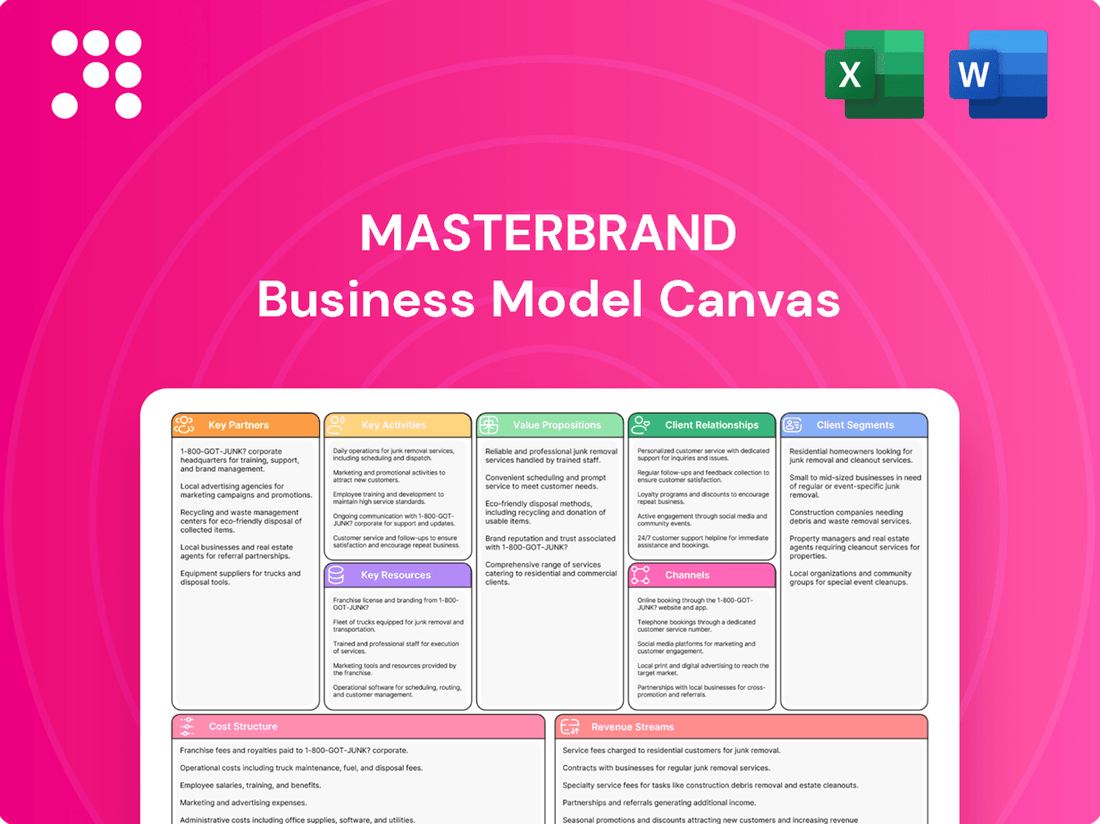

MasterBrand Business Model Canvas

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

MasterBrand Bundle

Unlock the strategic framework behind MasterBrand's impressive market position. This comprehensive Business Model Canvas breaks down their customer relationships, revenue streams, and key resources, offering a clear roadmap to their success. Discover the actionable insights that drive their value creation and competitive advantage.

Partnerships

MasterBrand's strategic dealer network is its backbone, connecting over 7,700 dealers across North America to its vast customer base. These partnerships are essential for delivering products and providing localized sales, design, and installation services, ensuring a comprehensive customer experience.

The company's commitment to this network was underscored by the 2024 acquisition of Supreme Cabinetry Brands, which significantly broadened its reach and strengthened its distribution channels. This expansion is key to MasterBrand's strategy for capturing a larger share of the residential market.

MasterBrand's partnerships with major home improvement retailers, such as The Home Depot, are foundational to its business model, driving a substantial portion of its net sales. In 2024, these alliances continue to be critical for achieving high-volume distribution, particularly for their stock and semi-custom cabinetry offerings.

These alliances offer MasterBrand unparalleled consumer reach and visibility. Strong relationships with these retail giants ensure prime product placement and facilitate cooperative marketing initiatives, directly impacting sales performance and brand recognition.

MasterBrand actively cultivates relationships with major single-family homebuilders and general contractors. These collaborations are crucial for MasterBrand to supply cabinetry directly into new residential construction projects, representing a significant revenue stream. For instance, in 2023, the company's success in securing large-volume contracts with builders was a key driver of its performance in the new construction market.

Raw Material and Component Suppliers

MasterBrand’s manufacturing hinges on dependable relationships with suppliers providing essential materials like wood, hardware, and finishes. These partnerships are foundational for maintaining a steady flow of components, ensuring the quality of their diverse cabinetry products, and achieving cost-effectiveness. In 2023, MasterBrand reported that its cost of goods sold was approximately $3.0 billion, underscoring the significant impact of supplier relationships on its financial performance and operational stability.

Strategic sourcing from these key partners is vital for MasterBrand to navigate potential supply chain disruptions and maintain uninterrupted production. For instance, securing long-term agreements for lumber, a primary input, can lock in favorable pricing and guarantee availability, which is crucial given the volatility in commodity markets. The company’s ability to manage these supplier dynamics directly influences its capacity to meet market demand efficiently.

- Wood and Lumber: Sourcing high-quality lumber is paramount for cabinetry production, with price fluctuations in 2024 impacting raw material costs.

- Hardware and Fixtures: Reliable suppliers for hinges, drawer slides, and handles ensure product functionality and aesthetic appeal.

