MasterBrand Porter's Five Forces Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

MasterBrand Bundle

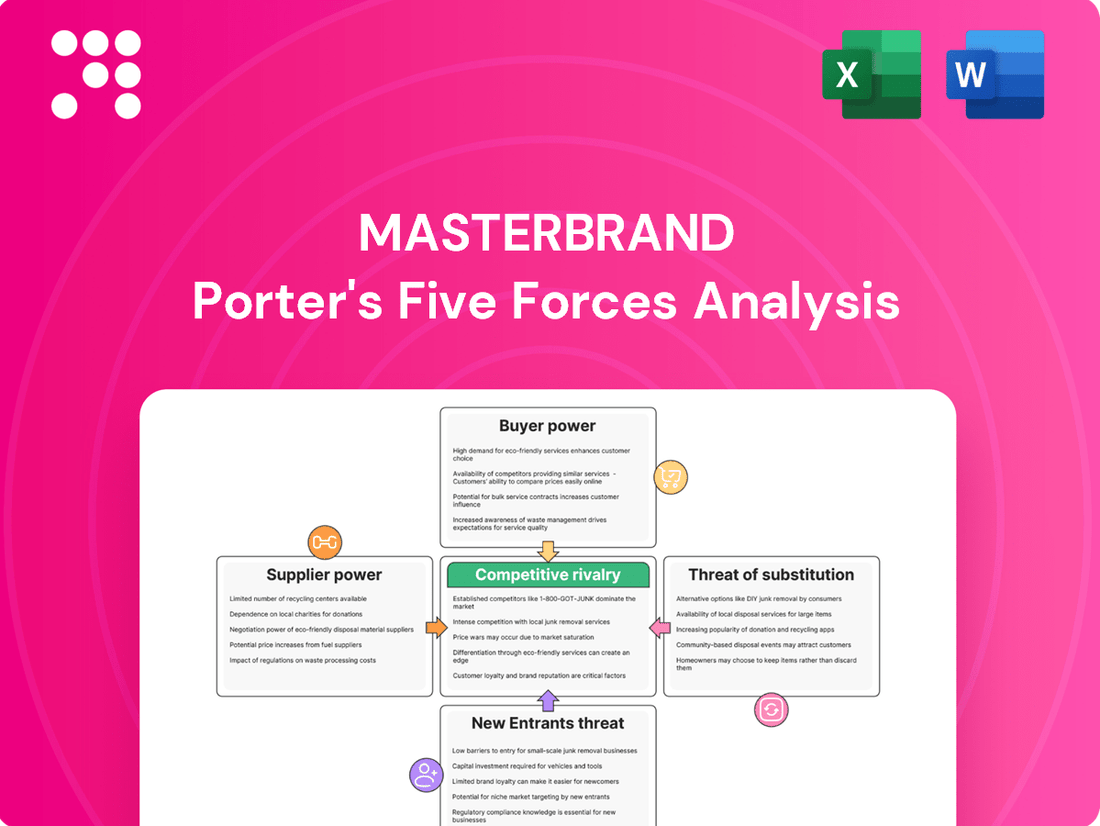

MasterBrand's competitive landscape is shaped by the interplay of five key forces, revealing significant pressures from rivals and the constant threat of new entrants. Understanding the bargaining power of both buyers and suppliers, alongside the availability of substitutes, is crucial to grasping MasterBrand's strategic positioning.

The complete report reveals the real forces shaping MasterBrand’s industry—from supplier influence to threat of new entrants. Gain actionable insights to drive smarter decision-making.

Suppliers Bargaining Power

The concentration of suppliers for MasterBrand's essential raw materials, such as lumber, hardware, and finishes, directly impacts their bargaining power. A limited number of providers for crucial components can lead to increased pricing and stricter contract terms for MasterBrand.

For instance, if MasterBrand heavily depends on specific hardwood varieties or unique hardware components, the suppliers of these items gain significant leverage. This reliance can translate into higher input costs, potentially affecting MasterBrand's profitability and pricing strategies.

The availability of substitutes for key inputs significantly influences the bargaining power of MasterBrand's suppliers. If MasterBrand can easily switch between different types of lumber, hardware, or finishing products, its leverage in negotiations increases. For instance, the widespread availability of various wood species or composite materials can dilute the power of any single lumber supplier.

