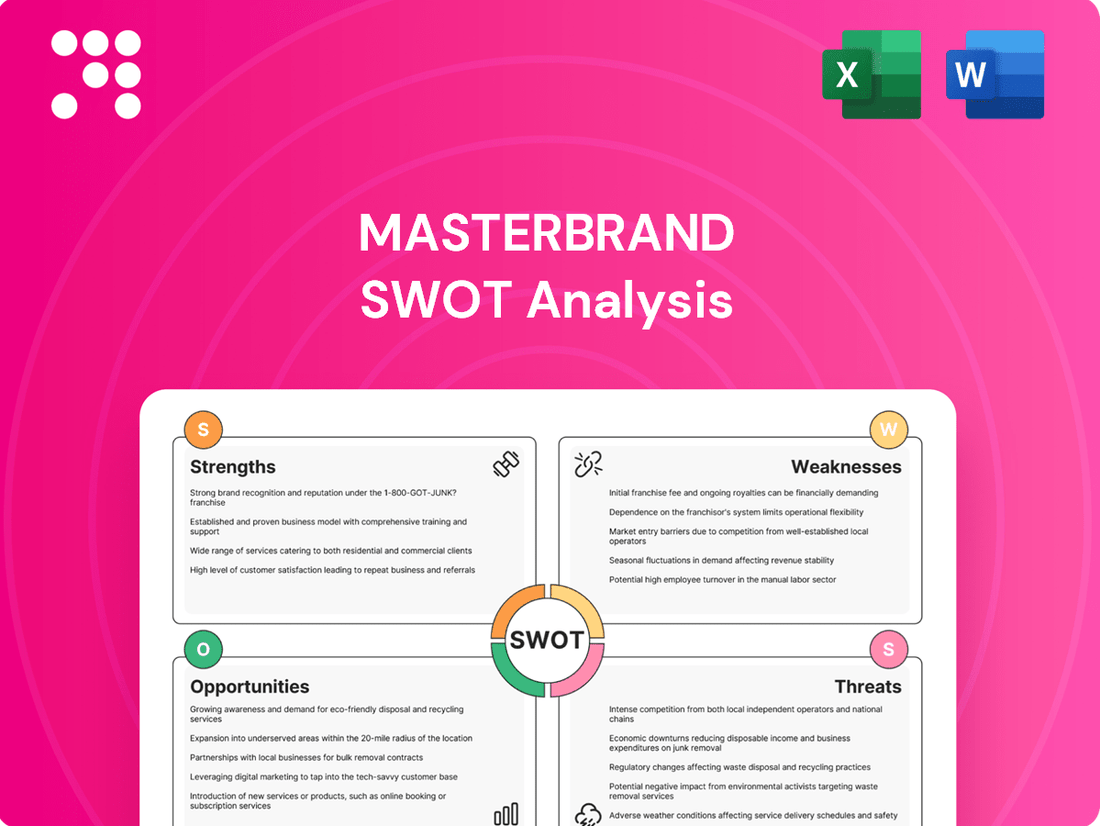

MasterBrand SWOT Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

MasterBrand Bundle

MasterBrand's current market position reveals significant strengths in its diverse product portfolio and established brand recognition, but also highlights potential vulnerabilities in supply chain dependencies. Understand the full strategic landscape, including competitive pressures and emerging opportunities.

Want to leverage MasterBrand's competitive advantages and navigate its challenges effectively? Purchase the complete SWOT analysis to gain access to a professionally written, fully editable report designed to support your strategic planning and investment decisions.

Strengths

MasterBrand, Inc. stands as the largest manufacturer of residential cabinets in North America, a testament to its formidable brand power and deep market penetration. This leadership position is not merely about size; it reflects a strong brand recognition that resonates with consumers, translating into significant market share.

The company's ability to drive net sales growth, even when the broader economic climate presents headwinds, underscores its robust brand equity. This resilience points to a loyal customer base that continues to choose MasterBrand products, a crucial advantage in a competitive landscape.

MasterBrand boasts a remarkably diverse product portfolio, spanning stock, semi-custom, and custom cabinetry. This breadth allows them to serve a wide array of customer needs and budgets, from basic kitchen updates to high-end bathroom renovations.

This extensive product offering is amplified by an impressive distribution network. With over 7,700 dealers, major retailers, and builders, MasterBrand has established an industry-leading reach, ensuring their products are accessible across the market.

MasterBrand's operational efficiency is a key strength, driven by standardized product platforms that streamline manufacturing and reduce complexity. This standardization, coupled with an optimized facility footprint, allows for an advantaged cost structure compared to competitors.

