Medline Industries Porter's Five Forces Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Medline Industries Bundle

Medline Industries navigates a complex healthcare landscape shaped by powerful forces. Understanding the intensity of buyer power, the threat of new entrants, and the bargaining power of suppliers is crucial for strategic success. This brief overview hints at the critical dynamics at play.

The complete report reveals the real forces shaping Medline Industries’s industry—from supplier influence to threat of new entrants. Gain actionable insights to drive smarter decision-making.

Suppliers Bargaining Power

Supplier concentration in the medical supply chain, particularly for specialized components and proprietary technologies, can grant significant leverage to a few key manufacturers. While Medline, a major distributor, can buffer this through strategic sourcing and long-term agreements, the dependence on unique raw materials or highly specialized medical devices remains a factor.

For instance, in 2024, the global medical device market saw continued growth, with certain niche segments experiencing supply constraints due to limited manufacturers. This highlights the ongoing challenge for large distributors like Medline to secure consistent supply for all product categories.

Looking ahead to 2025, supply chain resilience is a paramount concern. Companies are actively pursuing strategies to diversify their supplier base, aiming to reduce reliance on any single source for critical medical supplies and components. This proactive approach seeks to mitigate the bargaining power of concentrated suppliers.

Switching suppliers presents Medline with considerable costs. These include the expense of qualifying new products, reconfiguring inventory management systems, and navigating complex regulatory approvals, all of which can tie Medline to existing suppliers.

Entrenched suppliers, having built strong relationships and integrated their supply chains deeply with Medline, can leverage these switching costs to exert greater influence. For instance, a supplier of specialized surgical instruments might command higher prices if Medline faces substantial disruption and retraining costs to switch.

Despite these challenges, Medline's substantial scale and expansive global footprint provide a degree of leverage. This allows Medline to explore supplier diversification strategies, potentially spreading the risk and mitigating the impact of high switching costs associated with any single supplier.

The availability of substitute inputs significantly impacts supplier bargaining power. If Medline Industries can easily source alternative raw materials or components for its vast array of medical supplies, the power of any single supplier diminishes. For instance, if a particular type of sterile packaging has multiple manufacturers offering similar products, Medline can switch suppliers if prices rise, thereby limiting the original supplier's leverage.

However, this dynamic shifts for specialized or regulated medical products. For highly specific items, like unique biocompatible polymers for implantable devices or proprietary diagnostic reagents, the pool of qualified suppliers is often small. In such cases, suppliers of these critical inputs hold considerable bargaining power, as Medline has fewer alternatives and faces higher switching costs. Medline's extensive catalog, encompassing over 335,000 products, means this availability of substitutes varies dramatically across its supply chain.

Threat of Forward Integration by Suppliers

The threat of suppliers moving into direct distribution, effectively bypassing Medline, is a significant factor influencing supplier bargaining power. If suppliers can distribute their products directly to healthcare providers, they gain more control over pricing and customer relationships, thereby increasing their leverage over Medline.

This threat is particularly relevant for larger manufacturers of specialized medical equipment or pharmaceuticals. For instance, some medical device companies with proprietary technologies might possess the resources and incentive to establish their own direct sales and distribution networks. In 2024, the medical device market saw continued consolidation, with larger players often seeking to control more of the value chain.

However, the medical supply industry's intricate logistics and broad product range present a barrier to widespread forward integration. Managing a full continuum of products, from basic consumables to complex equipment, requires substantial investment in infrastructure, sales teams, and customer service, making it a challenging endeavor for most suppliers.

- Increased Supplier Leverage: Suppliers entering direct distribution can dictate terms more effectively, impacting Medline's cost structure.

- Market Dynamics: In 2024, the medical device sector experienced a 7.5% growth in direct-to-customer sales for certain high-margin products, indicating a trend.

- Distribution Complexity: The extensive product catalog of a distributor like Medline makes full forward integration by many suppliers impractical.

- Competitive Response: Medline's established distribution network and economies of scale provide a defense against smaller-scale supplier integration efforts.

Importance of Medline’s Business to Suppliers

Medline's immense scale as a global medical-surgical product and supply chain solutions provider, with annual sales exceeding $23 billion and a presence in over 100 countries, directly translates into significant bargaining power with its suppliers.