In 2024, the construction and home improvement sectors experienced fluctuations in lumber prices, with some reports indicating price increases of up to 15% in early 2024 compared to the previous year, driven by demand and supply chain issues. However, the growing adoption of engineered wood products and alternative materials like bamboo or recycled plastics offers MasterBrand more options, thereby mitigating the impact of traditional lumber supplier price hikes.

Conversely, if MasterBrand relies on highly specialized or proprietary inputs that are difficult to substitute, those suppliers gain considerable control. For example, a unique, patented finishing technology or a specific type of high-performance hardware could give the supplier significant pricing power, as MasterBrand would face higher switching costs and potential production disruptions.

Suppliers providing highly specialized inputs, like patented components or unique material treatments, wield significant bargaining power. If MasterBrand relies heavily on such inputs, for example, a specific type of high-performance laminate or a proprietary cabinet hinge system, its ability to switch suppliers becomes costly and complex.

This reliance on differentiated inputs can directly impact MasterBrand's product differentiation and increase its switching costs. In 2024, the global cabinetry market saw continued demand for customized and premium finishes, suggesting that suppliers offering these unique elements could command higher prices, thereby limiting MasterBrand’s negotiation leverage.

Impact of Input Costs on MasterBrand's Profitability

Fluctuations in lumber prices, a key input for MasterBrand, directly affect production costs and profitability. For instance, in Q1 2024, lumber prices saw significant volatility, impacting the cost of goods sold for cabinet manufacturers.

Suppliers can leverage periods of high demand or supply chain disruptions to pass on increased costs. This bargaining power means MasterBrand must carefully manage its supplier relationships and inventory to mitigate the impact of rising input prices.

- Lumber Price Volatility: Lumber prices can fluctuate significantly, impacting MasterBrand's cost of goods sold.

- Supplier Leverage: Suppliers can exert power by increasing prices, especially during periods of high demand or supply chain issues.

- Cost Absorption vs. Passing On: MasterBrand's ability to absorb or pass these increased costs to consumers is crucial for maintaining profit margins.

- Q1 2024 Impact: Early 2024 saw notable lumber price swings, directly affecting the profitability of companies like MasterBrand in the building materials sector.

Threat of Forward Integration by Suppliers

The threat of suppliers integrating forward into cabinet manufacturing themselves significantly amplifies their bargaining power. If suppliers can credibly threaten to enter the cabinet market, they can exert more pressure on pricing and terms.

For MasterBrand, this threat is generally considered low within the residential cabinet sector. The industry demands substantial capital investment for manufacturing facilities and requires well-established distribution networks, creating high barriers to entry for potential new players, including suppliers.

However, a nuanced view is necessary. Large, diversified material suppliers possessing significant financial resources and existing market reach might explore selective forward integration. This could involve acquiring smaller cabinet manufacturers or establishing their own production lines for specific product segments.

- Supplier Forward Integration Threat: Increases supplier bargaining power if credible.

- Industry Barriers: High capital and distribution needs generally limit this threat in residential cabinets.

- Potential Integrators: Large, diversified material suppliers may consider selective integration.

- MasterBrand's Position: The company benefits from the current high barriers to supplier entry.

MasterBrand's suppliers, particularly those providing lumber and specialized components, hold considerable bargaining power. This is amplified by the concentration of suppliers for essential raw materials and the potential for these suppliers to integrate forward into manufacturing. In 2024, fluctuating lumber prices, with some reports indicating up to a 15% increase in early 2024 compared to the prior year, underscored this leverage.

