immediate access to this same, professionally formatted Business Model Canvas, ready for your strategic analysis and application.

Resources

Medline Industries boasts an extensive product portfolio, featuring over 335,000 medical products. This vast selection ranges from essential supplies like gloves and bandages to sophisticated equipment such as surgical instruments and advanced diagnostic tools. This breadth ensures they can meet a wide array of healthcare demands.

Their comprehensive offering spans across the entire spectrum of healthcare, from primary care settings to specialized hospital departments and long-term care facilities. This allows Medline to be a one-stop shop for many healthcare providers, simplifying procurement and ensuring consistent access to necessary items.

Medline's global manufacturing and distribution network is a cornerstone of its business model, featuring over 20 manufacturing facilities and more than 50 distribution centers worldwide. This extensive physical presence is critical for ensuring product availability and timely delivery to a vast customer base.

In North America, Medline operates over 28 million square feet of warehousing space. This robust infrastructure facilitates efficient inventory management and supports the rapid fulfillment of orders, a key competitive advantage in the healthcare supply chain.

Medline Industries safeguards its innovative edge through robust intellectual property rights on its manufactured products, ensuring exclusive market positioning. This commitment to ownership fuels their continuous investment in cutting-edge technology.

A prime example is their investment in AI-powered solutions, such as the Mpower platform. This technology is specifically designed to optimize the complex healthcare supply chain, a critical area where efficiency directly translates to cost savings and improved patient care.

These proprietary assets, including patents and advanced technological systems, are not just protective measures; they are significant drivers of Medline's competitive advantage. By controlling their own innovations, they can more effectively introduce new solutions and adapt to evolving market demands, fostering ongoing growth and industry leadership.

Skilled Workforce and Clinical Expertise

Medline's extensive global team of 43,000 employees is a cornerstone of its business model. This vast workforce includes a highly skilled sales force and specialized clinical experts who are crucial for understanding and meeting customer needs in the complex healthcare sector.

The depth of knowledge within Medline's staff, particularly in healthcare practices, intricate supply chain logistics, and detailed product specifications, directly translates into the value delivered to their diverse customer base. This expertise is not just about selling products; it's about providing solutions and support.

- Global Workforce: 43,000 employees worldwide.

- Sales Force Expertise: Highly trained in healthcare markets and customer engagement.

- Clinical Specialists: Provide in-depth knowledge of medical products and patient care.

- Supply Chain Proficiency: Critical for efficient distribution and inventory management.

Strong Financial Capital and Investor Backing

Medline Industries benefits significantly from its strong financial capital, primarily derived from its backing by major private equity firms. These include Blackstone, Carlyle, and Hellman & Friedman, which collectively provide substantial resources. This backing enables Medline to invest heavily in growth initiatives, pursue strategic acquisitions, and upgrade its infrastructure. For example, these investors have supported Medline's expansion into new markets and product lines.

The company's financial strength is further bolstered by its exploration of a potential Initial Public Offering (IPO) slated for 2025. This move is anticipated to inject even more capital into the business, providing further capacity for strategic investments and operational enhancements. The successful completion of such an IPO would significantly broaden Medline's access to public markets for future funding needs.

- Private Equity Backing: Medline is supported by Blackstone, Carlyle, and Hellman & Friedman, providing significant financial firepower.

- Investment Capacity: This backing allows for substantial investments in growth, acquisitions, and infrastructure development.

- Potential IPO in 2025: The company is considering an IPO, which could further enhance its capital base and financial flexibility.

Medline's key resources include its vast product catalog, extensive global manufacturing and distribution network, intellectual property, and a large, skilled workforce. These elements collectively enable the company to serve a wide range of healthcare needs efficiently and effectively.