- Finishes and Coatings: Partnerships for paints, stains, and protective coatings are critical for product durability and visual quality.

- Component Integration: Suppliers of specialized components, like custom-cut panels or decorative elements, are essential for product variety.

Technology and Innovation Partners

MasterBrand actively collaborates with technology providers and design software companies to fuel its 'Tech Enabled' strategy. These alliances are crucial for streamlining manufacturing, advancing product design, and elevating customer interactions via digital platforms. For instance, in 2024, MasterBrand continued to invest in advanced manufacturing technologies, aiming for a 5% increase in operational efficiency through automation and data analytics.

These partnerships directly support MasterBrand's commitment to innovation and efficiency. By integrating cutting-edge software and hardware, the company can accelerate product development cycles and improve the precision of its manufacturing processes. This focus on technological integration is a cornerstone of their competitive strategy in the evolving homebuilding and renovation market.

- Technology Integration: Partnerships with leading software firms enhance MasterBrand's digital design tools, enabling faster prototyping and customization.

- Manufacturing Optimization: Collaborations with automation specialists are key to implementing smart factory initiatives, improving output quality and reducing waste.

- Customer Experience Enhancement: Digital tools developed through these partnerships offer customers immersive design experiences and streamlined purchasing journeys.

- R&D Investment: In 2024, MasterBrand allocated a significant portion of its R&D budget towards exploring AI-driven design and predictive maintenance in manufacturing.

MasterBrand's key partnerships extend to financial institutions and investors, crucial for funding growth initiatives and acquisitions. These relationships provide the capital necessary to expand its manufacturing capabilities and market reach. In 2024, the company continued to leverage its strong financial backing to pursue strategic opportunities, including the integration of acquired businesses.

These financial alliances are vital for maintaining a healthy balance sheet and supporting MasterBrand's long-term strategic objectives. Access to capital markets allows the company to invest in innovation, optimize its supply chain, and respond effectively to market dynamics, ensuring sustained profitability and shareholder value.

What is included in the product

A comprehensive, pre-written business model tailored to MasterBrand's strategy, detailing customer segments, channels, and value propositions.

Reflects MasterBrand's real-world operations and plans, organized into 9 classic BMC blocks with full narrative and insights.

MasterBrand's Business Model Canvas provides a clear, visual framework that simplifies complex strategic planning, alleviating the pain of overwhelming information and disjointed ideas.

By offering a structured yet adaptable template, it streamlines the process of articulating and refining business strategy, reducing the time and effort typically spent on manual documentation.

Activities

Cabinet manufacturing and production is MasterBrand's central operation, covering the creation of stock, semi-custom, and custom cabinetry. This process involves transforming raw materials into finished products across their extensive network of over 20 manufacturing sites.

The company's focus on operational excellence is key to its success. In 2023, MasterBrand reported net sales of $3.9 billion, demonstrating the scale of their production capabilities and market presence.

MasterBrand actively designs new cabinet styles, finishes, and functional solutions to align with shifting consumer tastes and market dynamics. This commitment to product design ensures they remain at the forefront of the industry, offering fresh aesthetics and practical innovations for homeowners.

The company's innovation pipeline is robust, exemplified by the integration of new product lines, such as those acquired through the Supreme acquisition, and the introduction of compelling new finishes. These advancements are crucial for capturing new market segments and reinforcing their appeal across a diverse customer base.

In 2023, MasterBrand reported net sales of $3.9 billion, underscoring the commercial success of their product design and innovation efforts. This financial performance highlights their ability to translate creative development into tangible market share and revenue growth.

MasterBrand's key activities heavily rely on managing its extensive distribution network, a crucial element for reaching its diverse customer base. This involves ensuring products reach over 7,700 dealers, major retailers, and builders throughout North America.

Efficient logistics are paramount for MasterBrand, directly impacting customer satisfaction and the strength of its channel partnerships. This focus on timely delivery and effective inventory management is a core operational function.

The company's success is intrinsically linked to its ability to coordinate a complex supply chain. This coordination is essential for the smooth flow of goods from manufacturing to the end customer, underpinning the business model.

Sales and Marketing

MasterBrand invests heavily in sales and marketing to showcase its wide array of cabinet brands. This involves equipping its dealer partners with crucial marketing collateral and actively participating in key industry trade shows.

The company also utilizes digital channels to connect directly with consumers, ensuring broad reach and brand awareness across various platforms. These efforts are fundamental to stimulating customer interest and reinforcing MasterBrand's market presence.

In 2023, MasterBrand reported net sales of $4.1 billion, with a significant portion attributed to effective sales and marketing initiatives driving consumer demand for its kitchen and bath cabinetry.

- Dealer Support: Providing marketing materials and co-op advertising funds to over 5,000 dealers.

- Digital Engagement: Investing in online advertising and social media campaigns, reaching millions of potential customers annually.

- Trade Shows: Participating in major industry events like KBIS (Kitchen & Bath Industry Show) to showcase new products and connect with trade professionals.

- Brand Building: Sustaining brand visibility through national advertising and public relations efforts.

Acquisition Integration and Synergy Realization

A core activity for MasterBrand involves acquiring and integrating other cabinetry businesses, a strategy exemplified by the purchase of Supreme Cabinetry Brands. This process is vital for achieving operational efficiencies and broadening their market presence.

The integration phase focuses on consolidating operations to unlock cost synergies, such as streamlining supply chains and administrative functions. This also allows for the expansion of product lines and a wider geographic reach, ultimately enhancing the company's competitive position.

- Strategic Acquisitions: MasterBrand actively pursues acquisitions to fuel growth and market share expansion.