This substantial market footprint means that Medline often constitutes a considerable percentage of a supplier's overall revenue. Consequently, suppliers face a strong incentive to maintain a favorable relationship with Medline, as losing such a key customer could have a substantial negative impact on their financial performance.

- Medline's Global Reach: Operates in over 100 countries.

- Annual Sales: Surpasses $23 billion.

- Supplier Dependence: Medline often represents a significant portion of supplier revenue.

- Negotiation Leverage: Suppliers are hesitant to risk losing Medline as a customer.

The bargaining power of suppliers for Medline Industries is influenced by supplier concentration, switching costs, and the availability of substitutes. While Medline's scale provides leverage, dependence on specialized components or proprietary technologies can empower certain suppliers. For instance, in 2024, the medical device market saw continued growth with niche segments facing supply constraints, underscoring this challenge.

Switching suppliers for Medline involves significant costs, including product qualification and regulatory approvals, which can entrench existing relationships. However, Medline's global reach and substantial annual sales, exceeding $23 billion, mean it often represents a large portion of a supplier's revenue, giving Medline considerable negotiation power.

| Factor | Impact on Medline | 2024 Context |

|---|---|---|

| Supplier Concentration | Can increase leverage for key suppliers of specialized items. | Niche medical device segments experienced supply constraints. |

| Switching Costs | High costs for Medline tie it to existing suppliers. | Product qualification and regulatory hurdles are significant. |

| Availability of Substitutes | Low for specialized/regulated products, high for commodities. | Medline's 335,000+ products show varied availability. |

| Medline's Scale | Significant leverage due to large order volumes. | Annual sales >$23 billion, presence in >100 countries. |

What is included in the product

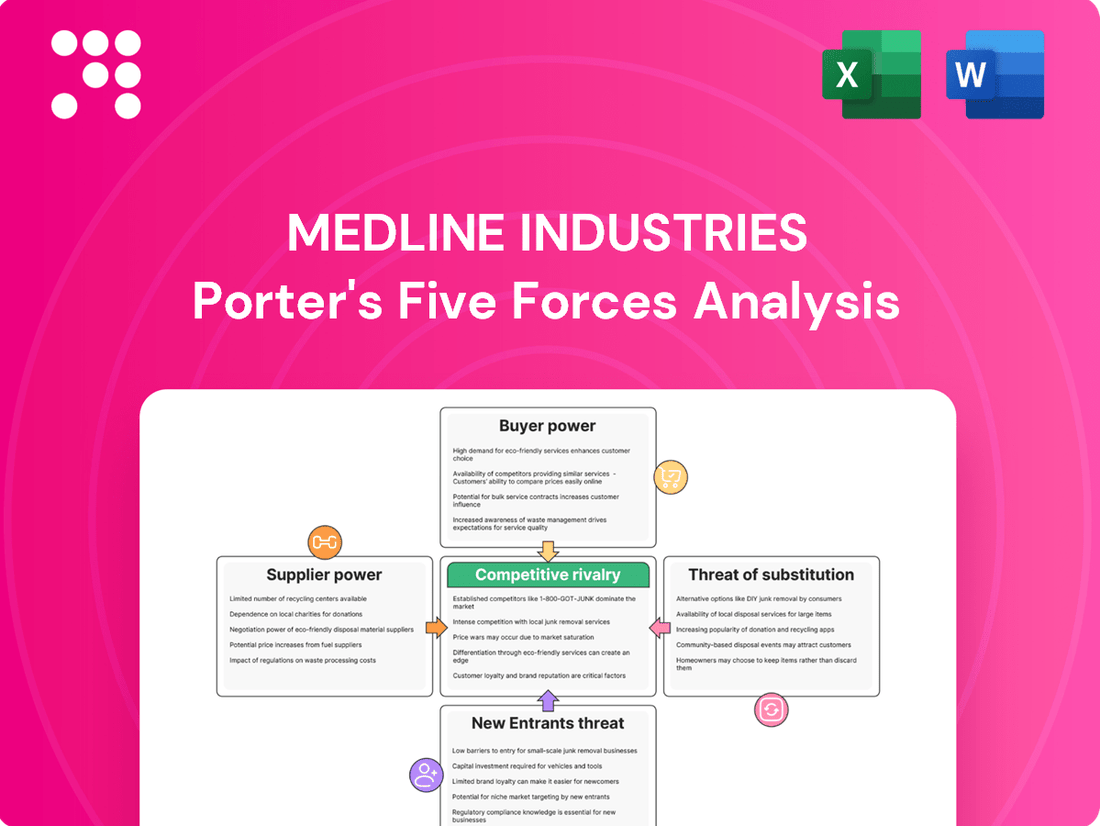

This Porter's Five Forces analysis for Medline Industries dissects the competitive intensity within the healthcare supply chain, evaluating supplier power, buyer power, threat of new entrants, threat of substitutes, and existing competitive rivalry.

