MasterBrand PESTLE Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

MasterBrand Bundle

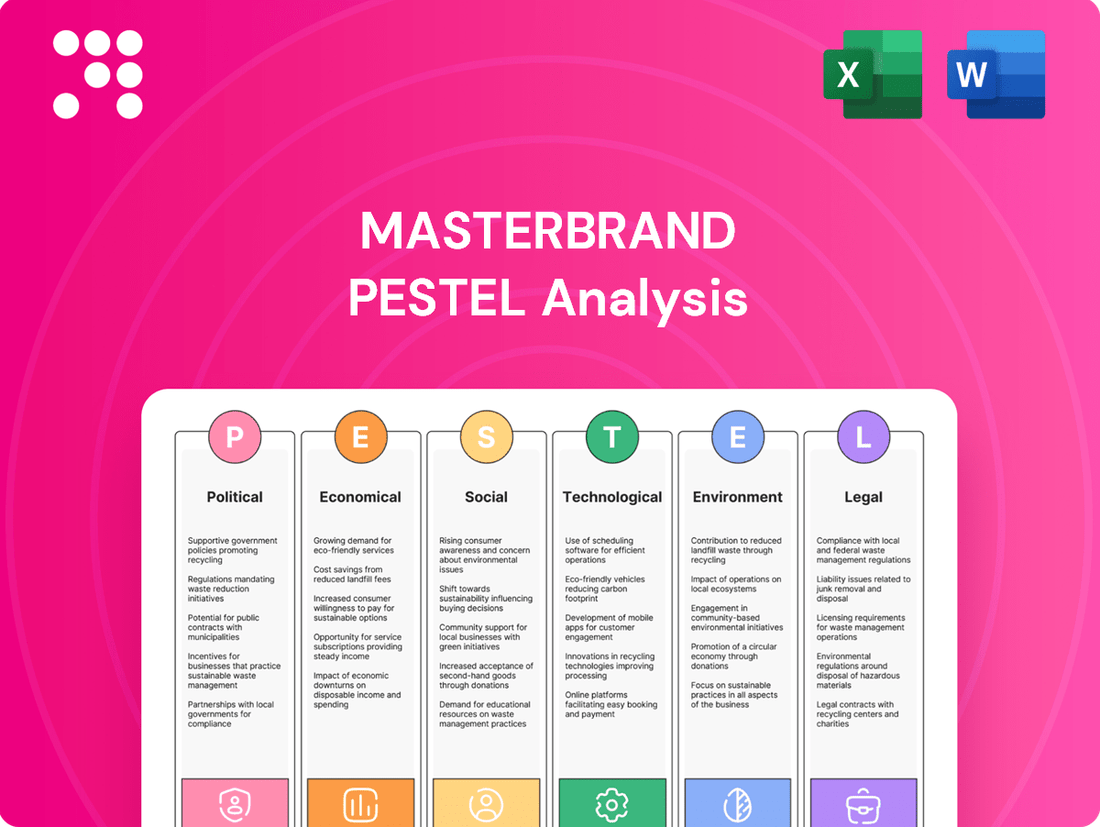

MasterBrand operates within a dynamic market, influenced by a complex web of external factors. Our PESTLE analysis delves deep into the political, economic, social, technological, legal, and environmental forces shaping its trajectory. Understand how these macro-environmental elements create both opportunities and threats for MasterBrand's strategic planning.

Gain a critical advantage by understanding the precise external pressures impacting MasterBrand. Our expertly crafted PESTLE analysis provides actionable intelligence, allowing you to anticipate market shifts and refine your own business strategy. Download the full version now for immediate, in-depth insights.

Political factors

Government housing policies significantly shape the market for residential cabinets. Initiatives aimed at boosting homeownership, such as first-time buyer tax credits or low-interest mortgage programs, directly translate into increased demand for new kitchens and renovations, benefiting companies like MasterBrand. For instance, the U.S. housing market saw a surge in activity in early 2024, with housing starts reaching an annualized rate of 1.5 million units by March, indicating robust demand for new construction and, by extension, cabinetry.

Affordable housing programs and renovation incentives also play a crucial role. Subsidies for energy-efficient upgrades or grants for low-income housing development can drive cabinet sales in specific market segments. In 2024, the U.S. Department of Housing and Urban Development continued to support various affordable housing initiatives, aiming to create more accessible living spaces, which often involve substantial kitchen and bath renovations.

Furthermore, changes in building codes and zoning regulations can impact construction timelines and costs, indirectly affecting cabinet demand. Stricter energy efficiency requirements, for example, might encourage more comprehensive renovations, including kitchen remodels, while streamlined permitting processes can accelerate new home construction. MasterBrand's performance is thus closely tied to the government's commitment to fostering a healthy and active housing sector through supportive fiscal and regulatory measures.