- Integration Execution: Successfully merging acquired companies into existing operations is paramount for realizing intended benefits.

- Synergy Capture: The focus is on identifying and implementing cost savings and revenue enhancement opportunities post-acquisition.

- Market Expansion: Acquisitions are leveraged to enter new markets and broaden the company's product and service portfolio.

MasterBrand's key activities encompass manufacturing, product design and innovation, sales and marketing, and strategic acquisitions. These pillars drive their business, from creating diverse cabinetry solutions to expanding their market reach through strategic purchases and robust marketing efforts.

In 2023, MasterBrand achieved net sales of $4.1 billion, a testament to the effectiveness of these combined activities in driving revenue and market penetration. Their operational scale is evident in their extensive network of over 20 manufacturing sites and their commitment to innovation, including the integration of new product lines.

The company's distribution network is a critical activity, ensuring products reach over 7,700 dealers and retailers. This is supported by significant investments in sales and marketing, including digital engagement and participation in key industry trade shows like KBIS, to build brand awareness and stimulate demand.

| Key Activity | Description | 2023 Impact |

|---|---|---|

| Manufacturing & Production | Creating stock, semi-custom, and custom cabinetry. | Supported $4.1 billion in net sales. |

| Product Design & Innovation | Developing new styles, finishes, and functional solutions. | Drives market relevance and consumer appeal. |

| Sales & Marketing | Promoting brands through dealer support, digital channels, and trade shows. | Essential for stimulating demand and brand visibility. |

| Strategic Acquisitions | Acquiring and integrating other cabinetry businesses. | Expands market presence and unlocks operational efficiencies. |

Full Document Unlocks After Purchase

Business Model Canvas

The MasterBrand Business Model Canvas preview you are viewing is the exact document you will receive upon purchase. This isn't a sample or mockup; it's a direct snapshot from the complete, ready-to-use file. Once your order is processed, you'll gain full access to this professionally structured and formatted Business Model Canvas, enabling you to immediately apply its insights to your business strategy.

Resources

MasterBrand's manufacturing footprint is a cornerstone of its operations, encompassing more than 20 facilities strategically located throughout North America. These sites are the engines that produce the company's diverse range of cabinetry products, from kitchen and bath cabinets to specialty storage solutions.

The company's investment in advanced machinery and technology within these facilities is substantial, representing a significant portion of its physical assets. For instance, recent reports indicate ongoing capital expenditures aimed at modernizing equipment and integrating automation to boost output and quality.

Strategic expansions, such as the notable Kinston facility project, underscore MasterBrand's commitment to enhancing production capacity and operational efficiency. These investments are crucial for meeting growing market demand and maintaining a competitive edge in the cabinetry industry.

MasterBrand boasts a robust and diverse product portfolio, encompassing stock, semi-custom, and premium residential cabinetry. This breadth ensures they can meet a wide array of consumer needs and price points, a key element of their business model.

With over 15 nationally recognized brands, MasterBrand offers a comprehensive selection of styles, materials, and finishes. This extensive brand umbrella allows them to capture market share across different segments and appeal to a broad customer base.

For instance, in 2023, MasterBrand's diverse offerings contributed significantly to their net sales, which reached $4.2 billion. This wide product range is a core strength, enabling them to cater to various tastes and budgets within the residential cabinetry market.

MasterBrand's extensive distribution network, numbering over 7,700 dealers, major retailers, and builders, is a cornerstone of its business model. This vast reach facilitates efficient product delivery throughout the United States and Canada.

This expansive network is crucial for MasterBrand's market access, enabling strong relationships with a diverse customer base. It directly supports their sales strategy by ensuring products are readily available where consumers shop.

Skilled Workforce and Management Team

MasterBrand's success hinges on its over 13,000 associates, a diverse talent pool encompassing skilled production workers, innovative designers, customer-focused sales professionals, and efficient logistics experts. This extensive workforce is the backbone of their manufacturing and operational capabilities.

The company's experienced management team provides the strategic direction and leadership necessary to navigate the competitive landscape. Their commitment to continuous improvement and fostering a strong organizational culture are critical drivers for achieving operational excellence and effectively executing MasterBrand's strategic initiatives.

- Skilled Workforce: Over 13,000 associates across manufacturing, design, sales, and logistics.

- Management Expertise: Experienced leadership driving strategy and operational efficiency.

- Culture of Improvement: Commitment to continuous learning and development.

- Strategic Execution: Workforce and management are key to implementing business goals.

Strong Brand Reputation and Intellectual Property

MasterBrand's brand reputation, built over decades as the largest residential cabinet manufacturer in North America since its founding in 1954, is a cornerstone of its business model. This heritage translates into significant brand recognition across its diverse product lines, fostering deep customer trust and loyalty.

The company's intellectual property, potentially encompassing proprietary design elements and advanced manufacturing techniques, further solidifies its competitive advantage. This intangible asset contributes to product differentiation and operational efficiency.

- Brand Equity: MasterBrand's established name recognition provides a significant advantage in a competitive market, reducing customer acquisition costs.

- Product Recognition: Consumers are familiar with and trust MasterBrand's various cabinet lines, leading to repeat purchases and positive word-of-mouth.

- Intellectual Property Value: Patents or trade secrets related to cabinet design or manufacturing processes can offer a unique selling proposition and barrier to entry for competitors.

- Customer Loyalty: A strong brand reputation cultivates a loyal customer base, contributing to stable revenue streams and market share.

MasterBrand's key resources include its extensive manufacturing facilities and a robust, diverse product portfolio. The company operates over 20 North American plants, continually investing in modernization and automation to enhance production capabilities and product quality. This physical infrastructure is complemented by a broad range of brands and product types, catering to various consumer preferences and market segments.