The availability of substitutes for key inputs, such as engineered wood products or alternative materials, helps MasterBrand mitigate supplier power. However, reliance on highly specialized or proprietary inputs, like unique finishes or patented hardware, significantly increases supplier leverage and switching costs for MasterBrand, a trend observed in the premium cabinetry market during 2024.

| Factor | Impact on MasterBrand | 2024 Data/Observation |

|---|---|---|

| Supplier Concentration | Increases bargaining power for key raw materials. | Limited number of providers for lumber and specialized hardware. |

| Availability of Substitutes | Decreases supplier bargaining power. | Growing adoption of engineered wood and alternative materials. |

| Input Differentiation | Increases supplier bargaining power due to high switching costs. | Demand for unique finishes and proprietary components in 2024 cabinetry market. |

| Lumber Price Volatility | Directly impacts production costs and profitability. | Reported price increases of up to 15% in early 2024. |

| Supplier Forward Integration | Potential threat, though generally low due to industry barriers. | Large suppliers may consider selective integration into specific product segments. |

What is included in the product

This analysis unpacks the competitive forces impacting MasterBrand, evaluating supplier and buyer power, the threat of new entrants and substitutes, and the intensity of rivalry within the cabinetry industry.

Effortlessly identify and neutralize competitive threats by visualizing the intensity of each of Porter's Five Forces, allowing for proactive strategic adjustments.

Customers Bargaining Power

MasterBrand's reliance on major home centers like Lowe's and Home Depot significantly amplifies customer bargaining power. These giants, accounting for substantial sales volumes, can leverage their scale to negotiate lower prices and more favorable terms, impacting MasterBrand's margins. For instance, in 2024, the top two home improvement retailers in the U.S. generated hundreds of billions in revenue, giving them immense leverage.

MasterBrand operates in a residential cabinet market where customer price sensitivity is a significant factor, especially for stock and semi-custom products. During economic slowdowns, this sensitivity intensifies as homeowners and builders alike scrutinize expenditures, leading them to prioritize cost-effectiveness.

Buyers, whether they are individual consumers or contractors, can readily compare pricing across various manufacturers and retailers. This transparency in the market grants them considerable leverage, compelling MasterBrand to remain highly competitive on its pricing strategies to capture and retain market share.

In 2023, the U.S. housing market saw a slowdown in new home construction starts, which directly impacts cabinet demand. For instance, housing starts declined from over 1.5 million units in early 2023 to closer to 1.3 million by year-end, indicating a more cautious consumer and builder environment where price becomes a more critical decision-making factor.

The sheer abundance of cabinet choices significantly bolsters customer bargaining power. Consumers can easily find alternatives from other large manufacturers, nimble custom cabinet makers, or even cost-effective imported options. This wide array of substitutes means customers face minimal switching costs, allowing them to readily shift to a competitor if MasterBrand's pricing or offerings aren't satisfactory.

In 2023, the kitchen and bath cabinet market saw robust activity, with U.S. shipments reaching an estimated $12.7 billion, indicating a competitive landscape where customer choice is paramount. Companies like MasterBrand must actively focus on product innovation, superior customer service, and unique design elements to create loyalty and mitigate the inherent power of a well-informed consumer with many alternatives.

Customer's Information Asymmetry

In today's digital age, customers wield significant power due to readily available information. Online platforms offer extensive product details, user reviews, and price comparisons, effectively leveling the playing field and reducing information asymmetry. This transparency allows consumers to make more informed choices and negotiate better terms.

For MasterBrand, this means that brand reputation and consistent product quality are paramount. Customers can easily research alternatives and hold brands accountable. For instance, in 2024, the average consumer spends over 10 hours researching a major purchase online, highlighting the impact of accessible data.

- Reduced Information Gap: Online resources empower customers with data on product features, pricing, and competitor offerings, diminishing the advantage previously held by manufacturers.

- Informed Negotiation: Access to pricing benchmarks and customer feedback enables buyers to negotiate more effectively, pushing for better value.

- Brand Differentiation is Key: MasterBrand must leverage its established reputation and commitment to quality to stand out in a market where transparency empowers consumer choice.

- Impact of Online Reviews: A significant percentage of consumers, reportedly over 90% in recent surveys, rely on online reviews before making a purchase, directly influencing their perception and bargaining power.

Threat of Backward Integration by Customers

The threat of backward integration by customers, particularly large home centers and distributors, poses a challenge to cabinet manufacturers like MasterBrand. While direct backward integration into manufacturing is a significant capital investment, these powerful buyers can exert pressure through other means.

A more tangible threat involves private-labeling programs, where retailers develop their own brands of cabinets, often sourced from lower-cost international manufacturers. This directly competes with established brands and can erode market share. For instance, in 2024, the private-label segment in the home improvement retail sector continued to grow, capturing an increasing share of consumer spending.