Fluctuations in trade policies, including import/export duties and tariffs, directly influence MasterBrand's operational expenses and market competitiveness. For instance, changes in tariffs on key raw materials like wood or steel, or on finished cabinetry products, can significantly alter production costs and the pricing of MasterBrand's offerings in different markets.

MasterBrand's management acknowledged in their Q1 2025 earnings call that tariffs have had a minor impact to date, suggesting the company is actively monitoring these developments. However, any substantial shifts in tariff structures could necessitate adjustments to their global sourcing strategies and potentially affect overall profitability.

Changes in labor laws, such as minimum wage increases or new workplace safety mandates, directly influence MasterBrand's operational expenses and its approach to managing its workforce. For instance, a significant rise in the federal minimum wage, if enacted, could necessitate adjustments to compensation structures across various roles within the company's manufacturing plants.

MasterBrand must diligently adhere to all applicable labor regulations to ensure uninterrupted operations at its numerous production facilities and corporate offices. This includes compliance with overtime rules, benefits mandates, and fair labor practices, which are critical for maintaining employee morale and avoiding legal complications.

The company's commitment to employee well-being, often detailed in its corporate social responsibility (CSR) reports, underscores its proactive stance on safety and labor standards. For example, MasterBrand's reported investments in safety training programs demonstrate an understanding of the financial and operational implications of robust workplace safety regulations.

Economic Stimulus and Infrastructure Spending

Government initiatives aimed at stimulating the economy or investing in infrastructure can significantly influence the housing sector. For instance, the U.S. Infrastructure Investment and Jobs Act, enacted in late 2021, allocated substantial funds towards improving roads, bridges, and public transit, which can indirectly support housing demand through job creation and increased economic activity. This can translate into greater consumer spending on home improvement projects, directly benefiting companies like MasterBrand that supply cabinets and related products.

These stimulus measures often inject capital into the economy, enhancing liquidity and supporting industries closely linked to residential construction and renovation. For example, in 2024, many governments continued to explore fiscal policies to counter economic headwinds, which could lead to increased construction permits and new home sales. A robust economic environment generally encourages consumers to spend more on non-essential goods and services, including upgrades to their homes.

- Infrastructure Spending Boost: Government infrastructure projects can create jobs and stimulate local economies, indirectly increasing demand for housing and home renovations.

- Consumer Confidence Impact: Economic stimulus packages often bolster consumer confidence, leading to higher discretionary spending on home improvement products.

- Liquidity Injection: Government spending can improve overall economic liquidity, benefiting sectors tied to construction and renovation, such as the cabinet industry.

Political Stability and Geopolitical Events

Political stability significantly impacts MasterBrand's operations. For instance, the U.S., a key market, maintained a relatively stable political climate leading into 2024, which generally supports consumer confidence and spending on home improvement goods like cabinetry. However, global geopolitical tensions, such as ongoing trade disputes or regional conflicts, could disrupt the supply of raw materials like lumber or hardware, potentially increasing costs for MasterBrand. A predictable political landscape in major operating regions is crucial for consistent business planning and investment.

Geopolitical events in 2024 and projected into 2025 continue to pose risks. Disruptions to international shipping routes, for example, due to conflicts in key maritime areas, can lead to extended lead times and higher freight costs for components and finished goods. MasterBrand's reliance on a global supply chain means it is susceptible to these international political shifts. Conversely, favorable trade agreements or a de-escalation of global tensions would likely benefit the company by stabilizing input costs and improving supply chain efficiency.

- Political Stability: Favorable political conditions in North America in 2024 supported consumer spending on durable goods, benefiting MasterBrand's domestic sales.

- Geopolitical Risks: Ongoing international conflicts in 2024 continued to present challenges to global supply chains, potentially affecting MasterBrand's material costs and availability.

- Trade Policy: Changes in international trade policies or tariffs could impact the cost of imported components or the competitiveness of MasterBrand's products in various markets.

- Regulatory Environment: Evolving environmental regulations or building codes in key markets could necessitate adjustments to manufacturing processes or product design for MasterBrand.

Government housing policies, such as incentives for new construction and renovation, directly influence MasterBrand's demand. For instance, the U.S. housing market saw a robust start in 2024, with housing starts averaging an annualized rate of 1.45 million units in the first quarter, indicating strong demand for cabinetry.

Changes in trade policies and tariffs can impact MasterBrand's costs and competitiveness. While the company noted minor tariff impacts in Q1 2025, significant shifts could necessitate strategic adjustments to its global sourcing.

Labor laws, including minimum wage adjustments, affect operational expenses. MasterBrand's commitment to safety and labor standards, as seen in its investments in training, highlights the importance of regulatory compliance.