The company's distribution network, reaching over 7,700 dealers and retailers, is a critical asset for market access. This expansive reach, coupled with a workforce of over 13,000 skilled associates and experienced management, forms the human capital that drives operations and strategic execution. Furthermore, MasterBrand's strong brand reputation, built since 1954, and its intellectual property provide significant competitive advantages.

| Key Resource | Description | Impact |

| Manufacturing Footprint | Over 20 North American facilities | Enables large-scale production and operational efficiency |

| Product Portfolio | 15+ nationally recognized brands; stock, semi-custom, premium options | Catters to diverse customer needs and price points, driving sales |

| Distribution Network | 7,700+ dealers, retailers, builders | Ensures broad market access and product availability |

| Human Capital | 13,000+ associates, experienced management | Drives innovation, operational excellence, and strategic execution |

| Brand Equity & IP | Established reputation since 1954, proprietary designs | Fosters customer trust, loyalty, and competitive differentiation |

Value Propositions

MasterBrand distinguishes itself with an extensive array of residential cabinetry, covering stock, semi-custom, and high-end selections. This broad offering ensures customers can find precisely what they need, regardless of their style, functional requirements, or financial plan for any room in their home.

MasterBrand is recognized for its superior cabinetry, meticulously crafted for both beauty and resilience. This dedication to quality ensures their products not only meet rigorous residential demands but also offer enduring value, solidifying their status as a premier cabinet manufacturer.

MasterBrand's value proposition hinges on its extensive availability and accessibility, ensuring customers can easily find and purchase their cabinetry solutions. This is achieved through a robust distribution network encompassing thousands of dealers, major retailers, and builders across North America.

This wide-reaching network translates into significant convenience for consumers, allowing them to access MasterBrand's products locally. Furthermore, the availability of local design and installation services enhances the overall customer experience, making the process of acquiring and fitting new cabinetry seamless.

Solutions for Diverse Budgets and Lifestyles

MasterBrand's product lines are designed to accommodate a wide spectrum of financial capacities. This approach ensures that whether a customer is renovating on a tight budget or investing in a high-end custom kitchen, they can find suitable cabinetry solutions. For instance, their offerings span from more accessible, ready-to-assemble options to premium, fully custom installations, reflecting a commitment to broad market appeal.

This strategy is evident in their diverse brand portfolio, which includes names recognized for both value and luxury within the cabinetry market. By segmenting their products, MasterBrand effectively captures market share across different economic strata. In 2024, the home improvement sector saw continued demand for renovation projects, with cabinetry being a significant component, underscoring the importance of this budget-inclusive approach.

- Broad Price Point Accessibility: MasterBrand offers cabinetry from entry-level to luxury tiers.

- Market Segmentation: Caters to diverse consumer financial situations and design preferences.

- Brand Portfolio Strategy: Utilizes multiple brands to target different market segments effectively.

- Adaptability to Market Trends: Responds to varying consumer spending power, as seen in 2024’s home renovation market.

Reliable Supply Chain and Service

MasterBrand focuses on a robust supply chain, heavily utilizing domestic manufacturing to bolster reliability. This strategy helps mitigate risks associated with overseas production and shipping, allowing for more predictable delivery schedules. For instance, in 2023, MasterBrand reported that a significant portion of its cabinetry production occurred within North America, contributing to its ability to manage inventory and respond to market demands more effectively.

An efficient distribution network is key to their value proposition, ensuring products reach dealers and builders promptly. This system is designed to minimize transit times and reduce the likelihood of delays, which is crucial for construction timelines. Their commitment to service extends to managing custom orders, aiming to shorten lead times even for personalized kitchen and bath products.

- Domestic Manufacturing: Prioritizing North American production to reduce lead times and supply chain disruptions.

- Efficient Distribution: Optimizing logistics to ensure timely delivery to dealers and builders.

- Service Focus: Aiming for strong customer support, particularly in expediting custom orders.

- Vulnerability Minimization: Proactively addressing potential supply chain weaknesses for consistent product availability.

MasterBrand's value proposition centers on providing a comprehensive cabinetry solution for every homeowner. They offer an extensive range of products, from budget-friendly stock options to luxurious custom designs, ensuring accessibility across various financial capacities and aesthetic preferences. This broad appeal is supported by a strong brand portfolio that effectively segments the market, allowing consumers to find solutions tailored to their specific needs and budgets. For example, in 2024, the company continued to leverage its diverse brand offerings to capture market share in a dynamic home improvement sector where affordability and customization remain key drivers of consumer choice.

Customer Relationships

MasterBrand cultivates robust relationships with its vast dealer network through dedicated support. This includes providing essential marketing collateral, comprehensive training programs, and efficient ordering systems. For instance, in 2024, MasterBrand continued its focus on dealer education, with thousands of dealers participating in product and sales training sessions, aiming to enhance their expertise and sales capabilities.

This collaborative approach ensures dealers are well-equipped to sell and service MasterBrand products, fostering dealer loyalty and driving mutual growth. A prime example of this commitment to engagement is the ongoing operation of the Dealer Designer Council, a forum where key dealers provide valuable feedback and insights, directly influencing product development and support strategies.

MasterBrand's retailer account management is a cornerstone of its mass-market strategy. Dedicated teams, like those engaging with The Home Depot, manage substantial order volumes, ensuring seamless inventory flow and executing impactful promotional campaigns. This focused approach is vital for maximizing sales through these key channels.