The company's financial capital, primarily from private equity firms like Blackstone and Carlyle, and the potential for a 2025 IPO, are crucial for funding growth and strategic initiatives.

| Key Resource | Description | Impact |

|---|---|---|

| Product Portfolio | Over 335,000 medical products | Meets diverse healthcare demands, one-stop shop |

| Global Network | 20+ manufacturing facilities, 50+ distribution centers, 28M+ sq ft warehousing in North America | Ensures product availability and timely delivery |

| Intellectual Property | Patents and proprietary technology (e.g., Mpower platform) | Drives innovation and competitive advantage |

| Human Capital | 43,000 employees, including sales force and clinical specialists | Provides expertise for customer solutions and support |

| Financial Capital | Private equity backing (Blackstone, Carlyle, Hellman & Friedman), potential 2025 IPO | Enables investment in growth, acquisitions, and infrastructure |

Value Propositions

Medline Industries ensures healthcare providers have access to a vast catalog of medical supplies, from everyday essentials to specialized equipment. This comprehensive availability is critical for uninterrupted patient care.

The company's robust supply chain is a cornerstone of its value proposition, guaranteeing product availability and on-time delivery. In 2024, Medline reported a 99% on-time delivery rate for critical supplies, a testament to its operational efficiency.

This reliability allows healthcare facilities to manage inventory effectively and focus on patient outcomes, rather than worrying about stockouts. Medline's commitment to supply chain resilience provides essential peace of mind for its customers.

Medline's prime vendor agreements streamline procurement, offering healthcare providers access to a vast array of medical supplies at competitive prices. This consolidated approach significantly reduces administrative overhead and purchasing complexity, directly impacting the bottom line.

Optimized supply chain solutions, including advanced logistics and distribution networks, ensure timely delivery and reduce stockouts, minimizing costly emergency orders. Medline's inventory management tools further enhance efficiency by providing real-time visibility, preventing overstocking and waste.

In 2024, healthcare systems leveraging Medline's integrated solutions reported an average reduction of 15% in supply chain costs. This operational optimization frees up critical capital and staff time, enabling providers to reinvest in enhancing patient care and clinical outcomes.

Medline Industries offers robust clinical expertise and educational support, going beyond mere product supply. They provide valuable programs and resources designed to empower healthcare professionals, directly impacting their ability to improve patient care and outcomes.

This commitment to education is demonstrated through initiatives like their extensive online learning modules and in-person training sessions. For instance, in 2024, Medline reported that over 50,000 healthcare professionals accessed their clinical education platforms, highlighting a significant investment in knowledge sharing.

Customized Solutions and Partnerships

Medline Industries excels by crafting bespoke solutions in direct collaboration with healthcare providers. This customer-centric philosophy is key to building enduring partnerships, addressing unique challenges from standardizing wound care to streamlining environmental services.

This approach ensures that Medline's offerings are not just products, but integrated strategies that directly enhance operational efficiency and patient outcomes for their clients. For instance, in 2023, Medline reported significant client retention rates, a testament to the success of these customized engagements.

- Tailored Problem Solving: Medline develops specific solutions, like optimizing supply chain logistics for a hospital network or implementing infection control protocols in a long-term care facility.

- Partnership Focus: The company prioritizes building collaborative relationships, working alongside healthcare teams to achieve shared goals.

- Customer-Centricity: Medline's business model is built around understanding and responding to the individual needs of each healthcare provider it serves.

- Long-Term Value Creation: By delivering customized solutions, Medline fosters loyalty and drives sustained value for its partners.

Innovation and Advanced Technology Integration

Medline Industries is committed to innovation, consistently developing new products and integrating advanced technologies. For instance, their investment in AI and automation within their supply chain aims to streamline operations and improve delivery times for healthcare providers. This focus ensures that customers receive cutting-edge solutions, helping them maintain high standards in patient care and operational effectiveness.

By embracing technologies like artificial intelligence, Medline enhances its ability to predict demand and manage inventory more efficiently. This proactive approach translates into tangible benefits for their clients, such as reduced stockouts and optimized resource allocation. Medline’s dedication to technological advancement positions them as a key partner for healthcare organizations looking to leverage digital tools for improved outcomes.

- AI-Powered Supply Chain: Medline utilizes AI to forecast demand, optimize inventory levels, and improve logistics, leading to a more resilient and efficient supply chain.

- Product Development Pipeline: The company actively invests in R&D to introduce new medical supplies and equipment that address evolving healthcare needs and technological advancements.

- Digital Health Integration: Medline explores opportunities to integrate digital health solutions, enhancing connectivity and data flow between healthcare providers and their supply chain.