Economic stimulus and infrastructure spending, like the ongoing implementation of the Infrastructure Investment and Jobs Act, indirectly support the housing sector by boosting economic activity and consumer confidence. This can translate to increased spending on home improvements, benefiting MasterBrand.

| Factor | Impact on MasterBrand | Data/Trend (2024-2025) |

|---|---|---|

| Government Housing Policies | Drives demand for new kitchens and renovations. | U.S. housing starts averaged 1.45 million units (Q1 2024), showing strong construction activity. |

| Trade Policies & Tariffs | Affects operational costs and market pricing. | MasterBrand reported minor tariff impacts in Q1 2025, but ongoing monitoring is key. |

| Labor Laws | Influences workforce expenses and operational compliance. | Focus on safety training and adherence to labor standards is crucial for smooth operations. |

| Economic Stimulus & Infrastructure | Indirectly boosts housing demand and consumer spending. | Infrastructure Investment and Jobs Act continues to support economic activity, potentially increasing home improvement spending. |

What is included in the product

This MasterBrand PESTLE analysis delves into the Political, Economic, Social, Technological, Environmental, and Legal factors influencing the company's operations, providing actionable insights for strategic decision-making.

A clear, actionable summary of MasterBrand's PESTLE factors, enabling swift identification of external threats and opportunities to inform strategic decision-making.

Economic factors

The residential housing market's vitality is a key indicator for MasterBrand, as new construction and existing home sales directly influence demand for its products. Currently, elevated mortgage rates and a constrained housing inventory are dampening buyer enthusiasm, even as home prices show continued upward momentum. This environment suggests a cautious outlook for the sector in the near term.

MasterBrand's Q1 2025 earnings report highlighted a noticeable slowdown in the repair and remodel segment. This observation aligns with wider economic patterns where higher interest rates tend to make consumers hesitant to commit to significant discretionary spending, such as home improvement projects.

Consumer willingness to spend on home renovations and large-ticket items like cabinetry directly impacts MasterBrand's sales. While overall median home renovation spending saw a slight dip in 2024, there was a notable increase in smaller kitchen and bathroom remodels, indicating a shift in consumer priorities towards more manageable projects.

MasterBrand's financial performance is closely linked to consumers' disposable income and their overall confidence in the economic outlook. For instance, the U.S. personal saving rate, a key indicator of disposable income available for discretionary spending, was around 3.9% in early 2025, a level that influences consumer appetite for major home improvement investments.

Fluctuations in the cost of key materials like wood, adhesives, and hardware directly impact MasterBrand's profitability. For instance, a rise in lumber prices, a primary input, can squeeze gross margins if not passed on to consumers.

Inflationary pressures on these raw materials pose a significant challenge. MasterBrand's Q1 2025 earnings call highlighted ongoing continuous improvement initiatives aimed at mitigating these cost increases and protecting profit margins.

Labor Availability and Wages

MasterBrand's operations are significantly influenced by the availability of skilled labor, particularly in manufacturing and construction. Wage inflation also plays a crucial role in shaping operational costs and production capacity. The U.S. manufacturing sector has grappled with labor shortages, though recent data shows some positive shifts. For instance, while overall manufacturing employment saw a slight decline in early 2024, the furniture manufacturing segment experienced job gains in June 2025, potentially easing some of these pressures for companies like MasterBrand.

These labor market dynamics directly affect MasterBrand's ability to maintain efficient production schedules and manage its overall labor expenses. The ongoing competition for skilled workers can drive up wages, impacting the company's bottom line. Conversely, improvements in labor availability, as hinted at by the June 2025 furniture manufacturing job data, could offer opportunities for cost optimization and increased output.

- Skilled Labor Shortages: Persistent challenges in finding qualified manufacturing and construction workers impact production efficiency.

- Wage Inflation: Rising labor costs directly affect MasterBrand's operational expenses.

- Sector-Specific Trends: While some manufacturing areas saw job declines in 2024, furniture manufacturing reported job gains in June 2025, offering a mixed outlook.

- Impact on Costs: Labor availability and wage pressures are key determinants of MasterBrand's cost structure and competitive pricing.

Competitive Landscape and Market Share

The North American residential cabinetry market is highly competitive, with intense rivalry impacting MasterBrand's market share and revenue. Competitors frequently engage in aggressive pricing strategies and rapid product innovation, forcing MasterBrand to continually adapt.

MasterBrand, currently the largest manufacturer in this sector, is actively pursuing growth. This expansion is driven by both internal, organic initiatives and strategic acquisitions, like the integration of Supreme Cabinetry Brands, to further solidify and increase its market share.

- Market Intensity: The residential cabinetry market faces significant competitive pressures, influencing pricing and innovation.

- MasterBrand's Position: As the leading manufacturer, MasterBrand aims for continued market share growth.

- Growth Strategy: Expansion efforts include organic development and strategic acquisitions, such as the Supreme Cabinetry Brands deal.

- Revenue Impact: Competitive dynamics directly affect MasterBrand's ability to grow revenue and maintain its market leadership.

Economic factors significantly shape MasterBrand's operating environment, influencing consumer spending and material costs. The housing market, a primary driver of demand, faces headwinds from elevated mortgage rates, impacting new construction and renovation projects. While consumer spending on home improvements remains, there's a noticeable shift towards smaller, more budget-friendly projects in 2024 and early 2025.