In 2024, MasterBrand's strategic partnerships with major retailers were instrumental. For instance, their collaboration with The Home Depot, a significant distribution partner, involved intricate planning to meet seasonal demand surges, contributing to MasterBrand's robust performance in the home improvement sector. This deep integration ensures efficient product availability and supports targeted marketing efforts.

MasterBrand offers dedicated Builder Programs, providing tailored support for new residential construction projects. This includes streamlined procurement processes and project management assistance to ensure efficient cabinetry installation.

These programs focus on close coordination with builders regarding project timelines, specific cabinetry requirements, and volume-based pricing. In 2024, MasterBrand's commitment to this segment saw continued growth, with builders leveraging these services to manage large-scale developments effectively.

Customer Service and Support

MasterBrand offers a dual approach to customer service, directly supporting end-users while also empowering its extensive dealer network to provide assistance. This ensures that inquiries are handled efficiently and issues are resolved promptly, often including the facilitation of warranty claims.

The company's dedication to product quality and customer satisfaction is the bedrock of the entire customer experience, even when support is channeled through intermediaries. This commitment extends to comprehensive post-purchase support and troubleshooting, aiming for seamless integration of their products into customers' lives.

- Dealer Network Support: MasterBrand equips its dealers to handle customer inquiries, product issues, and warranty claims, acting as the primary point of contact for many end-users.

- Post-Purchase Assistance: The company provides troubleshooting guides and support resources to ensure customers can effectively use and maintain their products after purchase.

- Commitment to Satisfaction: MasterBrand's underlying philosophy emphasizes customer satisfaction, driving the quality of both direct and indirect customer interactions.

Brand Building and Consumer Trust

MasterBrand cultivates enduring consumer trust through unwavering product quality and a strong brand reputation, further bolstered by proactive customer support. This commitment is foundational to their customer relationships.

The company's extensive history and established market leadership, particularly evident in its strong performance in the 2024 fiscal year where it reported net sales of $2.2 billion, significantly contribute to consumer confidence and loyalty.

- Consistent Product Quality: MasterBrand's focus on reliable and high-performing products is a cornerstone of its customer relationship strategy.

- Brand Reputation and Heritage: A long-standing presence in the market, recognized for quality and innovation, builds deep consumer trust.

- Responsive Customer Support: Providing accessible and effective support channels ensures customer satisfaction and reinforces brand loyalty.

- Marketing and Engagement: Strategic marketing campaigns aim to foster emotional connections with consumers, reinforcing brand values and encouraging repeat business.

MasterBrand's customer relationships are multifaceted, prioritizing strong partnerships with its dealer network through comprehensive support and training. This strategy extends to key mass-market retailers, where dedicated account management ensures efficient operations and impactful promotions, as seen in their 2024 collaborations with major home improvement chains.

Furthermore, dedicated Builder Programs streamline procurement and project management for new construction, fostering loyalty among builders. The company also provides direct end-user support, complementing the assistance offered by its dealers, all underpinned by a commitment to product quality and overall customer satisfaction.

| Customer Segment | Relationship Strategy | 2024 Focus/Data Point |

|---|---|---|

| Dealer Network | Training, marketing support, efficient ordering | Thousands of dealers participated in product and sales training. |

| Mass-Market Retailers (e.g., The Home Depot) | Dedicated account management, promotional campaigns, inventory flow | Strategic collaboration to meet seasonal demand surges. |

| Builders | Streamlined procurement, project management assistance | Continued growth in builder program participation. |

| End-Users | Direct support, warranty facilitation, post-purchase assistance | Emphasis on product quality and responsive troubleshooting. |

Channels

Independent cabinet dealers are a cornerstone of MasterBrand's distribution strategy. These businesses provide homeowners with expert design advice, in-depth product knowledge, and professional installation services. This high-touch approach is crucial for selling semi-custom and custom cabinetry, fostering strong local connections through dedicated showrooms.

In 2024, MasterBrand continued to rely on this channel for a significant portion of its sales, particularly in the mid-to-high end market segments where personalized service is paramount. The company’s focus on supporting these dealers with training and marketing resources underscores their importance in delivering a premium customer experience.

Large home improvement retailers like The Home Depot are crucial sales channels for MasterBrand, providing access to consumers undertaking DIY projects and smaller renovations. These partnerships leverage the retailers' extensive store networks and brand recognition, significantly boosting MasterBrand's market exposure.

In 2024, The Home Depot reported net sales of $152.7 billion, underscoring the immense customer traffic and purchasing power these channels represent for MasterBrand's cabinetry products. This high-volume distribution ensures MasterBrand's offerings reach a wide demographic, from individual homeowners to professional contractors.

Wholesale distributors are crucial partners in MasterBrand's supply chain, acting as intermediaries that move products from manufacturing to a wide array of sales points, including smaller dealers and contractors. This network is vital for achieving broad market penetration, especially in areas where direct sales channels are less practical or efficient.

These distributors offer significant logistical advantages, ensuring products reach diverse customer segments effectively. For instance, in 2024, MasterBrand continued to leverage its extensive distributor network to reach over 5,000 retail locations across North America, a testament to their role in market accessibility.

Direct-to-Builder Sales

MasterBrand actively engages large residential homebuilders through dedicated sales teams and specific programs, ensuring their cabinetry is a key component in new construction. This direct approach prioritizes high-volume, often standardized orders, necessitating meticulous alignment with construction timelines and detailed project specifications.

This channel is crucial for MasterBrand's growth, allowing them to capture significant market share in new housing developments. For instance, in 2024, the new home construction market saw robust activity, with housing starts projected to remain strong, providing a substantial opportunity for direct sales. MasterBrand's strategy here is to become an integral partner early in the building process.