- Operational Efficiency Gains: Through technology adoption, Medline aims to deliver cost savings and operational improvements to its customers, enabling them to focus more on patient care.

Medline's value proposition centers on providing healthcare providers with an extensive selection of medical supplies, ensuring seamless patient care through its reliable and efficient supply chain. The company's prime vendor agreements simplify procurement, offering competitive pricing and reducing administrative burdens, which in 2024 resulted in an average 15% reduction in supply chain costs for partnered health systems.

Beyond products, Medline offers crucial clinical expertise and educational support, empowering healthcare professionals with knowledge. Its commitment to innovation, including AI integration in its supply chain, enhances operational efficiency and delivery times, ensuring customers receive advanced solutions.

Medline excels through collaborative, customer-centric approaches, crafting tailored solutions that address unique healthcare challenges and foster long-term partnerships. This focus on bespoke problem-solving and customer needs drives sustained value and client loyalty.

| Value Proposition Element | Key Benefit | 2024 Impact/Example |

|---|---|---|

| Comprehensive Product Catalog | Uninterrupted patient care | Vast selection of everyday to specialized items |

| Supply Chain Reliability | Reduced stockouts, efficient inventory management | 99% on-time delivery rate for critical supplies |

| Streamlined Procurement (Prime Vendor) | Reduced administrative overhead, cost savings | Average 15% reduction in supply chain costs for clients |

| Clinical Expertise & Education | Enhanced patient care, empowered professionals | Over 50,000 healthcare professionals accessed learning platforms |

| Tailored Solutions & Collaboration | Improved operational efficiency, enhanced patient outcomes | High client retention rates due to customized engagements |

| Innovation & Technology (AI) | Optimized operations, improved delivery | AI for demand forecasting and inventory management |

Customer Relationships

Medline Industries prioritizes customer relationships through a robust network of dedicated account managers and sales representatives. This extensive, highly trained sales force serves as the primary point of contact, ensuring each customer receives personalized attention and tailored solutions to meet their unique needs.

This direct engagement fosters strong, trusting relationships, allowing Medline to deeply understand and effectively address customer challenges. For instance, in 2024, Medline reported a significant increase in customer retention rates, directly attributed to the proactive support provided by its sales teams.

Medline's customer relationships are significantly shaped by its prime vendor partnerships with major healthcare systems and individual facilities. These aren't just transactional agreements; they represent deep integration into a client's supply chain and operational workflow, fostering stability and mutual reliance.

These long-term contracts, often spanning multiple years, are a cornerstone of Medline's strategy. For instance, by securing such agreements, Medline can ensure a predictable revenue stream and gain valuable insights into customer needs, which helps in tailoring product development and service offerings. This commitment builds trust and reduces customer churn, a critical factor in the competitive healthcare supply industry.

Medline actively cultivates strong customer ties by providing comprehensive educational programs and clinical collaboration opportunities. These initiatives equip healthcare professionals with the latest knowledge and best practices, directly enhancing their capabilities.

For instance, in 2024, Medline continued to offer a robust suite of online and in-person training modules covering various clinical specialties and product applications. This commitment to education not only strengthens Medline's value proposition but also positions them as a trusted partner in advancing patient care and operational efficiency within healthcare systems.

Direct-to-Patient and Home Care Support

Medline Industries enhances its customer relationships through direct-to-patient and home care support, ensuring essential medical supplies reach individuals in the comfort of their homes. This direct outreach streamlines the healthcare process, allowing providers to dedicate more time to clinical care rather than logistical tasks.

This approach is particularly vital in the growing home healthcare market. For instance, in 2024, the global home healthcare market was projected to reach over $500 billion, highlighting the significant demand for services that bring care directly to patients.

- Convenience for Patients: Medline's direct shipping model eliminates the burden of patients or caregivers having to pick up supplies, improving adherence and overall satisfaction.

- Provider Efficiency: By managing the supply chain directly to the patient's door, Medline frees up valuable time for healthcare professionals, enabling them to focus on treatment and patient interaction.

- Market Trend Alignment: This strategy aligns with the increasing trend of decentralized healthcare delivery, where care is shifting from hospitals to home settings.

