Medline Industries PESTLE Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Medline Industries Bundle

Navigate the complex external forces impacting Medline Industries with our comprehensive PESTLE analysis. Understand how political shifts, economic volatility, and technological advancements are shaping the healthcare landscape, and how Medline is positioned to respond. Gain a competitive edge by downloading the full report for actionable insights and strategic planning.

Political factors

Government healthcare policies significantly shape the demand for medical supplies. Changes in reimbursement models, like the shift towards value-based care in the US, can influence purchasing decisions by healthcare providers, impacting Medline's sales. For example, the US government's Medicare spending, projected to reach over $1.3 trillion by 2034, highlights the substantial financial impact of public healthcare funding on companies like Medline.

Funding for healthcare facilities and public health initiatives are critical drivers for Medline. Increased government investment in hospital infrastructure or preventative care programs, such as those focused on chronic disease management, directly translates to higher demand for Medline's diverse product portfolio. The global healthcare spending, which surpassed $10 trillion in 2023, underscores the vast market influenced by these governmental allocations.

Medline's global footprint, spanning over 100 countries, exposes it to the complexities of international trade regulations and tariffs. Fluctuations in these policies, including new tariffs or shifts in trade agreements, directly impact Medline's cost of raw materials and the pricing of its finished goods. This can significantly affect profitability and the smooth functioning of its supply chain.

For instance, the imposition of tariffs can create market uncertainty. Reports from late 2023 and early 2024 highlighted how trade policy adjustments contributed to a volatile global trade environment. This uncertainty has been cited as a potential factor that could influence the timing and success of Medline's previously considered initial public offering (IPO).

Political instability, conflicts, or major geopolitical events in countries where Medline operates or sources its materials can disrupt supply chains, affect manufacturing capabilities, and impact market access. For instance, ongoing global tensions in 2024 continue to pose risks to international trade routes and the availability of critical medical supplies.

A stable political environment is crucial for consistent operations and expansion into new markets. This stability fosters investor confidence and allows for predictable business planning, essential for long-term growth in the healthcare sector.

The U.S. IPO market in 2024 has shown 'greenshoots' after two sub-par years, partly fueled by a more predictable geopolitical landscape compared to previous periods, indicating that improved political stability can unlock capital for companies like Medline looking to fund expansion or innovation.

Regulatory Environment and Compliance

The healthcare sector, including medical device manufacturing and distribution, operates under a stringent regulatory framework. Changes to these regulations, such as updated FDA guidelines on product safety or evolving distribution compliance for medical supplies, can significantly impact Medline's operational strategies and costs. For instance, the FDA's Medical Device User Fee Amendments (MDUFA) program, reauthorized through 2027, influences the fees manufacturers pay for device review, directly affecting the cost of bringing new products to market.

Medline's success hinges on its ability to navigate and adhere to the complex requirements set forth by various national and international regulatory bodies. Failure to comply with standards from agencies like the U.S. Food and Drug Administration (FDA) or the European Medicines Agency (EMA) can lead to substantial penalties, product recalls, and the inability to access key markets. In 2024, the FDA continued its focus on cybersecurity for medical devices, a critical area for companies like Medline to ensure patient safety and data integrity.

- FDA Oversight: The FDA's rigorous approval processes for medical devices and supplies are a constant factor for Medline, impacting product development timelines and market entry.

- International Compliance: Medline must also adhere to regulations in every country it operates, such as the MDR (Medical Device Regulation) in the European Union, which came into full effect in 2021 and continues to be a significant compliance area.

- Supply Chain Scrutiny: Regulatory bodies are increasingly scrutinizing supply chain integrity and product traceability, requiring robust compliance systems from distributors like Medline.

Government Procurement and Tendering Processes

Government healthcare systems, a major customer base for medical supply companies like Medline, rely heavily on structured tendering processes for procurement. Medline's success hinges on its capacity to effectively navigate these often intricate systems, fulfill stringent tender specifications, and win contracts with public health entities.

These government procurement policies directly impact Medline's revenue streams and market share within the public sector. For instance, securing a primary supplier agreement, like the one Jackson Hospital established with Medline for environmental services, signifies the importance of meeting specific performance and cost-saving criteria mandated by public institutions.

- Government Tenders: Medline's ability to secure contracts with public healthcare providers is directly tied to its proficiency in navigating government tendering processes.

- Contract Wins: Success in these tenders translates into significant revenue, as demonstrated by partnerships like the one with Jackson Hospital for environmental services.