Instantly identify and address competitive threats by visualizing Medline's Porter's Five Forces with a dynamic, interactive dashboard.

Customers Bargaining Power

Medline Industries caters to a wide range of healthcare providers, from extensive hospital networks to smaller, specialized clinics and home care services. This broad customer base, however, includes very large entities that wield considerable influence.

Major integrated delivery networks (IDNs) and significant health systems, such as those operated by large academic medical centers or multi-state hospital chains, represent substantial purchasing power. These organizations often negotiate 'prime vendor' contracts, which consolidate their purchasing with a single supplier like Medline.

The immense volume of goods and services these large customers procure grants them significant leverage. They can, and do, use this position to negotiate highly favorable pricing, extended payment terms, and customized service agreements, directly impacting Medline's profitability and operational flexibility.

For healthcare providers, the decision to switch from a long-standing distributor like Medline Industries isn't a simple one. Significant costs are often involved, such as retraining staff on new product lines and ordering systems, integrating new procurement software, and potentially overhauling existing inventory management processes. These hidden expenses can make staying with a familiar supplier more economically attractive.

Medline actively works to elevate these switching costs by offering an extensive portfolio of medical supplies and integrated service solutions. This comprehensive approach aims to embed Medline deeply within a healthcare provider's operational workflow, making it more complex and costly for them to disengage and seek alternatives, thus diminishing customer bargaining power.

Healthcare providers are facing significant financial strain, with many operating on narrow margins. This pressure is exacerbated by rising non-labor expenses and a move towards value-based care, where reimbursement is tied to patient outcomes rather than services rendered. For instance, a 2024 report indicated that hospital operating margins averaged around 3.5%, a figure that can quickly turn negative with unexpected cost increases.

This intense cost consciousness directly translates into heightened customer price sensitivity for medical supply distributors like Medline. Providers are actively seeking the best possible pricing to maintain their financial stability. This empowers them to negotiate more aggressively, demanding lower prices and favorable terms on a wide range of products.

Customer Information Availability

The bargaining power of customers in the healthcare supply industry, particularly for companies like Medline Industries, is significantly influenced by the increasing availability of customer information. Healthcare providers are becoming more sophisticated in their purchasing strategies due to readily accessible data.

Digital platforms and advanced analytics are now standard tools for many healthcare systems. These allow them to meticulously benchmark prices from various suppliers, including Medline, and pinpoint areas for substantial cost savings. This transparency directly bolsters their negotiating leverage.

- Increased Price Transparency: Healthcare purchasing data is more open than ever, enabling informed decisions.

- Benchmarking Capabilities: Digital tools empower hospitals to compare Medline's pricing against competitors.

- Negotiating Strength: Access to comparative data significantly enhances a customer's ability to negotiate favorable terms with Medline.

Threat of Backward Integration by Customers

The threat of backward integration by customers, particularly large healthcare systems and purchasing groups, poses a significant challenge to Medline Industries. These entities possess the scale and financial capacity to explore developing their own distribution networks or directly sourcing medical supplies from manufacturers. This capability exerts downward pressure on Medline’s pricing and necessitates a continuous focus on delivering superior value and service to retain business.

For instance, a major hospital network might assess the feasibility of managing its own inventory and logistics, thereby bypassing intermediaries like Medline. Such a move, while capital-intensive, could offer substantial cost savings and greater control over the supply chain. In 2023, the average operating margin for hospitals in the US hovered around 2-3%, highlighting the constant drive for efficiency and cost reduction that fuels such strategic considerations.

- Customer Bargaining Power: Large healthcare systems and purchasing groups can leverage their size to negotiate better terms or consider in-house solutions.

- Backward Integration Threat: Customers may invest in their own distribution or manufacturing capabilities to cut costs and gain control.