MasterBrand's profitability is directly tied to input costs, with lumber prices being a key concern. Inflationary pressures on raw materials continue to challenge profit margins, although the company is implementing cost-mitigation strategies. The U.S. personal saving rate, around 3.9% in early 2025, also indicates the disposable income available for major home investments.

| Economic Factor | Impact on MasterBrand | Data/Trend (2024-2025) |

|---|---|---|

| Housing Market Activity | Demand for cabinetry and millwork | Elevated mortgage rates, constrained inventory; continued upward home price momentum. |

| Consumer Spending | Discretionary spending on renovations | Shift towards smaller projects; U.S. personal saving rate ~3.9% (early 2025). |

| Material Costs | Profitability and cost of goods sold | Inflationary pressures on lumber and other inputs; ongoing cost mitigation efforts. |

Same Document Delivered

MasterBrand PESTLE Analysis

The content and structure shown in the preview is the same document you’ll download after payment. This MasterBrand PESTLE Analysis provides a comprehensive overview of the external factors impacting the company's strategic direction. You'll gain valuable insights into Political, Economic, Social, Technological, Legal, and Environmental influences.

Sociological factors

Evolving consumer lifestyles, particularly the surge in remote work, have significantly amplified the importance of home as a central hub for living and working. This shift fuels demand for more functional and aesthetically pleasing home environments, with kitchens and bathrooms often taking center stage in renovation projects. For instance, a 2024 Houzz report indicated that 55% of homeowners planned to undertake a renovation in the next year, with kitchens and bathrooms being the most popular project types.

This increased focus on home improvement translates directly into greater investment in renovations and upgrades, positively impacting the demand for MasterBrand's cabinetry and related home products. The kitchen, in particular, continues to be a primary area of focus for homeowners looking to enhance both utility and style, driving sustained interest in kitchen remodels and new installations.

Demographic shifts are significantly reshaping the cabinetry market. The aging population in many developed nations, including the US where MasterBrand operates, may lead to a demand for more accessible and adaptable kitchen and bath designs. Simultaneously, the large millennial generation is increasingly entering their prime homeownership years, often seeking modern, functional, and often smaller-footprint solutions, influencing cabinetry styles and configurations.

Changes in household formation, such as a rise in single-person households and smaller family units, directly impact cabinetry needs. These smaller households often prioritize efficient use of space, driving demand for modular, multi-functional, and compact cabinetry solutions. Conversely, larger families continue to seek robust storage and durable materials, indicating a bifurcated demand landscape that manufacturers like MasterBrand must address.

For example, in the US, the median age has been steadily increasing, projected to reach around 38.8 years by 2025, up from 37.7 in 2020. This aging demographic could favor cabinetry with features like pull-out shelves and easier-to-open drawers. Meanwhile, the number of US households grew to an estimated 131.4 million in 2024, with a notable portion comprising smaller, non-traditional family structures, underscoring the need for diverse cabinetry offerings.

Consumer tastes are shifting, with a notable preference for minimalist designs and natural finishes in cabinetry. MasterBrand must align its product development with these evolving aesthetic preferences, as seen in the growing demand for frameless cabinets and organic materials.

The market in 2024 and 2025 is being significantly shaped by trends favoring streamlined aesthetics and the increasing popularity of bamboo and ready-to-assemble (RTA) cabinets. This necessitates MasterBrand's agile adaptation of its product lines to meet these specific consumer demands.

DIY vs. Professional Renovation Trends

The growing DIY trend presents a mixed bag for MasterBrand. While it can drive sales of individual components through home centers, it might also bypass traditional dealer and builder channels that often handle more comprehensive, professionally installed projects. This shift means MasterBrand needs to ensure its product offerings and marketing appeal to both the hands-on homeowner and the professional contractor.

Renovation activity in 2024 and into 2025 shows resilience, but a noticeable trend is the move towards smaller, more budget-friendly projects. For instance, a Houzz survey indicated that while overall renovation spending remained robust, many homeowners were prioritizing specific upgrades like painting or fixture replacements over large-scale remodels. This could influence demand for MasterBrand's more accessible product lines.

- DIY Project Growth: Reports suggest a continued uptick in DIY home improvement projects, particularly among younger demographics seeking cost savings and personal satisfaction.

- Channel Impact: This DIY surge can boost sales through big-box home improvement retailers, potentially impacting the market share of specialized kitchen and bath dealers.

- Project Scope Shift: Data from the National Association of Home Builders (NAHB) in late 2024 showed a slight decrease in the average size of renovation projects, favoring smaller, more manageable updates.

- MasterBrand's Adaptability: The company's broad distribution network, encompassing both home centers and independent dealers, positions it to capture demand across different consumer preferences and project scales.