- Private-labeling: Retailers can develop their own cabinet brands, bypassing traditional manufacturers.

- International Sourcing: Large distributors can leverage global supply chains to find cheaper alternatives.

- Capital Intensity: Direct backward integration into manufacturing requires substantial investment, making it less common for retailers.

- Market Power: Major retailers possess significant bargaining power due to their sales volume.

MasterBrand faces considerable customer bargaining power due to the concentration of its retail partners, like Lowe's and Home Depot, which represent significant sales volumes. These large buyers can negotiate favorable pricing and terms, directly impacting MasterBrand's profitability. In 2024, the top two U.S. home improvement retailers collectively generated hundreds of billions in revenue, underscoring their substantial leverage.

The cabinet market's price sensitivity, especially for stock and semi-custom options, empowers consumers. During economic downturns, this sensitivity increases, pushing buyers to seek cost-effective solutions. In 2023, U.S. housing starts declined, signaling a more price-conscious environment where consumers and builders prioritize value, influencing cabinet purchasing decisions.

Customers benefit from market transparency, easily comparing prices and options from numerous manufacturers. This accessibility allows them to exert pressure on MasterBrand to maintain competitive pricing. The sheer volume of available cabinet choices, from large manufacturers to custom makers and imported goods, means customers face low switching costs, readily opting for alternatives if MasterBrand’s offerings are not satisfactory.

The digital age further amplifies customer power, with readily available online information, reviews, and price comparisons. This transparency empowers consumers to make informed decisions and negotiate better terms. For MasterBrand, maintaining brand reputation and product quality is crucial, as customers can easily research and compare alternatives. In 2024, consumers typically spend over 10 hours researching major purchases online, highlighting the impact of accessible data on their bargaining stance.

| Factor | Description | Impact on MasterBrand | 2023/2024 Data Point |

| Retailer Concentration | Reliance on a few large home centers | Increased leverage for buyers on pricing and terms | Top 2 U.S. home improvement retailers' revenue in hundreds of billions (2024) |

| Price Sensitivity | Consumer focus on cost, especially in economic slowdowns | Pressure on MasterBrand's margins; need for cost-effective offerings | U.S. housing starts declined from >1.5M to ~1.3M units (early to late 2023) |

| Market Transparency | Easy access to pricing and product comparisons | Empowers customers to negotiate and switch suppliers easily | Over 90% of consumers rely on online reviews (recent surveys) |

| Availability of Substitutes | Numerous manufacturers and private-label options | Low switching costs for customers, reducing brand loyalty | U.S. kitchen and bath cabinet market shipments estimated at $12.7 billion (2023) |

Full Version Awaits

MasterBrand Porter's Five Forces Analysis

This preview showcases the comprehensive MasterBrand Porter's Five Forces Analysis you will receive immediately after purchase. The document you see here is the exact, fully formatted report, ready for your immediate use and strategic planning. Rest assured, there are no placeholders or mockups; what you preview is precisely what you will download.

Rivalry Among Competitors

The North American residential cabinet market is a crowded space, featuring a blend of large national companies, strong regional players, and a vast number of smaller, custom cabinet makers. MasterBrand contends with this diverse competitive landscape, where businesses of all sizes actively compete for consumer attention and market share.

This fragmentation often fuels aggressive competitive tactics as companies strive to differentiate themselves. For instance, in 2024, the market saw continued price competition and increased marketing spend from major players like American Woodmark and Masco Corporation, both significant competitors to MasterBrand.

The residential cabinet industry is generally considered mature, with growth intrinsically linked to housing starts, renovation trends, and overall consumer spending on discretionary items. This maturity means that companies often vie for existing market share rather than expanding into new territories.

In 2024, the U.S. housing market experienced a mixed performance, with new housing starts fluctuating. For instance, data from the U.S. Census Bureau indicated a year-over-year increase in privately owned housing units authorized by building permits in early 2024, suggesting potential for cabinet demand. However, rising interest rates and material costs continued to present headwinds.

When the industry faces periods of slower growth, as it did in certain quarters of 2024 due to economic uncertainties, competitive rivalry intensifies. Companies may engage in price competition or boost marketing expenditures to capture a larger piece of the available market, impacting profit margins.