- Competitive Pressure: This threat forces Medline to offer competitive pricing and enhanced value-added services to maintain its market position.

- Financial Incentives: The pursuit of cost savings, driven by tight hospital operating margins, makes backward integration a viable consideration for major customers.

Medline's customers, especially large hospital systems, possess considerable bargaining power due to their substantial purchasing volumes. This leverage allows them to negotiate favorable pricing and terms, directly impacting Medline's profitability. The financial pressures on healthcare providers, with average hospital operating margins around 3.5% in 2024, further intensify their demand for cost savings, making them aggressive negotiators.

Increased price transparency, driven by digital platforms, empowers customers to benchmark Medline's offerings against competitors, enhancing their negotiating strength. Furthermore, the potential for backward integration, where large customers might develop their own distribution channels, presents a significant threat, compelling Medline to maintain competitive pricing and value-added services.

| Factor | Impact on Medline | Customer Action |

|---|---|---|

| Purchasing Volume | High leverage for large customers | Negotiate prime vendor contracts |

| Price Sensitivity | Increased due to narrow margins | Demand lower prices aggressively |

| Information Access | Enables effective benchmarking | Compare Medline's pricing digitally |

| Backward Integration Threat | Potential loss of business | Explore in-house distribution |

Same Document Delivered

Medline Industries Porter's Five Forces Analysis

This preview showcases the complete Medline Industries Porter's Five Forces Analysis, offering a thorough examination of the competitive landscape within the medical supplies sector. You're looking at the actual document detailing the bargaining power of buyers and suppliers, the threat of new entrants and substitutes, and the intensity of rivalry. Once you complete your purchase, you’ll get instant access to this exact, professionally formatted file, ready for your strategic planning needs.

Rivalry Among Competitors

The medical supply distribution market is intensely competitive, populated by global giants like Cardinal Health and McKesson, as well as a multitude of smaller, niche distributors. Medline, while the largest medical-surgical products and supply chain solutions provider, faces a landscape with deeply entrenched rivals, making market share gains challenging.

The global medical supplies market is on a strong growth trajectory, with projections indicating it will surpass USD 200 billion by 2025. This expansion is fueled by an aging global population, an increase in chronic diseases, and continuous technological innovation within the healthcare sector.

While this robust growth can temper intense price competition by creating room for multiple companies to thrive, it also acts as a magnet for new investments. Consequently, the expanding market attracts new entrants, potentially intensifying competition in the long run.

Medline distinguishes itself in a market where many medical supplies can become basic commodities. They achieve this through services like supply chain optimization, which can lead to significant cost savings for healthcare providers. For instance, a well-managed supply chain can reduce inventory holding costs by 10-15%.

Beyond mere distribution, Medline offers clinical programs and data analytics. These services help hospitals improve patient outcomes and operational efficiency. In 2024, healthcare systems are increasingly looking for partners that can provide these integrated solutions, moving beyond simple product delivery to strategic support.

Medline's emphasis on supply chain resilience and technological integration further sets them apart. In the face of global disruptions, a resilient supply chain is paramount. Companies that can offer reliable delivery and leverage data for better forecasting, as Medline aims to do, gain a competitive edge.

High Fixed Costs and Exit Barriers

The medical distribution sector necessitates significant capital for warehousing, sophisticated logistics networks, and robust IT systems. These high fixed costs act as a substantial deterrent for new entrants and make exiting the market particularly challenging for existing players. For example, in 2024, major distributors continued to invest heavily in automation and supply chain visibility technologies, with capital expenditures often running into tens of millions of dollars for facility upgrades alone.

These elevated exit barriers mean companies often remain in the market even when facing profitability challenges. This can intensify competitive rivalry as firms fight aggressively to preserve market share and cover their substantial overheads. The prolonged competition can suppress pricing and profit margins across the industry, as seen in the continued pressure on gross margins reported by many publicly traded medical distributors throughout 2023 and into early 2024.

- High Capital Investment: Warehousing, logistics, and IT infrastructure represent significant upfront and ongoing costs in medical distribution.

- Exit Barriers: Divesting specialized assets like climate-controlled warehouses and complex distribution networks is costly and time-consuming.

- Intensified Competition: High fixed costs encourage companies to stay in the market, leading to aggressive competition to maintain sales volumes and cover expenses.