- Policy Impact: Changes in government procurement regulations or budget allocations can materially affect Medline's sales performance in the public healthcare segment.

Government healthcare policies, such as reimbursement models and funding for public health, directly influence demand for Medline's products. For instance, the US Medicare spending, projected to exceed $1.3 trillion by 2034, underscores the significant financial impact of public healthcare budgets on companies like Medline.

International trade regulations and tariffs, including those impacting raw material costs and finished goods pricing, are critical for Medline's global operations. Political instability and geopolitical events in operating regions also pose risks to supply chains and market access, as seen with ongoing global tensions in 2024.

Stringent regulatory frameworks, like FDA guidelines and international compliance standards such as the EU's MDR, significantly affect Medline's operational strategies and costs. The FDA's continued focus on medical device cybersecurity in 2024 highlights the evolving compliance landscape.

Government procurement policies, including public healthcare tendering processes, are vital for Medline's revenue and market share. Successfully navigating these intricate systems, as exemplified by partnerships like Jackson Hospital's environmental services contract with Medline, is key to securing significant public sector business.

What is included in the product

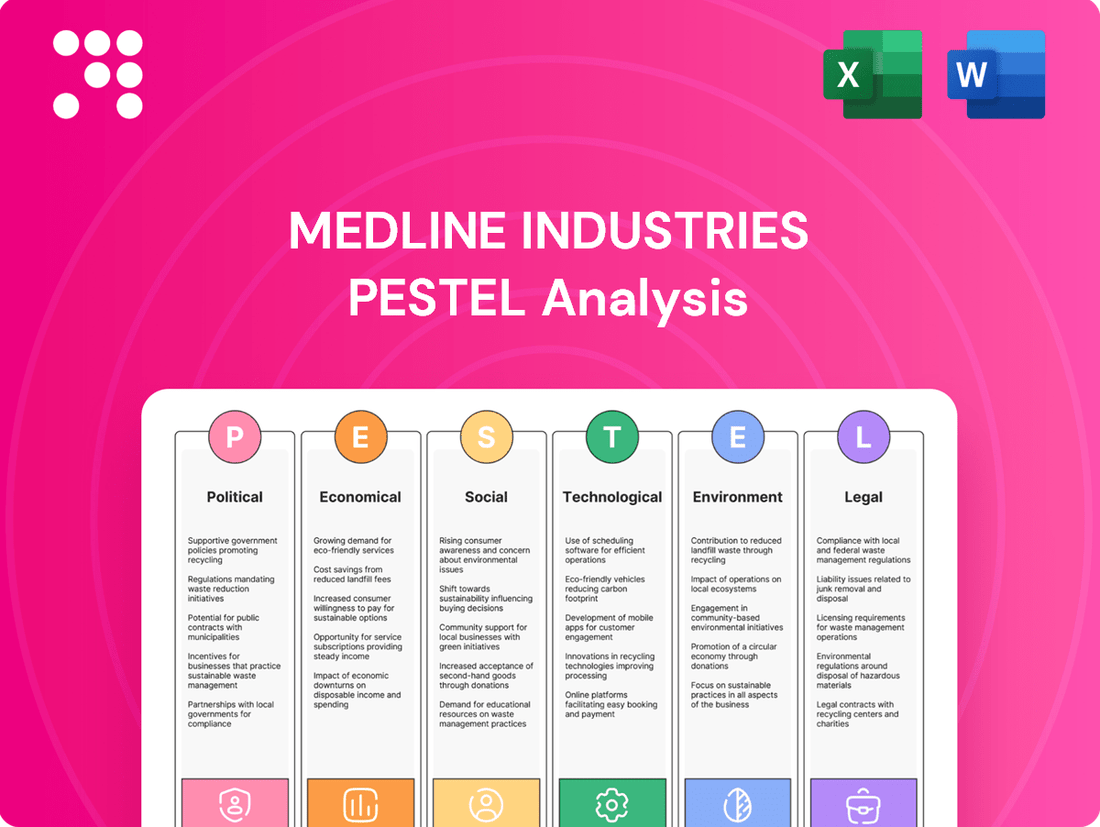

This PESTLE analysis delves into the external macro-environmental factors impacting Medline Industries, examining Political, Economic, Social, Technological, Environmental, and Legal influences.

It provides a comprehensive understanding of how these global and regional forces create both challenges and strategic advantages for Medline.