MasterBrand faces intense competitive rivalry, partly due to the difficulty in significantly differentiating its stock and semi-custom cabinetry lines. For instance, in 2024, the kitchen and bath cabinetry market is highly fragmented, with numerous players offering similar aesthetic and functional options, making it hard for any single brand to stand out solely on product features.

This lack of strong product differentiation is exacerbated by low switching costs for consumers. Customers can readily opt for alternative cabinet manufacturers with minimal effort or expense, which intensifies the pressure on MasterBrand to compete on factors beyond the product itself, such as price, service, and brand perception.

To combat this, MasterBrand, like its competitors in 2024, must focus on creating unique value propositions through superior craftsmanship, innovative design, exceptional customer service, or a strong, trusted brand reputation. Success hinges on building customer loyalty in an environment where alternatives are readily available and easily accessible.

Exit Barriers for Competitors

MasterBrand, like many in the kitchen and bath cabinetry sector, faces substantial exit barriers. The significant capital invested in manufacturing plants, specialized machinery, and maintaining extensive inventory means companies are often reluctant to cease operations, even when profitability is low. This reluctance stems from the desire to avoid substantial losses on sunk costs, as seen in the broader durable goods manufacturing industry where asset write-downs can be crippling.

These high fixed costs create a situation where competitors might continue to operate at reduced capacity or with minimal margins to simply cover ongoing expenses and attempt to recoup initial investments. This dynamic can lead to persistent overcapacity within the market, intensifying price competition and hindering natural market consolidation. As of 2024, the average capacity utilization for many furniture and fixture manufacturers remained below optimal levels, a testament to these ongoing challenges.

- High Capital Investment: Significant investment in specialized manufacturing equipment and facilities makes exiting the market financially punitive.

- Inventory Holding Costs: Maintaining large stocks of raw materials and finished goods ties up capital and incurs ongoing storage and obsolescence costs, discouraging rapid divestment.

- Asset Depreciation: The rapid depreciation of specialized manufacturing assets can lead to substantial book losses if a company attempts to sell them quickly during an exit.

- Employee Severance and Contractual Obligations: Companies face considerable costs related to employee severance packages and fulfilling existing contractual commitments, further increasing the expense of exiting.

Diversity of Competitors' Strategies

Competitors in the cabinetry and home building products sector, including those directly challenging MasterBrand, often pursue vastly different strategic paths. Some focus on achieving economies of scale through mass production and efficient supply chains to offer lower price points, while others differentiate through premium materials, bespoke designs, and extensive customization options. This strategic divergence creates a complex and dynamic competitive environment.

For instance, in 2024, while MasterBrand might emphasize its broad product portfolio and distribution reach, a competitor like IKEA could be aggressively expanding its affordable, modular kitchen solutions, targeting a different consumer segment entirely. Conversely, a high-end custom cabinet maker might be investing heavily in artisan craftsmanship and exclusive showroom experiences. This creates a multi-faceted competitive landscape where MasterBrand must remain agile.

- Strategic Differentiation: Competitors range from mass-market, low-cost providers to niche, high-end custom manufacturers.

- Distribution Channel Focus: Some players concentrate on big-box retailers, while others prioritize direct-to-consumer online sales or specialized design studios.

- Innovation Approaches: Strategies include investing in new materials, smart home integration, or sustainable manufacturing processes.

- Market Positioning: Competitors may target specific demographics, geographic regions, or project types (e.g., new construction vs. remodeling).

MasterBrand operates in a highly competitive North American residential cabinet market, characterized by numerous players from large national firms to smaller custom shops. This fragmentation intensifies rivalry, as seen in 2024 with aggressive pricing and marketing from competitors like American Woodmark and Masco. The industry's maturity means companies often battle for existing market share, especially when economic conditions, like fluctuating housing starts in early 2024, create slower growth periods.

| Competitor | 2024 Market Focus | Key Strategy Example |

|---|---|---|

| American Woodmark | Broad residential market, new construction and remodeling | Price competitiveness and extensive distribution networks |

| Masco Corporation (KraftMaid, Merillat) | Mid-to-upper tier residential, dealer and builder channels | Brand building and product innovation in design and materials |

| IKEA | Affordable, DIY-focused segment | Modular design, large-scale production, and direct-to-consumer sales |

| High-end Custom Shops | Luxury segment, bespoke design and craftsmanship | Exclusive showrooms, premium materials, and personalized service |

SSubstitutes Threaten

The threat of substitutes for traditional built-in cabinetry, like those offered by MasterBrand, is significant. Consumers are increasingly turning to open shelving, freestanding furniture pieces such as buffets and kitchen islands with integrated storage, and versatile modular storage units. These alternatives cater to a growing demand for minimalist aesthetics, flexibility, and often, more budget-friendly options.