Acquisition and Consolidation Activity

The healthcare supply chain, a critical component of Medline's operations, is experiencing significant consolidation. Larger distributors are actively acquiring smaller entities to broaden their product portfolios and extend their geographical reach, intensifying competition.

Medline itself has participated in this trend, demonstrating its commitment to strategic growth. Notable acquisitions include Ecolab's surgical solutions business and United MedCo, reinforcing Medline's market presence and capabilities. These moves reflect a broader industry pattern where companies aim to bolster their competitive standing through mergers and acquisitions.

- Industry Consolidation: The healthcare distribution sector saw a notable increase in M&A activity leading up to and during 2024, as larger players sought economies of scale and expanded service offerings.

- Medline's Acquisitions: Medline's strategic acquisitions, such as the purchase of Ecolab's surgical solutions, were aimed at enhancing its competitive edge in specialized healthcare markets.

- Market Share Impact: Such consolidation directly influences competitive rivalry by concentrating market share among fewer, larger entities, potentially leading to increased pricing power and reduced negotiation leverage for smaller suppliers and customers.

Competitive rivalry within the medical supply distribution sector is fierce, with Medline facing off against major players like Cardinal Health and McKesson, alongside numerous smaller distributors. The industry's robust growth, projected to exceed USD 200 billion by 2025, attracts new entrants, further intensifying competition despite the expanding market. Medline differentiates itself through value-added services such as supply chain optimization and clinical programs, which are increasingly sought after by healthcare systems in 2024.

High capital requirements for infrastructure and logistics create significant barriers to entry and exit. This encourages existing firms to remain in the market, even during periods of lower profitability, leading to aggressive competition and pressure on pricing and margins. For instance, major distributors continued substantial investments in technology and automation throughout 2023 and into 2024, with capital expenditures often in the tens of millions for facility upgrades alone.

Industry consolidation, marked by strategic acquisitions by larger distributors to expand portfolios and reach, directly impacts competitive dynamics. Medline's own acquisitions, such as Ecolab's surgical solutions business, underscore this trend. This consolidation concentrates market share, potentially increasing pricing power for dominant players and reducing leverage for smaller suppliers and customers.

| Metric | 2023/2024 Data Point | Implication for Rivalry |

|---|---|---|

| Medical Supplies Market Growth Projection | Exceed USD 200 billion by 2025 | Attracts new entrants, increasing competitive intensity. |

| Capital Investment in Logistics/IT | Tens of millions for facility upgrades (e.g., automation) | High barrier to entry; encourages existing players to remain, intensifying rivalry. |

| Industry M&A Activity | Notable increase leading up to and during 2024 | Consolidates market share, potentially increasing pricing power for larger players. |

SSubstitutes Threaten

The threat of substitutes for Medline Industries' traditional distribution model is significant, as healthcare providers increasingly explore alternative sourcing channels. Many hospitals and clinics are investigating direct purchasing agreements with medical device manufacturers, bypassing distributors altogether to potentially secure better pricing or more specialized products. For instance, a 2024 report indicated that 40% of large hospital systems were actively evaluating direct sourcing strategies for at least one major product category.

Furthermore, the proliferation of e-commerce platforms and advanced digital procurement systems presents a growing alternative. These digital marketplaces can streamline the acquisition process for medical supplies, offering greater transparency and potentially lower overhead costs compared to traditional distribution networks. Some providers are even considering in-house manufacturing for high-volume, standardized items, further diversifying their supply chain away from reliance on external distributors.

Innovations like telemedicine and remote patient monitoring are increasingly allowing for care to be delivered outside traditional hospital settings. This shift can reduce the demand for certain medical supplies that were previously essential for in-person treatments, presenting a significant threat of substitution for companies like Medline.

For example, the global telehealth market was valued at approximately $150 billion in 2023 and is projected to grow significantly. This expansion means fewer in-person visits might require the same volume of disposable medical products Medline typically supplies, as digital solutions and home-based care models gain traction.

The increasing adoption of reusable medical equipment presents a significant threat of substitutes for Medline Industries. As healthcare providers increasingly opt for durable, sterilizable devices over disposable alternatives, the recurring demand for Medline's consumable medical supplies could diminish. This trend directly impacts revenue streams that rely on the frequent repurchase of single-use items.