A clear, actionable PESTLE analysis for Medline Industries that highlights key external factors, enabling proactive strategies to mitigate risks and capitalize on opportunities.

Economic factors

The global economic climate significantly shapes healthcare expenditure. During economic slowdowns, governments and individuals often reduce healthcare budgets, which can directly affect Medline's sales. Conversely, economic expansion typically fuels greater investment in healthcare infrastructure and services, potentially boosting demand for Medline's products.

Medline Industries demonstrated robust financial performance, with revenues reaching $23.2 billion in 2023. This growth indicates a strong market position and the company's ability to navigate economic conditions, likely benefiting from increased healthcare spending in key markets.

Rising inflation directly impacts Medline by increasing the cost of essential raw materials, manufacturing processes, and logistics. For instance, the Producer Price Index (PPI) for medical supplies saw a notable uptick in late 2023 and early 2024, reflecting these pressures. If Medline cannot fully pass these elevated costs onto its customers, its profit margins could shrink.

The company's ownership by private equity firms Blackstone, Carlyle, and Hellman & Friedman, following a $34 billion acquisition in 2021, means there's a strong focus on operational efficiency and cost management. Medline's success in navigating these inflationary headwinds hinges on its robust supplier relationships and its capacity to implement effective cost-saving strategies across its operations.

Medline's extensive global operations, spanning over 100 countries, expose it significantly to the volatility of exchange rates. Fluctuations in currency values directly impact the translation of foreign earnings into Medline's reporting currency, potentially affecting reported revenue and profitability. For instance, a strengthening US dollar against other major currencies could reduce the reported value of sales made in those foreign markets.

The company's financial health is therefore intrinsically linked to global economic stability and the performance of various currencies. In 2024, major currency pairs like EUR/USD experienced significant shifts, with the euro trading around 1.08 against the dollar for much of the year, impacting companies with substantial European sales and operations. Similarly, emerging market currencies often exhibit higher volatility, posing additional challenges for Medline's financial reporting and strategic planning.

Interest Rates and Access to Capital

Changes in interest rates directly impact Medline's cost of borrowing for crucial initiatives like expanding its operations, funding research and development, or pursuing strategic acquisitions. For instance, if the Federal Reserve were to adjust its benchmark interest rate, Medline's future debt financing costs could rise or fall, influencing the profitability of new ventures.

Medline's ability to access capital markets is equally vital, particularly in light of its reported preparations for a potential initial public offering (IPO) slated for 2025. This IPO is anticipated to be substantial, with reports suggesting an aim to raise over $5 billion. The success and terms of such an offering are heavily influenced by prevailing market conditions and investor sentiment, which are themselves sensitive to interest rate environments.

- Interest Rate Impact: Higher interest rates increase the cost of debt financing for Medline's capital expenditures and potential acquisitions.

- Capital Market Access: Medline's planned 2025 IPO, targeting over $5 billion, is contingent on favorable capital market conditions.

- Borrowing Costs: Fluctuations in benchmark rates, such as the federal funds rate, will directly affect Medline's interest expenses on any new or existing variable-rate debt.

Healthcare Market Competition and Pricing Pressures

The medical supply industry is intensely competitive, with major players such as Cardinal Health, McKesson, and Owens & Minor vying for market share. This fierce competition directly translates into significant pricing pressures, compelling Medline Industries to constantly refine its cost management strategies and present compelling pricing to its clients without compromising on the quality of its products or the excellence of its service.

Medline's ability to navigate these competitive dynamics is evident in its financial performance. For instance, in the fiscal year ending January 2024, Medline reported revenues of approximately $20.2 billion, demonstrating robust growth that has, in certain periods, outpaced some of its key rivals. This suggests a strong market position built on effective operational strategies and a deep understanding of customer needs.

The ongoing pressure to offer competitive pricing necessitates continuous innovation and efficiency improvements across Medline's supply chain and operational processes. This includes exploring new sourcing strategies, optimizing logistics, and investing in technology to reduce overheads.

- Competitive Landscape: Key competitors include Cardinal Health, McKesson, and Owens & Minor.

- Pricing Pressures: Intense competition forces Medline to maintain cost-effectiveness and competitive pricing.

- Revenue Performance: Medline's revenue reached approximately $20.2 billion in FY2024, indicating strong market standing.

- Strategic Imperative: Continuous optimization of cost structures and service levels is crucial for sustained growth.