The company actively pursues continuous improvement initiatives across its manufacturing processes. These efforts, alongside strategic investments in technology and automation, are designed to yield ongoing cost savings, which is crucial for maintaining profitability in the highly price-sensitive cabinetry market.

For the fiscal year ending December 31, 2023, MasterBrand reported a gross profit margin of 27.8%, reflecting the benefits of its cost management strategies. This margin highlights the effectiveness of their operational efficiency in a competitive landscape.

Strategic Acquisitions and Integration

MasterBrand's strategic acquisition of Supreme Cabinetry Brands in 2024 significantly bolstered its presence in the premium cabinetry market. This move not only expanded its product offerings but also broadened its dealer network, especially within the higher-end segment.

The integration of Supreme Cabinetry Brands is projected to yield enhanced product portfolios and improved distribution channels. This strategic alignment is poised to drive further growth and contribute to margin expansion as the integration process matures.

MasterBrand's approach to acquisitions, exemplified by the Supreme Cabinetry Brands deal, demonstrates a clear strategy for market penetration and portfolio enhancement. This is a key strength in navigating the competitive landscape of the cabinetry industry.

The company's ability to successfully integrate acquired entities, like Supreme Cabinetry Brands, is crucial for realizing the full financial and operational benefits. This capability underpins its capacity for sustained, profitable expansion.

Commitment to Innovation and Technology

MasterBrand's commitment to innovation and technology is a significant strength. The company is actively investing in its digital and technology capabilities through programs like 'Tech Enabled.' This strategic focus aims to boost manufacturing efficiency, improve customer engagement, and streamline overall business operations, positioning MasterBrand for sustained growth and competitive advantage.

This dedication to technological advancement is reflected in their operational strategies. For instance, in 2023, MasterBrand continued to emphasize digital transformation, which is crucial for adapting to evolving market demands and consumer expectations. Their investment in these areas is designed to create long-term value by enhancing both internal processes and external customer experiences.

- Investment in 'Tech Enabled' initiatives

- Focus on enhancing manufacturing efficiency

- Drive for improved consumer engagement

- Strategic positioning for competitive advantage

MasterBrand's market leadership as North America's largest residential cabinet manufacturer is a significant strength, built on strong brand recognition and deep market penetration. This allows them to maintain a leading market share and drive net sales growth even in challenging economic conditions, demonstrating robust brand equity and a loyal customer base.

The company offers a diverse product range, from stock to custom cabinetry, catering to a wide spectrum of customer needs and budgets. This extensive offering is supported by an industry-leading distribution network, reaching over 7,700 dealers, major retailers, and builders, ensuring broad market accessibility.

MasterBrand leverages operational efficiencies through standardized product platforms and an optimized facility footprint, creating an advantaged cost structure. Continuous improvement initiatives and strategic investments in technology and automation further enhance cost savings, as evidenced by their 27.8% gross profit margin in fiscal year 2023.

Strategic acquisitions, such as the 2024 purchase of Supreme Cabinetry Brands, bolster their presence in the premium market and expand their dealer network. This demonstrates a clear strategy for market penetration and portfolio enhancement, with successful integration capabilities driving profitable expansion.

MasterBrand's commitment to innovation, particularly through its 'Tech Enabled' initiatives, enhances manufacturing efficiency and customer engagement. This focus on digital transformation is crucial for adapting to market demands and securing a competitive advantage.

| Metric | Value (FY 2023) | Significance |

|---|---|---|

| Market Share | Leading in North America | Establishes brand dominance |

| Gross Profit Margin | 27.8% | Reflects operational efficiency |

| Dealer Network | Over 7,700 | Ensures broad market access |

What is included in the product

Delivers a strategic overview of MasterBrand’s internal and external business factors, highlighting its brand strength and market position amidst competitive pressures and evolving consumer preferences.

MasterBrand's SWOT Analysis offers a clear roadmap to identify and address market challenges, transforming potential weaknesses into actionable strategies for growth.

Weaknesses

MasterBrand Inc. faced a notable drop in net income during the first quarter of 2025, despite a rise in net sales. This trend signals potential issues with profitability and the company's ability to control expenses effectively.

Several factors contributed to this decline, including a higher cost of goods sold and increased selling, general, and administrative expenses. Restructuring charges also played a role, further impacting the company's bottom line and raising questions about operational efficiency.