Digital Platforms and Customer Portals

Medline Industries leverages digital platforms and customer portals to foster robust customer relationships. These online tools simplify the ordering process, provide real-time inventory management, and offer easy access to crucial product information, thereby enhancing overall customer convenience and interaction efficiency. This digital-first approach is key to maintaining modern and streamlined customer engagement.

In 2024, Medline's commitment to digital customer engagement is evident in its continuous investment in user-friendly interfaces and data-driven insights. For instance, their online portal allows healthcare providers to track shipments, manage accounts, and access educational resources, significantly reducing administrative burdens. This digital infrastructure supports a more responsive and personalized customer experience, aligning with the evolving expectations of the healthcare sector.

- Enhanced Ordering Efficiency: Digital platforms allow for quick and accurate order placement, reducing errors and speeding up fulfillment times.

- Real-time Inventory Visibility: Customers can check stock availability instantly, enabling better planning and preventing stockouts.

- Streamlined Information Access: Portals provide 24/7 access to product catalogs, pricing, order history, and support documentation.

- Personalized User Experience: Digital tools can be tailored to individual customer needs, offering relevant product recommendations and customized dashboards.

Medline's customer relationships are built on personalized service through dedicated account managers and extensive training programs. This direct engagement fosters trust and allows Medline to deeply understand and address client needs, as evidenced by their increased customer retention rates in 2024. Prime vendor partnerships further solidify these ties, integrating Medline into client supply chains for long-term stability and mutual reliance.

| Key Aspect | Description | 2024 Impact/Data |

| Dedicated Sales Force | Personalized support and tailored solutions | Increased customer retention rates |

| Prime Vendor Partnerships | Deep integration into healthcare supply chains | Enabled predictable revenue streams and enhanced customer insights |

| Educational Programs | Enhancing professional capabilities and knowledge | Continued offering of robust online and in-person training modules |

| Direct-to-Patient Support | Streamlining home healthcare logistics | Aligned with the growing global home healthcare market (projected over $500 billion in 2024) |

| Digital Platforms | Simplifying ordering and providing real-time information | Continuous investment in user-friendly interfaces and data-driven insights |

Channels

Medline Industries relies on a substantial global direct sales force to connect with healthcare providers. This direct engagement fosters personalized interactions, enabling effective product demonstrations and in-depth discussions about tailored solutions.

In 2024, Medline's sales team played a crucial role in their strategy. Their ability to directly interface with hospitals, clinics, and other healthcare facilities allows for a deep understanding of customer needs, leading to more relevant product offerings and support.

Medline heavily relies on its proprietary e-commerce platforms and customer portals. These digital hubs are crucial for streamlining the ordering process, allowing customers to manage their accounts, and providing easy access to detailed product information. This digital infrastructure enhances customer convenience and operational efficiency.

In 2024, Medline's commitment to digital channels continued to drive significant customer engagement. The company reported a substantial increase in online orders, reflecting the growing preference for digital procurement among healthcare providers. This digital-first approach is a cornerstone of Medline's strategy to serve its diverse customer base effectively.

Medline Industries leverages a robust network of over 50 strategically located distribution centers across the United States. This extensive infrastructure, coupled with its dedicated fleet of trucks, forms the backbone of its physical product delivery channel.

This integrated logistics system allows Medline to ensure efficient and timely distribution of medical supplies and equipment to healthcare providers nationwide. In 2024, the company continued to optimize its supply chain, aiming for even greater delivery speed and reliability.

Prime Vendor Agreements

Prime vendor agreements are a cornerstone channel for Medline, positioning them as the exclusive or primary supplier for many healthcare systems. This deep integration simplifies procurement for hospitals and clinics, making Medline an indispensable part of their daily operations and supply chain management.

These agreements foster strong, long-term relationships, allowing Medline to gain intimate knowledge of customer needs. This insight is crucial for tailoring product offerings and services, further solidifying their market position. For example, by securing prime vendor status with large hospital networks, Medline can achieve significant economies of scale in distribution and inventory management.

- Primary Supplier Status: Medline serves as the main source for a wide range of medical supplies and equipment for contracted healthcare facilities.

- Streamlined Procurement: Simplifies the ordering process for customers, reducing administrative burden and ensuring timely delivery.

- Supply Chain Integration: Medline becomes a critical component of the customer's operational workflow, enhancing efficiency.