Economic growth is a key driver for Medline, with increased healthcare spending during expansionary periods boosting demand for its products. Conversely, economic downturns can lead to reduced healthcare budgets, impacting sales. Medline's 2023 revenue of $23.2 billion highlights its ability to capitalize on favorable economic conditions.

Inflationary pressures, particularly on raw materials and logistics, directly affect Medline's cost of goods sold. The Producer Price Index for medical supplies saw an increase in late 2023 and early 2024, underscoring these challenges. Managing these costs is crucial for maintaining profit margins, especially given the company's private equity ownership which emphasizes operational efficiency.

Interest rate fluctuations influence Medline's borrowing costs for expansion and R&D. The company's planned 2025 IPO, aiming to raise over $5 billion, is also highly sensitive to prevailing market conditions and investor sentiment, which are closely tied to interest rate environments.

| Economic Factor | Impact on Medline | Supporting Data/Trend (2023-2025) |

|---|---|---|

| Economic Growth | Increased healthcare spending, higher demand for Medline products. | Medline revenue reached $23.2 billion in 2023. |

| Inflation | Higher raw material and logistics costs, potential margin squeeze. | PPI for medical supplies increased late 2023/early 2024. |

| Interest Rates | Affects borrowing costs for capital expenditures and IPO viability. | Planned $5+ billion IPO in 2025 contingent on market conditions. |

| Exchange Rates | Volatility impacts translation of foreign earnings. | EUR/USD averaged around 1.08 in 2024, affecting European sales. |

Same Document Delivered

Medline Industries PESTLE Analysis

The preview shown here is the exact document you’ll receive after purchase—fully formatted and ready to use. This comprehensive PESTLE analysis of Medline Industries delves into the Political, Economic, Social, Technological, Legal, and Environmental factors impacting the company. It provides crucial insights for strategic planning and market understanding.

Sociological factors

The world's population is getting older, with a significant increase in individuals over 65, especially in developed nations. This demographic trend directly correlates with a higher incidence of chronic diseases and conditions that often accompany aging. For instance, by 2050, the UN projects that the global population aged 65 and over will nearly triple, reaching 2.0 billion.

This growing elderly demographic fuels a consistent and expanding demand for medical supplies, advanced clinical solutions, and products designed for long-term care. Medline's business model is well-positioned to capitalize on this, as these are central to its product portfolio. The market for rehabilitation equipment, a sector where Medline holds a strong presence, is also experiencing robust growth directly attributable to the needs of an aging population seeking to maintain mobility and quality of life.

Emerging public health trends, like the growing emphasis on preventative care and the persistent threat of global pandemics, directly influence the demand for Medline's diverse range of medical supplies. For instance, the increased diagnosis of chronic conditions in 2024 necessitates a steady supply of related consumables and equipment.

The ability of Medline to swiftly adjust production and distribution capabilities during health crises proved vital. The COVID-19 pandemic underscored the critical need for robust and resilient healthcare supply chains, a lesson that continues to shape operational strategies for companies like Medline in 2025.

Societal expectations for accessible and equitable healthcare are driving demand for medical supplies, influencing how companies like Medline distribute and price their products. Government initiatives often support this, aiming to ensure everyone can access necessary medical goods. In 2024, for example, the Biden-Harris administration continued efforts to expand healthcare access, impacting the market for medical equipment and supplies.

Medline's sustainability reports, including their 2023 disclosures, emphasize a commitment to health equity and community engagement. This focus on aligning business practices with societal values, such as ensuring fair access to healthcare resources, resonates with consumers and policymakers, potentially boosting brand reputation and market position.

Lifestyle Changes and Demand for Specific Products

Shifting consumer lifestyles significantly influence the healthcare market. For instance, a growing emphasis on health and wellness, coupled with an aging global population, is driving demand for products that support active living and recovery. This trend is particularly evident in the increased need for rehabilitation equipment and advanced wound care solutions.

Medline Industries must remain agile, adapting its product development and marketing to meet these evolving consumer needs. The company’s strategic initiatives, such as the expansion of its soft tissue fixation portfolio through Medline UNITE, directly address the demand for improved patient outcomes in areas like orthopedic surgery and sports medicine.

- Growing Health Consciousness: A significant portion of consumers, particularly in developed nations, are prioritizing preventative healthcare and active lifestyles.

- Aging Demographics: The increasing average age globally leads to a higher prevalence of chronic conditions and injuries requiring specialized medical products.

- Sports Medicine Boom: Participation in sports and fitness activities, even at amateur levels, has surged, creating a greater demand for sports injury prevention and rehabilitation products.