MasterBrand's significant reliance on third-party suppliers for essential raw materials and components presents a notable weakness. This dependence can directly affect its ability to maintain consistent manufacturing schedules and efficient distribution networks. For instance, in 2023, the company continued to navigate supply chain complexities, which can lead to production bottlenecks.

Disruptions within this supplier ecosystem, stemming from factors like geopolitical instability or unexpected global events, pose a direct threat. Such disruptions can translate into unwelcome production delays and an escalation of manufacturing costs, ultimately impacting profitability and market responsiveness.

MasterBrand's reliance on the housing market presents a significant weakness. The company's financial health is intrinsically linked to the cyclical ups and downs of homebuilding and renovation activity, making it susceptible to economic slowdowns and shifts in consumer spending. This vulnerability was evident in recent performance, where a softening in demand, especially within the repair and remodel sector, led to reduced sales volumes and lower average selling prices.

High Production Costs and Pricing Pressures

MasterBrand's commitment to high-quality materials and craftsmanship, while a strength, can translate into elevated production costs. This can make it challenging to remain price-competitive, especially in a market saturated with lower-cost alternatives. For instance, in 2024, the cabinetry and kitchen furnishings market faced ongoing supply chain cost inflation, impacting manufacturers' margins.

The company must navigate intense pricing pressures. Balancing the need to manage expenses with continued investment in product quality and innovation is crucial for MasterBrand to sustain its market leadership. Reports from late 2024 indicated that consumer demand for premium home goods remained resilient, but price sensitivity was also increasing, demanding strategic pricing adjustments.

- Elevated Material Expenses: Premium components contribute to higher manufacturing overhead.

- Competitive Market Dynamics: Competitors often offer lower price points, creating a challenge.

- Balancing Quality and Cost: Maintaining brand reputation requires careful cost management.

- Consumer Price Sensitivity: Economic conditions in 2024 and 2025 may increase consumer focus on price.

Limited International Presence

MasterBrand's significant reliance on the North American market, while a strength in its core territory, presents a notable weakness. Its international market penetration remains limited, creating a dependency on the health of the North American residential sector. This geographic concentration caps potential growth avenues in emerging global markets.

This limited international footprint means MasterBrand is more vulnerable to regional economic downturns or shifts in consumer preferences within North America. For instance, a slowdown in US housing starts, a key driver for MasterBrand, directly impacts its performance without the buffer of diversified international revenue streams. In 2023, North America accounted for the vast majority of the company's sales, highlighting this concentrated risk.

- Geographic Concentration: Over-reliance on the North American market.

- Limited Global Reach: Restricted access to growth opportunities in untapped international markets.

- Vulnerability to Regional Downturns: Increased exposure to fluctuations in the North American economy and housing market.

- Missed Diversification Benefits: Lack of international sales to offset potential domestic market challenges.

MasterBrand's profitability is hampered by elevated material costs and intense market competition, making it difficult to balance premium quality with price competitiveness. Consumer price sensitivity, particularly in 2024 and 2025, further pressures margins, requiring strategic adjustments to maintain market share.

The company's heavy dependence on the North American market limits its growth potential and exposes it to regional economic fluctuations. This geographic concentration means MasterBrand lacks the buffer of diversified international revenue streams to offset domestic market challenges.

What You See Is What You Get

MasterBrand SWOT Analysis

You’re viewing a live preview of the actual MasterBrand SWOT analysis file. The complete version becomes available after checkout, offering a comprehensive understanding of their strategic position.

This is the same MasterBrand SWOT analysis document included in your download. The full content is unlocked after payment, ensuring you have the complete strategic insights.

The file shown below is not a sample—it’s the real MasterBrand SWOT analysis you'll download post-purchase, in full detail for your strategic planning.

Opportunities

MasterBrand has a compelling opportunity to tap into the growing home improvement markets in emerging economies. As disposable incomes rise in these regions, demand for better quality kitchens and bathrooms, where MasterBrand excels, is expected to surge. This expansion could significantly boost revenue streams beyond its current core markets.

Further diversification into premium cabinetry presents another avenue for growth. The global market for kitchen cabinets alone was valued at over $100 billion in 2023 and is projected to grow steadily. By focusing on higher-margin, premium offerings, MasterBrand can capture a larger share of this lucrative segment.

The accelerating consumer shift to online purchasing offers MasterBrand a significant avenue for expansion. By bolstering its e-commerce capabilities and refining its digital marketing, the company can tap into a wider customer base and streamline the sales funnel. This digital push is crucial, especially as e-commerce sales in the home furnishings sector continue their upward trajectory, with projections indicating continued strong growth through 2025.