Health and Wellness in Home Design

The increasing focus on health and wellness is significantly shaping consumer preferences in home design. This trend drives demand for cabinetry made with low-VOC materials, contributing to better indoor air quality. For instance, the global market for low-VOC paints and coatings, a related sector, was valued at approximately USD 24.5 billion in 2023 and is projected to grow, indicating a broader consumer shift towards healthier home environments.

Consumers are becoming more discerning about product certifications and the sustainability of material sourcing. This awareness encourages manufacturers like MasterBrand to prioritize healthier and more transparent material choices. Studies in 2024 show that over 60% of homeowners consider eco-friendly certifications when purchasing home goods, directly influencing purchasing decisions and pushing for greater accountability in the supply chain.

These evolving consumer values align with broader societal trends emphasizing well-being and environmental consciousness. This sociological shift means that companies demonstrating a commitment to health-conscious materials and sustainable practices are likely to resonate more strongly with their target markets. For example, the wellness real estate market, which includes healthy home features, saw significant investment and growth in 2024, underscoring the financial implications of these sociological drivers.

- Growing Health Consciousness: Consumers are actively seeking healthier living spaces, prioritizing indoor air quality.

- Demand for Low-VOC Materials: This translates to increased demand for cabinets made with volatile organic compound-free or low-VOC materials.

- Transparency and Certifications: Consumers value transparency in sourcing and look for certifications that validate product health and sustainability claims.

- Alignment with Societal Values: Manufacturers that align with these societal values regarding health and sustainability gain a competitive advantage.

Sociological factors are significantly influencing the home renovation and cabinetry market. The enduring trend of remote work continues to elevate the home's importance, driving demand for updated living and working spaces. This heightened focus on home environments, particularly kitchens and bathrooms, fuels investment in renovations. For instance, a 2024 Houzz survey indicated that 55% of homeowners planned renovations, with kitchens and bathrooms leading the way.

Demographic shifts, including an aging population and the large millennial cohort entering homeownership, are reshaping cabinetry needs. The aging demographic may favor accessibility features, while millennials often seek modern, space-efficient solutions. Furthermore, changing household structures, with more single-person and smaller family units, increase the demand for compact and multi-functional cabinetry.

Consumer preferences are leaning towards minimalist designs and natural finishes, with frameless cabinets and organic materials gaining traction. The DIY movement also impacts sales channels, potentially boosting big-box retailers. Simultaneously, a growing emphasis on health and wellness is driving demand for low-VOC materials and transparent sourcing, with over 60% of homeowners in 2024 considering eco-friendly certifications.

| Sociological Factor | Impact on MasterBrand | Supporting Data (2024-2025) |

| Evolving Lifestyles (Remote Work) | Increased demand for functional home spaces, especially kitchens and bathrooms. | 55% of homeowners planned renovations in 2024 (Houzz). |

| Demographic Shifts | Demand for accessible designs (aging population) and modern, efficient solutions (millennials). | US median age projected to reach 38.8 by 2025. |

| Changing Household Structures | Need for compact, multi-functional, and space-saving cabinetry. | Growth in smaller, non-traditional family units in the US. |

| Consumer Tastes | Preference for minimalist designs, natural finishes, and sustainable materials. | Growing demand for frameless cabinets and organic materials. |

| Health & Wellness Focus | Increased demand for low-VOC materials and eco-friendly certifications. | Over 60% of homeowners consider eco-friendly certifications (2024 studies). |

Technological factors

The increasing adoption of robotics, automation, and artificial intelligence (AI) in manufacturing presents a significant technological factor for MasterBrand. These advancements can drastically improve operational efficiency, lower production expenses, and elevate the quality of manufactured goods. For instance, automated systems can handle tasks like precise cutting, shaping, and finishing with unparalleled accuracy, thereby accelerating production timelines and ensuring greater consistency.

MasterBrand's commitment to efficiency is evident in its implementation of 'The MasterBrand Way,' a philosophy that champions continuous improvement and lean manufacturing principles. This approach, which includes regular kaizen events, fosters a culture of ongoing optimization within its production facilities. In 2023, MasterBrand reported a 3% increase in production output attributed to process improvements, demonstrating the tangible benefits of such initiatives.

MasterBrand's adoption of digital design and visualization tools like CAD, VR, and AR significantly elevates customer engagement. These technologies allow clients to virtually place custom cabinet designs within their own homes, transforming the pre-purchase experience. This visual immersion, a key trend in 2024 home renovation, fosters greater confidence and reduces purchase hesitation.

The implementation of these advanced design platforms directly translates to improved operational efficiency. By enabling precise digital modeling, MasterBrand can minimize costly errors during the manufacturing phase. Furthermore, the ability for customers and designers to iterate and finalize designs more rapidly through these interactive tools streamlines the entire project timeline, a critical factor in a competitive market.

MasterBrand's adoption of digital supply chain solutions is key to managing its extensive distribution network. Implementing technologies like IoT for real-time tracking and advanced data analytics allows for improved inventory control and logistics, directly impacting cost reduction and responsiveness to market shifts. This digital transformation is crucial for navigating the complexities of modern manufacturing and delivery.