For instance, the market for reusable surgical instruments, which can be sterilized and used multiple times, has seen steady growth. While specific 2024 data for Medline's exposure to this shift is proprietary, broader industry trends indicate a growing preference for cost-effective, long-term solutions in healthcare settings. This could translate to reduced sales volumes for Medline's disposable product lines.

Preventative Care and Wellness Programs

The growing focus on preventative care and wellness programs presents a significant threat of substitutes for traditional medical supplies. As individuals and healthcare systems prioritize health maintenance, the demand for products addressing acute conditions may decrease. For instance, a rise in successful diabetes management through lifestyle changes rather than solely medication could reduce the need for certain testing supplies.

Policy shifts toward value-based care further amplify this threat. This model incentivizes providers to focus on patient outcomes and long-term health, potentially favoring less resource-intensive interventions or technologies that prevent illness rather than treat it. In 2024, the Centers for Medicare & Medicaid Services continued to expand its value-based purchasing programs, encouraging a move away from fee-for-service models that often drive the use of specific medical devices and consumables.

The impact is seen in areas like chronic disease management. For Medline, this could mean a reduced demand for wound care supplies if preventative measures and improved patient education lead to fewer pressure ulcers or diabetic foot complications. Similarly, advancements in wearable health trackers and remote patient monitoring technologies offer alternatives to traditional diagnostic tools, potentially impacting sales of certain lab supplies or monitoring equipment.

- Preventative Care Growth: The global wellness market, encompassing preventative health, was projected to reach over $5.6 trillion by 2024, indicating a strong consumer and institutional shift.

- Value-Based Care Adoption: By the end of 2023, over 60% of healthcare payments in the US were linked to value-based care models, a trend expected to continue influencing purchasing decisions in 2024.

- Reduced Demand for Certain Supplies: A successful shift to preventative health could lower demand for items like bandages, certain diagnostic kits, and disposable medical consumables used in treating preventable conditions.

- Alternative Technologies: Wearable health tech and telehealth platforms are increasingly substituting for in-person diagnostics and routine check-ups, impacting the market for associated medical supplies.

Cost-Effective Non-Medical Alternatives

The threat of substitutes for Medline Industries' products is present, particularly from cost-effective non-medical alternatives. In certain situations, individuals might opt for lifestyle adjustments, dietary changes, or readily available over-the-counter remedies instead of seeking medical interventions and the supplies they entail. For instance, managing minor ailments through rest and hydration, or addressing certain chronic conditions with significant lifestyle modifications, could reduce the demand for specific medical supplies or treatments.

While these non-medical options don't directly replace sophisticated medical equipment, they can influence the overall healthcare expenditure and, consequently, the market demand for certain product categories. For example, a growing trend towards preventative wellness and home-based health management could indirectly impact the sales of some hospital-grade supplies or pharmaceuticals. In 2024, the global wellness market was valued at over $5.6 trillion, indicating a significant consumer interest in alternatives to traditional medical care.

- Lifestyle Changes: Increased adoption of healthy diets and exercise regimes can reduce the need for certain medications and medical devices.

- Over-the-Counter Solutions: Many minor health issues can be managed effectively with readily available non-prescription drugs and remedies.

- Preventative Health: A focus on wellness and early intervention through non-medical means can decrease reliance on more intensive medical treatments.

- Home Health Trends: The rise of home-based health monitoring and management may shift demand away from traditional clinical settings and associated supply needs.

The threat of substitutes for Medline Industries is multifaceted, encompassing direct sourcing, digital procurement, and even in-house manufacturing by healthcare providers. The increasing adoption of reusable medical equipment also directly impacts Medline's disposable product lines. Furthermore, a significant shift towards preventative care and value-based healthcare models incentivizes less resource-intensive interventions, potentially reducing demand for certain traditional medical supplies.

| Substitute Type | Description | Impact on Medline | 2024 Data/Trend |

|---|---|---|---|

| Direct Sourcing | Hospitals buying directly from manufacturers. | Reduced sales volume for distributors. | 40% of large hospital systems evaluating direct sourcing in 2024. |

| Digital Procurement | Online platforms for medical supplies. | Increased competition, potential price pressure. | Growing e-commerce adoption in healthcare procurement. |

| Reusable Equipment | Durable, sterilizable medical devices. | Decreased demand for disposable alternatives. | Steady growth in reusable surgical instrument market. |

| Preventative Care/Wellness | Focus on health maintenance over treatment. | Lower demand for supplies treating acute conditions. | Global wellness market projected over $5.6 trillion by 2024. |

Entrants Threaten

The medical supply industry demands significant upfront investment in manufacturing plants, distribution networks, and advanced IT systems. For instance, establishing a modern, compliant medical device manufacturing facility alone can cost tens of millions of dollars.