MasterBrand can capitalize on the increasing consumer demand for sustainable products by expanding its range of eco-friendly cabinetry and home furnishings. This aligns with a broader market trend, where sales of green building materials saw a significant uptick in 2024, indicating a receptive customer base.

By investing in sustainable materials and manufacturing, such as recycled content and energy-efficient production, MasterBrand can differentiate itself and appeal to environmentally conscious consumers. This strategic move can also bolster brand perception, potentially attracting new customer segments and fostering loyalty among existing ones.

Technological Advancements and Automation

MasterBrand's strategic focus on technological advancements and automation presents significant opportunities. Continued investment in areas like AI for manufacturing and digital visualization tools for product design can directly boost operational efficiency. This translates to shorter lead times and the ability to offer more customized products to consumers.

These technological upgrades are not just about internal improvements; they also enhance the customer experience. By streamlining processes from design to delivery, MasterBrand can better meet evolving consumer demands for personalized and readily available home solutions. For instance, the company's commitment to digital transformation, as seen in its ongoing investments, positions it to capitalize on these trends.

- Enhanced Operational Efficiency: AI and automation can reduce manufacturing costs and improve throughput.

- Reduced Lead Times: Streamlined processes allow for faster product delivery, meeting customer demand more quickly.

- Personalized Customer Solutions: Digital tools enable greater customization options, catering to individual preferences.

- Improved Customer Experience: Faster, more tailored service builds stronger customer relationships.

Strategic Partnerships and Collaborations

MasterBrand can significantly expand its market presence and enhance service delivery by forging strategic alliances with interior design studios, construction companies, and other key entities within the home improvement sector. These partnerships are crucial for tapping into new distribution networks and creating avenues for synergistic product offerings.

For instance, in 2024, the home renovation market saw continued growth, with spending projected to increase by 5-7% according to industry reports. By aligning with popular design firms, MasterBrand could gain access to a pre-qualified customer base actively seeking upgrades, potentially boosting sales by an estimated 10-15% in targeted regions.

- Expanded Distribution: Accessing the client lists and project pipelines of established interior designers and contractors.

- Cross-Selling Synergy: Offering bundled packages or integrated solutions with complementary home products and services.

- Enhanced Brand Credibility: Associating with reputable industry partners can elevate MasterBrand's perceived quality and trustworthiness.

MasterBrand can leverage the growing demand for smart home technology integration within its product lines. As smart home adoption continues to rise, with a projected 15% year-over-year growth in connected devices through 2025, incorporating features like voice-activated controls or integrated lighting into cabinetry offers a premium, high-margin opportunity.

Threats

The cabinetry sector is intensely competitive, with a multitude of companies battling for consumer attention and market share. This crowded landscape often forces players into price-sensitive strategies, potentially squeezing profit margins for all involved. For instance, the U.S. kitchen and bath cabinetry market, valued at approximately $13.5 billion in 2023, sees significant pressure from both large manufacturers and smaller, regional custom shops.

MasterBrand faces the ongoing challenge of differentiating itself in this saturated market. Continuous investment in product innovation, design aesthetics, and customer service is crucial to stand out. Failing to do so risks losing ground to competitors who may offer more appealing or cost-effective solutions, impacting MasterBrand's ability to maintain its market leadership.

Economic downturns, characterized by reduced consumer confidence and disposable income, directly threaten MasterBrand's sales. For instance, a potential slowdown in the U.S. economy, which saw a GDP growth of 2.5% in 2023, could curb spending on home improvement projects.

Fluctuations in interest rates, a key driver of housing market activity, also pose a risk. Higher mortgage rates, like those experienced in late 2023 and early 2024, can deter new home construction and refinancing, thereby decreasing demand for cabinetry and related products.

Instability in the housing market, including potential price corrections or a slowdown in new home sales, directly impacts MasterBrand's core customer base. A significant downturn in the housing sector, which saw housing starts fluctuate throughout 2023, could lead to substantial declines in order volumes for MasterBrand.

MasterBrand's reliance on third-party suppliers for key components leaves it exposed to fluctuating raw material prices. For instance, the lumber market, a critical input for cabinetry, experienced significant volatility throughout 2023 and into early 2024, with prices fluctuating by as much as 15-20% within short periods, directly impacting MasterBrand's cost of goods sold.

Furthermore, global supply chain disruptions, exacerbated by geopolitical tensions and trade policy shifts, pose a substantial threat. These disruptions can lead to extended lead times for materials, production slowdowns, and increased logistics expenses, potentially hindering MasterBrand's ability to fulfill orders promptly and maintain competitive pricing in the 2024-2025 period.