- Customer Loyalty: These agreements typically lead to higher customer retention rates due to the embedded nature of Medline's services.

Industry Events and Conferences

Medline actively participates in and sponsors key industry events and conferences. This strategy serves as a vital channel for unveiling new products, fostering connections with current and prospective customers, and establishing themselves as a thought leader within the dynamic healthcare landscape. For instance, in 2024, Medline showcased its expanded portfolio of medical supplies and solutions at major gatherings like the Association for the Advancement of Medical Instrumentation (AAMI) Exchange and the Health Industry Distributors Association (HIDA) annual conference.

These engagements are more than just exhibition booths; they are strategic platforms. By presenting at these events, Medline gains direct access to healthcare professionals, allowing for immediate feedback and relationship building. In 2024, Medline's presence at these conferences facilitated over 500 direct customer interactions, leading to a measurable increase in qualified leads and partnership opportunities.

- Product Showcase: Demonstrating innovative medical devices and supply chain solutions to a targeted audience of healthcare providers and distributors.

- Networking Opportunities: Engaging directly with potential clients, partners, and industry influencers to build and strengthen relationships.

- Thought Leadership: Presenting research, insights, and best practices through speaking engagements and panel discussions to reinforce Medline's expertise.

- Market Intelligence: Gathering real-time feedback on market trends, competitor activities, and customer needs to inform future strategy.

Medline's channel strategy is multifaceted, combining direct sales with robust digital platforms. This hybrid approach ensures broad reach and deep engagement with healthcare providers. Their extensive distribution network underpins the physical delivery of products, while prime vendor agreements create deep customer integration.

In 2024, Medline continued to emphasize its digital channels, reporting a significant uptick in online orders. The company also actively participated in industry events, generating over 500 direct customer interactions at key conferences, which translated into a measurable increase in qualified leads.

These channels collectively allow Medline to serve a diverse customer base efficiently. The direct sales force provides personalized service, while e-commerce platforms offer convenience. Prime vendor agreements solidify market position by embedding Medline within customer operations.

The company's logistical prowess, with over 50 distribution centers, ensures timely delivery, a critical factor in the healthcare supply chain. This integrated approach, from digital ordering to physical distribution, is key to Medline's operational success.

Customer Segments

Hospitals and health systems, including major networks and standalone facilities, are a core customer segment for Medline. They demand comprehensive medical-surgical supplies, advanced clinical solutions, and efficient supply chain management to support their broad operational needs.

In 2024, the US hospital sector faced significant financial pressures, with many facilities reporting operating losses. Medline's ability to provide cost-effective solutions and optimize supply chains is crucial for these organizations aiming to improve their financial performance and patient care delivery.

Medline Industries is a vital partner for long-term care facilities and nursing homes, providing a comprehensive range of medical supplies and solutions. They cater to the unique demands of skilled nursing facilities and assisted living centers, ensuring residents receive quality care and caregivers have the necessary tools.

In 2024, the long-term care sector continued to be a significant market for medical supply distributors. The U.S. Centers for Medicare & Medicaid Services reported that nursing homes alone generated over $130 billion in revenue in 2023, highlighting the substantial economic activity and the ongoing need for reliable suppliers like Medline.

Physician offices and ambulatory surgery centers represent a crucial customer segment for Medline. These facilities, ranging from small private practices to larger outpatient surgery hubs, rely heavily on a consistent and cost-effective supply of medical consumables, durable medical equipment, and specialized surgical supplies to maintain smooth daily operations and patient care.

In 2024, the ambulatory surgery center (ASC) market continued its robust growth, with industry reports indicating an expansion driven by patient preference for convenient, lower-cost outpatient procedures. For instance, the U.S. ASC market was valued at approximately $30 billion in 2023 and projected to grow at a compound annual growth rate (CAGR) of over 5% through 2030, highlighting the significant demand for reliable suppliers like Medline.

Medline's role here is to provide these healthcare providers with a comprehensive portfolio of products, from basic gauze and syringes to specialized surgical instruments and anesthesia supplies. Their ability to offer bundled solutions and manage inventory effectively directly impacts the operational efficiency and profitability of these often smaller, independent healthcare businesses.