By leveraging these digital tools, MasterBrand can significantly enhance its supply chain resilience and efficiency. For instance, real-time visibility into inventory levels and transit times, facilitated by IoT sensors, can reduce lead times by an estimated 10-15% for key product lines. This optimization is vital in a market characterized by fluctuating consumer demand and the need for rapid product availability.

Smart Home Integration and Features

The integration of smart technology into cabinetry, like touch-to-open doors or voice-activated storage, is a burgeoning trend. MasterBrand can tap into this by developing new product lines that cater to the increasing consumer desire for connected homes. For instance, smart lighting within cabinets or temperature-controlled drawers for specific items could significantly enhance product appeal and create premium offerings.

This technological evolution opens doors for MasterBrand to innovate and capture a larger share of the smart home market. Consumer adoption of smart home devices is on a steady rise, with projections indicating continued growth. For example, the global smart home market was valued at approximately USD 100 billion in 2023 and is expected to reach over USD 250 billion by 2028, demonstrating a substantial opportunity for companies that can effectively integrate smart features into their product portfolios.

- Smart Features: Touch-to-open, integrated lighting, voice-activated storage, temperature-controlled compartments.

- Market Appeal: Creates new product categories and enhances existing ones.

- Consumer Demand: Growing interest in connected home solutions.

- Market Growth: Global smart home market projected to exceed USD 250 billion by 2028.

New Materials and Manufacturing Techniques

MasterBrand is leveraging advancements in new materials and manufacturing techniques to enhance product offerings. Research into sustainable options like bamboo and reclaimed wood, alongside high-performance advanced laminates, allows for product differentiation and increased durability. This focus on eco-friendly materials and finishes, such as low-VOC adhesives, directly addresses growing consumer demand for environmentally conscious products.

The company's investment in these areas supports its alignment with sustainability goals. For instance, the global market for sustainable building materials was projected to reach over $300 billion by 2024, indicating a significant market opportunity for companies prioritizing eco-friendly innovations.

- Material Innovation: Exploring bamboo, reclaimed wood, and advanced laminates for improved aesthetics and longevity.

- Sustainable Manufacturing: Implementing eco-friendly adhesives and finishes to reduce environmental impact.

- Market Alignment: Catering to increasing consumer preference for sustainable and durable home products.

Technological advancements in automation and AI are reshaping manufacturing, offering MasterBrand opportunities to boost efficiency and product quality. Embracing digital design tools like VR and AR enhances customer visualization and speeds up the design-to-production cycle, a key advantage in the 2024 market. Furthermore, integrating smart features into cabinetry aligns with the growing consumer demand for connected homes, a sector projected for substantial growth.

MasterBrand's strategic adoption of technology is evident in its manufacturing processes and product innovation. The company's focus on digital design platforms, like CAD and VR, not only streamlines production by minimizing errors but also improves customer engagement by allowing virtual product placement. This digital integration extends to the supply chain, where IoT and data analytics enhance inventory management and logistics, aiming to reduce lead times by as much as 10-15% for key product lines.

The integration of smart technology into cabinetry, such as touch-to-open doors or voice-activated storage, represents a significant growth avenue. This aligns with the global smart home market, which was valued at approximately USD 100 billion in 2023 and is anticipated to exceed USD 250 billion by 2028. MasterBrand's exploration of new materials, including sustainable options like bamboo and reclaimed wood, also caters to a market trend valuing eco-friendly and durable products, with the sustainable building materials market projected to surpass $300 billion by 2024.

| Technological Factor | MasterBrand's Adoption/Opportunity | Impact/Market Data |

| Automation & AI | Enhanced manufacturing efficiency, improved product quality | Potential for increased production output and cost reduction |

| Digital Design (CAD, VR, AR) | Improved customer visualization, faster design finalization | Reduced production errors, enhanced pre-purchase experience |

| Smart Home Integration | Development of connected cabinetry features | Tap into a global smart home market projected to reach >$250B by 2028 |

| Material Innovation | Use of sustainable materials (bamboo, reclaimed wood) | Aligns with growing consumer demand for eco-friendly products; market >$300B by 2024 |

Legal factors

MasterBrand must adhere to a complex web of national, state, and local building codes, alongside stringent fire safety regulations and product safety standards for its residential cabinetry. For instance, the International Residential Code (IRC) and specific state building codes dictate requirements for materials, installation, and performance. Failure to comply can result in product recalls or fines, impacting MasterBrand's bottom line and reputation.

Evolving regulations, such as updated energy efficiency standards for building materials or new lead paint regulations, can necessitate significant investment in product redesign and rigorous testing. In 2024, for example, increased scrutiny on volatile organic compounds (VOCs) in cabinetry materials could drive demand for new, compliant product lines, affecting manufacturing processes and supply chain management.