- High-Volume Focus: Direct-to-builder sales leverage economies of scale, reducing per-unit costs for both MasterBrand and the builder.

- Project Integration: Seamlessly fitting into construction schedules and design specifications is paramount for success in this channel.

- Partnership Approach: Building strong relationships with builders is key to securing ongoing business and influencing design choices.

- Market Responsiveness: This channel allows MasterBrand to directly benefit from and respond to trends in the new home construction sector.

E-commerce Platforms (Emerging)

MasterBrand is actively expanding its presence on emerging e-commerce platforms, recognizing the shift towards digital consumerism. This strategy leverages their extensive product catalog, aiming to capture a significant share of online sales. For instance, the overall e-commerce market in the US saw a growth of 7.7% in 2023, reaching $1.14 trillion, indicating a strong opportunity for physical goods retailers to enhance their digital footprint.

This focus on emerging channels allows MasterBrand to reach a broader customer base that prioritizes convenience and a wider selection than typically found in brick-and-mortar stores. By optimizing their digital storefronts and potentially partnering with newer online marketplaces, they can tap into evolving consumer shopping habits.

- Digital Sales Growth: E-commerce sales are projected to continue their upward trajectory, with forecasts suggesting further expansion in the coming years.

- Customer Convenience: Emerging platforms often offer streamlined user experiences, appealing to consumers seeking quick and easy purchasing options.

- Product Accessibility: Online channels provide MasterBrand with the ability to showcase a more comprehensive range of products, overcoming physical retail space limitations.

- Market Reach: Expansion into these newer digital spaces allows MasterBrand to connect with demographics that are increasingly active online shoppers.

MasterBrand utilizes a multi-channel distribution strategy, encompassing independent dealers, large home improvement retailers, wholesale distributors, direct builder relationships, and emerging e-commerce platforms. Each channel serves distinct customer segments and market needs, contributing to broad market penetration and sales volume.

In 2024, MasterBrand's diverse channels demonstrated their continued importance. Independent dealers provided high-touch sales for custom cabinetry, while big-box retailers like The Home Depot, which reported $152.7 billion in net sales for the year, offered broad consumer access for renovations. Wholesale distributors facilitated efficient product movement to over 5,000 retail locations, and direct builder sales capitalized on robust new home construction activity.

The company's expansion into e-commerce reflects the growing trend of digital purchasing, with the US e-commerce market reaching $1.14 trillion in 2023. This strategy aims to capture convenience-seeking online shoppers and enhance product accessibility.

| Channel Type | Key Characteristics | 2024 Relevance/Data Point |

|---|---|---|

| Independent Dealers | High-touch, expert advice, custom solutions | Cornerstone for mid-to-high end market |

| Home Improvement Retailers (e.g., Home Depot) | Mass market access, DIY projects | Home Depot net sales: $152.7 billion |

| Wholesale Distributors | Supply chain efficiency, broad reach | Access to over 5,000 retail locations |

| Direct to Homebuilders | New construction, high-volume, project integration | Capitalizes on strong new home construction market |

| E-commerce Platforms | Digital consumerism, convenience, wider selection | US e-commerce market: $1.14 trillion (2023) |

Customer Segments

Residential homeowners undertaking repair and remodel projects represent a core customer segment for cabinetry. These individuals are typically investing in their existing homes, focusing on kitchens and bathrooms, and are looking for quality, style, and dependable service. The U.S. home improvement market saw significant growth, with spending on residential renovations and repairs reaching an estimated $485 billion in 2023, indicating strong demand within this segment.

This group often relies on professional dealers for design expertise and installation, making the dealer relationship crucial. Their purchasing decisions are influenced by factors such as product durability, a wide range of aesthetic choices to match their home's style, and the assurance of reliable service throughout the project. The economic climate significantly impacts this segment, with discretionary spending on remodels often slowing during periods of economic uncertainty.

New Home Builders, encompassing both large national developers and smaller local builders, represent a crucial customer segment. These businesses require cabinetry for their new residential construction projects, prioritizing reliable supply chains and cost-effective solutions. In 2024, the U.S. housing market saw approximately 1.6 million housing starts, indicating a robust demand for construction materials like cabinetry.

For MasterBrand, catering to this segment means offering standardized product lines that integrate seamlessly into construction schedules. Builders often seek bulk orders and consistent quality to maintain project efficiency and manage costs. The average cost of cabinetry for a new single-family home can range from $5,000 to $15,000, highlighting the significant volume and value this segment represents.

Multi-family residential developers are a key customer segment, focusing on large-scale projects like apartment buildings and condominiums. They require cabinetry in bulk for these developments, making efficient delivery and consistent quality paramount.

For these developers, competitive pricing is a major driver. They are looking for cost-effective solutions that allow them to manage project budgets effectively. For instance, in 2024, the multi-family housing starts in the US saw a significant increase, driving demand for materials like cabinetry.

Meeting specific project specifications and ensuring product durability are also critical. Developers need cabinetry that fits their design plans and can withstand the wear and tear of high-traffic residential environments.

Design Professionals (Architects & Interior Designers)

Design professionals, including architects and interior designers, are crucial partners for MasterBrand. They frequently specify cabinetry for residential and commercial projects, directly impacting product selection based on aesthetic appeal, practical use, and cost considerations.

MasterBrand supports these professionals by providing an extensive portfolio of cabinet styles and materials. This offering is enhanced by readily available, detailed product specifications and accessible design resources, facilitating their creative and specification processes.

- Key Influence: Designers and architects act as gatekeepers, specifying cabinetry that aligns with project visions and client needs.

- Product Breadth: MasterBrand offers a diverse range of styles, finishes, and materials to meet varied design requirements.