For instance, the market for ready-to-assemble (RTA) furniture, which often includes freestanding storage solutions, has seen robust growth. In 2024, the global RTA furniture market was projected to reach billions, indicating a strong consumer preference for accessible and adaptable storage. This trend directly impacts the demand for custom or built-in cabinetry by offering consumers viable, often more immediate, alternatives.

While MasterBrand primarily utilizes wood for its cabinetry, the market offers a range of substitutes. These include metal, laminate, and various engineered wood products, often featuring different finishes. These alternatives can fulfill similar functional and aesthetic needs for consumers.

These substitutes can present a competitive challenge by offering advantages such as lower price points or distinct durability features. For instance, laminate cabinetry can be more resistant to moisture and easier to clean than some wood types. This competitive pressure necessitates that MasterBrand continuously innovate its material offerings and design aesthetics to maintain its market position.

The growing DIY movement and the increasing availability of ready-to-assemble (RTA) cabinetry from major retailers and online platforms pose a substantial threat of substitutes for MasterBrand. These alternatives often attract consumers prioritizing cost savings or those comfortable with self-installation. For instance, in 2024, the home improvement sector saw continued strong demand, with many consumers opting for projects they can manage themselves, directly impacting the market for pre-assembled goods.

Shift in Consumer Preferences and Lifestyles

Evolving consumer trends present a significant threat of substitutes for MasterBrand. Preferences for smaller homes, multi-functional spaces, or even less permanent built-in features could directly reduce the demand for extensive cabinetry. For instance, a growing embrace of open-concept living, which often means less reliance on upper cabinetry, could impact MasterBrand's sales volume. The company must actively monitor and adapt to these shifting consumer preferences to remain competitive.

The rise of alternative storage solutions and design philosophies also poses a threat. Consider the increasing popularity of modular furniture or freestanding storage units that offer flexibility and can be easily moved or replaced. These alternatives can serve the same functional purpose as built-in cabinetry, but with a different aesthetic and a lower commitment, potentially drawing customers away from traditional cabinet purchases. In 2024, the home furnishings market saw continued growth in modular and customizable options, indicating a consumer appetite for adaptable solutions.

- Shifting Housing Trends: A notable trend in 2024 saw continued interest in downsized living and multi-generational housing, which often prioritizes efficient use of space and may favor less expansive, built-in cabinetry solutions.

- DIY and Flat-Pack Alternatives: The accessibility and affordability of DIY furniture and flat-pack cabinetry options from non-specialized retailers offer a substitute for consumers seeking lower-cost, readily available storage.

- Open-Concept Design Impact: The persistent popularity of open-concept living spaces, which often de-emphasize traditional wall cabinetry in favor of islands or freestanding units, directly challenges the market for extensive built-in cabinet systems.

Built-in Appliances and Smart Home Integration

The rise of built-in appliances and smart home integration presents a subtle but growing threat to traditional cabinetry. While not direct replacements for cabinets themselves, these technologies are reshaping kitchen layouts and appliance placement. For instance, fully integrated refrigerators and dishwashers often require custom cabinetry to seamlessly blend into the kitchen design, potentially impacting the demand for standard cabinet offerings.

MasterBrand needs to actively monitor and adapt its product designs to accommodate these evolving consumer preferences. This includes offering flexible cabinet solutions that can integrate with smart home ecosystems and various appliance types. The market for smart home devices saw significant growth, with global revenue reaching an estimated $115 billion in 2023, indicating a strong consumer interest in connected living spaces that MasterBrand must acknowledge.

- Smart Appliance Integration: Appliances like built-in ovens and refrigerators are increasingly designed for seamless integration, influencing cabinet dimensions and styles.