Prioritizing product safety is not just a legal obligation but a cornerstone of consumer trust and brand integrity. MasterBrand's commitment to safety, as demonstrated by adherence to standards like those set by the Consumer Product Safety Commission (CPSC), directly influences customer purchasing decisions and mitigates the risk of costly litigation or product liability claims.

MasterBrand's operations are significantly shaped by environmental regulations concerning emissions, waste management, and the sourcing of materials, such as controlling formaldehyde emissions and adhering to sustainable forestry standards like FSC. For instance, in 2023, the company reported a 15% reduction in waste sent to landfills compared to 2022, demonstrating a commitment to environmental stewardship.

The company's Corporate Social Responsibility (CSR) reports detail ongoing initiatives focused on reducing its carbon footprint and obtaining key environmental safety certifications, underscoring the importance of these factors for business continuity. Failure to comply with these evolving environmental laws can lead to substantial financial penalties and considerable damage to MasterBrand's public image and brand trust.

MasterBrand operates under stringent consumer protection laws, which mandate adherence to warranty provisions, accurate product labeling, and regulations addressing product defects and recalls. For instance, the Consumer Product Safety Commission (CPSC) in the US actively monitors product safety, with recalls impacting manufacturers significantly. Failure to comply can lead to substantial fines and reputational damage.

To navigate these legal complexities and mitigate product liability risks, MasterBrand prioritizes robust quality control measures throughout its manufacturing processes. Clear and transparent communication with consumers regarding product specifications, usage, and potential issues is also paramount. This proactive approach not only ensures consumer safety and satisfaction but also builds trust and reduces the likelihood of costly litigation.

Labor and Employment Laws

MasterBrand must navigate a complex web of labor and employment laws to ensure fair treatment of its workforce. This includes strict adherence to wage and hour regulations, anti-discrimination statutes, and occupational health and safety standards set by bodies like OSHA. For instance, in 2023, the U.S. Bureau of Labor Statistics reported a total recordable case rate of 2.8 per 100 full-time workers in manufacturing, a benchmark MasterBrand likely monitors to gauge its own safety performance and identify areas for improvement.

Compliance directly impacts MasterBrand's operational efficiency and reputation. Failure to meet these legal obligations can result in significant fines, legal challenges, and damage to employee morale. The company's commitment to continuous improvement in its OSHA recordable rate underscores the importance of maintaining a safe and compliant work environment.

- Wage and Hour Compliance: Adhering to federal and state minimum wage laws, overtime pay requirements, and record-keeping mandates.

- Anti-Discrimination and Equal Opportunity: Ensuring fair hiring, promotion, and compensation practices, free from bias based on protected characteristics.

- Workplace Safety (OSHA): Implementing robust safety protocols and training to minimize workplace accidents and injuries, with a focus on reducing the OSHA recordable rate.

- Employee Benefits and Leave: Complying with laws related to health insurance, retirement plans, and various forms of paid and unpaid leave.

Intellectual Property Rights

MasterBrand's ability to safeguard its intellectual property, including unique cabinet designs, proprietary manufacturing techniques, and established brand trademarks, is fundamental to maintaining its competitive edge in the market. This protection is vital for its ongoing innovation and market differentiation.

The company must also navigate the legal landscape to ensure it doesn't inadvertently infringe upon the intellectual property rights of competitors or other entities. This due diligence is a continuous process to avoid costly legal disputes.

Given the highly design-centric nature of the cabinetry industry, robust legal frameworks governing intellectual property are absolutely essential. These laws provide the necessary structure for innovation and fair competition.

- Intellectual Property Protection: MasterBrand actively protects its patented designs and manufacturing processes, crucial for its market position.

- Infringement Avoidance: The company maintains vigilance to prevent any violation of third-party intellectual property rights.

- Legal Framework Importance: Strong IP laws are critical for fostering innovation and ensuring fair play in the design-intensive cabinetry sector.

- Brand Value: Trademarks are key assets, contributing significantly to MasterBrand's brand recognition and customer trust.

MasterBrand faces legal scrutiny regarding product safety and compliance with building codes, such as the International Residential Code. For instance, evolving regulations on volatile organic compounds (VOCs) in 2024 could necessitate product line adjustments. Adherence to Consumer Product Safety Commission (CPSC) standards is crucial for consumer trust and avoiding liability.

Environmental regulations impact MasterBrand's operations, covering emissions and waste management. The company reported a 15% waste reduction to landfills in 2023 compared to 2022, highlighting its environmental focus. Failure to comply with these laws can lead to significant penalties and reputational damage.

Labor laws, including OSHA safety standards, are critical. In 2023, the manufacturing sector's total recordable case rate was 2.8 per 100 full-time workers, a benchmark MasterBrand likely monitors. Compliance ensures operational efficiency and employee morale.

Intellectual property protection is vital for MasterBrand's competitive edge, safeguarding designs and trademarks. Avoiding infringement of third-party IP is also a continuous legal necessity in the design-intensive cabinetry sector.