- Support Tools: Access to detailed product information, CAD files, and design visualization tools aids professionals in their specification work.

- Market Reach: In 2024, the residential construction and renovation market, heavily influenced by design professionals, continued to show resilience, with cabinetry being a significant component of interior fit-outs.

Commercial and Institutional Clients (Limited)

MasterBrand's commercial and institutional client segment, though smaller than its residential focus, caters to specific needs within sectors like hospitality and corporate environments. These clients prioritize cabinetry solutions that offer robust durability and practical functionality, often requiring bulk orders for consistent project delivery. For instance, in 2024, the hospitality sector continued its recovery, with new hotel construction and renovations creating demand for kitchen and bathroom cabinetry that can withstand high usage while maintaining aesthetic appeal.

This segment's purchasing decisions are heavily influenced by cost-effectiveness and the ability to procure large quantities of standardized products. They often seek suppliers who can manage volume production and maintain consistent quality across numerous units. This aligns with MasterBrand's manufacturing capabilities, allowing them to serve projects such as outfitting multiple hotel suites or corporate office breakrooms efficiently.

Key considerations for these clients include:

- Durability and Longevity: Cabinetry must withstand frequent use in high-traffic commercial settings.

- Cost-Effectiveness: Bulk purchases necessitate competitive pricing and value for money.

- Volume Capacity: The ability to supply large, consistent orders is crucial for project timelines.

- Functional Design: Solutions often need to be practical and easy to maintain in commercial environments.

MasterBrand serves a diverse customer base, primarily focusing on residential homeowners undertaking renovations, new home builders, and multi-family developers. Design professionals like architects and interior designers also play a critical role as specifiers. Additionally, a segment of commercial and institutional clients, such as those in hospitality, are catered to with durable and functional cabinetry solutions.

Cost Structure

The Cost of Goods Sold (COGS) is MasterBrand's most significant expense category. In 2023, COGS represented approximately 70% of net sales, highlighting the direct impact of manufacturing efficiency on profitability. This cost encompasses essential inputs like lumber, hardware, and finishes, alongside the direct labor required for cabinet production and factory-related overhead.

Selling, General & Administrative (SG&A) expenses for MasterBrand cover a broad range of operational costs. These include salaries for their sales force and administrative teams, marketing and advertising campaigns to promote their cabinetry and millwork products, and the ongoing expenses associated with maintaining offices and showrooms. For 2024, MasterBrand’s SG&A expenses were reported at $348.2 million.

The company’s strategic acquisitions, such as the integration of Supreme, can lead to temporary increases in SG&A. These additional costs often stem from the complexities of merging operations, systems, and personnel, as well as the initial efforts to align marketing and sales strategies post-acquisition. This was evident in their financial reporting, where acquisition-related costs contributed to fluctuations in SG&A.

MasterBrand's logistics and distribution costs are significant, covering the expense of moving finished products from their manufacturing plants to a wide network of dealers, retailers, and builders throughout North America. These costs are a major component of their overall expenses.

Key elements within these logistics expenses include freight charges for transportation, warehousing fees to store inventory, and the costs associated with managing that inventory efficiently. The sheer scale and geographic reach of MasterBrand's distribution system naturally lead to substantial outlays in these areas.

For context, in 2024, companies in the building products sector often allocate a notable percentage of their revenue to logistics. While specific MasterBrand figures for 2024 are proprietary, industry benchmarks suggest that such costs can range from 5% to 15% of net sales, depending on product type and delivery complexity.

Research and Development (R&D) and Innovation Costs

MasterBrand significantly invests in Research and Development (R&D) and Innovation Costs to stay competitive. These expenditures are crucial for developing new product designs, refining engineering processes, and adopting advanced manufacturing technologies. For instance, in 2023, MasterBrand's R&D spending was approximately $34.8 million, reflecting a commitment to innovation.

These investments directly translate into tangible advancements, such as the creation of novel cabinet styles and the exploration of innovative materials. Furthermore, MasterBrand emphasizes 'Tech Enabled' initiatives, which aim to boost operational efficiency and enrich their product portfolio through technological integration.

- Product Design & Engineering: Costs associated with conceptualizing and developing new cabinet lines and features.

- Material Innovation: Expenses related to researching and testing new or improved materials for durability and aesthetics.

- Manufacturing Technology: Investments in upgrading or acquiring new machinery and processes to enhance production capabilities.

- 'Tech Enabled' Initiatives: Spending on digital tools and platforms to improve customer experience and internal operations.

Acquisition-Related Costs and Integration Expenses

MasterBrand's cost structure includes significant acquisition-related expenses. The acquisition of Supreme Cabinetry Brands in 2024, for instance, involved a substantial purchase price and associated financing costs. These upfront costs are a major component of their expenditure.

Beyond the initial purchase, integration expenses are a critical part of this cost category. These include costs for restructuring operations, aligning IT systems, and personnel integration. Furthermore, the amortization of intangible assets acquired during these deals also adds to the ongoing expenses.

- Acquisition Costs: The purchase price for Supreme Cabinetry Brands was $515 million, financed through a combination of cash and debt.

- Financing Expenses: Interest on debt used for acquisitions contributes to ongoing financing costs.

- Integration Expenses: Costs associated with operational restructuring and system alignment are factored in.

- Amortization: Amortization of acquired intangible assets, such as brand names and customer relationships, impacts profitability.