- Smart Home Ecosystems: The desire for a cohesive smart home experience may lead consumers to prioritize kitchen designs that incorporate technology, potentially affecting traditional cabinet choices.

- Customization Demand: As smart home technology becomes more prevalent, there's a growing demand for customized cabinetry solutions that accommodate these integrated systems.

The threat of substitutes for MasterBrand's cabinetry is significant, driven by evolving consumer preferences and market trends. Consumers are increasingly opting for open shelving, freestanding furniture with integrated storage, and modular units, which offer flexibility and often a more budget-friendly approach. The robust growth in the ready-to-assemble (RTA) furniture market, projected to reach billions in 2024, underscores this shift towards adaptable and accessible storage solutions.

Material innovation also contributes to substitute threats, with alternatives like laminate and engineered wood offering distinct advantages such as moisture resistance and ease of cleaning compared to traditional wood cabinetry. These substitutes, coupled with the growing DIY movement and the availability of flat-pack options, challenge MasterBrand's market position by providing cost-effective and readily available alternatives.

Furthermore, shifts in housing trends, such as downsized living and multi-generational housing, favor space-efficient solutions that may not involve extensive built-in cabinetry. The persistent popularity of open-concept designs, which often integrate islands or freestanding units, further reduces the demand for traditional wall cabinetry. MasterBrand must therefore adapt its offerings to meet these changing consumer needs and design philosophies.

| Substitute Category | Key Characteristics | Consumer Appeal | Market Trend (2024 Focus) |

|---|---|---|---|

| Open Shelving | Aesthetic, minimalist, accessible | Modern design, display opportunities | Continued popularity in kitchen and living spaces |

| Freestanding Furniture | Flexible, portable, multi-functional | Adaptability, cost-effectiveness | Strong growth in RTA furniture segment |

| Modular Storage Units | Configurable, scalable, customizable | Space optimization, personalization | Increasing demand for adaptable home solutions |

| Alternative Materials (Laminate, Metal) | Durable, low maintenance, cost-effective | Practicality, affordability | Growing consumer acceptance for non-wood options |

| DIY/Flat-Pack Cabinetry | Affordable, readily available | Cost savings, immediate availability | Significant market share due to accessibility |

Entrants Threaten

Entering the residential cabinet manufacturing industry, like the one MasterBrand operates in, demands a significant capital outlay. This includes establishing modern manufacturing plants, acquiring advanced machinery, stocking raw materials and finished goods, and setting up efficient distribution networks. For instance, a new entrant might need to invest tens of millions of dollars just to get production up and running at a competitive scale.

These substantial upfront costs serve as a formidable barrier, deterring many potential new players from entering the market. Without the necessary financial backing, it's incredibly difficult to compete with established firms that already possess these critical assets and operational efficiencies. This financial hurdle directly impacts the threat of new entrants.

Furthermore, achieving cost-effectiveness in cabinet manufacturing heavily relies on economies of scale. Larger production volumes allow for lower per-unit costs through bulk purchasing of materials and optimized factory utilization. New entrants often struggle to reach these scales initially, putting them at a cost disadvantage compared to incumbents like MasterBrand, which benefits from its existing infrastructure and market presence.

MasterBrand benefits from deeply entrenched distribution channels, encompassing a vast network of dealers, home centers, and independent distributors. Replicating this extensive reach, which took years to cultivate, presents a significant hurdle for any new competitor seeking market access. For instance, in 2024, MasterBrand's continued investment in its dealer network ensures prime shelf space and customer relationships, making it exceptionally challenging for newcomers to secure comparable visibility and sales volume.

MasterBrand, a prominent player in the home goods sector, enjoys significant advantages due to its deeply ingrained brand recognition and the loyalty of its customer base, cultivated over many years of operation. New companies entering this market must invest heavily in marketing and sales to even begin to establish a comparable level of awareness and trustworthiness. For instance, in 2024, the home furnishings market saw continued consumer preference for established brands, with surveys indicating that over 70% of consumers prioritize brand reputation when making large purchases for their homes, a hurdle for any new competitor.