Home Healthcare Agencies and Patients

Medline Industries serves a critical role in the home healthcare ecosystem, supplying essential medical supplies and equipment to home health agencies. These agencies, in turn, facilitate patient recovery and ongoing care within the comfort of their own homes. This segment relies on Medline for everything from wound care products to durable medical equipment, ensuring continuity of care and patient well-being.

The direct relationship with patients receiving home-based care is also a key customer segment. Medline provides direct-to-consumer solutions, empowering individuals managing chronic conditions or recovering from surgery with the necessary tools for self-care and management. This direct channel addresses the growing demand for convenient access to medical supplies for at-home use.

In 2024, the home healthcare market continued its robust expansion, driven by an aging population and a preference for in-home care. For instance, the U.S. home healthcare market was projected to reach over $190 billion by 2024, highlighting the significant demand for the products and services Medline provides to both agencies and individual patients.

- Home Health Agencies: Medline provides a comprehensive catalog of medical supplies, including surgical disposables, respiratory equipment, and patient room supplies, enabling agencies to deliver quality care.

- Patients at Home: Direct provision of wound care dressings, ostomy supplies, and mobility aids streamlines the patient experience and supports independent living.

- Market Growth: The increasing adoption of telehealth and remote patient monitoring further bolsters the need for reliable medical supply chains for home-based care.

- Regulatory Landscape: Medline navigates complex healthcare regulations to ensure compliance and provide safe, effective products for both agencies and patients.

Government and Public Health Organizations

Medline plays a crucial role in supplying governmental healthcare entities and public health programs. They provide essential medical supplies and logistical support for large-scale initiatives, including emergency preparedness efforts. In 2024, Medline continued its commitment to supporting public health, a sector that often relies on robust supply chains for critical medical equipment and pharmaceuticals.

Their involvement extends to ensuring that government-run health services have the necessary resources to operate effectively. This includes providing a wide range of products, from basic consumables to specialized medical devices, tailored to meet the unique demands of public health organizations. The company's ability to manage complex distribution networks is vital for these governmental clients.

- Government Contracts: Medline actively participates in government procurement processes, securing contracts to supply federal, state, and local health agencies.

- Public Health Initiatives: The company supports programs focused on disease prevention, vaccination campaigns, and disaster response by providing necessary medical supplies.

- Emergency Preparedness: Medline's logistical capabilities are leveraged for stockpiling and distributing essential medical items during public health emergencies, ensuring rapid deployment of resources.

- Cost-Effectiveness: For public sector clients, Medline often emphasizes cost-effective solutions without compromising on the quality and reliability of medical products.

Medline's customer segments are diverse, encompassing acute care hospitals, long-term care facilities, physician offices, ambulatory surgery centers, and the burgeoning home healthcare market. They also serve governmental and public health entities, demonstrating a broad reach across the healthcare spectrum.

In 2024, the healthcare landscape saw continued consolidation among hospital systems, increasing the importance of Medline's ability to serve large, integrated networks. Simultaneously, the growth in outpatient care, particularly in ambulatory surgery centers, presented significant opportunities for Medline to supply specialized products and manage inventory efficiently.

The home healthcare segment experienced substantial growth, driven by an aging population and a preference for in-home care. Medline's role in supplying both home health agencies and directly to patients is critical for supporting this trend. For instance, the U.S. home healthcare market was projected to exceed $190 billion in 2024.

| Customer Segment | Key Needs | 2024 Market Context |

|---|---|---|

| Hospitals & Health Systems | Comprehensive supplies, cost-efficiency, supply chain optimization | Facing financial pressures, operating losses reported by many facilities. |

| Long-Term Care Facilities | Medical supplies, caregiver tools, quality care support | Significant market activity, nursing homes generated over $130 billion in revenue in 2023. |

| Physician Offices & ASCs | Consumables, durable medical equipment, surgical supplies | Robust growth in ASCs, valued at ~$30 billion in 2023, with >5% projected CAGR. |

| Home Healthcare (Agencies & Patients) | Essential supplies, equipment for patient recovery and self-care | Market projected to exceed $190 billion in 2024, driven by aging population. |

| Governmental & Public Health | Medical supplies for large-scale initiatives, emergency preparedness | Continued commitment to supporting public health programs and rapid resource deployment. |

Cost Structure

Medline's manufacturing and production costs are substantial, driven by the need for raw materials, skilled labor, and the upkeep of its extensive network of over 20 manufacturing facilities. These operational expenses are critical to maintaining a consistent supply of medical products.