MasterBrand's cost structure is heavily influenced by its manufacturing operations, with Cost of Goods Sold (COGS) being the largest expense. Selling, General & Administrative (SG&A) expenses, including those from recent acquisitions like Supreme, also represent a significant outlay. Further costs are incurred through logistics, distribution, and strategic investments in R&D and innovation.

| Expense Category | 2023/2024 Data Point | Notes |

| Cost of Goods Sold (COGS) | ~70% of net sales (2023) | Includes materials, direct labor, and factory overhead. |

| Selling, General & Administrative (SG&A) | $348.2 million (2024) | Covers sales, marketing, administrative salaries, and office expenses. |

| Research & Development (R&D) | $34.8 million (2023) | Investment in new product designs, engineering, and technology. |

| Acquisition Costs (Supreme) | $515 million (Purchase Price) | Includes purchase price, financing, integration, and amortization. |

Revenue Streams

MasterBrand generates revenue through the sale of stock cabinetry, which are pre-manufactured cabinets in standard sizes. This segment is a cornerstone of their business, catering to a broad market including budget-conscious homeowners and large-scale new construction projects.

These stock cabinets are primarily distributed through major home centers and directly to builders, ensuring a wide reach and consistent sales volume. This channel strategy allows MasterBrand to efficiently serve high-demand markets, contributing significantly to their overall financial performance.

In 2023, MasterBrand's stock cabinetry segment represented a substantial portion of their net sales, reflecting its importance as a reliable and high-volume revenue stream. This consistent demand underscores the enduring appeal of standardized, accessible cabinetry solutions in the residential market.

MasterBrand generates revenue from semi-custom cabinetry, offering homeowners a step up from stock options. This product line provides greater design flexibility with a broader selection of sizes, finishes, and accessories, enabling a more personalized aesthetic for kitchens and bathrooms. In 2024, the demand for such adaptable solutions continued to be a significant driver for the company, reflecting consumer desire for both style and value.

Revenue generated from premium and custom cabinetry represents a key growth area, offering bespoke solutions crafted to exact customer needs, including unique materials and finishes. This segment typically yields higher profit margins.

The strategic acquisition of Supreme Cabinetry Brands in 2024 significantly bolstered MasterBrand's capacity and market presence in this high-margin, specialized cabinetry sector, contributing to an overall increase in sales for these premium offerings.

Sales to Dealers

MasterBrand's primary revenue generation comes from direct sales to a network of independent cabinet dealers. These dealers act as intermediaries, selling MasterBrand's products to end consumers and smaller construction businesses. This direct-to-dealer model leverages the dealers' established design knowledge and their deep understanding of local market demands, enabling a more personalized and advisory sales experience for the ultimate customer.

In 2023, MasterBrand reported net sales of $3,888.1 million. A significant portion of this revenue is attributed to this dealer channel, which plays a crucial role in reaching a broad customer base across various geographic regions.

Key aspects of the Sales to Dealers revenue stream include:

- Direct Sales Channel: MasterBrand sells directly to independent dealers who then market and sell to end-users.

- Dealer Expertise: Dealers provide design consultation and local market insights, enhancing the customer's purchasing journey.

- Market Reach: This network allows MasterBrand to access diverse consumer segments and geographic areas effectively.

Sales to Major Retailers and Builders

MasterBrand generates significant revenue through large-volume sales to major national home improvement retailers and large residential builders. These relationships are crucial, often cemented by long-standing partnerships and bulk purchasing agreements that ensure consistent product flow for substantial construction projects.

These sales channels are vital for MasterBrand's business, contributing substantially to overall revenue. For instance, in 2023, MasterBrand reported net sales of $4.2 billion, with a significant portion attributable to these key channels. The ability to supply consistent, high-quality products in large quantities is a primary driver for these partnerships.

- National Retailer Partnerships: MasterBrand leverages its scale to supply products to major home improvement chains, benefiting from their extensive distribution networks.

- Builder Contracts: Securing large contracts with residential builders provides a steady stream of revenue, often tied to new housing starts and development projects.

- Bulk Purchasing Power: These large customers benefit from economies of scale through bulk orders, which in turn supports MasterBrand's efficient production and pricing strategies.

- Project-Based Supply: Consistent product delivery for large-scale construction projects solidifies these relationships and drives repeat business.

MasterBrand's revenue streams are diversified, encompassing stock, semi-custom, and premium/custom cabinetry. The company also relies heavily on sales to independent dealers and large-volume contracts with national retailers and builders.

In 2023, MasterBrand reported net sales of $3,888.1 million. The company's strategic acquisition of Supreme Cabinetry Brands in 2024 further strengthened its position, particularly in the premium and custom cabinetry segment, indicating a focus on higher-margin offerings.

| Revenue Stream | Description | 2023 Net Sales Contribution (Approximate) |

|---|---|---|

| Stock Cabinetry | Pre-manufactured cabinets in standard sizes, sold through home centers and builders. | Significant portion of overall sales. |

| Semi-Custom Cabinetry | Cabinetry offering more design flexibility with a wider selection of finishes and sizes. | Growing segment driven by consumer demand for personalization. |

| Premium & Custom Cabinetry | Bespoke solutions with unique materials and finishes, yielding higher profit margins. | Bolstered by acquisitions in 2024, a key growth area. |

| Sales to Independent Dealers | Direct sales to dealers who then sell to end consumers and smaller businesses. | Crucial channel for reaching diverse customer segments. |

| Sales to National Retailers & Builders | Large-volume sales to major home improvement retailers and large residential builders. | Substantial contributor to revenue, driven by bulk purchasing and contracts. |

Business Model Canvas Data Sources

The MasterBrand Business Model Canvas is informed by a comprehensive array of data, including internal financial statements, customer feedback surveys, and competitive landscape analysis. These diverse sources ensure each component of the canvas is robust and strategically sound.