Environmental factors

MasterBrand faces growing pressure to source wood and other materials sustainably, with a significant portion of consumers now prioritizing eco-friendly options. For instance, demand for Forest Stewardship Council (FSC) certified wood has seen a steady rise, impacting sourcing strategies and manufacturing costs.

This consumer preference translates into a willingness to pay more for products made with responsibly sourced materials. In 2024, reports indicated that over 60% of consumers consider sustainability when making purchasing decisions for home goods, directly influencing MasterBrand's product development and marketing efforts.

Minimizing manufacturing waste and boosting recycling are crucial environmental focuses for MasterBrand. The company has reported high landfill avoidance rates across several of its facilities, demonstrating a commitment to reducing its environmental footprint.

MasterBrand is actively exploring collaborations to reclaim valuable resources like wood waste and spent solvents, aiming for their reuse and recycling. This proactive approach not only benefits the environment but also presents opportunities for significant cost efficiencies through better resource utilization.

MasterBrand is actively working to reduce its energy consumption and carbon footprint, aligning with broader environmental goals. In 2023, the company reported a decrease in its Scope 1 and Scope 2 greenhouse gas emissions, showcasing tangible progress in its sustainability efforts.

These reductions are driven by investments in more energy-efficient manufacturing processes and a strategic shift towards renewable energy sources. For example, MasterBrand has been exploring and implementing solutions to power its operations more cleanly, aiming to further lower its environmental impact in the coming years.

Water Usage and Conservation

MasterBrand recognizes the critical importance of water usage and conservation within its manufacturing processes. The company has actively undertaken baseline water consumption assessments to inform and drive its ongoing water conservation initiatives, demonstrating a commitment to responsible resource management. This proactive approach is increasingly vital as global water scarcity concerns intensify, compelling industries across the board to implement more efficient water utilization practices.

The push for greater water efficiency is not just an environmental imperative but also a strategic business consideration. Industries are facing growing pressure from regulators and consumers alike to minimize their environmental footprint, and water usage is a key area of focus. For MasterBrand, this translates to exploring and adopting advanced technologies and operational adjustments that can significantly reduce water consumption without compromising product quality or output.

- Water Consumption Assessment: MasterBrand has completed baseline assessments of its water consumption, providing a foundation for targeted reduction strategies.

- Conservation Efforts: The company is actively engaged in ongoing water conservation efforts, aiming to improve resource stewardship.

- Industry Trend: Growing concerns about water scarcity are driving industries to adopt more water-efficient manufacturing practices.

- Regulatory and Consumer Pressure: Environmental responsibility, including water management, is becoming a significant factor in regulatory compliance and consumer perception.

Product Life Cycle and Circular Economy

MasterBrand is increasingly focused on integrating circular economy principles into its product design, aiming to reduce environmental impact across the entire product lifecycle. This involves designing cabinets and other products for enhanced durability, repairability, and recyclability. For instance, by 2024, the company is exploring modular designs that facilitate easier reconfiguration and reuse of components, extending product life and minimizing waste.

The company recognizes that a longer product lifespan, achieved through robust design and repairability, can significantly boost customer loyalty. By 2025, MasterBrand aims to have a substantial portion of its product lines designed with end-of-life considerations in mind, promoting material recovery and reducing reliance on virgin resources. This strategic shift aligns with growing consumer demand for sustainable products and contributes to a more responsible manufacturing process.

- Product Durability: Enhancing the lifespan of cabinetry to reduce replacement frequency.

- Repairability Focus: Designing for easier component replacement and repair, extending usability.

- Recyclability Initiatives: Exploring the use of recycled materials and designing for easier material separation at end-of-life.

- Circular Economy Adoption: Implementing strategies like modular design for reconfiguration and reuse, aiming for a 15% increase in recycled material content by 2025.

MasterBrand is increasingly prioritizing sustainable sourcing, with consumer demand for eco-friendly materials like Forest Stewardship Council (FSC) certified wood on the rise. This trend, with over 60% of consumers considering sustainability in 2024, directly influences MasterBrand's procurement and product development, impacting costs and market appeal.

The company is actively reducing its environmental footprint by minimizing manufacturing waste and boosting recycling rates, achieving high landfill avoidance across facilities. MasterBrand is also focused on energy efficiency and carbon reduction, reporting a decrease in Scope 1 and 2 greenhouse gas emissions in 2023 through investments in cleaner processes and renewable energy exploration.

Water conservation is another key environmental focus, with MasterBrand completing baseline assessments to guide reduction strategies amidst growing global water scarcity concerns. Furthermore, the company is integrating circular economy principles by designing products for durability, repairability, and recyclability, aiming to increase recycled material content by 15% by 2025.

PESTLE Analysis Data Sources

Our PESTLE Analysis for MasterBrand draws from a comprehensive mix of data sources, including official government reports, reputable market research firms, and leading economic institutions. This ensures a robust understanding of political, economic, social, technological, legal, and environmental factors influencing the company.