Medline's extensive infrastructure, including over 50 distribution centers and 28 million square feet of warehouse space as of 2024, allows it to achieve substantial economies of scale. This operational efficiency translates into lower per-unit costs, creating a formidable barrier for new companies trying to enter the market and compete on price.

The medical supply sector is burdened by rigorous regulations, including FDA approvals, quality control mandates, and supply chain integrity rules like HIPAA. These complex legal hurdles significantly deter new companies from entering the market.

Medline Industries benefits significantly from its deeply entrenched relationships with healthcare providers, often solidified through prime vendor agreements with major health systems. These long-standing partnerships create substantial switching costs for customers, making it difficult for new competitors to penetrate the market. For instance, in 2024, Medline continued to report strong customer retention rates, a testament to the stickiness of these established ties.

Brand Loyalty and Reputation

Medline Industries has cultivated a robust brand and reputation over many years, recognized for its dependability and high-quality medical supplies. This established trust acts as a formidable barrier for potential new competitors.

New entrants would face substantial hurdles in trying to erode Medline's strong brand loyalty. They would need to commit significant resources to marketing efforts and consistently deliver superior product quality to even begin to challenge Medline's market standing.

- Established Brand Equity: Medline's decades of operation have fostered deep customer trust and recognition in the healthcare sector.

- High Marketing Investment Required: New entrants must allocate considerable funds to build brand awareness and communicate their value proposition effectively.

- Demonstrating Consistent Quality: Overcoming Medline's reputation for reliability necessitates a proven track record of product excellence, which takes time and effort to build.

Intellectual Property and Proprietary Technology

Medline's investment in proprietary technology, such as advanced robotics in its distribution centers, creates a significant barrier to entry. Patents and unique operational processes make it difficult for new competitors to replicate Medline's efficiencies and product offerings.

For instance, Medline's commitment to innovation is reflected in its ongoing capital expenditures, which have historically been substantial, enabling the development and implementation of such proprietary systems. These investments protect its market position by making it costly and time-consuming for potential entrants to match its technological capabilities.

- Patented Technologies: Medline holds patents on various medical devices and supply chain solutions, limiting direct replication by new market entrants.

- Robotic Automation: Significant investment in advanced robotics for distribution centers enhances operational efficiency and reduces costs, a difficult feat for newcomers to match.

- Proprietary Software: Development of custom logistics and inventory management software provides a competitive edge, acting as a barrier to those without similar capabilities.

The threat of new entrants for Medline Industries is generally considered low due to substantial capital requirements, stringent regulatory hurdles, and established customer loyalty. New companies would need to invest heavily in manufacturing, distribution, and compliance to even approach Medline's scale and efficiency. Furthermore, the deep integration Medline has with healthcare providers, often secured through long-term contracts as of 2024, creates significant switching costs for customers, making it difficult for new players to gain traction.

| Barrier Type | Description | Medline's Advantage |

|---|---|---|

| Capital Requirements | High cost of establishing manufacturing, distribution, and IT infrastructure. | Medline's existing vast network (over 50 distribution centers in 2024) provides significant economies of scale. |

| Regulatory Hurdles | Complex FDA approvals, quality control, and supply chain integrity mandates. | Medline's established compliance processes and expertise significantly reduce time-to-market for new products. |

| Customer Loyalty & Switching Costs | Long-standing relationships and prime vendor agreements with healthcare systems. | Medline's high customer retention rates in 2024 demonstrate the stickiness of these established ties. |

| Brand Reputation | Decades of building trust and recognition for reliability. | New entrants face high marketing costs to build comparable brand equity. |

| Proprietary Technology | Patented systems and advanced automation in operations. | Medline's investment in robotics and custom software creates difficult-to-replicate operational efficiencies. |

Porter's Five Forces Analysis Data Sources

Our Porter's Five Forces analysis for Medline Industries is built upon a foundation of diverse data sources, including Medline's own annual reports and investor disclosures, alongside industry-specific market research from firms like IBISWorld and Frost & Sullivan.