Economies of Scale in Production and Sourcing

MasterBrand, like other established cabinet manufacturers, benefits significantly from economies of scale. This means they can produce goods more cheaply per unit because of their large output volume. For instance, in 2023, the U.S. cabinet industry saw significant price fluctuations for key raw materials like particleboard and lumber, where larger players could negotiate better bulk purchasing agreements.

New entrants would find it challenging to match these cost efficiencies. Without the substantial production volumes that MasterBrand commands, newcomers would face higher per-unit costs for materials, manufacturing, and logistics. This inherent cost disadvantage acts as a substantial barrier, making it difficult for new companies to compete effectively on price against established leaders.

- Economies of Scale in Production: Large-scale operations allow MasterBrand to spread fixed costs over a greater number of units, reducing the cost per cabinet.

- Purchasing Power: MasterBrand's size enables bulk purchasing of raw materials like wood, laminate, and hardware, leading to lower input costs compared to smaller competitors.

- Manufacturing Efficiency: High-volume production often allows for investment in more advanced and efficient manufacturing technologies, further reducing production costs.

- Distribution Network: Established players typically have optimized and cost-effective distribution networks, a significant hurdle for new entrants to replicate.

Regulatory Hurdles and Quality Standards

The residential construction and home improvement sectors, where MasterBrand operates, are heavily regulated. New entrants face significant challenges in complying with a complex web of building codes, safety standards, and quality certifications. For instance, in 2024, the U.S. Department of Housing and Urban Development (HUD) continues to enforce stringent safety and performance standards for manufactured housing, requiring extensive testing and documentation for compliance.

Meeting these regulatory requirements is not only costly but also time-consuming, often demanding substantial investment in product development, testing, and legal expertise. This can act as a substantial deterrent for smaller or less capitalized new companies attempting to enter the market, effectively raising the barrier to entry.

MasterBrand benefits from its established infrastructure and experience in navigating these regulatory landscapes, which new competitors must replicate. The ongoing evolution of building codes, such as those related to energy efficiency and material sustainability, further necessitates continuous adaptation and investment, reinforcing the advantage of incumbents.

- Regulatory Compliance Costs: New entrants must factor in significant expenses for product testing, certification, and legal counsel to meet industry-specific regulations.

- Time to Market: The process of achieving necessary certifications can delay a new company's ability to launch products, giving established players a competitive lead.

- Evolving Standards: Continuous updates to building codes, like those focusing on sustainability and safety, require ongoing investment and expertise, which can be a burden for new entrants.

The threat of new entrants in the residential cabinet manufacturing market is moderate, primarily due to the substantial capital requirements and established brand loyalty. MasterBrand's significant investments in advanced manufacturing facilities, as of 2024, create high upfront costs, making it difficult for new players to achieve competitive scale. Furthermore, replicating MasterBrand's extensive distribution network and strong brand recognition, which surveys in 2024 indicate is a key purchasing driver for over 70% of consumers, requires considerable time and marketing expenditure.

Economies of scale also play a crucial role, allowing MasterBrand to achieve lower per-unit costs through bulk purchasing of materials like lumber and particleboard, a factor highlighted by price fluctuations in 2023. New entrants face a cost disadvantage without this volume. Regulatory compliance, including stringent HUD safety standards in 2024, adds another layer of complexity and expense, further deterring potential competitors.

| Barrier to Entry | Impact on New Entrants | MasterBrand's Advantage (2024) |

|---|---|---|

| Capital Requirements | High upfront investment needed for manufacturing and distribution. | Established facilities and efficient supply chain. |

| Brand Recognition & Loyalty | Requires significant marketing spend to build awareness and trust. | Strong customer preference for established brands. |

| Economies of Scale | Higher per-unit costs due to lower production volume. | Lower material and production costs through bulk purchasing and efficient operations. |

| Distribution Channels | Difficulty securing widespread market access and sales volume. | Extensive network of dealers and distributors. |

| Regulatory Compliance | Costly and time-consuming to meet building codes and safety standards. | Experience and infrastructure to navigate regulations efficiently. |

Porter's Five Forces Analysis Data Sources

Our MasterBrand Porter's Five Forces analysis is built upon a foundation of robust data, including detailed financial reports from MasterBrand and its key competitors, industry-specific market research from firms like IBISWorld, and publicly available trade association data.