- Focus on Recovery: Patients and healthcare providers alike are seeking advanced solutions for faster and more effective wound healing and post-operative recovery.

Workforce Demographics and Labor Availability

The availability of skilled labor is a critical factor for Medline, particularly in its core sectors of manufacturing, logistics, and healthcare services. A robust supply of qualified workers directly impacts Medline's ability to produce and distribute its medical supplies efficiently. For instance, a shortage of experienced manufacturing technicians or warehouse personnel could lead to production delays and increased labor costs.

Demographic shifts within the global workforce present both challenges and opportunities for Medline. An aging workforce in developed nations might mean a smaller pool of younger, potentially more adaptable workers, while also potentially increasing healthcare demand. Conversely, a global shortage of healthcare professionals, a trend projected to continue into 2025, could indirectly affect Medline's business by impacting the demand for its products and services within healthcare systems.

Medline's significant global workforce of 43,000 employees underscores the importance of managing these demographic trends.

- Skilled Labor Needs: Medline requires a steady supply of skilled workers in manufacturing, logistics, and healthcare-related roles to maintain operational efficiency.

- Demographic Impacts: An aging workforce and projected shortages of healthcare professionals by 2025 could influence operational costs and product delivery efficiency.

- Global Workforce Size: Medline's 43,000 employees worldwide highlights the scale at which demographic shifts can affect the company.

Societal expectations for accessible and equitable healthcare are a major driver for Medline. This influences how the company prices and distributes its products, with government initiatives in 2024, like those expanding healthcare access, playing a role. Medline's commitment to health equity, as seen in its sustainability reports, aligns with these values, potentially enhancing its brand reputation and market standing.

Shifting consumer lifestyles, especially the focus on health and wellness and the needs of an aging population, are increasing demand for products supporting active living and recovery. Medline's expansion into areas like soft tissue fixation directly addresses this trend, aiming for better patient outcomes in sports medicine and orthopedics.

The increasing global average age, with a projected near tripling of the population aged 65 and over to 2.0 billion by 2050 according to the UN, fuels consistent demand for medical supplies and long-term care solutions. This demographic shift also boosts the market for rehabilitation equipment, a sector where Medline has a strong presence.

Emerging public health trends, such as the emphasis on preventative care and the ongoing threat of pandemics, directly impact the need for Medline's diverse medical supplies. The rise in chronic condition diagnoses in 2024, for example, necessitates a steady supply of related consumables and equipment.

Technological factors

Continuous innovation in medical device technology directly impacts the products Medline manufactures and distributes, requiring them to stay ahead of the curve. For instance, the development of advanced surgical equipment and sophisticated diagnostic tools is critical for Medline to provide healthcare providers with competitive and effective solutions. In 2024, Medline continued to launch innovative products, including their ComfortTemp® Patient Warming System, designed to improve patient outcomes and operational efficiency in hospitals.

Medline's strategic investment in automation and robotics, particularly its extensive use of AutoStore™ technology, is a key technological factor. With nearly 2,000 robots deployed across 20 locations as of early 2024, Medline is significantly boosting operational efficiency and lowering labor expenses within its manufacturing and distribution network. This advanced automation directly contributes to a more robust and responsive supply chain, a critical advantage in the dynamic healthcare industry.

Medline is actively leveraging digitalization and data analytics to sharpen its supply chain operations. By integrating advanced technologies, the company aims to achieve superior inventory control, more accurate demand forecasting, and streamlined delivery processes, ultimately boosting efficiency across its network.

A key initiative in this digital transformation is Medline's collaboration with Microsoft to create Mpower, an innovative AI-driven platform. This tool is specifically designed to proactively identify and mitigate potential disruptions within the supply chain, ensuring greater resilience and reliability for Medline's operations and its customers.

Telemedicine and Remote Patient Monitoring Technologies

The rapid expansion of telemedicine and remote patient monitoring technologies is fundamentally altering where healthcare is delivered, increasingly shifting demand for medical supplies from hospitals and clinics to patients' homes. This trend necessitates that Medline Industries proactively adjust its product offerings and logistics to effectively serve this growing home-based care market. For instance, the global telemedicine market was projected to reach over $200 billion by 2023 and is expected to continue its strong growth trajectory through 2025, indicating a substantial and sustained shift in demand patterns.