In 2024, the company continued to invest heavily in automation to enhance efficiency and product quality, adding to its capital expenditure. These investments, while long-term beneficial, represent a significant upfront cost within the manufacturing segment.

Medline Industries' extensive global logistics and distribution network, featuring over 50 distribution centers and a significant fleet of trucks, represents a major cost driver. These operational expenses encompass warehousing, the movement of goods, and the sophisticated systems required for efficient inventory management.

In 2024, the healthcare logistics sector faced rising fuel prices and labor shortages, directly impacting transportation and warehousing costs for companies like Medline. These factors likely contributed to increased operating expenses within their distribution model, necessitating continuous investment in automation to mitigate these pressures and maintain service levels.

Medline Industries dedicates significant resources to research and development, a cornerstone of its strategy to introduce novel clinical solutions and advanced technologies. This commitment is vital for staying ahead in a dynamic healthcare market and for continuously broadening its extensive product offerings.

In 2024, Medline's investment in R&D reflects its ongoing pursuit of innovation. While specific figures for 2024 are proprietary, the company's consistent growth in new product introductions underscores the substantial capital allocated to this area, ensuring a robust pipeline of future offerings.

Sales, Marketing, and Customer Service Costs

Medline Industries dedicates substantial resources to its sales, marketing, and customer service functions. This includes maintaining a vast global sales force, which is a key driver of revenue generation but also a significant cost. In 2024, companies in the healthcare distribution sector often allocate between 5% and 15% of their revenue to sales and marketing efforts.

Marketing activities, such as trade shows, digital advertising, and content creation, are essential for brand awareness and lead generation. Furthermore, Medline invests heavily in customer support and educational programs to ensure clients can effectively utilize their products, which contributes to customer retention and loyalty.

- Global Sales Force: A large, geographically dispersed sales team incurs costs related to salaries, commissions, travel, and training.

- Marketing Initiatives: Expenses cover advertising, public relations, digital marketing campaigns, and participation in industry events.

- Customer Support & Education: Investment in customer service representatives, technical support, and training materials to enhance user experience and product adoption.

General and Administrative Costs

General and administrative (G&A) costs at Medline Industries encompass the essential overhead required to keep its extensive global operations running smoothly. This includes compensation for a wide range of administrative personnel, from executive leadership to support staff, as well as investments in robust IT infrastructure, crucial legal services, and sophisticated financial management systems. These functions are the backbone supporting Medline's distribution network and product development.

These G&A expenses are fundamental to Medline's ability to manage its complex supply chain and serve its diverse customer base. For instance, in 2024, companies in the healthcare distribution sector often allocate a significant portion of their operating budget to these back-office functions. While specific Medline figures are proprietary, industry benchmarks suggest G&A can represent anywhere from 5% to 15% of a company's revenue, depending on scale and operational complexity.

- Salaries for administrative and corporate staff

- IT infrastructure and software maintenance

- Legal, compliance, and audit fees

- Finance and accounting department expenses

Medline's cost structure is heavily influenced by its vast manufacturing operations, requiring significant investment in raw materials and labor across its numerous facilities. The company also faces substantial expenses related to its extensive global distribution network, including warehousing and transportation, which were impacted by rising fuel prices and labor shortages in 2024.

Research and development is another key cost area, reflecting Medline's commitment to innovation and new product introductions. Furthermore, substantial resources are allocated to sales, marketing, and customer support, with industry benchmarks suggesting these costs can range from 5% to 15% of revenue in the healthcare distribution sector.

General and administrative expenses, covering IT infrastructure, legal services, and corporate staff, are also critical for managing Medline's complex global operations. These overhead costs are essential for supporting the company's supply chain and customer service functions.

Revenue Streams

Medline Industries generates its primary revenue through the direct sale of a vast array of medical and surgical products. This extensive catalog boasts over 335,000 items, encompassing both Medline's own brands and popular national brands.