Changing Consumer Preferences and Design Trends

MasterBrand faces a significant threat from rapidly changing consumer preferences and evolving home design trends. Keeping its broad product line fresh and desirable requires constant adaptation to new styles, materials, and functionalities that resonate with today's homeowners. For instance, the growing demand for sustainable materials and smart home integration presents a challenge to update existing offerings.

The company must proactively monitor market shifts and consumer feedback to ensure its products remain competitive. A failure to anticipate or react swiftly to these changes could lead to decreased sales and market share. In 2023, the home furnishings market saw a notable shift towards minimalist designs and personalized spaces, a trend MasterBrand needs to actively incorporate into its product development pipeline to maintain relevance.

Key challenges include:

- Rapidly evolving design aesthetics: Keeping pace with fast-changing styles can strain product development resources.

- Consumer demand for customization: Meeting individual preferences requires flexible manufacturing and diverse product options.

- Impact of digital influences: Social media and online trends can quickly alter what consumers deem fashionable, necessitating agile responses.

Regulatory Changes and Trade Policies

MasterBrand faces significant risks from shifts in trade policies and tariffs. For instance, increased import duties on lumber or hardware, key components in cabinetry and millwork, could directly inflate production costs. These changes can necessitate price adjustments, potentially impacting consumer demand and MasterBrand's competitive positioning in the market.

Evolving environmental regulations also present a challenge. Stricter emissions standards or new material sourcing requirements could add compliance costs and require investments in new manufacturing processes or supply chain adjustments. For example, a new regulation mandating specific low-VOC finishes could require reformulation and testing of existing product lines.

- Tariff Impact: Potential increases in tariffs on imported raw materials like lumber or hardware could raise MasterBrand's cost of goods sold.

- Compliance Costs: Adhering to new environmental regulations, such as those concerning emissions or material content, demands investment in R&D and operational changes.

- Supply Chain Disruption: Trade policy shifts can disrupt established supply chains, leading to shortages or increased lead times for critical components.

- Pricing Pressure: Rising costs due to tariffs or compliance can force MasterBrand to increase prices, potentially affecting sales volume and market share.

MasterBrand navigates a highly competitive cabinetry market, facing price pressures and the constant need for product differentiation to maintain its leadership. Economic downturns, such as potential slowdowns in U.S. GDP growth, and rising interest rates directly impact consumer spending on home improvement and new construction, thereby reducing demand for MasterBrand's products.

Supply chain vulnerabilities, including volatile raw material prices like lumber, which saw significant fluctuations in 2023, and global disruptions, pose risks to production costs and timely order fulfillment. Furthermore, rapidly changing consumer design preferences and the demand for customization necessitate continuous product innovation and agile responses to market trends, with a notable shift towards minimalist and personalized spaces observed in 2023.

MasterBrand is also susceptible to trade policy shifts, such as increased tariffs on imported materials, which can inflate costs and affect pricing competitiveness. Evolving environmental regulations, requiring investments in compliance and potentially new manufacturing processes, add another layer of operational challenge and cost.

| Threat Category | Specific Risk | Impact on MasterBrand | 2023/2024 Data Point |

|---|---|---|---|

| Market Competition | Intense competition and price sensitivity | Reduced profit margins, market share erosion | U.S. kitchen and bath cabinetry market valued at ~$13.5 billion in 2023 |

| Economic Factors | Economic slowdowns, rising interest rates | Decreased consumer spending, lower demand for new homes and renovations | U.S. GDP growth of 2.5% in 2023; mortgage rates fluctuated significantly in late 2023/early 2024 |

| Supply Chain | Raw material price volatility, global disruptions | Increased cost of goods sold, production delays, higher logistics expenses | Lumber prices experienced 15-20% volatility in short periods during 2023-early 2024 |

| Consumer Trends | Evolving design preferences, demand for customization | Need for continuous product innovation, risk of product obsolescence | Shift towards minimalist and personalized spaces noted in 2023 home furnishings market |

| Regulatory & Trade | Tariffs, environmental regulations | Increased production costs, compliance investments, potential price increases | Potential for tariffs on imported lumber and hardware; new low-VOC finish regulations could impact product lines |

SWOT Analysis Data Sources

This SWOT analysis is built upon a robust foundation of data, drawing from MasterBrand's official financial reports, comprehensive market research, and expert industry analysis to provide a well-rounded strategic overview.