Medline's strategic response to these technological advancements is crucial for maintaining its market position. Adapting its supply chain to efficiently deliver a wider range of products suitable for home use, such as advanced wound care supplies, durable medical equipment, and diagnostic tools, will be key. Furthermore, ensuring its distribution network can support the unique needs of direct-to-consumer delivery and potentially integrate with digital health platforms will be important.

- Telemedicine Growth: The global telemedicine market is anticipated to exceed $250 billion by 2025, demonstrating a significant increase in virtual healthcare services.

- Remote Monitoring Adoption: The use of remote patient monitoring devices is expected to rise, with an estimated 70% of healthcare organizations planning to increase their investment in these technologies by 2024.

- Home Care Shift: This technological evolution directly impacts medical supply demand, with a growing percentage of procedures and ongoing care moving from traditional facilities to home settings.

Cybersecurity and Data Privacy Technologies

The increasing digitization of healthcare makes robust cybersecurity essential for Medline. Protecting sensitive patient and operational data is paramount, especially with the growing reliance on cloud platforms like Microsoft 365 and Azure AI. Failure to do so risks regulatory penalties and erodes customer trust.

In 2024, the healthcare sector experienced a significant rise in cyberattacks. Reports indicate that ransomware attacks alone cost the U.S. healthcare industry billions annually. Medline's investment in advanced data privacy technologies is therefore a critical technological factor for its operational integrity and competitive standing.

Key considerations for Medline regarding cybersecurity and data privacy include:

- Enhanced threat detection and response systems: Implementing AI-driven solutions to proactively identify and neutralize cyber threats in real-time.

- Data encryption and access controls: Ensuring all sensitive data is encrypted both in transit and at rest, with stringent access protocols.

- Compliance with evolving privacy regulations: Staying ahead of regulations like HIPAA and GDPR to maintain legal and ethical data handling practices.

- Employee training and awareness programs: Educating staff on best practices to prevent human error, a common vector for breaches.

Technological advancements are reshaping healthcare delivery, pushing Medline to adapt its product lines and distribution for the growing home-care market. The global telemedicine market was projected to exceed $200 billion by 2023, with continued strong growth expected through 2025, signaling a significant shift in where medical supplies are needed.

Medline's significant investment in automation, including nearly 2,000 robots deployed across 20 locations by early 2024, is enhancing operational efficiency and reducing labor costs. This technological adoption directly bolsters its supply chain's responsiveness, a crucial competitive edge in the fast-paced healthcare sector.

The company is also enhancing its supply chain through digitalization and data analytics, aiming for better inventory management and demand forecasting. Collaborations, such as with Microsoft for the AI-driven Mpower platform, are key to proactively mitigating supply chain disruptions and ensuring operational resilience.

The increasing digitization of healthcare necessitates robust cybersecurity. With billions annually lost by the U.S. healthcare industry due to cyberattacks, Medline's investment in advanced data privacy technologies is vital for operational integrity and customer trust, especially given its reliance on cloud platforms.

Legal factors

Medline Industries navigates a complex web of healthcare regulations. Compliance with standards set by entities like the U.S. Food and Drug Administration (FDA) for product safety, manufacturing, and labeling is paramount. Failure to adhere to these rules, such as those governing medical device reporting or pharmaceutical distribution, can result in substantial fines and operational disruptions.

In 2024, the healthcare sector continued to see increased scrutiny on data privacy and cybersecurity, impacting how Medline handles patient information and manages its supply chain. For instance, HIPAA violations can lead to millions in penalties, underscoring the critical need for robust compliance programs. The company must also stay abreast of evolving international regulations for its global operations.

Medline Industries, as a significant player in the medical supply sector, operates under stringent product liability laws designed to protect consumers. These regulations hold manufacturers and distributors accountable for any harm caused by defective products. For Medline, this means a constant focus on ensuring the safety and efficacy of its vast range of medical devices and supplies to avoid costly litigation and reputational damage.

Adherence to consumer protection regulations is paramount for Medline. This involves transparent labeling, accurate product information, and fair marketing practices. In 2024, the U.S. Food and Drug Administration (FDA) continued its robust oversight of medical products, with recalls and enforcement actions serving as a reminder of the critical importance of compliance. Medline's commitment to rigorous quality control and thorough product testing, including post-market surveillance, directly addresses these legal and ethical obligations, aiming to prevent product-related injuries and maintain consumer confidence.

Intellectual property laws are paramount for Medline Industries, safeguarding its innovations like the UNITE synthetic ligament augmentation implant, which leverages over three decades of clinical data. This protection is vital for maintaining its market edge and recouping significant R&D investments.