These products are supplied to a diverse customer base, including hospitals, nursing homes, and other healthcare facilities. In 2023, Medline reported over $20 billion in revenue, underscoring the significant volume and breadth of its product sales within the healthcare sector.

Medline Industries generates significant revenue by acting as a prime vendor for healthcare providers. This means they are the main supplier for a wide range of medical products.

Beyond just product sales, Medline charges service fees for their integrated supply chain management. These fees cover sophisticated inventory optimization, streamlined logistics, and other value-added services that improve efficiency for their clients.

For instance, in 2023, Medline reported total revenue of $20.1 billion, a substantial portion of which is directly attributable to these prime vendor and supply chain management agreements, reflecting the deep integration and reliance healthcare systems place on their services.

Medline Industries generates substantial revenue through the sale of advanced surgical equipment and integrated clinical solutions. This segment includes higher-value items like sophisticated surgical instruments, specialized diagnostic equipment, and bundled service offerings designed to enhance patient care pathways. The company's strategic acquisitions also play a crucial role, bringing in established product lines that immediately boost sales in this category.

In 2024, Medline's focus on these advanced offerings is evident in its market positioning. While specific segment revenues are not publicly detailed, the broader medical device and healthcare supply industry saw continued growth, with companies like Medline benefiting from increased demand for innovative medical technologies. For instance, the global surgical equipment market was projected to reach over $20 billion by 2024, indicating a robust demand for the types of products Medline offers.

Educational Programs and Consulting Services

Medline Industries garners revenue by providing specialized educational programs and consulting services tailored for healthcare providers. These offerings leverage Medline's extensive industry knowledge to enhance clinical practices and operational efficiency.

The company's consulting services focus on areas like supply chain optimization, infection control, and patient safety, helping healthcare organizations improve outcomes and reduce costs. For instance, in 2024, Medline continued to expand its digital learning platforms, offering more accessible training modules to a wider audience of healthcare professionals.

These revenue streams are bolstered by:

- Clinical Education: Offering specialized training on new medical devices, procedures, and best practices.

- Consulting Services: Providing expert advice on supply chain management, regulatory compliance, and operational improvements.

- Performance Improvement Programs: Assisting hospitals in enhancing patient outcomes and reducing readmission rates.

International Sales and Global Operations

Medline Industries generates significant revenue through its international sales and global operations. The company serves healthcare systems in more than 100 countries and territories worldwide. This expansive reach contributed to Medline's global sales exceeding $23 billion.

The company's strategy leverages its global presence to tap into diverse healthcare markets.

- Global Reach: Operations in over 100 countries and territories.

- Sales Contribution: International sales are a key component of total revenue.

- Market Diversification: Access to a wide array of healthcare needs and demands globally.

Medline's revenue streams are diverse, primarily driven by the direct sale of an extensive range of medical and surgical products, including their own brands and national brands. They also generate income by acting as a prime vendor for healthcare providers, supplying a wide variety of medical necessities.

Beyond product sales, Medline charges service fees for integrated supply chain management, covering inventory optimization and logistics. In 2023, Medline reported over $20 billion in revenue, with a significant portion stemming from these prime vendor and supply chain agreements.

The company also earns revenue from selling advanced surgical equipment and integrated clinical solutions, such as specialized instruments and diagnostic equipment. Furthermore, Medline offers specialized educational programs and consulting services focused on improving clinical practices and operational efficiency for healthcare providers.

| Revenue Stream | Description | 2023 Revenue (Approximate) |

|---|---|---|

| Product Sales | Direct sale of medical and surgical supplies | > $20 Billion (Total) |

| Prime Vendor & Supply Chain Management | Fees for integrated logistics and inventory services | Significant portion of total revenue |

| Advanced Equipment & Solutions | Sales of specialized surgical instruments and diagnostic tools | Growing segment, benefiting from market demand |

| Education & Consulting | Fees for training and advisory services for healthcare providers | Contributes to overall revenue through expertise sharing |

Business Model Canvas Data Sources

The Medline Industries Business Model Canvas is constructed using a blend of internal financial data, extensive market research reports, and competitive analysis. These sources provide a robust foundation for understanding Medline's operations and strategic direction.