Medline must diligently navigate the complex landscape of patents and IP rights to avoid infringing on existing technologies held by competitors. This due diligence is essential to prevent costly legal disputes and ensure uninterrupted market access for its product portfolio.

Labor Laws and Employment Regulations

As a global employer with approximately 43,000 employees, Medline Industries navigates a complex web of labor laws and employment regulations across its operating regions. These laws dictate critical aspects of the employment relationship, including minimum wage requirements, workplace safety standards, employee benefits mandates, and prohibitions against discrimination. Staying compliant is not just a legal necessity but also crucial for fostering a productive and ethical work environment, thereby mitigating risks of litigation and reputational damage.

Medline's commitment to its workforce has been recognized, with the company being named a 'Best Employer' by Forbes. This acknowledges their efforts in creating a positive employment landscape, which is often a direct result of robust adherence to labor laws and proactive employee relations strategies. For instance, in 2024, the U.S. Department of Labor continued to enforce wage and hour laws, with significant penalties for non-compliance, underscoring the importance of Medline's due diligence in this area.

- Wage and Hour Compliance: Ensuring all employees are paid at least the federal and state minimum wage, with overtime paid correctly for non-exempt employees, a critical area of focus for regulators in 2024.

- Workplace Safety Standards: Adhering to Occupational Safety and Health Administration (OSHA) standards to prevent workplace injuries and illnesses, a continuous effort for companies in the healthcare supply chain.

- Non-Discrimination and Equal Employment Opportunity: Implementing policies that prevent discrimination based on race, gender, age, religion, and other protected characteristics, a cornerstone of modern employment law.

- Employee Benefits Regulations: Complying with laws like the Employee Retirement Income Security Act (ERISA) for retirement plans and the Affordable Care Act (ACA) for health insurance, which are subject to ongoing regulatory updates.

Anti-Trust and Competition Laws

Medline's significant market presence, particularly in the healthcare supply chain, means its expansion and potential acquisitions are closely scrutinized under anti-trust and competition laws across numerous countries. These regulations are designed to foster a competitive marketplace and prevent any single entity from dominating, directly impacting Medline's strategic growth and any efforts towards market consolidation.

For instance, Medline's acquisition of Ecolab Inc.'s global surgical solutions business in 2024 highlights the practical application of these laws. Such transactions require regulatory approval to ensure they do not unduly stifle competition in the surgical supplies sector.

- Regulatory Oversight Medline's market position necessitates compliance with anti-trust regulations globally, impacting its M&A strategies.

- Competitive Landscape Laws aim to prevent monopolies, influencing Medline's approach to market share growth and consolidation.

- Recent Acquisition Impact The 2024 acquisition of Ecolab's surgical solutions business underscores the active role of competition law in shaping Medline's operational footprint.

Medline Industries operates under a stringent legal framework, with compliance to FDA regulations for product safety and efficacy being paramount. In 2024, data privacy laws like HIPAA continued to impose significant penalties for violations, affecting how Medline handles sensitive information. The company must also navigate product liability laws, ensuring its vast array of medical supplies are safe to avoid costly litigation.

Environmental factors

The intensifying global concern over climate change compels Medline to prioritize reducing its carbon footprint throughout its entire value chain, encompassing manufacturing, distribution, and product lifecycle. This commitment involves strategic investments in renewable energy sources and the widespread adoption of energy-efficient technologies. For instance, Medline has made substantial progress in expanding its solar panel installations across its facilities, demonstrating a tangible step towards operational decarbonization.

The healthcare sector is a significant contributor to waste generation, making robust waste management and the adoption of circular economy principles critical. In 2023, the U.S. healthcare system generated an estimated 6.9 million tons of waste, highlighting the urgency for sustainable solutions.

Medline is actively addressing this challenge through its ReNewal™ program, a key component of its broader sustainability strategy. This initiative focuses on reprocessing used medical devices, diverting them from landfills and giving them a new life, thereby reducing environmental impact and resource consumption.

Ensuring raw materials are sourced sustainably and tackling potential scarcity are key environmental concerns for Medline. The company's focus on ethical procurement and eco-conscious product design, as detailed in its 2023 sustainability disclosures, actively reduces these vulnerabilities.

Water Usage and Wastewater Management

Medline Industries, like many manufacturers in the medical supply sector, faces significant environmental considerations related to water usage. Its production processes, particularly those involving sterilization and cleaning, can be quite water-intensive. This reality necessitates a strong focus on responsible water management and wastewater treatment to minimize environmental impact and adhere to increasingly stringent regulations.

Medline actively pursues environmental initiatives aimed at reducing its overall water footprint. These efforts are crucial not only for compliance but also as a core component of its broader sustainability strategy. The company is committed to managing its water resources efficiently and treating wastewater effectively before discharge, reflecting a growing awareness of water scarcity and pollution issues.

Water management is explicitly highlighted as a key area within Medline's sustainability program. This indicates a strategic approach to addressing water-related risks and opportunities. The company's commitment to this area likely involves investments in water-saving technologies and advanced wastewater treatment systems across its global operations.

- Water-Intensive Processes: Manufacturing medical supplies often requires substantial water for operations like cleaning, cooling, and sterilization.

- Environmental Initiatives: Medline is implementing programs to manage water and wastewater responsibly, aiming to decrease its water consumption and discharge impact.

- Regulatory Compliance: Strict environmental regulations globally mandate careful management of water usage and wastewater quality, which Medline must meet.

- Sustainability Focus: Water management is a critical element of Medline's corporate sustainability efforts, demonstrating a commitment to environmental stewardship.

Environmental Regulations and Compliance

Medline Industries, like all major healthcare suppliers, navigates an increasingly stringent global environmental regulatory landscape. This includes strict rules on emissions, waste management, and the handling of chemicals across its operational footprint. For instance, in 2024, the U.S. Environmental Protection Agency (EPA) continued to enforce regulations like the Resource Conservation and Recovery Act (RCRA), which dictates the management of hazardous waste, a critical concern for medical product manufacturing.

Compliance is not merely a legal obligation but a strategic imperative. Failure to adhere to these environmental standards can result in substantial financial penalties, costly litigation, and significant damage to Medline's brand and reputation. In 2025, companies are facing heightened scrutiny from consumers and investors alike regarding their environmental impact, making proactive compliance crucial for maintaining market trust.

Medline's commitment to environmental stewardship is often detailed in its Environmental, Social, and Governance (ESG) reports. These reports, typically updated annually, provide insights into the company's efforts to minimize its ecological footprint. For example, Medline’s 2024 ESG report might detail initiatives focused on reducing greenhouse gas emissions from its logistics operations or improving recycling rates in its manufacturing facilities, aligning with broader industry trends towards sustainability.

- Emissions Control: Medline must manage air and water emissions to meet evolving national and international standards, such as those set by the European Union's Industrial Emissions Directive.

- Waste Management: Compliance with regulations concerning the disposal of medical waste and manufacturing byproducts is paramount, with strict guidelines in place for segregation, treatment, and disposal.

- Chemical Usage: Adherence to chemical safety regulations, like REACH (Registration, Evaluation, Authorisation and Restriction of Chemicals) in Europe, impacts the sourcing and use of materials in Medline's product lines.

- Sustainability Reporting: Public reporting on environmental performance, as seen in Medline's ESG disclosures, demonstrates accountability and commitment to sustainable practices.

Medline's environmental strategy is significantly shaped by the growing global imperative to reduce carbon emissions. The company is actively investing in renewable energy, such as expanding solar panel installations across its facilities, to lower its operational carbon footprint. This focus on decarbonization is crucial as the healthcare sector faces increasing pressure to adopt sustainable practices throughout its value chain.

Waste management is another critical environmental factor for Medline, given the healthcare industry's substantial waste generation. The company's ReNewal™ program, which reprocesses used medical devices, is a key initiative to divert waste from landfills and promote circular economy principles, reflecting a commitment to resource efficiency.

Medline also prioritizes sustainable sourcing of raw materials and addresses potential scarcity through ethical procurement and eco-conscious product design, as highlighted in its 2023 sustainability disclosures. This proactive approach aims to mitigate supply chain vulnerabilities and reduce environmental impact.

Water management is a significant consideration due to the water-intensive nature of medical supply manufacturing. Medline is focused on responsible water usage and advanced wastewater treatment to comply with stringent regulations and minimize its ecological impact, underscoring water conservation as a core sustainability objective.

PESTLE Analysis Data Sources

Our PESTLE analysis for Medline Industries is informed by a comprehensive review of official government publications, reputable market research firms, and leading economic and demographic data providers. This ensures that insights into political, economic, social, technological, legal, and environmental factors are grounded in current and reliable information.